Bay Area Municipal Transmission Group (BAMx)

Submitted 10/12/2022, 04:37 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Please provide comments on CAISO reliability assessment for the North area (PG&E).

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the CAISO’s 2022-23 Transmission Planning Process. The comments and questions below address the material presented at the CAISO Stakeholder meeting on September 27-28, 2022.

Need for Additional Data

In the September 27 presentation, the CAISO showed incremental reliability issues in each planning area under the 2035 Additional Transportation Electrification (ATE) Sensitivity over those identified in the 2032 Baseline scenario. BAMx appreciates those summary tables. However, without any access to the underlying 2035 ATE Sensitivity power flow cases or the detailed results as the CAISO posted for the remaining study cases, it is challenging to evaluate the CAISO 2035 Sensitivity findings. To provide meaningful stakeholder feedback, it is pertinent that the CAISO posts the following two data sets as soon as possible.

- Detailed CAISO Reliability Assessment - Preliminary Study Results for the 2035 ATE Sensitivity scenario similar to those posted on August 15, 2022, for remaining cases; and

- Underlying 2035 ATE Sensitivity scenario power flow cases for each planning area on the CAISO secured TPP portal.

Previously Approved PG&E Projects

BAMx applauds the CAISO's efforts in confirming the need for some of the previously approved projects. For example, the Fresno Area Preliminary Reliability Assessment Results identified the continued need for the following four previously-approved projects.[2]

- Wilson 115kV Reinforcement Project;

- Herndon-Bullard 115 kV Reconductor;

- Reedley 70 kV Reinforcement (Dinuba Battery Energy Storage); and

- Wilson-Oro Loma Reconductoring.

However, there are continued issues with other previously-approved projects.

Midway-Temblor 115 kV Line Reconductor and Voltage Support

The CAISO approved the Midway-Temblor 115kV Line Reconductor and Voltage Support reinforcement project in the 2012-2013 Transmission Planning Process (TPP). The project's scope is to reconductor approximately 15 miles of the Midway-Temblor 115kV line and install 45MVAR of shunt capacitors at the Temblor substation.

The latest identified need for the project, as identified by PG&E in its Stakeholder Transmission Asset Review Process (STAR), is to mitigate a thermal overload on the Midway-Temblor 115kV Line due to an N-1-1 outage of the Gates-Midway 500kV line and the Gates 500/230kV bank. The voltage support portion of the project also mitigates low voltages at Temblor due to an N-1 outage of Midway-Temblor 115kV.[3] However, the overloads identified by PG&E in the STAR process were not observed in the CAISO’s latest Preliminary Reliability Results for the years 2024 and 2027 posted by the CAISO for the 2022-2023 TPP. BAMx believes that the new second 500/230kV transformer at the Gates substation[4] that is currently operational potentially mitigates the identified N-1-1 or P6 overload on the Midway-Temblor 115kV line.

BAMx requests the CAISO to reevaluate the continued need and scope for the Midway-Temblor Project. If the project is needed, the CAISO should identify the contingencies and the related overloaded transmission facilities driving the continued need for the project.

Morgan Hill Area Reinforcement Project

The Morgan Hill Reinforcement project was originally approved in the 2013-2014 TPP cycle. Through project re-evaluation, the project’s scope has changed. As presented by PG&E in the STAR process, the latest project scope is to “Rebuild Metcalf-Green Valley 115kV into the Green Valley-Morgan Hill 115kV and convert Morgan Hill 115kV bus to a BAAH configuration”.[5]

The latest identified needs for the project are driven by the thermal overloads on the Metcalf-Llagas 115kV circuit, which are mitigated by the line re-arrangement associated with the Morgan Hill Area Reinforcement project. The justification for rebuilding the Morgan Hill 115kV substation into a breaker-and-a-half configuration is unclear. The existing substation configuration should be modified if PG&E needs an additional breaker position for the newly built Green Valley-Morgan Hill 115kV circuit. BAMx requests the CAISO to reevaluate the need for rebuilding the Morgan Hill substation into a breaker-and-a-half configuration. If such a need is not identified, the project’s scope should be adjusted to exclude rebuilding the Morgan Hill substation.

BAMx requests the CAISO to reevaluate the need to rebuild the Morgan Hill substation, a distribution substation, into a breaker-and-a-half configuration ?contrary to the enhanced-loop or the ring bus configuration as specified in PG&E’s design standards.

Need to Fully Evaluate Transmission Alternatives Without Approving Projects in the Current Cycle

Potential Cayetano-Lone Tree 230 kV line capacity increase

In the 2021-2022 Transmission Plan, the CAISO approved the Collinsville 500/230 kV substation as a policy-driven project.[6] The Collinsville project ($475M – $675M) was identified as a superior solution over three 230 kV reconductoring projects to address the deliverability constraints[7]

- Lone Tree-USWP-JRW-Cayetano 230 kV line ($55.1M – $71.6M)

- Cayetano-North Dublin 230 kV line ($42.4M – $55.1M); and

- Las Positas-Newark 230kV line ($47.65M – $62M).

The current planning cycle has identified a need to potentially reconductor the #1 project above even after assuming the Collinsville project to be operational.[8] Moreover, the 2035 ATE sensitivity identifies the need for the #2 project.[9] In other words, it appears the Collinsville project has proven inadequate for avoiding the need for reconductoring the Lone Tree-USWP-JRW-Cayetano 230 kV and Cayetano-North Dublin 230 kV lines for reliability purposes. This result indicates a need to re-evaluate whether the Collinsville project is the least cost policy-driven solution. We encourage the CAISO to fully evaluate the need and alternatives for satisfying the policy-driven needs for this network area in the current planning cycle.

Re-evaluation of on Hold Wheeler Ridge Substation Project

The original CAISO-approved project scope for the Wheeler Ridge Substation Project was to build a new 230/115 kV substation at Wheeler Ridge Junction using mostly existing right-of-way accesses to connect to the Stockdale 230 kV substation and convert the existing Wheeler Ridge-Lamont 115 kV to 230 kV operation, which provides a third 230 kV source to Wheeler Ridge Junction Substation. This project was driven by the overloads on both the 115 kV and 230 kV circuits. In the 2019-2022 Transmission Plan, the CAISO approved a 95 MW 4-hour storage resource on the Kern-Lamont 115 kV system (Lamont BESS) to mitigate the 115 kV issues on the Kern-Lamont 115 kV system.

For the P1, P2, and P6 230 kV issues seen in the current studies[10], we understand the CAISO is exploring several options, such as reconductoring the existing Midway-Wheeler ridge 230 kV lines, new 230 kV line either from the Midway 230 kV or Kern 230 kV to Wheeler ridge 230 kV substation.

Given the several options that the CAISO could consider addressing these issues, we encourage the CAISO to ensure that the proposed mitigation option is the most cost-effective.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] CAISO September 27th Presnetation, p.63.

[3] PG&E Stakeholder Transmission Asset Review Process Stakeholder Meeting, August 3, 2021, – Page 58 of 58.

[4] CAISO 2020-2021 Transmission Plan, February 1, 2021, Table 8.1-2: Status of Previously-Approved Projects Costing $50 M or More, shows that the Gates #2 500/230 kV Transformer Addition project has been completed.

[5] PG&E Stakeholder Transmission Asset Review Process Stakeholder Meeting, August 3, 2021, – Page 53 of 58.

[6] CAISO 2021-2022 Transmission Plan, March 17, 2022, p.6.

[7] CAISO 2021-2022 Transmission Plan, March 17, 2022, p.192-195.

[8] CAISO September 27th Presentation, p.39.

[9] CAISO September 27th Presentation, p.26.

[10] CAISO September 27th Presentation, p.84.

2.

Please provide comments on CAISO reliability assessment for the South area (SCE, SDG&E, VE/GLWS)

SCE Area

Serrano Banks 500/230 kV Thermal Overloads

CAISO's preliminary reliability assessment has found Serrano 500/230 kV Transformers

overloaded for the loss of any other two Serrano transformer banks (P6) in the 2032 Spring Off-peak case.[1] BAMx agrees with the CAISO that reliability-driven transmission mitigation for the Serrano bank overloads needs to coordinate with the area's policy and economic transmission needs. BAMx applauds the CAISO analysis that analyzed how energy storage can be utilized as alternative transmission mitigation up to the portfolio amount or the long-duration BESS

charging capability. The CAISO's analysis has determined that

"The 4-hour energy storage for system-wide resource adequacy can be used for local reliability up to the 4-hour charging limit for free. However, it is costly to use the 4-hour energy storage above the 4-hour charging limit as mitigating for the Serrano bank issue, as additional storage MWh needs to be added for achieving LDES capability, compared with its transmission mitigation."

BAMx believes that the CAISO does not necessarily need to add the cost of incremental 4-hour battery storage to mitigate the Serrano bank issue. The load-serving entities (LSE) have procured long-duration energy storage in response to the CPUC’s Reference System Plan issued in 2020.[2] Given the CPUC procurement guidance, CAISO should provide Long Duration Energy Storage (LDES) recommendations to the LSEs for the most effective areas like the Western LA Basin. Given that the Serrano Bank overloads are identified only in the long-term (2032), the required LDES resources that address the Serrano Bank issues could be developed given the CPUC procurement guidance.

