1.

Please provide your organization’s feedback to the MURA discussion.

Comments on Resource Adequacy Modeling and Program Design

Working Group

Department of Market Monitoring

March 13, 2025

Overview

The Department of Market Monitoring (DMM) appreciates the opportunity to comment on the Resource Adequacy Modeling and Program Design Working Group dated February 10 and 11, and March 4, 2025.[1],[2] In these comments, DMM adds to our previous comments from the ISO’s Resource Adequacy Modeling and Program Design (RAMPD) Revised Discussion Paper and Final Recommendation Plan and Issue Paper.[3],[4] DMM includes additional comments on the following five issues:

- Unforced capacity (UCAP). DMM continues to support creating a resource-level UCAP policy with a supply cushion approach, and recommends incorporating energy limitations for storage resources.

- Accounting for ambient derates. Ambient derates should be self-reported by the resource, for conditions specified by the ISO. As tight system conditions typically arise during the availability assessment hours (AAHs), DMM recommends the ambient conditions for the ambient derate (and thus the net qualifying capacity, or NQC value) be set during this time period of the day. DMM also notes the need to address interdependencies of ambient derate accounting during the availability assessment hours, and the must offer obligation with UCAP.

- Resource availability and performance mechanisms. DMM recommends the ISO consider implementing both a resource availability and performance mechanism, and set the price using a resource adequacy (RA) price benchmark. DMM agrees that RA penalty revenues should be allocated to load to defray RA costs to ratepayers.

- Outage substitution. DMM suggests that the ISO relax outage substitution requirements, and establish an outage substitution pool that operates as an auction. This approach could reduce search and coordination problems with finding substitute RA for planned outages. These comments provide data on the upper bound of the volume of the market for potential outage substitution capacity. These data indicate sufficient capacity would likely be available to offer into the auction during non-summer periods, when most planned maintenance occurs.

- Resource visibility. DMM supports increased resource reporting, but notes it may be obviated when incentives are improved for the capacity procurement mechanism (CPM).

Comments

Unforced capacity (UCAP)

DMM continues to support creating a resource-level UCAP policy with a supply cushion approach.[5] A UCAP mechanism levelizes the capacity valuation process across resource types to ensure a more fungible market, and reduces concerns for “like-for-like” substitution RA capacity. The increased transparency from UCAP will promote procurement of better performing resources, and allow buyers of RA more information in the bilateral RA market.

The UCAP design should incorporate all forced (and urgent) outages that are under the control of the scheduling coordinator (SC) for the particular unit. This would include most forced and urgent outages, but would exclude outages that are beyond the control of the SC, such as transmission induced, market software limitations, or environmental restriction outages.

DMM further recommends particular attention be given to storage resources and their state-of-charge (SOC) limitations.[6],[7],[8] Limitations that prevent a storage resource from accessing its full SOC range may lead the resource to not have the four-hours of deliverability required to provide their shown resource adequacy. This could prevent a resource from being able to deliver its full resource adequacy value for a full four hours, or only allow the resource to maintain a value less than its resource adequacy capacity for a four-hour period.

DMM highlights this in Figure 1 below, which shows the average derated energy of storage resources, presented as a capacity measure. The calculation takes the minimum and maximum SOC limits of resources submitted through scheduling infrastructure and business rules (SIBR) or the outage management system (OMS), quantifies it against the energy limits registered in Masterfile, and divides the difference by four hours to calculate a measure of average hourly missing capacity from the submitted energy limits. This is the effective reduction in capacity if a four-hour deliverability is maintained. Average missing capacity for July through September 2024 was around 620 MW.

Figure 1 – Effective average hourly missing capacity from submitted energy limits

Another consideration for storage resources and UCAP accounting is that physical limitations of the resource may prevent full deliverability of resource adequacy capacity. For example, foldback or cell voltage imbalances create temporary physical limitations on a storage resource that can be rectified and allow for access to the phantom energy. In the Storage Design and Modeling initiative, there has been work to address these concerns.[9],[10] DMM recommends the interdependency between these two policy initiatives be considered in the development of the UCAP mechanism.

Accounting for ambient derates

The ISO is also contemplating a UCAP-like framework to account for ambient derates. DMM supports an ambient derate accounting framework, and suggests that the ISO require resources to self-report their available capacity after accounting for ambient derates from their known thermodynamic limits.[11] If the ISO were to seek to verify that a resource was accurately reflecting their seasonal ambient availability, then CAISO Tariff Section 40.4.4 may apply, allowing the ISO to test the resource and readjust the resource’s true maximum ambient operating limit. In this situation, DMM suggests the ISO could also include a penalty for misrepresentation of the resource’s availability.

