ACP-California

Submitted 11/02/2021, 03:46 pm

Submitted on behalf of

ACP-California

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

ACP-California appreciates the opportunity to comment on the CAISO’s IPE issue paper and the discussion that took place at the October 19th workshop.

There are a number of more minor interconnection process improvements, such as those proposed by LSA/SEIA and many of those outlined in Section 3.1, which should be implemented through this initiative to improve the process for generation developers and their offtakers. Additionally, there are additional pieces of information and improvements to data accessibility, as discussed by Gridwell, that can be provided to developers to help reduce the number of unviable interconnection requests and partially reduce the overheated nature of the CAISO’s interconnection queue.

While both of the aforementioned reforms are necessary, they are unlikely to be sufficient to address the large volume of interconnection requests that CAISO has received and is expected to continue to receive in future clusters. Thus, through IPE, it will be necessary for CAISO to impose additional requirements for projects to be “ready” and/or increase the capital at risk to move forward in the interconnection queue. In developing requirements for “ready” projects within IPE, it will be critical to develop a suite of criteria that recognize the different development processes and land requirements for different technologies. Providing open access to the transmission system can be achieved while also accommodating and recognizing the unique development process for different technology types, especially Offshore Wind (OWS) and stand-alone Battery Energy Storage Systems (BESS), which may not be as well suited for site control/exclusivity requirements that often apply to other technology types.

ACP-California applauds CAISO for thinking creatively about modifications that might help address interconnection and deliverability issues, including wholesale changes to the deliverability allocation process. However, we caution CAISO about transitioning the deliverability process to one in which LSEs are allocated deliverability. That approach appears as though it would be similar to the Maximum Import Capability (MIC) process, which has its own set of challenges and results in substantial transaction costs for LSEs and resource developers. Additionally, as CAISO considers potential modifications to the deliverability allocation procedures, it should be mindful that if the CPUC implements major structural changes to the RA construct, they may directly affect deliverability and necessitate reevaluation of the deliverability study processes and allocation procedures. CAISO may wish to wait until the new RA construct is finalized (or close to finalized) before undertaking substantive changes to the deliverability allocation process.

ACP-California supports CAISO’s efforts to improve how the interconnection process functions and to allow viable projects to proceed forward in a timely fashion. We also support CAISO providing additional, more accessible information to developers to help reduce the number of unviable interconnection requests that CAISO receives in the future. However, the provision of additional information and data, while necessary, are unlikely to be sufficient. CAISO should explore increasing requirements for readiness in order to advance in the interconnection queue and should ensure that readiness requirements appropriately recognize the differences between technology types.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

ACP-California generally supports providing additional clarity and documentation surrounding the interconnection process, as outlined in Section 3.1, including providing additional criteria around changing sites and POIs during the study process and creating processes for transferring WDAT projects into the CAISO queue. While ACP-California generally supports addressing the issues proposed by CAISO in this section, additional discussion around the impacts of the proposed clarification to Reliability Network Upgrades should be undertaken as part of the upcoming stakeholder process.

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

Given the size of Cluster 14 and the need to move the interconnection process forward, it will likely be necessary to implement some form of “readiness” requirements for interconnection customers to proceed into Phase II. The Issue Paper specifically mentions potential site exclusivity or equipment requirements in order to proceed. As mentioned during the October 19th stakeholder workshop, it will generally be too early in the development process to impose major equipment requirements in order to proceed to Phase II (and, especially, to impose these requirements in order to enter the queue). Additionally, site exclusivity requirements may be appropriate demonstrations of readiness for certain types of projects, but will not be appropriate or reasonably achievable for others. Notably, OSW and BESS may not be well suited to meet site exclusivity requirements.[1] Given the unique nature of these technologies (and perhaps others), ACP-California encourages CAISO to explore having different requirements for different technology types to advance in the interconnection process. While there appears to be some concern about maintaining open access principles while applying different readiness criteria to different technology types, ACP-California points out that, elsewhere in the country, differing criteria for different technologies already apply. For instance, several western transmission providers enforce site control requirements have different acres per MW requirements for different resource types, to reflect the relevant land use needs each resource. Thus, we are confident that CAISO and stakeholders can work collaboratively to come up with different readiness requirements for different technology types while adhering to the principles of open and non-discriminatory access. ACP-California encourages CAISO to consider the different development processes for different resource types as it develops a Straw Proposal and to work with stakeholders to better understand the development processes for different resource types.

[1] OSW may not be well suited for site exclusivity demonstrations because, unless and until lease auctions occur, OSW resources are not capable of demonstrating site exclusivity. And stand-alone BESS may not be well suited for site exclusivity demonstrations to demonstrate readiness because many BESS applications will likely be situated in urban areas and site exclusivity will come much later in the development process in these areas than it does for wind/solar development.

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1:

The provision of additional, more accessible data, to interconnection customers should help to reduce the number of unviable requests that utilize the cluster study process as an information gathering exercise. But, even if substantial improvements to data accessibility and information access are achieved, they are unlikely to fully address the magnitude of the issue the interconnection queue is experiencing. Thus, as part of Phase 2 of this process, CAISO will need to implement other reforms that help to further reduce unviable interconnection requests in Cluster 15 and beyond. CAISO should consider higher fees, increased deposits (with more “at risk”) and implementation of other criteria to enter and advance in the interconnection process. Development of additional “capital at risk” requirements and/or “readiness” requirements, while being mindful of the need for different readiness criteria for different technology types, should be thorough explored as part of this initiative. ACP-California looks forward to additional discussion on the appropriate deposits, fees or criteria which could be implemented in order to discourage unviable interconnection requests from being submitted.

6.

Provide your organization’s comments on the General interconnection issues to be addressed in Phase 2, as described in section 4.2:

In Section 4.2, CAISO outlines potential modifications to the TPD Allocation process and asks whether CAISO should consider a revised TPD Allocation process where TPD is allocated to LSEs who would then enter into a PPA with a specific project. ACP-California appreciates CAISO’s creative thinking on the TPD-related challenges that exists. While we do not have a strong position on this idea at this early stage in the process, we do urge caution on this type of a modification to the TPD Allocation process. The allocation of deliverability to LSEs would appear to be analogous to the current process for allocating deliverability for import RA (the Maximum Import Capability or “MIC” process). The MIC process has significant transaction costs and can be difficult to navigate as it requires imported RA resources to identify LSEs that have, or can obtain, a MIC allocation at a particular location where the imported resource can deliver. CAISO should be aware of these challenges, and the associated transaction costs, of allocating deliverability in this manner and should ensure any proposals that are put forward on deliverability in this initiative do not recreate those challenges for internal resources. Additionally, given the potential wholesale modifications to the CPUC RA paradigm and their potential direct impacts on deliverability, CAISO may wish to postpone any substantive deliverability modifications until there is more certainty on the CPUC’s new RA rules.

7.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, the ISO is seeking stakeholder input on, as described in section 4.3:

8.

Provide your organization’s comments on specific changes that are needed to any of the above mentioned topics, including specific recommendations or proposals on new or revised methodology:

9.

Provide your organization’s feedback on the scope of issues presented by Southern California Edison during the October 19, 2021 stakeholder workshop:

10.

Provide your organization’s feedback on the scope of issues presented by Gridwell Consulting during the October 19, 2021 stakeholder workshop:

In part, Gridwell’s presentation highlighted the need to improve data accessibility in order to provide developers with more information the viability of their interconnection requests which, in turn, would help reduce the number of unviable interconnection requests that are submitted and take up valuable study resources. ACP-California supports improving data accessibility and improving overall information provided to developers in order to reduce the volume of unviable interconnection requests that are submitted. While addressing data and information provision is necessary, it is unlikely to be sufficient to address the current magnitude of the interconnection queue challenges. Thus, in addition to the scope of issues recommended by Gridwell, CAISO should explore implementation of additional requirements to advance in the interconnection queue.

