Bonneville Power Administration

Submitted 02/04/2021, 12:36 pm

1.

Provide a summary of your organization’s comments on the straw proposal:

The Bonneville Power Administration (Bonneville)[1] appreciates the opportunity to comment on the CAISO’s Market Enhancements for Summer 2021 Readiness Straw Proposal dated January 26, 2021. Bonneville notes its general support for the comments submitted by the EIM Entities and seeks to expand on them here in specific topic areas.

Bonneville emphasizes that the most important step California should take to ensure reliable operations in summer of 2021 is to forward procure adequate resources. As discussed more thoroughly in these comments, the CAISO forecasted thousands of megawatts of capacity shortfall for summer 2020 in net peak hours back in September 2019. The capacity gap was not remedied and resulted in significant reliability challenges, impacting not just the CAISO BAA but also its adjacent BAAs. The market enhancements proposed as part of this initiative are helpful in addressing some of the symptoms and repercussions of a resource inadequate system, but these enhancements are not enough to ensure reliable operations for summer 2021 and should not be a replacement to proper forward procurement. It is critically important to the reliability of the CAISO BAA and to the reliability of the western grid that the CAISO BAA have adequate forward procured resources available to meet its summer 2021 needs.

As such, Bonneville underscores the recommended priorities provided in the EIM Entity comments for summer 2021 readiness:

- Reconsider treatment of wheel-through schedules for summer 2021 by maintaining current priority level and pursue a more durable solution for future years

- Prioritize resource sufficiency enhancements for summer 2021 to ensure the EIM RS test is accurate and that all BAAs participating in EIM are required to come in balanced with sufficient capacity to meet their obligations

- Defer System Market Power Mitigation and Scarcity Pricing to the more comprehensive and thorough Scarcity Pricing Enhancements initiative scheduled to begin in Q2 of 2021.

Bonneville also provides a summary of its recommendations for each topic area:

- Export and load priorities

- Exports supported by a non-RA resource that have been contracted for by an external entity should not be identified by the market and curtailed to address supply shortfalls in the CAISO BAA.

- Until such time as CAISO develops a process to allow wheel through schedules to be treated similar to a PT export, avoid making changes to the priority of wheel-throughs.

- EIM Coordination and Resource Sufficiency Test

- The Straw Proposal does not resolve the underlying causes of inaccurate resource sufficiency test results.

- Changes need to be made to ensure an accurate RS test ahead of summer 2021 and every effort should be made to achieve this.

- The current failure consequence does not support reliability and needs to be revisited.

- Import and Export Market Incentives during tight system conditions

- Bonneville supports CAISO’s Option 1: to modify settlement of real-time market imports and exports based on the higher of the HASP or the FMM LMP during tight system conditions.

- Real-time Scarcity Pricing

- Bonneville recommends any new pricing rules under tight system conditions be considered as part of CAISO’s more comprehensive scarcity pricing initiative scheduled to begin in Q2 2021.

- Instead more direct incentives should be pursued to ensure accurate scheduling in the day-ahead market when tight conditions are anticipated.

- System Market Power Mitigation (SMPM)

- Analysis to date does not justify SMPM.

- SMPM does not enhance reliability and should not be prioritized for summer 2021.

- The SMPM initiative has been very contentious amongst stakeholders and does not have broad support.

- Bonneville does not support the SMPM draft final proposal as it results in triggering of mitigation when there is no potential for market power to be exerted.

- The SMPM proposal needs revision and should be considered as part of the comprehensive scarcity pricing initiative scheduled to begin Q2 of 2021.

- Bonneville agrees with the CAISO that LSEs engaging in long-term contracting is fundamentally essential protection against market power and should be actively pursued as a solution for summer 2021.

[1] Bonneville is a federal power marketing administration within the U.S. Department of Energy that markets electric power from 31 federal hydroelectric projects and some non-federal projects in the Pacific Northwest with a nameplate capacity of 22,500 MW. Bonneville currently supplies 30 percent of the power consumed in the Northwest. Bonneville also operates 15,000 miles of high voltage transmission that interconnects most of the other transmission systems in the Northwest with Canada and California. Bonneville is obligated by statute to give preference in sales to Northwest municipalities, public utility districts, cooperatives and then other regional entities prior to selling power out of the region.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

Bonneville strongly supports the comments provided by select EIM Entities on this topic and reiterates the EIM Entities’ recommendations:

- Exports supported by a non-RA resource that have been contracted for by an external entity should not be identified by the market and curtailed to address supply shortfalls in the CAISO BAA.

- Until such time as CAISO develops a process to allow wheel through schedules to be treated similar to a PT export, CAISO should avoid making changes to the priority of wheel-throughs.

3.

Provide your organization’s comments on the EIM coordination and resource sufficiency test review topic as described in slides 16-20:

- The Resource Sufficiency test is a foundational element of EIM design

Bonneville agrees with the CAISO that the purpose of the Resource Sufficiency (RS) test, along with the definition of leaning and repercussions of failure are foundational elements of EIM design. Consequently, to the extent the outcomes of the RS test result in a violation of the foundational principles of the EIM, which Bonneville believes is the case, modifications to the RS test should be prioritized and resolved without delay.

The CAISO has been clear about the purpose of the RS test from the inception of the EIM:

- A fundamental principle is that each EIM Entity will have a balanced resource plan for each operating hour, which would provide sufficient resources for that BAA to operate reliably without “leaning” on other EIM Entities or on the ISO. EIM then provides opportunity for EIM Entities and EIM Participating resources within their areas to operate more efficiently than they could on their own.” - Energy Imbalance Market Draft Final Proposal dated September 23, 2013[1]

- The purpose of the resource sufficiency evaluation is to ensure each EIM entity can adequately balance their own supply and demand prior to participating in the energy imbalance market… The resource sufficiency evaluation ensures that balancing authority areas do not inappropriately lean on the capacity, flexibility and transmission of other balancing authority areas in the EIM footprint. - EIM Resource Sufficiency Evaluation White Paper dated September 19, 2018[2].

A well-functioning resource sufficiency test that accurately assesses each EIM Entity’s resources and obligations, with failure consequences that prevent leaning and incent appropriate forward procurement to ensure reliability, has been and continues to be a foundational element in Bonneville’s decision to join the EIM, scheduled for Spring 2022. Bonneville is concerned about the CAISO’s statements that the RS test “performed as intended” during the August 2020 heat wave events and about the lack of commitment to ensure that changes needed to address both inaccurate passes of the RS test and failure repercussions that allow leaning on the EIM will be addressed in a timely manner.

- The EIM RS test is not producing accurate results

The CAISO BAA did not have sufficient resources to operate reliably during the heat wave events of summer 2020. As Bonneville has stated in its written comments to the Resource Sufficiency Evaluation workshop held on January 13, 2021 and oral comments provided on January 27, 2021, the CAISO BA was passing the EIM RS test during several intervals in which it was declaring an Energy Emergency Alert Stage (EEA) 2 and 3. NERC defines the circumstances around EEAs as follows[3]:

- EEA 1: All available generation resources in use.

- The BA is experiencing conditions where all available generation resources are committed to meet firm load, firm transactions, and reserve commitments, and is concerned about sustaining its required Contingency Reserves.

- Non-firm wholesale energy sales (other than those that are recallable to meet reserve requirements) have been curtailed.

- EEA 2: Load management procedures in effect

- The BA is no longer able to provide its expected energy requirements and is an energy deficient BA.

- An energy deficient BA has implemented its Operating Plan(s) to mitigate emergencies.

- An energy deficient BA is still able to maintain minimum Contingency Reserve requirements

- EEA 3: Firm load interruption is imminent or in progress

- The energy deficient BA is unable to meet minimum Contingency Reserve requirements.

