Bay Area Municipal Transmission Group (BAMx)

Submitted 09/16/2022, 03:12 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

Bay Area Municipal Transmission Group (BAMx)[1] is pleased to submit these comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder meeting.

BAMx supports developing a mechanism for entities with loads outside of the CAISO Balancing Authority Area to be able to obtain priority scheduling rights comparable to native load, but has some concerns about CAISO’s straw proposal. CAISO’s benchmarking in Appendix 2 shows that only two of the four ISO/RTOs include a forward reservation process (PJM and MISO). NYISO and ISO NE do not have such a process. If priority scheduling rights are to be made available by CAISO, they should be made available only after undertaking a reasonable determination of available transfer capability (ATC). Such a determination must account for transmission needed to meet native load needs under stressed system conditions, taking into consideration uncertainty. The party receiving the priority scheduling rights should be required to pay for the associated transmission capacity an amount that is commensurate with the benefits received.

BAMx believes that the analysis and mechanisms used to identify ATC available for wheeling should be used to release additional Maximum Import Capability (MIC) on an annual and monthly basis for native load use, prior to releasing the capacity for wheeling.

[1] BAMx comprises City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

2.

Provide your organization’s comments on the design principles discussed in section 4:

BAMx supports the design principles included in section 4:

- Ensure the CAISO maintains sufficient transmission capacity to meet native load needs reliably while providing non-discriminatory access to the transmission system consistent with open access principles;

- Ensure the framework is compatible with the CAISO’s existing, unique market design and does not unduly disrupt that design;

- Minimize seams issues between the CAISO organized market and the OATT framework prevalent across the west, while recognizing differences between the two frameworks exist;

- Support reliable service to load in the CAISO and across western balancing authority areas; and

- Ensure CAISO has the tools and processes necessary to manage the grid reliably.

3.

Provide your organization’s overall comments on calculating ATC in the monthly horizon, as described in section 5.1.1. In particular, the different approaches for calculating native load needs as an existing commitment and other components of the ATC methodology as discussed in the proposal. The ISO encourages stakeholders to share potential alternative methods for consideration in calculating components, particularly native load needs.

BAMx supports CAISO’s proposal to use a rolling 13-month horizon for calculating monthly ATC, but CAISO should use an increasing Transmission Reliability Margin (TRM) value for each future month to recognize there is greater uncertainty about the availability of transmission and the level of imports needed to serve native load the further one looks to the future. CAISO acknowledged this effect in Section 5.1.1 by planning to utilize more informed (and updated) assumptions in month 1 than in months 2-13. But CAISO should explicitly use higher TRM values for each future month to account for greater uncertainty about loads, transmission topology, and hydrological conditions within California that have a significant impact on the need for imports to serve native load. As the delivery month nears, and the transmission topology, California hydro availability and load forecasts are more certain, and actual RA showings are substituted for historical showings, the TRM could be reduced. More investigation is needed about whether a Capacity Benefit Margin (CBM) should be included, as is done by the two eastern RTOs that have a forward reservation process. If a CBM is not included, the TRM should be increased to address the potential EEA2+ emergency conditions.

4.

Provide your organization’s comments on each of the ISO’s proposed approaches for calculating existing transmission commitments (ETC) as it relates to the ATC methodology as described in section 5.1.1.2. Particularly, the ISO seeks comment on the methods or approaches identified for estimating native load needs across a 13-month horizon and encourages stakeholders to suggest potential variations to inputs in deriving the amount of transmission capacity to set aside for native load needs.

BAMx believes that the ATC methodology needs to take into consideration the amount of transmission reasonably expected to be available to support wheel through transactions, after taking into consideration transmission needed to serve native load under stressed conditions in the CAISO BAA. The approaches being considered by CAISO for determining the amount of transmission available to support wheel through transactions are mostly backwards looking. That is, they rely on historical RA showings or historical net interchange to estimate how much transmission to release for wheel through transactions. The approaches do not appear to consider the potential power flow impacts of the wheels and of resources within CAISO, including potential forced outages, on the deliverability of the proposed wheel through transactions. In contrast, CAISO’s benchmarking in Appendix 2 shows that each of the two RTOs that offer forward reservations incorporate forward looking assumptions about loads and the impacts of internal generation into their ATC assessments. PJM incorporates generation effectiveness factors and MISO includes forced outage rates in its assessment. PJM also has limited dependence on imports, unlike CAISO, so the ramifications for PJM’s native load of overstating the ATC are likely to be less severe than for CAISO. Because CAISO’s approaches rely on historical information, rather than a deliverability assessment using power flow modeling, there could be greater risk on native load that there will be insufficient transmission available to meet native load needs under stressed conditions.

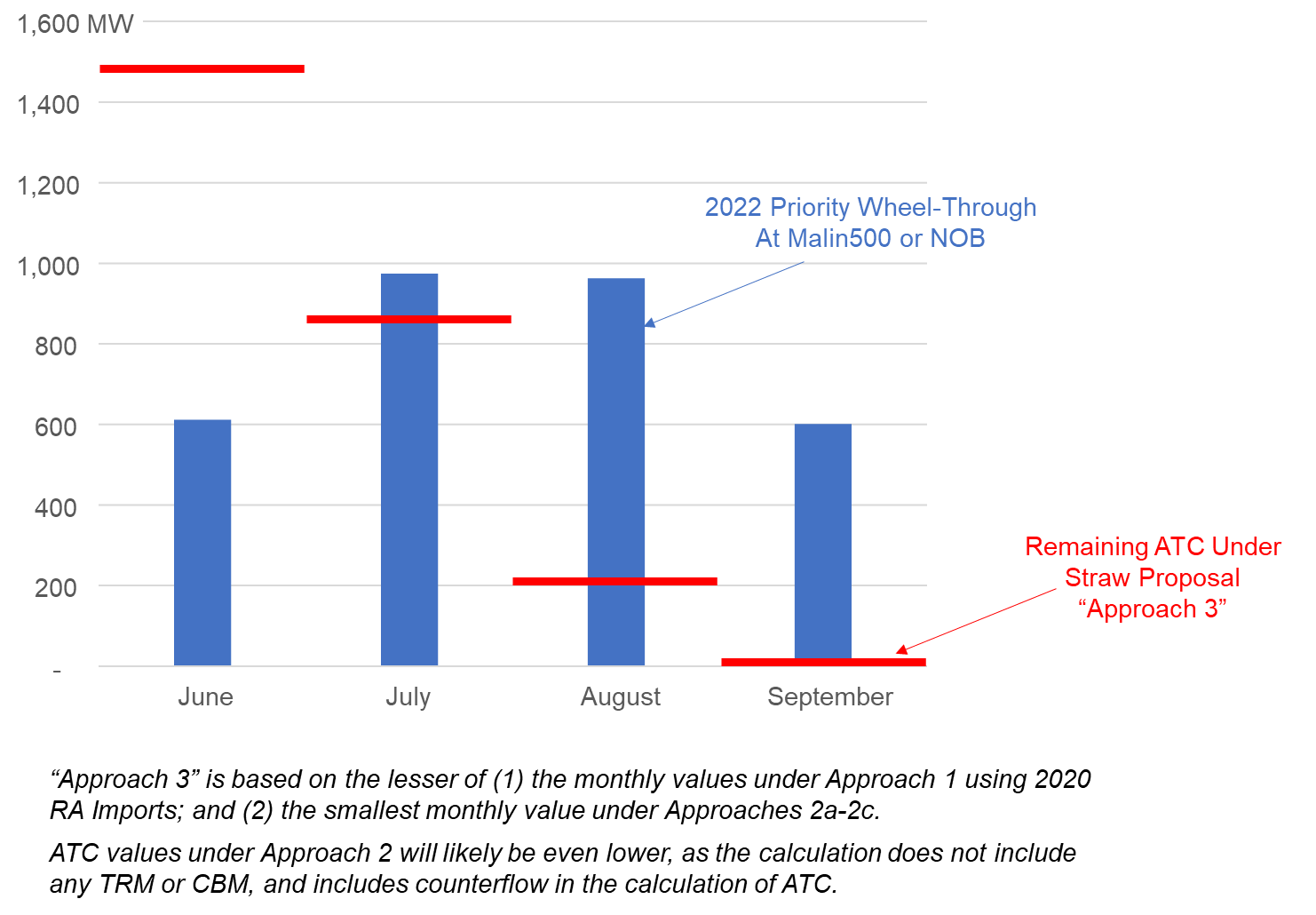

Of the three approaches proposed by CAISO, Approach 3, which uses the higher of the amounts determined to be needed to serve native load of Approach 1 (Historical RA showings) and Approach 2 (Historical Flows), is the most appropriate for ensuring that the transmission capacity that has been, and will be, paid for by native load is first made available to meet native load needs. However, modifications may be needed for both Approach 1 and Approach 2 to ensure that native load needs are protected, consistent with approaches used in other BAAs.