In addition, SCE’s projected short circuit duty (SCD) increase on all of its 230 kV circuit breakers at Serrano Substation is only 0.7% from 95.2% in 2024 to 95.9% in 2032; it would be premature for the CAISO to approve SCE’s proposal to rebuild its Serrano 230 kV GIS to 80 kA in the current planning cycle.

BAMx urges the CAISO not to approve any capital projects, such as adding a new Serrano 4AA 500/230 kV transformer bank in the current planning cycle.

[1] CAISO September 27th Presentation, p.168 and p.185-190.

[2] See https://www.greentechmedia.com/articles/read/the-first-long-duration-storage-procurement-has-arrived and https://cal-cca.org/california-community-power-members-approve-second-lithium-ion-long-duration-energy-storage-contract/

3.

Please provide comments on PG&E proposed mitigation alternatives.

North-East Kern 115 kV Reconductoring Project

BAMx appreciates PG&E considering the energy storage alternative to reconductoring several 115kV lines in the North-East Kern area to address the P1, P2, and P3 overloads. According to PG&E, adding 10 to 20 MW of BESS at Lerdo, Rio Bravo, Shafter, Ganso, and Goose Lake substations needs further investigation. [1] We encourage the CAISO to explore these and any other reasonable energy storage options in terms of their feasibility, size, and charging requirements before approving the PG&E-proposed North-East Kern 115 kV Reconductoring Project.

Cortina 60 kV Line and Garberville Area Reinforcement Projects

Similarly, BAMx encourages the CAISO to explore other options for PG&E’s Cortina and Garberville areas, where PG&E is proposing capital-intensive projects ($300 million) to accommodate small incremental demand increases. Specifically, PG&E anticipated demand increases of 10 MW and 16 MW, respectively, for these two areas. The CAISO and PG&E should explore options, including distributed generation and energy storage facilities, to meet this small demand increase, similar to the Oakland Clean Energy Initiative (OCEI) project approved by the CAISO in 2017-2018 TPP to address Oakland area reliability needs.[2]

[1] PG&E September 28th Presentation, p.48.

[2] CAISO 2017-2018 Transmission Plan, pp. 128-129.

4.

Please provide comments on SDG&E proposed mitigation alternatives.

San Diego Gas and Electric (SDG&E) has proposed the following three groups of projects.[1]

- Proposed projects in Suncrest / Miguel area (Cost $275 – $375 M)

- Proposed projects in the Old Town / Silvergate area ($620 - $750M)

- Proposed projects in the San Luis Rey/ San Onofre area ($110 - $150M).

None of the contingency overloads driving the need for any of the above-mentioned proposed projects are identified in the CAISO preliminary reliability assessments. For instance, SDG&E claims to have the following three overloads.[2]

- P-1 (N-1) - Outage of TL23003 Overload TL23011

- P-1 (N-1) - Outage of TL23011 Overload TL23003; and

- P-7 (N-2) - Outage of TL23002 & TL23010 Overload TL23006

However, none of these overloads were identified in the CAISO's reliability assessment for the SDG&E area. Upon probing during the September 28 stakeholder meeting, BAMx discovered that the underlying cases used by SDG&E are considerably different from the cases used by the CAISO, driving the discrepancies in SDG&E’s findings. BAMX believes it is imperative that the PTOs not deviate from the study assumptions CAISO has developed in coordination with the California Public Utility Commission (CPUC) and the California Energy Commission (CEC). BAMx, therefore, urges the CAISO to reject the analysis provided by SDG&E. BAMx also urges the CAISO to direct SDG&E to follow the CEC and CPUC directives and align SDG&E’s studies with the CAISO TPP assumptions if SDG&E wants its request window applications to be considered.

[1] SDG&E September 28th Presentation, p.6.

[2] SDG&E September 28th Presentation, p.2.

5.

Please provide comments on SCE proposed mitigation alternatives.

Please refer to the BAMx comments on the SCE proposed mitigation alternatives in response to Q.2 above.

6.

Please provide comments on VEA/GLW proposed mitigation alternatives.

Similar to SDG&E, as described above (Q.4), GridLiance West (GLW) also appears to be using power flow cases that deviate from the CAISO base cases to try to justify the need for its proposed projects, including but not limited to rebuilding the existing 230 kV circuit from Innovation to Desert View to match the second circuit project approved in the 2021-2022 TPP.[1] The CAISO's reliability assessment presented on September 27 identified no such need. Therefore, the CAISO should not consider GLW’s proposed project on a reliability basis in this year's TPP. If this project has any policy or economic merit, it needs to be separately studied for those attributes. BAMx also urges the CAISO to direct GLW to follow the CEC and CPUC directives and align GLW’s studies with the CAISO TPP assumptions if GLW wants its request window applications to be considered.

[1] GLW September 28th Presentation, p.2.

7.

Please provide comments on CAISO high voltage TAC presentation.

BAMx appreciates the continued work of the CAISO in keeping the stakeholders updated about the likely impact of its decision to approve transmission projects affecting the High Voltage (HV) Transmission Access Charge (TAC). BAMx appreciates the opportunity to comment on the CAISO's 2022 HV TAC Estimating Model ("TAC" Model" hereafter) that was posted on the CAISO website on September 23, 2022. We hope that the CAISO addresses the issues raised by BAMx below in the next update of the TAC Model.

- Caveat the TAC forecast as it does not provide an accurate signal for the outer years, i.e., 2024-2029, and does not address additional wildfire mitigation costs

BAMx notes that the tapering of the CAISO's TAC forecast in the outer years, that is, during 2027-2035, is primarily driven by the very low (or no) levels of transmission capital expenditures assumed in the HV TAC forecasting model. As shown in Figure 1, the HV TAC forecasting model assumes that the HV capital expenditures[1] will occur during 2022-2029, primarily driven by the CAISO-approved reliability-driven and policy-driven transmission projects.

Figure 1: A Comparison of the CAISO's TAC ($/MWh) and Assumed Capital Expenditures (M$)

.png)

As shown in Figure 1, no capital expenditures are assumed in the outer years (2030-2036) in the TAC Forecasting Model, as it does not include capital expenditures in the CAISO's upcoming TPP cycles. In other words, the HV TAC rates, especially for 2030-2036, will likely be higher than those depicted in the current version of the HV TAC Forecasting Model.

BAMx appreciates the CAISO providing a separate spreadsheet comprising the capital costs documented for several capital projects with high voltage components[2]. This spreadsheet (Capital Costs Estimates) helps the CAISO and stakeholders to easily modify the transmission projects, their commercial operation dates, and related capital costs going forward.

- Capital projects questions

BAMx has the following questions and comments on some of the capital transmission projects included in the TAC Model. We hope the CAISO addresses them in the next revision of the TAC Model. All the recommended corrections below are expected to increase the projected HV TAC further.

- Riverside Transmission Reliability Project (RTRP): We noticed that the latest TAC model continues to exclude the capital expenditure associated with Riverside Transmission Reliability Project (formerly Jurupa 230kV Sub). According to SCE's AB 970 quarterly report (Q1 2021), this project was approved by the CAISO in 2007 with a current planned in-service date of 10/15/2026. A Certificate of Public Convenience and Necessity (CPCN) for this project was granted on 03/12/2020 and indicates that its capital cost is approximately $450M. Please explain why the capital expenditures associated with the RTRP were excluded from the TAC Model.

- Alberhill Transmission Project: The TAC model continues to assume the old capital cost of $314M. This amount needs to be updated to $545M to reflect SCE's updated cost estimate.[3]

- Warnerville-Bellota 230 kV Line Reconductoring: The TAC model assumes a capital cost of $107M; however, based on the CAISO's reporting, the capital cost is expected to be as high as $151.6M.[4] Furthermore, the TAC model assumes a part of the capital expenditures ($19M) to be incurred in 2025; however, the CAISO has reported the in-service date for this project to be earlier, that is, 2024. Therefore, it appears the capital expenditures need to be adjusted to be consistent with the latest schedule.

[1] Any capital expenditures after the in-service year are added to rate base in the year of expenditure in the HV TAC forecasting model. Source: California ISO TAC Model Operating Instructions.

[2] 2021-2022 Transmission Plan High Voltage Transmission Access Charge Capital Costs (2021-2022TransmissionAccessCharge-HighVoltageCapitalCostEstimates.xlsx)

[3] See CPUC, A.09-09-022, Second Amended Application of Southern California Edison Company (U 338-E) For A Certificate Of Public Convenience And Necessity For The Alberhill System Project, May 11, 2020, P.7.

[4] CAISO September 27th Presentation, p.66.

8.

Please provide comments on CAISO policy assessment update.

CAISO staff collaborated with CPUC staff in identifying resource portfolio adjustments (reductions) that were needed to account for additional in-development resources PTOs modeled that were not included in the CPUC’s in-development resources list (possibly due to time lag).[1] BAMx appreciates the CAISO providing the details on the portfolio adjustments made to account for additional in-development resources. BAMx found the underlying spreadsheets provided by the CPUC and CAISO to be most helpful in understanding the adjustment process. BAMx endorses the CAISO-proposed future improvements that are being considered to minimize similar post-transmittal portfolio adjustments.[2] BAMx looks forward to reviewing the preliminary results of the policy-driven assessment at the November 17 stakeholder meeting.

[1] CAISO September 28th Presentation, p.13.

[2] CAISO September 28th Presentation, p.19.

9.

Please provide comments on CAISO economic assessment update.