Ambient derates are predominantly a function of temperature and humidity, and thus an ambient derate can vary throughout the day. To implement a self-reporting scheme with a monthly static value, the ISO will need to select the appropriate ambient conditions for resources to self-report an ambient derate. As tight system conditions typically arise during the availability assessment hours (AAHs), DMM recommends the ambient conditions for the ambient derate (and thus the NQC value) be set during this time period of the day. This may overstate potential production availability of resources during some warmer mid-afternoon hours, but the peak (and net peak) hours are when resources with ambient derates are most needed.

Currently, the CAISO Tariff includes a must-offer obligation (MOO) for resources up to their shown RA values. The interdependencies of ambient derate accounting during the AAHs, and the MOO with UCAP will need to be addressed. DMM understands the resulting NQC of a resource after ambient derate accounting and UCAP will be the result of taking deliverable qualifying capacity, adjusting to reflect ambient derates, and then the UCAP percentage adjustment will be made. If ambient derate accounting does not reflect real-time conditions, and a resource must take an ambient derate above the derated capacity accounted for in this policy, the ISO should make explicit the interaction with the UCAP mechanism and the additional derate. In these conditions, the resource will be unable to meet their MOO, and thus there could be a potential UCAP impact of the additional derate.

As a part of the interdependencies in RAMPD, if the resource has misrepresented their maximum operating limit, and cannot reach their true maximum output, the resource would owe availability or performance payments. Sufficiently strong availability or performance penalties would dissuade resources from misrepresenting their available capacity. Self-reporting with the possibility of testing would reduce the administrative burden to the ISO, and the interdependent outage policies from a well-designed UCAP mechanism and performance incentives would discipline the SCs in their self-reporting.

Availability and performance incentives

As formulated in the Issue Paper, availability and performance incentive mechanisms are assessed on different metrics.[12] An availability incentive uses bids to determine availability, while a performance incentive uses schedules and delivered supply. The distinction between these two mechanisms is important because it leads to two separate behavioral incentives, and thus potentially two different outcomes.

Currently, the ISO’s RA availability incentive mechanism (RAAIM) is calculated from a resource’s submitted economic bids or self-schedules, and compared to their shown RA capacity. Availability penalties are calculated as a resource’s monthly average availability during the availability assessment hours (AAHs), and multiplied by an administrative penalty price set at 60 percent of the capacity procurement mechanism soft offer cap. The ISO’s MURA (Measuring Unavailable RA) proposal uses the same definition of availability, but assesses availability only during stressed grid conditions, and recommends a higher penalty price. DMM believes the proposed MURA mechanism will improve resource availability incentives and system reliability.

Availability incentives provide financial motivation for resources to bid into the market, but do not provide a financial motivation to perform, i.e., meet the resource’s schedule. As a result, DMM recommends the ISO additionally consider a performance incentive mechanism that would be a measure of a resource’s schedule against their metered contribution to the system. A performance mechanism and an availability incentive are complementary, and could be considered as a package to meet the operational needs of the system.

DMM publishes RA availability and performance measures during hours with restricted maintenance operations, or higher level of system emergency. The most recent report found there was an average availability of 89 percent of capacity bid or self-scheduled, indicating 11 percent of capacity was unavailable. As for performance, an average of about 67 percent of RA capacity received schedules and only 62 percent of RA capacity responded, indicating 7.5 percent of the 67 percent of scheduled RA capacity did not meet their schedules.[13] This amounts to an average of approximately 2,500 MW that did not perform during stressed conditions. With the current and proposed availability incentives, this non-performing RA capacity would not be assessed penalties.

As an alternative to an availability incentive mechanism, the ISO could continue to maintain the must-offer obligation (MOO) with bid insertion, but extend bid insertion to all resources. Requiring all resources to bid into the market, either explicitly or tacitly through bid insertion, would overcome the need for an availability incentive mechanism. Bid insertion for all resources could ensure capacity is bid in and available for each resource’s contractual and physical capability as represented by their shown RA capacity and/or OMS availability. Bid insertion is a forceful method to ensure availability, while an availability incentive mechanism provides the financial motivation and flexibility for scheduling coordinators to bid resources into the market. Further, for some resource types (e.g., storage), determining an appropriate bid to insert in a given hour may be challenging. Market incentives such as an availability incentive mechanism may be preferable to bid insertion taking the place of the availability incentive mechanism.

Incentive prices

Availability and performance mechanisms should function as penalties against RA capacity that cannot meet their obligation. As a result, DMM believes the penalty should be priced to claw-back RA capacity payments that are associated with the difference between the obligation and their availability and performance. Because the penalty is a claw-back, the penalty price should be designed as a function of RA market prices.