Historical RA showings are based on 1-in-2 loads and are limited by MIC allocations that have been determined using conservative assumptions much further from the delivery month than is being proposed by CAISO for priority wheeling. Because of these factors, CAISO may need to use a significantly higher TRM adjustment to reflect that imports are used to address incremental increases in load above 1-in-2 conditions, and to fill in for reductions in hydro generation availability during dry years. The 5% level used in the analysis for Approach 1 could understate the usage of intertie capacity to address extremely variable hydrological conditions and load variations that are met using imports. BAMx suggests CAISO perform more analysis of the historical reliance on imports to serve load before determining the appropriate TRM adjustment for Approach 1. BAMx notes that historical Import RA showings understate CA LSE potential future usage of their MIC allocations, since parties can use these allocations to address increases in the monthly load forecast, or to address known outages of internal resources ahead of their monthly RA showings, which leads to under-utilization of the potential import capacity for RA showings, but preserves the transmission for market transactions and use during stressed conditions. To address this, CAISO should use a higher TRM as the reservation horizon increases. As the delivery month nears, and California hydro availability and load forecasts are more certain, and actual RA showings are substituted for historical showings, the TRM could be reduced.

For the historical import flows serving native load approach, the data provided by CAISO in the spreadsheets showed that for Malin, there are 1200 MW of existing contracts. During June-September 2021 450 MW were made available to the market, thus 750 MW remained as existing commitment. The implication of this is that analysis implicitly assumes that 450 MW of existing contract rights will continue to be made available to support wheel through transactions, without a commitment by the rights holder to do so. CAISO’s methodology, particularly beyond the prompt month, should not assume that existing contract rights will be available to support wheel through transactions. Similar issues apply for the applicable TRM for the historical import flow approach as for the RA Showings approach.

If CAISO does not adopt a forward looking methodology, it should take a conservative approach to determining the transmission to release. That is, it should use the results from Approach 2A (single highest net load peak per month) and Approach 2B (five highest net load peak hours) to identify the maximum amount of capacity needed to meet native load. CAISO also should use more than just a few years of data to make its determination, since the amount of imports needed for native load can vary greatly based on hydrological conditions.

Whichever approach is used, prior to releasing ATC for wheel through purposes, CAISO should provide an opportunity for CAISO LSEs to obtain incremental MIC consistent with the levels indicated in the analysis for each intertie.

5.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to the ATC methodology, as described in section 5.1.1.3:

CAISO should use an increasing TRM value for each future month to recognize there is greater uncertainty about the availability of transmission and the amount of imports needed to serve native load the further one looks to the future. CAISO acknowledged this effect in Section 5.1.1 by planning to utilize more informed (and updated) assumptions in month 1 than in months 2-13. CAISO should explicitly use higher TRM values for each future month to account for greater uncertainty about loads, transmission topology, and hydrological conditions within California that have a significant impact on the need for imports to serve native load. As the delivery month nears, and the transmission topology, California hydro availability and load forecasts are more certain, and actual RA showings are substituted for historical showings, the TRM could be reduced. In addition to these factors, TRM also can account for simultaneous path feasibility and loop flow. CAISO did not describe how it intends to account for simultaneous path feasibility and loop flow in determining the appropriate TRM.

CAISO is not proposing to include a Capacity Benefit Margin (CBM), despite the benchmarking in Appendix 2 – Benchmarking of Practices of RTOs and ISOs, Western Transmission Providers that shows that both ISOs/RTOs that offer forward transmission reservations include a CBM to address EEA2 or higher emergencies. More information is needed about why these entities use a CBM, and the ramifications for including/not including a CBM in the CAISO’s forward reservation process.

6.

Provide your organization’s overall comments on calculating the ATC in the daily horizon, as described in section 5.1.2:

BAMx believes a better approach for the daily ATC calculation would be for CAISO to perform operational engineering studies to calculate the daily ATC, rather than to rely only on the updated transmission topology and updated RA showings or the historical import flows. The latest load forecast and resource availability are critical inputs for determining whether import transmission is likely to be available in excess of native load needs, and these would not be reflected in any of the CAISO’s proposed approaches.

7.

Provide your organization’s comments on calculating existing transmission commitments (ETC), particularly native load needs, as it relates to the calculation of daily ATC, as described in section 5.1.2.2:

CAISO is proposing to calculate daily ATC on a rolling two-day basis prior to running the DAM and therefore can update the different inputs based on the most recent information and grid conditions to derive an ATC value across interties. CAISO is proposing to use updated information about the transmission topology, but would not use updated load forecast information or updated information about internal generation availability, for either the historical RA showing approach or for the historical import flow approach. BAMx believes a better approach for the daily ATC calculation would be for CAISO to perform operational engineering studies to calculate the daily ATC, rather than to rely only on the updated transmission topology and updated RA showings or the historical import flows. The latest load forecast and resource availability are critical inputs for determining whether import transmission is likely to be available in excess of native load needs, and these would not be reflected in any of the CAISO’s proposed approaches.

8.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to daily ATC, as described in section 5.1.2.3:

BAMx believes CAISO should include a TRM for the daily ATC calculation, but we would expect the daily TRM could be lower than the forward TRM. Conversely, the CBM likely would need to be consistent with the forward assumptions to address potential EEA2+ conditions.

9.

Provide your organization’s comments on the method for accessing ATC to establish wheeling through scheduling priority, as described in section 5.1.3. In particular, consider comments on the requirements identified for accessing ATC.

CAISO is proposing that parties requesting access to the limited ATC provide a demonstration of an executed firm power supply contract, or demonstration of ownership of a resource to serve external firm load, and pre-payment of the transmission charges equal to the monthly volumes associated with the underlying power supply contract. BAMx suggests an alternative approach that would not require demonstration of a firm contract or ownership, and instead prioritize awards based on the proposed length of service. The minimum pre-payment amount would be for 16 hours for the daily product and one month x 16 hours for all other products. Parties requesting longer terms would receive awards over parties requesting shorter terms. The party would pre-pay for the entire award, with a minimum daily payment for 16 hours and a minimum monthly payment for 16 hours/day for each month. There would need to be a true-up to reflect any changes to the WAC charge over the course of the wheeling priority, since WAC rates can be updated multiple times throughout the year.

10.

Provide your organization’s comments on the proposed enhancement to establish a window during which the submitted requests are vying for limited ATC based upon the underlying duration of the supply contract duration of ATC request as described in section 5.1.3:

See response to Item 9.

11.

Provide your organization’s comments on a wheeling through priority rights holder’s ability to resell the wheeling through scheduling priority as described in section 5.1.3:

If BAMx’s proposed approach to not require the contract demonstration and instead apply a minimum commitment quantity is adopted, there would be no reason to prevent a wheeling through priority rights holder from reselling the wheeling through scheduling priority. If, however, the contract requirement remained, questions would need to be addressed about a comparable underlying contract to support the continued priority.

12.

Provide your organization’s comments on the ISO’s proposal to establish a process through which entities seeking to establish wheeling through priority on a long-term basis (longer than 1-year) can do so through submission of a study request and the ability to fund upgrades on the ISO system, including the ability of import (wheel in) requests driving Maximum Import Capability (MIC) upgrades as described in section 5.1.4:

BAMx supports the study process approach proposed by CAISO for long-term (greater than 1 year) wheeling through priority requests, but opposes the CAISO having the choice of moving forward with the project as a reliability, economic or public policy transmission project. Such upgrades should be identified as part of the CAISO’s Transmission Planning Process and should not be influenced by the wheeling priority process. In other words, although the wheeling through priority requests can be studied along with the generator interconnection requests per the Generator Interconnection and Deliverability Allocation Procedures (GIDAP)[1], the transmission upgrades triggered by them should not be offered the same treatment as the generator interconnection requests. After all, the interconnected generation is primarily procured by California LSEs and used to meet California’s public policy goals. On the contrary, CAISO’s proposed approach could result in CAISO LSEs funding upgrades that are not needed to serve CAISO loads, do not provide economic benefits to CAISO loads commensurate with their costs, and do not meet California’s public policy goals. If such projects otherwise would meet these requirements, then they should be identified and pursued as part of the current Transmission Planning Process. Furthermore, the incremental cost associated with any expansion in the scope of the reliability, economic, or public policy transmission projects identified in the CAISO TPP that is driven by wheeling priority requests should be funded by the requesting wheeling through customer.

