ACP-California

Submitted 01/09/2024, 04:34 pm

Submitted on behalf of

American Clean Power (ACP) - California

1.

Please provide a summary of your organization’s comments on the revised straw proposal

ACP-California appreciates CAISO’s work on a difficult and complex topic which has many moving pieces. We offer our general support for the direction that CAISO is headed, so long as a few elements (discussed in these comments) are addressed ahead of the proposal being finalized. In these comments, we offer a number of comments and suggestions for improvements, which are summarized below. ACP-California’s key points include:

Related to Order 2023 Compliance

- ACP-California requests that CAISO retain an option for interconnection customers to request OPDS or for CAISO to provide “indicative” OPDS results such that this status can be maintained. This could be performed outside of the standard cluster studies and, thus, CAISO would still be able to comply with Order 2023 timelines.

- While ACP-California does not support application of Site Control requirements earlier in the process than would otherwise apply for Cluster 14 and earlier clusters, CAISO should provide clarity as soon as possible on its plans to apply Site Control requirements to Cluster 14 and earlier. Interconnection Customers without site control need to understand, as quickly as possible, what requirements they will need to comply with and when. To that end, CAISO should clarify the definition of Site Control (and any associated acreage requirements) in the near-term so that customers can make necessary preparations to comply with the requirements that CAISO will propose.

Related to interconnection request intake (the proposed Zonal approach and Option B process)

- ACP-California supports the general approach, though some modifications and additional details are required. Most notably, to maintain open access on the CAISO grid, it is imperative to ensure that there are ample opportunities for resources serving corporate offtakers to interconnect to the grid (both within and outside of the designated “zones”). We are concerned that the current provisions may severely hinder or entirely prevent corporate offtake arrangements and the underlying resources from interconnecting to the grid. The proposal needs to provide an opportunity for these resources, which are a substantial portion of the contracted clean energy resources in the country, to interconnect and, therefore, CAISO cannot rely entirely on LSE interest. CAISO must provide opportunities for corporate offtaker interest to be considered and, additionally, provide room from energy-only interconnections which are not requested by LSEs.

- Resolving this concern could include allowing commercial offtakers to provide “interest” as part of the scoring process and/or providing opportunities for these resources to interconnect in designated zones on an energy-only basis (without needing any LSE interest or support).

- CAISO should remove the proposed 25% cap on a developer’s ability to submit interconnection requests in a given cluster application window. The restriction is arbitrary and unnecessary in light of the other proposed reforms.

- CAISO should monitor the option for non-CPUC jurisdictional entities to have their preferred resources automatically included in the interconnection queue and revisit this element of the reforms should these resources comprise a significant amount of the resources admitted under the Option A/zonal approach (e.g. 5% or greater which is still significantly than the load ratio share of non-CPUC jurisdictional entities currently participating in CAISO). This will help ensure there is not an undue competitive advantage provided to LSE projects over those proposed by independent power producers. Additionally, CAISO should expand the resources which will automatically advance in the interconnection study process to include resources which the CPUC has specified as needed “eligible energy resources” to be procured through the Department of Water Resources Central Procurement Entity (CPE) established through AB 1373 (2023) and for which existing transmission is available or where the CPUC has approved a TPP portfolio with the same eligible resource that will trigger transmission expansion. This will ensure these resources can enter the queue.

- CAISO should update the “indicators of readiness” scoring criteria to provide different levels of points to projects based on the quality of the demonstrated business partnership and Engineering Design Plans. Engineering standards exist for what documentation is required to demonstrate design progress at different stages of project development which can be adopted by CAISO. Engineering standards exist for what documentation is required to demonstrate design progress at different stages of project development which can be adopted by CAISO. And CAISO should add scoring criteria for projects which have site control for the gen-tie required for the project (since this was not part of Order 2023, those projects that can demonstrate site control for a gen-tie should receive higher points on their “readiness”).

- Additionally, CAISO should modify the weighting of the individual readiness metrics to reduce the advantage currently given to projects that are expansions of existing facilities. As proposed, new projects, which will likely represent the majority of projects entering the queue, will only be eligible for 30 out of the 100 Project Viability points. This could lead to little distinction between scores of new projects, defeating the purpose of the scoring criteria.

- In addition to adding an option for resources procured by a CPE and part of a CPUC portfolio to enter the queue automatically, it is appropriate to retain the “Long-Lead time Resource” point allocation for long-lead time resources that meet the definition of “eligible resources” but that may not have been specifically identified by the CPUC for procurement through the CPE at the time of an interconnection request. Long-lead Time resources should be defined to align with the definition of “eligible resources” in AB 1373 (2023).

- ACP supports the modifications to the auction process, which will result in bids only being requested when necessary and after the viability scoring process has been completed.

- ACP supports the modifications to the Option B process to allow customers which fund an Option B ADNU that is ultimately required to support a CPUC portfolio to be relieved of the funding requirement and get refunded.

- Option B should also be further defined to allow for energy-only interconnections (as should Option A) in order to maintain open access to the CAISO grid and to provide optionality in project development structures.

- The TPD allocation modifications, which are forthcoming, will be critical. TPD allocation must be designed to ensure that Long-Lead Time Resources will be able to secure the TPD capacity that was approved to facilitate their interconnection.

Related to Contract and Queue Management

- CAISO should modify the timing requirements for the proposed Commercial Viability Criteria demonstration to better account for resources with commercial operation dates far in the future (including long-lead time resources) which may enter the queue and, though making development progress, not be able to demonstrate a PPA after 7-years in the queue, given their long development timelines.

Additionally, more time should be provided to customers that have a PPA cancelled as a result of a PTO delay. While we appreciate the CAISO offering an option, 12 months is highly unlikely to be sufficient to renegotiate a PPA, especially if there is not an active procurement cycle ongoing.

2.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

ACP-California appreciates CAISO’s continued efforts to improve data accessibility to support the zonal approach. And we appreciate CAISO’s willingness to consolidate disparate information sources that inform the zonal capacity availability to support ease of access for interconnection customers. While the process for assessing whether a project is in a designated zone with available capacity will be manual and challenging, the information that CAISO has provided has been useful and informative. We appreciate CAISO’s ongoing efforts to continue to improve information access for potential interconnection customers.

We also encourage CAISO to continue to evaluate and discuss with the CPUC how the transition to the zonal approach will change the data sources and availability of data sources that are relied upon in this process today. For instance, by transitioning to the zonal approach, the information used for the Transmission Capability Estimates may be more limited than it is today which will, in turn, make it more difficult for developers to understand whether projects will have available capacity. We understand that the CPUC and CAISO are considering these impacts and encourage ongoing discussion, as continued access to this information and data will be critical to the ultimate success of the zonal approach.

3.

Provide your organization’s comments on updates made throughout Section 2 Interconnection Request Intake

ACP-California supports the general approach, though some modifications and additional details are required.

CAISO Must Ensure Open Access to the Grid, which Includes Maintaining Options for Projects Selling to Corporate Offtakers to Enter the Queue:

The current proposal on interconnection request intake from CAISO focuses on resources seeking deliverability status and provides two options to enter the queue: Option A (the zonal approach) and Option B. ACP-California greatly appreciates CAISO developing Option B (which applies in areas with no available/planned deliverability capacity) to help ensure open access on the CAISO grid. While Option B is a good start, we are concerned that the present proposal may unduly hinder or entirely prevent access to the grid for resources which are looking to serve a corporate offtaker and/or which are seeking an energy-only interconnection. The final proposal must provide a pathway for resources which are serving corporate offtakers and for resources which wish to be energy-only to interconnect to the grid. Reserving interconnection capacity (even in designated zones) entirely for projects that are contracted to LSEs conflicts with open access principles and could thwart certain (significant) types of development projects, including those serving corporate offtakers. Projects serving corporate offtakers are not a niche market. They represent a significant portion of the generation development across the country. In fact, according to ACP’s most recent quarterly report (Q3 2023), corporate offtakers are the buyers for nearly 20% of clean power capacity in development across the country. This is a significant portion of resource development which cannot be written off or ignored as CAISO reforms its interconnection processes.

