Arizona Public Service

Submitted 01/06/2023, 02:26 pm

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 draft final proposal and December 16, 2022 stakeholder call discussion:

APS appreciates the opportunity to comment on the Transmission Service and Market Scheduling Priorities draft final proposal. A few crucial areas give the company cause for concern. APS would like to highlight certain elements of the proposal to fully understand the implications to entities attempting to reserve high priority wheeling status across the CAISO’s system.

In instances where a curtailment of high priority wheeling is required by CAISO “equal to load”, what will be the basis for when this will occur and how will it be applied? APS believes that there is a fundamental difference between a scenario involving line deration or outage and that in which the CAISO is resource deficient. To highlight this difference, APS would expect in a scenario where a line is derated or on forced outage that the transmission customer’s reservations at that import location would be pro-rata adjusted to the new line rating.

However, in instances where the CAISO load cannot be met because of resource insufficiency, a pro-rata adjustment to an import does not align with OATT practices of external transmission providers and should not be performed by the CAISO. A pro-rata adjustment to a high priority wheel only serves to harm an external entity wheeling through the CAISO without affording assistance to the CAISO in serving its own load absent import offers that can be awarded on the transmission displaced on the wheel. A reduction of a wheeling schedule does not change the net interchange of the CAISO BAA.

In an instance where there is an import offer that cannot be awarded due to inter-tie scheduling limits being fully utilized by previously held transmission for the CAISO native load and high priority wheeling transactions of external entities, APS believes no reduction to the high priority wheeling transactions should be performed. High priority wheeling transactions are paying the wheeling access charge as proposed but would be receiving secondary priority to imports of scheduling coordinators who are offering short-term energy to the CAISO. There is no parallel in the OATT construct in which a transmission customer can bump previously granted higher priority transmission service to other transmission customers.

In the draft final proposal and on the stakeholder call, it was unclear to APS if the latter scenario would occur and requests a definitive answer to this scenario. CAISO alluded that it would only happen if both a transmission derate and a power balance constraint violation were occurring simultaneously in the market run. APS believes that a scenario could arise where a power balance constraint could occur absent a transmission derate, in this scenario a short-term non-RA offer at the inter-tie should not supersede by any amount a previously awarded transmission right to a high priority wheel. The CAISO released ATC to high priority wheels with protections for native loads considered in the methodology and should not pro rate those commitments if additional import is needed in the short-term from a resource that is not contracted to native load previously. This is a similar concept to designated network resources and secondary network transmission in the OATT world, where a transmission customer serving native load has designated resources with 7-FN transmissions service, if that customer elects to serve load from non-designated resources they would do so with priority 6-NN transmission which is lower priority than 7-FN. APS also would like clarification surrounding the impact of load conformance in this example and how pro-rata curtailment of high priority wheel would occur if load conformance is utilized in the IFM, RUC, and HASP. Because load conformance appears to be placed in the upward direction in these market runs, but then is reduced in the RTD which could result in curtailment of hourly wheeling schedules that do not need to take place to serve actual demand within CAISO.

2.

Provide your organization’s comments on the overall methodology for calculating ATC in the monthly and daily horizons, as described in sections 6.1.1 and 6.1.2:

APS is supportive of the calculation of ATC that protects native load in a reasonable and transparent manner. APS would encourage CAISO to explore options that are forward looking in ATC calculation but understands the CAISO doesn’t currently know projected import needs utilizing inter-tie scheduling TTC for RA and can only rely on historic with true ups occurring at the time of RA showings. However, APS is concerned that historical looking assessments of native load needs may inadvertently release less ATC than is available to market participants seeking high priority wheeling access. The historical calculation could result in 0 ATC being made available to these market participants, while in September 2022 the CAISO was able to support both high priority wheels and meet native load utilizing the interim framework for reserving high priority wheels. The events of September 2022 should be evidence of the ability to protect native load in stressed system conditions while also offering ATC to those seeking high priority wheeling, and the ATC methodology should align with this occurrence.

APS is supportive of non-RA imports that are contracted by CAISO LSE’s ahead of the CAISO market runs utilizing TTC in the ATC methodology but does encourage specific language around the usage of this mechanism and timing that does not reduce any previously awarded wheeling transmission.

3.

Provide your organization’s comments on the proposed methodology for deriving the native load needs, including load growth as described in section 6.1.2.2:

APS encourages the most accurate source of load growth be utilized in the ATC methodology to best protect native load and make available excess transmission to external entities serving load utilizing the CAISO transmission system. The utilization of historic load growth can be improved by utilizing projected load amounts from LSE’s or other sources to reflect future native load needs, but APS does not oppose utilization of historical load growth values until a more accurate mechanism is found. APS is concerned that load growth could result in double counting or counting of load growth being supported from imports that LSEs plan to serve by alternative methods since the CAISO is not informed prospectively about future resource locations in the calculation of transmission reserved for native load.

4.

Provide your organization’s comments on the proposed methodology components for deriving the transmission reliability margin (TRM) as described in section 6.1.2.3:

APS does not oppose the components for determining TRM on inter-ties and the approach appears to be reasonable

5.

Provide your organization’s comments on the proposal to annually evaluate internal transmission network impacts as discussed in section 6.1.3:

APS has no comment on this topic but understands that deliverability of wheels may change regarding the evaluation of internal transmission system and appreciates CAISO’s review of previous high load days and the ability to import and export at different locations on the CAISO system.

6.

Provide your organization’s comments on the proposed approach for accessing ATC to establish wheeling through scheduling priority, including the contractual requirement, reservation windows and competition process, as described in section 6.1.4:

APS believes there should be some priority, if possible, with regards to re-sell requiring a contract to serve load by the purchaser, if the purchaser of the re-sell does not have a contract to serve load via the wheel, APS would prefer the ATC be released through daily ATC release. If a contract falls through prior to the start of the reservation and the transmission is given back to ISO any customers denied ATC should be awarded if the relinquish allows for it to be granted in whole or partially with a right of first refusal for the transmission customer being offered the relinquished ATC.

APS additionally is interested in the utilization of ETC in terms of scheduling priority vs high priority wheels and CAISO load. If an ETC was re-sold or transferred to someone other than the existing holder is the ETC at the import location considered higher priority than ATC granted by CAISO as high priority wheeling, or would it be categorized as the same priority?

APS would appreciate more information on the daily release and the seven-day window. The draft final proposal on Page 29 currently states this would be from 7:00AM to 12:00AM (believe should be 12:00PM). Would a request for transmission service for the next day be available until 12:00PM which would occur after the day ahead closing? APS also recognizes the 13-month horizon of the monthly release will result in some short windows for external LSEs to transact with developing resource adequacy programs in the West, and requests that the CAISO be open to evaluation of alternative horizons if transactions window, or issues related to firmness of high priority wheeling become operationally incompatible with external LSEs requirements for resource adequacy showings. APS also recognizes that this element may put LSEs inside the CAISO on in different terms during contract negotiations because they do not need to wait to procure based on transmission availability made available as is the case with external entities. APS appreciates that the CAISO allows contracts contingent on CAISO wheeling ATC availability to satisfy the contract requirement, but also realizes that the capacity becoming available may compress the resource options to external LSEs prior to the posting of ATC by CAISO out 13 months.

7.

Provide your organization’s comments on the proposed application of scheduling priorities in the post-HASP process as described in section 6.1.5:

As stated in question 1 economic imports that become reliability imports shouldn’t bump high priority wheels attempting to utilize the import capacity previously awarded to the high priority wheels. These short-term offers without demonstrated external transmission can cause bumps of high priority wheels if bids are accepted to reduce a power balance constraint, while simultaneously may not have a resource secured when submitted. The transmission capacity should only be awarded to previous RA, non-RA contracts by CAISO LSEs, and high priority wheels during this scenario and should not include offers that are only submitted in the day ahead or HASP market.

8.