[1] CAISO Business Practice Manual, Generator Interconnection and Deliverability Allocation Procedures, 2022.

13.

Provide your organization’s comments on compensation for wheeling through scheduling priority, as described in section 5.1.5, along with any suggestions your organization may have regarding other potential ways to assess transmission charges for high priority wheeling through transactions:

As noted in response to Item 9, the minimum pre-payment amount should be for 16 hours for the daily product and one month x 16 hours for all other products. The party would pre-pay for the entire award, with a minimum daily payment for 16 hours and a minimum monthly payment for 16 hours/day for each month. Shorter durations fail to provide adequate compensation for the fixed costs of the transmission used to support the wheeling through priority. In addition, for any duration less than one year, the rate paid should be a premium over the WAC rate (e.g., 140% of the WAC), consistent with how other BAAs charge a premium for their short-term products. The application of such a premium should not require an overhaul of the CAISO transmission rate design, as it is merely a factor to reflect the fact that the WAC rate is based on annual CAISO load assumptions, while the shorter term wheeling priorities would cover periods less than a year.

14.

Provide your organization’s comments on the proposed WEIM decisional classification, as described in section 6:

For the reasons outlined in Section 6 WEIM Decisional Classification, BAMx supports the CAISO’s conclusion that the proposals in this initiative fall outside the scope of joint authority, and because the proposals contemplate changes to the rules of the real-time market the WEIM Governing Body would have an advisory role regarding these changes.

15.

Provide any additional comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

No additional comments at this time.

Calpine

Submitted 09/15/2022, 01:39 pm

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

The CAISO’s historic practice of allocating all transmission on an hourly basis has failed to adequately facilitate the growing demand for high priority, regional transfer capacity on an open-access, non-discriminatory basis. The “wheeling wars” that spawned significant debate as well as interim rules in 2020, provided undeniable evidence of fundamental open-access issues and disagreements between regional partners.

Calpine appreciates the CAISO’s effort to address this tension by attempting to define its own native load obligations. Calpine does not comment on the technical calculations of native load reservations and leaves that effort to experts.

However, Calpine does have significant concerns, as described below, with the CAISO proposals for acquiring high-priority transmission rights from and through, the CAISO service territory. We expand on these three points in more detail below:

- The CAISO fails to address in any manner, how parties will be allowed to obtain firm export capacity.

- The CAISO’s proposal to tie transmission capacity access to energy contracts with external load serving entities is nationally unprecedented, administratively incomprehensible, discriminatory, and create an unsolvable commercial “chicken-and-egg” problem.

- The CAISO’s proposal to force longer-term transmission service requests into the overheated, impenetrable, interconnection queue is similarly unprecedented.

2.

Provide your organization’s comments on the design principles discussed in section 4:

The principles stated in section 4 suggest a need to design transmission reservation mechanisms that accomodate the CAISO’s “unique market design,” "recognizes differences” and does "not unduly disrupt that design”. Calpine believes that once capacity in excess of native load obligations is established, there is little unique or different about that CAISO capacity when compared to other markets. As such, Calpine would prefer a principle stating that once the CAISO determines its native load obligation, access to the remaining capacity “adheres to the just and reasonable provisions and procedures of Order 888 (OATT) to the maximum extent possible.”

3.

Provide your organization’s overall comments on calculating ATC in the monthly horizon, as described in section 5.1.1. In particular, the different approaches for calculating native load needs as an existing commitment and other components of the ATC methodology as discussed in the proposal. The ISO encourages stakeholders to share potential alternative methods for consideration in calculating components, particularly native load needs.

No Comment

4.

Provide your organization’s comments on each of the ISO’s proposed approaches for calculating existing transmission commitments (ETC) as it relates to the ATC methodology as described in section 5.1.1.2. Particularly, the ISO seeks comment on the methods or approaches identified for estimating native load needs across a 13-month horizon and encourages stakeholders to suggest potential variations to inputs in deriving the amount of transmission capacity to set aside for native load needs.

Calpine would support “Approach 1” to estimating native load capacity requirements at the interties. This approach would set aside capacity that was historically contracted under Resource Adequacy provisions (plus, possibly an accommodation for load growth.) Approach 1 preserves the value of the RA program – which in itself is based on reliability metrics – and supports future competitive contracting.

Calpine does not support the alternatives (2, 2A, 2B, 2C, 3) which propose to allocate scarce intertie capacity to native load based on all historical import flows across interties (presumptively adjusted for wheels and exports). This approach includes both economic- and reliability-based transactions. In essence, it would create a superior priority for native load inappropriately based on historic economics, not on reliability metrics. It would do nothing to encourage future RA contracting at the ties.

5.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to the ATC methodology, as described in section 5.1.1.3:

No Comment

6.

Provide your organization’s overall comments on calculating the ATC in the daily horizon, as described in section 5.1.2:

No Comment

7.

Provide your organization’s comments on calculating existing transmission commitments (ETC), particularly native load needs, as it relates to the calculation of daily ATC, as described in section 5.1.2.2:

No Comment

8.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to daily ATC, as described in section 5.1.2.3:

No Comment

9.

Provide your organization’s comments on the method for accessing ATC to establish wheeling through scheduling priority, as described in section 5.1.3. In particular, consider comments on the requirements identified for accessing ATC.

Calpine does not support the proposals included in Section 5.1.3.

First, we observe that the discussion does not address any conditions, process, or requirements to obtain high priority export service. This service should be a point-to-point service from a resource to an export point that has the same priority as load. The relative priorities of firm exports, wheeling and load must be addressed in the next draft of this initiative.

Second, the conditions of section 5.1.3 create an unsolvable chicken-and-egg problem. The proposed provisions require that in order to qualify for short-term firm transmission service, one must be able to demonstrate an energy consumption contract with an external load-serving entity. Hence a chicken-and-egg – one cannot reasonably execute a delivery contract without transmission and, if the CAISO proposal stands, one cannot get transmission without a contract.

To Calpine’s knowledge, no other OATT in the nation has a requirement tying wheeling or export service to a contract with an external load serving entity – and for good reason. Energy and capacity delivery contracts (especially, ones that attempt to overcome the CAISO’s past practices and the legacy of the “wheeling wars”) will require a demonstration of high priority transmission. Simply put from a commercial standpoint, transmission acquisition must precede supply contracting.

In the next draft of this proposal, if this tying arrangement survives, the CAISO must describe why it is necessary. Specifically, why is the CAISO concerned whether load is being served under long-term, short term, sporadic or opportunistic supply arrangements as long as it is receiving the fully allocated cost-of-service for the reserved transmission?

Third, the CAISO appears to further restrict transmission contracting to the hours of delivery in the underlying LSE supply contract. Again, no other OATT on the planet has a restriction that says, if you buy transmission, you only get priority for the hours in the underlying supply contract. Calpine questions the ability (or wisdom of doing so, even if possible) of the CAISO differentiating transmission rights on an hourly basis – conditions that may change day-to-day or month to month. In other OATT markets, an entity that is paying the full cost-of-service for capacity that is in excess of native load requirements has the rights to use it if, whenever, and however they choose. The CAISO should not depart from this simple and widely accepted precedent.

Fourth, the CAISO proposes that an entity that has a 6 by16 contract would have priority over an entity that has a 5 by 16 contract. Again, if this proposal survives, the CAISO must provide an explanation of the economic efficiency that is promoted by this “hours-based” preference and access mechanism.

These conditions would all create the need for new systems, allocation rules, business practices and ultimately costs. They will raise the reasonable risk premia charged in the market, will create great need for training and will likely result in unintended consequences.

Alternatively, Calpine suggests that the CAISO pattern wheel and export transmission access like all other just and reasonable FERC OATT point-to-point rules. These rules are based on posting available transmission (ATC), request windows, principles of first-come, first-served, full cost-of-service and no undue restrictions on use or resales. Several vendors (including the CAISO’s consultant, OATI) could stand-up a reservation system quickly and at very low cost.

10.

Provide your organization’s comments on the proposed enhancement to establish a window during which the submitted requests are vying for limited ATC based upon the underlying duration of the supply contract duration of ATC request as described in section 5.1.3:

See Answer 9

11.