CAISO Net Export Limit Assumption

The net export limit for the CAISO system is considered in CAISO’s production cost simulation (PCM) studies and CPUC’s IRP studies. BAMx believes that the net export limit is neither a transmission constraint nor a market constraint imposed by the CAISO in operation. BAMx understands that the CAISO plans to model the net export limit at 5,000 MW in the 2032 planning PCM for the 2022-2023 transmission planning study. We question why it should be limited to 5,000 MW. Having CPUC’s IRP and CAISO’s renewable studies use a 5,000 MW limit in and itself should not be the reason for the CAISO to restrict it to 5,000 MW. BAMx, therefore, encourages the CAISO not to model any net export limit in its PCM studies in the current planning cycle.

10.

Any additional comments?

BAMx appreciates the opportunity to comment on the 2022-23 Transmission Plan Reliability Assessment Results and the PTO Request window submissions and acknowledges the significant effort of the CAISO and PTO staffs to develop this material.

California Public Utilities Commission - Public Advocates Office

Submitted 10/12/2022, 05:55 pm

1.

Please provide comments on CAISO reliability assessment for the North area (PG&E).

The Public Advocates Office at the California Public Utilities Commission (Cal Advocates) is an independent consumer advocate with a legislative mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Cal Advocates provides its comments on CAISO’s reliability assessment for the North area in its response to question 3.

[1] PU Code Section 309.5.

2.

Please provide comments on CAISO reliability assessment for the South area (SCE, SDG&E, VE/GLWS)

Cal Advocates provides its comments on CAISO’s reliability assessment for the South area in its responses to questions 4,5 and 6.

3.

Please provide comments on PG&E proposed mitigation alternatives.

The following are descriptions of the reliability issues CAISO identifies in PG&E's service area, CAISO and PG&E's proposed solutions to address these issues, and Cal Advocates’ recommendations.

Redwood City Area System Reinforcement

CAISO’s reliability assessment for the Redwood City Area identifies overloaded lines during all the studied summer peak scenarios. To address these overloads, CAISO recommends increasing the Ravenswood-Bair line capacity and continuing to monitor the Ravenswood 230/115 kV Transformer #2. CAISO also stated that overloads on some of the lines could be mitigated by operating solutions.[1]

In contrast, PG&E proposes to reconductor the Ravenswood-Bair 115 kV line and install a new transformer. During the September 28, 2022, CAISO 2022-2023 reliability assessment project meeting, PG&E states that the load growth in the project area is due to new data centers, which are driving the need for this system upgrade, rather than general population growth and higher electrification. PG&E's proposes mitigations have a cost estimate of $55.4 million to $110.8 million.[2]

Since this project is only needed because of a few large data center customers, it is unreasonable to require all PG&E customers to bear these costs. Specific upgrades that are needed to support the demands of a single customer or industry should be paid for by that customer or industry.[3]

Cortina 60 kV Reconductoring

CAISO identifies overloads on the Cortina 230/115/60 kV Transformer in the base and sensitive scenarios and overloads on the Cortina 60 kV line No. 2 in the 2035 Additional Transportation Electrification (ATE) demand scenario. CAISO recommends that the approved Cortina 230/115/60 Transformer Bank No. Replacement project serve as a mitigation for the observed overloads as well as the 2017-2018 TPP recommended Special Protection Scheme (SPS).[4]

PG&E observes that in addition to the North America Electric Reliability Corporation (NERC) thermal overload issue there are low voltage issues on the Cortina line. PG&E proposes to remedy this issue by reconductoring the Cortina 60 kV line with project costs ranging between $47.14 million to $94.28 million. PG&E alternative option analysis included energy storage, but the results find that energy storage is not a viable option due to charging limitations in the project area.[5]

Cal Advocates recommends the CAISO not approve the proposed project and requests additional study on lower cost solutions to address the noted reliability issues. To address the observed voltage issues, a reactive support solution should be considered as a lower cost solution. Since PG&E states that the load growth in this area is due to one distribution-level electric vehicle (EV) charging customer,[6] Cal Advocates also requests a study on options to reduce the load at the EV charging customer site with behind-the-meter solar or other distributed energy resources (DERs). This study should determine if targeted DERs in the area could address any future reliability issues and avoid consideration of the proposed costly reconductoring project.

Tesla 115 kV Bus Reconfiguration

CAISO notes overloads in the Stockton/Stanislaus area including on the Tesla 115 kV line that could be mitigated with existing operating procedures, a Tesla 115 kV Bus upgrade, SPS, or system upgrade as needed. CAISO also mentions that Tesla 230 kV Bus Series Reactor is expected to be in place by August 2023.[7] PG&E's reliability assessment identifies voltage collapse issues that occur because of the breaker configuration at the Tesla 115 kV bus. PG&E proposes to mitigate this issue by reconfiguring the existing Double Bus Single Breaker (DBSB) configuration to a Breaker and a Half (BAAH) configuration, which has a cost estimate of $27.5 million to $55 million, and to discard CAISO's recommended mitigation solutions, which include an SPS.[8]

Cal Advocates recommends CAISO not approve the proposed project and requests further study on the effectiveness of CAISO’s proposed mitigations which include an existing operating procedure and SPS as an alternative to the bus reconfiguration. It may be possible to install a more cost effective SPS that would address the noted voltage issues without spending the estimated $27.5 million to $55 million on the bus reconfiguration. If an SPS alternative is more cost-effective, then it would be in PG&E customers' interests to ensure that the most cost-effective solution is pursued.

Los Banos 70 kV Area Reinforcement

CAISO’s reliability assessment for the Los Banos 70 kV Area identifies overloads in the 2027 and 2032 peak case. CAISO suggests increasing the substation’s bank capacity and reviewing the existing Oro Loma reinforcement project to mitigate the potential overload issues.

In contrast, PG&E proposes a new substation and to align the existing Oro Loma reinforcement project in-service-date with the new substation in-service-date. PG&E did not provide power flow and voltage results at the Los Banos 230/70 kV facilities with the previously-approved Oro Loma reinforcement project. PG&E also mentions a new 230 kV switching station project in the area and similarly did not explain the impact of this existing project on the identified overloads. Thus, PG&E’s presented analysis did not confirm that the proposed project would still be needed after the mentioned approved projects are in place. PG&E also presents no information on its consideration of a possible lower cost operational change, or the CAISO suggested substation bank capacity increase. Therefore, PG&E’s consideration of alternatives to address the noted overload issue is incomplete and the identified issues may be addressed with the implementation of the approved investments in the area including the Oro Loma reinforcement project. For this reasons, Cal Advocates recommends that the CAISO not approve the proposed project and that PG&E provide a complete assessment of the impact of the mentioned project alternatives.

North-East Kern 115kV Reinforcement

CAISO's reliability results identifies line overloads on the following lines: Midway-Shafter 115kV, Midway-Tupman-Rio Bravo-Renfro 115kV, and Semitropic-Famoso 115kV lines, and long-term line overloads on Kern-Lamont and Kern-Stockdale 115kV line under various scenarios. CAISO recommends reevaluating the previously proposed Wheel Ridge substation project, new Kern 115 kV area reconductoring, and the Lamont energy storage projects to address these issues.[9]

However, PG&E's reliability assessment shows overloads on the following lines: Rio Bravo-Renfro J 115kV line, Midway-Ganso 115kV Line, Midway-Shafter 115kV line, Shafter-Rio-Bravo 115kV line, Midway-Semitropic-E 115kV line, and the Lerdo J-Kern Oil 115kV line under various contingencies. PG&E proposes to reconductor all these lines, as well as to convert existing control points to a summer setup to open lines sections to mitigate the line overloads.[10] PG&E states that project load growth in the area is due to EV charging stations, warehouses, business parks and agricultural loads.[11 PG&E's cost estimate for this project ranges between $128 million to $256 million.

Cal Advocates recommends CAISO not approve this project in the 2022-2023 TPP cycle and conduct further study to determine if this project is the lowest cost alternative. Specifically, Cal Advocates recommends CAISO evaluate the Lamont Battery Energy Storage System (BESS) alternative to address the overload issues. Since PG&E did not mention the consideration of targeted energy efficiency (EE) or the other behind-the-meter solutions to reduce load growth in the project area, Cal Advocates requests that PG&E investigate options to reduce the anticipated load growth with targeted DER programs.

Cal Advocates also requests that either PG&E or CAISO provide clarification on the following project analysis details:

- Explain the differences between the CAISO and PG&E reliability study results. PG&E’s pre-project overloads, provided with their power flow results, are significantly higher than the overloads CAISO identified in its preliminary reliability assessment. Cal Advocates recommends PG&E re-scope the North-East Kern 115 kV Reconductoring Project as necessary to resolve this discrepancy in reliability results.

