1.

Please provide your organization’s feedback on the presentation by Western Power Trading Forum (WPTF) and the presentation by Calpine Energy Solutions LLC (also presenting on behalf of Calpine Energy Services, LP).

Feedback on Stakeholder Presentations

Comments on Congestion Revenue Rights Enhancements

Working Group Meeting #7 – September 8, 2025

Department of Market Monitoring

September 22, 2025

The Department of Market Monitoring (DMM) appreciates the opportunity to comment on the Congestion Revenue Rights Enhancements Working Group Meeting #7 – September 8, 2025.[1]

Congestion rent allocation under EDAM

The ISO began the working group meeting by noting that congestion rent allocation (CRA) in the extended day-ahead market (EDAM) has emerged as a major issue, and that further changes are expected and will be considered under the EDAM congestion rent allocation initiative. While such changes are outside the scope of this initiative, the ISO noted that it will need to consider how any changes to the ISO’s current congestion revenue rights (CRR) framework would fit into the context of an evolving longer-term regional framework.

The ISO specifically noted that potential longer term changes to regional congestion rent allocation include inter-balancing authority area (BAA) flow entitlements and an EDAM-wide CRR market. In the recent EDAM CRA initiative, there was nearly universal agreement that an approach based on allocation of financial congestion revenue rights was ultimately the most efficient and equitable long-term approach as EDAM expands regionally.

Given that participation in EDAM by other balancing areas/transmission owners is voluntary, DMM believes that allocation of CRRs to load serving entities or transmission owners combined with a CRR auction based on the willing seller design is ultimately the most compatible approach – if not a necessity – for regional expansion of EDAM. The willing seller approach that has been proposed by DMM would preserve the ability of transmission owners to retain congestion revenues or voluntarily auction off financial congestion rights.[2] The willing seller approach also maintains the ability for entities to seek to purchase financial hedges for congestion at a price that reflects the actual cost of providing such hedges.

DMM recognizes that the ISO and stakeholders have questions about the willing seller approach and how the allocation would work under this approach. However, many of these questions cannot be addressed unless and until the ISO conducts some of the analysis that has been requested by stakeholders and DMM.

Such analysis includes rerunning the current CRR allocation model with increased transmission limits, and rerunning the CRR auction model with just bids from load serving entities (LSEs) and other entities to sell CRRs (i.e., setting the transmission limits in the auction model equal to flows created by allocated CRRs). Since this only involves rerunning the CRR auction model with modified transmission limits (and making results available to DMM and stakeholders), DMM would assume this would not be extremely complicated or time consuming for the ISO to do.

DMM continues to encourage the ISO to move beyond wordsmithing “goal statements”, and begin serious consideration and analysis of the willing seller approach, and how this approach could help facilitate expansion of EDAM and development of a longer-term regional approach to congestion rent allocation based on CRRs or some similar financial mechanism.

Comments on the ISO’s goal statements

DMM continues to suggest that the first goal statement on slide 40 of the ISO’s presentation should refer to pricing CRRs based on a reasonable approximation of their costs.[3] When a product is sold it has a cost. In a well-functioning market, the payment received for selling that product should not be below its economic cost. This does not seem like it should be a controversial point.

The ISO also proposes: “Transmission customers should receive approximately commensurate value for payouts made to CRR rights purchased in the auction when considering all value provided by entities purchasing CRRs in the auction” (with underlined part added from the previous iteration). The ISO should be more explicit as to what value for transmission customers that the ISO assumes is provided by entities purchasing CRRs, and should seek to demonstrate or quantify this value.

DMM is aware that entities profiting from the current auction contend that auction losses are offset by reduced wholesale market costs for transmission ratepayers that result from the portion of CRRs that are used as financial hedges. However, there is no empirical evidence of any such benefits in the ISO markets. The only empirical analysis cited to support this assertion is in a 2020 report on financial transmission rights (FTRs) from the PJM market.[4] A detailed review of this report by DMM is included as an attachment to these comments. As shown in the attached review, the calculations of how FTRs reduce wholesale energy costs in this PJM report are nothing more than a “what-if” scenario based on a series of unsupported assumptions, rather than by any empirical data or analysis.

The addition of the refence to “value provided by entities purchasing CRRs in the auction” appears to be an invitation to justify selling CRRs below their cost as a cross subsidy. Such cross subsidies are inappropriate and dubious as to their actual effect. This additional language should be removed. This issue is discussed in more detail in the section on Lowering contracting costs.

Comments on WPTF’s presentation

Western Power Trading Forum (WPTF) presented slides that attempted to “fill in” the gap of the clear, and ongoing, transmission ratepayer CRR auction losses. The presentation also incorrectly claims that ISO’s auction efficiency metric is wrong, on the basis that there are expected reasons why auction prices would be less than CRR payouts, and that the metric is not a complete measure of the impact to ratepayers.[5]

Sold allocated CRRs

WPTF says the ISO’s auction efficiency metric excludes the revenues from allocated CRRs that are sold in the auction. If the ISO included the sold allocated CRRs, they would also need to include both the auction revenues and the day-ahead payments made to those CRRs. The DMM auction efficiency metric does account for the effects of allocated CRRs that are willingly sold in the auction and results are extremely similar to the ISO metric.