11.

Provide your organization’s feedback on the scope of issues presented by LSA/SEIA during the October 19, 2021 stakeholder workshop:

ACP-California generally supports addressing the issues presented by LSA/SEIA, as they can help improve the interconnection and deliverability allocation processes and help solve challenges that have been identified. As discussed above, additional reforms will also be required in order to reduce the number of unviable interconnection requests that are submitted in future clusters.

12.

Additional comments on the IPE 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

California Public Utilities Commission - Public Advocates Office

Submitted 11/02/2021, 04:02 pm

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

The following are comments from the Public Advocates Office at the California Public Utilities Commission (Cal Advocates). Cal Advocates is an independent consumer advocate with a mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Cal Advocates recommends changes to the CAISO’s existing generator interconnection policies to minimize ratepayer cost and ensure reliable service. Specific recommendations are provided on the topics covered in the 2021 Interconnection Process Enhancements Preliminary Issue Paper (2021 IPE) issued on September 30, 2021, in the order provided.

[1] Cal. Pub. Util. Code § 309.5.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

In Section 3.1 of the 2021 IPE, enhancements that would impact ratepayers were not discussed, thus Cal Advocates does not have any recommendations on this section.

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

In Section 3.2 of the 2021 IPE, the CAISO asks the following:

- Should an accelerated process for “ready” projects be considered?

- Would “different requirements for different technologies to advance in the interconnection process be appropriate”? “Between location-specific resources versus more location-flexible.”[1]

These questions are timely given the urgent need to bolster the California resource adequacy (RA) capacity fleet. Governor Newsom declared a state of emergency on July 30, 2021, ordering state agencies to undertake a variety of extraordinary measures to achieve energy stability.[2] The CAISO issued reliability must-run (RMR) designations to several resources seeking retirements to meet system-wide reliability needs.[3] The CAISO also identified local RA deficiencies in the San Diego Gas & Electric Company (SDG&E) and Pacific Gas and Electric Company (PG&E) service territories.[4] These tight supply conditions are reflected in California’s RA market prices.[5]

The CAISO initiated a 2021 IPE stakeholder initiative after receiving an unprecedented 373 interconnection requests in the Cluster 14 open window.[6] Given the tight RA capacity market, Cal Advocates supports an expedited path for technologies with demonstrated evidence of reducing transmission or energy costs for ratepayers. While Federal Energy Regulatory Commission (FERC) Order Nos. 888 and 2003 prohibit discriminatory treatment of interconnection requests,[7] the overlapping conditions of a tight RA capacity market, system-wide RMR designations by the CAISO, and local RA deficiencies compels swift action and a change in policy. California is not alone in facing an overwhelmed interconnection queue. For example, the Midcontinent Independent System Operator (MISO) has noted an unprecedented number of projects and gigawatts in its 2021 queue.[8]

The CAISO should expedite the interconnection process for preferred resources that can cost-effectively address reliability needs and achieve operational status in a timely fashion. To be eligible for expedited treatment, projects should either solve system reliability needs and reduce the need for RMR designations, or cure a specific need identified in the CAISO local capacity technical study.[9] To address the time-sensitive and outstanding RMR designations, the CAISO should seek temporary interconnection queue expediting authority from the FERC through a CAISO tariff amendment in 2021. For the long-term, the CAISO should also seek a permanent change to expedite interconnection queue requests to serve reliability needs in Phase 2 of the IPE initiative.

It is worth noting that FERC’s advance notice of a proposed (ANOPR) rulemaking entitled Building for the Future Through Electric Regional Transmission Planning and Cost Allocation and Generator Interconnection issued July 2021, also asks whether FERC should allow “a fast-track for ‘ready’ interconnection requests. FERC suggests that this fast-track policy could remove barriers to interconnection requests that meet certain readiness criteria that could include an executed power purchase agreement, utility selection through a request for proposal process or location at an existing interconnection facility.[10]

In response to this ANOPR, the California Public Utilities Commission and the MISO Transmission Owners stated interest in some form of fast-track mechanism for the interconnection process in their filed comments.[11],[12] Specifically, the MISO Transmission Owners support fast-tracking generator interconnection requests that are planned specifically to serve native load and or reserve margin requirements (resource adequacy),[13] which is in-line with Cal Advocates’ recommendation above.

[1] CAISO IPE 2021, p. 6.

[2] https://www.gov.ca.gov/wp-content/uploads/2021/07/Energy-Emergency-Proc-7-30-21.pdf

[3] The vast majority of RMR designations are intended to meet identified local RA needs. The CAISO has also noted, “the current fleet of available internal resources does not meet either the 15% or the 17.5% margin, at the net peak hour, for the month of September 2021, let alone the load forecast increase for year 2022.” http://www.caiso.com/Documents/Decision-Conditional-Approval-Extend-RMR-Contracts-Memo-Sep-2021.pdf.

[4]http://www.caiso.com/Documents/EvaluationReportofLoadServingEntitiesCompliancewith2021ResourceAdequacyRequirements.pdf

[5] The highest RA capacity prices in 2019—two years ago—reached $15.25/kilowatt-month (compared to the 2018 maximum of $10.09 in 2018), and supply constraints have only worsened since that point, which strongly suggests that prices will remain elevated until adequate supply is available to promote price competition (Jonathan Lakey, et al., 2019 Resource Adequacy Report, CPUC Energy Division, March 2021, p. 22; Simone Brant, et al., 2018 Resource Adequacy Report, CPUC Energy Division, August 2019, p. 23). See also increases in the Commission-developed Market Price Benchmark (MPB) RA Adder prices at Table 2: MPB RA Adders (Public) from IOU ERRA Forecast filings ($/kW-month) in The Public Advocates Office Comments on Administrative Law Judge’s Ruling Seeking Feedback on Mid-Term Reliability Analysis and Proposed Procurement Requirements (Public Version), March 26, 2021, p. 9.

[6] CAISO IPE 2021, pp. 3-4. Previously, the CAISO had received an average of 113 queue requests annually, and accommodating “supercluster” 14 has required extending the study process by an additional year, which could lead to delays for all resources involved (Neil Millar, Decision on Cluster 14 Interconnection Procedure [Memorandum to CAISO Board of Governors], July 7, 2021, http://www.caiso.com/Documents/Decision-Cluster-14-Interconnection-Procedures_Memo-July-2021.pdf.).

[7] Federal Energy Regulatory Commission, July 24, 2001, RM02-01-000, Order No. 2003, p. 1.

[8] MISO’s interconnection queue as of September 30, 2021, has 958 interconnection requests totaling 150.3 gigawatts of total new capacity, MISO, RM21-17-000, p. 90.

[9] The CAISO’s 2022 Local Capacity Technical Study identified local capacity deficits in the North Coast/North Bay (deficit listed on p. 41) and Kern (p. 112) Local areas. These local areas are at risk of CAISO using its backstop authority to cure deficits absent new generation or transmission. (CAISO, 2022 Local Capacity Technical Study Final Report and Study Results, April 30, 2021.)

[10] FERC ANOPR, item 157, p. 107.

[11] CPUC, RM21-17-000, October 12, 2021, p. 70.

[12] MISO Transmission Owners, RM21-17-000, p. 40.

[13] MISO Transmission Owners, RM21-17-000, p. 40.