- Explore additional BESS options. Cal Advocates recommends the CAISO and PG&E explore a BESS alternative that involves adding 10 to 20 megawatts (MW) of BESS at Lerdo, Rio Bravo, Shafter, Ganso, and Goose Lake Substations[12] in additional to previously approved Lamont BESS that is currently under review.[13]

PG&E Garberville Reinforcement Project

CAISO’s reliability assessment for the Bridgeville-Garberville-Laytonville 60 kV system identifies overloads and recommends a line capacity increase. CAISO also notes a low voltage issues in Garberville area. CAISO asserts that the recommended line capacity mitigation could address both the overloads and low voltage issues and if not, CAISO suggests adding reactive support in Garberville 60 kV area.[14]

PG&E, in contrast, proposea a Garberville Reinforcement project that has a cost estimate of $102 million and $204 million.[15] CAISO and PG&E’s reliability assessment analyses are based on assumptions and conditions that should be reexamined for the following reasons:

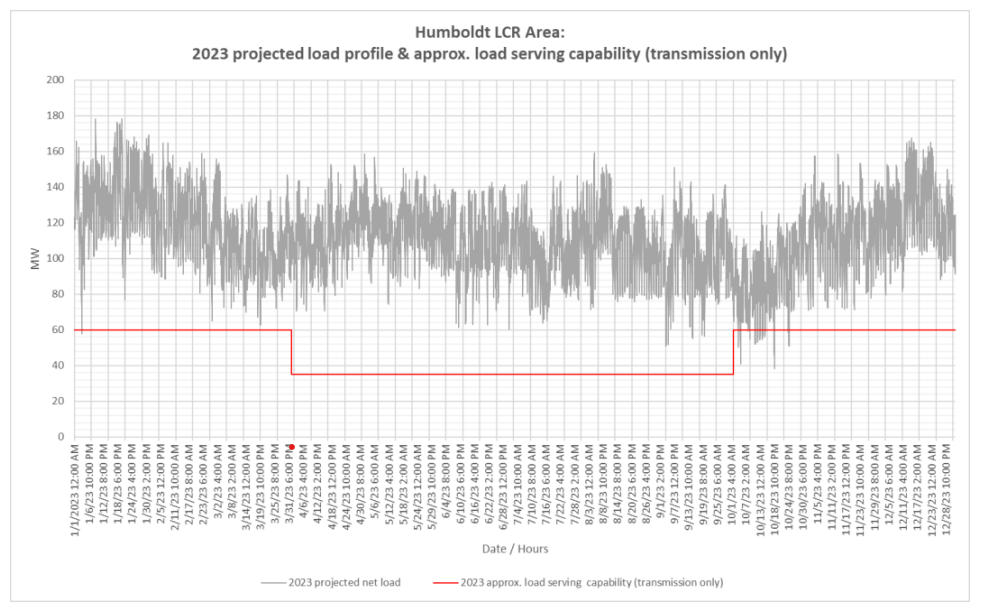

- The Humboldt Area is a winter peaking area. CAISO’s reliability analysis is based on a projected 2032 summer peak of 163 megawatt (MW), a projected 2032 winter peak of 125 MW as shown in Table 1.[16]

Table 1. CAISO Reliability Assessment 2032 Humboldt Area System Peaks[17]

|

Study Case

|

Description

|

Scenario Type

|

Gross Load (MW)

|

|

HUMB-2032-SP

|

2032 Summer Peak load condition. Peak load time -hours ending 21:00

|

Baseline

|

163

|

|

2032-WPK

|

2032 Winter Peak load condition. Winter Peak load time -hours ending 19:00

|

Baseline

|

125

|

2. The summer peak in the Humboldt area is not larger than the winter peak in the Humboldt area as is documented in the 2023 and 2027 CAISO Local Capacity Technical Studies.[18],[19]

Figure 1. CAISO Local Capacity Report Results Humboldt 2023 Forecast Hourly Profile[20]

3. The projected load growth of 50% to 100% is due to agricultural business in Humboldt, but this load growth does not reflect changes in the current cannabis market, which should have an impact on load growth in southern Humboldt County. [21],[22]

Cal Advocates recommends that CAISO not approve the proposed project in the 2022-2023 TPP cycle and instead use an independent power system consultant to confirm the Garberville Area growth assumptions and projected system needs, including the need for dynamic reactive support. Cal Advocates also requests that PG&E consider targeted energy efficiency (EE) programs for cannabis growers in the Humboldt area to address the Humboldt load growth needs as part of the mitigation strategy. The Sonoma Clean Energy program, for example, is aiming to reduce the energy intensive nature of cannabis cultivation with targeted EE programs that include retrofitting existing lighting to LEDs, upgrading HVAC systems with monitoring controls, and installing energy storage to prevent outages and reduce demand charges.

Since this project is only needed to serve the load needs of a few large customers, it is unreasonable that these costs be borne by the average PG&E customer. Upgrades that are needed to support the demands of a single customer or industry should be paid for by that customer or industry and not be passed on to other PG&E customers.

Project Budget Contingency – Project Estimate Accuracy Range

PG&E provides project cost estimate ranges for all their projects; this range allows for a budget contingency of 100%. In PG&E’s presentation they state “[Association for the Advancement of Cost Engineering (AACE)] Level 5 quality estimates include a 100% contingency.”[23] Per ACCE, Class 5/Level 5 cost estimates can have an estimated accuracy range of up to 100% because Class 5 estimates “are generally prepared based on very limited information.”[24]

To address the project definition, design and scope unknowns, Cal Advocates requests the Participating Transmission Owners (PTO) in the CAISO balancing authority area provide better defined projects prior to requesting project approval. With better defined projects, the range of project budget estimates should be significantly narrower and ideally be no higher than 50%. Cal Advocates requests all PTOs provide accurate representations of the project budget contingency versus the project cost estimate, as the project cost estimates should become more accurate as the project scope definition improves.[25]

[1] Greater Bay Area Preliminary Reliability Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, p 29.

[2] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 15-19.

[3] PG&E Electric Rule No. 2, Description of Service, section I.1., sheet 21. ELEC_RULES_2.pdf (pge.com)

[4] Central Valley Preliminary Reliability Assessment Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, pp. 128 and 135.

[5] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 34-36.

[6] California ISO Transmission Planning Process Update Meeting, Customized Energy Solutions, September 27-28, 2022, p. 11.

[7] Central Valley Preliminary Reliability Assessment Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, pp. 133-134.

[8] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 29-30.

[9] CAISO Reliability Assessment and Study Updates, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 85.

[10] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, slide 47. Available at: http://www.caiso.com/InitiativeDocuments/PG_EPresentation-2022-2023TransmissionPlanningProcess-Sep28-2022.pdf

[11] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation. September 28, 2022, slide 44.

[12] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation. September 28, 2022, slide 48. Available at: http://www.caiso.com/InitiativeDocuments/PG_EPresentation-2022-2023TransmissionPlanningProcess-Sep28-2022.pdf

CAISO Reliability Assessment and Study Updates, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 85.

[14]CAISO Reliability Assessment and Study Updates, CAISO 2022-2023 TPP Presentation, September 27, p. 43.

[15] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, p. 25.

[16] CAISO Reliability Assessment and Study Updates, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 42.

[17] CAISO Humboldt Preliminary Reliability Assessment, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 42.

[18] CAISO 2023 Local Capacity Technical Study, Final Report and Study Results, April 28, 2022, p. 34.

[19] CAISO 2027 Local Capacity Technical Study, Final Report and Study Results, April 28, 2022, p. 27.

[20] CAISO 2023 Local Capacity Technical Study, Final Report and Study Results, April 28, 2022, Figure 3.3-3 Humboldt 2023 Forecast Hourly Profile, p. 34.

[21] ‘It’s Gonna Look Like a Ghost Town’: Garberville Business Owners Sound the Alarm as Weed Industry Tanks, Lost Coast Outpost, October 5, 2022, https://lostcoastoutpost.com/2022/oct/5/its-gonna-look-ghost-town-garberville-business-own/

[22] ‘Times are really, really tough’: Plummeting cannabis prices strain small Northern California farmers, Silicon Valley.com, April 22, 2022, https://www.siliconvalley.com/2021/08/23/cannabis-farmers-barely-breaking-even-as-price-per-pound-plummets-2/

[23] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022, p. 7. footnote

[24] AACE 96R-18 Cost Estimate Classification System – As Applied in Engineering, Procurement, and Construction for Power Transmission Line Infrastructure Industries, AACE International, August 7, 2020, p. 8.

[25] AACE 96R-18: Cost Estimate Classification System – As Applied in Engineering, Procurement, and Construction for the Power Transmission Line Infrastructure Industries, AACE International, August 7, 2020, p. 20.

4.

Please provide comments on SDG&E proposed mitigation alternatives.

San Diego Gas & Electric Company’s (SDG&E) service area reliability assessment, in contrast to the assessments provided by PG&E and SCE, does not include power flow results to demonstrate the need and effectiveness of the solutions SDG&E proposes. SDG&E also states that its proposed transmission mitigations for its service area are reliability and policy-driven and aimed at increasing import capacity.[1] SDG&E also did not demonstrate that it considered CAISO’s recommended operational solutions or non-wire alternatives to address observed issues. Cal Advocates concludes that SDG&E’s presentation do not demonstrate the need for its proposed projects. Therefore, Cal Advocates recommends that none of SDG&E’s proposed projects be approved in the 2022-2023 TPP cycle.

The following are descriptions of the reliability issues CAISO identifies in SDG&E’s service area, CAISO and SDG&E's proposed solutions to address these issues, and Cal Advocates recommendations.