DMM also includes analysis of auction results broken out by participant group. This analysis shows that clearing price of CRRs voluntarily sold by LSEs in the auction are much more consistent with congestion prices.[6]

Time value of money

WPTF says the auction efficiency metric needs to include the interest on auction revenues and the time value of money, as if these are two separate things. The time value of money would come into play if the transmission ratepayers received the auction revenue at the time of the auction and made payments later. However, they do not get the auction revenue at the time of the auction. They receive the auction revenue at the same time they make the payments to the CRRs. Therefore the interest paid on the auction revenue completely accounts for their time value of money.

With respect to the time value of money, there is not that much time between the auction and the CRR payouts. The large majority of CRRs are settled within a year of their auction and many settle within weeks or days of their auction. To highlight this, DMM calculated the discounted cash flows for the notional CRR payouts based on the time between the auction and the day of each payout over a three-year period using several discount rates. The reductions in discounted payments from the non-discounted payments are shown in Table 1.[7]

Table 1. Reduction in discounted notional CRR payments

relative to non-discounted payments

Based on these discounted cash flows data, the average time between the auction and payment for monthly CRRs is equivalent to 20 days. For seasonal CRRs purchased in the annual auction held in November, this time period was the equivalent to an average of 233 days or about 7.6 months.

Thus, accounting for the time value of money between the auction and the CRR payouts would represent a relatively small change in the auction efficiency and losses of CRRs sold in the auction.

Risk Premiums and unexpected conditions

WPTF also claims the auction efficiency metric does not include risk premiums and states that CRR prices should reflect “unexpected conditions”. However, as shown in DMM’s annual and quarterly reports, the ISO’s auction has resulted in significant annual losses in every year and quarterly losses in almost every quarter since the auction started. DMM has also provided extensive data showing that all other regional transmission organizations (RTOs) that auction off FTRs/CRRs also incur significant and systematic losses on these every year.

In a well-functioning auction, there would be times when the payout transmission ratepayers make to CRRs would significantly exceed the auction revenues received. These losses would be offset by the risk premiums earned in other times. This is not what occurs in the CRR actual auctions. Instead, losses are systematic and do not consistently arise from unexpected conditions.

Ratepayers are also taking on risk by selling CRRs. Congestion costs are highly correlated with higher total market energy prices paid by LSEs. Thus, when CRRs are auctioned by the ISO (especially at losses), this reduces the hedging of overall energy costs that LSEs would otherwise receive from allocation of congestion revenue surplus back to load. This risk is also exacerbated by the fact that potential outcomes of congestion costs and total energy costs are very asymmetrical, with the potential higher end of energy costs being much higher than the potential lower end of energy costs.

Imbalance reserve congestion revenues

The WPTF presentation identified imbalance reserves as a potential missing revenue stream that will help “fill” some of the losses to transmission ratepayers. However, this will not be surplus revenue going to transmission ratepayers. The imbalance reserves will compete for space on transmission constraints with energy schedules and will pay congestion like energy schedules. This congestion will be included in the CRR settlements whether from energy or imbalance reserves. Thus, the implementation of imbalance reserves will not affect how the ISO auction efficiency metric should be calculated.

Lowering contracting costs

WPTF argues that supposed savings in procurement costs for other forward energy contracts should be counted as reducing CRR loss metric.

First, the assertion that CRR losses are actually reducing prices in the forward energy market is very dubious and has never been supported by any empirical analysis (e.g., see attached review of report on FTRs in PJM). Meanwhile, extensive empirical analysis has been provided showing that the large majority of CRRs sales and losses in the CAISO auction are not being used as hedges, and that a very small portion of losses could ultimately “trickle down” to transmission ratepayers through lower bilateral energy costs.

DMM’s analysis has also consistently shown that CRRs procured by generation owners account for a very small portion of CRR losses and that prices for CRR purchases by generation owners are much more closely aligned with actual congestion prices.[8] Moreover, analysis by DMM provides empirical evidence that under the willing seller approach, a substantial volume of CRRs sold by LSEs and non-LSEs would continue clear the auction.[9] This analysis shows that under the willing seller design, overall CRRs would be higher, but would still tend to be somewhat less than congestion costs and would be more closely aligned with actual congestion prices.

From an economic perspective, DMM does not think that it is economically efficient to maintain an auction design which consistently sells CRRs well below the actual cost of such a hedge. Selling CRRs at prices significantly below their cost in an attempt to lower energy costs for consumers is nothing more than an attempt to subsidize costs/prices in the bilateral energy market by funding incurring losses for ratepayers in the CRR auction. A well-designed market for CRRs would properly price CRRs at their marginal costs. This is an argument for a cross subsidy to the CRR market.

Analysis of the willing seller design by DMM shows that CRR prices under the willing seller model would be more closely aligned with actual congestion costs, and would therefore be much more economically efficient (i.e., with CRRs being sold for prices reflecting the cost and value of congestion hedges).[10] In addition, the argument that CRRs are needed by generation owners and traders to hedge congestion costs also ignores the fact that there are a variety of other means of financially hedging energy prices.

On reducing offsets

WPTF also argues that changing the allocation of CRR revenue inadequacy to lower deficit offsets will improve the auction results that currently sell CRRs on average for 67 cents per dollar paid out. The logic is that the value of CRRs would be higher due to higher expected payouts. However, historical data from before and after the Phase 1b changes were made clearly demonstrate that reducing or even eliminating deficit offsets would not lead to increased auction efficiency or reductions in ratepayer losses. Before 2019, there were no deficit offsets and CRRs were fully funded. In this historical period, the ISO auctioned CRRs for an average of 50 cents per dollar paid out – compared to 67 cents per dollar paid out after the Phase 1b changes. This highlights that even with full funding, the auction efficiency would be lower rather than higher under current deficit offset rules.

