1.

Please provide a summary of your organization’s comments on the final proposal:

Oppose with caveats

Vistra opposes the CAISO presenting the storage Default Energy Bid (“storage DEB”) for approval by its Board of Governors as detailed in the Final Proposal and the more detailed description in the Final Proposal on Energy Storage and Distributed Energy Resources.

In our polled response we note that our opposition is with caveats. Vistra opposes the CAISO’s proposed formulation described in its October 22nd Final Proposal unless the following revisions to the formulation and policy are adopted:

- Applies mitigation to any storage resource regardless of size if it fails the market power mitigation test and mitigates to its Default Energy Bid type based on its ranking.

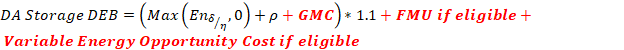

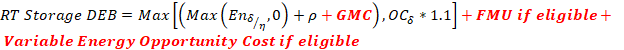

- New Default Energy Bid option for a Storage Default Energy Bid revised to[1]:

Where:

Estimated cost for resource to buy energy as function of duration and round-trip efficiency.

Estimated cost for resource to buy energy as function of duration and round-trip efficiency.

Energy duration as registered in Master File.

Energy duration as registered in Master File.

Round-trip efficiency as registered in Master File.

Round-trip efficiency as registered in Master File.

Custom Operations & Maintenance adder negotiated with the CAISO and registered in Master File as specified in Business Practice Manual Market Instruments Section 4.1, Page 47, and detailed in CAISO Tariff Section 39.7.1.3.2.2. where for storage custom O&M cell degradation costs are appropriate.

Custom Operations & Maintenance adder negotiated with the CAISO and registered in Master File as specified in Business Practice Manual Market Instruments Section 4.1, Page 47, and detailed in CAISO Tariff Section 39.7.1.3.2.2. where for storage custom O&M cell degradation costs are appropriate.

Daily opportunity cost as function of duration.

Daily opportunity cost as function of duration.

GMC Grid Management Charge adder pursuant to Section 39.6.1.6.4.

FMU Frequently Mitigated Unit adder pursuant to Sections 39.7.1.4 and 39.8.

In Vistra’s comments on the Storage Default Energy Bid Draft Final Proposal issued on September 15th we requested the CAISO update its proposal so that the storage DEB option would include expected costs and have access to other risk mitigation tools that the CAISO makes available today to DEB options for multiple other resource types. We reiterate the rationale for our opposition to a proposal that does not accommodate the following in its formulation of a mitigated price for storage resources:

- Grid Management Charge (“GMC”) adder[1] will apply across the full output: Storage will incur GMC costs across the full output range of the asset, so the GMC adder should be included in its DEB across all segments. Vistra would like to emphasize for CAISO that the storage DEB proposed is a cost estimate similar to the variable cost option and similarly should include costs the resource is expected to incur. The GMC is included in both natural gas and non-natural gas resources’ variable cost option DEB pursuant to Tariff Section 39.7.1.1.

- Frequently Mitigated Unit (“FMU”)[2] adder will be included, if eligible: FMU adder is eligible to any Frequently Mitigated Unit today that meets the CAISO’s criteria included in Tariff Section 39.8. We reiterate that since storage DEB is a cost-based DEB it should be treated similarly to the variable cost option cost-based DEB. Any storage resource that meets the criteria, including the mitigation frequency criteria, should have its mitigated price formulated with the FMU adder even when electing the storage DEB.

- Variable Energy Opportunity Cost[3] will be included, if eligible: Daily limitations are likely to be the majority of limitations on storage resources initially, but this may be in some instances a function of storage operators translating longer term limitations into daily limitations. Additionally, as storage technology development continues and a greater variety of technical configurations become operational, storage resources may be subject to longer term limitations. Vistra believes it is appropriate to allow storage the ability to seek use limited status and any associated Variable Energy Opportunity Cost for limitations that span beyond a single day. It is appropriate so that if the longer-term limitation can be supported, then the storage operator will have equivalent access to existing CAISO processes. Further, we reiterate the principle that the storage DEB is a cost-based DEB and should have access to include the adders that the variable cost option DEB has access to including the Variable Energy Opportunity Costs.

