Arizona Public Service

Submitted 01/12/2022, 07:46 am

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Since first proposed in early 2021, APS has had, and continues to have, considerable concerns with CAISO’s efforts to amend the transmission scheduling priorities in their Tariff. APS opposed these changes on numerous occasions throughout the 2021 Summer Readiness Enhancements Process, including in a formal Protest to CAISO’s filing of these changes at FERC in May of 2021. While we do not believe the current framework to be a durable, long-term solution, taking into account the realities of the situation we are faced with today, APS does not oppose the Phase 1 Draft Final Proposal and the extension of the current interim, wheeling through scheduling priorities framework for Summer 2022 and 2023. FERC’s order of June 2021 and the pending expiration of the current tariff language in May 2022 coupled with the need for planning certainty for the upcoming summers, leaves APS few options other than to work within the current tariff rules until more meaningful reform can be achieved through the CAISO stakeholder process. While we do not oppose the Phase 1 Draft Final Proposal, APS continues to believe that the current wheel through scheduling priorities are inconsistent with FERC’s open access transmission policies and precedent.

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

APS supports CAISO’s efforts to quickly begin Phase 2 of this initiative. However, APS encourages CAISO to prioritize this effort, perhaps even above other market related stakeholder efforts. CAISO has committed to finishing Phase 2 of this Initiative by the end of 2022 to as to allow them sufficient time for filing and approval at FERC, and subsequent implementation in advance of the Summer of 2024. APS believes it is of the utmost importance that CAISO stick to this timeline so that a fair and equitable scheduling paradigm may be achieved as soon as possible. APS remains concerned that enhancements/changes to the current CAISO market rules and processes continue to take a back-burner to market products that have yet to be developed (i.e.: EDAM). Additionally, given the importance of this issue to the non-California EIM Entities (including their Regulators and other stakeholders), APS requests that this initiative be placed under the joint authority of the EIM Governing Body and CAISO Board of Governors.

California Public Utilities Commission - Energy Division

Submitted 01/07/2022, 06:12 pm

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

The CPUC staff supports, with caveats, the extension of the current wheeling proposal until CAISO completes Phase 2 of this initiative (which is the longer-term solution).

CPUC staff opposes the proposed tariff amendments that would go into place on June 1, 2024, that would prioritize wheeling transactions over load in all circumstances as unjust and unreasonable. This provision would jeopardize reliability for California customers, and unjustly allow external entities the option to wheel through California with priority over load, even though California customers pay the embedded costs of $2.7 billion per year for the use of the transmission system.

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

CPUC staff has significant reservations about the current proposal, which staff has expressed in previous comments in this and the previous summer 2021 initiative, as well as in staff’s comments and limited protest at FERC.[1] In particular, CPUC staff is concerned that:

- This proposal continues to provide priority access to the California transmission system and does not sufficiently prioritize native load reliability needs,

- This proposal could jeopardize reliability for California customers if large volumes of wheel through transactions displace California’s access to resource adequacy imports that are necessary to reliably serve load, especially under stressed system conditions,

- This proposal does not consider resources that have received a CPM (capacity procurement mechanism) designation in the north as resource adequacy resources that should receive priority when allocating scarce transmission between resource adequacy resources and wheeling transactions, and

- This proposal does not sufficiently limit real-time wheeling transactions that are able to receive priority equal to load, which could exacerbate reliability concerns during stressed system conditions.

In addition, CPUC staff is also concerned that the proposed interim framework allows external entities to reserve valuable transmission capacity internal to CAISO (and receive priority equal to load during stressed system conditions), with no payment to California customers to reserve that transmission. To obtain this high priority access, external entities are required to obtain a “firm supply contract” and “monthly firm transmission” as shown below, and included in CAISO’s tariff.

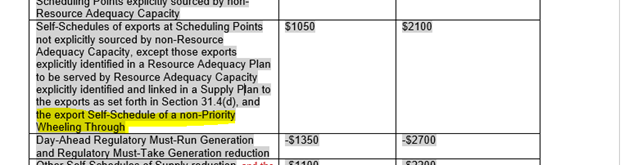

Priority Wheeling Through

A Self-Schedule that is part of a Wheeling Through transaction consistent with Section 30.5.4 that is supported by (1) a firm power supply contract to serve an external Load Serving Entity’s load throughout the calendar month and (2) monthly firm transmission the external Load Serving Entity has procured under applicable open access tariffs, or comparable transmission tariffs, for Hours Ending 07:00 through 22:00, Monday through Saturday excluding NERC holidays, from the source to a CAISO Scheduling Point. (Emphasis added.)

However, CAISO has reported that despite the “firm power supply contract” and “monthly firm transmission” requirements, external entities have reserved high priority wheel through transactions in much larger quantities than they have used, calling into question whether a “firm supply contract” means firm, in the common use of the term. For example, while external entities reserved 687 MW of high priority wheeling transactions with “firm power supply contracts” in September, they only wheeled up to 97 MW on the first 10 days in September.[2] In the words of the Market Surveillance Committee, “High priority wheels will gain the equivalent of firm access under ‘pay as you go’ terms,”[3] and this is what occurred despite these external entities attesting to holding “firm” supply contracts.