[1] Congestion Revenue Rights Enhancements, Working Group Meeting Session #7, California ISO, September 8, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-CongestionRevenueRightsEnhancements-Sep08-2025.pdf

[2] Willing seller market design for congestion revenue rights, Department of Market Monitoring, October 23, 2024 (“Willing seller report”): https://www.caiso.com/documents/willing-counterparty-whitepaper-oct-23-2024.pdf

[3] Ibid, Working Group Meeting Session #7 presentation, slide 40.

[4] Review of PJM’s Auction Revenue Rights and Financial Transmission Rights, London Economics International LLC, December 16, 2020 (“LEI report”): https://www.pjm.com/-/media/DotCom/committees-groups/task-forces/afmtf/postings/lei-review-of-pjm-arrs-and-ftrs-report.ashx

[5] CRR Enhancements: Pathway Forward, Wells, Kallie, Gridwell Consulting on behalf of WPTF, September 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/WPTF-Presentation-Congestion-Revenue-Rights-Enhancements-Sep-08-2025.pdf

[6] e.g., See DMM’s 2024 Annual Report on Market Issues and Performance, Figure 5.15, p 188.

https://www.caiso.com/documents/2024-annual-report-on-market-issues-and-performance-aug-07-2025.pdf

[7] The percents in Table 1 are the notional value of all the monthly and seasonal CRRs divided by the discounted notional values for these payments (using the listed discount rates) minus one. The data were for July 2020 through June 2023 as the daily values for these dates were already saved by DMM for prior data analysis.

[8] Results by participant group are provided in DMM’s annual and quarterly reports since 2018.

[9] Willing seller report, pp 16-25

[10] Ibid.

Comments of the CAISO Department of Market Monitoring on:

Review of PJM’s Auction Revenue Rights and Financial Transmission Rights (2020) [1]

Summary

This paper provides comments and analysis by the Department of Market Monitoring (DMM) on the Review of PJM’s Auction Revenue Rights and Financial Transmission Rights, released by London Economics International (LEI) in December 2020. This LEI report is frequently cited in the ISO stakeholder process on congestion revenue rights (CRRs) by CRR proponents as providing definitive evidence that the indirect market benefits of CRRs outweigh the direct losses incurred by transmission ratepayers from CRRs auctioned by the ISO.

As shown in Figure 8 on the following page, LEI’s report acknowledges that firm transmission rights (FTRs) sold to non-load serving entities in PJM’s auction was resulting in losses of $233 million per year during the timeframe of the study. Thus, the direct losses to transmission ratepayers from FTRs in PJM and CRRs in the California ISO are easily quantified based on publicly available data and very transparent calculations.

The LEI report compares these direct losses from PJM’s FTR auction to what LEI describes as “illustrative” and “what-if” calculations of the potential benefits of PJM’s FTR auction. LEI provides “what-if” calculations for two categories of potential benefits from PJM’s auction:

- Hedging benefits for new supply projects, which LEI suggests reduce total wholesale costs by $99–$318 million per year by lowering financing costs and prices in PJM’s energy markets.

- Lower transaction costs bilateral energy procured bilaterally, which LEI estimates at $424 to $889 million per year.

As shown in this paper, these calculations are nothing more than a “what-if” scenario based on a series of unsupported assumptions, rather than by any empirical data or analysis. LEI’s conclusion that FTRs auctioned by PJM provide significant benefits for energy customers is simply a tautological conclusion supported only by these assumptions, rather than any empirical data or analysis.

DMM encourages stakeholders, CAISO staff, and Market Surveillance Committee (MSC) members to review LEI’s report themselves. Key portions of the report describing LEI’s calculations is actually quite short, and include the following: pp 15-17, 88-92, and 183-189 (reproduced in Attachment A).

.png)

This paper reviews and critiques the “what-if” calculations of the benefits of PJM’s FTR auctions and other analysis in LEI’s report that seek to link PJM’s FTR auction to other aspects of PJM’s market activity and efficiency. This paper also examines how the metrics, assumptions, and calculations in LEI’s report might be applicable (or not) to the ISO market.

For example, the “what-if” calculations assess the benefits of PJM’s FTR auction compared to a counterfactual in which there is no FTR auction. However, under the willing seller auction proposed by DMM for the ISO market, the ISO would continue to allocate CRRs to load serving entities and then continue to hold an auction for additional sales and purchases of CRRs.[2] Under this approach, the CRR auction held by the ISO would be based only on bids from willing sellers and buyers as counterparties. This willing seller auction would simply exclude the additional CRRs that are offered for sale by the ISO at a $0/MW bid price as occurs under the current auction design.

The LEI report also comments on a range of changes in the FTR allocation, auction, and settlement put forth by PJM’s independent market monitor. These changes are much more extensive and differ significantly from the more narrow and specific willing seller design proposed by DMM for the ISO market. Thus, LEI’s conclusions regarding the various proposals by PJM’s independent market monitor are not applicable to the changes to the ISO’s CRR allocation and auction proposed by DMM.

This report is organized as follows:

- Section I reviews and critiques LEI’s assumption that FTRs/CRRs result in significant benefits from reduced long run marginal costs, which are reflected in wholesale market prices.