San Luis Rey/San Onofre Area

For the reliability assessment for the San Onofre area on the San Onofre – Capistrano line and the San Onofre – Talega line, CAISO identifies overloads in the in the spring-off peak scenarios.[2] CAISO recommends both short and long-term mitigation options. For the short-term, CAISO states that opening any segment of the 69 kV system during an overload would mitigate the observed overload. Regarding the long-term, CAISO refers to the previously-approved Japanese Mesa-Talega Tap and the Stuart Tap-Las Pulgas 69 kV Reconductor projects as solutions, which are expected to be in place in 2025 and 2026 respectively.[3]

In contrast, SDG&E recommends a new 230 kV line with a total cost of $110 million to 150 million, and only identifies the types of outages and overloads that are occurring and where the proposed investment would be located.[4] SDG&E provides no analysis of the impact of the approved projects on the observed overloads to demonstrate the remaining need for SDG&E’s proposed additional investment in the project area. Without this analysis, there is no evidence that the proposed project is needed or that it would be effective at addressing any remaining issues in the area. For these reasons, Cal Advocates recommends that this project not be approved.

Suncrest/Miguel Area

For the reliability assessment for the Suncrest/Miguel area, CAISO identified system overloads in the base and sensitivity scenarios . CAISO recommends a suite of solutions which include an existing Remedial Action Scheme (RAS), relying on a 30-minute emergency rating, and relying on system adjustments and operational actions.[5]

In contrast, SDG&E proposes two 230 kV lines and two new 500/230 kV Banks at Miguel with a cost of $275 million to $375 million.[6] SDG&E provides neither evidence that system readjustments and operational actions are not capable of mitigating the identified overloads nor analysis on the effectiveness of their proposed project. Cal Advocates recommends that the CAISO not approve this proposed $275 million to $375 million investment because SDG&E provides no project analysis and specifically no evidence on why CAISO's recommended system readjustments and operational actions are not capable of mitigating the identified overloads. Cal Advocates requests SDG&E evaluate the impact of CAISO’s lower cost solutions on the identified overloads and provide the results to stakeholders.

Old Town/Silvergate area

For the reliability assessment for the the Old Town – Mission and Silver gate area, CAISO identifies overloads . CAISO recommends relying on the 2-hour emergency rating and system adjustments, which could include either reducing generation output at the Otay Mesa substation or dispatch some sort of battery storage north of the Old Town substation area.[7] CAISO adds that energy storage as mitigation requires verification of sufficient megawatt-hour capacity to address the reliability issue and confirmation that it can be fully charged when needed.[8]

SDG&E proposes to rebuild the transmission line between Sycamore Canyon and Mission substations and to install two new phase shifter transformers at Mission 230 kV substation at a cost of $620 million to $750 million.[9] Here again, SDG&E provides no evidence that CAISO’s recommended operational solutions would not address the observed overloads effectively. Instead, SDG&E proposes an exceptionally costly project and provides no analysis demonstrating the need for the project and its effectiveness at addressing the identified need. Cal Advocates requests that SDG&E provide stakeholders an analysis that illustrates the impact of CAISO’s proposed solutions on the observed overloads as well as the possible impact of targeted DERs and EE programs on the anticipated overloads.

[1] 2022-23 TPP SDG&E BES Project Proposal, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 2 and 5.

[2] San Diego Study Area Preliminary Study Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 273.

[3]San Diego Study Area Preliminary Study Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 273.

[4] 2022-23 TPP SDG&E BES Project Proposal, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 3-6.

[5] San Diego Study Area Preliminary Study Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 263.

[6] 2022-23 TPP SDG&E BES Project Proposal, CAISO 2022-2023 TPP Presentation, September 28, 2022, pp. 4 and 6.

[7] San Diego Study Area Preliminary Study Results, CAISO 2022-2023 TPP Presentation, September 27, 2022, slide 265.

[8] SDG&E 2022-2023 ISO Reliability Assessment – Preliminary Study Results, San Diego, CAISO, August 15, 2022, p.1.

[9] 2022-23 TPP SDG&E BES Project Proposal, CAISO 2022-2023 TPP Presentation, September 28, 2022, p. 6.

5.

Please provide comments on SCE proposed mitigation alternatives.

SCE Serrano 4 AA 500/230 kV bank and 230 kV GIS rebuild

CAISO’s reliability assessment for the Serrano Substation area identifies overloads that occur if multiple transformers are lost. CAISO recommends dispatching available resources, including energy storage, demand response, and specified operational controls to address these possible overloads. Going forward, CAISO encourages further evaluation to determine whether the overload concern in the West Los Angeles basin can be eliminated and whether utilization of the portfolio of energy storage in the area can eliminate the overloads.[1]

Southern California Edison Company’s (SCE's) proposal is to add a fourth transformer at the Serrano substation and rebuild 230 kilovolt (kV) gas-insulated switchgear (GIS) to 80 kA capacity. SCE explains that the Serrano 500/230 kV substation is the main 500 kV hub for bringing renewable resources into the Los Angeles (LA) Basin/Orange County area. SCE states that adding the 4th AA bank will “facilitate more flow into Orange County but cause the existing 230 kV GIS switchback to exceed its rated Short Circuit Duty (SCD) limit.”[2]

Further study is needed to determine if this is the best course of action for this substation. CAISO’s suggested operational control temporarily mitigates the overloading, which allows time to explore the potential for more cost-effective alternatives. Regarding a storage alternative, CAISO states that the current portfolio of storage in the area is limited to four-hour battery storage systems, and that an eight-hour storage solution is needed and that it could be more costly. [3] However, the CPUC’s 2032 Preferred System Plan requires SCE to add 500 MW of new long-duration storage to its portfolio by 2032.[4] Therefore, Cal Advocates recommends that CAISO not approve SCE’s proposed solution in the 2022 TPP and instead requests that SCE evaluate a long duration energy storage alternative for the noted reliability issue.

[1] SCE Main System Preliminary Reliability Assessment Results, 2022-2023 Transmission Planning Process Stakeholder Meeting Presentation (CAISO 2022-2023 TPP Presentation), September 27, 2022, p. 168.

[2] Proposed SCE submittal into the 2022-2023 Transmission Planning Process, 2022-2023 CAISO TPP Presentation, September 28, 2022, slide 8.

[3] Southern California Bulk Preliminary Reliability Assessment Results, CAISO 2022-2023 TPP Presentation, pp. 187-188.

[4] CAISO Policy-driven Assessment Updates, CAISO 2022-2023 TPP Presentation, September 28, 2022, p. 16.

6.

Please provide comments on VEA/GLW proposed mitigation alternatives.

CAISO’s reliability assessment for the Valley Electric Association (VEA) service area indicates that both short- and long-term solutions are available to address observed overloads in this service area. These short-term solutions include the Sloan Canyon RAS and congestion management, and a long-term solution, which is the 2021 approved $278 million Gridliance West (GLW) upgrade project.[1]

The 2021 GLW upgrade project consists of rebuilding certain sections of the VEA 230 kV system and adding and upgrading transformers. CAISO’s economic assessment results for this project estimates that the project has a benefit-to-cost ratio of 1.77. CAISO also identifies the 2021 GLW upgrade project as a policy deliverability mitigation that is needed to provide sufficient transmission capability to deliver the renewable generation in the CPUC integrated resource plan portfolio in the GLW/VEA area to CAISO system load.[2]

This year GLW proposes additional transmission upgrades with a cost estimate of $305 million for a region that represents about 0.28% of CAISO’s grid load.[3] GLW did not provide any evidence that there are overloads in its service area that cannot be addressed with the previously approved project and CAISO’s identified RAS. Thus the proposed mitigations are not justified based on CAISO’s reliability assessment. The 2022 GLW upgrade project is similar in scope as the approved upgrade project and includes additional 230 kV circuit section rebuilds and replacements and adding three new 500/230 kV transformer banks and two new switching stations.

As Cal Advocates notes in previous comments, should GLW seek to justify upgrades on the premise that they are needed for reliability, GLW should provide evidence that the existing system design fails to meet NERC planning standards.[4] In this TPP cycle, VEA again did not provide any evidence that its proposed upgrades are needed to meet a reliability need and thus should not be approved.[5] To better understand the issues in the VEA area and possible alternatives, Cal Advocates recommends that the CAISO provide an assessment of Nevada Energy’s GreenLink West project, (which is expected to be on line by the end of 2025), possible impact on the VEA system with this project, and if this project could also provide California access to southern Nevada’s geothermal and other renewable resources.[6]

[1] Valley Electric Association Preliminary Reliability Assessment Results, CAISO 2022-2023 TPP Presentation, September 28, 2022, p. 247.

[2] CAISO 2021-2022 Transmission Plan, CAISO, March 17, 2022, p. 294.

[3] As of January 1, 2022, the filed MWh gross load for VEA was 544,970, relative the ISO total of 196,853,945. (Available at http://www.caiso.com/Documents/HighVoltageAccessChargeRatesEffectiveJan012022RevisedAug262022.pdf.)

[4] Cal Advocates Comments on the September 27-28 Stakeholder Call Discussion, 2021-2022 Transmission Planning Process, October 12, 2021, pp.7-8.

[5] GLW’s Presentation is available at http://www.caiso.com/InitiativeDocuments/GLWPresentation-2022-2023TransmissionPlanningProcess-Sep28-2022.pdf.

[6] https://www.nvenergy.com/cleanenergy/greenlink

7.

Please provide comments on CAISO high voltage TAC presentation.

Cal Advocates appreciates CAISO's updated high voltage (HV) transmission access charge (TAC) forecast based on the capital projects approved in the 2021-2022 transmission planning process (TPP).