Provide your organization’s comments on a wheeling through priority rights holder’s ability to resell the wheeling through scheduling priority as described in section 5.1.3:

See Answer 9

12.

Provide your organization’s comments on the ISO’s proposal to establish a process through which entities seeking to establish wheeling through priority on a long-term basis (longer than 1-year) can do so through submission of a study request and the ability to fund upgrades on the ISO system, including the ability of import (wheel in) requests driving Maximum Import Capability (MIC) upgrades as described in section 5.1.4:

Calpine sees no reason why the CAISO cannot adopt an analysis and study process similar to other Transmission Operators. Most TOs maintain two separate queues – one for transmission service and another for generation interconnection service. Transmission service requests that cannot be satisfied with available, posted, ATC are studied independently and are processed under tariff-based timelines independent of, and generally much more quickly than generation interconnection requests.

On the other hand, the CAISO proposes to insert transmission service requests into the generation cluster process. Without further explanation and detailed timelines, Calpine objects to this proposal as it could have the following effects:

- Places a one-year transmission service request behind over 200 Gigawatts of long-lived generation interconnection requests.

- Results in a minimum processing period of two and a half years

- Requires a significant rewrite of the GIDAP, to revise elements like site-control, electrical characteristics, modeling files, study deposits and credit requirements.

- Places all transmission service requests in the same queue window, possibly delaying submissions and defeating the widely-accepted principle of first-come, first-served.

The proposal also grants the CAISO a unilateral “right-of-first-refusal” to build transmission projects proposed in the cluster process and needed to support a transmission service request. An entity that seeks transmission service could therefore have to wait for (1) the queue cluster process to clear (2.5 years) and (2) the full processing of the next sequential TPP process (another 1.5 years) before upgrades would be considered. If an entity is willing to pay for an upgrade, Calpine sees no need for this ROFR.

Finally, the CAISO should clarify its proposal for the nature and duration of rights granted to entities willing to fund upgrades in order to receive firm rights. For instance, why would an investor only receive transmission credits and not all attributes, including the value of congestion and or reductions in losses? Would the rights be granted for the life of the facilities? Would the rights be protected from degradation because of load growth or generation interconnection? Would the CAISO commit to capital investment to avoid such degradation? How would this process interact with merchant development of transmission where the owner can seek full cost-of-service, rate-of-return ratemaking and regulation?

13.

Provide your organization’s comments on compensation for wheeling through scheduling priority, as described in section 5.1.5, along with any suggestions your organization may have regarding other potential ways to assess transmission charges for high priority wheeling through transactions:

No Comment

14.

Provide your organization’s comments on the proposed WEIM decisional classification, as described in section 6:

No Comment

15.

Provide any additional comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

Thanks

NV Energy

Submitted 09/15/2022, 07:04 am

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

Since the start of operations in March 1998, the CAISO has provided wheel-through transmission from the Northwest to the Desert Southwest. While CAISO experienced rolling blackouts in August 2020, these events were not caused by wheel-through transactions.[1] Nevertheless, CAISO acted in April 2021, right before the start of the critical summer season, to impose new, interim restrictions on wheel-though transactions. As approved by FERC in June 2021,[2] and as implemented by CAISO on August 4, 2021, entities can establish a firm (“high scheduling priority”) transmission reservation by registering a wheel-through transaction at least 45 days ahead of the month and demonstrating: (1) a firm power supply contract to serve an external Load Serving Entity’s load throughout the month, and (2) transmission for the month has been procured to deliver the supply to the CAISO border. According to a recent DMM report, a maximum of 408 MW of high priority wheels were used to cross CAISO’s system in July 2022.

On January 27, 2022, CAISO filed to extend the interim wheeling approach through May 31, 2024, to allow the CAISO and stakeholders additional time to develop a durable scheduling priorities framework, while providing certainty regarding the rules for wheeling through the CAISO system during the summer of 2023. On March 15, 2022, FERC approved the extension.[3]

NV Energy appreciates the opportunity to comment on the Initial Phase 2 Straw Proposal. We recognize the challenge for CAISO Staff to balance the needs of CAISO native loads with providing open access transmission to customers across the CAISO Controlled Grid in a manner commensurate with what the other western transmission providers offer under their FERC-mandated OATTs.

On July 29, 2022, CAISO posted the Initial Phase 2 Straw Proposal. The schedule in section 7, anticipates that the initiative will come to the Board of Governors for a decision in March of 2023. A FERC filing in April 2023 would mean a decision in June 2023, less than a year prior to the Summer 2024 season. Moreover, this is likely a “best case”. In accordance with its state requirements, NV Energy manages resource procurement by submitting an integrated resource plan every three years with a Supply Plan that is updated in years two and three. Accordingly, NV Energy is already looking for supply not only for the Summer of 2023, but also for the Summer of 2024. If a decision from FERC is not expected until June 2023, NV Energy would have finished two full requests for proposals (RFPs) for Fall 2022 and Spring 2023 that would be soliciting for Summer 2024 supply. Without certainty on rules, it will be difficult to execute on any high priority wheel through transactions which will lower the amount of available supply to participate in the RFPs. The CAISO should do everything feasible to bring what is likely to be a contested proceeding to FERC at the earliest possible date.

[1] See the CAISO’s April 28, 2021 filing letter in Docket No. ER21-1790 at 7 (“[t]he CAISO did not observe consequential wheeling through transactions during last summer’s load shed events . . .”).

[2] Cal. Indep. Sys. Operator Corp., 175 FERC ¶ 61,245 (2021).

[3] Cal. Indep. Sys. Operator Corp., 178 FERC ¶ 61,182 (2022).

2.

Provide your organization’s comments on the design principles discussed in section 4:

The CAISO proposes five criteria to guide the initiative:

- Ensure the CAISO maintains sufficient transmission capacity to meet native load needs reliably while providing non-discriminatory access to the transmission system consistent with open access principles;

- Ensure the framework is compatible with the CAISO’s existing, unique market design and does not unduly disrupt that design;

- Minimize seams issues between the CAISO organized market and the OATT framework prevalent across the west, while recognizing differences between the two frameworks exist;

- Support reliable service to load in the CAISO and across western balancing authority areas; and

- Ensure CAISO has the tools and processes necessary to manage the grid reliably.

With respect to the first criteria, it should be modified to “Ensure the CAISO maintains sufficient transmission capacity to support the external reservations of native load customers while providing non-discriminatory access to the transmission system consistent with open access principles. Consistent with the OATT principle, transmission reservations for network customers should be based on the CAISO LSE’s demonstration that they own or have committed to purchase the generation pursuant to an executed contract.

In addition, NV Energy would offer an addition to the second criteria so that it includes supporting the resource sufficiency requirements of EIM and EDAM. As the CAISO noted in Initial Phase 2 Straw Proposal:

There are interdependencies between this initiative and the Extended Day Ahead Market Enhancements (EDAM) initiative. The EDAM design reflected in in the EDAM straw proposal contemplates that entities depending upon import resources to meet their resource sufficiency evaluation will need to demonstrate and make available to the market high quality transmission associated with the delivery of that import, i.e., “Bucket 1” transmission. This ensures that high quality transmission supports resources used to demonstrate resource sufficiency, instilling further confidence in transfers and making high quality transmission available to the market to support transfers between EDAM balancing authority areas.

If the goal of this initiative is to establish a durable, long-term framework, it must also be compatible with the anticipated EDAM design.

3.

Provide your organization’s overall comments on calculating ATC in the monthly horizon, as described in section 5.1.1. In particular, the different approaches for calculating native load needs as an existing commitment and other components of the ATC methodology as discussed in the proposal. The ISO encourages stakeholders to share potential alternative methods for consideration in calculating components, particularly native load needs.

As the transmission provider, CAISO bears the burden to establish its native load obligations, as well as the amount of transmission capacity required to serve native load, and CAISO must justify any conditions that it seeks to impose upon the customers’ transmission service.[1] FERC has recognized that a transmission provider may reserve in its calculation of ATC transmission capacity necessary to accommodate native load growth reasonably forecasted in its planning horizon however “the Transmission Provider is obligated to provide transmission service to others… out of capacity reserved for native load growth up to the time the capacity is actually needed for such future needs.”[2] Additionally, “[n]ative load growth may be considered by the Transmission Provider in its calculation of its ATC, so long as the claimed load growth is reasonably forecasted and is supported by a reasonable plan for network resources to meet that native load growth.”[3] Stated another way, a transmission provider cannot simply identify a level of load growth but must identify an expected load growth.