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

In Section 3.3 of the 2021 IPE, the CAISO asks whether or not it should develop a one-time framework to allow resources such as storage to be added to existing sites on an expedited basis, despite potential impacts on earlier-queued projects, to meet pressing reliability needs?[1]

Cal Advocates supports the development of a framework to allow resources to be interconnected to the CAISO grid on an expedited basis if they will meet pressing reliability needs as stated in our response to question number 3.

Additionally, if a transmission solution (such as the installation of storage at an impacted area on the grid) is identified as the lowest cost and best fit option in the CAISO Transmission Planning Process (TPP) to address a reliability issue that is already impacting ratepayers, then Cal Advocates supports expediting both the competitive solicitation and interconnection study analysis for the transmission solution project. This would remedy the identified reliability issue and could expeditiously reduce ratepayer costs.

[1] CAISO 2021 IEP, p. 7.

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1:

In Section 4.1 of the 2021 IPE, the CAISO proposes several enhancements as questions. The following are Cal Advocates’ recommendations to these questions in the order that they are discussed in the 2021 IPE.

1.Should higher fees, deposits or other criteria be required for submitting an interconnection request?

Cal Advocates supports increasing the interconnection submittal fee for projects seeking an interconnection location point where there is limited or no available transmission capacity. This would deter developers from installing generation where it would require new or upgraded transmission, therefore, keeping costs down for ratepayers. This fee could be based on the estimated value of the project. Cal Advocates also recommends maintaining the current interconnection submittal fee of $50,000 for developers that locate projects where there is existing transmission capacity.

Cal Advocates also recommends the CAISO provide more user-friendly information regarding available transmission capacity on the CAISO grid per the recommendations provided in Gridwell’s October 19, 2021, workshop.[1] In addition, the CAISO should update this information on a monthly or quarterly basis. These changes will encourage developers to propose generation in locations where there is available transmission capacity. Cal Advocates also recommends that the CAISO provide information on how many developers are proposing to use the same interconnection point so that new interconnection requestors can make more informed decisions on their selected point of interconnection. As the CAISO states, “developers should be incentivized to find cost-efficient interconnection sites.”[2]

2. Should California ratepayers reimburse a generator for network upgrades on the CAISO grid if these network upgrades are required on the CAISO grid for generating facilities interconnecting in another balancing authority area.[3]

The CAISO should not unilaterally agree to expand inter-regional transmission capacity without assessing the benefits for each region along with the costs attributable to each region. New transmission project proposals should be required to identify each affected region or Balancing Authority Area (BAA) that could be impacted for project review and assessment. The CAISO should not unilaterally fund external project without proper review process as specified by FERC Order No. 1000.[4] Cal Advocates recommends that the costs for new transmission to accommodate new resources outside of the CAISO grid should be handled under the inter-regional review mechanism put into place by FERC Order No. 1000.[5]

3. Should the CAISO re-consider an alternative cost allocation treatment for network upgrades to low (below 200 kilovolts) systems where the associated generation benefits more than, or other than, the customers within the service area of the Participating Transmission Owning (PTO) facility?[6]

Cal Advocates requests that the CAISO evaluate and determine the likely benefits that network upgrades to low systems (below 200 kilovolts) could provide to other customers outside their PTO service area and to the CAISO grid. This analysis could then be used to determine network upgrade cost allocation between the PTOs’ service areas and California’s regional transmission access charge. As an example, in Southwest Power Pool (SPP), 67% of the costs for Network Upgrades between 100-300 kilovolts (kV) are allocated to the zone where the upgrades are constructed and 33% are allocated to the region.[7] This cost allocation split is based on a study SPP conducted that demonstrated the benefits of higher voltage transmission lines to the region as well as the local area in which they are located.

[1] 2021 Interconnection Process Enhancements – Gridwell Consulting Proposed Issues (presentation), October 2021, slides 6-7.

[2] CAISO, FERC RM21-17-000, October 12, 2021, p. 104.

[3] CAISO 2021 IEP, p. 8.

[4] FERC Order 1000, Docket No. RM10-23-000, Sections 164 - 178, pp. 90 – 101.

[5] FERC Order 1000, Docket No. RM10-23-000, Sections 164 - 178, pp. 90 – 101.

[6] CAISO 2021 IPE, p. 8.

[7] Southwest Power Pool, FERC RM21-17-000, October 12, 2021, p. 17.

6.

Provide your organization’s comments on the General interconnection issues to be addressed in Phase 2, as described in section 4.2:

In Section 4.2 of the 2021 IPE, the CAISO ask whether incentives should be considered for load serving entities (LSE) to procure generation projects at locations where transmission capacity has been built or approved based on the CPUC portfolios?

Cal Advocates does not support providing incentives to ensure that LSE procure projects in preferred areas. Instead, Cal Advocates recommends that the CAISO provide more information on the available transmission capacity on its managed facilities including the number of developers that are seeking to use the same point of interconnection so that developers can make more informed decisions on where to locate their projects. During the interconnection process enhancement meeting, a former CAISO interconnection policy staff and Gridwell representative also stated that “developers do not have sufficient data to evaluate potential project interconnection sites.”[1] This former CAISO staff recommended that the CAISO increase data accessibility to address and to improve CAISO interconnection queue opportunities.[2]

It is important for project developers to know where the CAISO has available transmission capacity in order to plan for a speedy project development effort. Project developers will be better served by the CAISO if they can complete a project in three to five years at a location that has available capacity versus a project that may take seven to ten years based on a renewable cluster analysis that leads to requiring new transmission upgrade(s).

[1] 2021 Interconnection Process Enhancements – Gridwell Consulting Proposed Issues (presentation), October 2021, slides 3.

[2] 2021 Interconnection Process Enhancements – Gridwell Consulting Proposed Issues (presentation), October 2021, slides 3-7.

7.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, the ISO is seeking stakeholder input on, as described in section 4.3:

As discussed in responses to questions 2 and 3 above, Cal Advocates supports fast-track treatment for generation interconnection requests that could meet reliability needs identified in the CAISO TPP or resource adequacy requirements. This recommendation is consistent with Cal Advocates’ prior recommendations on the CAISO’s 2018 IPE in which we supported measures to manage the queue “such as giving priority queue positions to resources that provide capacity or meet other energy services needs in the project area, and/or serve an identified CAISO controlled grid need.”[1]

In our response to questions 5 and 6 above, Cal Advocates also recommends that the CAISO provide better information on CAISO system conditions and available capacity, so that project developers could select the optimal locations for their projects.

The CAISO may also consider a separate track for requests that do not require system upgrades as this will reduce costs for ratepayers, but this track should not take priority over projects to meet reliability needs.

[1] Cal Advocates Comments on the 2018 IPE – Issue paper, February 7, 2018, p. 8.

8.

Provide your organization’s comments on specific changes that are needed to any of the above mentioned topics, including specific recommendations or proposals on new or revised methodology:

Please refer to Cal Advocates’ responses to questions 3 through 6 above.

Additionally, Cal Advocates recommends that the CAISO revisit the cost responsibility for network upgrades required to accommodate generator interconnection requests. Specifically, Cal Advocates recommends that the CAISO revise its cost responsibility policy so that the cost of interconnection upgrades that are not needed for reliability are assigned to interconnection customers, not ratepayers. This would be consistent with the interconnection cost responsibility policies in the MISO authority area.[1]

Currently in California, most interconnection customers do not fund network upgrade costs. As the CAISO states, interconnection customers only finance network upgrade costs, and participating transmission owners refund their payments over a five-year period.[2]

[1] Midcontinent Independent System Operator Transmission Owners, FERC RM21-17-000, October 12, 2021, p. 35.