Provide your organization’s comments on the proposed process for establishing long-term scheduling priority and the study and expansion process, including whether the funding entity should receive transmission credits as they take service or potential eligibility for congestion revenue rights (CRR), as described in section 6.1.6:

APS believes that congestion revenue rights should be included in the establishment of scheduling priority through the long-term framework. This would align with the ability of a transmission customer to receive the financial value of the transmission reservation along with the physical value of the transmission they funded. It can also insulate transmission customers from price differences at import and export locations of their wheeling transaction. APS believes that many wheeling transactions if not all will be scheduled in the integrated forward market since they are coupled with contracts to serve load, thus CRR’s will provide protection against congestion.

9.

Provide your organization’s comments on the proposed framework for compensation for wheeling through scheduling priority as described in section 6.1.7:

APS does not oppose the compensation framework of the CAISO for high priority wheeling. APS does request that CAISO review the transmission wheeling access charge to determine if it is appropriate to charge a capacity reservation since high priority wheeling will no longer be charged on an as scheduled basis.

Bay Area Municipal Transmission Group (BAMx)

Submitted 01/04/2023, 02:10 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 draft final proposal and December 16, 2022 stakeholder call discussion:

Bay Area Municipal Transmission Group (BAMx)[1] is pleased to submit these comments on the Transmission Service and Market Scheduling Priorities Phase 2 draft final proposal and December 16, 2022 stakeholder meeting. BAMx supports developing a mechanism for entities with loads outside of the CAISO Balancing Authority Area to be able to obtain priority scheduling rights comparable to native load, but has some concerns about CAISO’s draft final proposal.

- CAISO should consider applying a Transmission Reliability Margin (TRM) greater than the combined 6% for key interties prior to the prompt month to protect against committing more than the Total Transfer Capability (TTC), particularly where the allocated import capacity for native load for select interties exceeds the historical RA showings by a large amount.

- BAMx opposes allowing the wheeling customer that requested an upgrade to fund the project over time, rather than requiring up-front funding of the upgrade. Doing so would unreasonably shift risks associated with the cost of the upgrade to CAISO native loads.

- BAMx does not believe that simply applying the Wheeling Access Charge (WAC) rate is appropriate for shorter duration transactions (less than 1 year), because the WAC is derived using the annual forecast CAISO load. Wheeling transactions will be for much shorter durations than a year (as short as 4 hours for one day). It thus would be appropriate to apply a factor (e.g., 1.6 times the WAC) for the much shorter-than-annual duration wheeling transactions, as is done by other transmission providers.

[1] BAMx comprises City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

2.

Provide your organization’s comments on the overall methodology for calculating ATC in the monthly and daily horizons, as described in sections 6.1.1 and 6.1.2:

BAMx generally supports the CAISO’s proposed approach for calculating the Available Transfer Capability (ATC) in the monthly and daily horizons, though we suggest some adjustments to the draft final proposal. For the reasons described below in response to Item 3, BAMx recommends applying a TRM greater than 6% for selected interties prior to the prompt month reservation process to avoid overcommitting those interties. CAISO also should only release legacy transmission contracts and transmission ownership rights from the ATC calculation where the rights holders have made binding commitments to release the capacity to the markets (in exchange for congestion revenue rights) for the specific month for which CAISO will be making the ATC available for wheel through transaction scheduling priority. That is, CAISO should not rely on historical releases nor on non-binding representations of the amounts planned to be released.

3.

Provide your organization’s comments on the proposed methodology for deriving the native load needs, including load growth as described in section 6.1.2.2:

In the rolling 13-month process, CAISO is proposing to use the highest import RA showings plus the highest non-RA contracted import supply for each intertie from the previous two years as a proxy for estimating the native load needs. This approach could result in CAISO committing to support native load imports and wheel through transactions that exceed the capability of some interties if the historical estimates understate future native load usage of the intertie capacity by more than the amounts set aside by CAISO for TRM and native load growth.

As an illustration of the circumstances that could lead to CAISO over-committing intertie capacity, consider Appendix 1, Table 5. This table shows 329 MW of ATC potentially available for wheeling reservations at NOB for September 2023, after taking into consideration 1,092 MW of RA, 100 MW of non-RA, 20 MW of load growth, 0 MW of ETC, and 81 MW of TRM. CAISO has allocated 1,559 MW of NOB import capability to California LSEs for 2023.[1] This means that if external entities were to reserve the 329 MW of NOB import capability for September 2023 prior to August 2023, and California LSEs increased their RA showings beyond the 2-year historical amounts by more than the 101 MW margin for load growth and TRM, CAISO could overcommit the NOB intertie by up to 266 MW (1622 MW TTC - 1559 MW native load RA – 329 MW wheel through reservations). Similar over-commitments could occur at other interties, such as COB. CAISO should consider applying a TRM greater than the combined 6% for key interties prior to the prompt month to protect against committing more than the TTC. For the prompt month and the daily process, CAISO could use the 6% TRM, while considering actual RA showings and non-RA contracted imports. CAISO also should develop a process for California LSEs to communicate their intention to show greater amounts of import RA or non-RA contracted imports at an intertie than had been included in the previous two years, and CAISO should use this information to adjust the ATC calculations.

[1] 2023 Holders of Import Capability

4.

Provide your organization’s comments on the proposed methodology components for deriving the transmission reliability margin (TRM) as described in section 6.1.2.3:

BAMx supports the CAISO’s proposal to account for uncertainty related to aggregate load forecast, transmission system topology and generation dispatch by applying an adjustment to select interties. CAISO has proposed that these adjustments could amount to up to 6% reduction in the ATC for select interties where the CAISO has historically relied upon import supply to serve load. As described in the response to Item 3, CAISO should consider using higher TRM amounts for any months prior to the prompt month, particularly where the allocated import capacity for native load for select interties exceeds the historical RA showings by a large amount. For the prompt month and the daily allocations, the aggregate 6% TRM appears to be appropriate.

5.

Provide your organization’s comments on the proposal to annually evaluate internal transmission network impacts as discussed in section 6.1.3:

BAMx appreciates the CAISO’s proposal to closely monitor the impacts of import and wheel through volumes under different conditions, and to periodically evaluate the ability of the internal network to operate reliably without triggering internal reliability constraints. Because the CAISO’s simplified approach for determining ATC relies on historical RA showings and non-RA contract imports, and does not explicitly include any power flow modeling to validate that sufficient transmission is available to support native load and wheel through transactions, it is imperative that CAISO monitor the impacts of high priority wheeling reservations on internal transmission needed to support the wheeling reservations.

6.

Provide your organization’s comments on the proposed approach for accessing ATC to establish wheeling through scheduling priority, including the contractual requirement, reservation windows and competition process, as described in section 6.1.4:

BAMx supports the draft final proposal minimum supply contract duration of 4 hours per day for establishing scheduling priority.

7.

Provide your organization’s comments on the proposed application of scheduling priorities in the post-HASP process as described in section 6.1.5:

The draft final proposal provides for using T-30 day actual shown RA imports and non-RA imports under contract to derive a MW amount, per intertie, that is set aside for native load needs and is carried into the day-ahead timeframe. CAISO also will include designated import supply to meet reliability needs using its capacity procurement mechanism (CPM). The combined amounts would represent native load needs in the post-HASP process, and would be the amount to which pro rata allocation of transmission capacity will apply during instances in which the market solutions do not result in all load being served. BAMx supports the proposed approach for allocating intertie capacity to serve native load needs in the post-HASP process.

8.

Provide your organization’s comments on the proposed process for establishing long-term scheduling priority and the study and expansion process, including whether the funding entity should receive transmission credits as they take service or potential eligibility for congestion revenue rights (CRR), as described in section 6.1.6:

BAMx supports the CAISO leveraging the deliverability portion of the GIDAP process to study requests for long-term wheeling through scheduling priority.

CAISO notes that should it take the option to approve an upgrade as reliability, economic or public policy projects, the CAISO would need to determine how much capacity to set aside for native load needs and native load growth, and identify the incremental ATC created by such upgrade, if any, available to establish wheeling priority. As suggested by CAISO, it would not be appropriate to continue to determine native load needs based on historical RA showings, since the change in intertie capability could lead to changes in native load usage of the intertie.[1] CAISO also would need to study the impacts on internal transmission constraints on the ability of incremental capacity associated with intertie re-rating available for supporting wheeling through transactions.

