1.

Please Include redlined comments in the word version of the tariff language posted on the initiative webpage and attach below.

CPUC staff appreciates the opportunity to comment on CAISO’s revised final proposal posted on April 15th and draft tariff language posted on April 8th and appreciates the changes that have been made with regarding to PT wheel through transactions related to real-time submissions. The major revisions included in CAISO’s April 15th draft include the following:

-

CAISO removed the firm cut-off date to register PT wheeling transactions (proposed to be April 23 or the date of the FERC filing) and changed the process to allow PT wheeling transactions to register on an on-going basis (June 29 for July and August and 45 days before the month until June of next year).

-

CAISO changed the post-HASP process to allocate only between RA imports and PT wheels, rather than RUC imports (including RA and non-RA transactions) and explained that it would run the post-HASP process if it could not support load or all of the PT wheeling transactions.

-

CAISO changed its tariff language to allow VERS to support PT exports, where previously this was not allowed.

CPUC staff opposes these changes, as they could lead to additional reliability concerns this coming summer. CAISO also changed the PT export requirement that the scheduling coordinator needs to positively affirm that it can support a PT export to requiring the scheduling coordinator to notify CAISO if it is not able to support the PT export. CPUC staff does not oppose this change, but seeks clarification that the masterfile flag defaults to “no” (cannot support a PT export) and that a PT export with a masterfile flag set to “no” cannot support a PT export.

In addition, CPUC staff reiterates comments made previously regarding this initiative:

CPUC staff recognizes that California is interconnected to the entire Western electric grid and, as such, must work with neighboring balancing authorities and must treat in state and out of state entities fairly when it comes to access to the bulk transmission grid. We appreciate the challenges the CAISO faces in ensuring equal access to entities that are either exporting from California, or wheeling through California, while also meeting its obligations to provide reliable service to the load within the balancing authority. However, we are concerned that in some circumstances the proposals will unnecessarily increase the risks to California load.

CPUC staff is concerned that the existing and proposed rules prioritize exports and wheels over native load and, if allowed to continue, will seriously jeopardize reliability in the state and undermine the resource adequacy and transmission planning processes. To this end, CPUC staff agrees with the CAISO, the IOUs and other parties that ultimately a durable solution will need to be developed and ask the CAISO to make further development of these rules a priority.

CPUC staff is particularly concerned about this issue because of the uncertainty of the magnitude of wheeling transactions. If wheel throughs are limited to a few hundred MWs, the challenge would be manageable this coming summer, but staff is concerned that wheeling transactions could approach thousands of MWs. For example, during the 2020 August stressed system conditions, the CAISO system was exported 4,000 - 5,000 MW, primarily to the Southwest. CPUC staff agrees that that recent actions by the CAISO have foreclosed this risk going forward but, we are concerned that these export transactions during tight system conditions will migrate to wheeling transactions. CPUC staff’s concern is further exacerbated by the fact that entities wheeling through the state do not need to reserve this space in advance, nor pay for the entire month or schedule every day. Thus, there is little visibility regarding the magnitude of the issue and little opportunity to plan for and address it, should it arise.

Further, given that prices are now considerably higher at Palo Verde (in the south) than at Malin (in the north), CPUC staff expects that this could further increase wheeling transactions and, as a result, displace California resource adequacy import contracts for energy and the movement of energy from northern California (where there is typically excess generation) across the constrained transmission system to southern California. In other words, CPUC staff is concerned that the use of the California transmission system to move power from the Northwest to the Southwest could use valuable transmission space and crowd out use by Californians themselves and thereby jeopardize reliability this coming summer.

Finally, CPUC staff is concerned that any number of entities could indicate that they have signed a contract to obtain PT wheeling status to reserve space, but that these contracts could be provisional or have no penalty provisions, because there are no clear requirements or upfront costs. Thus, it seems possible that CAISO could give PT wheeling status to many entities for large quantities of MWs, which may or may not materialize in the operational space and, if they do, would be given priority over load in all instances, except when there is load shedding in which case they would be given a pro rata allocation, to the detriment of reliability for California customers.1

In addition, for situational awareness, CPUC staff had encouraged CAISO “to request that parties provide information on the wheeling transactions that are signed as of the date of the FERC filing as soon as possible to allow for coordinated planning for this coming summer.” However, in the latest iteration of its proposal, CAISO has moved the filing date back for PT wheeling transactions for July and August to June 29th, and now proposes to allow additional PT wheels to be nominated on a monthly basis. CPUC staff continues to support a firm cut-off date for PT wheeling status, as explained further below. At a minimum, however, RA imports are specifically limited by CAISO’s maximum import capability (MIC) process at each intertie point and CPUC staff requests that PT self-scheduled wheel through transactions be similarly limited.