Yet the RS test results showed CAISO passing the EIM RS test while declaring EEA 2 and EEA 3, enabling the CAISO to fully participate in the EIM for these intervals. This outcome does not reflect that the EIM RS test “worked as intended” as stated by the CAISO in several public forums. No BAA should be passing the EIM RS test while at the same time declaring an EEA 2 or and EEA3. Instead, the results of the RS test during these intervals signify that underlying components of the RS test are not properly evaluating the resources and obligations of the CAISO BAA. Changes are needed to ensure that the RS test is producing accurate results.

- The Straw Proposal does not resolve causes of inaccurate RS test results

In its Market Enhancements for 2021 Summer Readiness Straw Proposal, CAISO proposed additional improvements to the EIM RS test for summer 2021 that CAISO stated on the January 27 stakeholder call would correct the RS test and produce accurate results. These improvements included:

- Adding uncertainty requirements to the capacity test (the flexible ramping requirement for the BAA less the diversity benefit)

- Modifications to resource capacity accounting to better reflect actual availability (e.g. exclude offline resources whose startup time is greater than 1 hour).

Bonneville acknowledges that these are helpful improvements and should be pursued. However, Bonneville is concerned that these enhancements alone do not lead to an accurate RS test. For example, CAISO provided the following comparison of its RS capacity test requirement and the capacity shown to meet the requirement at the January 13 Resource Sufficiency evaluation workshop[4]:

During every interval of hour ending 18 of August 14, 2020, CAISO was declaring an EEA 2, which means that all available resources within the CAISO BAA were in use and CAISO was energy deficient.[5] Thus the blue bars in the graph above should show CAISO’s bid-range capacity below 0 MW.

- CAISO’s first proposed change would increase the capacity requirement by the uncertainty requirement (flexible ramping requirement for the BAA less the diversity benefit). The flexible ramping requirement for the CAISO BAA less the diversity benefit for hour ending 18 on August 14, 2020 was approximately 479 MW[6].

- Bonneville would like to better understand the interplay between the uncertainty that is already included in the capacity test and what uncertainty CAISO is proposing to add to the capacity test? Bonneville assumes it is additive but requests CAISO confirm this assumption.

- CAISO’s second proposed change would supposedly reduce the blue bar to better reflect actual resource availability. Bonneville requests CAISO provide the modifications it proposes to resource capacity accounting to better reflect actual availability along with the impact of each on resource capacity accounting.

Bonneville requests CAISO provide the re-calculated requirement and the re-calculated capacity values with these proposed improvements for all of the intervals in which CAISO was in an EEA2 or EEA3 provided in the below graph from Powerex’s presentation[7] at the January 13 RS workshop.

Bonneville urges the CAISO to prioritize changes to the RS test that are needed to produce accurate results, demonstrable by showing that the capacity test would have shown an available resource capacity shortfall for the CAISO BA while in an EEA. We urge the CAISO to fully investigate all of the root causes that contributed to the capacity test showing over 3,000 MW of available resource capacity for the CAISO BAA during periods it was declaring an EEA and develop a plan for resolving each issue. These enhancements should be prioritized for summer 2021 and every effort should be made to achieve this.

- The EIM RS failure consequence does not support reliability

-

- The EIM RS failure consequence enables leaning

As stated earlier, the RS test is intended to support reliability by ensuring each EIM Entity and the CAISO BA have enough supply to meet their own needs on a stand-alone basis and prevent entities from leaning on the EIM. Bonneville defines leaning as an entity relying on the EIM to meet its energy, capacity, and/or flexibility needs less the diversity benefit in place of procuring sufficient resources (i.e. schedules and economic bids offered into the EIM) to meet those needs prior to the operating hour. In other words, a BAA is leaning on the EIM if the BAA cannot operate reliably or needs to take operator actions (i.e. curtail exports, shed firm load, etc.) to meet its obligations absent the EIM.

For the intervals in which CAISO failed the RS test while declaring EEAs, CAISO was relying on those EIM transfers to meet its own energy, capacity, and flexibility needs, thereby leaning on the EIM. For example, in all intervals of hours ending 17 and 18 on August 14, 2020, CAISO was importing between 1,500 and 2,500 MW of EIM imports which could not be economic displacement for the CAISO’s own resources given that all available CAISO generation resources were in use for those periods (according to NERC’s definition of EEA). Additionally, CAISO’s diversity benefit for hour ending 17 and hour ending 18 on August 14, 2020 was approximately 341 MW and 480 MW respectively[8], significantly less than the amount of EIM imports CAISO received for those hours. In conclusion, the EIM failure consequence of allowing prior hour EIM imports to continue enables a BAA that failed the test to lean on the EIM.

-

- The EIM RS failure consequence undermines incentives for proper forward procurement

Bonneville believes the lack of meaningful repercussions for failing the EIM RS test undermine incentives to adequately forward procure resources needed to pass the RS test. This can lead to detrimental reliability challenges in real-time as was experienced in summer 2020.

Following rolling blackouts from the previous days, CAISO’s former CEO, Steve Berberich opened the CAISO ISO Board of Governors meeting on August 17, 2020 with these statements:

“The situation we are in could have been avoided. For many years, we [CAISO] have pointed out to the procurement authorizing authorities that there was inadequate power supply available during the net peak… We have indicated in filing after filing after filing that the Resource Adequacy program was broken and needed to be fixed. We told the CPUC that there was a 4,700 MW shortfall through 2022 and that the gap started in 2020. We even undertook notice of ex parte communications with the Commission on the matter. Despite all of that, only 3,300 MW was authorized for procurement and not starting until 2021. The bet has been that uncontracted imports will fill any void. We have told regulators over and over again that imports were drying up and that more imports should be contracted for. That was rebuffed.[9]”

Bonneville acknowledges that CAISO has been reporting on projected capacity shortfalls for its BAA far in advance of the CAISO BAA experiencing those shortfalls in real-time. CAISO provided a briefing to the ISO Board of Governors on September 18, 2019[10] that showed the following estimated capacity shortfalls at 7 p.m.:

The CAISO submitted a filing[11] to the CPUC on August 12, 2019 informing the CPUC of the projected capacity shortfalls and urging the CPUC to take immediate action on the basis of these deficiencies to ensure short-term resource adequacy sufficiency. The CPUC responded with a decision[12] requiring incremental procurement of 3,300 MW with resources to come online at least 50 percent by August 1, 2021, 75 percent by August 1, 2022, and 100 percent by August 1, 2023. The CPUC did not address the projected 2,300 MW capacity shortfall for 2020 and required 1,650 MW less procurement than the CAISO’s projected shortfall for 2021 and 2,775 MW less than the CAISO’s projected shortfall for 2022.

At the CAISO’s Board of Governor’s meeting on August 17th, CAISO estimated a resource deficiency for August 17 of up to 4,400 MW[13].

Bonneville believes that part of the reason the CPUC and California LSEs are not incented to adequately procure resources to meet the needs of the CAISO BA is that the direct consequences of failure to do so, such as failing the resource sufficiency test, are minimal. Yet these significant capacity shortfalls projected for the CAISO BAA that continue to increase dramatically year after year impose considerable reliability and financial risk to both the CAISO BAA and to adjacent EIM BAAs. For these reasons, it is important that the consequences for failing the RS test incent EIM Entities and LSEs within the CAISO BAA to procure the energy, capacity, and flexibility they need prior to the operating hour. The EIM is not a capacity market and should not be relied upon to meet those needs. Bonneville strongly recommends CAISO expand the current EIM RS failure consequence to include new physical, financial and oversight consequences which ensure that entities who fail the RS test are not enabled to lean on the EIM and sufficient incentives are provided for appropriate forward procurement of capacity. We request this be taken up as part of a comprehensive stakeholder process on resource sufficiency to begin in Q2 of 2021.

Regarding the calculation of uncertainty requirements, Bonneville appreciates the CAISO’s work to date on developing a new calculation approach through the Flexible Ramping Product Refinements initiative. We will provide more detailed feedback on CAISO’s specific proposal as part of that stakeholder forum.

