1.

Please provide a summary of your organization’s general comments on the straw proposal and presentation for this initiative.

During the multiple times Minimum State of Charge (“MSOC”) constraint has been used, it has been clear to Vistra that the use of MSOC does not achieve the CAISO’s goal to rationally reserve state of charge going into the critical need hours. In September 2022, the CAISO reports show that it enforced MSOC on nine days.[1] In its August 2002 report, the CAISO indicated that while a process gap led to CAISO operations not enforcing the MSOC in August 2022 that if the process gap had not occurred it would have been enforced on two days.[2] In 2021, the CAISO reported that the MSOC was enforced on three days.[3]

Vistra’s experience over the last two years suggests that MSOC has not resulted in the actual state of charge being preserved early enough to produce a rational way to manage state of charge. We believe this is occurring because the real-time market optimization window that does not look out farther than 75 minutes in the future. In practice, operators issuing a hold state of charge exceptional dispatch (“hold ED”) appear to effectively preserve the state of charge during the middle of the day in advance of expected tight conditions in the evening net peak.

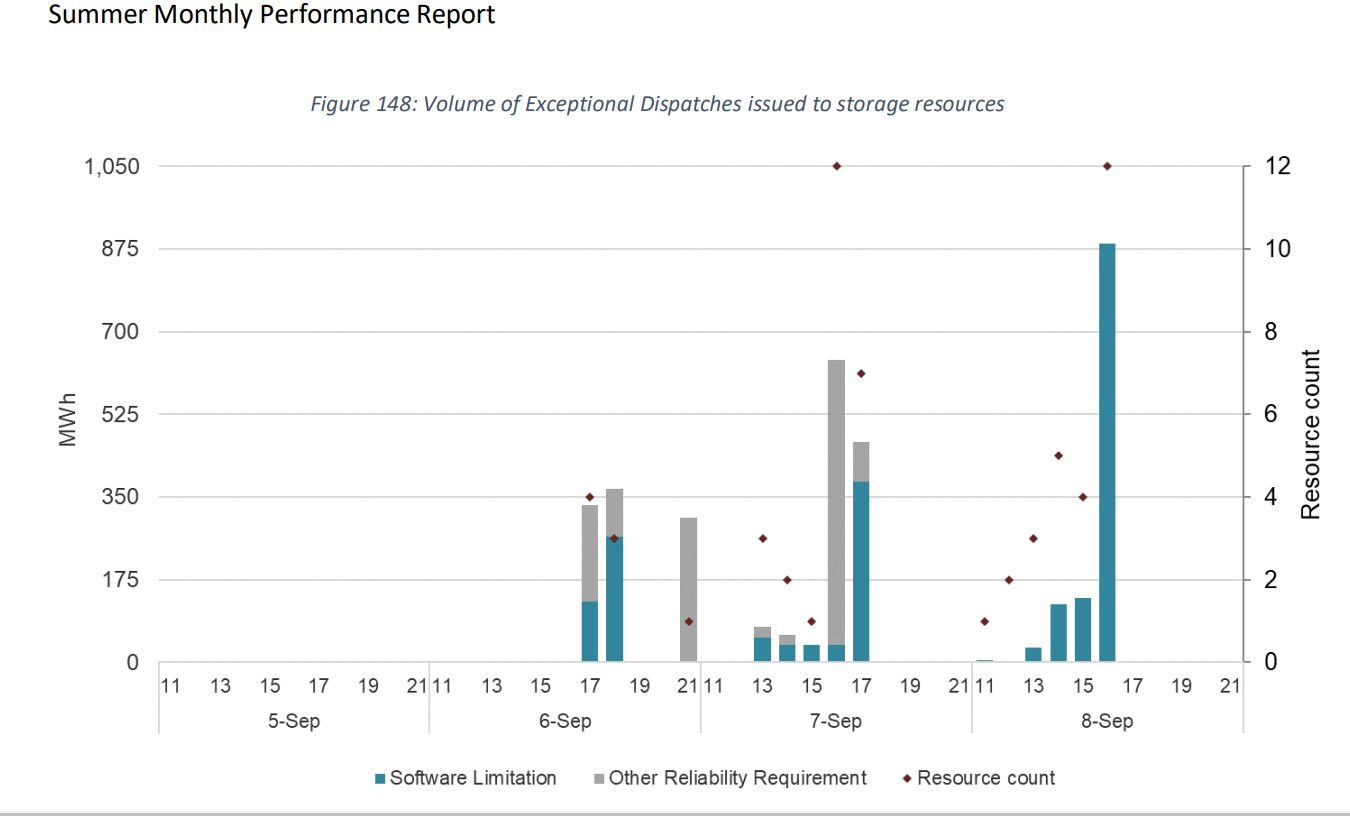

CAISO Summer Market Performance Report for September 2022 identified CAISO operators issued exceptional dispatches to “preserve state of charge for the peak hours”.[4] Figure 148 shows the use of exceptional dispatches to charge or preserve the state of charge on September 6, 7, and 8.[5]

As a storage owner and operator, we received hold EDs during September 2022 and found them the key to successful operations. Even on days with MSOC enforced we believe that CAISO will need to issue hold EDs earlier in the day to achieve the desired outcome of preserving the state of charge for the net peak hours. Before CAISO operations started issuing hold EDs, Vistra notified CAISO real-time operations that there were MSOCs enforced later in the day and they were dispatching storage sub-optimally to deplete the state of charge sooner than those hours. The real-time market window cannot ensure that the SOC required in the hours with MSOC limits are preserved sooner than one hour in advance. In contrast, an ED to hold SOC can ensure that the market does not drive charges during hours bordering under generation risks. After CAISO operations began issuing the EDs, we observed the state of charge begin to be used in a much more efficient way to better support net peak needs.