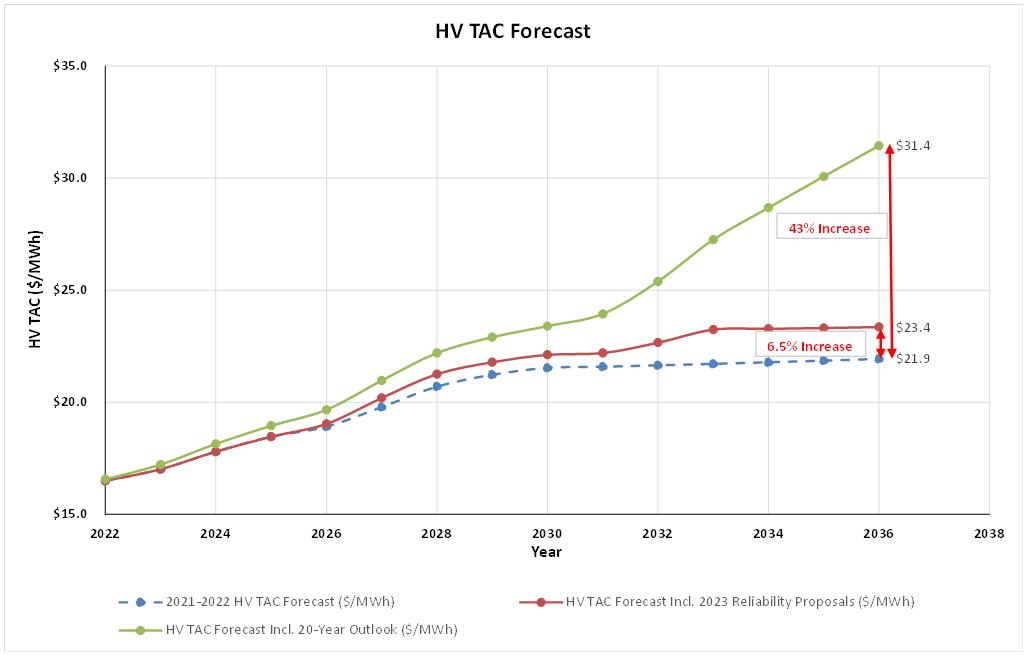

However, Cal Advocates is concerned that the proposed $2.9 billion in capital expenditures for the proposed reliability projects presented at the September 2022 TPP meetings[1] may not be needed, as explained in these comments and that these possible new costs were not considered in CAISO's forecast amongst other potential costs. In addition, Cal Advocates is concerned about the escalating cost of transmission as a portion of the total ratepayer energy bills. To illustrate the impacts of the presented 2022-2023 TPP reliability projects, Cal Advocates updated CAISO's 2021-2022 HV TAC forecast, shown in Figure 2., to include the revenue from all PTO-proposed reliability projects and additional capital expenditures included in CAISO's 20-Year Transmission Outlook, issued in 2021, and estimated at $30.5 billion.[2]

Figure 2.: Cal Advocates’ Supplemental HV TAC Forecast[3]

As shown in Cal Advocates' forecast above, approval of the proposed reliability projects would result in an approximately 6.5% increase in the already historically high HV TAC. CAISO’s 2021 HV TAC forecast is likely an underestimate of possible future TAC increases. Given the staggering estimated $30.5 billion needed in transmission investment from the CAISO’s 20-Year Transmission Outlook,[4] the HV TAC can only be expected to increase further as new transmission investments are constructed and come on-line. This projection of capital expenditures does not even include the historical cost increases of 41% above the CAISO’s upper end estimates.[5] If this cost escalation trend persists, it will further increase the burden on ratepayers. Cal Advocates also notes that the CAISO HV TAC forecast stops at year 2036 and does not extend to 2042 and, thus, leaves out the remaining capital expenditures in the 20-Year Outlook that Cal Advocates estimates at approximately $10 billion.

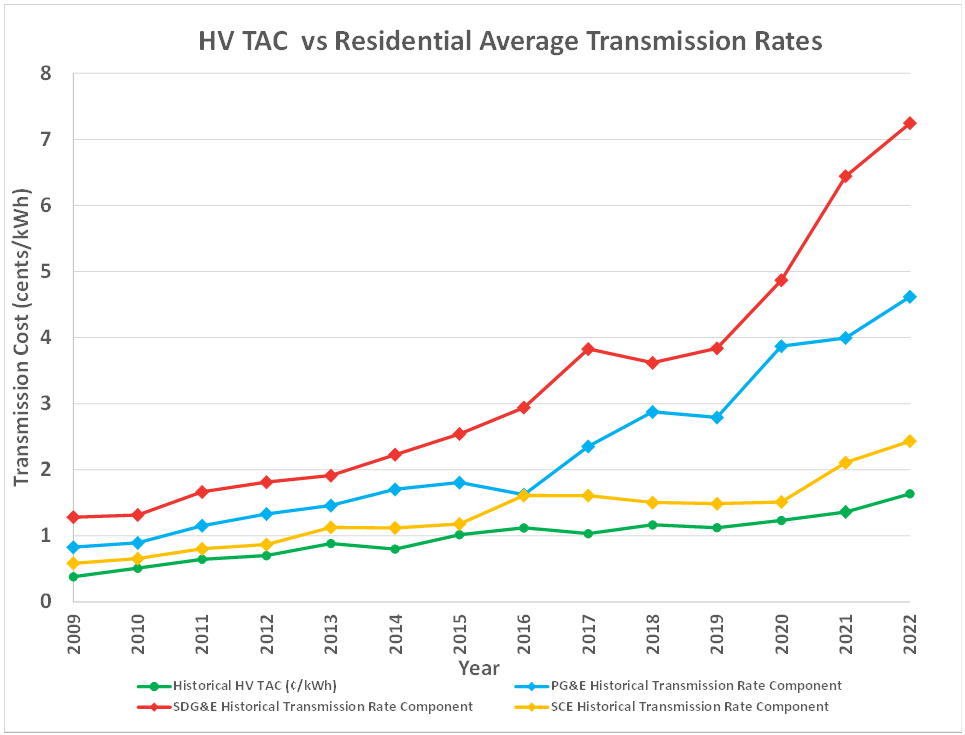

To further emphasize ratepayer impacts, Figure 3. below presents a comparison of the historical HV TAC to the residential average transmission rate components for the three major PTOs in the CAISO’s balancing authority area. As seen in Figure 3., there are modest increases expected in the HV TAC in comparison to the significant increases in transmission charges to SDG&E and PG&E ratepayers. The actual transmission cost increases for residential average ratepayers in 2022 ranged from 150% to 440% of the HV TAC value, and the portion of residential average utility bills dedicated to transmission charges increased by 6% to 12.3% between 2009 and 2022.[6] This steep increase in transmission costs deserves consideration along with the evaluation of the proposed projects specifically for those projects that have no justification.

Figure 3: Historical HV TAC vs Residential Average Transmission Rates[7]

To address these rising transmission costs, Cal Advocates recommends CAISO pursue the most cost-efficient solutions, and fully explore non-wire alternatives and CAISO’s mitgation suggestions contained in these comments to address the projected reliability issues in the 2022-2023 TPP. Cal Advocates also requests CAISO identify the investments that are in-line with the 20-Year Outlook and identify investments that are in addition to the 20-Year Outlook’s $30.5 billion investment estimate.

[1] PG&E’s 2022 Request Window Proposals, CAISO 2022-2023 TPP Presentation, September 28, 2022; Proposed SCE submittal into the 2022-2023 Transmission Planning Process, 2022-2023 CAISO TPP Presentation, September 28, 2022; Gridliance West Project Proposal for the 2022-2023 TPP Reliability Request Window, September 28, 2022; 2022-23 TPP SDG&E BES Project Proposal, CAISO 2022-2023 TPP Presentation, September 28, 2022

[2] CAISO 20-Year Transmission Outlook, CAISO, May 2022, p. 3.

[3] Cal Advocates’ HV TAC forecast was produced from CAISO’s 2021-2022 HV TAC Forecast Model, with the proposed reliability projects from the 2022-2023 TPP modeled as entering the rate base with the capital cost estimate and expected in-service date listed in each PTO’s reliability proposal presentation (see footnote 44).

[4] CAISO 20-Year Transmission Outlook, CAISO, May 2022, p. 3.

[5] Cost Savings Offered by Competition in Electric Transmission, The Brattle Group, April 2019, Appendix A. Figure 23.

[6] Transmission charges and residential average rate were obtained from annual utility advice letter filings with the CPUC. Between 2009 and 2022, the portion of the residential average rate taken up by transmission charges increased from 5.2% to 17.2% for PG&E, 3.8% to 9.7% for SCE, and 7% to 19.3% for SDG&E.

[7] Historical HV TAC Charges obtained from archived CAISO HV TAC publications.

8.

Please provide comments on CAISO policy assessment update.

9.

Please provide comments on CAISO economic assessment update.

10.

Any additional comments?

CAISO’s reliability assessments consider the impact of California Energy Commission (CEC) 2021 demand forecasts under different scenarios[1] as well as an additional CEC transportation electrification (ATE) demand scenario for 2035. However, CAISO only provided its reliability assessment results for years 2024, 2027 and 2032. CAISO did not provide similar results using the ATE demand scenario for 2035. Cal Advocates requests that the CAISO posts its reliability assessment results using the (ATE) demand scenario for 2035.