BAMx opposes allowing the wheeling customer that requested an upgrade to fund the project over time, rather than requiring up-front funding of the upgrade. Doing so would unreasonably shift risks associated with the cost of the upgrade to CAISO native loads. Instead, the wheeling customer should be required to up-front fund the upgrade costs and would receive transmission credits until it recovers the amount it up-front funded (along with the wheeling priority). This latter approach appropriately places the risk on the party that requested and thereby triggered the upgrade.

[1] A similar issue could arise if an intertie’s rating were to be increased, such as is being considered for the Pacific AC Intertie.

9.

Provide your organization’s comments on the proposed framework for compensation for wheeling through scheduling priority as described in section 6.1.7:

BAMx supports the proposal to charge for the wheeling priority based on the duration of the underlying supply contract, with a minimum of 4 hours per day. However, BAMx does not believe that simply applying the Wheeling Access Charge rate is appropriate for shorter duration transactions. The WAC is derived using the annual forecast CAISO load, and it is trued up in subsequent years using a balancing account. That is, CAISO native load eventually will be charged or credited for decreases/increases in actual vs. forecast annual loads. In contrast, the wheeling transactions will be for much shorter durations than a year (as short as 4 hours for one day). It thus would be appropriate to apply a factor (e.g., 1.6 times the WAC) for the much shorter-than-annual duration wheeling transactions, as is done by other transmission providers.

BAMx supports the CAISO proposal to allow wheeling through parties that seek and receive CRRs through the OBAALSE CRR allocation process to receive credit for their pre-payments of the OBAALSE CRR WAC amounts (for the same intertie for which they have received wheeling priority) towards their payments for the wheeling through reservation. As noted by the CAISO, the entity would have to separately meet the conditions for the OBAALSE process and the conditions for the wheeling priority reservation process.

NV Energy

Submitted 01/04/2023, 09:23 am

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 draft final proposal and December 16, 2022 stakeholder call discussion:

Summary

NV Energy appreciates the opportunity to comment on the Transmission Service and Market Scheduling Priorities Draft Final Proposal (DFP). While an improvement over the initial Straw Proposal, the DFP fails to provide a just and reasonable, reciprocal basis for open access transmission across the CAISO controlled grid. As the transmission provider, the CAISO bears the burden to establish the amount of transmission capacity required to serve native load in its Balancing Authority Area, and the CAISO must justify any conditions that it seeks to impose upon the wheeling customers’ transmission service.[1] As discussed further in these comments, NV Energy’s primary concerns with the proposal include the following:

- The CAISO needs to offer firm transmission service in a manner comparable to that the CAISO’s Load Serving Entities (LSE) receive under the open access transmission tariffs (OATTs) of neighboring transmission providers. Order No. 888 required transmission providers to offer two products “firm” and “non-firm”. As the operator of a regional real-time market and proposed day-ahead market, comprised of multiple Balancing Authority Areas with OATTs, the CAISO should move away from the nomenclature “equal to load” and use the standard terminology, associated NERC transmission service reservation priorities and NAESB scheduling requirements, and curtailment priorities of the OATT products. Interoperability with the Western Power Pool’s Resource Adequacy Program (WRAP) requires the CAISO to offer “firm” transmission.

-

- The CAISO needs to specify how transmission curtailment is different from load reductions for resource insufficiency. Under the FERC-approved OATT, transmission curtailment is a reduction in non-firm or firm transmission service in response to a transmission system outage or derate. The NERC transmission service reservation priorities indicate the order in which schedules are curtailed. Non-firm schedules are curtailed first. If the transmission derate makes it impossible to accommodate all firm schedules, there is a pro rata reduction of all the firm schedules in order to alleviate the problem. On the other hand, if a customer has not scheduled and delivered sufficient resources to cover their load, and the shortage is impacting the reliability of the Balancing Authority Area, that customer is directed to immediately implement their transmission reduction plan. The loss of load is not socialized to the other transmission customers, but rather is directed at the resource insufficient LSE. CAISO needs to identify the very limited situations under which a high-priority, firm wheel can be curtailed. Specifically, CAISO should state the conditions that need to be met in order for a pro rata curtailment of the high-priority, wheels to occur along with examples that illustrate if the curtailment occurs from a supply shortage. Furthermore, CAISO should also provide examples about how the load bias could or could not impact the conditions that need to be met in order for a curtailment to occur.

-

- The CAISO’s Available Transmission Capacity (ATC) methodology may overstate the transmission capacity needed for native load service. The native load reservation should be based on current and future needs not historical reservations. If a non-resource adequacy agreement provides capacity, in the event of an outage it would be double counting to include it in the calculation. Moreover, taking the higher of resource adequacy and non-resource adequacy contracts over two years may inflate the total native load reservation as a higher resource adequacy reservation in one year may mean less of a need to secure non-resource adequacy capacity in that same year to maintain the targeted planning reserve margin. In the next year the situation may reverse and the same total planning reserve amount can be met by a split of less resource adequacy capacity and more non-resource adequacy capacity. Taking the higher would inflate the overall planning reserve margin required by the CAISO LSEs. In addition, the CAISO is reserving capacity for native load growth in both the short-term and long-term horizons, but has not required any forward planning demonstration by CAISO LSEs as to how much capacity will be utilized in the future. As shown in Appendix 1, resource adequacy imports through Malin decreased from 1,981 MW in September 2021 to 1,751 MW in September 2022, while imports through NOB decreased from 1,092 MW to 1,083 MW across the same timeframe. It is not enough to say the CAISO’s load is growing. Rather there should be a showing as to the location of the resources that will be used to meet the new load.

-

- The DFP states that after the monthly process, if there is no remaining ATC at an intertie because it has been reserved in advance, then the set aside for native load will remain as originally calculated, and the CAISO will continue to honor the scheduling priority of wheel through transactions for which ATC has been reserved in advance to the extent a grid or market condition arises that requires application of market scheduling priorities. Rather than respect this critical aspect of first-in-time firm reservations, the CAISO’s proposed post-Hour Ahead Scheduling Process (HASP) process also would include in any pro rata shortfall allocation: (1) resource adequacy and non-resource adequacy contracted imports as increased in the T-30 timeframe and (2) Capacity Procurement Mechanism (CPM) import volumes. Thus, the CAISO’s proposal would harm the high priority firm wheeling service and in effect, increase the curtailment priority of the California entities above and beyond: (1) the original native load allotment, (2) the load growth set aside, and (3) the 6 percent Transmission Reliability Margin (TRM). All transmission providers face the risk that a situation may arise beyond their original plans, but that possibility does not permit them to raise the curtailment priority of lower-tiered conditional firm or non-firm service to native load. The CAISO LSE’s additional 30-day showing or the CAISO CPM can only have high priority curtailment protection up to the level of capacity set aside for the TRM, not higher.

-

- An entity with a monthly or daily wheeling through priority must notify the CAISO immediately if the supply contract supporting the wheeling through priority is terminated or modified such that the quantity, import point, or export point changes. While the CAISO states that, under these circumstances the wheeling through priority would terminate, that may be too harsh an outcome in the case of a contract modification that reduces the quantity or duration, but does not alter the points of receipt and delivery, especially if the CAISO is proposing to continue to assess the wheeling access charge based on the parameters of the original power purchase agreement. A better approach in this situation may be to reduce the ATC reservation to accord with the revised agreement and make the remainder of the transmission capacity available for use by others.

-

- The DFP proposes that entities obtaining wheeling through scheduling priority pay the wheeling access charges for the months or days across which ATC is reserved based upon the energy delivery timeframes of the underlying power supply contract. Currently, the CAISO LSEs only pay the transmission access charge based on the MWs of energy they actual schedule and deliver. It is an energy charge and not a demand charge. Thus, the CAISO is converting a rate devised as an energy charge and utilizing it on a demand basis for the external parties. That having been said, it is better that the wheeling demand charge apply only to the potential hours of delivery based on the underlying power purchase agreement than on a 24/7 basis.