For example, CAISO cannot simply equate a certain percentage of load growth with an increased native load reservation on each and every intertie. Rather there must be a connection to a plan of service similar to the CAISO’s recent solicitation of interest in external wind resources.[4] Increased reservations with the Pacific Northwest would not be needed if CAISO LSEs plan to meet that load growth through a combination of: (1) in-state storage and other in-state resources, (2) off-shore wind, (3) out-of-state wind imported into Southern California from SWIP North, TransWest Express, Sunzia, or other projects connected into southern California, (4) geothermal from Imperial Valley or Nevada connected into southern California, or (5) rooftop solar or distributed generation resources.

CAISO proposes to calculate a monthly ATC value, across a rolling 13-month horizon, stating that this is “largely consistent with the horizon other western transmission providers use, under their OATTs, to calculate monthly firm ATC.” As noted below in response to Question 12, the CAISO misapplies the OATT practice by missing a key step – making an evaluation whether ATC is available, even for a request of more than a year, before initiating a study process. To be clear, the CAISO’s proposed process sets up a discriminatory preference for California LSEs who may engage in multi-year forward contracts. Thus, for any supply agreement with duration more than a year in advance, CAISO LSEs are the only potential counterparties.

[1] Sierra Pacific Power Co., 143 FERC ¶ 61,144 (2013) at P. 115.

[2] Order No. 888, FERC Statutes and Regulations, Regulations Preambles January 1991-June 1996 P 31,036, at pp. 31,693-94; and Order No. 888-A, FERC Statutes and Regulations P 31,048, at pp. 30,219-21.

[3] Arizona Public Service Company v. Idaho Power Company, 87 FERC ¶ 61,303 (1999), on reh’g 89 FERC ¶ 61,061 (1999) at 61,203.

[4] 2021-2022 Transmission Planning Process - Accessing Out-of-State Wind Resources: ISO Responses to Comments, Request for Expressions of Interest Posted (caiso.com).

4.

Provide your organization’s comments on each of the ISO’s proposed approaches for calculating existing transmission commitments (ETC) as it relates to the ATC methodology as described in section 5.1.1.2. Particularly, the ISO seeks comment on the methods or approaches identified for estimating native load needs across a 13-month horizon and encourages stakeholders to suggest potential variations to inputs in deriving the amount of transmission capacity to set aside for native load needs.

The CAISO proposes to calculate ATC across a rolling 13-month horizon and permit entities seeking to wheel through the CAISO to establish a firm transmission scheduling priority by reserving that ATC in advance. CAISO proposes to set aside: (1) a reasonable amount of transmission capacity for meeting native load needs, and (2) transmission capacity to account for different uncertainties because the monthly ATC is calculated far in advance of need. CAISO then potentially doubles up on this uncertainty by applying a transmission reliability margin (TRM) and/or a capacity benefit margin (CBM).

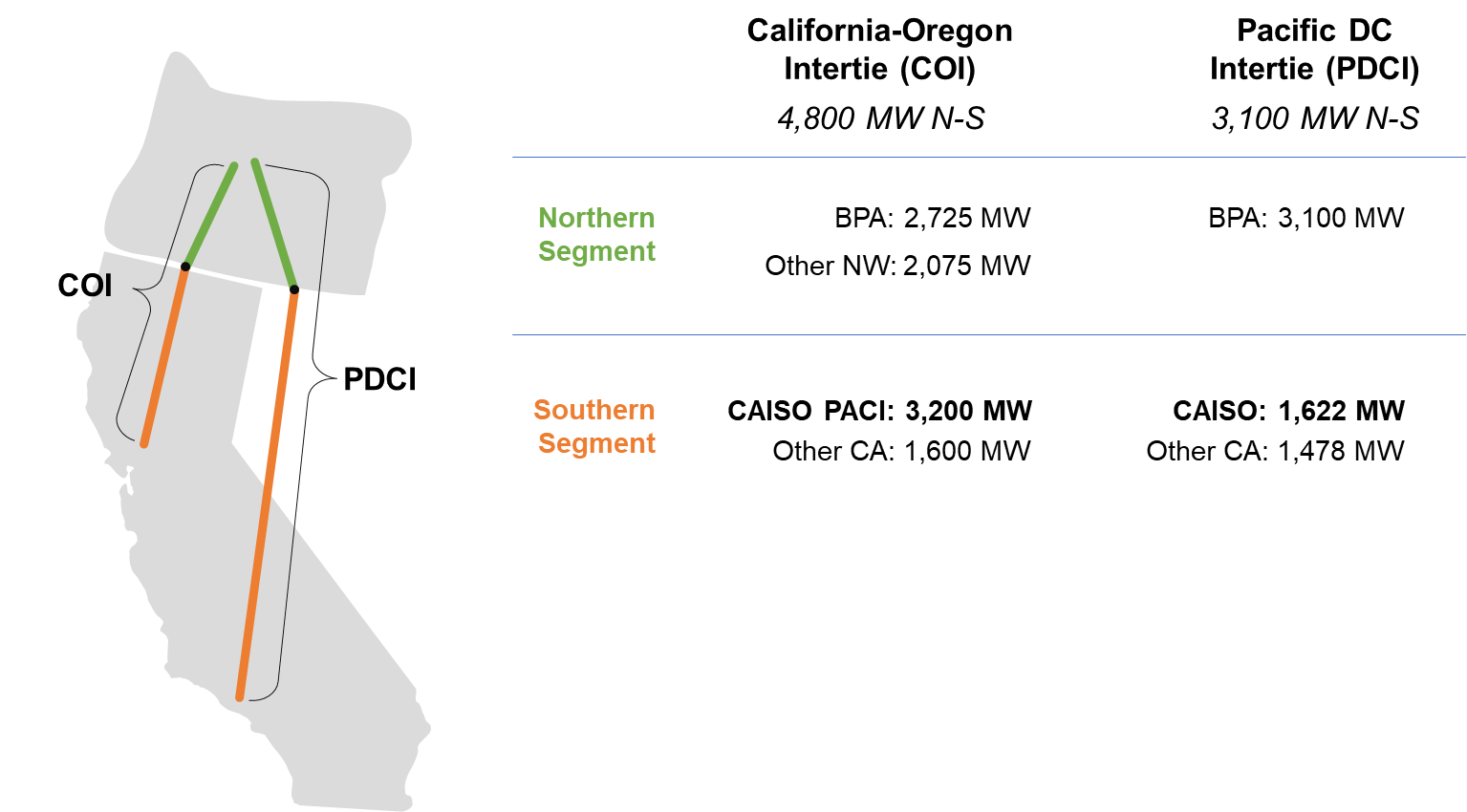

CAISO identifies several approaches to determining the native load set-aside. Approach 1 is based on historical monthly Resource Adequacy showings. Approach 2 is based on historical import flows across interties attributable to serving native load. This would either represent native load needs based on the volume of imports during the single highest net load peak hour for the month; represent native load needs based on the average volume of imports during the five highest net load peak hours for the month; or represent native load needs based on the average volume of imports during the highest 10% of net load peak hours for the month. Approach 3 would be the “higher of” approaches 1 and 2.

NV Energy notes that none of the approaches are based on prospective supply contracts executed by CAISO LSEs for identified physical capacity that is firmly deliverable to the CAISO boundary as is the practice under the Commission’s OATT. NV Energy also challenges CAISO’s description of a 13-month projection as “far in advance”. Again, FERC’s requirement is that the transmission provider is obligated to provide transmission service to others out of capacity reserved for native load growth up to the time the capacity is actually needed for such future needs.

Moreover, with respect to Approaches 1 and 2, CAISO should provide additional information on the proposed TRM and CBM methodology. NV Energy would strongly oppose Approach 3 as it would provide an improper level of conservativeness with respect to native load reservations.

5.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to the ATC methodology, as described in section 5.1.1.3:

NV Energy utilizes a TRM, to meet its obligations under the Wester Power Pool Reserve Sharing Agreement. A total TRM of 375 MW is allocated 175 MW to the Sierra Pacific northern system and 200 MW to the Nevada Power southern system. NV Energy does not reserve a CBM. An examination of the OASIS shows that none of the Desert Southwest transmission providers set aside CBM.[1]

NV Energy recognizes that FERC indicated in Order No. 890 that transmission providers may set aside TRM for (1) load forecast and load distribution error, (2) variations in facility loadings, (3) uncertainty in transmission system topology, (4) loop flow impact, (5) variations in generation dispatch, (6) automatic sharing of reserves, and (7) other uncertainties as identified through the NERC reliability standards development process. However, care must be taken to prevent double-counting of uncertainty as it will lead to an unnecessary reduction in ATC. This is especially true under the CAISO proposals where, unlike the methodology typical of OATT providers, CAISO is not basing the reservation of native load only on actual forward contracts, but includes a factor for historical usage and uncertainty under different conditions.

In the Straw Proposal, CAISO repeats the Order No. 890 factors but does not provide examples on how they would be applied. Rather, CAISO “expects” a TRM of 2-10% across interties. This is an extremely wide range. In the next iteration of the Straw Proposal, CAISO should provide additional detail on the methodology that will be used for any final determinations and justifications with respect to TRM and CBM.

[1] NV Energy, Capacity Benefit Margin Policy (“NV Energy Transmission Service Provider (TSP) has not defined a need to maintain CBM on any of its interfaces in the Operating, Planning, or Study Horizons. As such, the importing and exporting CBM on all interfaces is set to zero.”), available at http://www.oasis.oati.com/NEVP/. Arizona Public Service Co. CBM is currently set at zero for all ATC paths for all periods. See http://www.oasis.oati.com/azps/index.html; Salt River Project does not currently set aside CBM. Seehttp://www.oasis.oati.com/SRP/index.html; It is Tucson Electric Power Company’s (“TEP”) practice to not set aside transfer capability for CBM. Therefore, TEP’s CBM value is set to zero (0). Should TEP determine that it is necessary to use an amount other than zero (0) for CBM, TEP will post the required information on its OASIS, including any required reasons and or methodology used in determining the CBM and location, See TEP Capacity Benefit Margin Implementation Document, http://www.oatioasis.com/tepc/index.html.

6.

Provide your organization’s overall comments on calculating the ATC in the daily horizon, as described in section 5.1.2:

The CAISO proposes to calculate Daily ATC across a rolling 2-day horizon ahead of the Day Ahead Market close. Going into the Day-Ahead Market, external entities could know whether they have secured ATC to support a firm wheeling through transaction. In the daily ATC horizon, the CAISO will calculate existing uses similar to the manner in the monthly horizon with the addition that CAISO would include wheel through transactions that secured firm scheduling rights in the monthly time horizon.

NV Energy strongly supports the development and implementation of the day-ahead firm transmission product. Daily firm transmission service is required under the OATT. It also can be a vital tool in EDAM. As noted in the EDAM Revised Straw Proposal,

This revised straw proposal maintains the bucket 1 transmission framework whereby each BAA must make bucket 1 transmission available to the market to support resource sufficiency plans across an intertie with an adjoining EDAM BAA. As such, bucket 1 would consist of transmission rights held by transmission customers of the EDAM entity or other transmission service providers within the EDAM BAA that have contractual agreements for energy or capacity transfers used for RSE accounting purposes in the day-ahead timeframe. In other words, if EDAM entity A relies on a resource located in the adjacent EDAM entity B area, EDAM entity A would need to bring bucket 1 transmission to deliver that resource across the interface.

Bucket 1 transmission must be firm or conditional firm for the market to have confidence in reliable transfers.

Depending on the elements that support any TRM holdback, these could be adjusted from the monthly process based on shorter-term forecasts and current system conditions.

7.

Provide your organization’s comments on calculating existing transmission commitments (ETC), particularly native load needs, as it relates to the calculation of daily ATC, as described in section 5.1.2.2:

Please see response to (6).

8.

Provide your organization’s comments on the Transmission Reliability Margin (TRM) and the Capacity Benefit Margin (CBM) as it relates to daily ATC, as described in section 5.1.2.3:

Please see response to (6).

9.

Provide your organization’s comments on the method for accessing ATC to establish wheeling through scheduling priority, as described in section 5.1.3. In particular, consider comments on the requirements identified for accessing ATC.

The CAISO proposes that ATC be accessible on a first-come first-served basis by qualified entities seeking to wheel through the CAISO system. Monthly ATC can be accessed during the period for which it is calculated, effectively up to 365 days in advance and up to 30 days prior to flow. Daily ATC can be accessed three days prior to flow and up to one day prior to flow by the close of the DA market for the applicable day (10am). The CAISO further proposes that wheeling through scheduling priority be established for the period of the underlying duration of the supply contract supporting the wheeling through priority. For example, if the underlying supply contract provides for firm energy delivery on a 6x16 basis (6 days a week, 16 hours), the wheeling through scheduling priority is established for that particular period. The periods for which wheeling through scheduling priority may be established would be commensurate with the duration of resource adequacy imports that can be secured, e.g., 7x24, 6x16, 6x8, and 6x4, as described further in section 5.1.5. NV Energy supports these proposals.

The CAISO proposes the following pre-requisites must be met in order to access the limited ATC: (1) demonstration of an executed firm power supply contract to serve external load, a firm power supply contract to serve external load where execution is contingent upon the availability of wheeling through scheduling priority on CAISO’s system, or demonstration of ownership of a resource to serve external load; and (2) pre-payment of transmission charges equal to the monthly volumes associated with the underlying power supply contract. Similar to California resource adequacy contracts, CAISO proposes that wheeling through transactions establishing firm service have a duration each month no less than 6x4.

NV Energy supports the requirement that in order to secure firm transmission service the customer demonstrate a contract to serve load. The requirements are similar to those associated with external Designated Network Resources under the OATT paradigm and will help prevent speculation over extremely limited transmission. The CAISO has not demonstrated that pre-payment is necessary. This requirement should be removed from the next proposal as it is unduly discriminatory to the non-CAISO LSEs. Under the existing CAISO Tariff and the OATT’s of the external parties, there is no pre-payment of transmission charges. Rather these are assessed on a monthly basis after-the-fact. Moreover, pre-payment is not needed to differentiate firm transmission from non-firm under the CAISO proposal. Firm transmission is charged on a demand basis based on the type of contract. Non-firm transmission continues to be charged only for the hours in which the energy actually flowed.

One aspect of the requirements of interest is what is not there – a requirement that the external agreement have firm transmission to the California border to secure firm transmission across the CAISO Controlled Grid. At first glance, this change from the current interim rules associated with high priority wheels appears less discriminatory – neither the CAISO LSEs nor the external LSEs need to secure firm transmission to secure firm service into and across CAISO. Upon further analysis, this change appears to be inconsistent with OATT policy and EDAM and could send improper price signals regarding the value of firm transmission external to California. In a pleading before the CPUC, CAISO has noted,

it is common practice among other ISOs to require RA imports be supported by Firm transmission from source to sink which has the highest curtailment priority. Similarly, under non-organized market pro-forma OATT, when it comes to service to Native Loads and Network Loads by “off-system” (import) designated network resources, these resources must be delivered to the BAA on Firm transmission service because these resources are critical to the LSEs ability to serve load.[1]

Again CAISO recognized, under the OATT,

A load serving entity seeking to designate an off system network resource must provide: (a) the source balancing authority area where the resource is located; (b) the transmission arrangements supporting delivery of the “off-system” resource, which must be on firm or conditional firm transmission across intervening transmission systems to the border with the balancing authority area, for the duration of the designation period; and (c) an attestation the capacity is under contract and not committed to any other third parties. Independent system operators and regional transmission organizations impose similar requirements on imports providing resource adequacy or capacity.[2]

The CAISO went on to state that the firm service requirement was, “intended to ensure import resources dedicated to serving load are not speculative and provide greater assurance of delivery to the border with the balancing authority area even when there are supply shortages or conditions across intervening systems may be transmission constrained.”

Thus, the better question may be not why is the CAISO removing the requirement for wheel-through transactions but rather why is the CAISO not imposing a firm transmission requirement to the CAISO border for CAISO resource adequacy resources that will qualify for an allocation of the firm import transmission capacity. Indeed, the practice of all other RTOs and the pro forma OATT appears to be reflected in the Revised EDAM Straw Proposal.

This revised straw proposal maintains the bucket 1 transmission framework whereby each BAA must make bucket 1 transmission available to the market to support resource sufficiency plans across an intertie with an adjoining EDAM BAA. As such, bucket 1 would consist of transmission rights held by transmission customers of the EDAM entity or other transmission service providers within the EDAM BAA that have contractual agreements for energy or capacity transfers used for RSE accounting purposes in the day-ahead timeframe. In other words, if EDAM entity A relies on a resource located in the adjacent EDAM entity B area, EDAM entity A would need to bring bucket 1 transmission to deliver that resource across the interface.