The remainder of these comments focus on the changes made to the revised proposal and revised tariff provisions.

CPUC staff does not support moving the contract execution date for PT wheels from the FERC filing date to June 29 and allowing PT wheels on a continuing basis

CAISO removed the firm cut-off date to register PT wheeling transactions (proposed to be April 23 or the date of the FERC filing) and changed the process to allow PT wheeling transactions to register on an on-going basis (June 29 for July and August and 45 days before the month until June of next year). CPUC staff does not support this change.

CAISO’s initial rationale for the cut-off date was the following: “Several stakeholders commented they had secured imported energy to serve their load that they planned to import using wheeling schedules across the CAISO balancing authority area. They stated they had planned these transactions in reliance on the CAISO’s current treatment of wheeling schedules and that the approach outlined in the draft final proposal, without a forward process to procure transmission, would violate open access principles.” CAISO changed this proposed policy based on further stakeholder feedback “that requirements for CAISO imports and PT wheels were not balanced” and now proposes “to rather require such a contract by June 29, 2021, for July and August 2021, and 45 days prior to the month for subsequent months,” reasoning that “[t]he requirement for LSE procurement of monthly firm transmission shows an external LSE’s dependence on using the CAISO system to routinely serve its load, demonstrating a similar level of dependence and commitment as CAISO load serving entities.”

CPUC staff supports the notion that there should be some grandfathering provisions to account for paradigm shifts, but does not agree that it is appropriate to continue this practice through the critical summer months as it could lead to additional PT wheeling transactions, crowding out RA imports and jeopardizing reliability this coming summer. Further, CPUC staff notes that wheeling transactions during the tight system conditions last summer amounted to only about 300 MW, belying the notion that external entities have been relying on wheeling transactions to serve their load on a regular and continuing basis.

CPUC staff does not support the changes CAISO made to the PT wheeling requirements and suggests further tariff revisions

In its revised tariff language, CAISO has changed the requirements for PT wheels to seemingly reduce the stringency of these requirements.

Initial Tariff Language: Priority Wheeling Through Self-Schedule

A Self-Scheduled Wheel Through that is supported by (1) a firm power supply contract to serve load in another balancing authority area that was entered into prior to April 23, 2021, and (2) monthly firm transmission under applicable open access transmission tariffs, or comparable transmission tariffs, to deliver the Wheel Through Energy from the sink to the CAISO border during all of the hours covered by the firm power supply contract.

Revised Tariff Language: Priority Wheeling Through Self-Schedule

A Self-Scheduled Wheeling Through that is supported by (1) a firm power supply contract to serve an external load serving entity’s load for the entire calendar month and (2) monthly firm transmission for all the hours reflected in the power supply contract.

CPUC staff supports the initial tariff language, with the following modifications:

.png)

We note that some parties have proposed fairly lenient provisions that would seemingly allow any short-term transaction that could arise during tight system conditions to qualify, even contracts that are as of yet not executed. For example, IID noted the following in their comments:

IID’s concern goes to the phrase, “for the entire calendar month” with a potential, related concern as to the phrases, “monthly firm transmission” and “for all the hours.” These phrases suggest that the new definition of “Priority Wheeling Through Self-Schedules” does not contemplate partial month commitments. IID’s foreseeable monthly contracts for power supply that would need to be wheeled through the CAISO’s Balancing Authority Area (BAA) would not necessarily involve consistent supply each day of the calendar month. Were the CAISO to mean that an entity wheeling-through the CAISO be required to wheel consistently equal quantities day-to-day or more extreme, round-the-clock, such contracts would be infeasible for IID. In addition, IID wishes to ensure that it would subject to a Wheeling Access Charge only when the supply was actually intended to be scheduled as opposed to being charged Wheeling Access Charges for time periods that are not needed.