NV Energy also requests clarification on aspects of the DFP, including the following:

- With respect to access to the internal CAISO transmission system, Appendix 1 of the DFP indicates that 1,200 MW of Existing Transmission Contracts (ETCs) would be set aside during the summer months at Malin. The CAISO should identify the entities holding these ETC rights and how often these rights are fully scheduled. Also, the CAISO should explain the priority associated with potential use of these rights. For example, does a wheel using ETC capacity at Malin carry with it associated firm transmission rights to Mead at a priority equal to ATC acquired from CAISO?

-

- Significant questions remain regarding the CAISO’s proposed procedures for processing long-term transmission requests. These include: (1) the study scope and timing with respect to shorter term (18 to 24 month) requests for transmission service over interties with historic ATC availability and (2) the consistency with FERC’s transmission pricing policy of the proposed repayment approach for customer-funded upgrades.

CAISO Needs to Offer Firm Transmission Consistent with How that Product Is Implemented in the West

Order No. 888 required all public utilities that own, control, or operate facilities used for transmitting electricity in interstate commerce to file open access non-discriminatory transmission tariffs that contain nondiscriminatory service.[2] The CAISO needs to offer firm transmission service in a manner comparable to that the CAISO’s LSEs receive under the OATTs of neighboring Transmission Providers. Figure 1 illustrates the NERC transmission service reservation priorities as implemented under the OATT:

Figure 1

|

Transmission Service Reservation Priorities

|

|

Priority

|

Acronym

|

|

|

0

|

NX

|

Next-hour Market Service

|

|

1

|

NS

|

Service over secondary receipt and delivery points

|

|

2

|

NH

|

Hourly Service

|

|

3

|

ND

|

Daily Service

|

|

4

|

NW

|

Weekly Service

|

|

5

|

NM

|

Monthly Service

|

|

6

|

NN

|

Network Integration Transmission Service from sources not designated as network resources

|

|

CF

|

Conditional Firm Point-to-Point Transmission Service during the conditional curtailment hours or conditions

|

|

7

|

F

|

Firm Point-to-Point Transmission

|

|

FN

|

Network Integration Transmission Service from Designated Resources

|

The DFP states that “[t]he proposed framework minimizes seams issues between the Open Access Transmission Tariff (OATT) framework that is prevalent across the west” Rather than use the standard industry terminology, however, the DFP repeatedly uses the phase “scheduling priority equal to load”.[3] The CAISO needs not and should not depart from the standard transmission product definitions.

For example, the CAISO has recognized:

Entities that participate in both the WRAP and the EDAM will ultimately be responsible for managing their participation in each; however, harmonizing both designs on an ongoing basis to ensure the success of both programs in providing the intended value proposition is important. Based on preliminary review of program timelines and technical implementation, there appear to be pathways to ensuring interoperability. The WRAP requires that entities procure or build adequate firm resources and transmission from a long-term resource planning and adequacy perspective to meet their expected needs during the summer and the winter months. [Emphasis added]

The CAISO has stated, “continued coordination is necessary to ensure the two programs complement each other and are interoperable when implemented.” However, the only way this can be achieved is if the wheel through initiative provides for a transmission product equal to the WRAP requirement – firm transmission. The need to meet this criteria is illustrated by the following excepts from the WRAP tariff pending FERC approval:

- Demonstrated FS Transmission: A Participant’s demonstration in its Forward Showing Submittal that it has secured firm transmission service rights of the type and quantity sufficient to provide reasonable assurance, as of the time of the Forward Showing Submittal, of delivery of capacity from the Qualifying Resources and the resources associated with the power purchase agreements in the Participant’s Portfolio QCC.

- 16.3.1 As part of its Forward Showing Submittal for a Binding Season, each Participant must demonstrate, as specified in the Business Practice Manuals, that it has secured firm transmission service rights, including under supply arrangements with a third party that holds or has committed transmission service rights, sufficient to deliver a MW quantity equal to at least 75% of the MW quantity of its FS Capacity Requirement. To the extent a Participant holds transmission service rights with a point of receipt at a Qualifying Resource, or in connection with an RA Transfer to such Participant, any such rights from such point in a MW quantity, respectively, in excess of the Qualifying Capacity Contract (QCC) of such Qualifying Resource, or in excess of the value of such RA Transfer, shall not contribute toward satisfaction of such Participant’s FS Transmission Requirement. The FS Transmission Requirement must be met with NERC Priority 6 or NERC Priority 7 firm point-to-point transmission service or network integration transmission service, from such Participant’s Qualifying Resource(s) or from the delivery points for the resources identified for its Net Contract QCC or for its RA Transfer to such Participant’s load….

In order to satisfy the WRAP Forward Showing requirement, an entity must secure firm transmission from the source to its border. Accordingly, the CAISO must provide the required product or the two programs will not be harmonized.

More important than just the label of firm or non-firm is what the quality of the service signifies, especially with respect to curtailment priorities. For example, if a CAISO LSE has contracted with a geothermal resource in Nevada and secured firm point-to-point transmission to the CAISO border, NV Energy would not curtail that transmission if its own Balancing Authority Area was short supply. Under the OATT, there is a distinction between transmission curtailment and resource insufficiency.[4] Transmission curtailment is a reduction in non-firm or firm transmission service in response to a transfer capability shortage resulting from system reliability conditions, such as a transmission system outage or derate. Non-firm schedules are cut first. If a transmission derate makes it impossible to accommodate all firm schedules, there is a pro rata reduction of the firm transmission schedules that can alleviate the problem.[5] On the other hand, if a network customer has not scheduled sufficient resources to cover their load, and the shortage is impacting the reliability of the Balancing Authority Area, that customer is directed to implement their load reduction plan in accordance with their Network Operating Agreement.[6] As noted by Idaho Power in the presentation during the CAISO stakeholder process:

[a] general principle with respect to historic inter-BA practice is that one BA does not propagate its supply deficiency to another BA by cutting firm energy exports:

- Export transactions (Off-System Sales) by the transmission provider’s merchant arm are only done based on calculated surplus energy

- Third-party exports are not interruptible for supply deficiencies

- As such, firm exports are not cut by the native BA transmission provider, even to the possible detriment of native load.

- Abandoning this concept is a slippery slope that jeopardizes inter-BA comity and interconnected reliability[7

It is imperative that the next iteration of the CAISO’s proposal differentiate between transmission derates and supply insufficiency: (1) If a LSE is resource insufficient any load reduction is relegated to that LSE and not to other transmission customers and (2) only if there is a derate of the transmission system are the effected high priority transactions reduced pro rata. The CAISO should provide clear examples as to how it would handle different load reduction and curtailment situations.

In the following table, NV Energy summarizes its understanding of the relationship between the standard OATT products and the CAISO’s proposal as reflected in the DFP. NV Energy requests that the CAISO confirm the characterization of the transmission program in the Final Proposal.

|

OATT Service

|

Type and duration

|

CAISO Proposal

|

Relation to OATT

|

|

Firm

|

Network (year or longer)

|

CAISO Native Load

|

Consistent with OATT priority - but no designation of specific resources

|

|

Long-Term (1 year or more)

|

High Priority Wheels

|

Needs to be equal to OATT Firm Service using the NERC transmission service reservation priorities

|

|

Short-term firm (monthly, weekly, daily, some cases hourly)

|

|

Conditional Firm

|

Long-Term Firm equivalent to firm during non-conditional period

|

Low Priority Wheels (Firm Provisional) –can be curtailed just prior to CAISO load shed

|

Can be slightly higher or slightly lower than conditional firm depending on the type of conditional agreement (hours of curtailment vs. seasons or specific conditions)

|

|

Secondary Network

|

Can be used for any duration, if available and while network agreement is in place

|

CAISO Native Load

|

Higher priority than OATT as there is no distinction between resource adequacy contracted resources and other contracted resources. For resources that are not designated, under the OATT, secondary network has a lesser priority when it come to curtailment (6NN vs. 7FN)

|

|

Non-Firm

|

Monthly

|

Not applicable

|

Not applicable

|

|

Weekly

|

|

Daily

|

Day-Ahead Market Purchases

|

Non-firm (first product to be recalled)

|

|

Hourly

|

EIM Transfers

|

Uses as-available transmission

|

|

Pt-to-Pt Service over secondary receipt and delivery points

|

Up to duration of underlying reservation

|

Not applicable

|

Not applicable

|

[1] Sierra Pacific Power Co., 143 FERC ¶ 61,144 (2013) at P. 115.