Below are estimates of wheeling payments under various scenarios that demonstrate how these pay-as-you go terms work:

- $0 -- if the external entities reserved 687 MW for “firm” power supply contracts, but did not use any of it.

- $214,176 - if the external entities reserved 687 MW, but only used 97 MW for 10 days in a month (10 days x 16 hours x $13.8/MW x 97).

- $3,640,550 -- if the external entities had to pay for transmission six days a week for 16 hours a day for what would commonly be considered a firm power contract (6 days x 16 hours x 4 weeks x $13.8/MW x 687 MW).

Given that entities only need to pay for the wheeling transaction if they wheel, this means that this is, essentially, a free option to use the transmission system paid for by California customers, $2.7 billion annually – hardly a just and reasonable result, and clearly not what was intended in requiring firm power supply contracts to reserve this transmission capacity. Accordingly, CPUC staff strongly urge CAISO to require external entities to pay for the transmission system that they reserve, for implementation next summer (and for Summer 2024 if the second phase of this initiative is delayed by another year). If this change were implemented, rather than paying only $214,000, the reservation charge would be an order of magnitude higher and would reflect costs somewhat more commensurate with the benefits of reserving this transmission capacity.

Not only does CPUC staff believe that the proposed interim provisions largely favor external entities, but CAISO itself acknowledged as much in its filing, stating that this proposal “arguably is more favorable to external entities than the frameworks of other transmission providers who reserve firm transmission capacity for native load in their initial [Available Transfer Capacity] calculations as an Existing Transmission Commitment prior to identifying the amount of transmission available to use for other transactions, including wheels.”[4]

And the Market Surveillance Committee (MSC) expressed similar concerns:

On these points we largely agree with the perspective of CAISO DMM that the CAISO’s proposed solution still grants access to the CAISO transmission system on terms that are more “open” than those typically found outside the CAISO. Our understanding of the principle of open-access is that it recognizes that transmission owners have a right and obligation to reserve the network capacity needed serve their own retail load as part of its existing transmission commitments (ETC), and that non-discriminatory access must be provided for any transmission capacity that is available after accounting for these local reliability needs (ATC). Access truly comparable to what some BAs are requesting of the CAISO would require that those BAs market all of their transmission capacity on a daily basis and treat those transactions with the same priority as their own load. This is clearly not the standard practice outside of CAISO. The CAISO, unlike other BAs, is proposing to provide high priority wheeling access without requiring a long-term commitment to pay for a higher level of firm access. Even the least “firm” of wheeling transactions, low-priority wheels scheduled in realtime could still crowd out real-time imports to serve CAISO load if those imports are priced above $400. Thus, CAISO load may have to be curtailed in order to accommodate real-time low priority wheeling transactions.[5] (Footnotes omitted and emphasis added.)

Despite these continuing concerns, CPUC staff supports the proposal to retain the existing framework, at this point in time, even if these recommended changes are not adopted, primarily because there are no other options currently on the table, given that CAISO has rejected CPUC staff and other parties’ proposals to cap or otherwise constrain – beyond the current, limited measures – the number of wheeling transactions that will be given priority equal to load during stressed system conditions.

At the same time, CPUC staff strongly opposes CAISO’s proposal to sunset this interim proposal on June 1, 2024, and return to a situation where wheeling transactions have super priority over load. The reliability concerns associated with those rules have been recognized by CAISO, as well as CAISO Board members, the MSC, the Department of Market Monitoring (DMM), as well as numerous California parties. For example, the CAISO itself recognized that returning to a situation where wheeling transactions have priority over load was, in its own words, “untenable” and “could potentially result in load shedding”:

Although the CAISO did not observe consequential wheeling through transactions during last summer’s load shed events, it expects increased wheeling through transactions this summer, which would displace RA imports under the current parameter settings. … Increased wheeling through transactions potentially can prevent the CAISO from serving its native load even from internal RA resources built to serve CAISO load and paid for by CAISO LSEs. This is untenable, and it could cause load shedding if not addressed.[6] (Emphasis added.)

It seems untenable and unjust and unreasonable to include a sunset provision in these interim rules that would result in a return to tariff provisions (that is, those that would go back into effect on June 1, 2024, absent adoption of new tariff provisions) that are widely understood to be “untenable,” that could threaten reliability and that, in CAISO’s own words, “could cause load shedding if not addressed.”

[1] Available at https://elibrary.ferc.gov/eLibrary/filelist?accession_number=20210519-5179.

[2] http://www.caiso.com/Documents/SummerMarketPerformanceReport-Sep2021.pdf, p. 6.

[3] Attachment I – Market Surveillance Committee Opinion, Load, Exports & Wheeling Tariff Amendments, available at, http://www.caiso.com/Documents/Apr28-2021-Tariff-Amendment-Load-Exports-and-Wheeling-Tariff-Amendment-ER21-1790.pdf, Attachment I, p. 16.

