1.

Please provide a summary of your organization’s comments on the Washington WEIM Greenhouse Gas Enhancements draft final proposal and September 29, 2022 stakeholder call discussion:

Powerex appreciates the opportunity to comment on the CAISO’s September 22, 2022 Washington State Western Energy Imbalance Market Greenhouse Gas Enhancements Draft Final Proposal (“Draft Final Proposal”)[1].

The Draft Final Proposal Will Double-Count The Output Of Clean Washington Resources

As described in the Draft Final Proposal, CAISO would use EIM dispatches, based on instructed imbalance energy, to provide WEIM entities with an annual calculation of WEIM transactions used to serve electricity demand in Washington.

The specifics of how this calculation would be performed are unclear from the Draft Final Proposal. During the stakeholder call on September 29, however, CAISO indicated that it intends to calculate a “net” EIM transaction quantity for WEIM entities in Washington equal to:

- An entity’s total load served by the WEIM; minus

- The entity’s internal generation dispatched in the WEIM.

This calculation will serve as a proxy for the quantity of WEIM imports for the respective entity.

For example, Powerex’s understanding is that an entity in Washington with 1000 MW of load served by the WEIM and 800 MW of internal generation dispatched in the EIM would be calculated to have received 200 MW of WEIM imports for purposes of Washington State GHG reporting (i.e., 1000 MW load – 800 MW generation = 200 MW import).

Netting the dispatches of internal generation and load in Washington implicitly “assigns” all of the output of in-state resources to serving Washington load. However, the CAISO already uses a separate algorithmic “deeming” approach to assign the output of resources outside of California – including EIM resources located in Washington – to imports into California that serve California load. The CAISO uses this “deeming” approach for reporting purposes under California’s Cap and Trade Program.

It is critical to note that the CAISO’s WEIM optimization model identifies resources, including those located in Washington State, as “deemed delivered” to California to be serving load in California.[2] This can occur even when the resource is not actually increasing its production in the EIM, and even when the BAA in which it resides is not actually exporting any energy.

Powerex believes this will result in systemic double-counting of the output of clean resources in Washington—and particularly Washington hydro resources—as simultaneously meeting load in two different states. Specifically, the same megawatts from the same clean resource will be:

- Explicitly deemed to have been exported from Washington to serve load in California (by the CAISO’s deeming algorithm); and simultaneously

- Implicitly assigned to meet Washington load (through the netting of generation and load to calculate each entity’s WEIM imports).

For example, assume an entity in Washington has:

- 1000 MW of load served by the WEIM;

- 800 MW of internal generation that is dispatched by the WEIM; and

- All 800 MW of the WEIM output is deemed to be delivered to California.

In this case, CAISO apparently intends to calculate and report that the entity received only 200 MW of EIM Imports. The inescapable implication is that the 800 MW produced by the resources in Washington will be simultaneously reported to:

- Washington State’s Department of Ecology as serving load in Washington State; and also

- California’s Air Resources Board as serving load in California.

The Draft Final Proposal confirms that CAISO does not intend to make any adjustments to its proposed calculation of net WEIM imports to Washington to reflect instances when the output of Washington resources is deemed to serve California load.

Not a Hypothetical Concern - Evidence from 2021

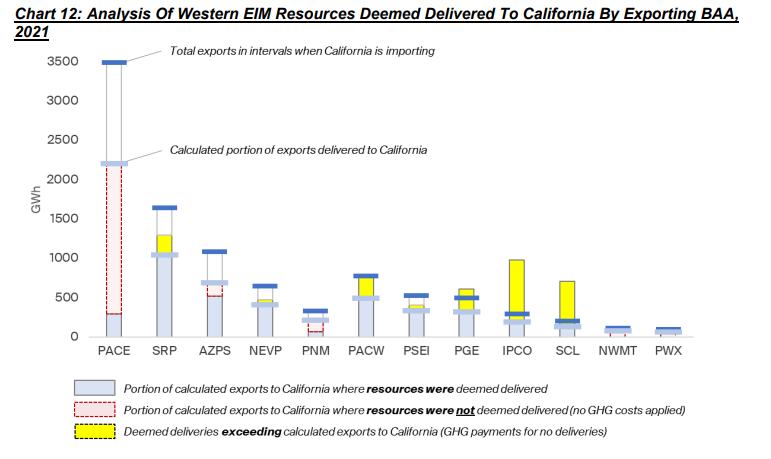

Powerex notes that the double-counting concern is not hypothetical, nor would it be insignificant.[3] Powerex’s recent analysis of the WEIM GHG approach illustrates that the WEIM deeming algorithm already results in a volume of annual deemed deliveries from hydro-based BAAs that substantially exceeds the total EIM exports from those BAAs, sometimes multiple times over.

Washington regulation creates an obligation to report a wide range of import and export activity, including that which occurs through the EIM.[4] Failure to acknowledge and include the magnitude of Washington State generation that the CAISO’s optimization model is deeming to be exported out of Washington in order to serve load in California leaves a glaring and unreported gap, as there will be no tracking or record of the volume or type of generation that must implicitly be imported into Washington State to make up for the deemed exports to California.

The Draft Final Proposal explicitly identifies that “…Washington resources attributed to California will not impact volume of net WEIM transfers into WA, as the GHG transfers will not be calculated.”[5] It is critical to note that:

1. Washington clean resources that are deemed to have served California load are paid an explicit payment (GHG shadow price) by CAISO in the EIM for this delivery.

2. Failure to recognize the offsetting unspecified imports to Washington State that are created by deeming Washington generation as serving California load, will:

- reduce the demand for Washington State carbon allowances; and

- reduce the incentives to procure new clean and renewable supply by allowing the same clean resources to simultaneously meet load in two different states.

The CAISO’s proposed calculation of imports will result in clear and unambiguous double-counting of clean resource output towards both California and Washington’s carbon pricing programs, and is in clear conflict with the environmental goals of these programs. Powerex urges the CAISO to revise its calculation of imports. Avoiding this double-counting would be straightforward, requiring that the reported import quantity into Washington State for each applicable entity for each interval be increased to properly reflect the quantity of that entity’s Washington sourced electricity that the CAISO is reporting as serving load in California.

The Draft Final Proposal Risks DEBs That Do Not Allow Washington GHG-Emitting Resources To Accurately Reflect Their GHG Compliance Costs

Powerex supports the CAISO’s proposal to allow generation resources located inside Washington state that are subject to Washington GHG regulation to include GHG compliance costs in the calculation of their default energy bids and default commitment costs, recognizing that these are real costs that in-state generators face (and therefore will appropriately include in their hourly offer prices in the WEIM).

Prior to an allowance auction in Washington, CAISO proposes to use $41/MTCO2e as a proxy for the cost of Washington GHG allowances. CAISO’s proposal is based on a modelling scenario produced by Vivid Economics that assumes that the Washington program will be linked with California by 2025. The same report also provides a second “no linkage” scenario that results in an estimated allowance cost of $58/MTCO2e. Both values are estimates only. The only known information regarding the potential cost of allowances that will be available prior to an auction is the ceiling price, expected to be roughly $80/MTCO2 for 2023[6].

Powerex believes CAISO must balance two competing risks:

- That an inaccurately low DEB could cause Washington resources to sell their output below their actual costs (including their own independent estimate of their GHG compliance costs) when CAISO’s market power mitigation procedures are triggered; or

- That an inaccurately high DEB could allow GHG-emitting resources in Washington to successfully identify and exercise local market power by increasing their offer prices relative to their actual costs, and that those actions could have a material impact on competitive outcomes in the WEIM.

Powerex believes that this latter potential risk - of local market power being exercised based on over-stated GHG costs - is very limited, for several reasons:

- The difference between using the allowance ceiling price of approximately $80/MTCO2e (relative to CAISO’s proposal to use $41/MTCO2e) is only roughly $17/MWh[7] for a typical natural gas plant;

- The timeframe for using the cap is limited until the first auction occurs; and

- The WEIM is a competitive market in which natural gas resources in Washington will continue to be highly incented to offer their supply at their estimated marginal costs.

For these reasons, Powerex believes that the risk of local market power being exercised and having a material impact on competitive market outcomes due to over-stated GHG costs is de minimis and falls well short of warranting the negative consequences of potentially over-mitigating resource to levels that are below their costs.

Powerex instead believes that CAISO should respect the autonomy of each market participant to submit offers that are consistent with their own independent estimate of their operating costs, including their potential GHG compliance costs.

[1] Draft Final Proposal - Washington WEIM Greenhouse Gas Enhancements

[2] CARB MRR §95102 - “Imported electricity” means electricity generated outside the State of California and delivered to serve load located inside the State of California.…. Imported electricity shall include Energy Imbalance Market (EIM) dispatches designated by the CAISO's optimization model and reported by the CAISO to EIM Participating Resource Scheduling Coordinators as electricity imported to serve retail customers load that are located within the State of California. (definition shortened, emphasis added).

[3] See Powerex.com (July 2022). “Examining the Western EIM’s Deeming Approach to GHG Pricing Programs” (executive summary and full paper available). Chart 12 from the full paper demonstrates that several balancing authorities experienced deemed exports of specified generation to California that exceeded their total physical exports during the same periods.

[4] WAC 173-441-124.(3).(a).(ii) Delivered electricity. The electric power entity must report imported and exported electricity in MWh disaggregated by first point of receipt (POR) or final point of delivery, as applicable, and must also separately report imported and exported electricity from unspecified sources and the energy imbalance market, and from each specified source. First points of receipt and final points of delivery (POD) must be reported using the standardized code used in e-tags, as well as the full name of the POR/POD. (emphasis added)

[5] CAISO Draft Final Proposal, page 9. GHG Transfers as calculated by CAISO are otherwise referred to as “deemed deliveries” from outside California to serve California load.

[6] See WAC 173-446-335 (page 59) for an explanation of the calculation of the auction ceiling price.

[7] A typical gas plant in Washington may face a potential GHG compliance cost of approximately $34.50/MWh (i.e., 0.43 MTCO2e/MWh * $80/MTCO2e). CAISO’s proposal to use an allowance price of $41/MTCO2e, however, would only allow a gas plant to include GHG costs in its default bid for approximately $17.50/MWh.