PG&E's presentation on reliability issues and proposed mitigations in its service area identifies specific customers that are driving load growth in certain load pockets such as cannabis growers, data centers, and business parks. When specific industries can be identified as the sole drivers of needed new upgrades, PTOs should approach these customers with targeted programs to reduce their load; if these customers are seeking interconnection, these customers should contribute to needed upgrades to serve their load to ensure that project cost allocation is consistent with the cost drivers and beneficiaries.

Cal Advocates also notes that none of the PTOs listed consideration of lower-cost behind-the-meter solutions as part of their mitigation strategies in their presentations, such strategies could lower the cost or need for the proposed wire solutions. Cal Advocates also requests the PTOs consider DER solutions in their project approach and mitigation design practices to avoid unnecessary costs for ratepayers.

[1] CAISO 2022-2023 Preliminary Reliability Assessment Results, August 15, 2022 at California ISO - 2022-2023 Transmission planning process (caiso.com)

New Leaf Energy, Inc.

Submitted 10/12/2022, 03:12 pm

1.

Please provide comments on CAISO reliability assessment for the North area (PG&E).

New Leaf Energy, Inc. has no comment at this time.

2.

Please provide comments on CAISO reliability assessment for the South area (SCE, SDG&E, VE/GLWS)

New Leaf Energy, Inc. has no comment at this time.

3.

Please provide comments on PG&E proposed mitigation alternatives.

New Leaf Energy, Inc. has no comment at this time.

4.

Please provide comments on SDG&E proposed mitigation alternatives.

New Leaf Energy, Inc. has no comment at this time.

5.

Please provide comments on SCE proposed mitigation alternatives.

New Leaf Energy, Inc. has no comment at this time.

6.

Please provide comments on VEA/GLW proposed mitigation alternatives.

New Leaf Energy, Inc. has no comment at this time.

7.

Please provide comments on CAISO high voltage TAC presentation.

New Leaf Energy, Inc. has no comment at this time.

8.

Please provide comments on CAISO policy assessment update.

New Leaf Energy, Inc. has no comment at this time.

9.

Please provide comments on CAISO economic assessment update.

New Leaf Energy, Inc. has no comment at this time.

10.

Any additional comments?

New Leaf Energy, Inc. (New Leaf) strongly supports the CAISO’s efforts to include non-transmission alternatives in its reliability-driven transmission analyses. New Leaf, an independent developer of energy storage that was recently spun out of solar and storage developer Borrego, looks forward to providing solutions to CAISO system reliability needs.

The CAISO has identified energy storage systems as possible non-transmission solutions in several areas, according to the reliability analysis results presented at the September 27th-28th Transmission Planning Process (TPP) stakeholder meetings.[1] However, New Leaf fears that non-transmission solutions will not be successful if the CAISO does not provide needed structure and guidance beyond simple approval. Therefore, New Leaf makes the following recommendations:

- On an interim basis, for purposes of meeting the needs identified in this TPP cycle, the CAISO should allow for the procurement of non-transmission storage solutions without requiring deliverability; and

- The CAISO should revive its work, begun in the Storage as a Transmission Asset (SATA) initiative, on creating a durable framework for SATAs and market-based resources that would meet reliability needs in place of transmission upgrades.

Background

Prior to the CAISO’s 2021-2022 TPP, the CAISO approved two energy storage non-transmission solutions: a 10MW/51MWh battery at Dinuba Substation (Reedley 70 kV Reinforcement) and a 10MW/40MWh battery at Oakland C Substation (Oakland Clean Energy Initiative). [2] FERC directives later motivated the CAISO to initiate the SATA stakeholder process to explore how reliability-based storage assets could participate in CAISO markets without jeopardizing their primary purpose. The CAISO and stakeholders worked hard to develop a framework (the “Second Revised Straw Proposal”) that included the following features: [3]

- Determination of transmission need: The CAISO would determine on a daily basis when it expected to need the SATA as transmission. If the CAISO determined that the SATA would be needed for reliability, the resource would be reserved for transmission use and could not participate in the market. If the CAISO determined that the SATA would not be needed for reliability, the resource could bid into the Day Ahead or Real-Time market.

- No GIDAP requirement: SATA resources would not be required to go through the generator interconnection process (GIDAP) but would be studied in the TPP (and modeled in later generator interconnection studies) as a transmission addition.

- No Resource Adequacy (RA) Net Qualifying Capacity (NQC) requirement: SATA resources would be modeled as transmission in determining local capacity area needs and thus would not have a deliverability requirement or count for RA.

During the SATA initiative, the CAISO indicated its preference that procurement of storage assets for reliability needs would be procured by Load-Serving Entities (LSE) through their market contracting and purchases[4] and that such resources should be treated as Non-Generator Resources to the extent possible.[5]

The CAISO never completed the SATA initiative. It was suspended pending further CAISO development of storage rules in the Energy Storage and Distributed Energy Resources (ESDER) initiative and never resumed.[6]

Unresolved Issues

Because the SATA initiative was suspended, key issues remain unresolved related to SATAs and to resources approved as transmission substitutes but procured by LSEs as market resources. It is critical for the success of the transmission-alternative approach that the CAISO address these issues expeditiously in the SATA forum, where stakeholders can provide input and the framework can be finalized.

The nexus between reliability needs and market participation is one issue that is currently unresolved. For example, when the CAISO identifies a battery storage resource as a transmission substitute, clearly the battery must be available whenever needed by the CAISO to fulfill the reliability need for which it was identified. If the resource has been procured as a SATA, it is not clear whether or how the resource could also participate in CAISO markets. If the resource is procured by an LSE as a market resource, it is not clear how the transmission reliability need would be met given the resource’s market activity, or how meeting that reliability need could constrain the resource’s market activities.

Moreover, issues relating to participation in the GIDAP, including RA deliverability, are an integral part of the CAISO’s assessment of the alternative. The last determination in the SATA initiative was that SATAs need not participate in the GIDAP process nor have RA deliverability, because those resources would be modeled and included in CAISO base cases as transmission (essentially the same as a transmission line or transformer).[7]

The same basic concept should apply to resources identified to meet a reliability need but procured by LSEs. The funding mechanism may be different, but the modeling issue would be the same. This is a critical issue because there are significant consequences to requiring market resources procured to meet an identified reliability need to go through the GIDAP and/or to have RA deliverability. These consequences include:

- The time lag for the Interconnection Studies (two to three years or more, depending on whether any resources that could meet the reliability need are already in the queue). If there are no resources in the queue in these specific locations, then new Interconnection Requests would have to be submitted in Cluster 15, and the distinct possibility of a large cluster could lengthen the study process even further, similar to the situation for Cluster 14.

- The likely time lag for construction of identified Distribution and/or Network Upgrades, at a time when PTO construction durations seem to be continually lengthening, including the delays and additional requirements now commonly included in annual Reassessment Reports.

- The increasing possibility that there may be no deliverability available in the project area, in which case it would be impossible for the resource to meet this requirement, at least in any timely fashion and perhaps never.

The latter consequence is existential. The very purpose of the resources selected as non-transmission reliability solutions is to address local reliability needs in areas of significant constraint. It follows that these areas are very unlikely to have available deliverability for a new resource. Requiring a transmission solution intended to support areas with low or no deliverability to be deliverable is illogical and increases the probability that energy storage will not be a feasible reliability solution.

Lamont Battery

The lack of guidance is already having a negative real-world impact. In the 2021-2022 TPP, after suspending the SATA initiative, the CAISO recommended a 95MW/380MWh energy storage system to be sited at Lamont Substation as a non-transmission alternative to specific identified transmission upgrades (the “Lamont Battery”). The energy storage system would provide protection against several contingencies (including two P2 contingencies).[8]

In Decision (D.) 22-02-004, the CPUC directed PG&E to conduct a competitive solicitation to procure the Lamont Battery in its capacity as the Central Procurement Entity (CPE).[9] However, because the SATA initiative was never completed, PG&E has no official guidance in the CAISO tariff or market rules on how it should proceed with this procurement, including any rules regarding reliability limitations on market activity or any GIDAP or RA requirements.

The CAISO should inform the CPUC and PG&E that deliverability is not necessary for the Lamont Battery to be able to serve the reliability need identified in the 2021-2022 TPP. The reason that the Lamont Battery was recommended was to address local reliability needs in a constrained area. As contemplated, the Lamont Battery would address the local reliability need by effectively reducing the amount of NQC required in the local capacity area.

D. 22-02-004 required PG&E to report on its progress toward procuring the Lamont Battery by December 31, 2022.[10] PG&E’s reporting deadline is less than three months away. If sufficient progress is not made, the non-transmission approach will fail, and the transmission project will be selected instead.

Conclusion

Key issues raised in the SATA initiative for SATAs and market-based resources that would meet reliability needs in place of transmission upgrades remain unresolved. As a result, non-transmission alternatives identified by the CAISO in the 2022-2023 TPP will likely face significant uncertainties and delays. Therefore, New Leaf reiterates its recommendations:

- On an interim basis, for purposes of meeting the needs identified in this TPP cycle, the CAISO should allow for the procurement of non-transmission storage solutions without requiring deliverability; and

- The CAISO should revive its work, begun in the Storage as a Transmission Asset (SATA) initiative, on creating a durable framework for SATAs and market-based resources that would meet reliability needs in place of transmission upgrades.