To address this concern, we recommend two modifications to the zonal approach (and additional modifications to Option B, discussed later in these comments):

- Within the scoring criteria, LSE interest should be expanded to include other offtakers, such that a corporate offtaker has an opportunity to express its interest in projects and support their entry into the queue.

- In comments early in this initiative, ACP-California suggested that, in addition to providing LSEs with a limited amount of MW in which to express interest, CAISO should develop a process for corporate entities which could “require documentation of clean energy procurement goals and the quantity of resources needed, within CAISO, to meet those goals.” This could be augmented with attestations from corporate representatives as to their level of interest in procurement within CAISO to arrive at a MW limit that an individual corporate offtaker could utilize under this element of the scoring criteria.

- Develop a process for projects to interconnect within Option A (the zonal approach) on an energy-only basis, without requiring such projects to have interest expressed by an LSE. This would allow energy-only interconnection projects serving corporate offtakers or looking to connect on a merchant basis to enter the queue and would, therefore, help ensure open access across the entirety of the CAISO grid.

CAISO Should Remove the Proposed Cap on Interconnection Submissions from a Single Parent Company

ACP-California urges CAISO to remove the proposed 25% restriction on a developer’s ability to submit interconnection requests in a given cluster application window. Many developers and other stakeholders have previously raised concerns with this proposal, which is arbitrary and will be difficult to implement with different project structures, joint ventures, etc. ACP-California is further concerned that it could result in suboptimal projects moving forward in the interconnection process because superior projects are deemed ineligible due to this restriction. Furthermore, this restriction should be unnecessary given the use of the scoring criteria in the interconnection process. The scoring criteria should help to determine which projects can move forward and should help reduce the ability for any one developer to overwhelm the system with speculative interconnection requests. CAISO should implement the other reforms that are proposed and, if it still sees this to be an issue, revisit this proposal at that time.

CAISO Should Monitor the Option for Non-CPUC Jurisdictional Entities to Automatically Enter the Queue in a Zone

ACP-California understands the need to have an “automatic entry” process for certain categories of resources to enter the queue. While we have some concern about providing non-CPUC jurisdictional entities with an automatic in, given the potential for preferential treatment of utility-owned generation through such a process, we do not object to such a process at this time. However, we urge CAISO to build into the proposal and associated tariff language a trigger which would require CAISO to revisit this rule should non-CPUC jurisdictional preferred resources comprise a significant (e.g., 5%) amount of the capacity allowed to enter the queue through the zonal process. This will help provide certainty that there is a process to revisit the approach should it be utilized more than is currently anticipated.

CAISO Should Expand the Types of Resources Eligible to Automatically Advance to Include Resources Procured By a Central Procurement Entity for Which There Is Existing or Planned Transmission Capacity

ACP-California urges CAISO to create another category of resources which can automatically advance to the study phase in the queue. Specifically, resources which 1) meet the definition of “eligible energy resources” in AB 1373 (2023); 2) have been specifically identified by the CPUC as eligible resources to be procured through the Central Procurement entity (CPE); and 3) for which transmission capacity is available or has been planned for in accordance with a CPUC portfolio that identifies the same eligible resource. For example, if the CPUC identifies a quantity of offshore wind for procurement by the CPE, in accordance with the process established in AB 1373, and the CPUC has also advanced a portfolio with 1,000 MW of North Coast offshore wind in the base case of a TPP, then any North Coast offshore wind project in the queue should automatically advance, so long as they meet site control and other standard queue entry requirements. Similarly, if the CPUC identifies geothermal resources for procurement by the CPE and there is a combination of existing and planned transmission to access geothermal resources in the Salton Sea, geothermal interconnection requests within this resource zone should also automatically advance. This will provide a pathway for CPE resources to be entered into the queue and will also ensure the amount of CPE resources is in line with what the CPUC is planning for while allowing for sufficient competition. It will further align with the concepts CAISO has proposed to develop in later phases of IPE to preserve capacity upgrades driven by specific resources for those specific resources. Because of the restrictions on these types of resource getting automatically advanced in the queue, and the naturally limited universe of projects that will also meet basic site control and project viability criteria, a similar trigger or limit (as discussed above for non-CPUC jurisdictional resources) is not warranted. These CPE resources are already limited by the CPUC’s process for identifying specific eligible resources for the CPE as part of the cyclical IRP process. But this will provide a necessary level of certainty that these resources can enter the queue even if they are in an early stage of a long project development process, and unlikely to be awarded points by individual LSEs given their long-lead time and/or large-scale nature. Indeed, this suggested accommodation for CPE resources would be in keeping with the purpose and need for central procurement itself: filling a gap in planning and procurement processes to enable development of diverse, long-lead time resources not typically procured by individual LSEs or under widespread development, but necessary for portfolio diversity and long-term reliability. We suggest that the CAISO monitor the interconnection requests that advance through the queue as a result of a CPE resource automatic trigger, to consider if any modification to the request intake process is needed in the future. To ensure these resources are treated appropriately, we highlight that additional policy development will be necessary, as part of the TPD allocation changes in this initiative, to ensure that the TPD planned for these resources continues to be available for them. ACP-California looks forward to working with CAISO on this item in the next phase of IPE 2023.

4.

Provide you organization’s comment on section 2.4 – Scoring Criteria

CAISO Should Provide a Pathway for Corporate Offtaker Interest to be Included in the Scoring Criteria

As discussed in response to question #3, CAISO must ensure that the combined set of queue reforms continue to provide open access to the grid and, therefore, opportunities for projects serving corporate offtakers to interconnect. ACP-California recommends that, within the scoring criteria, LSE interest should be expanded to include other offtakers, such that a corporate offtaker has an opportunity to express its interest in projects and support project entry into the queue.

In comments early in this initiative, ACP-California suggested that, in addition to providing LSEs with a limited amount of MW in which to express interest, CAISO should develop a process for corporate entities which could “require documentation of clean energy procurement goals and the quantity of resources needed, within CAISO, to meet those goals.” This could be augmented with attestations from corporate representatives as to their level of interest in procurement within CAISO to arrive at a MW limit that an individual corporate offtaker could utilize under this element of the scoring criteria.

CAISO Should Update the Indicators of Readiness Criteria to Provide a Range of Scores Based on the Quality of Engineering Design Plans and Business Partnerships

CAISO should update the “indicators of readiness” criteria to provide different levels of points to projects based on the quality of the demonstrated business partnership and Engineering Design Plans. While we understand CAISO is seeking to avoid subjective criteria, we believe that different scores for different percentages of completed engineering design studies would be appropriate and could be reasonably implemented based on existing industry standards.[1]

Additionally, CAISO should add a new element in this category that provides additional points to projects which have site control for the gen-tie required for the facility. Because gen-tie site requirements were not part of Order 2023, projects achieving this metric would have an opportunity to differentiate themselves from other interconnection requests. We urge CAISO to add this scoring criteria as another metric to help indicate project readiness.

Finally, the current point weighting in this category, with 70 of the 100 available points being allocated to expansion at existing facilities, is unnecessarily high. Having so much weight on projects at existing facility locations could lead to a lot of ties amongst the “new” projects, which would be problematic. We suggest lowering the allocation to existing facilities to 30 or fewer points.