- Section II reviews and critiques LEI’s assumption that FTRs/CRRs significantly reduce transaction costs from hedging and contracting bilaterally by increasing energy market liquidity.

- Section III provides an analysis of LEI’s estimate of total benefits of FTRs/CRRs as a percentage of total market costs.

- Section IV reviews other assumptions and analysis in LEI’s report and explains why these support LEI’s conclusions, or how these would apply to the ISO markets.

I. Hedging benefits from reduced financing costs

LEI calculates the “hedging benefits” of FTRs by assuming that without PJM’s FTR action, (1) financing costs for all new combined cycle units would increase significantly, and (2) that this levelized increase in costs would be directly passed on to locational marginal prices (LMPs) for the entire PJM system during 50% to 80% of hours.[3] Based on these assumptions, LEI concludes that PJM’s FTR auction reduces total wholesale energy costs by $99 to $318 million per year due. More details of the series of assumptions used by LEI are provided below:

- LEI assumes that without PJM’s FTR auction, new combined cycle projects would have more risk and would have a bond rating drop from BB to B. LEI calculates this drop in bond rating would increase their long-term financing costs by .39% to .78%.

- LEI then calculates how this increase in financing costs would translate into a $.26/MWh to $.51/MWh increase in the long-term levelized cost of energy from a new combined cycle unit. LEI performs this calculation using the same assumptions and methodology PJM used to calculate the Cost of New Entry (CONE) in 2019.

- LEI then assumes that prices in PJM’s entire energy market would be increased by this $.26/MWh to $.51/MWh increase in long-term levelized costs during all hours that gas units are marginal. LEI’s low assumption of total market costs assumes that PJM system prices in 50% of hours would increase by $.26/MWh, and LEI’s high estimate assumes PJM system prices would increase by $.51/MWh in 80% of hours. LEI supports these assumptions by noting that in 2019, PJM’s market monitor reported that gas units were marginal 69.4% of hours.

- LEI assumes this reduction in wholesale energy costs applies to sales in PJM’s market, as well as all energy that is met through bilateral contracts, excluding load that LEI estimates is met by regulated self-supply.

- These assumptions result in total energy cost savings ranging from a low of $99 million per year to a high of $318 million per year just from higher bond ratings caused by PJM’s sales of FTRs.

DMM’s replication of these calculations of “hedging benefits” along with other benefits assumed by LEI are provided in Tables 1 and 2 later in this report. As shown in these tables, LEI’s “what-if” scenario assumes that higher bond ratings caused by PJM’s sales of FTRs alone would equal about 1% to 2% of the total weighted average cost of energy in the entire PJM during 2019, and about 17% to 55% of total congestion costs. After adding LEI’s “what-if” scenarios of savings from reduced bilateral transaction costs, LEI assumes total benefits would be 3.2% to 7.2% of total energy purchase costs for the entire PJM system, and would almost equal 89% to 207% of total congestion costs in PJM in 2019.

DMM Comments

Problems with LEI’s analysis, especially as applied to the ISO market, include the following.

LEI’s analysis assumes that PJM’s FTR auction is entirely eliminated

The willing seller proposal maintains an auction for CRRs in which LSEs can sell allocated CRRs, and other entities can bid to buy/sell CRRs as financial hedges. Results of DMM’s analysis of 2017/2018 data show that a significant volume of CRRs would continue to clear under the willing seller design—including CRRs sold by LSEs and financial entities bidding to buy “counterflow” CRRs. This analysis showed that about 40% of CRRs acquired by non-LSEs in the actual 2017/2018 auctions would have cleared under the willing seller design.[4]

LEI’s analysis of financing costs assumes that PJM’s FTR auction is the only way that new gas projects can acquire hedges

LEI notes that “if a project is unable to obtain a financial hedge, creditors of the project would demand a higher return to compensate for the higher risk of the project…[and]... It is reasonable to assume projects that cannot obtain financial hedges would be on the lower end of the spectrum [of credit ratings]. Therefore, LEI tested a quarter-notch and a half-notch increase in spread from B-rated debt to conservatively reflect the impact of hedging.”[5] However, as noted elsewhere in LEI’s report, “market participants can purchase and sell futures in addition to or in lieu of acquiring FTRs. There is [sic] a variety of business uses for futures, in addition to hedging basis differences (congestion risk).”[6] LEI goes on to note that of twenty new gas-fired combined cycle gas turbine (CCGT) projects brought on-line between 2017 and 2020, LEI’s research found that “twelve of these projects… employed financial hedges as part of their financing arrangements, including revenue puts, heat rate call options, and gas netback contracts.”[7] Thus, as noted in LEI’s report, there are a variety of ways that the risk associated with new supply projects are actually hedged as part of their financing arrangements that do not involve or require FTRs sold by an ISO.

LEI’s analysis assumes that the FTR auction is complexly eliminated

As previously noted, the willing seller proposal does not eliminate the ISO’s CRR auction, but would maintain an auction based on bids from willing sellers. DMM’s analysis shows that under this willing seller auction, a significant volume of CRRs would to continue to clear—including CRRs sold by LSEs as well as financial entities willing to “sell” hedges by bidding to buy “counterflow” CRRs. This willing seller auction facilitated by the ISO would complement, and could be used in conjunction with, all the other ways that new supply projects are actually hedged financially that are listed in LEI’s report.

LEI’s analysis assumes that new supply projects are developed without long-term contracts

As noted in LEI’s report, S&P Ratings states that “a plant that has no contracts with off-takers or hedges could be assessed as having high market exposure.”[Emphasis added.][8] LEI goes on to acknowledge that “although there are many independent generation owners in CAISO, the investment signal in California is motivated by Requests for Offers (“RFOs”) issued by the regulated local electric distribution utilities and required as part of the integrated resource plans mandated by the California regulator… utilities in CAISO are not dependent on a market-based investment signal because of the integrated resource planning.”[9] “A less liquid forward market can be compensated for using long-term contracts under the RFO process.”[10]

LEI’s analysis assumes that reductions in fixed financing costs would be directly incorporated in the energy bids of all gas units, and would be fully reflected in LMPs for all hours that any gas units are marginal

Financing costs are fixed (or sunk) costs, and do not affect the marginal operating costs of gas resources. In competitive markets, bids and prices reflect marginal operating costs rather than fixed financing costs. Moreover, when gas units are marginal, these are often the less efficient units that have higher marginal operating costs than new combined cycle units.

Almost all CRRs acquired by non-LSEs in the CAISO are purchased on a year-ahead and month-ahead basis, rather than the longer-term horizon on which project financing is based

This further undermines LEI’s assumptions about how the impact of FTRs on long-term financing costs and spot market prices could apply to the CAISO market.

II. Benefits from decreased bilateral transaction costs

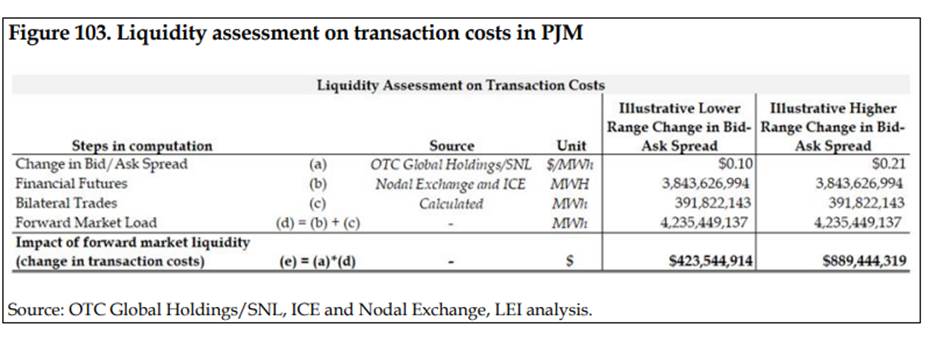

LEI’s report also includes an “Illustrative analysis of the impact of bid-ask spreads on transaction costs in forward markets.” This “illustrative analysis” assumes that without the FTR auction, liquidity of bilateral energy trading would decrease, and this would in turn increase total bilateral market transaction costs by an additional $424 to $889 million per year.

First, LEI looks at the bid-ask spreads in the bilateral energy trading markets for PJM, which average $.46/MWh. LEI assumes that without PJM’s FTR auction, the “transaction costs” of all bilateral market trades would go up by the standard deviation of this bid-ask spread (or $.21/MWh). For a lower bound, LEI assumes that without PJM’s FTR auction, transaction costs for all bilateral trades would increase by half of its high end assumption ($.10/MWh). LEI explains this logic as follows:

To analyze the impact of the increasing cost of losing liquidity, LEI developed a what-if (counterfactual) analysis based on the bid-ask spreads. PJM has had an average bid-ask spread $0.45/MWh to $0.47/MWh in 2018-19, with a standard deviation of $0.21/MWh to $0.22/MWh. PJM’s average bid-ask spread in 2018-19 has been $0.19/MWh to $0.21/MWh lower than that of MISO and $0.10/MWh to $0.11/MWh lower than that of CAISO. Based on various empirical studies reviewed on liquidity assessments of commodity markets, one standard deviation in bid-ask spreads is a common metric of analysis. Therefore, LEI incorporated the impact of the observed ‘one standard deviation’ in PJM’s actual bid-ask spreads as an illustrative computation of potential increase in transaction costs if the liquidity of the PJM market was compromised. This value of $0.21/MWh also aligns with the average difference in bid-ask spreads between PJM and MISO. We also tested $0.10/MWh for the lower range of potential changes; this is the observed average difference between the bid-ask spreads in PJM and CAISO.

Second, LEI estimates the volume of bilateral contracts impacted by this change in bid-ask spread as the summation of two components:

- PJM load met by bilateral purchases. LEI calculated the net load served by bilateral purchases by taking total 2019 PJM load, and subtracting estimates of load met by self-supply and purchases in PJM’s day-ahead and real-time market. This appears to equal about 51% of PJM load.[11]

- Financial futures volume. As shown in Figure 103 of LEI’s report (shown below), LEI assumes a total volume of financial futures traded on Nodal Exchange and ICE of 3,844 TWh. DMM notes that this volume of 3,844 TWh is about 498% of total PJM load (772 TWh) and about 980% of LEI’s calculation of PJM served by physical bilateral market purchases (391 TWh).[12]

Results of these calculations are provided in Figure 103 of LEI’s report shown below:

DMM Comments

LEI simply assumes that FTRs reduce transaction costs

Rather than providing any empirical evidence, LEI’s analysis starts by simply assuming that PJM’s FTR market significantly reduces transaction costs for all bilateral market trades:

To analyze the impact of the increasing cost of losing liquidity, LEI developed a what-if (counterfactual) analysis based on the bid-ask spreads. PJM has had an average bid-ask spread $0.45/MWh to $0.47/MWh in 2018-19, with a standard deviation of $.21/MWh to $.22/MWh. Based on various empirical studies reviewed on liquidity assessments of commodity markets, one standard deviation in bid-ask spreads is a common metric of analysis. Therefore, LEI incorporated the impact of the observed ‘one standard deviation’ in PJM’s actual bid-ask spreads as an illustrative computation of potential increase in transaction costs if the liquidity of the PJM market was compromised.

Thus, by LEI’s own admission, the analysis is merely a “what-if” estimate based on the simple assumption that PJM’s FTR auction results in a very significant decrease in the cost of every single financial and physical transaction in PJM’s bilateral market.

DMM has reviewed all three “empirical studies” referenced by LEI.[13] While the standard deviation is indeed a commonly used statistical measure of the distribution of data, absolutely nothing in these papers supports the assumption that PJM’s auction reduces transaction costs by one standard deviation of the bid-ask spreads in PJM’s bilateral markets. LEI essentially makes the arbitrary assumption that PJM’s auction is reducing transaction costs for all financial and physical bilateral markets in PJM by up to $.21/MWh, which represents a very significant portion (47%) of the actual average bid-ask spread ($.46/MWh).

The fallacy of LEI’s comparison of bid-ask spreads in PJM, MISO, and CAISO

LEI seeks to empirically support its assumptions about transaction cost savings based on the difference in bid-ask spreads in PJM compared to MISO and CAISO. As LEI explains:

This value of $0.21/MWh also aligns with the average difference in bid-ask spreads between PJM and MISO. We also tested $0.10/MWh for the lower range of potential changes; this is the observed average difference between the bid-ask spreads in PJM and CAISO.

Thus, LEI essentially tries to use the CAISO as two “control groups” to quantify what PJM’s bid-ask spread would be without PJM’s FTR auction by comparing PJM’s bid-ask spread to that of CAISO and MISO. The obvious fallacy with this comparison is that MISO and CAISO both have FTR/CRR auctions that are essentially the same as PJM’s. All three of these RTOs sell FTRs/CRRs to non-LSEs for prices well below the value (congestion payments) of these FTRs/CRRs. Thus, the lower bid-ask spread in PJM cannot be attributed to PJM’s FTR market.[14]

The efficiency (or inefficiency) of the FTR/CRR markets in each of these three RTOs is roughly the same. As noted in prior DMM comments, FTRs auctioned in MISO are sold for 72 cents per dollar in congestion payments, resulting in hundreds of millions of dollars per year in profits for non-LSEs that buy FTRs from MISO.[15] Similarly, the CAISO auctions CRRs to non-LSEs for about 69 cents per dollar of congestion revenue, also resulting in tens of millions of dollars per year in profits to non-LSEs buying CRRs from the CAISO. Despite selling CRRs/FTRs at a significant discount relative to CRR payouts, CAISO and MISO simply have higher bid-ask spreads. But the different bid-ask spreads in PJM, MISO, and CAISO cannot be attributed to FTRs/CRRs auctioned by these RTOs.

Data presented in the LEI report contracts LEI’s assumption that CRRs increase bilateral market liquidity in the ISO markets

As noted in LEI’s report, the ISO implemented significant changes to reduce losses from the CRR auction in 2019, including elimination of bids to buy gen-to-gen and other “non-delivery path” CRRs (such as load-to-gen CRRs) in 2019. As noted in LEI’s report:

Following the implementation in 2019 of CAISO’s CRR revenue sufficiency improvement process, the year-on-year CRR auction results showed a material contraction. CRR auction participation (measured through bid-in volumes) declined by an overall 50% in 2019 from the prior year. The quantity of CRRs cleared in auctions fell by 57%, and net auction revenues declined by 24% to $63 million in 2019 (as compared to an average of $83 million in 2017 and 2018). CAISO's experience raises the possibility of negative consequences of reducing FTR auctions paths.[16]

However, as shown below in Figure 48 from the LEI report, LEI’s key measure of bilateral market liquidity (“churn rate”) shows a slight increase in bilateral market liquidity in the ISO from 2018 to 2019, while liquidity in most other RTOs decreased. Figure 48 shows a churn rate in the ISO of 1.05 in 2018 and 1.07 in 2019.

As shown in prior DMM reports, changes made in 2019 significantly reduced payouts and profitability of CRRs bought by non-LSEs compared to 2018. Non-LSEs purchasing CRRs in the ISO’s auction paid 45 cents per dollar of payouts in 2018, compared to 80 cents per dollar in 2019.[17] This contradicts LEI’s conclusion that bilateral market liquidity in the ISO is closely linked with the sales of discounted CRRs by the ISO in its auction.

.png)

III. Total Market Benefits

The ISO and its Market Surveillance Committee (MSC) have suggested that the benefits of the CRR auction may be 1% of total wholesale costs. This is not based on any empirical analysis, but is an even simpler “what-if” calculation than is used by LEI.[18]

Table 1 puts LEI’s “what-if” calculations into a similar perspective, by comparing low and high benefit scenarios to total PJM market costs and total congestion costs in 2019. As shown in this table:

- LEI’s low benefit scenario ($522 million) would be 3.2% of total energy purchase costs for the entire PJM system, and would be almost equal (89%) to the total congestion costs in PJM in 2019.

- LEI’s high benefit scenario ($1,207 million) would be 7.2% of total energy purchase costs for the entire PJM system, and would be more than double (207%) total congestion costs in PJM in 2019.

Thus, the magnitude of the benefits assumed in these scenarios is certainly quite significant.

Table 1. LEI’s Estimate of Benefits of FTRs Sold in PJM Auction

Compared to Total Energy Market Costs and Congestion Costs[19]

Millions of dollars, 2019

.png)

IV. Other Issues

Impact of FTRs on futures trading

LEI’s report notes that:

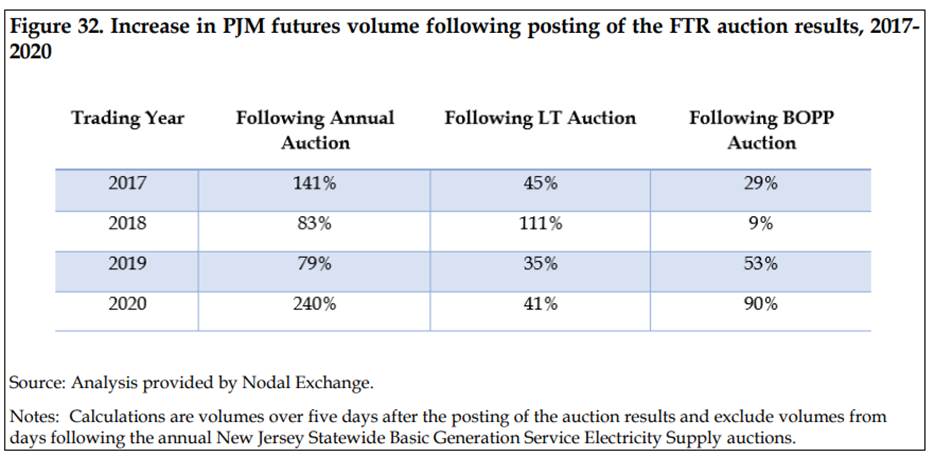

The argument that the FTR auction result influences forward markets is not a purely theoretical hypothesis, and the relationship between FTR auctions and forward markets is not simple. Although FTR auctions occur at concrete points in time, futures trading is occurring daily. Market participants can purchase and sell futures in addition to or in lieu of acquiring FTRs. There is [sic] a variety of business uses for futures, in addition to hedging basis differences (congestion risk). Moreover, the price discovery provided by FTR auctions is not strictly to predict precise CLMPs, but rather to inform on general market sentiment regarding congestion and expected energy flows. To understand how PJM FTR market activities influence the forward market, LEI worked with Nodal Exchange to examine trends in volumes of basis-related futures right after PJM FTR auction result [sic] are published. The data indicates that volumes of futures traded on Nodal Exchange increase significantly after each FTR auction. The results are summarized in Figure 32. The uptick in volumes indicates the presence of price discovery process and influence of FTR auctions over futures activity in PJM. (p 74)

As shown in the table above, the LEI report shows a very dramatic increase in bilateral trading in the 5 days after PJM’s FTR results are released for all types of FTRs (long term, annual and monthly). No additional details or data supporting this analysis are provided by LEI.

To test if this hypothesis applies in the ISO markets, DMM performed this same type of analysis using data on the daily volume of bilateral trades on the International Commodities Exchange (ICE) for monthly futures contracts at delivery points relevant to the CAISO market (SP15, NP15, Palo Verde, and Mid-C). For this analysis, DMM identified the day on which results of each annual/seasonal and monthly CRR auction were posted over the last four years. DMM then calculated the average trading volume for all monthly futures contracts covered by each CRR over the five trading days before and after the dates that auction results were posted on OASIS.[20]

As shown in Table 1, analysis for annual CRR auctions show no statistically significant difference in trading volumes before and after annual CRR results were released, with a very slight decrease in average trading volumes in the five trading days after CRR results were posted.

As shown in Table 2, analysis for monthly CRRs shows that monthly trading of monthly energy contracts on ICE dropped 15% in the day after monthly CRR results were released. However, as shown in Table 2, results of the monthly CRR auctions are released toward the end of each month. It seems logical to assume that at the point monthly CRR auction results are released, most bilateral trading (especially for purposes of hedging) would have been completed.

Table 1. Monthly futures trading volumes before/after annual CRR auction results

Table 2. Monthly futures trading volumes before/after monthly CRR auction results

Price Discovery

LEI’s report includes extensive analysis demonstrating that there is a statistically significant correlation between FTR prices and day-ahead congestion. LEI concludes that this “econometric analysis of monthly auctions suggests that monthly auction prices are efficient and provide valuable information to the market about realized congestion in the day-ahead energy market, supporting price discovery.” (p 168)

As noted in the prior section, results of the monthly CRR auctions are only released several days before the start of the month covered by the monthly CRRs being sold. LEI provides no support for the assumption that market participants utilize these CRR prices to project congestion prices during the following month, and use this information to somehow increase market efficiency or reduce overall market costs. Moreover, common sense suggests that participants would instead assess potential congestion risk based on other sources of information such as past market prices and differences in bilateral energy prices at different delivery points, which are available on an ongoing basis months in advance of each trading month.

Benefits of non-LSEs participating in FTR auction

LEI cites counterfactual FTR auction results performed by PJM as evidence that the FTR auction provides benefits to LSEs.

Earlier this year, PJM examined the effect of non-load participation on FTR auction revenues using simulation techniques. PJM stated that ‘[i]n order to illustrate whether or not financial participants create competitive forces which can enhance market liquidity and contribute to price discovery, a hypothetical study removing the bids from purely financial traders and holding all other bids constant was performed to show the impact on ARR values for the 2018/2019 and 2019/2020 Planning Periods. The results showed a devaluation of roughly $329 million in 2018/2019 and $150 million in 2019/2020 without financial participation.’ This is an important attribute of non-load participation, as such an outcome would mean reduced payments to ARR holders through a competitive, market-based mechanism… used to measure forward markets' effectiveness and state of competition.

This “what-if” analysis by PJM is exactly the opposite of DMM’s recommendation and analysis of the willing seller auction design. To simulate the willing seller approach, rather than removing bids submitted by non-LSEs, the CRR model is run with all bids submitted by all participants after removing only CRR capacity that is effectively offered at a $0 bid price by the CAISO in the auction.[21] This CRR capacity offered by the CAISO at $0/MW has the effect of devaluing the price of allocated CRRs sold by LSEs and other participants in the auction.

The counterfactual simulation of the CRR auction under the willing seller design shows that auction prices resulting from the willing seller design are significantly closer to actual congestion costs. Thus, under LEI’s assumption that FTRs provide significant benefits that stem from the “price discovery” provided by final FTR auction prices, the willing seller auction design would provide better price discovery for all participants than the current auction prices.

[1] Review of PJM’s Auction Revenue Rights and Financial Transmission Rights, London Economics International LLC, December 16, 2020 (“LEI report”): https://www.pjm.com/-/media/DotCom/committees-groups/task-forces/afmtf/postings/lei-review-of-pjm-arrs-and-ftrs-report.ashx

[2] Willing seller market design for congestion revenue rights, Department of Market Monitoring, October 23, 2024, (“Willing seller report”) https://www.caiso.com/documents/willing-counterparty-whitepaper-oct-23-2024.pdf

[3] LEI report, pp 89-90, 184-186

[4] Willing seller report, p 16

[5] LEI report, footnote 128, p 89

[6] Ibid. p 74

[7] Ibid. p 89

[8] LEI report, p 89

[9] Ibid. p 98

[10] Ibid. p 104

[11] 392 TWh / 772 TWh = 51%

[12] 3,844 TWh / 772 TWh = 480% and 3,844 / 391 = 998%

[13] Bjonnes, Geir, Neophytos Kathitziotis and Carol Osler (2016). “Bid-Ask Spreads in OTC Markets”, Brandeis University Working Paper Series, 2016-102. March 20, 2016. https://www.brandeis.edu/economics/RePEc/brd/doc/Brandeis_WP102.pdf

Liquidity and the Law of One Price: The Case of the Cash/Futures Basis, Eduardo Schwartz, Richard Roll, and Avanidhar Subrahmanyam, The Journal of Finance, October 2007, Vol. 62, No. 5 (Oct. 2007): https://papers.ssrn.com/sol3/papers.cfm?abstract_id=615721

Liquidity and Market efficiency: European Evidence from the World’s Largest Carbon Market, Gbenga Ibikunle, Andros Gregoriou, Andreas G.F. Hoepner, and Mark Rhodes, University of Edinburgh: https://www.biee.org/wp-content/uploads/Ibikunle-Liquidity-and-Market-Efficiency.pdf

[14] As LEI notes, “There are more similarities than differences in the FTR product and auction design across the three case study markets and PJM. For example, all four markets use path-based (point-to-point construct), and the FTR instrument is settled against day-ahead energy market congestion as measured by "CLMP" or equivalent between the source and sink points. All four RTOs/ISOs host auctions for the sale of FTRs (or equivalent product).” LEI report, p 102.

[15] Comments on Congestion Revenue Rights Enhancements Working Group Meeting #5 – April 1, 2025, Department of Market Monitoring, April 16, 2025: https://www.caiso.com/documents/dmm-comments-on-crr-enhancements-apr-1-2025-working-group-meeting-no-5-apr-16-2025.pdf

[16] LEI report, pp 195-196

[17] https://www.caiso.com/documents/2019annualreportonmarketissuesandperformance.pdf

[18] The ISO and MSC have both suggested that the CRRs sold by the ISO may provide benefits of at least 1% of total wholesale energy costs, e.g., see Opinion on Congestion Revenue Rights Auction Efficiency, Market Surveillance Committee, March 15, 2018, p 23: https://www.caiso.com/documents/mscdraftopiniononcongestionrevenuerightsauctionefficiency-mar15_2018.pdf

[19] Total PJM market costs include LEI’s estimates for load met by bilateral energy purchases and PJM market energy, excluding load that LEI estimates is met by regulated self-supply.

[20] For example, for the annual auction results released in November, DMM included trading volumes for monthly contracts for each of the 12 months of the following year. For monthly auction results released toward the end of each month, DMM included trading volumes for contracts covering the following month.

[21] One way to model this is to set transmission limits in the CRR model to be equal to flows created by allocated CRRs, and then run the CRR model with all bids submitted by LSEs and non-LSEs. An equivalent modeling approach is to enforce a constraint so that the net injection and withdrawal at each node nets to 0.