[2] Promoting Wholesale Competition Through Open Access Non-Discriminatory Transmission Services by Public Utilities; Recovery of Stranded Costs by Public Utilities and Transmitting Utilities, Order No. 888, FERC Stats. & Regs. ¶ 31,036 (1996) (cross referenced at 75 FERC ¶ 61,080), order on reh’g, Order No. 888-A, FERC Stats. & Regs. ¶ 31,048 (cross-referenced at 78 FERC ¶ 61,220), order on reh’g, Order No. 888-B, 81 FERC ¶ 61,248 (1997), order on reh’g, Order No. 888-C, 82 FERC ¶ 61,046 (1998), aff’d in relevant part sub nom. Transmission Access Policy Study Group v. FERC, 225 F.3d 667 (D.C. Cir. 2000), aff’d sub nom. New York v. FERC, 535 U.S. 1 (2002.

[3] See, for example, the DFP at p. 4,5, 7-8. 21, 23 and 27.

[4] NV Energy OATT at § 1.10 defines “Curtailment” as, “[a] reduction in firm or non-firm transmission service in response to a transfer capability shortage as a result of system reliability conditions.”

[5] See id. at §13.6.

[6] NV Energy’s pro forma Network Operating Agreement at § 10.6 ( “If in real time, the Network Customer has not scheduled sufficient resources to match its actual load and the Network Customer is notified by the Balancing Authority Area operator that its resource shortage is impacting system reliability, the Network Customer shall supplement and/or adjust its scheduled Network Resources within fifteen (15) minutes of such notification by the Balancing Authority Area operator.”).

[7] Idaho Power Co., Export and Load Scheduling (Jan. 12, 2021), http://www.caiso.com/InitiativeDocuments/IdahoPowerPresentation-MarketEnhancements-Summer2021Readiness-Jan122021Workshop.pdf.

2.

Provide your organization’s comments on the overall methodology for calculating ATC in the monthly and daily horizons, as described in sections 6.1.1 and 6.1.2:

The CAISO proposes to calculate ATC in monthly increments across a rolling 13-month horizon and in the daily timeframe across a 7-day rolling horizon. Requests would be submitted during a specified window period, and parties can request ATC across the horizon for which ATC is calculated, both in the monthly horizon and daily horizons. If there is not sufficient ATC to accommodate all the requests, the requests will compete with each other based upon the number of hours for which they seek a priority across the horizon for which ATC is available (the requested hours must align with the service hours in an underlying supply contract, which is a requirement to support priority wheeling through transactions across the CAISO).

CAISO proposes that ATC is determined in accordance with the following formula:

ATC = TTC – ETC – TRM - CBM

This is similar to the formula utilized in most OATTs in accordance with FERC Order 890. For example, NV Energy’s formula in Attachment C of its OATT for firm ATC is ATCF = TTC – ETCF – CBM – TRM + PostbacksF. .As explained in NV Energy’s comments on the Straw Proposal, neither NV Energy nor any of the other Desert Southwest entities reserve a CBM. Closer inspection, however, shows that the CAISO’s proposed formula is more akin to the following:

ATC = TTC – ETC (both RA + Non RA) + TRM (2% for TRM load uncertainty + 2% for transmission uncertainty + 2% for generation dispatch) + 2-3% load growth (even though it is only calculated 12 months ahead) + anything more the CAISO LSEs buy in the 30 day resource adequacy showing + any capacity that gets a Capacity Procurement Award from CAISO.

The DFP recognizes, “[t]here should not be “double counting” of set-aside capacity among the different components of the ATC calculation methodology” but fails to demonstrate this important rule in practice. As explained in the following paragraphs, the CAISO’s proposal may overstate the native load reservation.

The DFP states:

ATC is calculated on a looking forward basis to derive the amount of transmission capacity that is available for reservation in advance of need, across different time horizons. As such, the ATC calculation is inherently based on estimates and forecasts within a number of its components and particularly within the calculation of ETC and the margins allowed under the ATC methodology.

It should be noted that this is no different an issue for any other OATT transmission provider. Yet all other transmission providers determine ATC based on prospective resource plans. In contrast, the CAISO proposes to use retrospective data to reserve future transmission capacity. The DFP’s proposed methodology sets aside transmission capacity at the interties for CAISO LSEs based in the higher quantity of resource adequacy and non-resource adequacy imports for that month over the prior two years.

FERC has found that simply listing the amount of the transmission providers’ native load and generation resources designated to serve that load is not sufficient to support a future reservation for existing native load.[1] Rather, the transmission provider should take into account a wide range of factors when evaluating its existing native load obligation and resulting ATC reservation, including “reasonable assumptions about the resources it has designated to serve native load . . . .”[2]

The CAISO does not provided detail on the non-resource adequacy contracts. If, for example, those agreements provide back-up capacity in the event of an outage of a resource adequacy unit, it would be double counting to include both the original resource adequacy capacity and the back-up capacity in the native load reservation. Moreover, If the purpose of the non-resource adequacy agreements is to meet a planning reserve margin, it is improper to take the higher value over different years. This issue is illustrated in the following table:

|

|

Year 1

|

Year 2

|

CAISO Proposal

|

|

RA

|

15%

|

17%

|

17%

|

|

Non-RA

|

5%

|

3%

|

5%

|

|

Total PRM

|

20%

|

20%

|

22%

|

The DFP does not include a discussion of the relationship between the purpose of these non-resource adequacy agreements and why it is just and reasonable to take a higher historical value among the two products across two years as a projection of future planned need.

As to the load growth reservation, it is important to note that the CAISO is only looking 12-months ahead. A transmission provider may reserve in its calculation of ATC transmission capacity necessary to accommodate native load growth reasonably forecasted in its planning horizon. However, the transmission provider is obligated to provide transmission service to others under the pro forma tariff out of capacity reserved for native load growth up to the time the capacity is actually needed for such future needs.[3] Furthermore, in Arizona Public Service Co. v. Idaho Power Co., FERC noted the distinction between setting aside ATC for current uses of the system (which require owned or contracted for designated network resources and future uses of the system (which do not). The Commission held that “[n]ative load growth may be considered by the transmission provider in its calculation of its ATC, so long as the claimed load growth is reasonably forecasted and is supported by a reasonable plan for network resources to meet that native load growth.”[4] Here the CAISO is reserving capacity for native load growth in both the short-term and long-term horizons, but has not required any forward planning requirement by CAISO LSEs as to how much capacity will be utilized in the future. As shown in Appendix 1, resource adequacy imports through Malin decreased from 1,981 MW in September 2021 to 1,751 MW in September 2022, while imports through NOB decreased from 1,092 MW to 1,083 MW across the same timeframe. It is not enough to say the CAISO’s load is growing. Rather there has to be a showing as to what resources will be used to meet that new load. In the LSE’s resource adequacy showings required one year in advance, the LSE must demonstrate 90% of its resource adequacy showings and must provide the remaining resource adequacy showings 45-days out. These showings could be used for native load reservations. If the CAISO wants to use non-resource adequacy resources as well, a showing will need to be developed to appropriately reserve transmission.

NV Energy notes that in September 2022, when the CAISO hit its all-time peak of 50,061 during a one in 25-year event, the CAISO flowed up to 200 MW of high priority wheels at Malin. Now, CAISO proposes that for September 2024 based on a showing of the contracts reserved for 2021 and 2022 there is negative 261 MW of oversubscribed utilization on the path. The DFP does not provide sufficient justification for these future restrictions on wheel-through transactions.

