1.

Please provide your organizations comments on concerns regarding the current deliverability assessment methodology.

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the CAISO's Generator Deliverability Challenges Update Paper ("Update Paper," hereafter) issued on December 12, 2022. BAMx applauds the CAISO's willingness to revisit some of the elements of the current deliverability methodology to address the concerns regarding generator access to deliverability for Resource Adequacy (RA) purposes.

BAMx is extremely concerned about the scale and cost of network upgrades to provide additional deliverability to the interconnecting generation needed to meet the State's policy goals. Per CAISO's preliminary policy-driven assessment presented during its November 17, 2022 stakeholder meetings, the delivery network upgrades could range anywhere from $6 billion to $12 billion, excluding those potentially needed in the PG&E area.[2] We are concerned that some of these large transmission costs associated with making the interconnecting generating resources fully deliverable using the CAISO Deliverability Assessment Methodology (DAM) might not be necessary for achieving the State's goals for providing reliable electric service while cost-effectively meeting Renewable Portfolio Standard (RPS) requirements and generator Power Purchase Agreement (PPA) RA requirements.

Although significant progress has been made in improving the feedback loop between the CPUC Integrated Resource Planning (IRP) and CAISO Transmission Planning Process (TPP), the deliverability assessments have failed to provide accurate market signals for the generation project developers. Otherwise viable generation projects have been deemed undeliverable, becoming unviable in the competitive market due to a lack of RA credit. Most importantly, expensive transmission upgrades have been deemed necessary by the CAISO to make projects "deliverable," and have initially burdened the particular generators, but ultimately the cost of those upgrades is borne by ratepayers. The CAISO should not sanction a transmission planning and generation interconnection and deliverability allocation process (GIDAP) whose underlying theme seems to be "deliverability at any cost." The CAISO has an obligation to ensure just and reasonable transmission rates. Deliverability at any cost is not consistent with this obligation. BAMx believes that changes in the CAISO deliverability assessment methodology (described below) can be implemented that would allow significantly more renewable resources to be interconnected quickly, with fewer required transmission upgrades, without compromising the CAISO's ability to meet reliability requirements.

We look forward to working with the CAISO and other stakeholders to ensure a reliable and economical transmission infrastructure.

Dispatch assumptions…and, in particular, simultaneous dispatch of resources in resource basins

BAMx agrees with the CAISO that multiple resource adequacy resources could potentially be needed simultaneously to provide capacity under stressed system conditions.[3] However, the assumptions about the level of generation for FCDS resources during both the High System Need (HSN) and Secondary System Need (SSN) periods should realistically represent their expected levels of operation and should not necessarily assume simultaneous operation at their "qualifying capacity" level, as assumed in the CAISO's deliverability assessment methodology. Therefore, BAMx is supportive of revisiting the current methodology elements that require FCDS resources in the same area to be simultaneously called upon to serve local load or export from the resource area.

The need for a High System Need and Secondary System Need scenarios that were developed in 2019 replacing the former single peak load scenario.

The SSN scenario represents when the capacity shortage risk will increase if the intermittent generation, while producing at a significant output level, is not deliverable. In other words, the SSN represents the hours when solar resources contribute to the system reliability. It is critical, however, to be sure that assumptions for co-located storage resource charging and discharging align with market expectations to avoid overstating the loading on the area delivery network. In both the generation interconnection study and the TPP policy study, there is often a significant over-supply during the high load consumption hours. Therefore, generation from some small local pockets not being deliverable is not likely to affect the overall system reliability than generation not deliverable in a larger area. BAMx understands that the SSN assessment focuses on the area delivery constraints. In many cases, adequate battery storage resources are, or will be, co-located with the solar resources in generation pockets to absorb the excess solar generation for charging purposes and will be discharged at appropriate hours without overloading available transmission.

BAMx appreciated CAISO's review of the deliverability study dispatch assumptions in mid-2022, leading to a reduction in the dispatch assumptions for the storage study amount for the SSN study. However, the storage discharge may need to be further reduced based upon their typical operation during HE15 ~ 17 in the summer months at levels significantly lower than 80% of their full capacity. If the expected storage discharging behavior is properly modeled, the SSN assessment should not identify more area delivery network upgrades (ADNU) than the High System Needs (HSN) assessment. As the Update Paper indicates, "in all but the SCE metro study area, the SSN was less binding than the HSN study," per the draft 2022-2023 transmission planning analysis shared with stakeholders on November 17, 2022.[4] BAMx is not opposed to studying the SSN scenario as part of the deliverability assessment. However, when it triggers ADNUs that are not identified in the HSN study, like in the case of the SCE metro area in the 2022-2023 transmission planning analysis, it should be flagged to see whether the appropriate dispatch of battery storage has been modeled in the generation pockets to avoid unneeded and excessive ADNUs.