The goal of the penalties should be to create an incentive for resources to only provide RA capacity up to their expected operational capabilities. Any RA shown to the market that is unavailable or cannot perform should be financially clawed-back to ensure an efficient market.

Because load serving entities bear the cost of RA, DMM agrees that is would be reasonable that penalties should returned to load. Determining a price for an availability and/or performance incentive mechanism should be set such that it does not incentivize resources to sell RA in the bilateral markets unless there is an expectation of availability and performance. A few price estimates were suggested in the recent March 4 meeting, including (1) the value of lost load (VOLL), (2) scaled real-time prices, and (3) RA price benchmarks.[14] Among these, DMM recommends RA price benchmarks.

DMM recommends using the RA price benchmark penalties because the price is comparable to the RA prices transacted in the bilateral RA markets. The VOLL and scaled real-time prices are estimates derived from an energy price, and are not fundamentally a capacity concept. The VOLL is an estimate used to approximate load’s willingness to pay for energy to avoid curtailment. DMM does not support the empirical foundation of the VOLL, and further does recommend the application of it in an RA framework.[15] Real-time prices are derived from energy supply and demand conditions, and are not an estimate of a capacity cost. DMM does not recommend the use of the VOLL or real-time energy prices to approximate the value of capacity.

To ensure a financial incentive that is directly comparable to RA availability and performance in the bilateral RA markets, the ISO should use an RA price benchmark for their penalties. Importantly for setting the penalty price, the incentive mechanism(s) should unwind capacity payments, plus a penalty, from the resources that under-perform on their capacity obligation. DMM understands there will be a delay in the timing of the benchmark data, and this should be discussed with stakeholders. The incentives of using the RA price benchmark are efficient and simple, and prices should be derived from the market the policy will impact.

Innovation

Lastly, competitive market signals will incentivize market participants to innovate within the framework of the market they are competing in. A policy, such as availability and performance mechanisms, incents innovative behavior aligned with the policy goals, and thus system reliability. Such innovations could include installing dual fuel, adjusting gas scheduling practices, and making adjustments to improve performance and penalty risk. There are other short- and long-term adaptive changes that could be made, such as resource redundancies, changes in bidding behavior, optimization, fuel-types, and many we are unaware of that require the correct market incentives to be realized. DMM believes the current incentives are not providing appropriate market signals for the desired outcomes, and encourages the ISO to be attentive to potential innovations in the development of new incentives.

Outage substitution

The ISO proposes to allow for conditional approval of planned outages without substitution, or if there would be a reliability impact, to procure from an outage substitution pool. DMM continues to support these policy developments.[16]

DMM suggests if the ISO elects to design an outage substitution pool, that it be designed as a reverse second price auction.[17],[18] In the February 11 RAMPD working group meeting, DMM detailed a theoretical structure for the auction.[19] A reverse second price auction would be economically efficient, incents the showing of resources, and is a reliable process for buyers, sellers, and the ISO. The theoretical structure of the auction will reduce search and coordination frictions, reduce market power concerns, and be designed to disincentivize strategic interactions between market participants. A reverse second price auction elicits true reservation prices by market participants, and results in an economically efficient outcome known as a Nash equilibrium, where no participant could be better off by choosing a different strategy.[20]

As described in DMM’s presentation at the February 11 working group meeting, reverse second price auction functions similar to an eBay auction, but with multiple buyers and sellers.[21] In the auction, the buyers are the market participants planning an outage, and the seller is the provider of the substitution capacity. It is termed a reverse auction because the roles of the buyers and sellers are reversed, i.e., the buyers need the good, and the sellers are the ones bidding to provide the good. In a reverse second price auction, the price is determined not by the winning (lowest) bid price of the auction, but by the next highest price, i.e., the lowest losing bid price. The second price aspect leads to buyers and sellers bidding their true values for the good, and not bidding strategically in the auction. This provides for efficient price formation properties, as the auction is seeking to reveal true reservations prices of the outage capacity, and not marginal prices.

With multiple buyers and sellers, the auction would be run sequentially. The auction begins with the highest priced bidder, and the auction clears that buyer’s capacity. The auction then repeats with the next highest priced bidder until prices or quantities on the buy or sell side can no longer support any further transactions. The final clearing price is the auction clearing price at the second price of the final transaction.