[2] CAISO, FERC RM21-17-000Comments, October 12, 2021, p. 90.

9.

Provide your organization’s feedback on the scope of issues presented by Southern California Edison during the October 19, 2021 stakeholder workshop:

Cal Advocates has no comment, at this time regarding the Southern California Edison presentation provided at the October 19, 2021, stakeholder workshop.

10.

Provide your organization’s feedback on the scope of issues presented by Gridwell Consulting during the October 19, 2021 stakeholder workshop:

As stated in our response to questions 5 and 6, Cal Advocates agrees with Gridwell’s recommendations to improve transmission capacity information.[1]

Cal Advocates also requests that the CAISO review and either confirm or update Gridwell’s estimate that only one in 10 interconnection requests and 4% of proposed megawatts reach completion[2] with information on the estimated dropout rate in the CAISO interconnection queue.

[1] 2021 Interconnection Process Enhancements – Gridwell Consulting Proposed Issues (presentation), October 2021, slides 6-7.

[2] 2021 Interconnection Process Enhancements – Gridwell Consulting Proposed Issues (presentation), October 2021, slide 10.

11.

Provide your organization’s feedback on the scope of issues presented by LSA/SEIA during the October 19, 2021 stakeholder workshop:

Cal Advocates supports the Large-Scale Solar Association (LSA) and Solar Energy Industries Association (SEIA) requests for greater transparency on interim deliverability further described in their presentation during the October 19, 2021, stakeholder workshop.[1]

[1] 2021 Interconnection Process Enhancements – LSA & SEIA Proposed Issues, Stakeholder Workshop, October 19, 2021, p. 6.

12.

Additional comments on the IPE 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

At this time, Cal Advocates has no additional comments on the CAISO’s 2021 IPE.

California Wind Energy Associations

Submitted 11/02/2021, 03:06 pm

Submitted on behalf of

California Wind Energy Associations

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

CalWEA believes that a number of the items are ill-advised, and we encourage CAISO to move forward and focus on the following issues –

- Have a resilient interconnection process to deal with the issues caused by the over-crowded queue and keep it accessible to smaller developers.

- Honor queue integrity and provide better transparency. No special treatment should be given for technology, location, or other considerations unless circumstances clearly warrant. No queue jumping should be allowed.

- Focus on helping projects in the queue complete the interconnection study process and receive deliverability, thus creating a competitive procurement environment.

- Provide better opportunities for Energy Only resources to seek deliverability.

- Streamline the process to allow projects to interconnect before the GRNU that is triggered by a group of projects. Improve flexibility to deal with network upgrade construction delays.

- Strengthen the cost cap established by the lower of the Phase I and Phase II studies and minimize disruption from post-Phase II activities.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

CalWEA supports enhancement of the downsizing process, such as allowing downsizing requests to be submitted at any time. Interconnection requests that do not share any network upgrade cost with other projects could be processed in an expedited manner, e.g., through the MMA process.

Errors or omissions identified after the second IFS posting should not increase an interconnection customer’s (IC) maximum cost responsibility and maximum cost exposure as the IC could have already made financial decisions and commitments based on the previous network upgrade assignment.

CalWEA supports full refund of IFS and un-used study deposits if the project withdraws after being notified of any new network upgrade requirements or delays in COD.

The ISO should, at a minimum, clarify in the BPM that, when congestion management is sufficient to maintain system reliability in lieu of a RAS, the RAS is not required for the generation project to interconnect and should not delay the COD. This is especially true for projects in the ISP where the ISP reliability assessment does not identify any need for a RAS, even if later deliverability assessment requires the RAS for FCDS.

CalWEA supports formalizing the process of transferring an IR between the ISO Queue and a PTO’s WDAT Queue, as well as establishing rules for changing sites and POI during IR validation. Regarding the latter, the rules should be based on geographic distance or electrical distance, whichever is further.

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

CalWEA strongly opposes changes to the current site exclusivity requirement. A deposit in lieu of site exclusivity document should be allowed when submitting IRs.

The ISO should not introduce equipment requirements. There are many uncertainties associated with project development, many of which are out of the developer’s control. Also, technologies can evolve quickly. Requiring developers to make early commitments to specific equipment is unrealistic and will prevent developers from making the most efficient and effective equipment decisions that may benefit the grid and ratepayers.

An accelerated process for “Ready” projects could be beneficial. For example, “Ready” projects could skip the Phase I study and be put into a Phase II study directly as long as the projects are willing to forego Phase I cost protections and accept sole allocation of any new upgrade requirements. However, the coordination of the “ready” projects process with the main study process could be complicated and should be designed carefully so as not to delay the study process for other projects. Readiness criteria also should be developed to prevent abuse by the utilities intending to develop their own projects.

CalWEA opposes special treatment based on technology unless circumstances clearly warrant. For example, if an EO project agrees to fund DNUs to obtain FCDS, CAISO should allow that. Another example is to relax technical requirements for offshore wind in the early stage of the study process, given the long development lead time for these projects. A conceptual user-written model, instead of a site-specific model, should be allowed before the Phase II study.

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

CalWEA strongly opposes queue-jumping. The ISO should play no role in favoring specific projects. If desired, LRAs or LSEs can promote specific projects already in the queue by awarding PPAs or mandating certain types of resources, or CAISO can issue RMR contracts.

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1:

CalWEA opposes higher fees and study deposits for entering the queue. Fees are sufficiently high and shouldn't become unaffordable to smaller developers.

The ISO clarified that it intends to reduce the study scope instead of expanding the study timeline. CalWEA is concerned about the cost implication of the reduced scope. Reducing study scope should not remove the cost protections in the Phase I study process and should not have the unintended consequence of PTOs inflating the Phase I cost to cover potentially missed network upgrade requirements.

For generation projects interconnecting outside the ISO BAA, but impacting the ISO grid, the study of ISO as an affected system should use the latest available ISO cluster study base case, instead of waiting for the current cluster to complete its Phase I or Phase II study. The network upgrade costs identified in the study are reimbursable if the generator will export to the ISO.

6.

Provide your organization’s comments on the General interconnection issues to be addressed in Phase 2, as described in section 4.2:

Incentives to align LSE procurement with CPUC portfolios already exists in the CAISO’s GIP and the CPUC’s IRP-TPP processes, and resources are available at the locations identified by the CPUC’s busbar mapping process. The ISO approves policy upgrades by studying the CPUC portfolios. The approved upgrades support generation in the queue to obtain deliverability. LSE procurement requires deliverability. This loop is already there and there is more than enough generation already in the queue. The ISO should focus on helping projects in the queue complete the interconnection study process and receive deliverability, thus creating a competitive procurement environment. The ISO should consider deliverability methodology refinements to make more deliverability available. CALWEA, together with the California Energy Storage Alliance, has submitted deliverability methodology reform into the CAISO’s policy initiatives catalog.

TPD should be allocated directly to generators, not to LSEs. Allocating TPD to LSE would introduce inefficiencies and create the potential for market power for LSEs.

The ISO should consider enhancing opportunities for EO projects to receive deliverability.

7.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, the ISO is seeking stakeholder input on, as described in section 4.3:

See comments above for 4.2 regarding aligning the interconnection process with procurement.

As for the proposal for the ISO to be able to terminate a GIA earlier than the 7-year period if a project cannot prove that it is moving forward towards permitting and construction, this is impractical and thus not worth pursuing. Projects can always show some progress towards obtaining a PPA or land-use permit. Moreover, even after the 7-year period, the ISO tariff allows the ISO only to take away the full capacity or partial capacity deliverability status if the project fails the commercial viability test, not to terminate the GIA.