[1] Reference: Page 38 of CAISO’s Energy Imbalance Market Draft Final Proposal dated September 23, 2013

[2] Reference: Page 3 of CAISO’s EIM Resource Sufficiency Evaluation White Paper dated September 19, 2018

[3] See NERC Attachment 1-EOP-011-1

[4] Reference: Slide 17 of CAISO’s January 13 Resource Sufficiency Workshop presentation

[5] “At 3:25 p.m., the CAISO declared a Stage 2 Emergency for the CAISO BAA from 3:20 p.m. to 11:59 p.m.” “At 6:38 p.m., the CAISO declared a Stage 3 Emergency because it was deficient in meeting its reserve requirement. The CAISO was not able to cure the deficiency with generation, because all generation was already online, and solar was rapidly declining while demand remained high.” “At 8:38 p.m., the CAISO downgraded from a Stage 3 to Stage 2, and Stage 2 was cancelled at 9:00 p.m.” Final Root Cause Analysis, CAISO, CPUC, CEC, January 13, 2021, pages 28-29 referring to the events of August 14, 2020.

[6] Reference: Slide 31 of CAISO’s January 13 Resource Sufficiency Workshop presentation

[7] Reference: Slide 4 of Powerex’s January 13 Resource Sufficiency Workshop presentation

[8] Reference: Slide 31 of CAISO’s Resource Sufficiency Evaluation presentation from January 13, 2021

[9] Reference: CAISO Board of Governors August 17, 2020 meeting Audio Recording

[10] Reference: Slide 6 of CAISO’s Post 2020 Grid Operational Outlook briefing; September 18, 2019

[11] Reference: Rulemaking 16-02-007. Reply Comments of the California Independent System Operator filed August 12, 2019

[12] Reference: D.19-11-06; November 7, 2019

[13] Reference: Slide 6 of CAISO’s Briefing on System Operations; August 17, 2020

4.

Provide your organization’s comments on the import and export market incentives during tight system conditions topic as described in slides 21-25:

Bonneville supports CAISO’s Option 1: to modify settlement of real-time market imports and exports based on the higher of the HASP or the FMM LMP during tight system conditions. Bonneville believes this option provides the greater incentive for hourly block imports during tight supply conditions. Bonneville’s preference is also informed by our understanding that Option 1 would be incorporated within the market optimization rather than Option 2 which we understand would be an “out of market” administrative pricing adjustment.

5.

Provide your organization’s comments on the real-time scarcity price enhancements topic as described in slides 26-30:

Bonneville agrees with comments made on the January 27 stakeholder call that CAISO’s proposals on scarcity pricing for summer 2021 should be characterized more as “pricing rules under tight system conditions” rather than scarcity pricing enhancements. Bonneville believes more work needs to be done to understand all of the implications of implementing these pricing rules and the interaction with implementation of Order 831.

Bonneville recommends any new pricing rules under tight system conditions be considered as part of CAISO’s more comprehensive scarcity pricing initiative scheduled to begin in Q2 2021.

Bonneville believes a more direct approach to incent more accurate scheduling in the day-ahead market should be pursued for summer 2021. One option may be to require day-ahead load schedules be at least 95% of the forecast when conditions are expected to be tight.

6.

Provide your organization’s comments on the reliability demand response dispatch and real-time price impacts topic as described in slides 31-33:

No comments.

7.

Provide your organization’s comments on the management of storage resources during tight system conditions topic as described in slides 34-36:

No comments.

8.

Provide your organization’s comments on the system market power mitigation topic as described in slides 37-38:

- Analysis to date does not justify System Market Power Mitigation

CAISO is proposing to implement system market power mitigation (SMPM) in August 2021 without providing the further analysis it committed to provide that would show a strong need for SMPM prior to this summer[1]. CAISO’s SMPM proposal attempts to solve a problem that analysis to date has shown does not exist. In its Report on System Market Issues for August and September[2], DMM stated that it “found no evidence that market results on August 14-15 were the result of market manipulation”. And in its 2019 Annual Report on Market Issues and Performance[3] stated that “overall prices in the ISO energy markets in 2019 were competitive, averaging close to what DMM estimates would result under highly efficient and competitive conditions, with most supply being offered at or near marginal operating cost… DMM estimates an average price-cost markup of $0.71/MWh or just under 2 percent… [which] indicates that prices have been very competitive, overall, for the year.”

- Current SMPM Proposal results in inappropriate mitigation

SMPM has been a very contentious initiative and various stakeholders have raised significant concerns with the revised draft final proposal. And while Bonneville understands the desire to mitigate the risk of market participants potentially exerting system market power, we believe there are significant consequences of applying SMPM when there is not actually potential for market power. In CAISO’s SMPM Revised Draft Final Proposal, CAISO stated:

“Applying system market power mitigation when there is not actually potential for market power:

- Discourages supply participation

- Leads to market prices that do not support suppliers’ real operating costs

- Discourages LSEs from engaging in long-term contracting, which is fundamentally essential protection against market power.”

Bonneville also reiterates that we do not support CAISO’s revised draft final SMPM proposal as it results in inappropriate triggering of mitigation. CAISO’s analysis showed that the proposal would have inappropriately triggered SMPM in around 50% or more of the intervals between HE13 and HE 21 on August 14, 15, 17, 18, and 19, 2020 and in 231 fifteen-minute intervals in 2019[4]. Bonneville believes further refinements are needed in order to ensure the SMPM framework does not inappropriately trigger SMPM, which would discourage supply participation, exacerbate reliability challenges and violate CAISO’s principle of having an SMPM design that maintains strong incentives for suppliers and consumers to economically participate in the CAISO’s market and to enter into long-term forward energy contracts.

- A revised SMPM proposal should be considered with comprehensive scarcity pricing initiative

Bonneville agrees with the CAISO that LSEs engaging in long-term contracting is fundamentally essential protection against market power and should be actively pursued as a solution for summer 2021. Bonneville recommends the CAISO defer implementation of a revised SMPM framework as part of the comprehensive Scarcity Pricing initiative scheduled to begin in Q2 2021.

[1] Reference: System Market Power Mitigation, Revised Initiative Schedule Market Notice

[2] www.caiso.com/documents/reportonmarketconditionsissuesandperformanceaugustandseptember2020-nov242020.pdf

[3] www.caiso.com/documents/2019annualreportonmarketissuesandperformance.pdf

[4] See CAISO’s presentation to the Market Surveillance Committee on October 9, 2020: www.caiso.com/documents/systemmarketpowermitigation-presentation-oct9_2020.pdf

9.

Provide your organization’s comments on the other items considered in this initiative based on stakeholder feedback as described in slides 39-42:

No comments.

10.

Provide your organization’s comments on the proposed EIM Governing Body role as described in slide 45:

Based on the current EIM Governing Body Charter and rules for decisional classification, Bonneville understands CAISO’s proposed EIM Governing Body role for each topic described in slide 45. Bonneville strongly supports the CAISO’s recommendation that the EIM Governing Body role is primary authority for resource sufficiency. While Bonneville recommends CAISO defer the scarcity pricing and system market power elements of this initiative, Bonneville asks the CAISO to be open to reconsidering the EIM Governing Body decision classification for a combined scarcity and SMPM initiative. Bonneville believes scarcity pricing mechanisms could meet the decision classification rules for EIM Governing Body primary authority and believes that changes to the competitive LMP may also meet the decisional classification rules for primary authority.

11.

Additional comments on the Market Enhancements for Summer 2021 Readiness straw proposal:

No further comments.

12.