During the February 11 meeting, several questions arose surrounding the details of the auction design. DMM sought to provide a theoretical framework founded in economic principles, and appreciates the need to consider additional design details for the auction. Such concerns included the timing of the auction, the timeframes of capacity offered in the auction, what product is transacted (e.g., NQC values, ELCC, etc.), to continue to allow for bilateral contracting (or self-provision), who is the procurement entity (e.g., the scheduling coordinator), and whether offerings into the auction are voluntary.

DMM suggests the auction could run daily after the month-ahead RA showings. Capacity could be offered for a selected number of different timeframes, which could include daily, weekly, and potentially others. The auction would use the NQC values since the auction is transacting RA capacity. Lastly, DMM suggests the auction is voluntary, transactions are between scheduling coordinators, and the auction could allow for scheduling coordinators to self-provide substitution capacity.

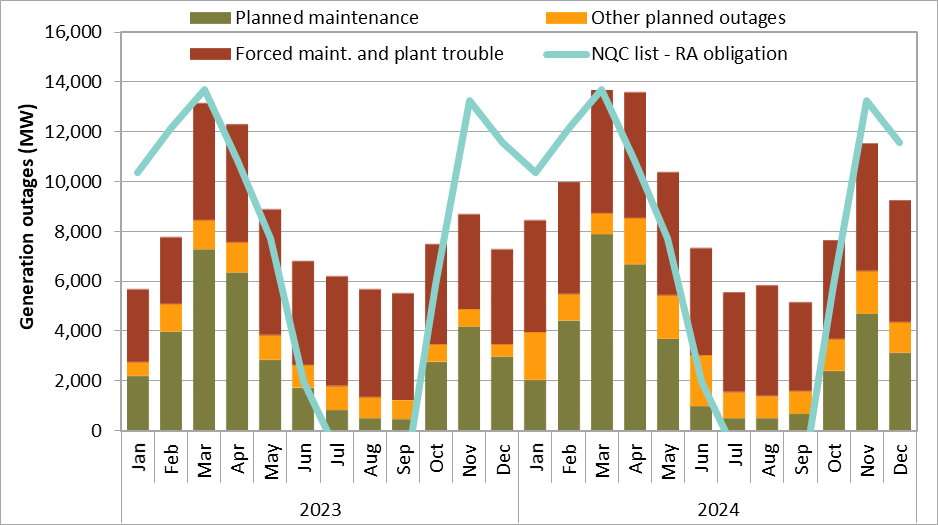

The auction will function most efficiently in an environment with a relatively thick market, with sufficient buyers and sellers. To assess the potential thickness of this market, DMM computed the monthly average of maximum daily outages during peak hours from 2023 through 2024. The data is then supplemented by potential available substitution capacity, measured as the difference between capacity shown on the CAISO NQC lists and CAISO RA obligations. These data are presented in Figure 2.[22],[23],[24]

The analysis in Figure 2 suggests during the non-summer months, when the majority of resources take planned maintenance outages, there is likely to be sufficient additional capacity to offer into the auction to meet substitution outage needs. It should be noted the measured outages may be non-RA resources that are presented as potential substitution capacity. Figure 2 is a measure to help facilitate a deeper understanding of potential market thickness, though the measure is more of an upper bound of potential capacity offerings into the auction.

Figure 2 includes all planned outages, and forced outages that are for plant maintenance or trouble. DMM has raised the concern previously that resources are being denied their planned outages due to a lack of substitution capacity, and the planned outages are transferred into the forced timeframe.[25],[26]

Figure 2 – CAISO outages and potential substitution capacity

Resource visibility

DMM agrees it would be valuable for system reliability for the ISO to have visibility into resource capacity that is above the RA showings, to allow a more effective and efficient capacity procurement. The ISO has highlighted the lack of capacity that is bidding into the capacity procurement mechanism (CPM) competitive solicitation process, and near-term visibility may be necessary if the system reaches tight conditions. DMM notes improvements to the CPM bid cap may obviate the need for the added visibility.

[1] Resource Adequacy Modeling and Program Design Working Group, California ISO, February 10-11, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Resource-Adequacy-Modeling-and-Program-Design-Feb-10-2025.pdf

[2] Resource Adequacy Modeling and Program Design: Straw Proposal Options: Track 2 Availability and Incentive Mechanisms, California ISO, March 4, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Resource-Adequacy-Modeling-and-Program-Design-Mar-03-2025.pdf

[3] Comments on Resource Adequacy Modeling and Program Design, Department of Market Monitoring, August 12, 2024: https://www.caiso.com/documents/dmm-comments-on-resource-adequacy-modeling-and-program-design-revised-discussion-paper-and-final-recommendation-plan-aug-12-2024.pdf

[4] Comments on Resource Adequacy Modeling and Program Design Issue Paper, Department of Market Monitoring, December 6, 2024: https://www.caiso.com/documents/dmm-comments-on-resource-adequacy-modeling-and-program-design-issue-paper-dec-06-2024.pdf

[5] Ibid.