CAISO Should Define Long-Lead Time Resources Consistent with AB 1373

In addition to adding an option for resources procured by a CPE and part of a CPUC portfolio to enter the queue automatically (as discussed in response to question #3), there may still be Long-Lead Time resources that do not fit into that bucket. For example, there may be long-duration storage projects that are “eligible energy resources” as defined by AB 1373 (2023) but that have not yet been specifically identified by the CPUC for CPE procurement, or which may be sited in different zones across the state and therefore not linked to a specific TPP zone. To continue to encourage development of diverse resources, these projects should have a pathway to receive “points” even if not receiving the automatic qualification described above. Therefore, it is appropriate to retain the “Long-Lead Time Resource” point allocation metric in the scoring system. ACP-California also recommends CAISO define Long-Lead time resources consistent with the definition of “eligible resources” in AB 1373[2] The CPUC could further define which resources are to be considered in this category in the transmittal of resource portfolios for the TPP. In any event, the definition should be limited so that it cannot be interpreted as applying to all the resource type locations in the CPUC portfolios. Otherwise, its application will be rendered meaningless.

CAISO Should Develop an Open Access Approach for Energy-Only Resources

While the focus to date has been on resources entering the queue and securing deliverability, ACP-California reiterates that CAISO must develop a process for energy-only resources to enter the queue. This may require a scoring/ranking process for these resources in addition to the metrics that have been developed for those seeking deliverability in a given zone. But it is imperative that a process be developed for energy-only interconnections and that it not be entirely dependent on LSE interest in these resources.

[1] For example, the different cost estimation classes defined by AACEI can inform the level of engineering plan completion (see here: https://web.aacei.org/docs/default-source/toc/toc_18r-97.pdf?sfvrsn=4). And there may be standards from IEEE or other sources that could be utilized to inform the level of points provided for this criterion and help differentiate projects with more complete plans.

[2]PUC 454.52 (h) (1) Only a new energy resource that meets all of the following requirements is eligible to be procured by the Department of Water Resources pursuant to this section:

(A) The resource directly supports attainment of the goals specified in Section 454.53 without increasing the state’s dependence on any fossil fuel-based resources.

(B) The resource is determined by the commission to not be under contract at sufficient levels as shown in load-serving entities’ most recent individual integrated resource plans submitted to and reviewed by the commission pursuant to this section to achieve the goals specified in Section 454.53.

(C) The resource has a construction and development lead time of at least five years.

(D) The resource does not generate electricity using fossil fuels or fuels derived from fossil fuels.

(E) The resource does not use combustion to generate electricity, unless that combustion use is ancillary and necessary to facilitate geothermal electricity generation.

5.

Provide your organization’s comment on Section 2.5.1 - Fulfillment of 150% of available and planned capacity

ACP-California offers limited comments on the fulfillment of the 150% of available and planned capacity. We do, however, urge CAISO to provide additional details on how and when capacity levels will be determined. And, in calculating the available capacity for a given zone, we recommend that any TPD allocations to Group D projects not be “counted” as already utilized. Group D projects are less certain and their temporary allocation of TPD should not serve to restrict the amount of interconnection capacity requests that CAISO will permit into the queue.

6.

Provide you organization’s comment on section 2.5.2 – Zonal Auctions

ACP supports the modifications to the auction process, which will result in bids only being requested when necessary and only after the viability scoring process has been completed. We appreciate CAISO’s responsiveness to our comments and the comments of other stakeholders on this issue.

7.

Provide you organization’s comment on section 2.5.3 – Modifications to the Merchant-Financing “Option B” Process

ACP-California supports the modification to Option B that CAISO proposed in the Revised Straw proposal to relieve Interconnection Customers of the ADNU funding requirement and get refunded should CAISO determine that an Option B project is required to support a future CPUC portfolio. This is a reasonable approach to address uncertainty in the timing of various network upgrades and is equitable to those projects which may have initially funded an upgrade that is later found to be beneficial to the system to support a CPUC portfolio.

Additionally, as with Option A, we encourage CAISO to better define how energy-only interconnections in Option B areas would be treated. It is imperative that energy-only interconnections (whether to support LSE interest, corporate offtake, or for a merchant project) be allowed to proceed across the CAISO grid, in both Option A and Option B locations.

8.

Provide you organization’s comment on the ISO’s proposal to remove both the off-peak and operational deliverability assessments to enable the ISO to meet Order No. 2023’s prescribed timelines (section 2.6.1)

CAISO proposes to remove both the off-peak and operational deliverability assessments (and therefore the Off-Peak Deliverability Status “OPDS”) to support meeting Order 2023 study timelines. While ACP-California understands the need to simplify the study process, we have seen some potential benefit to OPDS under future iterations of the Slice of Day RA paradigm – specifically, in that it can illustrate deliverability in certain “slices” or hours of the day.

Therefore, ACP-California requests that CAISO retain an option for interconnection customers to request OPDS or to provide “indicative” OPDS results such that this status can be maintained and CAISO can comply with Order 2023 timelines

Additionally, while ACP-California does not support application of site control requirements beyond what is required to comply with Order 2023 , CAISO should provide clarity as soon as possible on its plans to apply Site Control requirements to Cluster 14 and earlier. Interconnection Customers without site control need to understand, as quickly as possible, what requirements they will need to comply with and when. To that end, CAISO should provide clarity on the definition of Site Control (and any associated acreage requirements) in the near-term so that customers can make necessary preparations to comply with the requirements that CAISO will propose.

9.

Provide your organization’s comments on updates made to Section 3.1 - One-time Withdrawal Opportunity

While recognizing the challenges of a free one-time withdrawal opportunity, ACP-California continues to support exploration of an opportunity to withdraw with less risk than currently exists. This may facilitate a significant reduction in the size of the current queue, and we encourage continued discussion on how to achieve this objective, even if the final proposal includes a cost obligation for those withdrawing.

10.

Provide your organization’s comments on updates made to Section 3.2 - Limited Operation Study Updates

11.

Provide your organization’s comments on updates made to Section 3.3 - Requirements for Asynchronous generating facilities

12.

Provide your organization’s comments on updates made to Section 3.4 - Removal of suspension rights

ACP-California continues to oppose CAISO’s proposed removal of suspension rights, as we have in the past. Please see past comments for additional details (here and here).

13.

Provide your organization’s comments on updates made to Section 3.5 – Limitations to TPD

14.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue

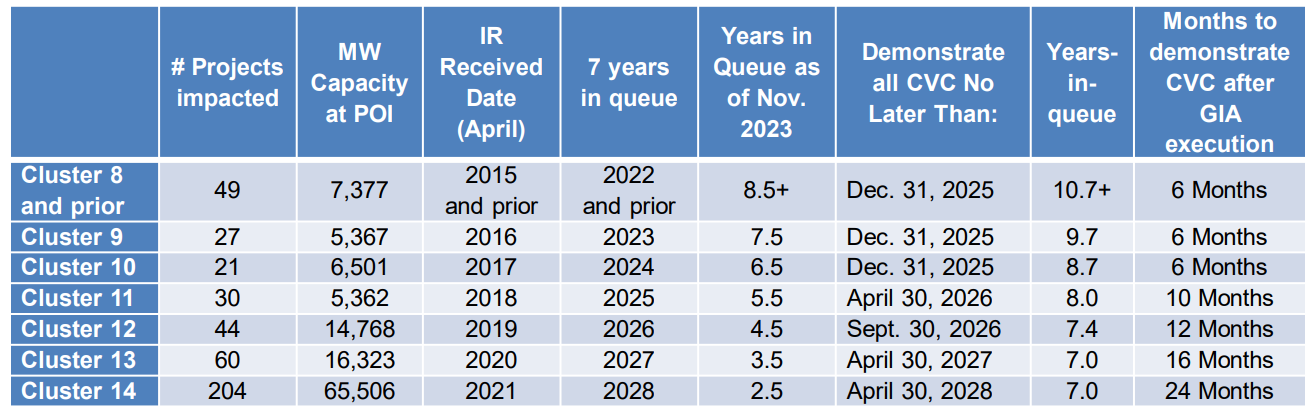

CAISO should modify the timing requirements for the proposed Commercial Viability Criteria demonstration to better account for resources with commercial operation dates far in the future (including long-lead time resources) which may enter the queue and, though making development progress, may not be able to demonstrate a PPA after 7-years in the queue given their long development timelines. We recommend considering a “later of rule” where resources must demonstrate Commercial Viability Criteria at the later of 7-years after entering the queue or three years prior to their initially submitted commercial online date.