Provide your organization's suggestions for how to prioritize the topics included in the proposal:

Bonneville reiterates the recommended priorities provided in the EIM Entity comments for summer 2021 readiness:

- Reconsider treatment of wheel-through schedules for summer 2021 by maintaining current priority level and pursue a more durable solution for future years

- Prioritize resource sufficiency enhancements for summer 2021 to ensure the EIM RS test is accurate and that all BAAs participating in the EIM are required to come in balanced with sufficient capacity to meet their obligations

- Defer System Market Power Mitigation and Scarcity Pricing to the more comprehensive and thorough Scarcity Pricing Enhancements initiative scheduled to begin in Q2 of 2021.

California Efficiency + Demand Management Council

Submitted 02/04/2021, 04:14 pm

Submitted on behalf of

California Efficiency + Demand Management Council

1.

Provide a summary of your organization’s comments on the straw proposal:

The California Efficiency + Demand Management Council (Council) appreciates the CAISO’s efforts to improve the functioning of its market for summer 2021. The Council’s comments do not pertain to the straw proposal, but rather, what is currently missing from it.

The Council is concerned that the CAISO has not taken steps to ensure that Proxy Demand Resources (PDR) are being fully awarded in the day-ahead market (DAM) when the market clearing price exceeds the bid price. This occurred on several occasions to at least one demand response (DR) provider during the August 2020 heat event. The CAISO should work with the DR community and investigate the cause of this issue so that it can be fixed in time for summer 2021 deployment.

One potential solution the CAISO might want to consider is adopting a trigger similar to the one in place for Reliability Demand Response Resources (RDRR) that would allow the CAISO to dispatch PDRs capable of real-time market (RTM) dispatch that were not scheduled in the DAM under emergency conditions pursuant to Operating Procedure 4420. The CAISO DAM is designed to clear based on economics and not on system conditions, so emergency events are not reflected in the DAM. To the extent that the CAISO is not economically scheduling PDRs in the DAM despite bids below the market clearing price, this will ensure that those capable of 30-minute dispatches can be used during emergency events.

Another critical issue the CAISO should address for summer 2021 is the accuracy of its DR baselines. The Council is very concerned that the CAISO’s DR baseline options undercount DR performance under extreme heat conditions which can lead to under-compensation of DR participants. This can have a disenfranchising impact on participants and reduce the amount of DR capacity that is available to maintain reliability.

The CAISO’s 10-in-10 baseline caps the day-of adjustment at +/- 20% and its 5-in-10 baseline, which is only available to residential customers, has a day-of adjustment capped at +40%/- 29%. In some instances, the sustained extreme heat events during August 14-19 and September 5-7 resulted in such high and sustained customer loads relative to their baselines that even with the day-of adjustment, curtailed customer loads were still greater than the adjusted baseline, despite the customer’s actions to execute their load reduction plans which resulted in no compensation for their load reductions.

The CAISO should consider alternative baselines, including a higher day-of adjustment, to ensure accurate measurement of DR resource performance. One potential approach could be to work with the IOUs to assess the August 14-19, 2020 and September 5-7, 2020 loads of customers not participating in a DR program to determine an appropriate alternate day-of adjustment. As a corollary, this alternate day-of adjustment could be attached to a trigger such that it is only applied during emergency or high-heat conditions so that it does not over-count performance under less-than-extreme heat conditions.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

3.

Provide your organization’s comments on the EIM coordination and resource sufficiency test review topic as described in slides 16-20:

4.

Provide your organization’s comments on the import and export market incentives during tight system conditions topic as described in slides 21-25:

5.

Provide your organization’s comments on the real-time scarcity price enhancements topic as described in slides 26-30:

6.

Provide your organization’s comments on the reliability demand response dispatch and real-time price impacts topic as described in slides 31-33:

7.

Provide your organization’s comments on the management of storage resources during tight system conditions topic as described in slides 34-36:

8.

Provide your organization’s comments on the system market power mitigation topic as described in slides 37-38:

9.

Provide your organization’s comments on the other items considered in this initiative based on stakeholder feedback as described in slides 39-42:

10.

Provide your organization’s comments on the proposed EIM Governing Body role as described in slide 45:

11.

Additional comments on the Market Enhancements for Summer 2021 Readiness straw proposal:

12.

Provide your organization's suggestions for how to prioritize the topics included in the proposal:

California Energy Storage Alliance

Submitted 02/03/2021, 06:31 pm

1.

Provide a summary of your organization’s comments on the straw proposal:

CESA appreciates the work of the ISO to ensure the necessary market updates are applied in advance of this year’s summer months. Given the reliability deficiencies that were exposed by the August 2020 heatwave, CESA recognizes the commitment of the ISO to identify and address issues with its market tools and processes that could, even inadvertently, exacerbate reliability concerns during periods of grid stress.

While these objectives are reasonable, CESA believes urgent market changes should be limited and targeted to the areas and issues the ISO and other pertinent authorities have identified as key during the August 2020 events. To this end, the ISO should base its prioritization on the findings of the Preliminary and Final Root Cause Analyses, two reports the ISO co-authored with the California Energy Commission (CEC) and the California Public Utilities Commission (CPUC). In these reports, the authors note that only 200 MW of RA battery storage were operating in the ISO market, and that “it is difficult to draw specific conclusions about fleet performance from such a small sample size.”[1] In this context, CESA does not believe there is sufficient evidence to preempt solutions to unsubstantiated “problems” and advance the implementation of a proposal such as the minimum state-of-charge (MSOC) requirement.

Moreover, CESA continues to be concerned with particular elements of the Straw Proposal as currently drafted. Namely, the MSOC proposal continues to lack clarity regarding its trigger condition, the compensation or settlement related to its application, and the period for which it will be applicable. As such, CESA’s comments can be summarized as follows:

- The ISO should not implement the MSOC as currently defined in the Resource Adequacy (RA) Enhancements Draft Final Proposal; instead, it should consider applying the proposal put forth by LS Power.

- If the ISO moves forward with the current MSOC proposal, it should include the following modifications:

- Update the RA Enhancements Draft Final Proposal to properly reflect the reservations stakeholders have regarding the MSOC requirement.

- Include a sunset provision for December 31, 2021 and commit to develop a market-oriented solution within its forthcoming storage-focused initiative.

- Provide stakeholders with the data analyses on the different trigger conditions considered in order to evaluate their impact and pertinence.

- Hold an additional stakeholder call within the RA Enhancements Initiative to timely incorporate stakeholder feedback prior to the March Board of Governors meeting.

[1] Final Root Cause Analysis, at 6.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

CESA offers no comment at this time.

3.

Provide your organization’s comments on the EIM coordination and resource sufficiency test review topic as described in slides 16-20:

CESA offers no comment at this time.

4.

Provide your organization’s comments on the import and export market incentives during tight system conditions topic as described in slides 21-25:

CESA offers no comment at this time.

5.

Provide your organization’s comments on the real-time scarcity price enhancements topic as described in slides 26-30:

CESA offers no comment at this time.

6.

Provide your organization’s comments on the reliability demand response dispatch and real-time price impacts topic as described in slides 31-33:

CESA offers no comment at this time.

7.

Provide your organization’s comments on the management of storage resources during tight system conditions topic as described in slides 34-36:

The ISO should not implement the MSOC as currently defined in the RA Enhancements Draft Final Proposal; instead, it should consider applying the proposal put forth by LS Power.

While CESA recognizes and shares the ISO’s commitment to reliability, we have previously expressed serious concerns with regards to the MSOC proposal. In essence, this requirement is unwarranted, potentially discriminatory by virtue of its targeting of a specific technology class, unduly restrictive, and currently incomplete given its omission of a clear compensation structure. As such, the MSOC proposal as currently drafted does not represent a workable solution and the ISO should refrain from rushing its implementation to summer 2021.

