2.

Please provide your organization's comments on the Interaction of Hourly Intertie Schedules and WEIM Transfers.

The analysis shows that the California Balancing Area is not leaning inappropriately on the WEIM. This analysis shows that during high-load (‘critical’) hours, the CAISO is exporting more through the WEIM than it is importing (as shown in Figure 1).

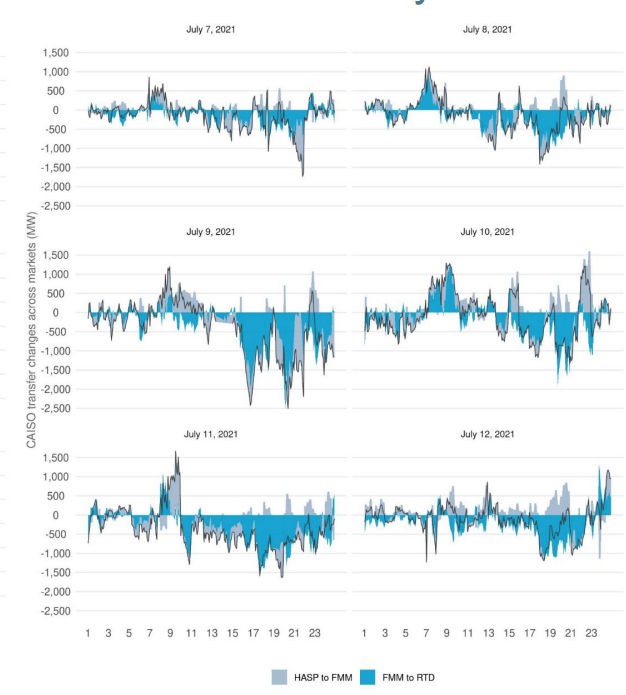

Figure 1. WEIM transfers in RTD came in lower than HASP transfers during peak hours in critical summer days, as illustrated by the illustration of WEIM transfers to/from CAISO on July 7th to 12th of 2021. Slide 10 of the CAISO presentation on May 3rd, 2022.

This demonstrates that the CAISO Balancing Area is not inappropriately leaning on the WEIM. This was also supported by the analysis by the MSC and CAISO with respect to load conformance resulting in leaning.[1]

The policy phase of this initiative should address any asymmetric rules that were motivated by this false impression that the CAISO Balancing Area is inappropriately leaning on the WEIM.

The analysis shows that the California Balancing Area is firming up energy for free and risking additional RSE failures. The data show that there is a persistent under-delivery of WEIM transfers into CAISO when comparing the advisory (or expected) import transfers during the Hour-Ahead Scheduling Process (HASP) with the real-time dispatch (RTD). The HASP is taking non-firm advisory WEIM imports and allowing them to support firm exports in real-time.

It is worth noting here that, based on discussions in the Transmission Service and Market Scheduling Prioritization initiative[2], no other WEIM Balancing Area would schedule firm exports unless there was (i) an accompanying firm import or a firm power contract; and (ii) a contract for firm transmission service. The CAISO Balancing Area is providing a firm export without either of those two.

This is illustrated by the counter-factual HASP analysis performed by CAISO. The counter-factual analysis shows what the CAISO software could do when facing unrealized transfers: i) dispatching internal generation, ii) paying for additional imports, or iii) cutting exports. However, it should be noted that CAISO considers the HASP exports firm and currently only relies on the first two tools: increasing internal generation or increasing imports, both of which come at a cost to CAISO load.

Not only is the CAISO paying to support exports based on unrealized transfers, but the unrealized transfers put the California Balancing Area at a higher risk of failing the WEIM Resource Sufficiency Evaluation. This has been noted before. The CAISO has found that “the interaction between HASP and the RSE during stressed system condition already significantly disadvantages the CAISO in passing the RSE[3]…the HASP process has the potential to award block hourly exports from the CAISO based on the assumed availability of EIM transfers; to the extent this occurs, this adds to the CAISO’s capacity test obligations while not adding to its available supply.”[4] Further, the unrealized transfers may actually reduce the supply available to CAISO balancing area to meet its RSE as the CAISO market software will dispatch internal generation is backfill the unrealized transfers.

The MSC and CAISO have already identified that the misalignment between the RSE and the HASP process can cause the CAISO BAA to fail the RSE test inappropriately. This issue should be addressed urgently and does not require additional analysis to diagnose it. The policy phase of this initiative should address the appropriateness of the CAISO providing this firming service and address how it disadvantages the CAISO Balancing Area.

[1] The MSC’s opinion concluded there is “no leaning on the rest of the system as a result of using load conformance adjustments in HASP and RTPD; rather, the CAISO loads buy power at high prices in the FMM and sells it back in RTD. This should be a concern to CAISO ratepayers, but it benefits non-CAISO EIM entities who export power to the CAISO in the FMM.”

See “Opinion on Energy Imbalance Market (EIM) Resource Sufficiency Evaluation Enhancements.” Members of the Market Surveillance Committee of the California ISO. February 2, 2022. Pg. 20 at http://www.caiso.com/Documents/MSCFinalOpiniononEIMResourceSufficiencyEvaluationEnhancements-Phase1.pdf

[2] To our knowledge, all non-CAISO EIM entities require firm transmission service in order for a transaction to be considered firm. Salt River Project, Bonneville Power Administration, and Idaho Power Company all gave presentations on how one obtains firm transmission service on their networks. See Transmission Service and Market Schedule Prioritization initiative Phase 2: https://stakeholdercenter.caiso.com/StakeholderInitiatives/Transmission-service-and-market-scheduling-priorities

[3] EIM Resource Sufficiency Evaluation Enhancements Phase 1. Revised Draft Final Proposal. December 16, 2021. Pg. 15 at http://www.caiso.com/InitiativeDocuments/RevisedDraftFinalProposal-EIMResourceSufficiencyEvaluationEnhancements.pdf

[4] Id. pg. 14