The CAISO may not intend the provision to be implemented in the ways outlined above, but for clarity, but IID requests that the CAISO modify the proposed Tariff language in the following or substantially similar manner:

Priority Wheeling Through Self-Schedule

A Self-Scheduled Wheeling Through that is supported by (1) a firm power supply contract to serve an external load serving entity’s load for during the entireapplicable calendar month and (2) monthly firm transmission for all the hours reflected in the power supply contract.

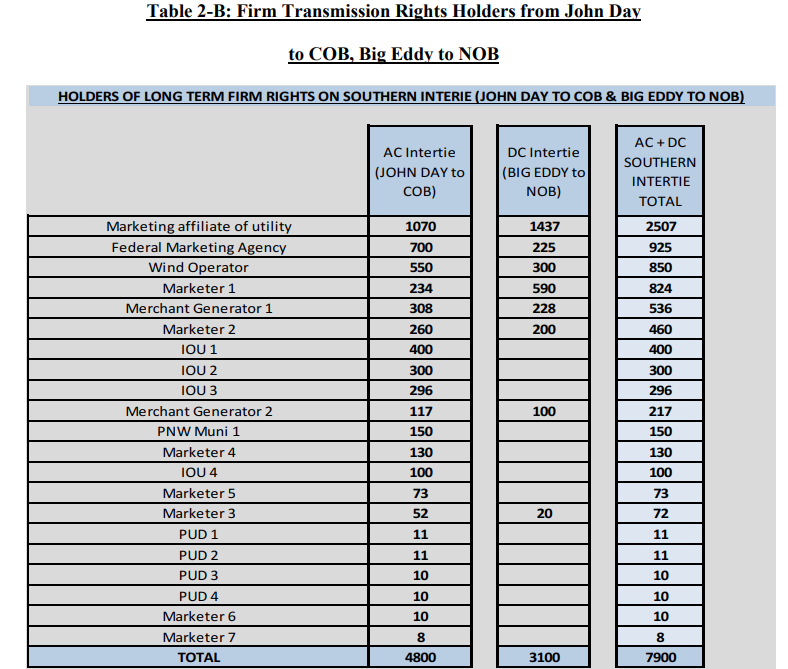

Further, the bar to have firm transmission would seem to be low because numerous entities have firm transmission to the CA border, as shown in the table below, which was submitted by Morgan Stanley in the CPUC’s proceeding.2 This suggests that significant quantities of PT wheel could be designated through CAISO’s process and crowd out RA imports needed to serve load during critical reliability events, thereby jeopardizing reliability this coming summer.

Post-HASP process needs further clarification and could still lead to real-time reliability issues

CAISO changed the post-HASP process to allocate only between RA imports and PT wheels, rather than RUC imports (including RA and non-RA transactions) and explained that it would run the post-HASP process if it could not support load or all of the PT wheeling transactions. CPUC staff does not support this change and recommends that the post-HASP process allocate to RUC imports (including RA and non-RA transactions) and wheels.

In addition, CPUC staff has identified several issues that require further clarification, including the following:

-

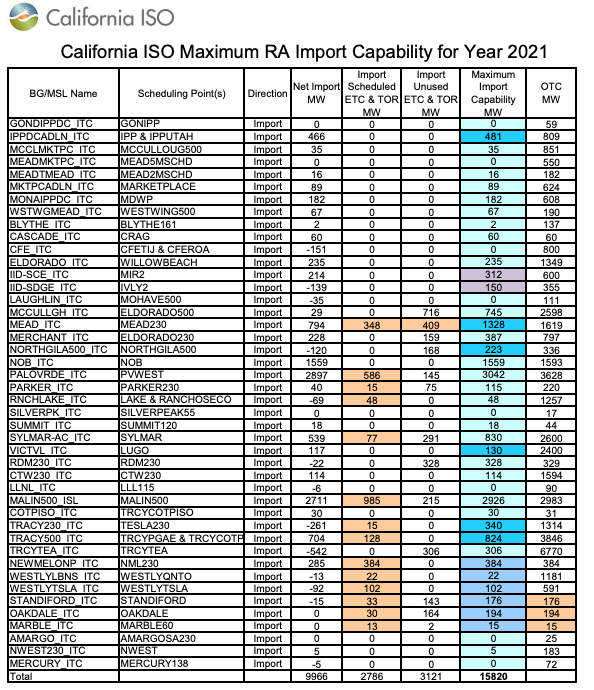

CAISO indicates that it plans to allocate import capability based on the post-HASP process. It would be helpful to clarify what CAISO means by import limit in its examples – is this total import capability or maximum RA import capability and is this after taking out ETCs and TORs? See figure below. Also, in CAISO’s examples, how could RA transactions ever exceed the import limit?