8.

Provide your organization’s comments on specific changes that are needed to any of the above mentioned topics, including specific recommendations or proposals on new or revised methodology:

No further comment at this time.

9.

Provide your organization’s feedback on the scope of issues presented by Southern California Edison during the October 19, 2021 stakeholder workshop:

Shared IRNUs should not be exempted from GIDAP 14.2.2 if the projects sharing upgrades have no affiliation with each other.

10.

Provide your organization’s feedback on the scope of issues presented by Gridwell Consulting during the October 19, 2021 stakeholder workshop:

The public queue could be enhanced by including more non-confidential information, especially for Partial Capacity Deliverability Status. Regarding the availability of transmission capacity, plenty of information is available and accessible on the ISO website although, given the complexity of the technical studies underlying such information, advanced technical skills are required to interpret the information.

11.

Provide your organization’s feedback on the scope of issues presented by LSA/SEIA during the October 19, 2021 stakeholder workshop:

CalWEA generally supports enhancements to the TPD allocation to provide greater flexibility and accessibility to deliverability. TPD can be tradeable for projects at the same POI although it would not always be a MW-for-MW trade, depending on the ISO deliverability assessment methodology for different technologies. When increased scope and construction time are identified in the annual reassessment, impacted projects should be given an additional opportunity to meet TPD seeking/retention criteria. EO projects should be able to seek deliverability before they are operational. Furthermore, CalWEA urges that the ISO allow EO projects to fund LDNUs to obtain full capacity or partial capacity deliverability status. Prioritization of TPD groups should be revisited. CalWEA supports merging groups 1 and 4 and treating them the same, and the same for groups 2 and 5.

CalWEA agrees it is important to system reliability that a formal process is established to deal with battery performance degradation.

CalWEA supports more proactive actions by the ISO to help developers deal with high-cost upgrade requirements and significant delays of COD due to affected system studies performed by the neighboring utilities.

12.

Additional comments on the IPE 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

Although the ISO allows generators to interconnect before all the RNUs are in service through a limited operational study (LOS), the process is still missing pieces. The LOS is done 5 months ahead of the synchronization date. However, without knowing if the generator can interconnect, the IC can’t plan for the synchronization date. The process needs to be streamlined to allow generators to interconnect until the triggered GRNUs are actually needed and have policy on treating generators after the actual needs arise.

When a generator seeks interconnection to an old substation, the PTO may require the substation to be converted in accordance with current design standards. In such a situation, the PTO should not assign the full converting cost to the generator. The generator should only be assigned the cost for the facilities it uses to interconnect.

The ISP electrical independence test (EIT) should be re-examined by the ISO. Per EIT criteria, projects of any size with >= 5% shift factor on the selected transmission element fails the EIT. However, the flow impact of a small project is insignificant and non-material for a high voltage transmission facility. CalWEA recommends a flow impact consideration for projects with impacts, e.g., shift factor >= 5% and flow impact >=2%. Also with the super-cluster timeline, a requirement to perform the EIT using the current cluster results should be re-considered and revised.

Diamond Generation, LLC

Submitted 11/02/2021, 03:30 pm

Submitted on behalf of

Diamond Generation LLC

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

Diamond Generating Corporation (“Diamond”) is pleased to provide comments on the California Independent System Operator’s (“CAISO’s”) Interconnection Process Enhancements 2021 Preliminary Issue Paper, dated September 30, 2021 (“Issue Paper”). The Issue Paper indicates:

The CAISO is seeking stakeholder input on whether a one-time option should be adopted to allow resources such as storage to be added to existing sites on [an] expedited basis to meet pressing reliability needs despite the potential impacts on earlier-queued projects.

Issue Paper at 7. Diamond believes the CAISO should make this one-time option available immediately in response to the Governor’s Proclamation of a State of Emergency issued on July 30, 2021, (“Proclamation of Emergency”) which permits the California Energy Commission (“CEC”) to issue permits for battery storage systems (“BSS”) of 20 MW or more that will deliver net peak energy by October 31, 2022.[1]

On September 8, 2021, the CEC issued Order No.: 21-0908-2 (“CEC Order”) which establishes a process for licensing new or expansions of battery storage systems of 20 MW or more and required that applications be filed by November 1, 2021.[2]

On October 29, 2021, the CPUC issued a Proposed Decision in Docket No. 20-11-003, finding “The Commission has conducted an analysis of the need for new resources and found that a range of 2,000 to 3,000 megawatts of new supply and demand-side resources is needed to address grid reliability in 2022 and 2023.”[3] For supply side resources, the Proposed Decision notes that resources with June 1, 2022 ,Commercial Online Dates are preferred but recognizes that resources that are operational by the following year, August 1, 2023, should also be considered.[4] The Proposed Decision goes on to propose rules which require the investor-owned utilities to conduct the necessary procurement activities.

Now it is the CAISO’s turn to take action. The Proclamation of Emergency specifically provides:

14. The CAISO is requested to take all actions available and use best efforts, including seeking waivers to its existing tariff processes, to expedite the interconnection to the transmission grid of resources specified by the California Energy Commission for purposes of meeting the intent of this proclamation.

Proclamation of Emergency at ¶ 14.

The Issue Paper is an excellent first step to meeting the Governor’s proclamation, but success in achieving the Governor’s objective requires the CAISO act with utmost speed. As discussed in the further comments, Diamond intends to permit two BSS projects under the CEC Order, but the capital investments for these projects can only be made if the CAISO takes the steps necessary over the next two to three months to seek the necessary waivers ensuring a clear path for the BESS projects to interconnect by October 31, 2022. Diamond has uploaded a fuller set of comments as an attachment to this submission.

[1] A copy of the Proclamation of Emergency is available at https://www.gov.ca.gov/wp-content/uploads/2021/07/Energy-Emergency-Proc-7-30-21.pdf . See Section 11 (“With respect to new, and expansions of, battery storage systems of 20 megawatts or more that the California Energy Commission determines are capable of discharging for at least two hours and will deliver net peak energy by October 31, 2022, the provisions of Public Resources Code, Division 13 (commencing with Section 21000) and regulations adopted pursuant to that Division, are suspended to the extent that the Energy Commission determines that such systems should be licensed. Public Resources Code section 25500 shall apply to the issuance of a license under this Paragraph (notwithstanding the 50-megawatt limitation in Public Resources Code section 25120). The California Energy Commission shall implement the provisions in this Paragraph in consultation with local jurisdictions and state agencies.”)

[2] The order is available at https://www.energy.ca.gov/sites/default/files/2021-09/Expedited%20Battery%20Licensing_Order_N0_21-0908-2_ADA.pdf . The CEC has also prepared a “Battery Storage System (“BSS”) Application Checklist” available at https://www.energy.ca.gov/media/6104. The checklist requires “proof of interconnection authorization by October 31, 2022.” Checklist at 1.12.

[3] Proposed Decision, Docket No. 20-11-003, issued October 29, 2021 at 2, which is available at https://docs.cpuc.ca.gov/SearchRes.aspx?docformat=ALL&docid=418927517.

[4] Id. Ordering paragraph 60 at 164.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1:

6.

Provide your organization’s comments on the General interconnection issues to be addressed in Phase 2, as described in section 4.2:

7.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, the ISO is seeking stakeholder input on, as described in section 4.3:

See attached Comments of Diamond Generation LLC

8.

Provide your organization’s comments on specific changes that are needed to any of the above mentioned topics, including specific recommendations or proposals on new or revised methodology:

9.