Consideration of N-2 and Extreme Events

BAMx urges the CAISO to make a clear distinction between the need to follow NERC Transmission Planning Standard TPL-001 for reliability assessment versus CAISO's policy assessment that is performed for resource adequacy purposes. Any facility overload, voltage limit violations, or system collapse that would prevent the CAISO from serving load reliably in compliance with the NERC Planning Standard would be unacceptable. However, applying the higher level contingencies, such as N-2 and extreme events, for all generator deliverability assessments is overly conservative, because it does not consider the locational diversity of resources available to meet the TPL-001 standard. This is especially true where transmission linkages/contingencies to the broader system are few, generation pockets are small, and/or where constraint-mitigating redispatch outside of the load pocket is not being modeled. In addition, the CAISO TPP reliability modeling considers 1-in-5 peak Loads and upward-stressed dispatch, for a system that has a substantial planning reserve margin. If the planning reserve margin does not result in sufficient resources to reliably serve load without requiring every FCDS generator to be fully deliverable for all N-2 contingencies, the planning reserve margin could be increased, and/or the locational diversity of resources could be reevaluated in the IRP process.

Given the large amount of new capacity (~70GW) that is envisioned in the CPUC's draft portfolios for the 2023-2024 transmission plan, it is critical to consider whether every MW of generator seeking FCDS needs to be fully deliverable under extreme conditions in order for CAISO to meet the TPL-001 standard with the aggregate resources available to it. BAMx, therefore, encourages the CAISO to apply a three-prong approach to avoid potentially unneeded and excessive network upgrades that would be triggered by a large amount of FCDS generation in the upcoming years.