Vistra appreciates the work that CAISO has put into developing this new Default Energy Bid option for a more robust cost-based approach to valuing storage resources expected costs. However, it is unclear how valuable the proposal will be if it excludes from this cost-based DEB for storage the above detailed mechanisms available to improve the valuation of the existing cost-based DEB, variable cost option. Vistra continues to believe that the Opportunity Cost for the daily duration limitation could be improved by using the average of the nth highest hour evaluated or the n-1th highest hour because it would better mitigate forecasting error in this component. However, we understand that compromises are needed to move forward in this effort. We appreciate the CAISO requesting stakeholders be open to evaluating the success of its proposed method for the Opportunity Cost before seeking a different approach. Vistra can support the CAISO’s proposed method for the Opportunity Cost. However, we cannot support the proposal without the revisions described above and respectfully ask the CAISO to revise its proposal accordingly.

[1] CAISO Tariff, Section 39.6.1.6.4.

[2] CAISO Tariff, Sections 39.7.1.4 and 39.8.

[3] CAISO Tariff, Sections 39.7.1.1.3.

[1] Vistra requested revisions to the storage DEB formulation shown in bold red font or bold black font where the CAISO proposed formulation is shown in black font.

3.

Provide your organization’s comments on the exemptions from the mitigation for small resources:

Vistra does not support the CAISO’s proposal to exempt storage resources 5 MW or below (“small”) from market power mitigation. We understand from the CAISO’s written proposal and the discussion at the October 29, 2020 stakeholder meeting that the primary concern raised by the Market Surveillance Committee (“MSC”) was a concern for small resources “that an inaccurate default energy bid could potentially be harmful to those resources” and that “small resources may not have the ability to exercise market power”.[1] We do not agree that the concern raised is reasonable or sufficient to support a need for preferential treatment that could unduly discriminate against other resources.

As explained in our prior comments and at the stakeholder meeting, Vistra views this proposal as imposing differential treatment on similarly situated resources. By proposing to treat a certain class of resources differently, CAISO is proposing to create two classes of storage resources for applying mitigation that introduces asymmetry to the rules in a way that provides preferential participation rules to a specific class over another.

Vistra understands the basis for the CAISO and MSC concerns that the new rules may (1) over mitigate and (2) storage DEB could be inaccurate. We disagree that these concerns are unique to “small” resources as defined by the CAISO. This same risk would be held by 6 MW storage resources, 100 MW storage resources, or even 4 MW gas turbines. In fact, the concerns about over mitigation exacerbated by the potential inaccuracy of the variable cost option has been vetted repeatedly in CAISO’s stakeholder processes on mitigation, mitigated prices, and bidding flexibility since Market Redesign and Technology Upgrade go live. To address these concerns, the CAISO includes a Frequently Mitigated Unit Bid Adder as described in CAISO Tariff Section 39.8. Market participant eligibility for a FMU Bid Adder for the next operating month is based in part on if in the previous twelve months its mitigation frequency is greater than 80 percent. The Tariff Section 39.8.3 further specifies that the FMU Bid Adder will either be “a unit-specific value determined in consultation with the CAISO; or (ii) a default Bid Adder of $24/MWh.”

To put a fine point on it, the risks raised by the CAISO and MSC are inherent in CAISO’s mitigation design regardless of the DEB option selected. The responsibility for managing these risks is placed on market participants. This proposal inappropriately removes tools that increase market participants’ ability to mitigate these risks from one type of resource without sufficient justification.

[1] Final Proposal Energy Storage and Distributed Energy Resources – Storage Default Energy Bid, California ISO, October 22, 2020, Page 11, http://www.caiso.com/InitiativeDocuments/FinalProposal-EnergyStorage-DistributedEnergyResourcesPhase4-DefaultEnergyBid.pdf.