Provide your organization’s feedback on the scope of issues presented by Southern California Edison during the October 19, 2021 stakeholder workshop:

10.

Provide your organization’s feedback on the scope of issues presented by Gridwell Consulting during the October 19, 2021 stakeholder workshop:

11.

Provide your organization’s feedback on the scope of issues presented by LSA/SEIA during the October 19, 2021 stakeholder workshop:

12.

Additional comments on the IPE 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

See attached Comments of Diamond Generation LLC

EDF-Renewables

Submitted 11/02/2021, 03:40 pm

Submitted on behalf of

EDF-Renewables

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

EDF-R appreciates this opportunity to provide comments and suggestions for consideration as the CAISO develops the scope for the Interconnection process enhancements 2021 stakeholder initiative. EDF-R supports many of the reforms proposed during the Oct 19 stakeholder workshop with two notable exceptions:

- EDF-R does not support the CAISO’s proposal to provide interconnection customers a one-time opportunity to allow resources such as storage to be added to existing sites on an expedited basis, despite potential impacts on earlier-queued projects.

- EDF-R does not support CAISO’s suggestion to initiate a new or different method to terminate generation interconnection agreements that have not yet passed the seven (7) year time-in-queue limit.

In addition to giving feedback on proposals in CAISO’s paper and at the Oct 19 workshop, EDF-R also proposes that the CAISO completely restructure its material modification assessment (MMA) process. The process as it exists today is onerous for interconnection customers, the CAISO’s own reports on the process prove that the process has little value, and the CAISO simply will not be able to provide reasonable response times given their already limited staff resources are devoted to the enormous task of reviewing Supercluster 14.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

EDF-R supports simplifying the downsizing process.

EDF-R believes that CAISO should enact policy changes to protect interconnection customers from increased costs and in-service date delays caused by an error or omission discovered after the initial and the second postings have passed. In this circumstance these costs should be borne by the Participating Transmission Owner (PTO). This is particularly important if the newly discovered cost is for an interconnection item the interconnection will not receive reimbursement for. Furthermore, EDF-R believes that the PTO should be obligated to identify and fund interim solutions to remedy any delays to the earliest achievable in-service date if the interconnection customer can provide proof of PPA or shortlist for the project. This would create a more equitable responsibility balance in universe of energy contracts:

- LSEs are responsible for RA showings, and pay penalties when they are short

- Interconnection Customers are responsible to perform on their contract, and pay liquidated damages when they fail to perform, and

- PTOs should be obligated to remedy any harm caused by an error or omission discovered after two and a half years of study work

EDF-R supports easy offramps for projects impacted by new costs and/or delayed in-service date after initial posting.

EDF-R suggests that in addition to considering criteria for POI changes during the scoping meeting, the CAISO should improve transmission system data availability and accessibility. If developers had information such as Transmission Plan Deliverability availability, congestion, and the magnitude of upgrades needed to accommodate new supply in a particular area, the CAISO would not see as many speculatory interconnection requests. MISO’s POI Analysis tool is a good example of a high value scalable tool for this purpose. https://giqueue.misoenergy.org/PoiAnalysis/index.html

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

EDF-R suggests that it would be unfair to increase the requirements for interconnection requests (site exclusivity, equipment requirements, etc.) without simultaneously reducing the length of the study process.

- In EDF-R’s experience, landowners are not enthusiastic about extending long term exclusive options and the CAISO’s 2.5 year study process often consumes a large portion of the opportunity window developers have to act on those land options.

- EDF-R also sees requirements on equipment procurement as ill-suited as a queue-reduction technique.

- EDF-R suggests that certain studies should only be performed during Phase II (i.e short circuit, stability)

- EDF-R suggests that the CAISO should review if Appendix DD section 8.6 “Accelerated Phase II Interconnection Study Process” can be expanded to include a larger number of projects, and that if it is clear that interconnection capacity and Transmission Plan Deliverability in an area is sufficient to accommodate all projects in that area requesting it, then the projects should be offered the opportunity to skip Phase II and be grouped for TPD allocation with the next TPD group (I.e. a cluster 19 project that elects to skip Phase II would be grouped for TPD allocation with cluster 18)

- EDF-R does not support an accelerated first ready process or the CAISO’s proposal for another one-time modification opportunity, it’s unclear what criteria would be used to identify ready projects, nor how the CAISO would ensure performance once the projects received their study results. EDF-R would prefer CAISO focus its resources streamlining its existing processes.

- EDF-R does support the creation of a non-refundable fee that is scaled with interconnection capacity MW to proceed into the Phase I study after the scoping meeting. Supercluster 14 has 14 projects seeking interconnection for 1,000 MW or more, and yet in its entire history no project larger than 800 MW has declared commercial operation. Projects of this size increase the volatility of study results and exacerbate an already bloated queue.

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

EDF-R does not support a one-time opportunity to allow resources such as storage to be added to existing sites on expedited basis to meet pressing reliability needs despite the potential impacts on earlier-queued projects. CAISO MMA and BTM processes are already sufficient to accommodate such requests. EDF-R encourages CAISO to instead focus any resources that would be spent on a one-time effort to be used to reduce the turn time on MMAs.

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1:

EDF-R support creation of a study process for CAISO as an affected system. EDF-R also supports the notion that network upgrades identified in this process that improve transmission or when resource is set to provide RA in CA should be eligible for reimbursement.

6.

Provide your organization’s comments on the General interconnection issues to be addressed in Phase 2, as described in section 4.2:

EDF-R supports and highly encourages increased coordination between the Joint Agencies. On this topic EDF-R notes that if developers had information such as Transmission Plan Deliverability availability, congestion, and the magnitude of upgrades needed to accommodate new supply in a particular area, the CAISO would not see as many speculatory interconnection requests or interconnection requests being proposed in already difficult and saturated areas. MISO’s POI Analysis tool is a good example of a high value scalable tool for this purpose. https://giqueue.misoenergy.org/PoiAnalysis/index.html

7.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, the ISO is seeking stakeholder input on, as described in section 4.3:

EDF-R does not support CAISO’s suggestion to initiate a new or different method to terminate generation interconnection agreements that have not yet passed the seven (7) year time-in-queue limit. CAISO already has the ability to hold projects in breach for failure to perform on Appendix B milestones in the project’s executed GIAs. It would be more appropriate for the CAISO to focus its attention on the 83 projects cluster 11 and prior that are already at or beyond their 7 year time-in-queue limit.

8.

Provide your organization’s comments on specific changes that are needed to any of the above mentioned topics, including specific recommendations or proposals on new or revised methodology:

EDF-R proposes that the CAISO completely restructure its material modification assessment (MMA) process. The process as it exists today is onerous for interconnection customers, the CAISO’s own reports on the process prove that the process has little value, and the CAISO simply will not be able to provide reasonable response times given their already limited staff resources are devoted to the enormous task of reviewing Supercluster 14.

EDF-R is an experienced developer and has submitted dozens of modification requests since the process was formalized in the Interconnection Process Enhancements 2013 stakeholder initiative and memorized in the BPM for Queue Management[1]. In the seven (7) years since the CAISO has rarely denied a modification proposal. In CAISO’s data on the MMA process for 2017, 2018, and 2019 the CAISO reviewed 163 requests for modification. Of those 163 requests, one was denied outright, two were partially denied. The MMA process results in an approved modification 98% of the time.

Despite the fact modifications are approved 98% of the time, it can take 6 months to receive the CAISO’s modification approval letter. All the while development plans are in limbo, as interconnection customers are not assured their modifications will be approved. This timeframe is sure to get worse in the coming years as the CAISO’s already lean staff works to study Supercluster 14.