Without the hold ED the market can only issue charge instructions for the MSOC hour within one hour during an hour nearing shortage conditions, instead of earlier in the day during hours where the grid is less stressed. This observed performance appears to undermine reliability rather than to improve it.

We believe the real-time default energy bid (DEB) for energy storage fails to adequately reflect prevailing opportunity cost of the state of charge being used sooner than optimal. This suppressed DEB relative to other offers makes storage look more economic and mutes the signal to preserve its use for later hours. The DEB not sufficiently capturing real-time opportunity costs drives the need to use hold EDs to maintain state of charge. Storage operator’s ability to bid to manage the state of charge is impeded during these periods since it is not allowed to bid above the $1,000/MWh based on its opportunity cost. The ability to manage state of charge faces even greater challenges when mitigated at levels well below real-time prices since the real-time default energy bid is based on day-ahead prices. These bidding limitations put storage at an operational disadvantage compared to other resources such as imports or transfers because it cannot request an energy reference level adjustment to reflect the opportunity cost of its use. Instead, it is seen as incorrectly more economic because its opportunity cost is not accurately being valued under mitigation or cost verified bids.

If CAISO is going to request a year extension, Vistra encourages CAISO to include in the changes reforms that allow us to make the MSOC workable in practice. We believe changes to the DEB would be the most important near term complementary change. We would like to share with the CAISO staff specifics about our experience with the MSOC to support why the change in the default energy bid, and the ability to request reference level adjustments based on opportunity cost above $1,000/MWh, will limit the unintended consequences of extending the MSOC.

[1] Summer Market Performance Report for September 2022, California ISO, Page 152, http://www.caiso.com/Documents/SummerMarketPerformanceReportforSeptember2022.pdf.

[2] Summer Market Performance Report for August 2022, California ISO, Page 83, http://www.caiso.com/Documents/SummerMarketPerformanceReportforAugust2022.pdf.

[3] Summer Market Performance Report for July 2021, California ISO, Page 108, http://www.caiso.com/Documents/SummerMarketPerformanceReportforJuly2021.pdf.

[4] Summer Market Performance Report for September 2022 at Page 150.

[5] Summer Market Performance Report for September 2022 at Page 151.