[4] Available at http://www.caiso.com/Documents/Apr28-2021-Tariff-Amendment-Load-Exports-and-Wheeling-Tariff-Amendment-ER21-1790.pdf, p. 59.

[5] Id, Attachment I, p. 15.

[6] Id, at p. 7.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

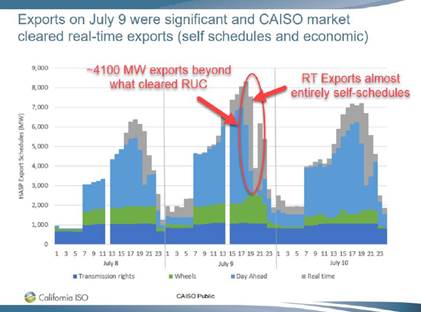

In its previous comments, CPUC staff requested additional information on exports and wheels that occurred on July 9th, as shown below:

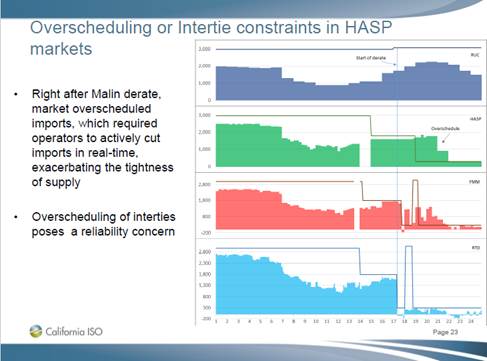

It would be helpful to understand how CAISO prioritizes LPT exports and load in the day-ahead and day-of time frame. In particular, it would be helpful if CAISO could explain why LPT exports were not curtailed on July 9th, despite being cut in the RUC process and being not feasible in the real-time market due to loss of a substantial imports due to transmission outages on Malin and NOB (see figures below).

In addition, it would also be helpful to understand when CAISO will cut wheeling transactions (including real-time wheeling transactions), when the import and the export leg are not paired. This question/concern arises from market results from July 9th, when CAISO’s portion of Malin intertie was derated from ~3,000 MW to ~300 MW because of the Bootleg fire and NOB was derated as well. Despite these derations, it does not appear that any wheeling transactions were cut, as shown in the figure below, with the day-ahead (DA) wheels and real-time (RT) wheels in green.[1]

It would be helpful to understand under what conditions wheels are cut if the import and the export leg are not paired, and whether this occurred on July 9th and why or why not.

These questions/issues were not addressed in CAISO’s revised proposal, nor were they addressed during the stakeholder call, despite the issue being raised there as well. CPUC staff’s concern is that while CAISO has indicated that wheels must be “paired,” it is not clear this occurred on July 9th. Despite losing considerable import capacity due to significant transmission outages, it does not appear that any wheeling transactions were cut.

While part of the explanation may be that the transmission penalty parameters did not cut the imports in the HASP process, and thus the wheels were mistakenly scheduled, the wheels continued to occur even after the HASP process accounted for the transmission derates (see above – hours 7 – 8 pm) and even as CAISO remained in an EEA2. Staff’s concern here is that if unpaired wheels do not get cut, then this means that CAISO and California customers will be supporting the export leg of a wheeling transaction, even if the import leg does not exist, which could jeopardize reliability for California customers.

[1] CAISO, “Summer Market Performance Report – July 2021,” September 7, 2021, p. 19, available at http://www.caiso.com/Documents/Presentation-July2021SummerMarketPerformanceReport-Call-Sept7-2021.pdf#search=summer%20market%20performance%20presentation%20July.

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

CPUC staff opposes the draft tariff language that would go into effect on June 1, 2024, in its entirety, for the reasons discussed above. Notwithstanding that opposition, CPUC staff notes that it appears that the proposed draft tariff language should omit the language highlighted in yellow below, which is contained in the draft tariff document.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

CPUC staff is pleased that CAISO staff is prioritizing Phase 2 of this initiative, but staff is concerned that the Phase 2 process could be complex and take more time than expected, which could delay implementation beyond June 1, 2024, at which time the current temporary solution would expire. This could jeopardize reliability for California customers, should this occur. In addition, CPUC staff is concerned that if CAISO develops a proposal which the CPUC does not fully support, the expiration of the current temporary solution will serve as a “sword of Damocles,” in which the CPUC could be placed in the untenable situation of supporting a sub-optimal solution for California customers and the reliability of the electrical grid, in order to prevent an even worse outcome – that is, returning to a situation where all wheel through transactions are prioritized over load and, in stressed system conditions, could result in load shedding. Further, it is unclear what incentive external entities have to agree to a revised wheeling structure, when the current structure is arguably very favorable to them and the expiration of it would be even better.