-

Does CAISO intend to limit PT wheels to the RA import capacity? If would seem inconsistent to limit RA transactions at a tie to seemingly feasible transactions, but not to limit PT wheels in the same fashion. For example, assume RA transactions at Malin are limited to 2000 MW due to the maximum import capability (and the existence of existing transmission contracts). Why would it make sense to allow PT wheels to attempt to schedule 4,000 MW across this tie? CPUC staff request that CAISO clarify this issue and limit PT wheels to the maximum import capability assigned to RA imports, since this will affect the post-HASP pro rata allocation ratios.

-

Does CAISO intend that the post-HASP process only occurs if day-ahead PT wheels or demand is infeasible or also if RT PT wheels or LPT wheels make the schedule infeasible? For instance, assume there is an intertie with 4,000 MW of capacity and 2,000 MW of non-RA import and 2,000 MW of PT wheels, and the schedule is feasible in IFM and RUC. If RT PT wheels do not make the schedule infeasible, this schedule would continue. If this is the case, what happens if an additional 2,000 MW of PT wheels come in the real-time and there are now uneconomic adjustments? Would the calculation be as follows: RA transactions/(RA transactions + wheels), so 0/(0+2000) = 0, so in this case, would 2,000 MW of day-ahead wheels get scheduled or would 4,000 MW of PT wheels? If it is the case that 4,000 MW of PT wheels get scheduled, then again CAISO would have an unexpected reliability issue in the real-time, precisely the outcome we are attempting to avoid. CAISO’s proposal attempts to address this by only including day-ahead wheels in this calculation, but this fails to take into account the interaction between real time wheels and RA bids. To address this, CPUC staff recommends that CAISO revert to its initial proposal, which includes RUC imports (including RA and non-RA transactions) in the post-HASP adjustment or only allow PT wheels that are scheduled in the day-ahead process.

The post-HASP process for allocating the scarce transmission across Path 26 should be revised

In its revised final proposal, CAISO indicates that it will use the following process for allocating Path 26 transmission capacity between load and PT wheeling transactions:

The administrative schedule adjustment process after HASP will also be applied for flowgate congestion, e.g., Path 26 north to south congestion, which results in uneconomic adjustments among generation/import schedules north of Path26 and high priority wheels southbound through Path26, and or under-generation power balance constraint relaxation because the load forecast south of Path 26 cannot be served. This administrative schedule adjustment for Path 26 north to south congestion is similar to the one applied for congested interties in the import direction if the problem is transformed as follows:

-

The Import Limit is the Path26 north to south limit.

-

The RA Bid/Self-Schedule is the sum of the RA bid capacity in HASP from all RA resources north of Path26 (generators, NGRs, and imports).

-

The PT Wheel Self-Schedule is the sum of all PT Wheel Self-Schedules from wheels that cross Path26 in the north to south direction.

-

The demand forecast of the PG&E TAC is subtracted from the RA Bid/Self-Schedule to yield the RA supply that competes with PT wheels for transmission capacity on Path26.

It would be helpful if CAISO could clarify the following:

-

Will CAISO be using the import limit on Path 26 or the import limit after taking into account any firm transmission rights across this path?

-

Will CAISO be using bids from all RA resources or just bids up to the NQC of RA resources? For example, assume that the NQC of RA resources in the north is 15,000 MW but these RA resources are bidding 20,000 MW (recall that the CPUC reduces the NQC below pmax for hydro, solar and wind to address reliability concerns but that at any time, the RA resources can be bidding above their NQC). This will matter especially during stressed system conditions, when we expect RA resources could be bidding above their NQCs, which have been estimated low for reliability purposes but can exceed these estimates under stressed conditions when resources are being called upon to generate the maximum amount of energy possible. This issue was noted in DMM’s report on the August events, in which they showed that bids from RA resources were in excess of their NQCs.