[1] Nev. Power Co., 145 FERC ¶ 61,237, P 43 (2013).

[2] Nev. Power Co., 145 FERC ¶ 61,237, P 47-48 (2013).

[3] Order No. 888, FERC Statutes and Regulations, Regulations Preambles January 1991-June 1996 P 31,036, at pp. 31,693-94; and Order No. 888-A, FERC Statutes and Regulations P 31,048, at pp. 30,219-21.

[4] Arizona Public Service Company v. Idaho Power Company, 87 FERC ¶ 61,303 (1999), on reh’g 89 FERC ¶ 61,061 (1999) at 61,203.

3.

Provide your organization’s comments on the proposed methodology for deriving the native load needs, including load growth as described in section 6.1.2.2:

See discussion in response to Question 2. In addition, the DFP contends, “transmission providers do not leave load unserved when calculating ATC if there is not a supply contract in place; rather, they make reasonably informed assumptions based on historical information as to where supply is likely to be contracted.” NV Energy disagrees with this statement. As explained earlier, FERC in the Arizona Public Service case found that near-term ATC is based on resources under contract while future capacity can be reserved based on a future plan. Furthermore, if that plan understates native load needs and the transmission is reserved by a third party before the assumption can be corrected, the OATT transmission provider is not permitted to “true-up” its assumption and have an equal curtailment priority to the third-party customer who acquired the ATC. NV Energy does not agree either with ATC methodology that the CAISO has presented, or the curtailment priorities that CAISO has placed on transmission.

4.

Provide your organization’s comments on the proposed methodology components for deriving the transmission reliability margin (TRM) as described in section 6.1.2.3:

See the response to Question 7.

5.

Provide your organization’s comments on the proposal to annually evaluate internal transmission network impacts as discussed in section 6.1.3:

The DFP proposes to conduct an annual assessment, through a power-flow analysis, leveraging existing studies, to test ability of CAISO’s system under different conditions to support imports and wheels throughs. The CAISO’s recent assessment of heat wave events suggests internal transmission network constraints generally do not pose an impediment to supporting wheels through or exports from the system while at the same time serving native load in peak conditions when northern generation is dispatched to serve northern load while southern generation dispatched generally to serve southern load. The proposal appears consistent with FERC precedent. The Commission has indicated a preference for quantitative evidence like a load flow analysis that will permit transmission customers to understand and independently evaluate the transmission provider’s reservation pursuant to its native load priority.[1]

In Appendix 1 of the DFP, the CAISO includes sample ATC calculations based on 2021 and 2022 data. The table indicates that 1,200 MW of ETCs would be set aside during the summer months at Malin. The CAISO should identify: (1) what entities hold these 1,200 MWs of ETC rights, (2) how often these rights are fully scheduled, and (3) who controls the potential resale of these rights. Importantly, the CAISO should explain the priority associated with potential use of these rights. For example, as asked above, does a wheel using ETC capacity at Malin carry with it associated firm transmission rights to Mead at a priority equal to ATC acquired from CAISO? In other words, is this ETC capacity able to be redirected to a different Point of Delivery with the same level of firmness associated with the original ETC contract path?

[1] See, e.g., Nev. Power Co., 145 FERC ¶ 61,237 at P. 40 and note 57. See also Am. Elec. Power Serv. Corp., 101 FERC ¶ 61,384, 62,597-58 (2002); Nev. Power Co., 97 FERC ¶ 61,324, 62,493 (2001).

6.

Provide your organization’s comments on the proposed approach for accessing ATC to establish wheeling through scheduling priority, including the contractual requirement, reservation windows and competition process, as described in section 6.1.4:

The proposed monthly process establishes a two-week window each month during which entities can submit wheeling requests. The CAISO will prioritize requests based on the power purchase agreements that utilize more hours during the ATC horizon. In the monthly horizon the minimum requirement for establishing scheduling priority would be a 6x4 supply contract.

For the daily process, the CAISO would hold a five-hour window every day, from 7:00 a.m. to 12pm.[1] In in the daily horizon the minimum requirement is a 1x4 (one day, four hours) supply arrangement, but it could span multiple days across the seven-day horizon for which ATC is calculated. The entity requesting wheeling would need to demonstration it had an executed firm power supply contract to serve external load or a firm power supply contract to serve external load where execution is contingent upon the availability of wheeling through scheduling priority on CAISO’s system. NV Energy would like to confirm that firm transmission service awards would be included in the EDAM market results that are published the day ahead at 1pm. If not, the CAISO will need to work on making the two processes align such that transmission can be reserved for resource sufficiency prior to the day ahead market run.

An entity with a monthly or daily wheeling through priority must notify the CAISO immediately if the supply contract supporting the wheeling through priority is terminated or modified such that the quantity, import point, or export point changes. CAISO’s DFP states that, under these circumstances the wheeling through priority would terminate. This may be too harsh an outcome in the case of a contract modification that reduces the quantity or duration, but does not alter the points of receipt and delivery, especially if the CAISO is proposing to continue to assess the wheeling access charge based on the parameters of the original power purchase agreement. A better approach in this situation may be to reduce the ATC reservation to accord with the revised agreement and make the remainder of the transmission capacity available for use by others. This is similar to allowing the resale of a non-refundable airline seat because the passenger didn’t show up.

[1] The DFP says “12:00 am” on page 29. Presumably, this is a typo.

7.

Provide your organization’s comments on the proposed application of scheduling priorities in the post-HASP process as described in section 6.1.5:

The DFP states,

If the amount of estimated transmission capacity set aside for native load and load growth needs at a specific intertie is greater than the actual contracted import supply by LSEs to serve load, as represented by monthly RA plans showings and showings of non-RA contracted imports at T-30 (30 days ahead of the month), the excess transmission capacity will be released as ATC and available for reservation. However, if the opposite is true and the amount of transmission capacity set aside for native load and load growth at an intertie is less than the contracted import supply (RA and non-RA), including the margins for uncertainty, if there is any remaining ATC at that intertie that has not been reserved, it will be reduced to make up this deficit or difference. If there is no remaining ATC at an intertie because it has been reserved in advance, then the set aside for native load will remain as originally calculated, and the ISO will continue to honor the scheduling priority of wheel through transactions for which ATC has been reserved in advance to the extent a grid or market condition arises that requires application of market scheduling priorities. [emphasis added]

This is consistent with the approach under an OATT in which the transmission provider’s merchant function can reserve additional ATC if it is available but cannot displace prior-in-time firm reservations of third parties, even if the merchant needs additional transmission capacity to serve native load. Yet, the CAISO’s proposed HASP process appears to contradict this critical prioritization. The DFP starts off reasonably:

- To the extent there are constraints affecting individual interties such that these trigger a market infeasibility, and all schedules cannot be accommodated, scheduling priorities become relevant.

- In the Hour Ahead Scheduling Process (HASP), the market will seek to adjust economic schedules and low priority self-schedules.

Then the concerns begin to arise:

- If additional relief is needed, through the post-HASP process the market will seek to adjust high priority wheeling through transactions serving CAISO load on a pro-rata basis. Effectively, an allocation of limited transmission capacity on an intertie between high priority wheels and ISO load transactions.

As noted above this situation should only arise in the case of a transmission outage or derate and not as a means to address resource insufficiency. However, then the DFP goes off in a direction inconsistent with the protection of the first-in-time reservation priority – when determining the pro rata allocation, the DFP’s post HASP process would not only consider the forward resource adequacy and non-resource adequacy capacity held out from the ATC originally available to non-CAISO wheeling parties, but also: (1) resource adequacy imports and non-resource adequacy contracted imports as derived at the T-30 timeframe, as a representation of contracted imports to serve load; and (2) CPM import volumes.

Stated another way, the CAISO’s proposal would harm the firm service and higher curtailment priority of the non-California entities reserving transmission on the ATC that was available after the CAISO had taken its native load allotment, and after the CAISO had taken its load growth set aside, and after the CAISO had applied its 6percent TRM to protect against aggregate load forecast uncertainty, forecast uncertainty in transmission system topology (including planned and unplanned transmission outages), and variations in generation dispatch (for variations in generation dispatch driven by resource outages or other conditions recognizing that in some circumstances, supply may need to be replaced or additional supply brought into the system to meet the changing needs).