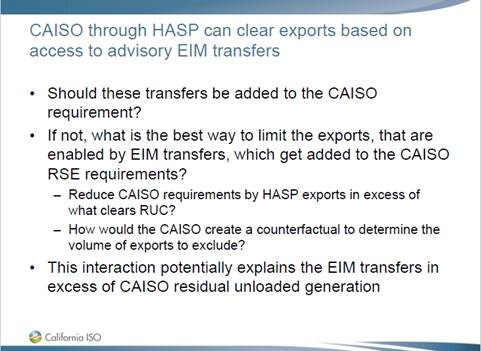

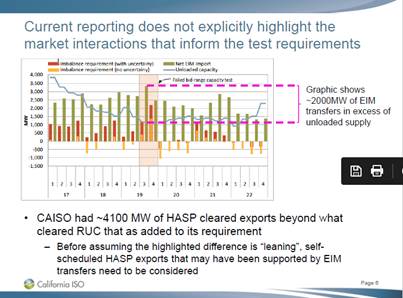

Separately, and in addition, CPUC staff recommends that the scope of Phase 2 be expanded to include the issue of advisory EIM transfers supporting exports (and more broadly of non-firm imports supporting exports). CAISO identified this issue in its EIM resource sufficiency stakeholder process and, in particular, after in-depth review of the events on July 9th, when CAISO lost access to significant transmission capacity due to the Bootleg fire, and entered into an EEA 2 and EEA3. CAISO initially identified two issues that occurred and is working to address them through, as highlighted in the following slide:[1]

In addition, CAISO recently identified another issue and that is that exports appear to be supported by EIM advisory transfers.

This crux of this approach is that CAISO and California customers could be supporting exports that are unsupported and could even fail the EIM resource sufficiency test (and be prevented from obtaining EIM imports specifically to support otherwise unsupported exports). An example is illustrative. Assume that CAISO load is 40,000 MW and that this is fully supported by 40,000 MW of internal generation (and no imports are necessary and no additional generation is available). Assume that 2,000 MW of EIM advisory imports supports exports of 2,000 MW. If the EIM advisory imports do not materialize, CAISO will not have sufficient resources to meet its load and support the exports. Alternatively, CAISO could fail the EIM resource sufficiency test and be blocked from access to the EIM imports that are necessary to support the exports. This is because the EIM advisory imports do not factor into the EIM resource sufficiency test – CAISO has 40,000 MW of resources to support its own 40,000 MW of load + 2,000 MW of exports. In this case, CAISO would fail the RSE, lose access to EIM advisory, and need to drop load.

It is CPUC staff’s understanding that CAISO would not be able to cut the exports because this entire process, the EIM resource sufficiency test, occurs after the HASP process, which is the last opportunity for CAISO to cut exports without out-of-market action, which CAISO has indicated that is unwilling or unlikely to take because it could jeopardize the reliability of another balancing authority and because of reciprocity concerns. Accordingly, this issue is of the utmost importance to the reliability and stability of the grid, especially during stressed system conditions, and should be addressed as expeditiously as possible. CPUC staff suggests that this may be the appropriate stakeholder initiative to address this important issue, since it will be addressing “market scheduling priorities.”

[1] http://www.caiso.com/Documents/Presentation-July2021SummerMarketPerformanceReport-Call-Sept7-2021.pdf, p. 23.

Imperial Irrigation District

Submitted 01/06/2022, 10:19 pm

Submitted on behalf of

Imperial Irrigation District

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Oppose with caveats

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

The Imperial Irrigation District ("IID") thanks the California Independent System Operator Corporation (“CAISO”) for the opportunity to submit comments on the Phase 1 draft final policy proposal and tariff language for the Transmission Service and Market Scheduling Priorities Initiative, which proposes to extend the interim wheeling through scheduling priorities framework through June 1, 2024. IID has raised multiple concerns regarding the framework’s treatment of exports and wheel throughs in its previous comments in this initiative and in the Market Enhancements for Summer 2021 Readiness process, yet these concerns have not been resolved. Accordingly, IID emphasizes and reiterates these concerns.

The present framework has not resolved IID’s concerns regarding the treatment of exports. For instance, the present framework fails to address resource access concerns. Contrary to what the present priorities framework appears to presume, Non-Resource Adequacy (“Non-RA”) contracts are not widely available. IID has not seen widespread availability of Non-RA resources to be able to secure and rely upon for export to serve IID load.

Further, the present framework continues to fail to address challenges in identifying resources in between the Day-Ahead and Real-Time Markets. As an entity located outside the CAISO’s Balancing Authority Area (“BAA”), IID has commented previously that it should be able to rely on its Day-Ahead E-Tag submittals carrying through with priority into the Real-Time Market. However, the change effectuated through Business Practice Manual (“BPM”) Proposed Revision Request (“PRR”) 1282 resulted in non-award of schedules to IID through the Real-Time Market that were scheduled in the Day-Ahead Market. Under PRR 1282, the CAISO’s market timeline for declining exports through publication of Residual Unit Commitment (“RUC”) awards for the day ahead horizon is too late for market participants to respond by obtaining equivalent, day-ahead products in Western markets outside of the CAISO because such markets are formally closed. This creates a considerable obstacle for IID to then obtain alternative supply quickly, as IID cannot turn to Western day-ahead markets outside of the CAISO as an option to substitute for non-awarded schedules. IID’s concerns regarding resource access and securing substitute power after the Day-Ahead Market closes have not been resolved through the stakeholder process, nor have they been resolved in this draft final policy proposal.

Additionally, the present framework has not resolved IID’s concerns regarding the burden presented by the advanced contractual commitments required for wheel through transactions. For wheel through transactions to obtain a high priority, an entity must first procure monthly firm transmission external to the CAISO BAA to reach the CAISO BAA for the hours of delivery in the executed contract. The entity must then notify the CAISO at least 45 days prior to the month of the MW quantity of the wheel, and scheduling coordinators must attest that appropriate firm transmission has been secured to the CAISO border. These requirements create unreasonably high hurdles for IID in accessing wheeled-through resources, limit the number of high priority transactions for which IID can qualify, and fail to provide IID with the flexibility it needs during peak periods. Instead, IID is left to rely on non-priority wheel-throughs, purchasing energy first and bearing a higher risk that the energy paid for will not actually flow, to serve IID’s load.

IID understands that the CAISO is extending the interim provisions to provide greater certainty as to the rules for wheeling through the CAISO system and to provide time for the CAISO and stakeholders to develop and implement the longer term transmission reservation framework. The present state of affairs, however, is unsatisfactory and fails to resolve resource access concerns and challenges, which IID has raised in previous comments. Accordingly, IID reiterates its concerns and urges the CAISO to accelerate its focus on developing more durable solutions to address these concerns.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

IID reserves the right to comment on this question at a future time.

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

IID reserves the right to comment on this question at a future time.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

IID reserves the right to comment on this question at a future time.

Joint CA LSEs

Submitted 01/07/2022, 04:59 pm

Submitted on behalf of

The comments below are submitted jointly on behalf of the Bay Area Municipal Transmission Group, the California Community Choice Association, the Cities of Anaheim, Azusa, Banning, Colton, Pasadena, and Riverside, California (collectively, the Six Cities), Pacific Gas and Electric Company, and San Diego Gas & Electric Company. The comments below refer to the entities submitting these comments as “Joint CA LSEs.”

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Support with caveats

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

The CAISO should make the completion of the remainder of this initiative a high priority in 2022.

The Joint CA LSEs support the CAISO’s proposal to extend the interim wheeling-through scheduling priorities framework approved by FERC and currently in effect, which otherwise would expire on June 1, 2022. FERC found these scheduling priorities to be just and reasonable on an interim basis, not unduly discriminatory, and consistent with open access principles. Reverting to the previously effective priorities would be unjustified.

The CAISO should make the completion of the remainder of this initiative a high priority in 2022. As such, the CAISO should consider accelerating the current Phase 2 timeline in order to open up the possibility of implementing elements of the long-term scheduling priorities framework as soon as summer 2023. The proposed two-year extension of interim scheduling priorities to June 2024 should not preclude the CAISO from striving to develop and implement remaining elements of this initiative before then. One approach to accelerating the process could be revising the Phase 2 timeline to target submitting the proposal to the CAISO Board and EIM Governing Body by August 2022, rather than December 2022.[1] We believe a modified timeline could enable the implementation of elements of the long-term scheduling priorities framework as soon as summer 2023.

The Joint CA LSEs understand the need to provide certainty for entities outside of the CAISO BAA and to set a realistic timeline for developing and implementing a new transmission reservation process. But while the interim scheduling priorities framework constitutes a significant improvement over the priorities structure previously in effect, the interim framework nevertheless falls short of providing CAISO BAA customers with reliability and native load protections that are on par with those of other BAAs. The interim framework also does not include a rate structure that ensures wheeling customers electing to obtain high priority wheeling access are contributing to the revenue requirement for the CAISO transmission system in a manner that is commensurate with receiving priority comparable to native load. The Joint CA LSEs believe that, in the subsequent phase of this initiative, the CAISO can and should consider implementing improvements to the interim scheduling priorities framework earlier than two-and-one-half years from now, as well as accelerating the process to develop and begin implementation of the long-term framework.

[1] See proposed Phase 2 schedule at pp. 31-32 of Draft Final Proposal: http://www.caiso.com/InitiativeDocuments/DraftFinalProposal-TransmissionService-MarketSchedulingPriorities.pdf

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

The CAISO should take further actions to ensure high priority (PT) exports do not exceed the non-RA capacity of designated supporting resources

The Joint CA LSEs appreciate the CAISO’s attention to concerns regarding instances in which PT export schedules could exceed the non-RA capacity of the designated supporting resource. The Draft Final Proposal includes improvements that should help mitigate the risk of underproducing or physically unavailable resources supporting PT exports. These improvements include:

- Creating new technology functionality in the Scheduling Infrastructure Business Rules (SIBR) system to provide scheduling coordinators for both the exporters and designated supporting resources with more visibility into the resource’s non-RA capacity and ability to support a PT export.

- Updating the CAISO tariff to require that the “most recent forecast” for VERs supporting PT exports, rather than the forecast at the time of bid submission, is equal to or greater than the PT export quantity.

While these are positive steps, the Joint CA LSEs disagree with the CAISO’s decision to forego the opportunity to create flexibility for the CAISO to make adjustments to PT export schedules in cases in which they exceed the non-RA capacity of the supporting resource and in order to maintain reliability.[1] We urge CAISO to reconsider its current proposal and consider ways to provide flexibility in the tariff to adjust PT export schedules, particularly in instances when the PT export can no longer be supported due to changes in the availability of the supporting resource and the CAISO BAA’s reliability is at risk. We also request that CAISO monitor and report instances in which PT exports exceed the available non-RA capacity of the designated supporting resources.

CAISO should clarify the definition of non-RA capacity

The Joint CA LSEs request clarification of non-RA capacity values that are used in determining the quantity that may support a PT export. Specifically, we ask the CAISO to address the comments made by the CPUC Energy Division on the December 20, 2021 stakeholder call that identified a potential discrepancy in the definition of “non-RA capacity” between the CAISO Tariff and the CAISO market software. We would appreciate clarification of this issue and how defining non-RA capacity as the amount above the NQC for hydro resources or the ELCC NQC for wind and solar resources would impact the amount of capacity that can be used to support PT exports.

Transparency enhancements should include monthly reporting of wheeling revenues from PT wheel through transactions

The Joint CA LSEs appreciate and support the CAISO’s publication of regular data related to wheel through and export transactions on the CAISO system. We request that the CAISO also provide monthly reporting of wheeling revenues from PT wheeling transactions.

[1] The DMM has commented that “allow[ing] curtailment of PT exports before CAISO load when availability or production capability of the designated supporting resource is observed to be less than the quantity of the associated PT export … would better align with DMM’s understanding of the practices of other BAAs, which may curtail exports associated with a specific resource in order to maintain reliability if the resource is unavailable to support the export.” California ISO Department of Market Monitoring, “Comments on External Load Forward Scheduling Rights Initiative Issue Paper (Sept. 30, 2021), available at https://stakeholdercenter.caiso.com/Comments/AllComments/61b0d47d-74ba-4d26-97d5-74468db1e99c#org-08196aef-854f-41a7-b1da-f68eec95dc5a

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

The CAISO should clarify the meaning of “the most recent forecast” for Variable Energy Resources supporting PT exports

The CAISO proposes to modify section 30.5.1(aa) to include a reference to a Variable Energy Resource’s “most recent forecast.” We would appreciate clarification of which forecast this refers to.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

As discussed under Item 2 above, the Joint CA LSEs are concerned that the extended timeline for this initiative contemplated in the CAISO’s proposal will unduly prolong elements of the interim priorities framework that fail to provide CAISO BAA customers with reliability and native load protections that are on par with those of other BAAs. To mitigate such impacts, in the subsequent course of this initiative, the CAISO should be open to accelerating the Phase 2 schedule for the long-term scheduling priorities framework and considering implementation of improvements to the interim framework earlier than two-and-one-half years from now. The CAISO should attach high priority to completion of this initiative by the end of 2022. In no event should the proposed timeline delay implementation of improvements to the priorities structure beyond June 1, 2024.

NV Energy

Submitted 01/05/2022, 03:00 pm

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Support

NV Energy supports the Phase 1 Draft Final Proposal.

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

In comments submitted on September 9, 2021, NV Energy noted, “[m]oving ahead with the continuation of the priority wheeling approach with a FERC filing immediately would give EIM Entities, especially those in the Desert Southwest, certainty as to the rules governing the qualifications for obtaining priority wheeling status as soon as possible.” NV Energy’s recommendation was for the “CAISO [to] file immediately to extend the current priority wheel structure approved by FERC for the summer of 2021 at least for the summers of 2022 and 2023.”

The Phase 1 Draft Final Proposal is very consistent with these recommendations. With the pending expiration of the current interim wheeling priority framework at the end of May 2022, NV Energy supports the Draft Final Proposal and urges the CAISO to proceed expeditiously to seek Board and FERC approval.

Every three years, NV Energy files a supply plan with the Public Utilities Commission of Nevada as part of an integrated resource plan. The Company provides annual updates to that plan to review the forecasts and assumptions, including the price and availability of external supplies. Given this structure, the CAISO’s proposal to extend the current interim approach for at least the next two summers is of great importance. NV Energy must have both: (1) certainty as to the rules and (2) time to implement them in a reasonable manner, consistent with our state regulatory review cycle. NV Energy also agrees with the CAISO that extending the existing framework for the next two summers will permit the CAISO and stakeholders to focus their efforts on the developing a long-term transmission reservation process for establishing market scheduling priorities under Phase 2 of this initiative.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

In addition to the extension of the current interim, wheeling through scheduling priorities framework for Summer 2022 and 2023, the Phase 1 Draft Final Proposal includes:

- enhancements to provide additional visibility of the non-RA capacity for a supporting resource as well as notifications when a high priority export (PT export) schedule exceeds the non-RA capacity of the supporting resource, and

- clarification to tariff language regarding PT exports from Variable Energy Resources.

NV Energy supports these improvements as they will make the CAISO practices more consistent with those used under the OATT framework in the rest of the West. NV Energy also supports the data transparency enhancements, particularly the publication of Aggregate Resource Adequacy import data and Residual Unit Commitment load forecast adjustments

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

No comments.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

NV Energy support of the Phase 1 Draft Final Proposal and the extension of the current interim, wheeling through scheduling priorities framework for Summer 2022 and 2023 is based on the realities of the current situation. Given FERC’s order of June 2020, the pending expiration of the current tariff language in May 2022, the need for certainty for the upcoming summer, and the limitations on the CAISO’s ability to file for, receive approval, and implement any alternative, this is clearly the best, and possible only, reasonable course.

This realization does not mean that NV Energy believes the current wheel through paradigm is consistent with transmission service in the rest of the West under the FERC’s pro forma, OATT. In particular, the lack of any firm transmission product shorter than a month-ahead basis, limits the ability of entities in the Desert Southwest to respond to unexpected weather, generation or transmission outages, as well as shorter-term economic opportunities for Northwestern suppliers who might not be comfortable with long-term horizon sales.

The Phase 2 background sessions to date have been helpful and NV Energy commends the presenters who have shared their experience and expertise. NV Energy is tentatively supportive of the proposed scheduled but concerned about the overall volume of significant stakeholder initiatives: EIM resource sufficiency, price formation, EDAM, resource adequacy, and others. In pursuing so many high priority issues, it will be hard to adhere to the current projected timeframes.

One change NV Energy would recommend would be to the decisional classification of Phase 2. We do not disagree that under the currently-approved framework the EIM Governing Body would only have advisory authority. Given the importance of this issue to non-California EIM Entities, their customers, and their regulators, NV Energy would respectfully request that the CAISO seek Board of Governor authorization to place this initiative under joint authority.

Salt River Project

Submitted 01/06/2022, 12:17 pm

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Support with caveats

Salt River Project Agricultural Improvement and Power District (SRP) supports with caveats the California Independent System Operator’s (CAISO) Transmission Service and Marketing Scheduling Priority (TSMSP) Draft Final Proposal (Proposal).

SRP understands and appreciates CAISO’s commitment that implementation of Phase 1 enhancements is to occur before June 1, 2022. It is critical that implementation include adequate software testing opportunities prior to implementation to ensure any errors are resolved prior to the effective date.

The EIM Governing Body decisional classification for this initiative is currently advisory. SRP requests this initiative be recategorized to joint authority because firm transmission rights for transfers will be foundational and play an important role in the Extended Day-Ahead Market (EDAM). SRP is requesting the CAISO make this change due to the evolution of the TSMSP initiative from External Loads Forward Scheduling Rights Process to its current state, as well as the new joint authority governance structure. SRP’s request for joint authority for the TSMSP initiative is similar in nature to the decisional classification change that was made by the CAISO for Day-Ahead Market Enhancements. TSMSP’s framework will ensure EDAM transfers have a high and constant degree of reliability thus justifying Joint Authority for TSMSP.

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

SRP supports, with caveats, the Phase 1 proposed extension of the wheeling through priorities and associated framework with the understanding that it is an interim solution, and not a long-term durable framework. SRP agrees that the interim Phase 1 solution provides a degree of certainty to SRP and other load serving entities for serving load during critical periods while a more durable solution is developed.

CAISO’s draft tariff language - Transmission Service and Market Scheduling Priorities - Phase 1 (Effective Jun 1, 2024) Section 4.1.1 Wheeling Through Scheduling Priorities, and page 10 of the Proposal states:

"By extending the interim wheeling through scheduling priorities framework, parties wheeling through the CAISO will continue to be able to establish scheduling priority equal to CAISO load – Priority Wheeling Through - by registering a wheeling through transaction at least 45 days ahead of the month and meeting the associated requirements. Under the interim rules the CAISO proposes to extend Priority Wheeling Through customers must demonstrate their wheeling through transaction is supported by (1) a firm power supply contract to serve an external LSE’s load throughout the calendar month, and (2) and monthly firm transmission from the source to the CAISO border for Hours Ending 07:00 through 22:00, Monday through Saturday excluding North American Electric Reliability Corporation (NERC) holidays (CAISO Tariff, Appendix A – Definition of Priority Wheeling Through)."