[6] Comments on Resource Adequacy Enhancements Sixth Revised Straw Proposal – Phase 2A, Department of Market Monitoring, February 1, 2021: https://www.caiso.com/Documents/DMMCommentsonResourceAdequacyEnhancements-SixthRevisedStrawProposal-Feb12021.pdf

[7] Comments on Resource Adequacy Modeling and Program Design, Department of Market Monitoring, January 30, 2024: https://www.caiso.com/Documents/DMM-Comments-on-the-Resource-Adequacy-Modeling-and-Program-Design-Jan-16-2024-Working-Group-Jan-30-2024.pdf

[8] 2022 Annual Report on Market Issues and Performance, Department of Market Monitoring, July 11, 2023, p 253: https://www.caiso.com/Documents/2022-Annual-Report-on-Market-Issues-and-Performance-Jul-11-2023.pdf

[9] Storage Design and Modeling Workshop, California ISO, December 11, 2024: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Storage-Design-and-Modeling-Dec-11-2024.pdf

[10] Storage Design and Modeling Workshop, California ISO, January 23, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Storage-design-and-modeling-Jan-23-2025.pdf

[11] Comments on Resource Adequacy Modeling and Program Design Issue Paper, Department of Market Monitoring, December 6, 2024: https://www.caiso.com/documents/dmm-comments-on-resource-adequacy-modeling-and-program-design-issue-paper-dec-06-2024.pdf

[12] Resource Adequacy Modeling and Program Design Issue Paper, California ISO, November 7, 2024, p 51: https://stakeholdercenter.caiso.com/InitiativeDocuments/Issue-Paper-Resource-Adequacy-Modeling-and-Program-Design-Nov-07-2024.pdf

[13] 2023 Annual Report on Market Issues and Performance, Department of Market Monitoring, July 29, 2024, p 271, table 8.3: https://www.caiso.com/documents/2023-annual-report-on-market-issues-and-performance.pdf

[14] Resource Adequacy Modeling and Program Design: Straw Proposal Options: Track 2 Availability and Incentive Mechanisms, California ISO, March 4, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Resource-Adequacy-Modeling-and-Program-Design-Mar-03-2025.pdf

[15] Comments on Price Formation Enhancements: Scarcity Pricing Working Group Sessions, Department of Market Monitoring, February 27, 2025, pp. 5: https://www.caiso.com/documents/dmm-comments-on-price-formation-enhancements-scarcity-pricing-working-group-sessions-feb-27-2025.pdf

[16] Resource Adequacy Modeling and Program Design Issue Paper, California ISO, November 7, 2024: https://stakeholdercenter.caiso.com/InitiativeDocuments/Issue-Paper-Resource-Adequacy-Modeling-and-Program-Design-Nov-07-2024.pdf

[17] Ibid.

[18] Outage substitution capacity pool auction: A theoretical framework, Department of Market Monitoring, February 11, 2025: https://www.caiso.com/documents/presentation-outage-substitution-dmm-feb-11-2025.pdf

[19] Ibid.

[20] Vickrey, William. “Counterspeculation, Auctions, and Competitive Sealed Tenders.” Journal of Finance, col. 16, no. 1, pp 8-37.

[21] Outage substitution capacity pool auction: A theoretical framework, Department of Market Monitoring, February 11, 2025: https://www.caiso.com/documents/presentation-outage-substitution-dmm-feb-11-2025.pdf

[22] Final Net Qualifying Capacity Report for Compliance Year 2023, California ISO, November 16, 2023: https://www.caiso.com/library/net-qualifying-capacity-nqc-and-effective-flexible-capacity-efc

[23] Final Net Qualifying Capacity Report for Compliance Year 2024, California ISO, December 13, 2024: https://www.caiso.com/library/net-qualifying-capacity-nqc-and-effective-flexible-capacity-efc

[24] There are values where the difference goes to zero, and the difference between the NQC list and the RA obligation is met with RA imports.

[25] Planned-to-forced outages: Issue overview and discussion, Department of Market Monitoring, March 13, 2024, pp 35-41: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Resource-Adequacy-Modeling-and-Program-Design-Working-Group-March13-2024.pdf

[26] Comments on Resource Adequacy Modeling and Program Design, Department of Market Monitoring, January 30, 2024: https://www.caiso.com/documents/dmm-comments-on-the-resource-adequacy-modeling-and-program-design-jan-16-2024-working-group-jan-30-2024.pdf