Additionally, CAISO should provide more time to customers that have a PPA cancelled as a result of a PTO delay. While we appreciate CAISO offering an option, 12 months is highly unlikely to afford sufficient time for a project to renegotiate a new PPA, especially if there is not an active procurement cycle ongoing. We recommend that, in the event a PTO delay causes cancellation of a PPA, developers be provided with the greater of three years or the length of the PTO delay (e.g., four years if that is how long the PTO project is delayed).

15.

Provide your organization’s comments on updates made to Section 3.7 – Timing for Construction Sequencing Requests

16.

Provide your organization’s comments on updates made to Section 3.8 – Shared Network Upgrade Postings and Payments

17.

Provide your organization’s comments on updates made to Section 3.9 – Timing of GIA Amendments

18.

Provide your organization’s comments on updates made to Section 3.10 – PTO starting work on NTPs

19.

Provide your organization’s comments on Section 3.11 - Deposit for ISO implementation of interconnection projects

20.

Provide your organization’s comments on Section 3.12 - Update to the Phase Angle Measuring Units data

AES

Submitted 01/09/2024, 03:01 pm

1.

Please provide a summary of your organization’s comments on the revised straw proposal

AES Clean Energy, “AES”, appreciates the opportunity to submit comments on the CAISO’s IPE Revised Straw Proposal. AES appreciates the stakeholder timeline extension to May Board of Governors given the complexity and substantial changes of the proposed revisions. AES provides a summary of the comments, with more details in the respective comments section.

AES supports the following with some/no modifications:

- Consolidated document of data required to enable the zonal approach if the CAISO includes a capacity number that will be studied in the following cluster for each interconnection zone. The CAISO should reconsider the queue window opening date to at least September to align with the Transmission Planning Process (TPP) and Transmission Plan Deliverability (TPD) allocation processes. The consolidated document provided in January 2024 will provide misleading transmission capability estimate information to interconnection customers because the 2023-2024 TPD allocation cycle will not conclude until May 2024.

- Data of the additional number of new gen-ties that can come into a substation without upgrades in addition to the expandability of the substations.

- Data of the short circuits at each CAISO bus.

- Inclusion of major electrical equipment purchase order and preliminary engineering design into the scoring criteria. The long lead time equipment definition must include transformers and generation set up.

- Utilizing DFAX level for tie-breakers project applications.

- Option B modifications if Option B is allowed as an option for projects unselected through the scoring criteria process.

- Removal of the off-peak and operational deliverability assessment.

- One time withdrawal opportunity for all existing projects in the queue.

- Requesting limited operation studies nine months prior to synchronization.

- Updating the GIA nine months prior to synchronization with the amended MMAs.

- Requiring PTOs to notify the interconnection customer and CAISO that network upgrade activities have begun within 30 days from the interconnection customer providing the Notice to Proceed and posts the 3rd IFS posting to minimize upgrade delays.

AES opposes the following:

- The justification of the developer cap has not met its burden of proof that developers submitting more applications lead to higher attrition rates. AES provides statistical analysis from Cluster 12 and 13, demonstrating that there isn’t any statistical significance in attrition rates between developers submitting more or less than three projects.

- Non-CPUC jurisdictional entities’ projects should not be automatically included within the 150% available transmission capacity study cap as it raises discriminatory treatment between utility-backed generation and IPPs. At minimum, non-CPUC jurisdictional entities’ projects should be studied above the 150% available transmission capacity.

- POIs within subzones should not “close” once it reaches its expandable capacity. The CAISO should study all capacity within the zone and provide an opportunity for customers to upgrade the POI if needed.

- Utilizing an auction methodology for tie-breaker project applications.

- Removal of suspension rights.

- Requiring projects transferring TPD to withdraw from the queue.

AES seeks clarity on the following:

- Treatment of Energy Only project applications. AES believes Energy Only projects should not be subject to study caps and be allowed as Option A and B.

- Preventing LSEs from self-awarding points to their own projects in the LSE scoring criteria.

- Phasor Angle Measuring Units sample number. Does CAISO mean to update the samples from 30 samples/second to 60 samples/second?

2.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

AES appreciates the CAISO’s willingness to consolidate existing information into one document. AES supports including transmission constraints, single line diagrams of resources, single line diagrams of POIs behind constraints, transmission capability estimates, and list of substations within each interconnection area into the document. However, AES urges the CAISO to include a capacity number that will be studied in the following cluster cycle for each interconnection zone. While a heatmap will be made available to customers that identifies the available capacity at the POI level based on the latest cluster study and annual TPD allocation study, providing customers with concrete numbers of the studied capacity in each zone will minimize uncertainties of guessing what the studied capacity will be in each zone. Setting this studied capacity number up front will also provide administrative efficiencies down the line when CAISO must score and accept projects into the study process. This will reduce the likelihood of disputes or complaints at FERC because all parties will have a clearer picture upfront of how many potential MWs would be accepted in each zone. In addition, the CAISO needs to include physical data consideration into the report. AES recommends that the CAISO work with TOs to compile a list of the number of new gen-ties that can feasibly come into a substation without expansion and the substations’ expandability. AES also recommends the document to include published short circuits at each CAISO bus.

In addition, CAISO should clarify how reassessments and WDAT clusters would be incorporated into the document.

Continuously updating the document as new information becomes available has good intentions but will not provide stakeholders with certainty on what assumptions would be made in the following cluster cycle. For Cluster 16 and beyond, AES urges the CAISO to determine a cut-off date that will then identify the assumptions made for the following cycle. For example, CAISO can utilize June 1 as the cut-off date for assumptions made in the next cycle. June 1 will allow other processes (e.g. TPP and TPD allocation) to take place that affect the following cluster cycle. The document will include all the proposed data information that is most up-to-date, and identify the capacity that will be studied in each interconnection zone. This document will allow interconnection customers to understand the cluster cycle assumptions and studied capacity. As the proposal stands, interconnection customers will essentially need to guess whether or not a zone has capacity or are behind any constraints given the timing misalignment with other important processes, such as the TPP and TPD allocation processes. Since CAISO’s TPD allocation methodology will allocate TPD to projects if additional TPD is available, only a small fraction of deliverability will remain available after each allocation cycle. This makes it difficult for developers to commit resources to projects until after TPD allocation process is complete. To ensure timing alignment with other related processes, CAISO will need to reconsider changing the annual queue opening date from April to at least September of each year. This would allow interconnection customers time to process the updated information prior to being scored.

In the short term, the CAISO has indicated that a single document with all consolidated information will be provided to customers by the end of January. AES appreciates the CAISO’s willingness to provide information as soon as possible, but is concerned with the timing misalignment between the report and the 2023-2024 TPD allocation cycle. Specifically, AES is concerned that the January report will misinform interconnection customers with the available transmission capability estimates in each zone. The 2023-2024 TPD allocation report will not be released until May 2024, which may significantly decrease the actual transmission capability estimate given the total capacity of projects included in Cluster 14 that will be eligible for TPD allocation.