Given this context, and recognizing the ISO commitment to implement market changes that will ensure all storage resources contribute to the grid’s reliability, CESA supports the alternative proposal put forth by LS Power in its comments relative to the RA Enhancements Draft Final Proposal.[1] In this proposal, LS Power offers a pathway to improve the ISO’s multi-interval optimization (MIO) tool to mitigate its current unintended negative impacts on the state-of-charge (SOC) of storage assets. Currently, the MIO is a design aspect of the Real Time (RT) market that estimates market conditions several intervals in the future, known as the advisory intervals, in order to optimize the dispatch signals given to resources in the immediately following interval, known as the binding interval. Storage resource dispatch signals (DOTs) are moved up and down in the binding interval in a way that is beyond the control of resource owners any time CAISO estimates a very low or high price materializing in the advisory intervals. Unfortunately, the MIO tool does not consider Day Ahead (DA) schedules in any way when determining RT market dispatches. This results in DOTs being often awarded at LMPs outside of the resource’s bid curve in any given interval. Moreover, this means CAISO sometimes discharges resources for lower prices than the resource has offered into the market, leaving them emptier than they would otherwise be in intervals prior to their DA schedules. As a result, the current MIO formulation creates the very risks the ISO is trying to mitigate.

Considering the need to modify the MIO, LS Power’s proposal recommends only discharging and charging storage assets at the prices they have indicated in their bid curves. This would minimize the unintended effects of the MIO while granting additional financial certainty to resource owners. LS Power also recommends minimizing the number of advisory intervals considered in the issuance of DOTs. These modifications will strengthen the already existing incentives that link financial risk and rewards to reliability-driven outcomes.

With these core modifications applied, LS Power offers an MSOC alternative that is based on market principles, limits the number of days and intervals affected by a MSOC-like requirement, and ensures the tracking of this requirement in a manner consistent with exceptional dispatch (ED). LS Power’s alternative framework can be summarized as follows:

- The ISO should focus on market-based tools first such as a revised MIO; out-of-market tools such as MSOC should only enforced when CAISO sees a reliability risk or an imminent System Emergency.

- The ISO should run sufficiency tests on a regular basis throughout the day to determine if MSOC is still needed, not limiting itself to a single test after the DA schedules are determined.

- The ISO should set MSOC to the minimum amount and time needed given the results of the sufficiency tests. This should result in the minimum quantities of charge power (in MW) and stored energy that must be maintained across the storage fleet (in MWh). Once the ISO counts the MW of DA storage awards in each hour and sum over the appropriate time scales, it should estimate the appropriate fraction of a resource’s storage capacity to be reserved from the RT market, as opposed to all of it.

- The ISO should ramp MSOC requirements smoothly and linearly to allow grid and resource flexibility on days where the sufficiency tests described above indicate that a certain MSOC is needed across the storage fleet for system reliability. The portion of each resource’s capacity subject to the MSOC requirement should be proportional to its maximum energy capacity relative to the total storage on the grid. The ramp should take place over N hours immediately preceding the start of that resource’s DA schedule, where N is the number of hours it would take to charge that resource from empty to achieve an SOC equal to the quantity of MWh it is needed to discharge based on DA, plus a safety factor (LS Power offers 20% as an example).

- The ISO should modify the bid cost recovery (BCR) mechanism to ensure storage resources are compensated for the reliability service they provide.[2]

- The ISO must track and report MSOC usage in a manner consistent with ED.

In sum, the framework offered by LS Power represents a workable solution that could be applied by summer of 2021. This proposal targets fundamental issues related to the ISO’s optimization tools, better equipping the ISO’s systems for the expected rise of energy storage assets. As such, CESA supports adopting LS Power’s proposal rather than pursuing the MSOC as currently drafted.

If the ISO moves forward with the current MSOC proposal, it should include the following modifications.

As previously stated, CESA opposes the implementation of the MSOC proposal as currently drafted within the RA Enhancements Initiative. In this section, CESA puts forth several modifications the ISO must address of it decides to move forth with the MSOC requirement despite the reservations communicated by stakeholders.

- Update the RA Enhancements Draft Final Proposal to properly reflect the reservations stakeholders have regarding the MSOC requirement: CESA considers the current RA Enhancements Draft Final Proposal does not fully capture the type and magnitude of reservations communicated by stakeholders during the development of the MSOC requirement. Specifically, the ISO has not captured CESA’s and other stakeholders’ comments regarding the potentially discriminatory nature of this requirement, nor does it reflect the provision of alternative requirements by engaged parties.

- Include a sunset provision for December 31, 2021 and commit to develop a market-oriented solution within its forthcoming storage-focused initiative: CESA considers the MSOC proposal as currently drafted is incomplete and overlooks the need for urgent modifications to the ISO’s systems to properly operate storage assets. In this context, CESA appreciates the ISO commitment to institute a new storage-focused initiative in the upcoming weeks.[3] CESA believes this future initiative will be the adequate venue for the ISO and stakeholders to develop a permanent solution to the issues the MSOC proposal seeks to address. In order to guarantee this outcome and allow the ISO to implement an interim solution for this year’s summer, CESA recommends including a sunset provision to the MSOC proposal for December 31st, 2021. CESA believes this provision will enable the ISO to manage immediate risks while communicating to stakeholders and investors this measure will not be permanent and shall be improved in the near term.

- Provide stakeholders with the data analyses on the different trigger conditions considered, to evaluate their impact and pertinence: If the ISO decides to move forward with its current MSOC proposal, CESA requests it shares detailed data analyses on the different trigger conditions staff has considered over the course of its development. As of February 2021, CESA has heard the ISO put forth at least three different trigger methodologies for the MSOC requirement; nevertheless, we have yet to see analyses that demonstrate the pertinence of said methods. CESA recognizes that the ISO has committed to share this information as part of the Final Proposal, and urges staff to do so expeditiously.[4] The lack of information related to the probability of the MSOC requirement to become binding for any given day seriously hinders stakeholders’ ability to provide substantial feedback on the methodologies considered by the ISO. In order to guarantee market participants have an adequate understanding of the new conditions they will face, the ISO must share this data in advance of the March Board of Governors meeting, where this proposal is set to be voted.

- Hold an additional stakeholder call within the RA Enhancements Initiative to timely incorporate stakeholder feedback prior to the March Board of Governors meeting: During the January 29th Market Enhancements for Summer 2021 Readiness Q&A call, CESA noted that the current procedural schedule grants little time for stakeholders to offer substantial feedback on the proposal and ISO staff to incorporate said feedback prior to the March Board of Governors meeting. In order to mitigate this concern and ensure stakeholders are heard, CESA recommends the ISO schedule and additional stakeholder call under the RA Enhancements Initiative dedicated to the MSOC proposal.

[1] See LS Power, LS Power’s Comments on RA Enhancements Draft Final Proposal, filed January 21, 2021.

[2] See LS Power, LS Power’s Comments on the Market Enhancements for Summer 2021 Readiness Initiative, filed January 14, 2021.

[3] This was noted by Gabriel Murtaugh during the January 29th Market Enhancements for Summer 2021 Readiness Q&A call.

[4] Ibid.

8.

Provide your organization’s comments on the system market power mitigation topic as described in slides 37-38:

CESA offers no comment at this time.

9.

Provide your organization’s comments on the other items considered in this initiative based on stakeholder feedback as described in slides 39-42:

CESA offers no comment at this time.

10.

Provide your organization’s comments on the proposed EIM Governing Body role as described in slide 45:

CESA offers no comment at this time.

11.

Additional comments on the Market Enhancements for Summer 2021 Readiness straw proposal:

CESA offers no comment at this time.

12.

Provide your organization's suggestions for how to prioritize the topics included in the proposal:

CESA offers no comment at this time.

California Large Energy Consumers Association

Submitted 02/03/2021, 05:30 pm

1.

Provide a summary of your organization’s comments on the straw proposal:

CAISO should address the bidding rules for proxy demand resources so they are dispatched prior to reliability demand response resources. See the response to question 6 for more details.

CAISO should implement restrictions on charging of batteries during the times of Alerts, Warnings, and Stage 1-3 Emergencies. See the response to question 7 for more details.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

3.