New Leaf thanks the CAISO for the opportunity to provide these comments.

[1] See, e.g., “Agenda: Reliability Assessment and Study Updates,” p. 187. (September 27-28, 2022.) Available at: http://www.caiso.com/InitiativeDocuments/Presentation-2022-2023TransmissionPlanningProcess-Sep27-2022.pdf.

[2] “California ISO 2017-2018 Transmission Plan (Board Approved),” p. 142, 129. (March 22, 2018.) Available at: http://www.caiso.com/Documents/BoardApproved-2017-2018_Transmission_Plan.pdf.

[3] “Storage as a Transmission Asset – Second Revised Straw Proposal,” p. 29, 15. (October 16, 2018). Available at: http://www.caiso.com/InitiativeDocuments/SecondRevisedStrawProposal-Storageas-TransmissionAsset.pdf.

[4] Id., p. 17.

[5] “Storage as a Transmission Asset.” (January 14, 2019.) Available at: http://www.caiso.com/InitiativeDocuments/Presentation-Storage-TransmissionAsset-Jan142019.pdf.

[6] Id. p. 15.

[7] Storage as a Transmission Asset – Second Revised Straw Proposal,” p. 15. (October 16, 2018). Available at: http://www.caiso.com/InitiativeDocuments/SecondRevisedStrawProposal-Storageas-TransmissionAsset.pdf.

[8] “California ISO 2021-2022 Transmission Plan – Board Approved.” (March 17, 2022.) Available at: http://www.caiso.com/InitiativeDocuments/ISOBoardApproved-2021-2022TransmissionPlan.pdf.

[9] CPUC Decision 22-02-004, Ordering Paragraph 12: “Pacific Gas and Electric Company (PG&E) shall conduct a competitive solicitation for the 95 megawatt four-hour storage project at the Kern-Lamont Substation identified in the California Independent System Operator’s 2020-2021 Transmission Planning Process as the Central Procurement Entity under the process established in Decision 20-06-002. PG&E shall submit the results of its progress in a Tier 2 Advice Letter by no later than December 31, 2022.” Available at: https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M451/K412/451412947.PDF.

[10] Id.

Silicon Valley Power

Submitted 10/12/2022, 07:09 pm

1.

Please provide comments on CAISO reliability assessment for the North area (PG&E).

SVP Supports the CAISO-Approved Projects in 2021-2022 Transmission Plan

The City of Santa Clara, dba Silicon Valley Power (SVP), appreciates the opportunity to comment on developing the 2022-23 Transmission Plan. The comments and questions below address the material presented at the CAISO Stakeholder meeting on September 27-28, 2022. SVP acknowledges the significant efforts of the CAISO and PTO staff to develop this material.

SVP supports the Study Plan’s assumption that all transmission projects that the CAISO has approved, including those in the 2021-2022 Transmission Plan, are modeled in the reliability study.[1]

SVP appreciates the CAISO staff’s tremendous efforts throughout the 2021-2022 transmission planning cycle, resulting in the CAISO recommending both short- and long-term solutions to address the SVP’s reliability issues. In particular, SVP supports the CAISO management recommended approval of the two HVDC lines in the area, that is, one 500 MW HVDC line from Newark 230 kV to near the Los Esteros 230 kV substation and connected to the SVP’s NRS 230 kV substation with 230 kV AC lines or cables, and another 500 MW HVDC line from Metcalf 500 kV to San Jose B 115 kV substation.

SVP’s Load Continues to Grow At a Dramatic Rate, and CEC and SVP Expect a Significant Load Growth Over the Next Several Years

As the CAISO is aware, SVP’s load is expected to grow considerably in the next several years, primarily driven by hyper-scale data centers. Table 1 compares the 1-in-10 Summer Peak loads for SVP modeled in the last three planning cycles with the actual 2022 peak load. SVP’s actual peak load in September 2022 was 703 MW (a major increase from 592 MW of peak load in 2021), well exceeding the 2030 1-in-10 peak load of 670 MW assumed in the CAISO 2020-2021 TPP. SVP understands there is uncertainty concerning the rate of load growth but is quite concerned about the CAISO not approving sufficient transmission to meet the needs for reliable electric service to SVP’s customers. We understand the need to follow the projections of the CEC in its base cases, but we believe that the CAISO should consider the projected SVP peak loads in the years 2024, 2027, and 2032 assumed in the 2022-2023 TPP as load levels that are likely to be exceeded.

Table 1: A Comparison of SVP’s Actual 2022 Peak Load and 1-in-10 SVP Summer Peak Loads (MW) Modeled in Last Three TPP Cycles

|

Year

|

Actual (MW)

|

CAISO 2020-2021 TPP (MW)

|

CAISO 2021-2022 TPP (MW)

|

CAISO 2022-2023 TPP (MW)

|

|

2021

|

592

|

|

|

|

|

2022

|

703*

|

624

|

|

2023

|

|

|

821

|

|

2024

|

|

814

|

|

2025

|

657

|

|

|

2026

|

|

1,076

|

|

2027

|

|

1,082

|

|

2030

|

670

|

|

|

2031

|

|

1,175

|

|

2032

|

|

1,168

|

*SVP's CY2022 actual instantaneous system peak was recorded on SVP's NCP1 meter as 703 MW on 09/06/2022 @ HE13:00 with 13MW of load curtailment. By HE14:00, SVP was curtailing >80MW of load and would have peaked at 760MW had customer load curtailment not occurred.

Additional Transmission Upgrades Are Required to Address Multiple NERC and CAISO Planning Criteria Violation In the Interim

The CAISO has recognized that other improvements to the transmission system's capability to serve load reliably will be needed before the HVDC projects can be constructed. In the 2021-2022 Transmission Plan, the CAISO also approved adding series compensation devices to one of the 115 kV lines serving the SVP load. SVP fully supports this short-term mitigation.[2] The CAISO 2021-2022 Transmission Plan correctly recognized that this solution would not be adequate to address the near-term reliability issues for the SVP system. And we see strong evidence of that in CAISO’s preliminary reliability assessment in the current TPP cycle. Column A in Table 2 below shows that there are multiple P1, P6, and P7 contingency overloads on the PG&E facilities SVP depends on to serve its load reliably, as identified in the CAISO preliminary reliability assessment.[3] SVP conducted an independent power flow analysis to replicate the CAISO findings, which reached the same conclusions. SVP conducted an additional scenario, which assumes a 50MW of battery energy storage system (BESS) at SVP’s 60kV Kenneth substation.[4] SVP found that adding the 50MW BESS eliminates some of the P1 and P7 overloads in 2027, reducing the overloads in the remaining cases, but not eliminating them.

Table 2: Multiple NERC and CAISO Planning Criteria Violations in 2027 from CAISO Preliminary Reliability Analysis in 2022-2022 TPP

.png)

In those remaining overloads, SVP found that adjusting the angle of phase shifter setting at SVP’s SSS substation would not relieve all the overloads for 2027. Some relevant contingencies include the loss of the phase shifter path, that is, the outage of either SSS-NRS 230 kV, or SVP's PST.

In order to mitigate the contingency overloads on the Newark-NRS 115kV, SVP believes the CAISO needs to study the reconductoring of the two existing Newark-NRS 115 kV lines. SVP studies indicate the reconductoring project would eliminate the major P7 and P6 overloads on the Newark-NRS 115 kV lines. To address the remaining P1 and P6 overloads on the other facilities included in Table 2, SVP suggests the CAISO explore additional mitigation measures. One should be the addition of series compensation to the reconductored lines. SVP believes that such devices, operating in a capacitive mode when needed, can be an effective, relatively low-cost additional mitigation measure. As an alternative to the installation of the series compensators, SVP suggests the CAISO explore the strategic installation of battery energy storage system on the SVP system. SVP believes that the CAISO should consider adding the mitigations above to projects included in this year's TPP.

Value of Mid-Term Mitigation Solutions in the Long Term After the HVDC Project is Online

Table 3 shows that there are two P6 contingency overloads on the Newark-NRS 115kV lines in 2032 after the Newark-NRS HVDC project is built.[5] We expect that a higher load scenario assumed in the Additional Transportation Electrification (ATE) load sensitivity scenario in 2035 assessed by the CAISO in the current planning cycle will show higher P6 and even some new P7 overloads. With the additional hyperscale data center loads in SVP and the surrounding San Jose sub-area than anticipated earlier in conjunction with transportation electrification, such a high load scenario seems increasingly likely to materialize. Any combinations of transmission solutions found to be effective in the outer years, such as 2032, should also remain effective in the longer term. SVP believes that a combination of the reconductoring of the Newark-NRS 115kV project in combination with series compensation and/or BESS would be effective in the long-term. So, these solutions are not only effective in relieving overloads before the completion of the CAISO-approved HVDC lines but improve the capability to serve growing loads after their installation.

Table 3: NERC and CAISO Planning Criteria Violations in long-term with both CAISO-Approved HVDC lines installed

|

Overloaded Facility

|

Contingency

|

Cat

|

2032 Summer Peak Baseline

|

|

Newark - Northern Receiving Station #1 115kV line

|

HVDC Newark-NRS (230kV AC line) and SSS-NRS 230kV same as outage of SVP's PST

|

P6

|

107%

|

|

HVDC Newark-NRS (230kV AC line) and Newark D 230/115 TB 7

|

P6

|

104%

|