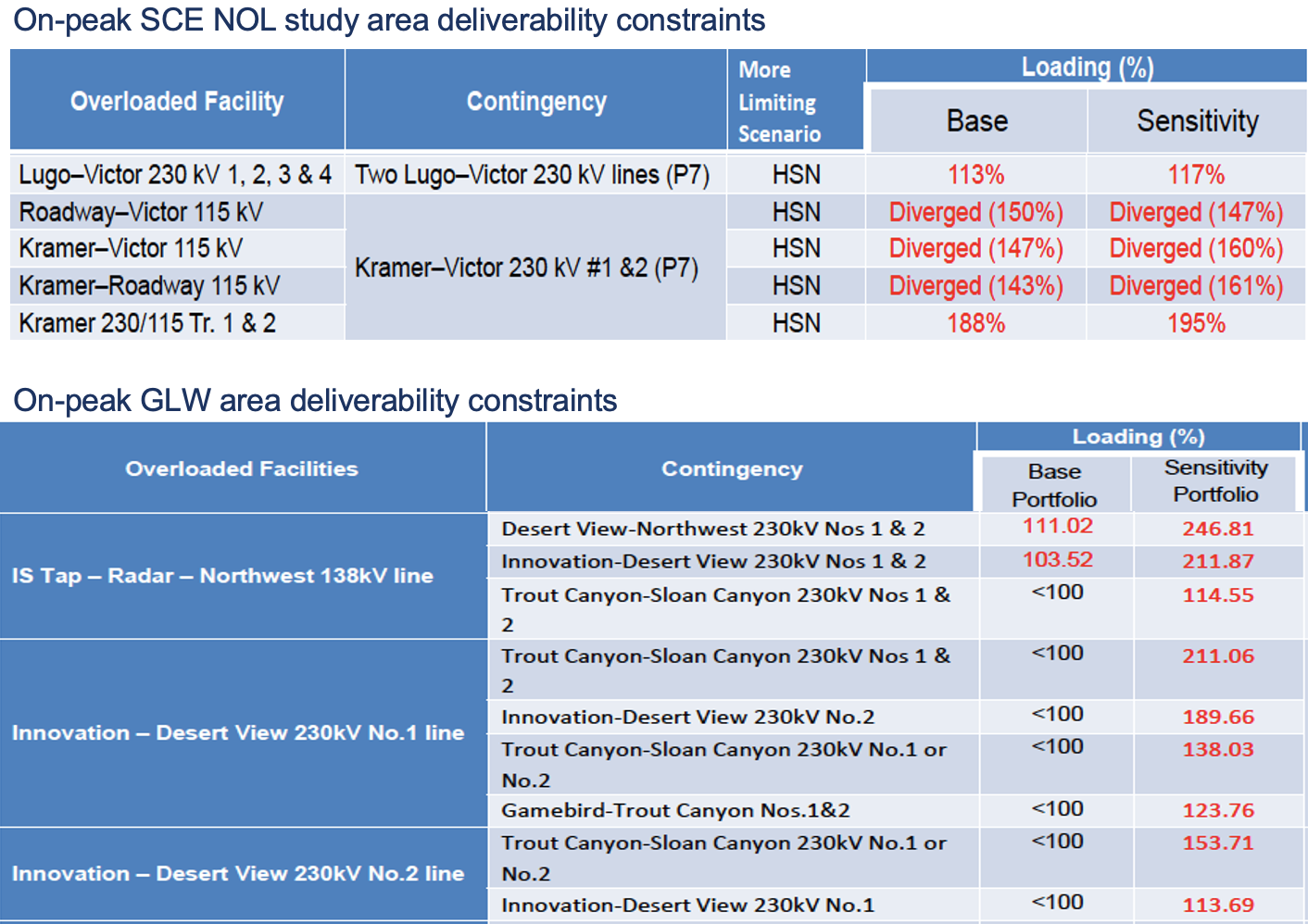

First, only apply the higher level contingencies, such as N-2 and extreme events at the end of the process when assessing the aggregate ability to meet the TPL-001 standards. That is, for the GIDAP and TPP deliverability assessments of specific generation pockets only apply N-1 contingencies, and then determine in the TPP reliability assessment whether there are any resultant TPL standard violations (including N-2) that cannot be adequately mitigated. We believe that taking this approach, in conjunction with the steps below, is likely to eliminate the need for at least some of the transmission upgrades exclusively driven by higher-level contingencies, as shown in Table 1.

Table 1: Constraints Based on P7 (N-2) Contingencies Driving Major Transmission Upgrades: Preliminary 2022-2023 TPP Policy Assessment

BAMx believes that the deliverability assessment methodology needs to provide consistent treatment under both GIDAP and TPP so that ratepayers are not burdened with extra costs that would be missed under the relaxation of deliverability assessment methodology if it is only made in the GIDAP.[5] BAMx believes that generation-dropping RAS will continue to be an effective solution to address the potential deliverability issues triggered under low-probability events, in conjunction with the broader resource and locational diversity captured via the IRP-TPP process feedback loop.

Second, any revisions to the deliverability assessment methodology, like the relaxation of higher-level contingencies, should be accompanied by a practical economic assessment to address potentially increasing levels of generation curtailments due to congestion. It is important to note that curtailment is not a resource adequacy (RA) issue for which the deliverability assessment is designed, but rather an economic and/or policy issue. Any potential curtailment increase can be addressed by identifying needed policy and economic-driven transmission upgrades in the TPP. BAMx believes that the existing Transmission Economic Assessment Methodology (TEAM) provides a reasonable framework for that to be studied thoroughly, leading to transmission upgrades if they are economically justified.

Third, the impact of overlapping transmission outages should be evaluated in the overall Loss of Load Expectation (LOLE) studies and, if necessary, the Planning Reserve Margin requirements may need to be increased. This should be done at the system level, rather than imposing it on individual resources seeking FCDS as part of the deliverability assessment methodology. This approach will balance the concerns about having sufficient RA resources to simultaneously provide needed capacity under stressed system conditions against the cost-effectiveness and timeliness of network upgrades.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] Policy-driven Deliverability Assessment Preliminary Results, Nebiyu Yimer, Amanda Wong, Meng Zhang, Lyubov Kravchuk, Lindsey Thomas, 2022-2023 Transmission Planning Process Stakeholder Meeting, November 17, 2022, pp.14-108.

[3] Update Paper, p.4.

[4] Update Paper, p.5.

[5] Update Paper, p.6.