Provide your organization’s comments on the EIM coordination and resource sufficiency test review topic as described in slides 16-20:

4.

Provide your organization’s comments on the import and export market incentives during tight system conditions topic as described in slides 21-25:

5.

Provide your organization’s comments on the real-time scarcity price enhancements topic as described in slides 26-30:

6.

Provide your organization’s comments on the reliability demand response dispatch and real-time price impacts topic as described in slides 31-33:

CLECA is concerned that CAISO is only focusing on the performance of Reliability Demand Response Resources (RDRR) and is ignoring improving the performance of Proxy Demand Resources (PDR). Per the CAISO’s Department of Market Monitoring (DMM) Report on events on August and September,2020, the following occurred:[1]

For August 14 delivery, out of 244 MW of supply plan DR, 48 MW were not bid into peak net load hours in the day-ahead market.[2]. Out of these 244 MW of supply plan DR for August, 133 MW were not bid into the day-ahead market for August 15 delivery. Furthermore, only about 53% of supply plan DR was available to the CAISO on August 15.

Real-time availability was worse. On August 14 there was 53 MW less capacity available in real-time compared to day-ahead and on August 15 there was 30 MW less available in real-time compared to day-ahead. The majority of supply plan PDR that did not bid into the market is less than 1 MW so it is exempt from resource adequacy availability incentive mechanism (RAAIM).

On August 14 in hours ending 19 and 20, about 50% of supply plan DR was dispatched by the CAISO and on August 15, during those hours, only about 25% of supply plan DR was dispatched. None was manually dispatched despite the manual dispatch of RDRR.[3] DMM stated contributing factors were the use of $1000/MWh bid cap offers and the use of start-up bids and minimum load costs resulting is resources being uneconomic in the day-ahead market.

All PDR should be dispatched before RDRR. Since RDRR bids between 95-100% of the bid cap, the bid cap for PDR should be set at 94% of the maximum bid price. The CAISO should also consider removing start-up bid parameters for PDR to prevent them being used as a tool to increase the bid cost further and which can result in its dispatch after RDRR resources. The CAISO should also investigate how it can improve the exceptional dispatch of PDR prior to exceptional dispatch of RDRR.

The CAISO should also consider the proposals for supply plan demand response resources listed in the DMM report:

1. The ISO should be able to manually dispatch supply plan demand response before needing to resort to exceptional dispatch of non-resource adequacy capacity and firm load curtailment. The ISO has the ability to manually dispatch utility demand response and did so on high load days in August and September.

2. Consider removing the exemption for long-start proxy demand response to be available in the residual unit commitment process. This exemption does not exist for other types of long-start resources providing resource adequacy.

3. Continue to review why demand response resources in the same sub-lap continue to be sized less than 1 MW. Consider applying RAAIM to demand response resource adequacy capacity at the demand response provider and sub-lap level rather than the resource level to ensure this capacity remains exposed to resource adequacy availability incentives.[4]

The CAISO should provide more detail on what changes the CAISO will be making to expected performance of Reliability Demand Response Resources the Load Forecast Adjustment as mentioned on slide 32.[5]

CAISO’s proposal to have scheduling coordinators spread the bids of RDRR between $950-1000 is problematic because it involves equity issues among participating customers.[6] For the Base Interruptible Program, which consists of relatively few customers with very large loads, spreading the bids means that some customers could be dispatched more than other customers. This would result in equity issues among customers that receive the same incentive. This is an issue that would need to be resolved prior to implementation. CLECA does not believe there is sufficient time to resolve this before Summer 2021, and this aspect of the proposal should be dropped.

[1] CAISO DMM, (November 24, 2020) Report on System and Market Conditions, Issues and Performance: August and September 2020 at 55-56.

[2] Most of the supply plan DR is proxy demand resources.

[3] CAISO DMM, (November 24, 2020) Report on System and Market Conditions, Issues and Performance: August and September 2020 at 56.

[4] CAISO DMM, (November 24, 2020) Report on System and Market Conditions, Issues and Performance: August and September 2020 at 60.

[5] CAISO, (Jan 27, 2020) Market Enhancements for 2021 Summer Readiness, Slide 32.

[6] CAISO, (Jan 27, 2020) Market Enhancements for 2021 Summer Readiness, Slide 33.

7.

Provide your organization’s comments on the management of storage resources during tight system conditions topic as described in slides 34-36:

Batteries were charging during Stage 2 and Stage 3 Emergencies or during the times when Reliability Demand Response Resources were utilized. This occurred five times on August 14-15, August 18, and September 5-6. (See attachment A which shows the battery operation chart from the CAISO website with the times of Warnings, Stage 2, and Stage 3 events.) It does not make sense for batteries to charge during times when customers are on rotating outage (August 14) or when the CAISO has, or anticipates having, insufficient operating reserves, resulting in activation of which RDRR. The optimization may be producing dispatch anomalies that do not make sense during conditions when the system is unable to maintain the necessary number of operating reserves. The final root cause analysis report does not address this issue.

While CLECA supports improvements to encourage storage to have sufficient charge during periods of resource need, it is not clear the CAISO’s proposal will actually prevent a reoccurrence of what happened last year. With 1700 MW of batteries expected for summer 2021, there need to be changes so that the storage can be sure to resolve shortfalls, not contribute to resource shortfalls. There should be a set of rules that apply just during periods of stress on the electrical grid. CLECA recommends the following rules:

- When a Grid Alert occurs (which forecasts by 3 pm the day before of operating reserve deficiencies), storage will not be given day-ahead awards to charge from the grid during specified times of expected reserve deficiency.

- When a Warning is called, Storage is not allowed to charge from the grid and prior dispatch awards for charging are canceled. If charging from the grid does occur without a dispatch instruction there is a penalty charged.

- An exception is made for a manual (exceptional) instruction from the grid operator; this would waive any penalty

- During any Stage Emergency storage is not allowed to charge from the grid. If storage charges from the grid it is subject to a penalty.

CLECA believes this set of rules will offer several benefits to prevent storage from contributing to resource shortfall. With a day-ahead notice that storage is not permitted to charge during certain hours, the operator can change its real-time bidding strategy to charge outside the restricted hours. The prohibition to charging during Warnings and Stage Emergencies will prevent any market anomalies that contribute to operating reserve shortfalls instead of resolving shortfalls. Yet, there should be a manual (exceptional) dispatch provision for operators in case there is some unusual reason for the grid operator to request some storage to charge, with no penalty.

8.

Provide your organization’s comments on the system market power mitigation topic as described in slides 37-38:

9.

Provide your organization’s comments on the other items considered in this initiative based on stakeholder feedback as described in slides 39-42:

10.

Provide your organization’s comments on the proposed EIM Governing Body role as described in slide 45:

11.

Additional comments on the Market Enhancements for Summer 2021 Readiness straw proposal:

12.

Provide your organization's suggestions for how to prioritize the topics included in the proposal:

Calpine

Submitted 02/03/2021, 02:23 pm

1.

Provide a summary of your organization’s comments on the straw proposal:

First, do no harm. The scale and scope of CAISO proposed initiatives is impressive. Implementing a fraction of the proposals will require significant dedication on both the part of the CAISO and its vendors, but also significant effort on the part of market participants. In fact, the CAISO can create a platform for reliability and market confidence by winnowing this list early and applying uncommon diligence to understanding programmatic interactions, software testing, market simulations and roll-out preparedness.

The CAISO may be exposed to challenging market conditions this summer driven by exogenous climate factors. In the past, the CAISO has recognized that reliability risks can be amplified by unintended consequences as well as “bugs” embedded in new operational systems software. As such, it has avoided software changes during or near summer peak conditions. Nonetheless, the CAISO appears to be headed to major software drops and or activations in June, and possibly on August 1, at the height of summer. The CAISO may not be able to avoid the challenges of a hot summer, but it can avoid the self-inflicted harm of attempting to do too much at the wrong time and with too little preparation.