All transmission providers face the risk that a situation may arise beyond their original plans, but that possibility does not permit them to raise the curtailment priority of lower-tiered conditional firm or non-firm service to native load. The CAISO LSE’s additional 30-day showing or the CAISO CPM can have high priority curtailment protection up to the level of capacity set aside for the TRM, but not higher.

For example, in June 2021, The California Public Utilities Commission and the California Energy Commission jointly requested CAISO to use the CPM authority, which resulted in the procurement of 624 MW in July, 650 MW in August, and approximately 400 MW for September. These purchases, coming after the monthly allotment process, should not be included any pro rata curtailment allocation with high-priority wheels. The only pro-rata allocation in the event of a transmission derate should be based on the original ATC calculation. Any CPM capacity procured above the amount reserved for native load (including the TRM set aside) would need to be curtailed first. Only if additional transmission needed to be curtailed would there be a pro rata allocation between the firm wheeling customer and the previously-reserved native load reservations.

In addition, the CAISO should confirm that load biasing will have no effect on the wheel-through curtailment priority. Load biasing is not a derate or change to a system condition that can lead to pro rata reduction of transmission right.

Transmission curtailment priorities are of critical importance at the most critical time of stressed system conditions. In the quotation citied above, Idaho Power had it exactly right, abandoning the concept of reliance on first-in-time firm transmission reservations “is a slippery slope that jeopardizes inter-BA comity and interconnected reliability.”

8.

Provide your organization’s comments on the proposed process for establishing long-term scheduling priority and the study and expansion process, including whether the funding entity should receive transmission credits as they take service or potential eligibility for congestion revenue rights (CRR), as described in section 6.1.6:

The DFP contains a process where entities seeking to establish wheeling through scheduling priority for one-year or longer can submit a request for a study. The CAISO proposes to study such requests in a cluster with other transmission and generator interconnection requests using the Generator Interconnection and Deliverability Allocation Procedures (GIDAP). The CAISO notes that the GIDAP study process includes a reliability study of generation interconnection requests, a deliverability study identifying the necessary upgrades for the generation projects seeking deliverability, and a deliverability allocation process for generators seeking deliverability. The requests for long-term wheeling through scheduling priority would not be part of the reliability study of generation interconnection requests, but it would be part of the deliverability study and deliverability allocation process.

This approach raises a number of questions. First and foremost, what is the backlog of CAISO’s generator interconnection queue and how will a study of new generator deliverability account for the projects that will never be built? Second, how will the CAISO ensure that the transmission study, especially for more limited requests for service in a shorter 18-to-24 month timeframe, are processed in a manner that can promote efficient resource planning by external parties?

For example, Appendix 1 shows based on 2021 and 2022 data the ATC at NOB runs from a high of 1,009 MW in June to 329 MW in September. What would happen if:

- A CAISO LSE entered into a two-year PPA for 50 MW to be delivered at NOB. Would the request need to be studied? Would it be assumed to be part of the existing native load holdback? If the CAISO LSE entered into the PPA in September 2024, could it be reflected in the resource adequacy plans for 2025?

- What if NV Energy entered into a PPA for 50 MW to be delivered at NOB. Would the request need to be studied, even if the ATC is well below the historical usage? How and when would the study be performed? When would the ATC be confirmed? If NV Energy entered into the agreement in September 2024, would the analysis be completed by January of 2025?

With respect to the study of a long-term request, the CAISO writes on page 32 of the DFP that, “[w] heeling transactions across the [CA]ISO transmission system can adversely impact the deliverability of internal generation and imported generation that is serving [CA]ISO load. This impact is of primary concern during resource shortage conditions.” This statement appears contradictory to the conclusion early on page 24 of the DFP:

the [CA]ISO’s recent assessment of heat wave events suggests internal transmission network constraints generally do not pose an impediment to supporting wheels through or exports from the system while at the same time serving native load, including in more stressed system conditions. This seems to be the case in part because during peak conditions where there is internal congestion and internal generation is committed and dispatched for local area purposes – northern generation is dispatched to serve northern load and solve local area congestion while southern generation dispatched generally to serve southern load and solve local area congestion on the system – reducing north to south flow and limiting the risk of congestion or overloading through the middle of the system, including path 26 under various stressed system conditions that impedes the ability to serve load in an area due to competing wheel through uses of the system.

The CAISO should reconcile these statements and provide additional detail on the study process, especially how transmission capacity associated with new generators impacts the overall needs.

If a transmission upgrade is needed to accommodate the requested transmission service, the DFP offers several paths with respect to potential cost allocation for the upgrade. If, after releasing the Phase II study, the CAISO identifies the upgrade as a reliability, economic, or public policy transmission project under the CAISO Tariff, the CAISO will reimburse the facility study cost and proceed to construct the project under its competitive transmission development process, with the costs being rolled-into the transmission access and wheeling access charges. This approach is consistent with how transmission upgrades are handled under the OATT. For example, NV Energy did not require transmission customers to securitize the initial costs of the Greenlink project as those facilities were identified as needed as part of NV Energy’s own transmission planning process.

If the CAISO does not approve the proposed upgrade under its planning criteria, the transmission customer or some other entity can choose whether to proceed and will need to fund the upgrade to receive firm transmission service on a long-term basis. Under this path, the CAISO recognizes the transmission customer must be reimbursed once the upgrade is completed and provides benefits not only to the transmission customer who paid the initial cost, but also to CAISO’s other customers as part of the integrated transmission system.

If there is no PTO that steps forward to fund and develop the project, FERC’s pricing policy requires transmission customers to initially fund network upgrades. The customer is then entitled to a cash equivalent refund equal to the total amount paid for the network upgrades. Under this policy, the transmission provider must pay the total amount that the transmission customer paid for network upgrades as credits against the customer’s payments for transmission services. The period for reimbursement may not be longer than the period that would be required customer paid for transmission service directly and received credits on a dollar-for-dollar basis, or 20 years whichever is less. CAISO’s proposal to utilize CRRS would seem inconsistent with this policy, especially as the value of the CRR would presumably be less due to the incremental transmission capacity made available by the upgrade.

NV Energy would like to confirm that if a third party does choose to fund the upgrades and develop the project, that the firm transmission service will be granted for the life of the power purchase agreement, subject to renewal. It is inequitable to believe that a third party could fund an upgrade and later, the CAISO could take the capacity for native load usage while the contract is still in place.

9.

Provide your organization’s comments on the proposed framework for compensation for wheeling through scheduling priority as described in section 6.1.7:

The DFP proposes that entities obtaining wheeling through scheduling priority pay the wheeling access charges for the month(s) or day(s) across which ATC is reserved based upon the energy delivery timeframes of the underlying power supply contract. Currently, CAISO LSEs only pay the transmission access charge based on the MWs of energy they actual schedule and deliver. It is an energy charge and not a demand charge. Thus, CAISO is converting a rate devised as an energy charge and utilizing it on a demand basis for the external parties. That having been said it is better that the wheeling demand charge apply only to the potential hours of delivery based on the underlying power purchase agreement than on a 24/7 basis.

Powerex

Submitted 01/04/2023, 04:20 pm

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 draft final proposal and December 16, 2022 stakeholder call discussion:

Powerex submits the following comments on the CAISO’s December 9, 2022 Transmission Service and Market Scheduling Priorities Phase 2 Draft Final Proposal (“Draft Final Proposal”), as further discussed at the December 12 meeting of the CAISO Market Surveillance Committee and the December 16 stakeholder meeting in this initiative.