3.

Provide your organization’s comments on updates made throughout Section 2 Interconnection Request Intake

AES continues to strongly oppose the implementation of a 25% developer cap as discussed in the Revised Straw Proposal. The CAISO has not met its burden of proof in demonstrating that developers submitting more projects have statistically significantly different dropout rates than developers submitting fewer projects. The data provided in the Revised Straw Proposal identifies the number of projects submitted by companies and does not demonstrate that companies submitting more projects are correlated to higher attrition rates, which would indicate that parent companies that submit more projects are more speculative than those that submit fewer. In fact, AES has previously conducted a difference of proportion test for Clusters 12 and 13 from data provided in IPE 2021 to determine if the appearance of companies submitting more projects having a higher retention rate was statistically significant.[1] The difference of proportion test evaluates whether the difference in percentages across two groups is meaningful or if the differences are the product of random chance, and thus the apparent differences can’t be associated with the difference between the two groups, in this case, the number of applications submitted by a parent company per cluster leading to different retention rates. The results of the test can be shown in Table 1. For Clusters 12 and 13, there is not a statistically significant difference between these two groups because the alpha values are greater than 0.05. The data does not support a significant difference in retention rates between companies submitting 3 or more projects than companies submitting less than 3 projects.[2]

Table 1.

|

Cluster

|

Number of IRs submitted per parent company

|

Total Number of IRs submitted

|

Percentage still active

|

Z-score

|

Alpha (2-tailed test)

|

Significant at 95% confidence level?

|

|

12

|

1-2

|

35

|

45.83

|

1.78

|

0.075

|

No

|

|

3+

|

143

|

30.00

|

|

|

|

|

|

|

|

|

|

13

|

1-2

|

62

|

44.19

|

0.82

|

0.418

|

No

|

|

3+

|

152

|

38.18

|

In addition, the CAISO justifies using the auction mechanism for tie-breaker projects by agreeing with stakeholders that projects required to participate in an auction would advantage large, well-capitalized entities. The CAISO states this is not a poor outcome because generation development requires significant capitalization. Given this acknowledgment, developers with the resources to invest in projects with higher entry requirements should be able to submit their applications for consideration since they are the ones who bear all of the risks in the process.

The CAISO claims that the developer cap is also meant to reduce administrative burdens, however, this could be solved through outsourcing the validation of applications or legal review of supporting documentation, as PJM has recently done in their queue transition process. The scoring system is intended to be binary, so developers either have it or not. Therefore, the volume of projects to score should not matter, especially since CAISO requests customers to self-score some of the categories in our interconnection application. AES believes that with the new FERC Order 2023 entry requirements in addition to the proposed scoring mechanism, CAISO will unlikely be receiving an influx of interconnection applications. Therefore, an additional developer cap may be redundant and require unnecessary administrative processes through the yet-to-be-defined determination of which projects belong to which “parent company”.

The CAISO also states that the developer cap intends to ensure that no one developer captures an inappropriate share of transmission capacity. AES continues to argue that the interconnection process is not the appropriate venue in assessing market power issues. If market power were created, regulatory authorities would be the appropriate entities to assess via market power analysis.[3] In fact, applying a blanket 25% developer cap on the available transmission capacity for clusters may result in project sizes that are uneconomical, with higher pricing, or may inhibit the local market. This will contribute to the market power concern that CAISO is attempting to address through the developer cap. Project sizes may become uneconomical because of the need to size projects to meet the developer cap given the uncertainty of the available TPD after the allocation cycle.

AES seeks clarity on how the CAISO intends to identify the parent company. Identifying the parent company can be complicated if there are joint ventures or companies that have interactions. AES worries that the internal processes of ensuring that subsidiaries of the same parent company, who could be considered competitors, do not submit projects above the MW cap could violate NERC anti-trust rules.

AES seeks clarity on whether the developer cap would apply to LSEs in addition to IPPs. AES believes that applying developer cap to only to IPPs would result in discriminatory treatment between LSEs and IPPs and would violate FERC principles.

[1] AES Clean Energy Comments on Interconnection Process Enhancements 2021 Revised Straw Proposal, June 28, 2022.

[2] AES Clean Energy Comments on Interconnection Process Enhancements 2021 Revised Straw Proposal, June 28, 2022.

[3] Horizontal Market Power | Federal Energy Regulatory Commission (ferc.gov)

4.

Provide you organization’s comment on section 2.4 – Scoring Criteria

AES believes the scoring criteria need further refinement. Below are recommendations and questions on the revised scoring criteria:

- Regarding the LSE interest category, how will the CAISO prevent LSEs from only awarding points to their own projects?

- What information basis will the LSE have to make decisions on rewarding points to projects?

- AES recommends a lower weighting in the LSE interest category to minimize the power from LSE in determining what interconnection applications are submitted into the studies.

- AES also urges CAISO to include non-LSE interest into the scoring criteria. Non-LSE interest can include a letter supporting a project that demonstrates carbon reduction.

- AES believes the project viability category weighting should increase to 40% from the proposed 30%.

- AES supports including long lead time equipment purchasing orders. AES does not believe that including a Master Service Agreement to demonstrate business partnerships for future supply of major equipment would create granularity in the scores as this can be easily met. However, including a purchase order for major long lead time equipment can create competition in the scoring criteria. The CAISO would need to define major generating equipment and include transformers and generation step up.

- AES believes a preliminary engineering design is a reasonable criterion to be included and recommends the following definition:

- Long lead time equipment count

- General arrangement with total system size and developer substation

- Single line diagram showing metering and protection

- Parcels/easements with site control highlighted

- Site layout that indicates multiple gen-tie routes

- AES recommends the expansion of facilities’ weighting be lowered to lower the preference of existing generation owned by utilities.

- The CAISO should clarify how long lead time resources are defined. Given that limited resources (e.g. long duration storage and offshore wind) would qualify, this category weighting should be lowered. The CAISO should also consider creating a separate interconnection process for these long lead time resources, such as offshore wind.

- The CAISO should clarify how Energy Only projects would be treated given that the 150% study capacity is based on full deliverability capacity studies, which Energy Only projects would not require. Energy-only projects should be allowed to continue as Option A. These projects should not be subject to the 150% available transmission cap nor the developer cap. Energy Only projects should only be responsible for interconnection costs, and not network upgrade costs.

AES supports utilizing DFAX levels as the first mechanism to break tie-breakers, selecting applications with the lowest DFAX. To best understand DFAX levels across the queue, AES recommends CAISO to publish DFAX values from the current queue prior to interconnection studies.

5.

Provide your organization’s comment on Section 2.5.1 - Fulfillment of 150% of available and planned capacity

AES appreciates the CAISO’s additional details on how it intends to fulfill each zone’s 150% of available and planned capacity. Within each zone, AES does not support the CAISO “closing” the POI once it reaches the maximum expandable capacity before an upgrade is needed. The expandability of the POI in each subzone largely depends on the CPUC’s busbar mapping process, which is not 100% accurate. AES believes all capacity at the POIs should be studied regardless of whether the nested constraints cause a network upgrade. If an upgrade is needed, interconnection customers triggering the upgrade should be given the option to fund it.

AES continues to oppose including non-CPUC jurisdictional entities automatically into the interconnection studies without scoring, inclusive of the 150% available transmission capacity study cap. AES continues to believe this raises discriminatory treatment between independent power producers and utility-back generation, in addition to between CPUC jurisdictional and non-jurisdictional entities. While CAISO staff has noted that non-CPUC jurisdictional entities make up a small portion of the CAISO footprint,[1] AES agrees with others on the December 19, 2023 stakeholder call that some municipal utilities are large and may potentially contribute to a higher footprint. AES recommends the CAISO to, at minimum, study non-CPUC jurisdictional LRAs studies outside of the 150% available transmission capacity cap.