Also, as stated above, PT wheels should be limited in the above calculation to the maximum RA import capability.

VERS should not be able support firm PT exports, as this could lead to real-time reliability issues

As noted by the CPUC staff in previous comments, variable energy resources (VERS) should not be able support firm, hourly block PT export and be given priority equal to load, because the forecast for VERS can material differ from actual production.

Notably, CPUC staff does not object to VERS being exported, but objects to allowing VERS to support PT exports with priority equal to load at their scheduled quantity which can result in the CAISO system exporting an amount greater than VERS production. This can further exacerbate shortages within CAISO and jeopardize reliability if the CAISO is supporting an export from a resource whose schedule materially differs from its forecast. For example, assume a wind resource is scheduled for 200 MW (and CAISO is exporting the 200 MW PT export as a result), but the resource is only generating 20 MW -- this could result in reliability issues during tight system conditions. For this reason, CPUC staff recommended (and continues to recommend) that CAISO revert to its earlier tariff language (shown below), rather than the updated tariff language.

CPUC staff supports previous tariff language that addresses this issue:

CPUC staff does not support the currently proposed tariff language:

As a solution, CPUC staff supports DMM’s suggestion that CAISO develop a manual process that would allow CAISO operators to curtail PT exports from a VERS that is operating below its scheduled quantity before curtailing internal load. CAISO has indicated that it is unable to implement such a process this summer and, as a result, CPUC staff strongly encourage CAISO to change the tariff language to exclude VERS for this summer, given the urgent need to ensure reliability and to ensure that all reasonable actions are taken to avoid load shedding events this coming summer.

If this suggestion is not adopted, CPUC staff request that CAISO and/or DMM provide data on PT exports during any system emergency and load shedding events to determine whether the CAISO system was exporting power at a schedule above the actual production during any tight system conditions for the upcoming summer in order to allow the CAISO and stakeholders to re-evaluate whether changes should be made for Summer 2022 and/or whether the manual process recommended by DMM could/should be implemented.

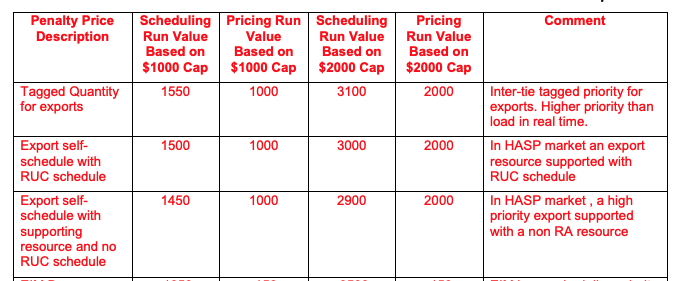

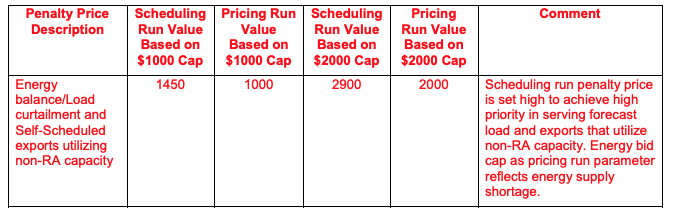

Parameters at the end of the revised final proposal should be updated to reflect all changes that will be made this summer

In the revised final proposal, CAISO included the penalty parameters that would be when the bid cap is $1000 per MWh and when the bid cap is $2000 per MWh. However, these penalty parameters do not appear to be the penalty parameters that would be in place this summer, as a result of CAISO’s Summer 2021 readiness initiative. In particular, CAISO includes the penalty parameter for export self-schedule with RUC schedule at $1500 per MWh, which is above load. Although CAISO indicated in its April 14, 2020 presentation3 that this value would be updated in a subsequent BPM, it would be helpful if this table in the revised final proposal were updated to include all penalty paraments that will be in place this summer, in order to avoid any confusion regarding what is being approved by the Board. In addition, given that the tariff places PT exports at equal priority to load, it would be helpful if CAISO could explain why the penalty parameter for tagged exports is higher than load.