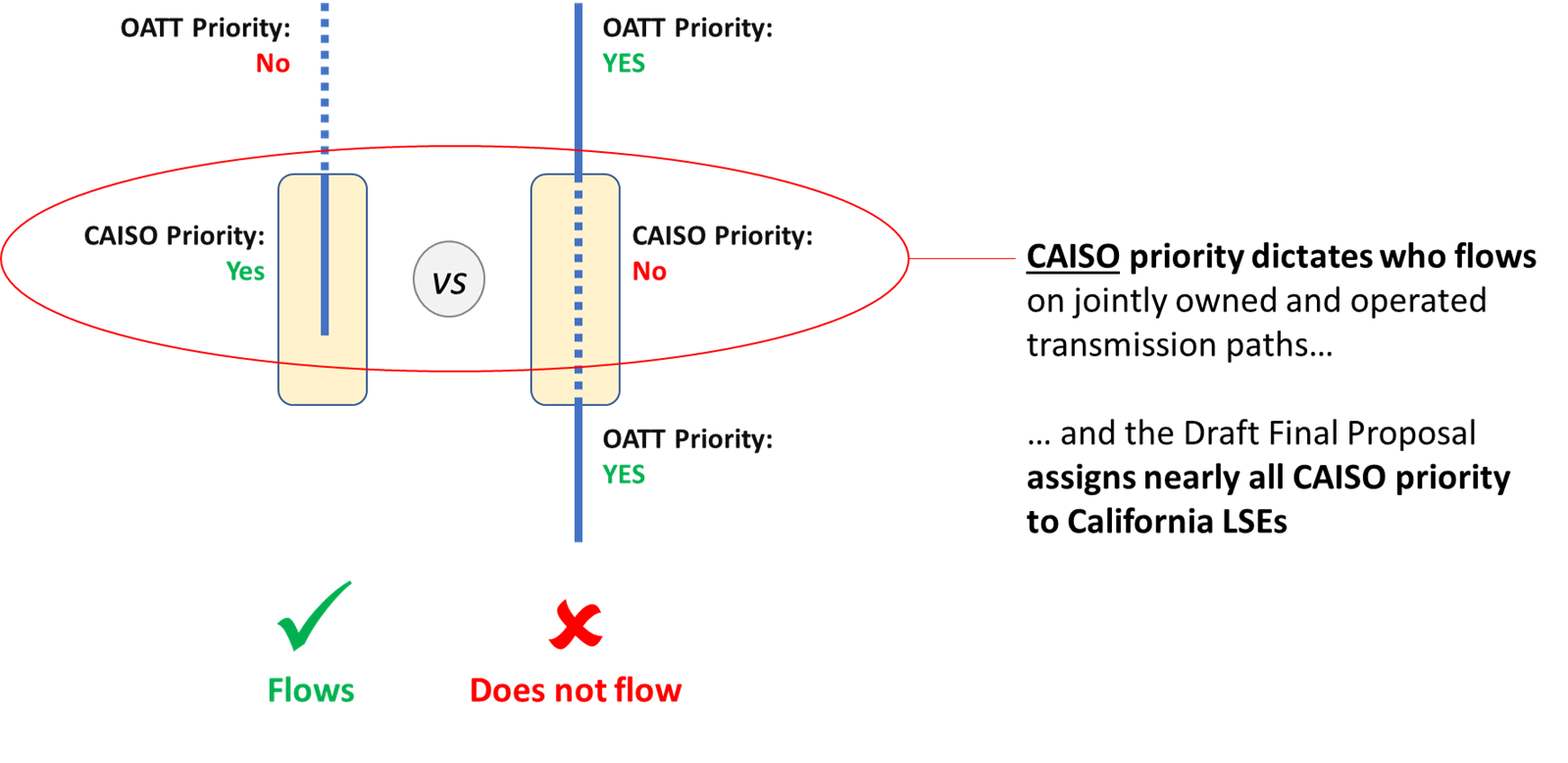

Powerex strongly opposes the approach that the CAISO has elected to pursue in this initiative. The Draft Final Proposal does not represent a framework for providing open access to the CAISO-controlled grid. Instead, the Draft Final Proposal will further extend the CAISO’s preferential allocation of transmission service on the jointly owned and operated Pacific AC and Pacific DC interties to California load-serving entities (LSEs), shielding them from having to compete with Southwest entities for external available supply and from having to compete to obtain priority transmission service on external systems.

This highly problematic outcome results from:

- CAISO market rules, which award schedules on CAISO’s share of the Pacific AC and Pacific DC interties without requiring a complete source-to-sink delivery path. In contrast, external transmission providers do not approve a delivery schedule on their systems without a complete path. This makes receiving a CAISO market schedule the determining element for which entities are able to flow on the jointly owned and operated Pacific AC or Pacific DC interties.

- The Draft Final Proposal would preferentially grant to California LSEs priority in receiving a CAISO market schedule on the CAISO’s share of the Pacific AC and Pacific DC interties, ahead of other market participants seeking CAISO market schedules to deliver supply on these same joint facilities but to serve load outside the CAISO BAA.

In short, the CAISO market rules ensure that CAISO scheduling priority is the priority that matters most, and the Draft Final Proposal will grant that priority preferentially to California LSEs to the greatest extent possible, inconsistent with the principles of open access.[1] The outcome of the Draft Final Proposal will be that California LSEs will have priority not only on the CAISO’s share of the jointly owned and operated Pacific AC and Pacific DC interties, but on the entire jointly owned and operated paths, including on segments where California LSEs have not procured firm OATT rights. The Draft Final Proposal amounts to an effort to bypass the service priority established under the OATT by external transmission service providers, particularly on the Pacific AC and Pacific DC interties, for the benefit of California LSEs and at the direct expense of:

- External transmission service providers and their ratepayers;

- Northwest physical suppliers seeking a competitive market for their supply; and

- Southwest load serving entities seeking to compete for Northwest supply.

The CAISO has already applied some of these preferential elements under the interim approach it put in place days before the start of summer 2021. This interim approach gave California LSEs priority transmission rights to schedule energy imports for their executed Resource Adequacy contracts (without requiring any identified source or any external transmission rights), and has been highly divisive, with many entities outside California opposing it at FERC. The CAISO claimed that prioritizing access for CAISO loads was critical to maintaining reliability in the CAISO BAA going into the summer; it was argued that there simply was no time for a fulsome stakeholder process to develop more carefully considered approaches.[2] Approval of the admittedly controversial interim approach, CAISO claimed, would give the CAISO and all stakeholders the time needed to develop an appropriate and durable long-term solution.[3]

A broad cross-section of stakeholders, including Powerex, have participated in this initiative with the hope that a long-term framework would be developed that eliminates the more problematic elements of the interim approach, and provides access to CAISO transmission service on a comparable basis to the open access enjoyed by California LSEs on other transmission providers’ systems. Under a comparable approach, the CAISO would provide transmission priority to California LSEs similarly to how external transmission service providers under the OATT provide firm service to native load customers in their areas. Namely, a California LSE would receive CAISO scheduling priority if:

- The California LSE had built or contracted to receive the output of an identified external resource, including transmission service to the CAISO boundary (i.e., comparable to network service for delivery of a designated network resource under the OATT); or

- The California LSE had successfully competed for that scheduling priority through an open access process that includes competing requests from entities seeking to wheel-through the CAISO grid to serve external load (i.e., comparable to the open access process for procuring point-to-point service under the OATT).

In both cases, the granting of priority transmission service is the result of competition: either competition to procure external supply delivered to the CAISO border, or competition to directly procure transmission rights on the full transmission path, including scheduling priority on the CAISO grid. Stakeholders have put forward proposals that would achieve this comparable open access, and that would appropriately respect transmission priority on all systems.[4] The CAISO has repeatedly ignored these concerns and proposals, without even engaging in substantive discussion on the merits.

Rather than develop a long-term framework that addresses the most controversial elements of the interim proposal, the CAISO appears intent on pushing through a Draft Final Proposal that effectively doubles down on the CAISO’s views of which customers should have access to flow on jointly owned and operated regional transmission paths, particularly the Pacific AC and Pacific DC interties. Contrary to the open access principles applied elsewhere in the west, the Draft Final Proposal largely shields California LSEs from having to compete for external supply, external transmission and CAISO transmission access. Specifically, under the Draft Final Proposal: