1.

Please provide a summary of your organization’s comments on the WEIM Resource Sufficiency Evaluation (RSE) Enhancements Phase 2 revised draft final proposal and September 2, 2022 stakeholder call discussion:

Powerex appreciates the opportunity to submit comments on CAISO’s September 7, 2022 EIM Resource Sufficiency Evaluation Enhancements Phase 2 Revised Draft Final Proposal (“Draft Final Proposal”), and the discussion at the September 2 workshop on this topic.

- The September Heat Wave Once Again Demonstrated The Current EIM RSE Is Not Working For The CAISO BAA

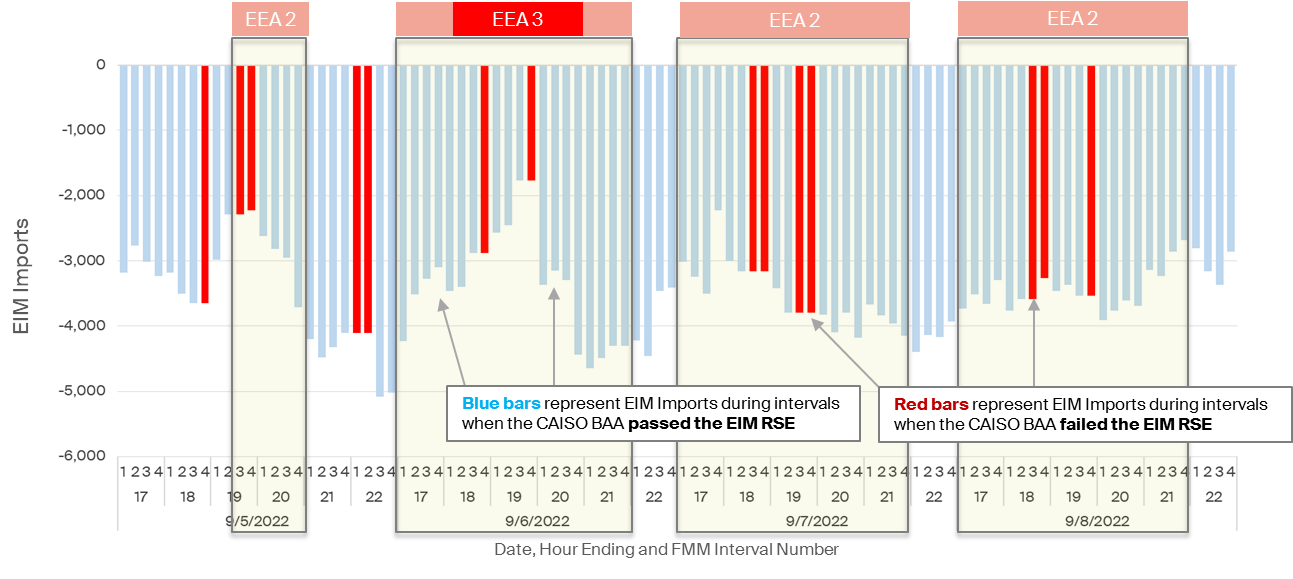

This stakeholder initiative is the result of longstanding stakeholder concerns that the EIM resource sufficiency evaluation (“RSE”) is not being accurately applied to the CAISO BAA, resulting in the CAISO BAA passing the RSE when it is clearly not, in fact, resource sufficient. These concerns—as well as the highly inequitable RSE failure consequences that enable the CAISO BAA to extensively capacity lean even when it fails the RSE—were once again laid bare during the extended heat event of early September. During this event, the CAISO BAA was in a declared Energy Emergency Alert 3 (EEA3)—clear evidence that its resources were not “sufficient” under any reasonable interpretation of the term. The CAISO BAA was in this EEA3 state even though it was receiving between 1,700MW and 4,500 MW of FMM imports from the rest of the EIM. Nevertheless, the current RSE determined that the CAISO BAA was fully resource sufficient in all but 2 of the 15-minute intervals of this EEA3 event:

EIM Transfers (FMM) to CAISO BAA During September 2022 Heatwave (HE 17 – 22)

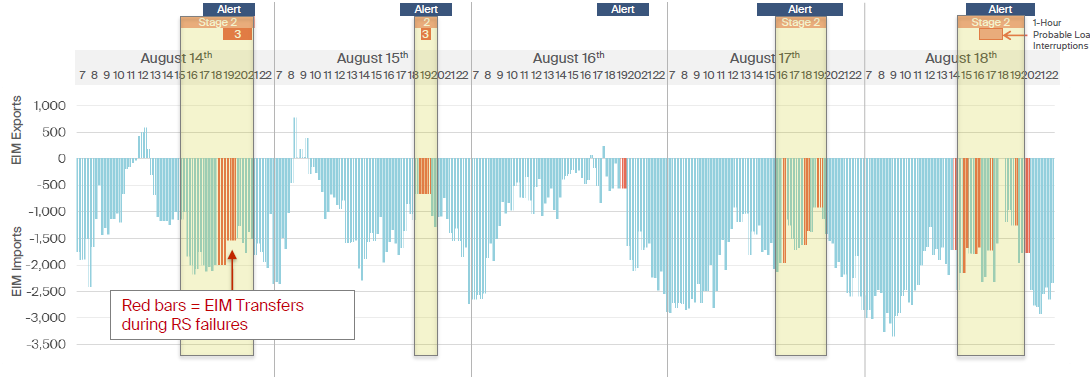

Theses outcomes will be familiar to stakeholders that voiced significant concerns with the CAISO BAA’s extensive capacity leaning during the summer of 2020, as illustrated in the chart presented by Powerex at a “Summer Readiness” workshop in January 2021:

EIM Transfers (FMM) to CAISO BAA During August 2020 Heatwave

http://www.caiso.com/InitiativeDocuments/PowerexPresentation-MarketEnhancements-Summer2021ReadinessJan13,2021Workshop.pdf.pdf

The data above illustrate that despite the concerns raised by Powerex in written comments in September 2019, and despite widespread industry concerns voiced following the CAISO BAA’s extensive capacity leaning during the summer of 2020, the CAISO has not made the necessary comprehensive reforms—or committed to making the comprehensive reforms—to address these problems. In fact, the CAISO BAA’s capacity leaning during the summer of 2022 was as large as it’s ever been, with the inaccuracies in applying the RSE to the CAISO BAA growing to thousands of MWs.

To be clear, Powerex fully supports the ability of all BAAs experiencing reliability challenges to receive supply, including through the Western EIM, provided it does not create reliability challenges for other entities. But Powerex believes it is highly problematic that the Western EIM continues to employ an RSE that enables extensive, ongoing capacity leaning by its largest BAA, without any meaningful financial consequences to deter such behavior. It has long been recognized that absent the adoption of a common forward resource adequacy framework applied to all organized market participants, organized markets must be designed to “bridge” different resource adequacy approaches in order to:

- ensure sufficient aggregate resources are available to maintain reliability across the entire market footprint; and

- ensure that each participating entity brings their “fair share” of those resources.

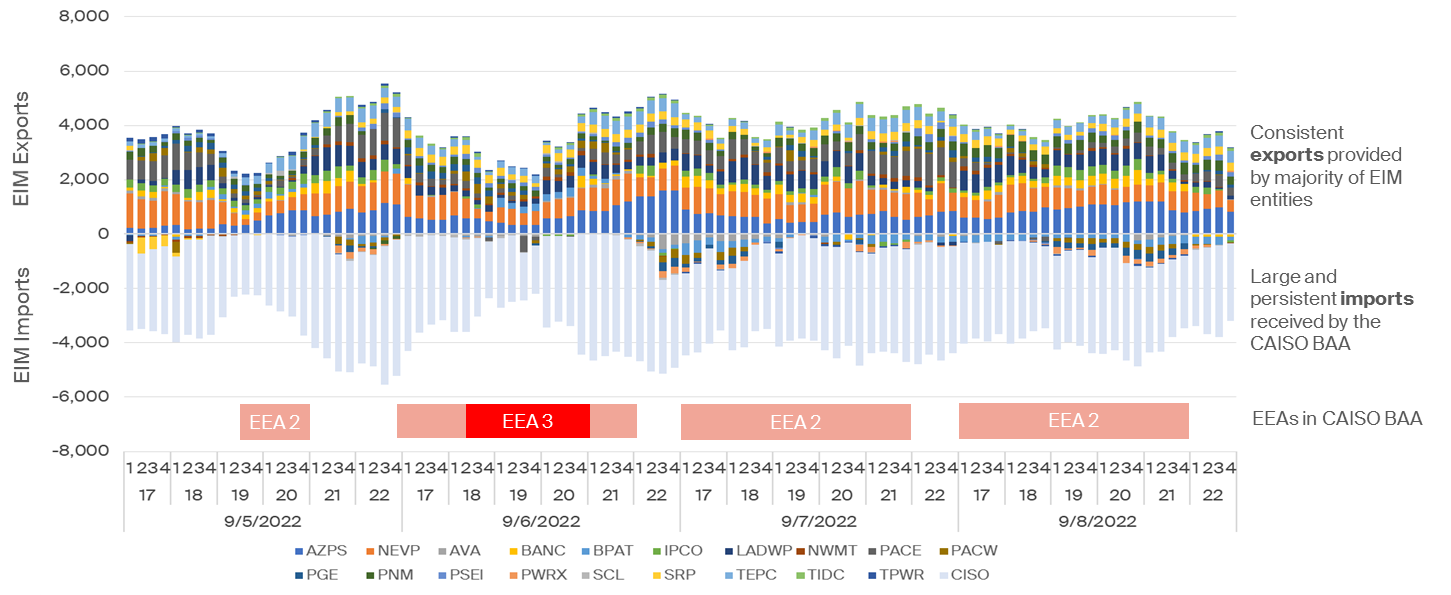

The RSE was intended to provide that “bridging” mechanism in the Western EIM, but its design and application to the CAISO BAA clearly does not—and never has—fulfilled this objective. This has enabled CAISO LSEs to avoid the costs of building or procuring sufficient capacity—costs which the ratepayers of other EIM entities must incur. If and when tight conditions arise, the CAISO BAA—unique among EIM entities—is able to fill its sizeable summer capacity deficit by leaning on the capacity and firm energy supply procured by other EIM entities. As shown below, the vast majority of EIM entities provided exports—but the CAISO BAA received virtually all of the imports—throughout the critical hours of the September heatwave:

EIM Exports Transfers to CAISO BAA During September 2022 Heatwave

These sizeable and persistent transfers into the CAISO BAA during the September 2022 heatwave’s critical hours occurred despite the challenging weather conditions being widespread throughout much of the western grid, and despite multiple EIM entities experiencing their own resulting emergency conditions.

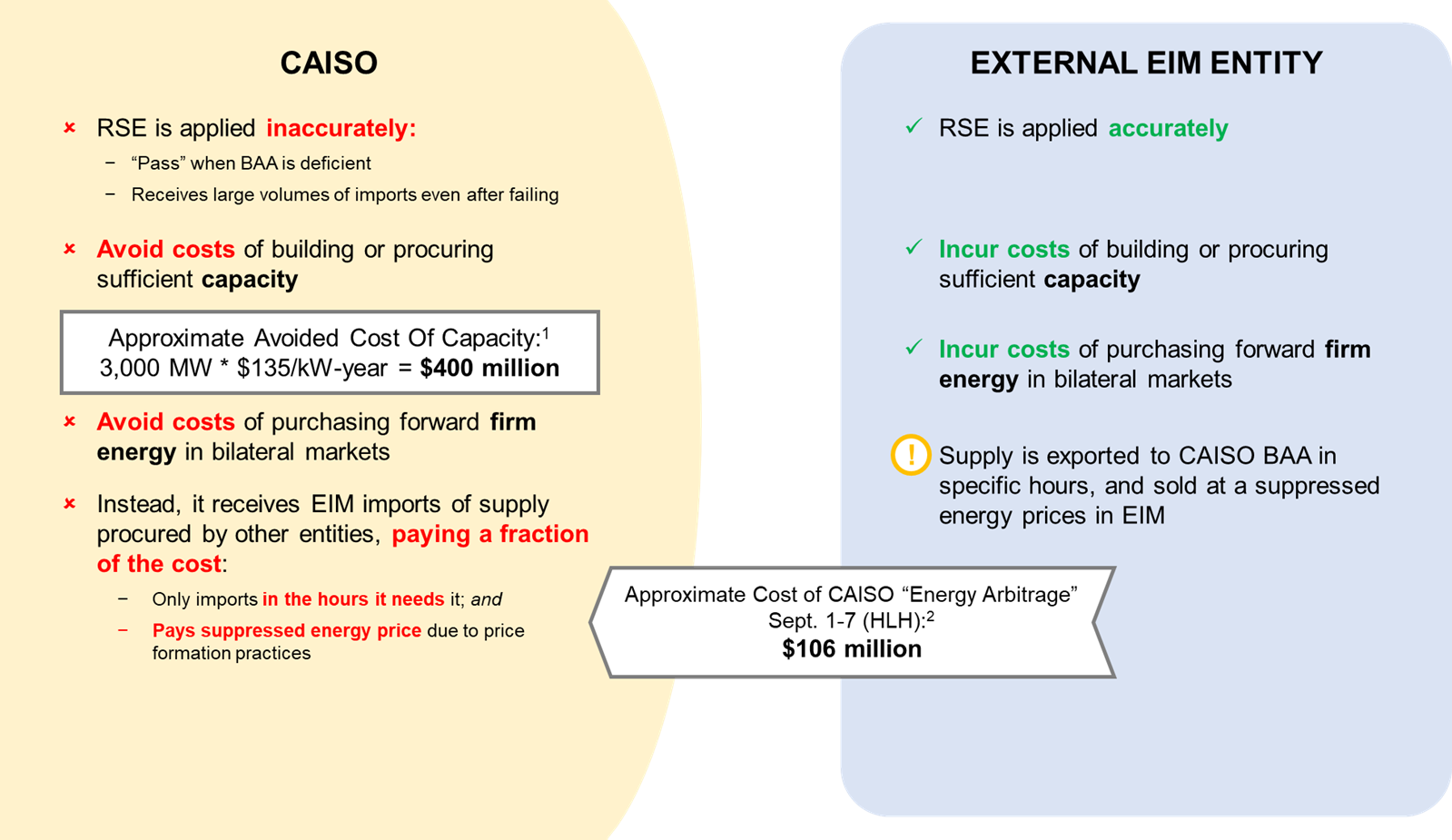

From an economic perspective, each of the EIM entities supplying these exports incurred significant costs related to one or more of the following:

- building sufficient capacity resources;

- bilaterally purchasing yearly, seasonal, and/or monthly capacity (and/or firm energy); and/or

- bilaterally purchasing 16-hour on-peak blocks of daily firm energy at elevated short-term bilateral market prices.

Such efforts were necessary for each EIM entity to ensure their own reliability, and to pass the EIM RSE as calculated and applied to each EIM entity.

The CAISO BAA, in contrast, was uniquely enabled to instead meet its summer capacity needs through the Western EIM, paying for energy imports only in the hours and intervals they were actually needed. And when those imports do occur, the CAISO pays only the energy price that is determined in the Western EIM, which, as a result of the CAISO’s unique price formation practices, is well below the price of firm energy in the bilateral markets. This result produces highly inequitable outcomes in which CAISO LSEs save hundreds of millions of dollars at the expense external EIM entities and their ratepayers, as illustrated below:

- 3,000 MW capacity deficiency based on CAISO’s September 1, 2022 Request for Emergency Order to U.S. Department of Energy, at p. 3; $135/kW-yr. cost is based on DMM’s estimate of the total fixed cost revenue requirement, less energy market net revenues, for a hypothetical combustion turbine, as explained in DMM’s 2021 Annual Report on Market Issues and Performance, at pp. 83-84.

- Daily calculation for September 1-7, 2022, of the maximum FMM EIM Transfer into the CAISO BAA multiplied by the difference between (1) the ICE Day-Ahead On-Peak Index Price at Palo Verde for that day; minus (2) the average FMM price at SP-15 across the 16 on-peak hours for that day. September 4 and 5 are excluded from this calculation since there is no on-peak index for Sundays and NERC holidays.

- The CAISO’s Track Record on the EIM RSE Undermines EDAM

Three years have elapsed since RSE concerns were first raised. Given that the CAISO intends to tackle a far more ambitious challenge—launching a regional day ahead market (EDAM)—in the same amount of time, implementing an RSE that genuinely requires all EIM entities to bring a fair share of supply could undoubtedly have been achieved. The fact that it has not, and that the RSE continues to enable extensive leaning by the BAA that is operated by the market operator in charge of designing and implementing the RSE, raises serious concerns.

The track record on this issue also undermines any confidence that a future EDAM will prevent similar widespread and inequitable leaning by the CAISO BAA, but on a larger scale. An EDAM RSE that is largely an extension of the Western EIM RSE has the potential to result in entities outside of the CAISO incurring significant costs to build or contract for supply to meet their share of a regional resource adequacy requirements (e.g., under WRAP), while LSEs in the CAISO BAA avoid incurring such costs, with the CAISO BAA extensively leaning on other entities’ resources through the EDAM, purchasing energy during critical hours for a fraction of the full cost. Chronic CAISO BAA resource insufficiency in an EDAM would expose all other participating entities to increased reliability risk, and to increased price volatility. Nothing in the experience of the Western EIM points to a different outcome.

Powerex believes that an extensive re-design of the RSE is necessary in order to ensure that all entities participating in the Western EIM and EDAM genuinely and equitably contribute to the physical supply resources required to maintain reliability. Only a market design with such a requirement can provide potential participants with the credible expectation of equitably sharing in the diversity benefits that a regional organized market can unlock. If the EDAM design moves forward without this necessary reform, however, potential EDAM entities may reasonably be required by their regulators and ratepayers to explicitly quantify the costs of procuring capacity and/or firm energy supply that is then sold to the CAISO BAA at a loss, as a result of the CAISO BAA leaning on the EDAM (i.e., as part of any cost-benefit analysis).

- The Draft Final Proposal Includes Conceptual Improvements, But Requires Considerable Refinement To Be Effective

While Powerex is supportive of several of the concepts put forward in the Draft Final Proposal, these modifications will not lead to the comprehensive reform that would be necessary to address the significant inaccuracies of the Western EIM RSE discussed above. Furthermore, as summarized further below, Powerex believes that the specific design elements in the Draft Final Proposal will require considerable refinement to ensure that the proposal improves on the current EIM RSE and produces more equitable outcomes in the EIM.

- While Powerex Supports The Proposed Energy Assistance Framework, It Must Not Be An Option To Maintain The Status Quo

The Draft Final Proposal contains a straightforward and workable framework for EIM entities that fail the RSE to nevertheless receive EIM transfers for “energy assistance” at a price of $1,000/MWh (or $2,000/MWh under certain conditions). This proposal strikes a balance between making supply in the EIM available to entities experiencing reliability challenges, while strengthening the financial incentives for entities to procure sufficient supply ahead of the EIM so that they pass the RSE.

But this proposal would be rendered largely irrelevant by the proposal to continue to allow EIM entities to operate under the status quo:

The CAISO proposes that BAAs be able to elect whether they want to utilize energy assistance as part of their participation in the WEIM. If a BAA does not elect to utilize energy assistance, the CAISO market would limit its WEIM energy transfers when it fails the RSE as under the current rules.[1]

The Draft Final Proposal, in effect, will only curb capacity leaning if the BAAs that benefit from leaning voluntarily elect whether they “want” to stop doing so. This is not a credible approach to deterring ongoing capacity leaning.

Powerex does not object to EIM entities having the ability, upon failing the RSE, to decline to receive EIM transfers at a price $1,000/MWh (or $2,000/MWh under certain conditions). But that choice must be to decline to receive EIM transfers at all, not merely to decline to accept the price implications but continue to receive the transfers as occurs today. The Draft Final Proposal should be revised as follows:

- An EIM entity that fails the capacity test of the RSE should have an EIM transfer import limit equal to the greater of 0 MW or the base scheduled transfers; and

- An EIM entity may elect, via the Master File, whether to allow this limit to be relaxed, at a penalty price equal to the offer price cap of $1,000/MWh or $2,000/MWh, as the case may be.

- Lower-Priority Exports (However Defined) Should Be Clearly Communicated To All Entities, And Should Be Excluded From the RSE Of Both the Source And The Sink BAAs

Powerex agrees that the design of the CAISO’s HASP may lead to hourly intertie export schedules clearing the market that are effectively supported by non-binding advisory EIM transfers into the CAISO BAA. Powerex has also been supportive of the CAISO’s proposals to view these hourly intertie export schedules as lower-priority and subject to curtailment. And because such exports would be subject to curtailment ahead of CAISO load, Powerex has also supported the exclusion of these exports from the RSE for the CAISO BAA.

Transparency and consistency in communicating interchange is a bedrock requirement for ensuring reliable operation in real-time. For this reason, Powerex objects to the Draft Final Proposal stopping short of providing for full transparency and consistent treatment of these interruptible imports. Powerex believes that these exports—like any interchange transaction that is subject to interruption—should be clearly identified as “Non-Firm Energy.” The proposed use of “Firm-Provisional” does not, in Powerex’s opinion, accurately convey the interruptible nature of the schedule, as is not meaningfully different from the “Non-Firm Energy” designation that is standard in the industry.

Powerex also objects to the Draft Final Proposal calling for the exclusion of interruptible export from the RSE obligations of the CAISO BAA, but not symmetrically requiring them to be excluded from the RSE supply of EIM entities on the receiving end of the same schedule. It is plainly inconsistent for a 100 MW interruptible export to not be included as an obligation of the CAISO BAA, but for a receiving EIM entity to include it as “supply” that can be relied upon to pass the RSE. The Draft Final Proposal not only enables intermediaries to re-sell non-firm CAISO energy as firm (by not requiring it to be identified as “Non-Firm Energy”), it also raises self-evident reliability concerns if the EIM footprint relies on supply that nobody is accountable for.

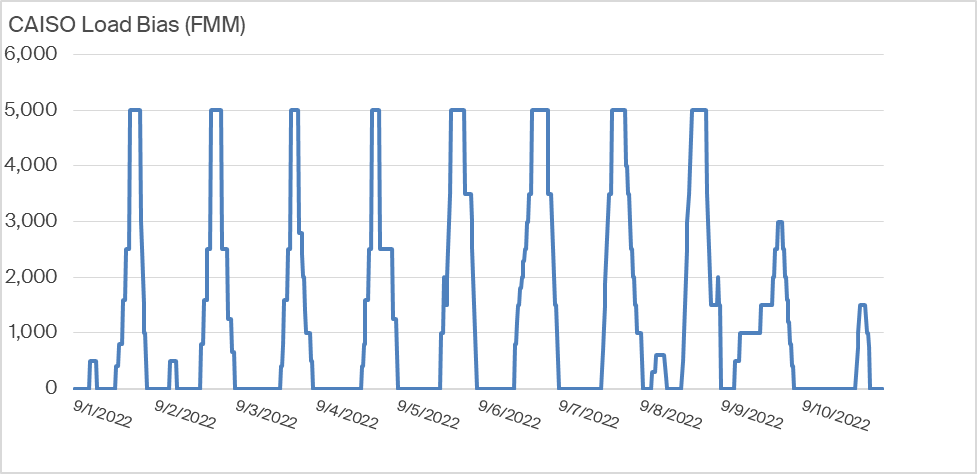

- The Large And Growing Use Of Load Biasing By CAISO Operators Reflects A Capacity and Flexibility Need That is Not Reflected in the RSE

The use of load biasing by CAISO operators continues to grow. During the September heat event, CAISO operators consistently increased the CAISO BAA load forecast in the FMM by 5,000 MW during peak hours:

As has been previously described by the CAISO, load biasing is used by CAISO operators to force the market software to procure additional supply. In other words, a market solution that procures only the supply to meet the load forecast (without load bias) would fall short of the supply that CAISO operators believe is necessary to maintain reliability.

The Draft Final Proposal declines to include any measure of load bias in the RSE, arguing that load biasing “does not regularly benefit any BAA in passing the WEIM RSE.” In Powerex’s view, this misses the point. If CAISO operators believe that simply procuring supply to meet the load forecast does not result in resource sufficiency, then an RSE that only tests for sufficient supply to meet the load forecast must similarly fall short of the mark. Powerex recognizes that the best solution may not be to simply add the load bias quantity into the RSE requirements for the BAA, but an RSE that only tests for a quantity of supply that is known to fall well short of the actual amount of supply needed by CAISO operators to maintain reliability is incomplete. At a minimum, the RSE must test each BAA for a quantity of supply that includes a reasonable measure of net load uncertainty, as discussed further below.

- The Draft Final Proposal Should Include A Commitment To Include Net Load Uncertainty Prior To Summer 2023

Reliable operation requires sufficient resources to not only meet the forecasted level of load, but to cover the potential error in that forecast. The RSE previously included net load uncertainty in the quantity of supply required to pass the RSE. As explained in the Draft Final Proposal, “Based on concerns with the existing calculation of net load uncertainty that were causing spurious RSE failures, the CAISO proposed and FERC approved suspending net load uncertainty as a component of each BAA’s RSE obligation.”[2]

While the Draft Final Proposal does not claim that net load uncertainty is irrelevant to the quantity of supply that a resource sufficient entity should be required to demonstrate, it proposes to “defer this topic until after it has implemented the quantile regression methodology in conjunction with the FRP Refinements implementation and has had the opportunity to assess its performance.”[3] The Draft Final Proposal stops short of committing to actually re-introduce the net load uncertainty requirement in the RSE. Powerex does not believe this is appropriate or acceptable for any length of time. At a minimum, the CAISO should commit to re-introducing a net load uncertainty requirement into the RSE prior to summer 2023.

[1] Revised Draft Straw Proposal, at 23.

[2] Revised Draft Final Proposal, at 22.

[3] Id.