Finally, annually after Cluster 17, the CAISO should reevaluate whether 150% of available transmission is the appropriate study cap that ensures competition, minimizes attrition, and meets state procurement goals.

[1] CAISO Interconnection Process Enhancements 2023 Track 2 Working Group Meeting, November 15, 2023.

6.

Provide you organization’s comment on section 2.5.2 – Zonal Auctions

AES continues to oppose auctions as an appropriate mechanism for tiebreakers. Bidding is not an appropriate mechanism to compare projects against one another. Projects selected through the auction will have different at-risk security than projects admitted through the scoring criteria. AES continues to believe this is discriminatory treatment given that the CAISO will withhold auction security that are subject to different refund rates compared to projects selected not through the auction mechanism.

Given that CAISO will break tie-breakers by selecting projects with the lowest DFAX levels, an auction mechanism is not necessary. If projects still exist after the DFAX screen, the CAISO should consider studying more projects, even if it exceed the 150% available transmission capacity cap.

7.

Provide you organization’s comment on section 2.5.3 – Modifications to the Merchant-Financing “Option B” Process

AES appreciates the modifications made to the Option B process. AES continues to urge the CAISO to allow projects that are unselected through the scoring process (Option A) and “energy only” projects to be given the opportunity to continue as Option B. If companies are willing to self-fund network upgrades within the priority zones, the CAISO should allow this to occur. The additional network upgrade built by self-funded projects will provide additional grid benefits than just interconnecting the project. The CAISO stated that allowing Option B projects in priority zones would result in studying capacity in those zones potentially well above the 150% threshold and would be counterproductive to solving the issue identified in the problem statements of studying capacity levels so high that the study results lose accuracy, meaning, and utility. To prevent this issue, the CAISO can study Option A projects first, then study Option B projects to prevent the loss of study accuracy. Option B projects in the interconnection priority zones can help increase generation supply and help keep any potential market power in check by increasing competition. Option B projects could also provide cushion and more margin of error if the state’s resources planning process does not identify enough resources to cover increases in demand as they actually materialize in the future.

AES appreciates the CAISO publishing ADNU cost estimates but seeks clarity on where and when the CAISO will publish the ADNU estimates. AES recommends publishing the ADNUs cost in the single document that is discussed in the data accessibility section. AES is concerned whether Option B will be a viable option given historical ADNUs estimates that may cost over $1 billion. AES recommends the CAISO to identify methods for cost recovery for ADNUs, otherwise, this option may continue to be unviable.

AES supports the CAISO’s modification to allow customers to be relieved of funding ADNUs if the upgrade is approved in the Transmission Planning Process.

8.

Provide you organization’s comment on the ISO’s proposal to remove both the off-peak and operational deliverability assessments to enable the ISO to meet Order No. 2023’s prescribed timelines (section 2.6.1)

AES supports the CAISO’s proposal to remove the off-peak and operational deliverability assessments if it improves the study timelines.

9.

Provide your organization’s comments on updates made to Section 3.1 - One-time Withdrawal Opportunity

AES continues to believe that the CAISO should allow a one-time withdrawal opportunity to clear out the existing queue. The most recent survey results indicated that existing projects would consider withdrawing if there was an opportunity.[1] AES recommends the CAISO to explore additional sources of funding for the network upgrade costs associated with the withdrawals.

[1] Stakeholder Working Group Survey Results presented post working groups

10.

Provide your organization’s comments on updates made to Section 3.2 - Limited Operation Study Updates

AES continues to support allowing interconnection customers to request limited operation studies at least 9 months prior to synchronization.

11.

Provide your organization’s comments on updates made to Section 3.3 - Requirements for Asynchronous generating facilities

12.

Provide your organization’s comments on updates made to Section 3.4 - Removal of suspension rights

AES does not support the removal of suspension rights as it does not allow the flexibility to accommodate delays out of the interconnection customer control, such as permitting. At minimum, the CAISO will need to continue allowing customers to have a one-time delay in construction milestones based on existing practices if suspension rights are removed to allow some flexibility for interconnection customers to accommodate delays outside of their control.

13.

Provide your organization’s comments on updates made to Section 3.5 – Limitations to TPD

AES continues to oppose requiring projects transferring TPD to withdraw from the queue unless an Energy Only PPA is provided at the time of transfer request. On the contrary, in the short run, AES believes the CAISO should maintain flexibility in TPD transfers to ensure that developers can contract to convert projects with assigned TPD into projects that can reach COD. Existing projects have already been studied, and the CAISO should make it as easy as possible to convert this sunk cost in terms of studies and TPD allocation into operational MWs. In the long run, the CAISO’s concern of having TPD as a tradable commodity will vanish because of the scoring criteria limiting studies to 150% of the available transmission capacity. In addition, providing an Energy Only PPA at the time of transfer request is not viable because the offtaker may not want to sign an offtake agreement until they are certain that the TPD has been transferred. At minimum, if CAISO moves forward with this proposal, it should allow a minimum of 90 days after the TPD transfer for transferring project to provide an Energy Only PPA.

14.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue

AES understands the intent of the proposed commercial viability criteria (CVC) deadlines and GIA execution deadlines for all existing and future clusters. The CAISO should understand that network upgrade schedules may well exceed six years and therefore may inhibit the developer from meeting the CVC requirements. The CAISO should consider how longer network upgrade schedules would be incorporated into the CVC requirements.

For good merit, AES recommends that CAISO allow customers of existing queues to request a one-time timeline extension meeting the CVC requirements. For Cluster 15 and beyond, the CAISO states that projects must meet the CVC no later than 7 years from the original interconnection request application. AES urges the CAISO to require Cluster 15 projects to meet the CVC requirements 7 years from the date of validation given that the IPE 2023 stakeholder process will have taken over a year since Cluster 15 projects were originally submitted.

15.

Provide your organization’s comments on updates made to Section 3.7 – Timing for Construction Sequencing Requests

16.

Provide your organization’s comments on updates made to Section 3.8 – Shared Network Upgrade Postings and Payments

AES supports requiring all parties to post for shared network upgrades within 60-90 days from the first customer’s posting. This will ensure network upgrades are built in time. AES seeks clarity on how and when the due dates for the payments will be communicated. In the event that a customer without an executed GIA withdraws, all other customers should not be financially responsible for the withdrawn customer’s pro rata cost responsibility and costs should be originally allocated such that interconnection customers do not bare the full cost of the shared upgrade. AES also seeks clarity on how shared upgrades will be allocated to multiple projects (i.e. MW, total cost, # of projects).

17.

Provide your organization’s comments on updates made to Section 3.9 – Timing of GIA Amendments

AES supports updating the GIA nine months prior to synchronization with the amended MMAs. AES supports that the New Resource Implementation process qualifying criteria are revised to accept MMA approvals in lieu of updated GIAs.

18.

Provide your organization’s comments on updates made to Section 3.10 – PTO starting work on NTPs

AES strongly supports requiring PTOs to notify the interconnection customer and CAISO that network upgrade activities have begun within 30 days from the interconnection customer providing the Notice to Proceed and posts the 3rd IFS posting to minimize upgrade delays. AES also supports requiring the PTO to meet the Initial Synchronization Date in the GIA to allow interconnection customers to meet their PPA requirements.

19.

Provide your organization’s comments on Section 3.11 - Deposit for ISO implementation of interconnection projects

AES is not opposed to including an implementation cost but requests the CAISO to publish periodic reports of resource development progress. The CAISO should also consider utilizing implementation deposits to hire additional resources to assist with resource implementation. Additional contractors hired should be published on the CAISO webpage, similar to utility practice. AES is not opposed to including an implementation cost, but requests the CAISO to publish periodic reports of resource development progress. The CAISO should also consider utilizing implementation deposits to hire additional resources to assist with resource implementation. Additional contractors hired should be published on the CAISO webpage, similar to utility practice.

20.

Provide your organization’s comments on Section 3.12 - Update to the Phase Angle Measuring Units data

AES seeks clarification on the CAISO’s proposal. The CAISO believes the current 30 samples per second of Phasor Angle Measuring Units is not granular enough to use for fault analysis, but recommends a revision of 16 samples per second. To have more granularity, the samples per second would need to be higher than 30. AES is not opposed to increasing the Phasor Angle Measuring Unit, with a limit of 60 samples per second.

Avantus Clean Energy LLC

Submitted 01/09/2024, 04:10 pm

1.

Please provide a summary of your organization’s comments on the revised straw proposal

Avantus remain highly concerned by proposed reforms unbacked by sufficient quantitative and qualitative data. At a high level, we view the following topics require additional data and/or consideration before moving forward:

- Developer Cap (Data Request) - See detailed response under 3.

- IR submittal and withdrawal rates after Scoping Meeting and Phase I study

- This provides one data point differentiating entities submitting “unready” projects vs having a large portfolio.

- Scoring Criteria – See detailed response under 4.

- Avantus requests CAISO to clarify that MWs to be assigned to CPUC jurisdictional LSEs to allocate can be applied toward their own projects.

- If so, this enables LSEs to indirectly exclude competing projects from a study.

- 150% Capacity Limit (Data Request) - See detailed response under 5.

- Proof of concept using previous queue entry data (C12 – C14 minimum) demonstrating how it would have shaped preceding clusters.

- Removal of Suspension Rights

- With only 7 projects of many projects having requested suspension, this is not sufficient data to justify eliminating a long-standing pro forma LGIP tool.

- Potential exclusion of Energy Only Projects

- CAISO clarified intentions at the 12/19 meeting to exclude EO projects unless requested by LSEs. Avantus urge the ISO to provide further guidance soon.

- The intended outcome would exclude all projects intending to be merchant.

- Auction Tie-Break Mechanism

- Between the proposed scoring criteria and DFAX tie-break, an auction tie-break is not necessary and would further burden relevant CAISO staff.

- Avantus recommend deploying a bell-curve or pro rata mechanism to screen out capacity that can’t be accommodated in each cluster.

2.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

Avantus appreciates the separate workshop on 12/18 which provided a detailed overview and explanations of use and timing of data CAISO is working to consolidate. With various categories of data being available at different times, it appears challenging to obtain all necessary information at once. Regardless, we recommend CAISO to keep them in one document with a placeholder section and anticipated available date. Alternatively, these can be published under CAISO’s GI website as a standalone subsection accompanied by a master explainer document.

3.

Provide your organization’s comments on updates made throughout Section 2 Interconnection Request Intake

Zonal approach: Avantus appreciates CAISO's clarification on projects at POIs without capacity within a zone that has capacity would be excluded from study with no option to pursue Option B. In this case, Avantus is unsure why CAISO is approaching the IPE 2023 reform from a zonal perspective, rather than a simple, granular POI approach that is easier to follow.

We request that 1) CAISO provide further reasoning to support this intent, and 2) provide a demo of the mechanics outlined IPE presentation slide 21, which corresponds with section 2.5.1 page 41 of the revised proposal, using a set of IR requests and zone constraints, either from previous queue entry data or made up data, whichever is more convenient.

Developer Cap: Avantus strongly oppose an arbitrary developer cap until further data is provided on Figure 4 of page 31 of the revised proposal. Specifically, we request CAISO to produce subsequent withdrawal data as follow:

|

Parent Companies

|

IRs Submitted

|

IRs Withdrawn after Scoping Meeting

|

IRs Withdrawn after Phase I

|

|

27

|

1

|

|

|

|

9

|

2

|

|

|

|

18

|

3-5

|

|

|

|

10

|

6-10

|

|

|

|

7

|

11-20

|

|

|

|

3

|

21-35

|

|

|

The withdrawal to submittal ratio (and vice versa), while not comprehensive, could provide one data point to differentiate whether an entity is submitting excessive unready projects vs. simply having a larger portfolio. Additional data points to consider include site control, median construction lead time and median $/MW upgrade cost. Additionally, we request CAISO for clarifications on how the developer cap would apply for joint ventures, jointly owned projects, and M&As that take places throughout the interconnection process.

4.

Provide you organization’s comment on section 2.4 – Scoring Criteria

LSE Interest

Avantus appreciates CAISO removing previously concerning elements (e.g., permitting) from the scoring criteria; however, we are genuinely alarmed by the refined criteria which furthers LSEs' outsized influence on IR intake.

- We request clarification on whether the capacity amounts assigned to CPUC jurisdictional LSEs for scoring allocation can be applied toward their own projects.

- If yes, we urge both CAISO/LSEs to consider FERC's response to LSEs having indirect abilities to exclude competing resources in each study cycle.

- We recognize there are several WECC region tariffs that already allow LSE owned projects or projects being developed for LSEs/large end users/C&I customers to bypass financial based commercial readiness requirements.

- However, these are not considered unduly discriminatory as they do not bar other projects from entering the queue so long as they meet IR entry and readiness requirements.

Project Viability

Under project viability in the proposed scoring criteria, CAISO clarified in its proposal and at the 12/19 meeting that sub-category expansion of an existing facility (+gen-tie with capacity) would only include operational projects. Avantus views exclusion of phased projects typically spanning over several clusters as missed opportunities per the following:

- Existing operational facilities unassociated with other projects are unlikely to have appropriately sized gen-ties capable of accommodating additions.

- Modifying operational facilities to accommodate expansion would require logistics that PTOs may not entertain, and most certainly interrupt service, leading to lost revenue opportunities.

- Additionally, operational facilities are assumed to have PPA obligations where they cannot go offline for extended periods (other than maintenance or unplanned outage) to accommodate expansion work.

- Phased projects are more efficiently planned/sequenced to maximize a given gen-tie/bay position capacity limit (1100MW), which translates to more comprehensive engineering, permitting, and procurement workflow prior to start of construction.

5.

Provide your organization’s comment on Section 2.5.1 - Fulfillment of 150% of available and planned capacity

Avantus continue to find the 150% proposal problematic per the following:

- The 150% figure is arbitrary, lacking quantitative and/or qualitative analysis which demonstrate enough capacity would be studied to ensure long-term Resource Adequacy.

- Future IR qualifiers being based on existing/planned transmission capacity, specifically deliverable capacity.

- Most developers agree that after the 2024 TPD cycle, it is likely that no capacity will be left for C15 to qualify into.

- This does not factor in anticipated late-stage withdrawals or longer term TPP projects that will open deliverable capacity downstream in successive years closer to project CODs.

- This also does not consider future peak load amount or resource accreditation (We encourage the ISO to review AES Clean Energy’s comments on MISO’s proposed queue cap, starting page 5).

- CAISO did not conduct a proof-of-concept demo using previous queue entry data (at minimum C12, C13, and C14) as to how the proposal would have shaped the preceding clusters.

- This serves to provide critical insight for determining functionality and reasonableness of the proposed mechanism.

- CAISO has not cleared any resources through Phase II study since C14 kicked off in 2021, closing in on 3 years of inactivity.

- Paired with PTO delays, it is critical for CAISO to quantitatively and qualitatively verify that further restrictions from IPE '23 Track 2 will not lead to or exacerbate long term generation shortage.

Additional unanswered question(s):

- What happens to the 50% of 150% admitted project MWs that do not receive TPD after completing a study cycle?

- Will these MWs be required to withdraw or convert to Energy Only?

6.

Provide you organization’s comment on section 2.5.2 – Zonal Auctions

Avantus remain opposed to all auction mechanism per the following:

- There are close to no stakeholder support.

- A more reasonable second tie-breaking mechanism (DFAX) has been introduced.

- Order 2023 requirements will be sure to screen out a substantial amount of projects.

Should the ISO insist on implementing additional tie-breaking mechanisms, we recommend using a bell curve (after DFAX) or pro rata allocation to screen out capacity that can’t be accommodated in each cluster.

7.

Provide you organization’s comment on section 2.5.3 – Modifications to the Merchant-Financing “Option B” Process

Avantus reserves the right to comment on this proposal under future iterations.

8.

Provide you organization’s comment on the ISO’s proposal to remove both the off-peak and operational deliverability assessments to enable the ISO to meet Order No. 2023’s prescribed timelines (section 2.6.1)

Avantus requests CAISO to 1) provide additional insight (e.g., Gantt chart showing the workflow) on why the two assessments would not be accommodatable under Order 2023 prescribed timelines and 2) reasoning on why this wouldn’t qualify for Independent Entity Variation, considering these assessments have been a long-standing part of CAISO’s GIDAP.

9.

Provide your organization’s comments on updates made to Section 3.1 - One-time Withdrawal Opportunity

Avantus views CAISO ceasing further considerations on the one-time withdrawal proposal before quantifying any benefits as missed opportunity to reduce queue sizes. Along with LSA, Avantus provided detailed recommendations to produce a least harm scenario by bucketizing priority withdrawals. Avantus’ proposal is as follow for re-consideration (partially incorporated into LSA’s proposal presented to CAISO in August 2023):

|

Assumptions:

- Use C13PhII as a base line for “filtering” since upgrades assigned to C14 projects do not yet have downstream impact

- Filter out projects that have given NTP for construction (NOT E&P NTP)

- For projects that gave NTP (meaning upgrades are now in-flight), the proposal below could still work, however, CAISO/PTOs will need to work out a more extensive solution that minimizes harm to all parties

Bucketize queue positions that have not yet given Construction NTP in the following priority:

- C14 projects

- Withdrawals likely won’t have an immediate effect on PTO, should be given max possible refund less cost incurred

- Pre-C14 Projects that have no NU

- Withdrawals likely won’t affect PTO, should be given max possible refund less cost incurred

- Pre-C14 Projects with IRNUs only

- Withdrawals likely won’t affect PTO, should be given max possible refund less cost incurred

- Pre-C14 Projects with a combo of shared/individual NUs that are not identified as PNUs for downstream projects (Hence the suggestion to use C13PhII as a baseline)

- Restudy impact on equal queued projects using what-if withdrawing scenarios

- Any project’s withdrawal that would lead to cost reduction for affected parties because upgrades are no longer needed or scope is reduced, should be given max possible refund less cost incurred

- Pre-C14 Projects with a combo of shared/individual NUs that are identified as PNUs downstream

- Restudy impact on equal and later queue projects using what-if withdrawing scenarios

Any project’s withdrawal that would lead to cost reduction for affected parties because upgrades are no longer needed or scope is reduced, should be given max possible refund less cost incurred.

|

10.

Provide your organization’s comments on updates made to Section 3.2 - Limited Operation Study Updates

Avantus continues to advocate for a planning horizon LOS post LGIA execution, in addition to built-in LOS during study process based on IC requested COD akin to SPP’s process. Having the ability to bring a portion of a project online (pending long lead upgrades) is critical for fulfilling mid-term reliability needs.

(Please refer to previous comments for comprehensive details)

11.

Provide your organization’s comments on updates made to Section 3.3 - Requirements for Asynchronous generating facilities

Avantus reserves the right to comment on this proposal under future iterations.

12.

Provide your organization’s comments on updates made to Section 3.4 - Removal of suspension rights

Avantus continue to oppose removing suspension rights as stated in previous comments. Per CAISO’s data in the straw proposal, only 7 projects of many have requested/used suspension, which demonstrates it’s a tool rarely used due to CAISO’s TPD process and unique RA structure. This is insufficient data to support the elimination of a long-standing tool included with the pro forma LGIP.

13.

Provide your organization’s comments on updates made to Section 3.5 – Limitations to TPD

Avantus opposes restricting TPD transfer and views the proposed requirement for EO PPA to remain in queue and Group C only TPD allocation to be counter intuitive. Splitting EO projects with PPA into two classes of TPD eligibility is sure to complicate matters while simultaneously creating additional burden for ISO staff.

14.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue

Avantus continue to disagree with 1) CVC criteria on EO projects and 2) PPA being part of that CVC criteria for EO projects per the following:

- This effectively require all CAISO projects to have an offtaker to stay in the queue.

- We request CAISO to provide guidance on how projects can pursue the merchant path. (note: not referring to proposed option B merchant path, rather, a project that intend to reach COD as a fully merchant project)

- This also moots and contradicts TPD allocation Group C, as no projects will be able to stay in the queue and reach COD without a PPA. If an EO project obtains a PPA, they will be sure to seek deliverability under Group A or Group B in the next nearest TPD cycle.

Additionally, Avantus questions the logic of a 7-yr in queue CVC or ISD/COD requirement given C14 Study Results, PTO delays, and newly identified SCD mitigation.

- The 7-yr limit was initially part of pro forma LGIP language to prevent IR from submitting a project with ISD/COD too far out of a 10-yr planning cycle, accounting for 3-yr suspension/EPC delay allowance (Section 3.4.1 of LGIP, page 25 before Order 2023).

- Additionally, CAISO and other RTOs have since evolved to include a voluntary 20-yr Transmission Planning outlook.

- Further, considering that final FERC ruling on TPP docket could make some of these extended outlooks more permanent, the ISO should reconsider whether 7-yr CVC is just to impose across all resources and all project schedules.

15.

Provide your organization’s comments on updates made to Section 3.7 – Timing for Construction Sequencing Requests

Avantus requests clarification on whether CAISO is delaying Construction Sequencing 9 months before synchronization date or COD, considering that there is a wide span (6-11 months) between the two referenced dates itself. Nonetheless, CAISO has not thoroughly explained why it is proposing the change or demonstrated sufficient reasoning on how this would bring upon improvements.

16.

Provide your organization’s comments on updates made to Section 3.8 – Shared Network Upgrade Postings and Payments

The requirements outlined in this section to execute E&P Agreements and GIA, appear to moot the purpose of parking allowance. Avantus requests CAISO to further clarify in the proposal how deliverability status would be reflected in GIA Appendix C section (g) with the project in parked status.

17.

Provide your organization’s comments on updates made to Section 3.9 – Timing of GIA Amendments

Avantus reserves the right to comment on this proposal under future iterations.

18.

Provide your organization’s comments on updates made to Section 3.10 – PTO starting work on NTPs

Avantus reserves the right to comment on this proposal under future iterations.

19.

Provide your organization’s comments on Section 3.11 - Deposit for ISO implementation of interconnection projects

Avantus requests CAISO to 1) tally unused non-refundable Interconnection Study Deposit amounts from the last few Clusters and 2) Consider updating the GIDAP section 7.6 to redirect Interconnection Study Deposit and Non-Refundable Site Exclusivity Deposits toward post LGIA admin cost before implementing additional fees at the time of LGIA execution.

20.

Provide your organization’s comments on Section 3.12 - Update to the Phase Angle Measuring Units data

Avantus reserves the right to comment on this proposal under future iterations.

aypa power

Submitted 01/09/2024, 03:27 pm

1.

Please provide a summary of your organization’s comments on the revised straw proposal