Sundays and holidays can be just as crucial as other days, as SRP has historically had peak summer loads occur on such days. As a result, SRP includes these dates in forward adequacy contracts and believes that such dates should be included in Priority Wheeling Through contracts, provided that customers can demonstrate or attest to the inclusion of such dates within their forward contracts. SRP requests that CAISO reevaluate its position and include on-peak hours for all days including Sundays and NERC holidays for Phase 1 implementation. As noted in the Western Electricity Coordinating Council (WECC) 2021 Western Assessment of Resource Adequacy, the risk of load loss is increasing during off-peak hours, including at night and on Sundays, as variable resources make up a larger percentage of generation portfolios (chapter 3, page 6). SRP requests the CAISO Tariff language in Appendix A be reflective of this change resulting in a strikethrough of “Saturday excluding NERC holidays” and adding the word “Sunday” as shown below:

Appendix A

Priority Wheeling Through

"A Self-Schedule that is part of a Wheeling Through transaction consistent with Section 30.5.4 that is supported by (1) a firm power supply contract to serve an external Load Serving Entity’s load throughout the calendar month and (2) monthly firm transmission the external Load Serving Entity has procured under applicable open access tariffs, or comparable transmission tariffs, for Hours Ending 07:00 through 22:00, Monday through Sunday Saturday excluding NERC holidays, from the source to a CAISO Scheduling Point."

Additionally, SRP requests that CAISO provide an opportunity for testing software functionality prior to June 2022 Phase 1 implementation to ensure all software variances are addressed prior to Summer 2022. In 2021, SRP worked with the CAISO Market Simulations team to identify a software bug related to the pro rata curtailment. This bug was fixed prior to promoting the software to production; however, EIM participants did not have an opportunity to validate the fix. In addition to this software issue, SRP is aware of a separate defect that prevented utilization of the registered priority wheel in production. SRP proposes adding formal scenarios to a Market Simulation that would allow participants to validate all relevant software that would be required for Phase 1 implementation.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

SRP appreciates CAISO’s effort toward more transparency by offering additional data reports related to this initiative. SRP will review and evaluate the scope and utility of these reports as they become available, which may result in future additional data transparency requests and refinements in the reports.

SRP requests additional transparency regarding manual curtailments, specifically the methodology CAISO operators utilize after T-75 in advance of the Hour-Ahead Scheduling Process (HASP) run for manual curtailments to reduce exports. SRP would like more information on how the CAISO operator makes the decision on who, how much, and when to curtail while conducting manual curtailments.

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

SRP requests clarification on the 2024 draft tariff language that are deletions of the language effective in 2022. SRP would like confirmation that the 2024 draft tariff language is a placeholder or clean version only so that the Phase 2 updates can be added as they become available.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.

SRP supports with caveats the Phase 2 direction and information update provided by the CAISO in the Proposal. SRP requests the CAISO implement Phase 2 – a long-term durable solution that is equitable and rooted in Open Access Tariff principles – as soon as possible before June 1, 2024, if feasible. Additionally, SRP requests that CAISO build in sufficient time for testing market software and resolving potential software variances prior to Phase 2 implementation.

WPTF

Submitted 01/08/2022, 02:00 pm

Submitted on behalf of

Western Power Trading Forum

1.

Please share your organization’s overall position on the Phase 1 draft final proposal.

Support with caveats

WPTF appreciates the opportunity to submit comments on the CAISO’s draft final proposal for Transmission Service and Market Scheduling Priorities. We understand the reasoning behind extending the interim measures through May 2024 such that there is sufficient time to vet and implement a robust and long-term durable solution with stakeholders. That being said, WPTF respectfully requests that the FERC filing includes the sunset date (e.g., May 31, 2024) in the filed Tariff language and not just in the transmittal letter to FERC.

Based on the Draft Tariff Language posted, it appears as though the CAISO is planning to draft two separate sets of languages – one with an effective date of June 1, 2022 and another with June 1, 2024. WPTF would like to first confirm that the CAISO plans to file these at FERC simultaneously and ask for approval as a package rather than just approval of the first set (Effective date June 1, 2022). Assuming this is accurate, WPTF appreciates the CAISO setting that expectation up front though suggests that maybe including the sunset date in the draft tariff language itself would be a more effective way to ensure the interim solution is no longer effective as of June 1, 2024.

The interim solution that the CAISO and stakeholder community filed to be effective for summer 2021 was done so with the understanding that it was an interim solution; it had some known issues/concerns that would need to be addressed in the effort to develop a long term solution (this effort).Thus, having the sunset date in the Tariff will ensure the known issues/concerns will not be in place any longer than the sunset date absent either another filed extension or the Tariff language reflecting the outcome of this effort. For example, it could be the case that updated Tariff language is not filed in time due to resource constraints on the CAISO side or overloaded implementation schedules. Having the sunset date in the tariff language itself will take a more proactive approach rather than passive, requiring the CAISO and stakeholders to continually move this effort forward in a timely manner.

2.

Please share your organization’s perspective on the Phase 1 proposed extension of the wheeling through priorities and associated framework for the next two summers, through Jun 1, 2024.

3.

Please share your organization’s perspective on other proposed elements of the Phase 1 draft final proposal, and any other aspects of the Phase 1 draft final proposal.

4.

Please share your organization’s perspective on the proposed draft tariff language on Phase 1 elements.

5.

Please share your organization’s perspective on the Phase 2 direction and information update, including the associated timeline for the phase.