With that, Calpine recommends that the CAISO prioritize the following initiatives to be implemented as soon as possible before summer. We base our priorities on our own perception of implementation difficulty as well as the need to address real and present danger to reliability or irreparable harm. All other proposals can and should be pursued diligently, but implemented, as needed, after this summer.

- Modify and rationalize the priority for intertie transactions including wheel-through, exports, loads and imports.

- Consider bid-assurance for HASP imports, coupled with transparency and limits on operator load bias.

- Move RDRR into the 15 minute market and bias the cleared load to avoid price suppression.

We strongly discourage any changes that affect market optimization, scheduling or dispatch on August 1 or anytime during the summer/fall peak period.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

As one of the highest priorities, Calpine supports the realignment / clarifications of scheduling priorities identified in the presentation. Rationalizing the treatment of wheels-through, exports, imports and load is absolutely critical to the CAISO obtaining the incremental energy it needs to support reliable operations.

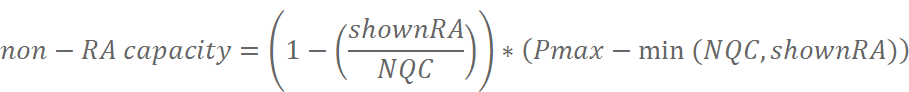

We agree with commenters that the CAISO must specifically define “non-RA capacity” that can be used to support the higher priority for PT exports. It seems the intent is that non-RA capacity is NQC of an internal resource that is not submitted on any RA supply plans.

3.

Provide your organization’s comments on the EIM coordination and resource sufficiency test review topic as described in slides 16-20:

Calpine supports modifications, if administratively feasible, to rationalize the quantities demanded or supplied in the resource sufficiency tests. In the longer term, we support modifications such as those proposed by Powerex and WPTF to create scarcity prices when a BAA test reveals capacity insufficiency. This can be consider as part of the holistic review of scarcity pricing proposed by the CAISO.

4.

Provide your organization’s comments on the import and export market incentives during tight system conditions topic as described in slides 21-25:

With caveats regarding operator load biasing incentives, Calpine supports the proposal to grant bid assurances to HASP imports during tight market conditions.

The CAISO eliminated BCR for HASP imports in about 2012 as it implemented FERC Order 764. The CAISO’s intention was to eliminate BCR in order to avoid a disincentive to 15 minute scheduling at the interties. Nonetheless, the volume of 15 minute intertie scheduling has never met expectations and the absence of BCR continues to place significant risk on hourly intertie transactions. This risk discourages intertie bids – which are generally required for reliability, particularly during stressed system conditions.

The risk is manifest in the difference between HASP (hourly) and FMM (15-minute) pricing. Intertie transactions are confirmed in the hourly market, based on hourly bids, but settled at the 4 individual FMM prices. Under normal conditions, one would not anticipate substantial price difference given the close sequential clearing of these markets. However, because they lack confidence in other market products (specifically, but not isolated to ineffective Flexible Ramping awards), the CAISO grid operators substantially increase (bias) the load forecasts in HASP – increasing the demand for HASP cleared imports and subsequently reducing the demand for FFM capacity.

The resulting higher prices in HASP are of course applied to imports – and would be assured by BCR -- but those prices are not available to internal resources. This discriminatory access to a preferred market should be eliminated over time, but given the exigent circumstances Calpine understands the CAISO’s desire to eliminate the disincentive to import bidding during tight system conditions.

While paying ALL resources (including internal resources) the higher-of HASP or FMM would resolve this discrimination, Calpine assumes that such a fundamental change might create implementation infeasibility as well as unintended consequences.

Rather, Calpine asks that if the CAISO moves forward with this proposal that the CAISO report, in a transparent matter, and as close to RT as possible, the amount and direction of load biasing performed by the CAISO operators. While this may not reduce market intrusion necessary for reliability, the transparency could create a discipline on overly-conservative actions that harm price formation.

5.

Provide your organization’s comments on the real-time scarcity price enhancements topic as described in slides 26-30:

The CAISO proposes two modifications that it coins “scarcity pricing” and proposes to implement concurrently with its system market power mitigation mechanism. The CAISO proposes that this “balanced approach” would be activated on August 1st.

First, Calpine disagrees with the characterization that the implementation of the two proposed “scarcity” modifications in any significant way “balances” the ubiquitous, and continuous imposition of system market power mitigation. The two scarcity proposals would only be triggered when the CAISO is in a dire circumstance (either SMEC over $800 or load shedding is “armed”) and even then, their impacts on price formation are entirely speculative due to likely contemporaneous factors. On the other hand, the evaluation of system market power would apply to every internal resource during every interval of the entire year. Calpine urges the CAISO to once again commit to a holistic review of scarcity pricing and not presume that the largely toothless proposals it puts forward here are a sufficient replacement for a more comprehensive review.

Second, with respect to the specific scarcity proposals, Calpine can support implementation so long as they do not deter from other more important initiatives and as long as the CAISO restates its commitment to a holistic review of scarcity pricing.

The first proposal suggests that if DA SMEC is $800 or other conditions are met, the pricing parameters in RT would be raised to or above the hard bid cap. The possible increase in pricing parameters above the hard cap was mentioned in the discussion, but not included in the presentation materials. Since these speculative proposals have a direct and consequential influence on market confidence, expectations and near term hedging, the CAISO must either dispel this possibility or provide details of the proposal immediately.

There has been no detailed discussions of how this proposal may interact with Order 831 Enhancements, SMPM, or how these proposed systemic differences in DA-RT price expectations would affect virtual bidding incentives. Nonetheless, one might reasonably conclude that this new trigger for higher pricing parameters is likely over shadowed and subsumed by triggers in the 831 Enhancements proposal – for example, the maximum import bid screen -- making this proposal ineffectual and unnecessary.

The second proposal would set prices at the bid cap (either soft or hard cap, depending on circumstances) whenever the CAISO has run short of reserves, is on the verge of blackouts, and therefore must “arm” load shedding as a contingency reserve. The CAISO presentation does not describe the duration of this proposed administrative pricing – that is, whether the price would be set at the cap for a single interval, or as Calpine would propose, for the duration of “arming’ and any subsequent load drop.

Calpine’s tepid support for these measures is driven by the fear that the CAISO may conclude that they have done enough – that the measures are sufficient (albeit ineffective) to (1) deem the proposal “balanced” with SMPM or (2) avoid or significantly defer consideration of a more holistic review of scarcity and price formation.

6.

Provide your organization’s comments on the reliability demand response dispatch and real-time price impacts topic as described in slides 31-33:

The joint report on the events of the summer 2020 blackouts observed that RDRR was “manually dispatched” on several, if not all occasions. The unstated, but logical conclusion of manual dispatch is that RDRR, (as well as PDR) did not set or affect prices. Ironically, rather than raise price, the manual dispatches of load curtailments most likely had the effect of suppressing prices as the load reductions softened demand.

In part, the need for manually dispatching RDRR is attributed to the fact that RDRR is not included in the 15-minute pre-dispatch runs (RTPD) and does not generate start-up instructions. The CAISO proposes to correct this by allowing RDRR to be dispatched in RTPD and carry through to each of the succeeding 3, 5-minute RTD periods. Calpine supports this change.

Calpine also supports the process of load-biasing to avoid the double-counting of DR. That is, it appears that when DR supply is dispatched up, telemetered data also shows a demand reduction. Counting a single action with both a supply response and a demand response would have the outcome of reducing prices rather than reflecting an accurate representation of marginal cost. The CAISO indicates that to solve this, operators will inject a positive load bias coincident with demand reductions. While Calpine seeks much more detailed discussion of how much and when this biasing occurs, we support this correction to support proper price formation. Additionally, we support further analysis of historic performance of DR programs as well as a critical review of the crediting processes performed at the CPUC.