EDF-R is not proposing the CAISO eliminate the process altogether. EDF-R acknowledges the CAISO needs the detailed technical data it collects during the modification process. However, it is not clear that the study work being undertaken by the CAISO and PTO are a required control for preventing issues, since 98% of modifications are approved. EDF-R proposes the CAISO shift the process to one where approval is automatic if the interconnection customer presents:

- a complete technical data package (as verified by the CAISO),

- agrees to abide by standard control mechanisms, and

- provides a one-time fee of $5,000 to cover the cost of validating technical information and memorializing the modification in a letter from the CAISO to be endorsed by the interconnection customer

[1] Now known as the BPM for Generator Management.

9.

Provide your organization’s feedback on the scope of issues presented by Southern California Edison during the October 19, 2021 stakeholder workshop:

10.

Provide your organization’s feedback on the scope of issues presented by Gridwell Consulting during the October 19, 2021 stakeholder workshop:

EDF-R is supportive of the topics presented by Gridwell and more specifically the items regarding information sharing that would improve decision making. One example would be to improve the curtailment data the CAISO publishes by showing curtailment by specific planning sub-regions as well as curtailment as a percentage of renewable potential. The existing data that shows system wide curtailment on a MWh basis provides little to no value to interconnection customers.

11.

Provide your organization’s feedback on the scope of issues presented by LSA/SEIA during the October 19, 2021 stakeholder workshop:

EDF-R supports continuing the conversation on LSA/SEIA’s proposal to “Re-stack” LDNUs & RNUs triggered in the interconnection process, allowing later-queued projects w/earlier declare COD and reach FCDS.

EDF-R cautions the implementation of such a procedure without a tightening up of queue management procedure; if interconnection customers can cure material harm to other projects by allowing them to skip ahead of them in line, there would be no remaining cause to deny COD extension requests.

EDF-R would also like to call attention to a similar program that was previously a part of SPP’s interconnection process. Staring in 2014, Attachment Z2 of the SPP tariff created revenue credits that stemmed from transmission service that could not have been provided “but for” the upgrade, and then upgrade sponsors would receive payments. On April 29, 2020, SPP submitted revisions to its tariff to eliminate these transmission revenue credits as an option for compensation Attachment Z2. SPP’s the Holistic Integrated Tariff Team (HITT) concluded that the Attachment Z2 approach increased transmission service rates by roughly two percent on average and created additional directly assigned upgrade costs. Unraveling the program has been complicated by technical and legal issues, and California would do well to consider these if it decides to create a model where some interconnection requests effectively “sponsor” others.

------

EDF-R appreciates LSA/ SEIA presenting on BESS degradation and encourages the CAISO to develop a procedure proactively to address BESS degradation concerns. This is a problem that will "snowball" quite quicky given the volume of BESS needed to meet near term supply needs. EDF-R can imagine two solution approaches:

Proposal 1

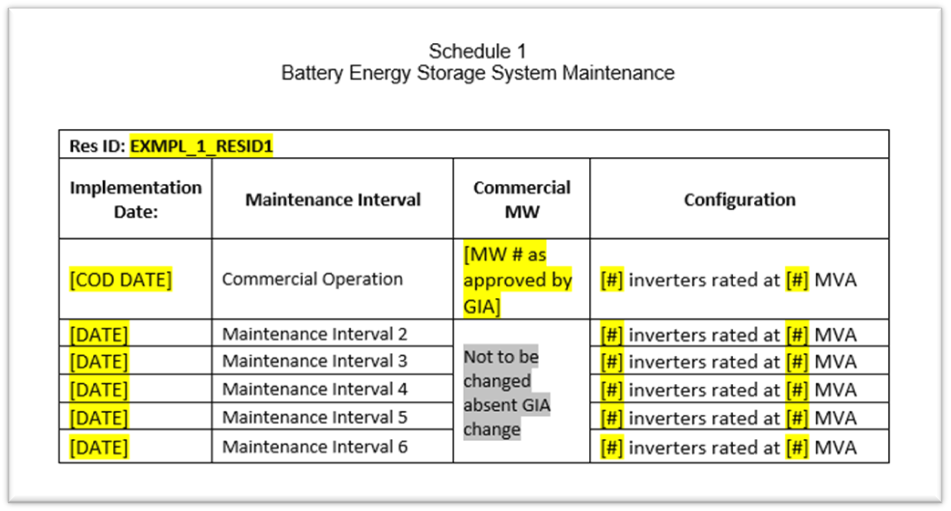

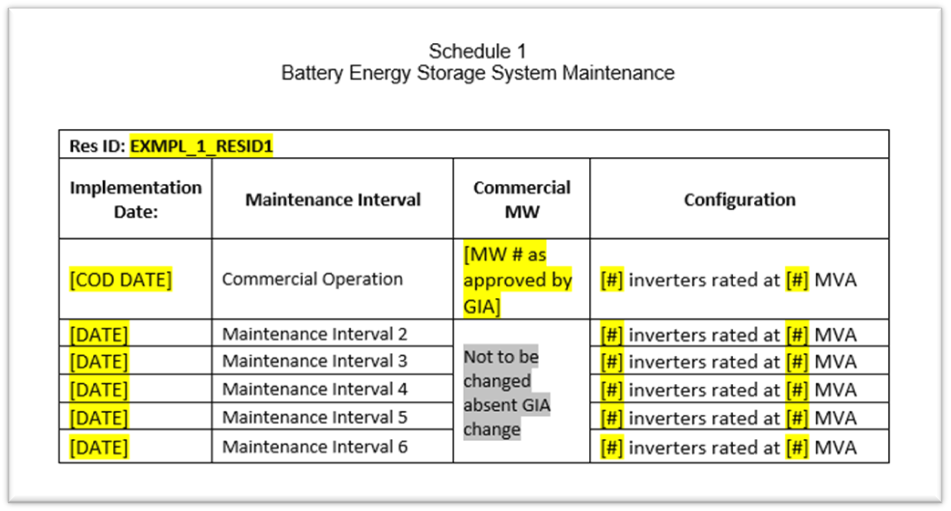

Energy storage customers may request preapproval for their maintenance plans. EDF-R envisions a process where, using the existing modification review framework (including required deposit and technical data), an interconnection customer could request and receive approval for post-maintenance configurations well in advance of the date the maintenance would be performed. For tracking purposes timeline and details of the post-maintenance facility configuration could be codified in the project’s GIA or a separate CAISO form (perhaps like the CAISO’s process for facilities to declare phased implementation[1]).

This proposal has multiple benefits:

- Improvement to cost and timing concerns

- Interconnection customers receive CAISO results well in advance of critical dates

- Less modification requests overall reduces costs and administrative burden for the interconnection customer and the CAISO

- Increase transparency regarding the interconnection customers operating characteristics for the CAISO

- Potentially benefitting the transmission planning process and avoiding chaotic deliverability outcomes soon (explained in detail below)

- CAISO may be able to implement pre-approved maintenance plans without extensive stakeholder effort or tariff changes

Figure 1 Concept for Battery Energy Storage System Maintenance Schedule

Proposal 2

The CAISO adds Battery Energy Storage System Maintenance activities up to a certain level as a change that is allowable without a modification review in Section 6.2.1 of the BPM for Generator Management, “Modifications That Are Approved Without Material Modification Assessment.” It is well understood that acceptable maintenance activities may not be a facility betterment or replacement. EDF-R proposes that the CAISO outline acceptable criteria under which interconnection customers can perform routine maintenance on non-degrading batteries. While this would be a divergence from the CAISO’s current practices, the treatment is appropriate and consistent with CAISO’s treatment of energy storage elsewhere in the BPM for Generator Management.