Bucket 1 transmission must be firm or conditional firm for the market to have confidence in reliable transfers.[3]

Absent the requirement that both CAISO LSEs and Non-CAISO LSEs retain the same firm to-the-border requirement, CAISO is creating a dynamic where CAISO LSEs do not need to compete for and properly support the value of firm transmission on external transmission systems. Simply by exercising monopoly control over what goes into and through the CAISO Controlled Grid, CAISO dictates usage of the external transmission, as the CAISO recognized in the Resource Adequacy Enhancements Draft Final Proposal-Phase 1 and Sixth Revised Straw Proposal:

There is a reason why the eastern ISO/RTOs have required that resource adequacy imports be supported like native load in the host balancing authority areas. It sends the signal for parties to procure that service, either from the transmission provider or from the secondary markets. Secondly, if firm transmission is not available, it sends the signal that there may be a need for additional enhancements on existing transmission systems external to the CAISO. Such enhancements may be necessary if California intends to count resource adequacy imports to meet its requirements. It also sends the strong signal to existing holders of firm transmission rights and other parties that there may be an opportunity to trade their rights through secondary markets. Firm transmission procured through such secondary markets retains the firmness of the service traded. Although this might affect the cost of obtaining these arrangements, it may be necessary to ensure California load is served by dependable imports. If California seeks to ensure that dependable capacity is available to it, it must take the actions necessary to ensure that result.[4]

The CAISO must approach the wheel-through initiative and EDAM in a consistent, coordinated manner. Bucket 1 firm transmission should be part of both the resource adequacy and resource sufficiency expectations.

[1] California Independent System Operator Corp., Final Track 3.B Proposals at Attachment B page 39, CPUC Docket. No. 19-11-009 (Dec. 19, 2020) (emphasis added), http://www.caiso.com/Documents/Dec18-2020-FinalTrack3BProposals-ResourceAdequacy-Exhibits-R1911009.pdf In that same pleading, CAISO goes on to state,“Firm transmission rights on interties are used to meet the needs of utilities across the west.” Id. at 47-48.

[2] California Independent System Operator Corp., Track 3B.1 Proposals at 4-5, CPUC Docket. No. 19-11-009 (Jan. 28, 2021), https://docs.cpuc.ca.gov/PublishedDocs/Efile/G000/M362/K887/362887738.PDF .

[3] August 16, 2002, Revised Straw Proposal at 26 (emphasis added).

[4] California Independent System Operator Corp., Reply Comments on Workshop Report and Proposals at 10-11, CPUC Docket. No. 19-11-009 (Mar. 6, 2020), http://www.caiso.com/Documents/Mar11-2020-ReplyComments-WorkshopReport-Proposals-ResourceAdequacy-R19-11-009.pdf.).

10.

Provide your organization’s comments on the proposed enhancement to establish a window during which the submitted requests are vying for limited ATC based upon the underlying duration of the supply contract duration of ATC request as described in section 5.1.3:

The CAISO is contemplating establishing a limited window during which entities seeking a wheeling through priority submit a request for the limited ATC across an intertie with the request(s) having the longer underlying supply contract receiving preference to the ATC over those supported by a shorter underlying supply contract. For example, a request for ATC to establish wheeling through priority based on an underlying 6x16 supply contract would have preference to the ATC over a 6x8 or a 6x4 supply contract to the extent there is not sufficient ATC to accommodate all requests.

For example, all requests submitted on the same day would compete against each other so that after the request submission period there is certainty regarding who has established scheduling priority. The same process could apply to accessing ATC in the daily timeframe. A request seeking to establish priority for 16 hours would have preference over one seeking to establish priority for 8 or 4 hours.

NV Energy does not have a comment on this aspect of the proposal.

11.

Provide your organization’s comments on a wheeling through priority rights holder’s ability to resell the wheeling through scheduling priority as described in section 5.1.3:

The CAISO proposes that the holder of an established wheeling through scheduling priority can resell the firm transmission right during the term of the priority and based upon the underlying duration of the supporting supply contract. NV Energy supports the proposal with conditions to prevent this proposal to be an end-run of the original requirements. First the reseller should be required to record, subject to DMM’s review the reason for the changed conditions supporting the resale. Second, the buyer must meet the original qualifying conditions, specifically an executed firm power supply contract to serve external load, a firm power supply contract to serve external load where execution is contingent upon the availability of wheeling through scheduling priority on CAISO’s system, or demonstration of ownership of a resource to serve external load.

12.

Provide your organization’s comments on the ISO’s proposal to establish a process through which entities seeking to establish wheeling through priority on a long-term basis (longer than 1-year) can do so through submission of a study request and the ability to fund upgrades on the ISO system, including the ability of import (wheel in) requests driving Maximum Import Capability (MIC) upgrades as described in section 5.1.4:

The CAISO proposes that any request for firm transmission service more than 13 months out would automatically be assigned to the “annual” interconnection request study process. NV Energy understands that the current CAISO interconnection queue contains approximately 236,000 MW of renewable capacity and storage and that study process for the April 2021 supercluster with 62% of the resources will be complete by November 24, 2023. NV Energy further understands that the interconnection cluster 15 study was delayed from April 2022 to April 2023 and that the volume of projects seeking in-service dates of 2026 or earlier is 10 times the amount required to be procured to meet CPUC preferred system plan targets. Thus, the CAISO’s proposal appears to consign any wheeling request greater than a year in length or greater than a year in advance to a prolonged odyssey rather than promote a realistic path consistent with OATT practice.

First, CAISO’s proposal fails to treat interconnection and transmission as separate products with separate queues contrary to long-standing FERC policy.[1] Thus, priority in the interconnection queue does not automatically translate to priority in the award of transmission capacity.[2] By studying the requested transmission service with generator interconnections, the CAISO is arbitrarily assigning transmission capacity to generator interconnections during the study process which would lead to more significant and costly transmission upgrades.

Second, by directly assigning the request to the interconnection study queue, CAISO omits a crucial step from the OATT. Under the OATT, “The Transmission Provider shall notify the Eligible Customer as soon as practicable, but not later than thirty (30) days after the date of receipt of a Completed Application either (i) if it will be able to provide service without performing a System Impact Study or (ii) if such a study is needed to evaluate the impact of the Application.” CAISO simply assumes a study is always needed.

If, for example, NV Energy seeks to purchase 50 MW of capacity in September 2024 not only for the following summer, but also for the Summer of 2026, CAISO’s response is not to even look to see if that would be feasible based on existing ATC. Rather, it is to consign the request to a process that is unlikely to have an outcome prior to the requested service date.

After releasing the facility study, the CAISO will have “first choice” to move forward with the project as a reliability, economic, or public policy transmission project if it meets the applicable criteria under the tariff. If so, the CAISO will reimburse the facility study cost to the original requestor and any other requesting party. If the CAISO does not approve the project under one of these transmission categories, the entity – whether a wheeling through customer or some other entity -- can choose whether to proceed with the transmission upgrade. CAISO should clarify that it not necessarily an elective “choice” but rather a test to see if the project meets the applicable criteria.

[1] Tennessee Power Co., 90 FERC ¶ 61,238, at 61,761-62 (2000) (interconnection service is separate from and does not convey a right to transmission delivery service); Entergy Services, Inc., 91 FERC ¶ 61,149, at 61,559 (2000); Arizona Public Service Co., 94 FERC ¶ 61,027 at 61,076, order on reh'g, 94 FERC ¶ 61,267 (2001). See also Interstate Power & Light Co. v. ITC Midwest, LLC, 144 FERC ¶ 61,052 at P 36 (2013) (“[E]ach generator, or other transmission customer, seeking to use the transmission system to deliver power from the generator must take transmission service and pay the transmission provider’s transmission service rates separate from paying for any interconnection-related network upgrade costs”).

[2] This distinction is reflected in longstanding precedent, Order No. 2003, and the OATT. Order No. 2003, the Commission explained at P 23 that “Interconnection Service or an interconnection by itself does not confer any delivery rights from the Generating facility to any points of delivery.” Standardization of Generator Interconnection Agreements and Procedures, Order No. 2003, FERC Stats. & Regs. ¶ 31,146, 104 FERC ¶ 61,103 at P 23 (2003) (citations omitted) (“Order No. 2003”), order on reh’g, Order No. 2003-A, FERC Stats. & Regs. ¶ 31,160 (2004) (“Order No. 2003-A”), order on reh’g, Order No. 2003-B, FERC Stats. & Regs. ¶ 31,171 (2004) (“Order No. 2003-B”), order on reh’g, Order No. 2003-C, FERC Stats. & Regs. ¶ 31,190 (2005) (“Order No. 2003-C”), aff’d sub nom. National Association of Regulatory Utility Commissioners v. FERC, 475 F.3d 1277 (D.C. Cir. 2007).

13.

Provide your organization’s comments on compensation for wheeling through scheduling priority, as described in section 5.1.5, along with any suggestions your organization may have regarding other potential ways to assess transmission charges for high priority wheeling through transactions:

The CAISO states that applying the transmission charge only during hours when the priority wheeling through is scheduled does not reflect the value conferred to a priority wheeling through customer and proposes that high priority wheeling through transactions prepay for transmission access based upon the underlying quantity and duration of the power supply contract supporting the wheel through transaction to serve external load.

While CAISO would continue to charge its own LSEs on an energy basis, NV Energy can support the proposal to charge firm transmission customers on a demand basis in accordance with the quantity and duration of their supply contract. This is a unique application combining a rate based on energy usage to a demand charge. NV Energy would not support application of a 24/7 demand charge unless the CAISO converts its own LSEs to a similar demand charge for transmission usage.

As noted in response to Question 9, the CAISO has not demonstrated that pre-payment is necessary. This requirement should be removed from the next proposal. Under the existing CAISO Tariff and the OATT’s of the external parties, there is no pre-payment of transmission charges. Rather these are assessed on a monthly basis after-the-fact. Moreover, pre-payment is not needed to differentiate firm transmission from non-firm under the CAISO proposal. Firm transmission is charged on a demand basis based on the type of contract. Non-firm transmission continues to be charged only for the hours in which the energy actually flowed. Based on the CAISO Tariff language, a pre-payment requirement from third party transmission system users seems discriminatory in nature.

14.

Provide your organization’s comments on the proposed WEIM decisional classification, as described in section 6:

The CAISO Board of Governors and the WEIM Governing Body have joint authority over any proposal to change or establish any CAISO tariff rule(s) applicable to the EIM Entity balancing authority areas, EIM Entities, or other market participants within the EIM Entity balancing authority areas, in their capacity as participants in EIM. This scope excludes from joint authority, without limitation, any proposals to change or establish tariff rule(s) applicable only to the CAISO balancing authority area or to the CAISO-controlled grid.

The CAISO proposes to place the initiative under the sole authority of the Board of Governors because,

None of the currently contemplated tariff changes would be “applicable to EIM Entity balancing authority areas, EIM Entities, or other market participants within EIM Entity balancing authority areas, in their capacity as participants in EIM.” Instead, the proposed tariff rules would be applicable “only to the CAISO balancing authority area or the CAISO-controlled grid.” Accordingly, these proposals fall outside the scope of joint authority.

This determination does not withstand scrutiny. The ability to access external supply and bring it on a firm basis to the Desert Southwest is a vital element in passing the EIM Resource Sufficiency Test. CAISO recognizes that there are “interdependencies” with the EDAM initiative because the “EDAM design reflected in in the EDAM straw proposal contemplates that entities depending upon import resources to meet their resource sufficiency evaluation will need to demonstrate and make available to the market high quality transmission associated with the delivery of that import. NV Energy agrees that this demonstrates the wheel-through initiative is a critical element of EDAM. However, the fact that the transmission is not identified as a self-schedule day ahead makes it no less important to the EIM Entity required to pass a real-time resource sufficiency evaluation in order not to be cut-off from the real-time market. The firmness of transfers through CAISO is a vital element of the EIM resource sufficiency process which is itself a vital element in regional reliability.

NV Energy submits that the Transmission service and market scheduling priorities is clearly related to EIM Entities and their customers due to their participation in the EIM and the relation to the EIM resource sufficiency test. Accordingly, the initiative falls within the joint authority of the EIM Governing Body and the CAISO Board of Governors.

Moreover, even if this relationship did not exist, no initiative has been more divisive with respect to a division between the CAISO LSEs and the regional EIM participants. The CAISO Board of Governors should recognize the importance for independent decisional participation and ensure that this initiative is taken up under joint authority. FERC has stated, “[c]ontrol of the Board by one state threatens the CAISO’s ability to treat in-state and out-of-state transmission users on a non-discriminatory basis, thus undermining the prospect of broader regional cooperation in the West.”[1] The Governing Board should take immediate action. As FERC noted in the same order, “even the perception that the authority who controls the interstate grid is biased can be enough to prevent proper market forces from working, thus hindering market reliability and efficiency.” To remove this perceived bias, the CAISO’s proposal will benefit from a joint authority review and approval, prior to a filing at FERC.

[1] Mirant Delta, LLC, 100 FERC ¶ 61,059, at P 57 (July 17, 2002), vacated, California Independent System Operator Corp. v. FERC, 372 F.3d 395, 304 (D.C. Cir. 2004),

15.

Provide any additional comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

In the next iteration of the Transmission Service and Market Scheduling Priorities Phase 2 Straw Proposal, the CAISO needs to clarify what it means by establishing a “scheduling priority equal to load.” Currently in the Straw Proposal, there is no discussion of curtailment priority except a desire to develop a holistic and balanced framework under which entities seeking to wheel through the CAISO system can reserve to establish a scheduling priority equal to CAISO load and higher than other wheeling transactions.

Under the FERC-approved OATT, there is a distinction between transmission curtailment and load reductions as a result of resource insufficiency. Transmission curtailment is a reduction in non-firm or firm transmission service in response to a transmission system outage or derate. Non-firm schedules are curtailed first. If the transmission derate makes it impossible to accommodate all firm schedules, there is a pro rata reduction of all the firm schedules in order to alleviate the problem.

On the other hand, if a network customer, including NV Energy on behalf of our native load, has not scheduled and delivered sufficient resources to cover their load, and the shortage is impacting the reliability of the Balancing Authority Area, that customer is directed to immediately implement their Transmission Reduction Plan in accordance with their Network Operating Agreement. In other words, the loss of load is not socialized but rather is directed at the resource insufficient load serving entity. Therefore, NV Energy is requesting CAISO to clarify during what situations a scheduling priority is equal to load and if CAISO has the same distinction for resource insufficiency that is under FERC approved OATTs.

Pacific Gas & Electric

Submitted 09/15/2022, 06:41 pm

1.

Please provide a summary of your organization’s comments on the Transmission Service and Market Scheduling Priorities Phase 2 straw proposal and August 11, 2022 stakeholder call discussion:

PG&E appreciates the opportunity to provide comments on the CAISO’s straw proposal for the Transmission and Market Scheduling Priorities Phase 2 initiative. We offer feedback on the proposed process and substance below.

PG&E is unable to conclude from the current methodology and supporting documentation that reliability is appropriately identified and provided for in the calculation of total and available transmission capability.

Support for total transmission and the reservation estimates of Available Transmission Capacity (ATC) provided by the CAISO is limited and not representative of the full set of analysis expected to ensure CAISO Transmission Providers, Load Serving Entities, and customers are able to determine a sufficient volume of transmission is available to serve native load and provide transmission capability to those entities outside the CAISO seeking access. This raises concerns for overall system reliability, support for native load needs, and support for firm delivery via transmission for those outside of CA.

PG&E provides more detail in response to the questions below which include power flow analysis, internal constraints and loop flow considerations, and connections to the Transmission Planning Process as a basis for information used to calculate these amounts - similar to what is taking place in the other ISO/RTOs as well as by many transmission entities in the western US.

The proposed compensation lacks a connection to value, which is evidenced in pricing structures from other ISO/RTOs as well as by many transmission entities in the western US. Value implies the usefulness and desirability of a product or service to a customer and the CAISO’s proposed compensation does not try to draw out that value through price differences for a product that definitely has different value based on the month, day, hour of the year it is being procured.

Additionally given the early September 2022 heat event in the western US, it would be a valuable exercise for many stakeholders to understand how the CAISOs proposed methodology would have been calculated and utilized during the event.

2.

Provide your organization’s comments on the design principles discussed in section 4:

PG&E generally supports the principles that the CAISO describes in its Straw Proposal. PG&E recommends that the CAISO ensure that native load needs are emphasized within the principles.

Similar to other BAAs in the West, the CAISO has a responsibility to meet native load, since it is the Balancing Authority, and to provide access to its transmission grid to other Western BAAs.

3.