However, Calpine has remaining concerns about the durability of price signals created by load interruptions. On one hand, if the load biasing is performed for the duration of the DR dispatch prices could reasonably reflect the appropriate marginal cost of shedding load. However, if load biasing lasts only the initial or a few intervals, prices may only sporadically represent those true costs. As such, perhaps the CAISO could revisit the application of fast-start (or constrained-output generation) modeling to DR supply resources. In essence, these programs model resources as if they are fully dispatchable, and able to set LMP for the full duration of dispatch.

7.

Provide your organization’s comments on the management of storage resources during tight system conditions topic as described in slides 34-36:

Calpine would set a fairly low priority on implementing a state-of-charge constraint prior to the summer of 2021. However, we understand the CAISO’s concern that a storage device must be positioned to meet a DA award, especially during tight conditions. As such, Calpine would not object if the CAISO and its consultants have the bandwidth to build, test and implement this scaled down proposal.

8.

Provide your organization’s comments on the system market power mitigation topic as described in slides 37-38:

Calpine objects to the implementation of SMPM, especially in the middle of the summer.

The CAISO has presented no evidence that market power has been exercised by the resources that would be targeted by this proposal (i.e., internal generation). In fact, the ISO appropriately suspended action on this initiative in November pending further demonstrations of need. The cryptic and unsupported rebirth of the initiative presents no further evidence which would compel a rushed implementation of a potentially transformative policy.

The CAISO’s own analysis concluded that SMPM would have triggered in a majority of the intervals during the summer tight conditions. These triggers could have resulted in false-positive indications of market power, mitigated bids and lowered prices when the CAISO’s need to attract imports was at its peak. Alternatively, or possibly concurrently, mitigated bid prices from internal resources coupled with operator fears of inadequacy could cause aggressive biasing of the HASP load forecast, favoring imports and as described above, putting further downward pressure on the 15 and 5 minute mitigated prices applicable to internal generation.

Calpine recommends that the CAISO consider implementation of SMPM at a later date (and certainly not in the middle of the summer) after the interactions of SMPM, Order 831 and the prospective implementation of scarcity pricing can be evaluated with due diligence and any unintended interaction and consequences can be discovered and addressed. Only this would be a truly balanced approach to implementation.

9.

Provide your organization’s comments on the other items considered in this initiative based on stakeholder feedback as described in slides 39-42:

The CAISO has not provided any evidence or cause to modify the provisions of RAAIM. Such evidence should be presented and evaluated before consideration of changes. For example, changing RAAIM assessment hours could be a time-consuming and complicated endeavor, distracting programming and vendor time. Given the higher relative priorities of other initiatives, this proposal should be dropped – only to reemerge if and when specific problems can be identified. And then, the CAISO should consider whether RAAIM is appropriately structured (if in fact, UCAP efforts are unsuccessful). Eastern markets have used much stronger performance incentives, such as New England’s Pay-for-Performance mechanisms.

Additionally, RAAIM should not be changed in the middle of an RA cycle. Parties have made decisions to sell/buy, or not sell/not buy NQC based on current penalty structures. Any modifications should only be made prospectively and for the next (2022) RA cycle.

10.

Provide your organization’s comments on the proposed EIM Governing Body role as described in slide 45:

No Comment

11.

Additional comments on the Market Enhancements for Summer 2021 Readiness straw proposal:

No Comment

12.

Provide your organization's suggestions for how to prioritize the topics included in the proposal:

As stated in the summary, above, Calpine recommends that the CAISO prioritize the following initiatives to be implemented as soon as possible before summer. We base our priorities on our own perception of implementation difficulty as well as the need to address real and present danger to reliability or irreparable harm. All other proposals can and should be pursued diligently, but implemented, as needed, after this summer.

- Modify and rationalize the priority for intertie transactions including wheel-through, exports, loads and imports.

- Consider bid-assurance for HASP imports, coupled with transparency and limits on operator load bias.

- Move RDRR into the 15 minute market and bias the cleared load to avoid price suppression.

Desert Southwest EIM Entities

Submitted 02/04/2021, 03:39 pm

Submitted on behalf of

Arizona Public Service, NV Energy, Salt River Project, Tucson Electric Power

1.

Provide a summary of your organization’s comments on the straw proposal:

In addition to the comments in the paragraphs below, which mirror those submitted by the EIM Entities, Salt River Project (SRP), Arizona Public Service (APS), Tucson Electric Power (TEP), and NV Energy (NVE) would like to highlight concerns with the CAISO proposed reprioritization of loads and exports. The reprioritization results in a significant modification to previous scheduling priorities and is being done on an extremely tight timeline. The modifications as proposed can directly impact the ability of Desert Southwest load serving entities to import power contracted to serve load. SRP, APS, TEP, and NVE contract for energy with the Northwest, whether for resource adequacy, month ahead, day ahead or bilateral trades. With the proposed reprioritization of exports and loads for next summer, firm energy purchased from the Northwest could be curtailed by the CAISO to address the insufficient supply within its own Balancing Authority Area (BAA), leaving the Southwest short.

2.

Provide your organization’s comments on the export and load priorities topic as described in slides 7-15:

The Commenters appreciate and support the CAISO’s proposal to modify scheduling priorities to better align CAISO’s priority practices with those of other Balancing Authorities (BAs) across the West. By establishing Price Taker (PT) Exports as a primary priority within the Day Ahead and Real-Time market runs, CAISO would help to ensure that it does not inadvertently transfer any reliability issues it may face to other BAs across the West.

However, in proposing to differentiate Residual Unit Commitment (RUC) exports without generation, CAISO’s proposal fails to consider how curtailment of generation originating outside of its BAA, transported through the CAISO BAA, and delivered to another BAA for firm load (wheel-through generation) would be consistent and aligned with practices and protocols across other utilities in the West. SRP, APS, TEP, and NVE are significantly concerned with the CAISO’s proposal to lower the priority of wheel-through schedules in favor of CAISO Resource Adequacy schedules in the RUC process. Such an approach would be inconsistent with practices and protocols across other utilities in the West and would likely pass along reliability issues from CAISO to Desert Southwest entities. Throughout the West, wheel-through transactions are afforded the same opportunity to acquire and use firm transmission service to deliver energy from one BA to another as import transactions, and BAs are unable to selectively de-prioritize and/or curtail wheel-through schedules to address a supply shortfall in their own BAA. This concept is also reflected within the EIM, where some entities experience a significant volume of wheel-through transactions across their areas. When an EIM Entity BA fails to pass relevant sufficiency tests, net imports or net exports to and from that BA are frozen, but wheel-through transactions can continue unaffected. This reflects the principle of not passing along issues from a deficient EIM participant to other participants. In lacking consistency, it is clear that CAISO wishes to have it both ways – limiting wheel through when it is detrimental for its own system, but establishing rules to ensure wheeling is fundamentally available through other BAAs when it is beneficial to CAISO. This is a particular concern in light of CAISO’s own challenges in meeting EIM sufficiency tests and its dependence upon wheel-through itself within the EIM environment.

CAISO’s proposal is problematic in two ways. First, CAISO’s proposal does not consider the many opportunities and competitive practices that occur in a forward environment. Load serving entities across the west routinely compete for forward products to ensure resource adequacy needs are met. Competitive processes exist for capacity and energy in the forward markets and allow entities to ensure deliverability attributes and firmness of transmission. Such products often come at a premium price in the marketplace due to the deliverability attributes – load serving entities all across the Western Interconnection willingly compete in these processes. CAISO’s proposal would fundamentally upend competitive practices for energy and capacity across the West. SRP, APS, TEP, and NVE view the congestion issues faced by CAISO as resulting from deficiencies of forward products procured by load serving entities within CAISO, and such entities should further consider the deliverability of the product and not merely the economics of the product.