- This change approval process provides the CAISO and PTO opportunity to review and approve the technical details

- The cost, timing, and effort in this scenario is appropriately scaled to the potential impact the changes

- Maintenance changes are insignificant at a macro level since typical degradation is between 2 and 5% annually

- Modifications under section 6.2.1 are reviewed within 5 business days

- CAISO may be able to implement pre-approved maintenance plans without extensive stakeholder effort or tariff changes

[1] http://www.caiso.com/Documents/PhasedCommercialOperationImplementationPlanTemplate.doc

12.

Additional comments on the IPE 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

EDF-Renewables

Submitted 11/03/2021, 11:41 am

Submitted on behalf of

EDF-Renewables

1.

Provide a summary of your organization’s comments on the Interconnection Process Enhancements (IPE) 2021 preliminary issue paper and October 19, 2021 stakeholder workshop discussion:

EDF-R appreciates this opportunity to provide comments and suggestions for consideration as the CAISO develops the scope for the Interconnection process enhancements 2021 stakeholder initiative. EDF-R supports many of the reforms proposed during the Oct 19 stakeholder workshop with two notable exceptions:

- EDF-R does not support the CAISO’s proposal to provide interconnection customers a one-time opportunity to allow resources such as storage to be added to existing sites on an expedited basis, despite potential impacts on earlier-queued projects.

- EDF-R does not support CAISO’s suggestion to initiate a new or different method to terminate generation interconnection agreements that have not yet passed the seven (7) year time-in-queue limit.

In addition to giving feedback on proposals in CAISO’s paper and at the Oct 19 workshop, EDF-R also proposes that the CAISO completely restructure its material modification assessment (MMA) process. The process as it exists today is onerous for interconnection customers, the CAISO’s own reports on the process prove that the process has little value, and the CAISO simply will not be able to provide reasonable response times given their already limited staff resources are devoted to the enormous task of reviewing Supercluster 14.

EDF-R is an experienced developer and has submitted dozens of modification requests since the process was formalized in the Interconnection Process Enhancements 2013 stakeholder initiative and memorized in the BPM for Queue Management[1]. In the seven (7) years since the CAISO has rarely denied a modification proposal. In CAISO’s data on the MMA process for 2017, 2018, and 2019 the CAISO reviewed 163 requests for modification. Of those 163 requests, one was denied outright, two were partially denied. The MMA process results in an approved modification 98% of the time.

Despite the fact modifications are approved 98% of the time, it can take 6 months to receive the CAISO’s modification approval letter. All the while development plans are in limbo, as interconnection customers are not assured their modifications will be approved. This timeframe is sure to get worse in the coming years as the CAISO’s already lean staff works to study Supercluster 14.

EDF-R is not proposing the CAISO eliminate the process altogether. EDF-R acknowledges the CAISO needs the detailed technical data it collects during the modification process. However, it is not clear that the study work being undertaken by the CAISO and PTO are a required control for preventing issues, since 98% of modifications are approved. EDF-R proposes the CAISO shift the process to one where approval is automatic if the interconnection customer presents:

- a complete technical data package (as verified by the CAISO),

- agrees to abide by standard control mechanisms, and

- provides a one-time fee of $5,000 to cover the cost of validating technical information and memorializing the modification in a letter from the CAISO to be endorsed by the interconnection customer

[1] Now known as the BPM for Generator Management.

2.

Provide your organization’s comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 1, as described in section 3.1:

EDF-R supports simplifying the downsizing process.

EDF-R believes that CAISO should enact policy changes to protect interconnection customers from increased costs and in-service date delays caused by an error or omission discovered after the initial and the second postings have passed. In this circumstance these costs should be borne by the Participating Transmission Owner (PTO). This is particularly important if the newly discovered cost is for an interconnection item the interconnection will not receive reimbursement for. Furthermore, EDF-R believes that the PTO should be obligated to identify and fund interim solutions to remedy any delays to the earliest achievable in-service date if the interconnection customer can provide proof of PPA or shortlist for the project. This would create a more equitable responsibility balance in universe of energy contracts:

- LSEs are responsible for RA showings, and pay penalties when they are short

- Interconnection Customers are responsible to perform on their contract, and pay liquidated damages when they fail to perform, and

- PTOs should be obligated to remedy any harm caused by an error or omission discovered after two and a half years of study work

EDF-R supports easy offramps for projects impacted by new costs and/or delayed in-service date after initial posting.

EDF-R suggests that in addition to considering criteria for POI changes during the scoping meeting, the CAISO should improve transmission system data availability and accessibility. If developers had information such as Transmission Plan Deliverability availability, congestion, and the magnitude of upgrades needed to accommodate new supply in a particular area, the CAISO would not see as many speculatory interconnection requests. MISO’s POI Analysis tool is a good example of a high value scalable tool for this purpose. https://giqueue.misoenergy.org/PoiAnalysis/index.html

3.

Provide your organization’s comments on further adjustments to the Cluster 14 “supercluster” process for Cluster 14 and earlier clusters, as described in section 3.2:

EDF-R suggests that it would be unfair to increase the requirements for interconnection requests (site exclusivity, equipment requirements, etc.) without simultaneously reducing the length of the study process.

- In EDF-R’s experience, landowners are not enthusiastic about extending long term exclusive options and the CAISO’s 2.5 year study process often consumes a large portion of the opportunity window developers have to act on those land options.

- EDF-R also sees requirements on equipment procurement as ill-suited as a queue-reduction technique.

- EDF-R suggests that certain studies should only be performed during Phase II (i.e short circuit, stability)

- EDF-R suggests that the CAISO should review if Appendix DD section 8.6 “Accelerated Phase II Interconnection Study Process” can be expanded to include a larger number of projects, and that if it is clear that interconnection capacity and Transmission Plan Deliverability in an area is sufficient to accommodate all projects in that area requesting it, then the projects should be offered the opportunity to skip Phase II and be grouped for TPD allocation with the next TPD group (I.e. a cluster 19 project that elects to skip Phase II would be grouped for TPD allocation with cluster 18)

- EDF-R does not support an accelerated first ready process or the CAISO’s proposal for another one-time modification opportunity, it’s unclear what criteria would be used to identify ready projects, nor how the CAISO would ensure performance once the projects received their study results. EDF-R would prefer CAISO focus its resources streamlining its existing processes.

- EDF-R does support the creation of a non-refundable fee that is scaled with interconnection capacity MW to proceed into the Phase I study after the scoping meeting. Supercluster 14 has 14 projects seeking interconnection for 1,000 MW or more, and yet in its entire history no project larger than 800 MW has declared commercial operation. Projects of this size increase the volatility of study results and exacerbate an already bloated queue.

4.

Provide your organization’s comments on the broader issues that warrant discussion given existing supply conditions and the need to accelerate and sustain the pace of resource procurement and interconnection, as described in section 3.3:

EDF-R does not support a one-time opportunity to allow resources such as storage to be added to existing sites on expedited basis to meet pressing reliability needs despite the potential impacts on earlier-queued projects. CAISO MMA and BTM processes are already sufficient to accommodate such requests. EDF-R encourages CAISO to instead focus any resources that would be spent on a one-time effort to be used to reduce the turn time on MMAs.

5.

Provide your organization's comments on the necessary enhancements or adjustments the ISO has become aware of since the 2018 IPE initiative that need to be addressed in Phase 2, as described in section 4.1: