Bay Area Municipal Transmission Group (BAMx)

Submitted 10/11/2023, 03:23 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Provide your organization’s comments on the preliminary reliability results for the North area:

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the CAISO’s 2023-24 Transmission Planning Process. The comments and questions below address the material presented at the CAISO Stakeholder meeting on September 26-27, 2023.

Previously Approved PG&E Projects

BAMx applauds the CAISO's efforts in testing and confirming the need for some of the previously approved projects. For example, the Fresno Area Preliminary Reliability Assessment Results identified the continued need for the following twenty-four (24) previously-approved projects.[2] However, there were a lot more previously-approved projects that were modeled in base cases. Although the CAISO did not confirm the continued need for all those projects, the presumption is that all those projects are needed. BAMx suggests that the CAISO confirm the continued need for all the previously-approved projects as listed below.

Greater Bay Area

- San Jose Area HVDC Lines: Newark–NRS and Metcalf–San Jose

- Metcalf-Piercy & Swift and Newark-Dixon Landing 115kV Upgrade

- Morgan Hill Area Reinforcement (formerly Spring 230/115kV substation)

Humboldt

- Willow Creek Reactive Support (Formerly Maple Creek)

- Garberville Area Reinforcement

Fresno

- Reedley 70 kV Reinforcement

Central Coast and Los Padres

- Morgan Hill Area Reinforcement

- Salinas-Firestone 60 kV line #1 & line #2 Re-conductor

- Previously recommended RAS in 2018-2019 TPP

- Estrella Substation Project

- Existing UVLS at Morro Bay & Mesa • South of Mesa Upgrades

Kern

- Wheeler Ridge 230 kV project

North Coast and North Bay

- Atlantic 230/60 kV transformer voltage regulator

- Rio Oso Area 230 kV Voltage Support

- Vaca Davis Area Reinforcement Project

- Tesla 115 kV Bus Reconfiguration Project

Central Valley

- Vaca Davis Area Reinforcement Project

Sierra

- Pease Sub-Area LCR Mitigation Project

Stockton/Stanislaus

- Atlantic 230/60 kV transformer voltage regulator

- Rio Oso Area 230 kV Voltage Support

- Vaca Davis Area Reinforcement Project

- Tesla 115 kV Bus Reconfiguration Project

Need to Scrutinize the Load Growth and Allocation

As the CAISO presented during the September 26th stakeholder meeting, there is considerable load growth and allocation assumed across multiple areas in the Greater Bay area[3] as well as other planning areas within the North area. For several reliability criteria violations, especially in the long-term (2035), the CAISO has recommended an approach that entails “reviewing” and “continuing to monitor” the load forecast. BAMx understands that the CAISO is in the process of conducting due diligence as the load growth assumptions, especially for transportation electrification, are scrutinized. BAMx supports the CAISO’s approach to closely scrutinize the load growth and allocation of that load growth before approving the need for reliability mitigation projects in the current cycle. BAMx requests that this due diligence process be made transparent to the stakeholders.

BAMx Appreciates CAISO’s Consideration of Low-Cost Transmission Alternatives

BAMx applauds the CAISO staff’s efforts in relying on the implementation of Remedial Action Schemes (RAS) and storage solutions in its Preliminary Reliability Assessment. The CAISO has effectively and rightfully utilized the existing/planned RAS solutions and also included some new battery storage projects to mitigate the contingency overloads. BAMx understands the CAISO’s recommendation for transmission upgrade alternatives takes into consideration the inadequacy and complexity of RAS in certain planning areas. BAMx encourages the CAISO to transfer such valuable feedback to the California Public Utilities Commission (CPUC) and California Energy Commission (CEC) so that it is incorporated as part of the battery storage mapping exercise in the next Transmission Planning Process (TPP) cycle from the reliability standpoint.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] CAISO September 26th Presentation.

[3] Greater Bay Area Preliminary Reliability Assessment Results, 2023-24 Transmission Planning Process Stakeholder Meeting, September 26-27, 2023, slide #7.

2.

Provide your organization’s comments on the preliminary reliability results for the South area:

Similar to PG&E area, BAMx appreciates the CAISO's efforts in testing and confirming the need for some of the previously approved projects in the SCE, SDG&E and VEA/GLW areas, and requests the CAISO confirm the continued need for all the previously-approved projects.

Also, see BAMx’s response to the SCE, SDG&E,-proposed request window applications in #3 below.

3.

Provide your organization’s comments on the PTO’s proposed reliability alternatives (SDG&E, PG&E, SCE, GLW):

PG&E’s Proposed Reliability Applications/Alternatives

- Martin-Millbrae 60 kV Area Reinforcement Project: PG&E is proposing to reconductor the Martin-Sneath Lane and Millbrae-Sneath Lane 60 kV Lines. The CAISO’s preliminary reliability assessment indicates that these 60 kV lines could be overloaded because of a significant load increase at Sneath Lane and Pacifica. BAMx recommends the CAISO review and monitor load growth in this area prior to approving any capital projects.

- Crazy Horse Canyon-Salinas-Soledad #1 and #2 115 kV Line Reconductoring: The CAISO preliminary reliability assessment indicates that the Crazy Horse-Moss landing 115 kV lines #1 and 2 overloads for Category P6 and P7 contingencies in 2028 (line #2) and 2035 (both lines). Also, the Crazy Horse-Natividad and Crazy Horse-Soledad 115 kV lines overload for P6 and P7 contingencies starting from 2025. BAMx supports the CAISO’s proposed RAS and the CAISO’s approach to closely monitor the high load forecast. Until the load forecast issue is resolved, BAMx recommends that the CAISO does not consider any capital projects, such as reconductoring the 115kV lines as included in the PG&E presentation to address the P2-1 issues[1].

- Camden 70 kV Reinforcement Project: PG&E’s September 2023 Request Window Presentation asserted a P0 (normal) condition overload on this line. However, BAMx does not recall the CAISO assessment identifying this issue.[2] The overloads shown in the PG&E presentation may be due to different load growth assumptions. Until the load forecast issue and assessment differences are resolved, BAMx recommends that the CAISO does not consider any capital projects.

- Reedley 70KV Capacity Increase Project: PG&E has identified several P1 issues on multiple facilities in the Reedley 70 kV Sub-area, which is consistent with the CAISO’s preliminary reliability assessment. [3] BAMx agrees with PG&E that these reliability issues could occur as early as 2025 and need mitigation. PG&E claims that at least 30 MW of battery energy storage system (BESS) will be required to mitigate all the identified overloads, and there will not be sufficient capacity to charge the BESS without reconductoring the transmission lines. BAMx believes PG&E should determine the amount of battery storage capacity that can be added and charged without reconductoring the transmission lines. PG&E can then identify the revised scope of the reconductoring project for CAISO’s approval.

- Vaca Dixon Reinforcement (Rescope): The P0 and P1 issues on the 60kV lines (Vaca Dixon-Plainfield and Vaca Dixon-Winters) identified by PG&E[4] are consistent with the CAISO’s preliminary reliability assessment. The CAISO has previously approved Vaca Davis Area Reinforcement project with an in-service date of December 2025.[5] PG&E’s proposal is to further reconductor the Vaca-Plainfield 60 kV line (about 30 miles). PG&E considered alternative mitigation of installing 25 MW of BESS at Winters Substation and reconductoring about 22 miles Winters-Plainfield but rejected it due to space limitations at Winters Substation. BAMx believes that PG&E should consider alternative locations for BESS before rejecting this cost-effective alternative.

- French Camp Reinforcement: PG&E considers several alternatives entailing looping the French Camp Substation into either 115kV or 230kV lines to address P1-2 and P2-1 overloads on the Weber-French Camp #2 60 kV. PG&E separately investigated the alternatives entailing reconductoring the Weber-French Camp #1 and #2 60 kV lines and installing BESS at the French Camp 60 kV transmission substation. PG&E rejected this alternative due to load-serving limitations in the long term. BAMx recommends that a combination of the reconductoring of the 60kV lines and BESS be investigated once the CAISO completes its due diligence on the transportation electrification-related load growth.

- Diablo Canyon High voltage mitigation: PG&E states that high voltage conditions are observed in the 230 kV system in the Los Padres area (San Luis Obispo County) in real-time operation.[6] However, the CAISO’s preliminary reliability assessment does not identify any such overloads on the Diablo, Morro Bay, or Mesa 230kV busses. BAMx notes that the CAISO base cases include shunt capacitors modeled at the Diablo Canyon 230 kV bus, and the voltages are within an acceptable range even in the off-peak cases. BAMx recommends the CAISO investigate if the PG&E-proposed project of installing a total of 120 MVAR shunt reactor along with the existing shunt capacitors at Mesa Substation 115 kV bus is needed.

- Tejon Area reinforcement: The P1 overloads on 70 kV lines Wheeler Ridge – San Bernard and Wheeler Ridge – Tecuya –Tejon identified in the PG&E presentation[7] are consistent with the CAISO’s preliminary reliability assessment. PG&E informed the stakeholders that PG&E is currently studying several alternatives to convert the 70kV lines to either 115kV or 230kV. BAMx recommends the CAISO and the PG&E include a detailed cost-benefit analysis to compare these alternatives.

SDG&E’s Proposed Reliability Applications/Alternatives

Many contingency overloads driving the need for SDG&E proposed projects are not identified in the CAISO preliminary reliability assessments. One such example is the overload TL6959 (PQ-MTO) identified by SDG&E under normal conditions starting in 2030.[8] Upon probing during the September 27 stakeholder meeting, BAMx discovered that the cases used by SDG&E are considerably different from the cases used by the CAISO, driving the discrepancies in SDG&E’s findings. BAMX believes it is imperative that the PTOs not deviate from the study assumptions CAISO has developed in coordination with the California Public Utility Commission (CPUC) and the California Energy Commission (CEC). BAMx, therefore, urges the CAISO to reject the analysis provided by SDG&E unless the load forecast and load allocation due diligence determine that the SDG&E’s local load forecast is more accurate.

GridLiance West Project Proposal for Reliability Request Window

GridLiance West (GLW) has proposed the Trout Canyon-Lugo 500kV, which entails building a new series-compensated 500 kV transmission line from the Trout Canyon 500 kV substation to the Lugo 500 kV substation.[9] GLW claims the CAISO’s preliminary 2023-2024 TPP assessment showed overloading and divergence on the GLW and surrounding transmission system.[10] However, it fails to note the following two points. First, the divergence occurs on the 138kV lines under P7 contingencies only in the 2035 Spring Off-peak conditions. Second, the CAISO solution for this potential issue is the future Trout Canyon RAS that trips 1,450MW installed capacity generation at Trout Canyon 230kV, which is significantly more cost-effective than the $2 billion Trout Canyon-Lugo 500kV project. BAMx recognizes that there are policy benefits associated with the Trout Canyon-Lugo 500kV project as identified in the CAISO 2022-2023 Transmission Plan.[11] The merits of the Trout Canyon-Lugo 500kV project need to be compared with its alternative, such as the Mead - Adelanto Project Upgrade project. [12] In other words, the Trout Canyon-Lugo 500kV project should be assessed as primarily a policy-driven project. In addition, if there are any reliability benefits associated with it, they should be identified as such. However, the Trout Canyon-Lugo 500kV project should not be approved as a reliability-driven transmission project in the current planning cycle.

[1] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.45-48.

[2] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.58-60.

[3] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.66-70.

[4] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.16-90.

[5] Central Valley Area Preliminary Reliability Assessment Results, 2023-24 Transmission Planning Process Stakeholder Meeting, September 26-27, 2023, slide #8.

[6] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.38-40.

[7] PG&E’s 2023 Request Window Proposals, September 27, 2023, pp.72-82.

[8] SDG&E’s 2023 Request Window Proposals, September 27, 2023, p.11.

[9] GLW’s 2023 Request Window Proposals, September 27, 2023, p.2-4.

[10] Ibid.

[11] CAISO 2022-2023 Transmission Plan, May 10, 2023, p.82.

[12] See http://www.caiso.com/InitiativeDocuments/Letter-Alternative-to-Trout-Canyon-Lugo-500-kV-line-Apr242023.pdf

4.

Provide your organization’s comments on the high voltage TAC update:

BAMx appreciates the continued work of the CAISO in keeping the stakeholders updated about the likely impact of its decision to approve transmission projects affecting the High Voltage (HV) Transmission Access Charge (TAC). BAMx appreciates the opportunity to comment on the CAISO's 2022-2023 HV TAC Estimating Model ("TAC Model" hereafter) that was originally posted on the CAISO website on September 21, 2023, and subsequently updated on October 2, 2023. However, it appears that the spreadsheet comprising the capital costs documented for several capital projects with high voltage components[1] was not updated. Therefore, we now have inconsistency between the costs for the reliability projects in the capital cost spreadsheet and those assumed in the Reliability tab of the TAC model. BAMx’s comments are applicable to the updated October 2nd version. We hope that the CAISO addresses the issues raised by BAMx below in the next update of the TAC Model.

CAISO needs to point out their current TAC forecast as it does not provide an accurate signal for the outer years, i.e., 2024-2029, and does not address additional wildfire mitigation costs

BAMx notes that the tapering of the CAISO's TAC forecast in the outer years, that is, during 2029-2037, is primarily driven by the very low (or no) levels of transmission capital expenditures assumed in the HV TAC forecasting model. As shown in Figure 1, the HV TAC forecasting model assumes that the HV capital expenditures[2] will occur during 2023-2032, primarily driven by the CAISO-approved reliability-driven and policy-driven transmission projects.

Figure 1: A Comparison of the CAISO's TAC ($/MWh) and Assumed Capital Expenditures (M$)

.png)

As shown in Figure 1, relatively very little capital expenditures ($229 million) are assumed in the outer years (2033-2036) in the TAC Forecasting Model, as it does not include capital expenditures in the CAISO's upcoming TPP cycles. In other words, the HV TAC rates, especially for 2033-2037, will likely be higher than those depicted in the current version of the HV TAC Forecasting Model.

BAMx appreciates the CAISO providing a separate spreadsheet comprising the capital costs documented for several capital projects with high voltage components[3]. This spreadsheet (Capital Costs Estimates) helps the CAISO and stakeholders to easily modify the transmission projects, their commercial operation dates, and related capital costs going forward.

Capital Project Cost Comments

BAMx has the following questions and comments on some of the capital transmission projects included in the TAC Model. We hope the CAISO addresses them in the next revision of the TAC Model. All the recommended corrections below are expected to increase the projected HV TAC further.

- Riverside Transmission Reliability Project (RTRP): We noticed that the latest TAC model continues to exclude the capital expenditure associated with Riverside Transmission Reliability Project (formerly Jurupa 230kV Sub). According to SCE's AB 970 quarterly report (Q1 2021), this project was approved by the CAISO in 2007 with a current planned in-service date of 10/15/2026. A Certificate of Public Convenience and Necessity (CPCN) for this project was granted on 03/12/2020 and indicates that its capital cost is approximately $450M. Please explain why the capital expenditures associated with the RTRP were excluded from the TAC Model.

- Alberhill Transmission Project: The TAC model continues to assume the old capital cost of $235M. This amount needs to be updated to $545M to reflect SCE's updated cost estimate.[4] Please explain why the capital expenditure associated with the Alberhill in the TAC Model is so low.

- Warnerville-Bellota 230 kV Line Reconductoring: The TAC model assumes a capital cost of $107M; however, based on the CAISO's reporting, the capital cost is expected to be $151.6M.[5] Furthermore, the TAC model assumes a part of the capital expenditures ($19M) to be incurred in 2025; however, the CAISO has reported the in-service date for this project to be earlier, that is, 2024. Therefore, it appears the capital expenditures need to be adjusted to be consistent with the latest schedule.

- Tulucay-Napa #2 Line Capacity Increase Project: The estimated total cost of the original scope to replace limiting switches and jumpers at Basalt and Tulucay 60 kV substations and the expansion of the project to reconductor the Tulucay-Napa #2 60 kV line from Tulucay to Basalt was $4.6 million, which is currently included in the TAC Model. However, the expected cost of the project's expansion is $2.3 to $4.6 million, with a new total estimated cost of $14.6M approved in the 2022-2023 Transmission Plan with an expected in-service date of 2028.[6]

- GLW/VEA area upgrades: The TAC model assumes a capital cost of $278M, consistent with its estimated cost when it was approved in the 2021-2022 Transmission Plan. However, based on the CAISO's 2022-2023 Transmission Plan, the estimated cost of the increased scope is $228 million for a total cost of the recommended re-scoped project of $506M with an estimated in-service date 2027.[7]

If we include the missing capital costs associated with the above-mentioned five (5) transmission projects, adding to almost $1 billion, the estimated HV TAC increases by approximately $0.61/MWh in 2030, as shown in Figure 2 below.

Figure 2: A Comparison of the CAISO's Original and Revised TAC ($/MWh) and Assumed and Missing Capital Expenditures (M$)

.png)

[1] 2022-2023 Transmission Plan High Voltage Transmission Access Charge Capital Costs (2022-2023TransmissionAccessCharge-HighVoltageCapitalCostEstimates.xlsx)

[2] Any capital expenditures after the in-service year are added to rate base in the year of expenditure in the HV TAC forecasting model. Source: California ISO TAC Model Operating Instructions.

[3] 2022-2023 Transmission Plan High Voltage Transmission Access Charge Capital Costs (2022-2023TransmissionAccessCharge-HighVoltageCapitalCostEstimates.xlsx)

[4] See CPUC, A.09-09-022, Second Amended Application of Southern California Edison Company (U 338-E) For A Certificate Of Public Convenience And Necessity For The Alberhill System Project, May 11, 2020, P.7.

[5] CAISO September 27th Presentation, p.66.

[6] CAISO 2022-2023 Transmission Plan, May 10, 2023, p.42.

[7] CAISO 2022-2023 Transmission Plan, May 10, 2023, p.79.

5.

Provide your organization’s comments on the policy assessment update:

BAMx found the schematics for the resource to busbar mapping for the Base portfolio used under the policy-driven assessment presented by the CAISO on the September 27th meeting to be helpful.[1] BAMx requests the CAISO to also include the gas-fired generation retirements as part of this mapping. This will provide stakeholders with a better picture of these retirements and the new resource additions on the local capacity area deficiencies.

[1]

6.

Provide your organization’s comments on the economic assessment update:

No comments at this time.

7.

Provide your organization’s comments on the 20-year transmission outlook update:

BAMx, along with several stakeholders, provided comments to the CAISO’s August 16, 2023, stakeholder meeting presentation on the 20-year transmission outlook update and its proposed approach to offshore wind on August 30, 2023. The CAISO has not provided any response to stakeholder questions and comments to date. In the interest of transparency and meaningful stakeholder feedback, BAMx strongly urges the CAISO to provide timely responses to stakeholder feedback. Without the CAISO’s response, providing CASO with any further comments on its September 27 meeting presentation is unproductive.

8.

Provide any additional comments your organization has on the September 26-27, 2023 Transmission Planning Process Meeting:

No comments at this time.

California Public Utilities Commission

Submitted 10/13/2023, 11:38 am

1.

Provide your organization’s comments on the preliminary reliability results for the North area:

The CPUC Energy Division staff (CPUC staff) are grateful for this opportunity to provide comments on the September 26-27 meeting for the 2023-2024 Transmission Planning Process.

Reliability Issues with Previously Approved Reliability Projects

The CAISO identified three previously approved Bay Area reliability projects with new reliability issues[1]: Oakland Clean Energy Initiative, East Shore-Oakland J 115kV Reconductoring, and Miscellaneous Oakland Issues (various contingencies). CPUC staff requests further details from the CAISO on how such previously approved projects will be treated if found to be ineffective and are not addressing the issues they were intended to. CPUC staff seeks details on the methodology used to determine how CAISO will handle these projects.

CPUC staff also seeks clearer understanding of why development of the Moraga-Sobrante 115kV Line Reconductor project[2] is resuming if the P2 contingency-driven overload that occurs on the Moraga-Sobrante #1, 115 kV line disappears in future scenarios. During the September 26th and 27th meetings the CAISO made note of the irregularity and stated that it would look into this project further. CPUC staff requests that updates be provided to all stakeholders.

[1] CAISO September 26th TPP Presentation, Greater Bay Area Preliminary Reliability Assessment Results, Slide 9 (Slide 24 of the compiled slide-deck).

[2] CAISO September 26th TPP Presentation, Greater Bay Area Preliminary Reliability Assessment Results, Slide 12 (Slide 27 of the compiled slide-deck).

2.

Provide your organization’s comments on the preliminary reliability results for the South area:

CPUC staff has no comments at this time on the preliminary reliability results for the South area.

3.

Provide your organization’s comments on the PTO’s proposed reliability alternatives (SDG&E, PG&E, SCE, GLW):

3.1. Standardized Cost Estimating Methodology

While the proposed reliability projects are in the early stages of planning, CPUC staff requests further clarity on cost estimates and cost estimating methodology. It is unclear whether the CAISO expects that all Participating Transmission Owners (PTO) employ a standard methodology to determine cost estimates or whether there is a process by which the contingencies and/or cost ranges are further refined prior to CAISO approval. The four presenting PTOs indicated the following: PG&E provided a base cost estimate with 100% contingency (using an AACE Level 5 estimate); SCE provided a singular cost estimate figure using the 2023 Draft Per Unit Cost Guide; and SDG&E and GridLiance West (GLW) stated nothing about the methodologies used to arrive at their estimates. CPUC staff requests that the CAISO require consistent cost estimating methodology from its PTOs and that the PTOs provide a clearer explanation of how they arrive at their estimated costs. Further, between now and approval of reliability, economic, and policy projects in 2024, CPUC staff requests that the CAISO carefully vet the cost estimates included in the final Transmission Plan.

3.2. Re-Scope or Modification of Previously Approved Projects

As explained in the stakeholder meeting, rescoping or modifying projects previously approved by the CAISO has been proposed, even after only one or two years (i.e., projects previously approved in the 2021-2022 or 2022-2023 TPP). For example:

- The PG&E Atlantic High Voltage Mitigation Project was originally approved for a voltage regulator estimated at $7 million - $14 million in the 2021-2022 Transmission Plan. A component failure in 2022 required an additional $4 million - $8 million installation to preserve the original work scope but PG&E identified significant disadvantages compared to a re-scope. PG&E’s re-scope request is a new transformer and associated bus work totaling $20 million - $40 million.

- The SCE Mira Loma 500kV Bus SCD Mitigation Project was originally approved as the replacement of four circuit breakers estimated at $10 million in the 2022-2023 TPP. Field verification identified the need for an additional two circuit breaker replacements for a proposed project modification of $5 million.

CPUC staff would like to understand the process the CAISO goes through in its analysis when a PTO proposes a significant scope change or modification of a project recently approved in a CAISO Transmission Plan. Is it known by the CAISO at the time of original approval that such projects could require changes so soon after CAISO approval?

3.3. Load Forecasts

CPUC staff requests clarification from the CAISO on whether the same load forecasts are being used by all PTOs to determine transmission needs and proposed solutions. It is unclear whether the CAISO is aware which load forecasts and perhaps other assumptions are being used for proposed projects. Other stakeholders during the September 26th and 27th meetings noted that PG&E reported higher thermal overloads than the levels reported in the CAISO base case, and CAISO reliability assessment results appeared to be different than what was presented by SDG&E. PG&E responded in the meetings that the same base case was used but a different load forecast “makes sense to their system.” Similarly, SDG&E mentioned the difference in reliability assessment results for their situation was due to the SDG&E team using peak load cases for their analysis. Such occurrences could result in identification of different mitigation needs, discordant transmission planning, and inflated costs of projects.

CAISO indicated they were fine-tuning the load forecast, specifically in multiple areas of concern (e.g., East Bay Area and San Jose), and are aiming to post results of the reliability assessment that incorporate the updated load forecast by the end of October. CPUC staff commends the CAISO for their work on this and echoes other stakeholders’ request to identify all changes made to the load forecast and the impact of those changes on the determination of transmission needs and solutions.

3.4. Proposed Project Alternatives

For many of the proposed reliability projects, alternatives were mentioned. In certain cases, PTOs dismissed alternatives due to the costs being higher than the preferred scope[1], but cost information was not included. CPUC staff encourages the CAISO and PTOs to provide cost estimates of all alternatives considered, and if none can be provided, an explanation of why costs have been omitted.

Additionally, during the September 26th and 27th meetings, stakeholders suggested battery storage and Dynamic Line Rating as alternatives to SDG&E’s proposed reliability projects. SDG&E responded that it would follow up on that suggestion. CPUC staff requests that any follow-up information from SDG&E be provided to all stakeholders.

3.5. Trout Canyon-Lugo 500 kV Project

The GridLiance West Trout Canyon-Lugo 500 kV Project was originally presented in the 2022-2023 TPP, but was removed from the Final Transmission Plan “pending additional analysis of stakeholder input and a recommendation will be brought to the [CAISO] Board at a later date.”[2] CPUC staff requests clarification on what has changed regarding transmission needs and/or this particular transmission solution that would make it a more viable project in the 2023-2024 TPP.

[1] See PG&E’s 2023 Request Window Proposals Presentation, Covelo 60 kV Voltage Support Project, slide 8.

[2] Board Approved 2022-2023 Transmission Plan, page 3, reference #7.

4.

Provide your organization’s comments on the high voltage TAC update:

CPUC staff has no comments at this time on the high voltage TAC update.

5.

Provide your organization’s comments on the policy assessment update:

CPUC staff has no comments at this time on the policy assessment update.

6.

Provide your organization’s comments on the economic assessment update:

CPUC staff has no comments at this time on the economic assessment update.

7.

Provide your organization’s comments on the 20-year transmission outlook update:

CPUC staff has no comments at this time on the 20-year transmission outlook update.

8.

Provide any additional comments your organization has on the September 26-27, 2023 Transmission Planning Process Meeting:

CPUC staff has no further comments on the September 26-27, 2023 meeting at this time.

California Public Utilities Commission - Public Advocates Office

Submitted 10/11/2023, 05:38 pm

1.

Provide your organization’s comments on the preliminary reliability results for the North area:

The Public Advocates Office at the California Public Utilities Commission (Cal Advocates) provides these comments on the California Independent System Operator’s (CAISO) and its Participating Transmission Owner’s Reliability Assessment Study Update presentations on September 26-27, 2023. Cal Advocates is an independent consumer advocate with a mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Cal Advocates has no specific comments on the North area projects, at this time. Rather, Cal Advocates has the following six recommendations for future discussions on improvements to the CAISO transmission planning process.

- CAISO Participating Transmission Owners (PTOs) should have more than one month to develop reliability solutions for consideration and approval. Cal Advocates makes this request because PTOs continue to present transmission projects for approval that are still in the conceptual stage. A Pacific Gas and Electric Company (PG&E) representative stated in the September 27, 2023 stakeholder meeting that several of PG&E’s projects are still conceptual because PG&E was given only one month to develop project solutions. Cal Advocates understands that this one-month timeframe commences when CAISO posts its reliability results in late August and ends when CAISO holds its reliability results stakeholder meetings in late September. If the PTOs are stating that they need more time to evaluate alternatives that include non-wire solutions and develop near final project designs and project costs, they should be given more time. To illustrate the issue with the cost figures, PG&E provides project cost estimate ranges for all its proposed projects with a budget contingency of 100%. PG&E supports its cost estimate range with the following footnote on its presentation slides “[Association for the Advancement of Cost Engineering (AACE)] Level 5 quality estimates include a +100% contingency.”[2] Per ACCE, Class 5/Level 5 cost estimates can have an estimated accuracy range of up to 100% because Class 5 estimates “are generally prepared based on very limited information.”[3] With more time to evaluate project alternatives, scope projects and identify all needed project components, PTOs should be able to provide more complete project designs with more accurate project costs.[4]

- Require the PTOs to provide cost estimates for all the transmission solutions considered. As stated in the California Independent System Operator Corporation’s (CAISO) Business Practice Manual (BPM) document for the CAISO TPP, one purpose of the TPP is to identify alternatives to proposed reliability and policy infrastructure solutions.[5] To confirm whether a proposed project is the low-cost, best-fit solution, it is necessary to evaluate and compare the proposed project to feasible alternatives. A reliability-driven project can, in part, be justified based on its costs compared to alternatives.[6] Thus, to fully justify a reliability-driven project, CAISO and the PTOs should consider feasible alternatives and provide their associated costs.

- Investigate the California Energy Commission’s and the PTO’s load forecasts that are not consistent with service area trends and uses.

Cal Advocates supports CAISO’s proposed load forecast investigation for the East Bay and San Jose.[7]

- Require all PTOs to consider solutions that can be scaled.

Cal Advocates supports PG&E’s transmission solution approach, which considers scalable solutions to address potential major load growth increases.[8] Cal Advocates requests that all PTOs consider scalable solutions to address forecasted load growth. This approach is prudent in the event that the forecasted load growth does not appear when estimated. For example, incremental improvements to existing lines such as adding energy storage or advanced energy flow technologies and changing line ratings should be considered and phase-in first, before more costly solutions such as line reconductoring and new lines and new substations are considered and implemented. Hybrid solutions that include energy storage and existing line upgrades should also be considered before new lines are proposed as they are likely to be more cost efficient. Considering grid enhancing technologies to meet grid needs instead of or in combination with wire solutions is consistent with proposed Federal Energy Regulatory Commission transmission planning reforms.[9]

- Maximize the capacity of existing and proposed grid connected energy storage. It is in the ratepayers’ interest that the full capacity of the proposed energy storage capacity on the CAISO grid by 2035, which is estimated at 28,381 megawatts (MW), be maximized. [10] Energy storage has the capacity to meet transmission reliability, economic and policy needs since it can provide both energy and grid services.[11] Given the existing and proposed energy supply, PTOs have been asked to only consider the interconnection costs for energy storage when evaluating energy storage as a feasible transmission solution. The PTOs alternative project analysis should also consider locating energy storage just outside of a substation if there isn’t sufficient room in a given substation.

6. CASIO and the PTOs should evaluate alternative solutions to address voltage stability issues.

CAISO should assess whether existing resources can contribute to meeting voltage stability requirements. Existing resources (or resources that are already planned) may be able to provide the services of equipment such as static synchronous compensators (STATCOMs) at a lower cost. Potential resources include existing transmission-interconnected inverter-based resources (IBRs), and distributed energy resources (DERs) coordinated through DER management systems (DERMS) or autonomous smart inverter functions, such as the volt-var function.[12]

Existing or new transmission-scale IBRs, such as energy storage and solar photovoltaic (PV) plants provide voltage support through injection of reactive power. Real power output limits the ability of IBRs to provide reactive power, which should be considered in modeling, but these IBRs will often have headroom to provide low-cost or no-cost reactive power.[13] This is especially true of PV during evening and nighttime hours. DERs can provide the same services. DERs interconnected through the utilities’ Rule 21 are already required to provide voltage support. Moreover, as the utilities develop the ability to directly control DERs through their ongoing deployments of DERMS, these distributed IBRs can provide a coordinated response, which may be more useful to the CAISO.

[1] Cal. Public Util. Code, § 309.5.

[2] PG&E’s 2023 Request Window Proposal CAISO 2023-2024 Transmission Planning Process, September 27, 2023 at pp. 7, 12, 17, 24, 26, 27, 28, 40, 46, 60, 65 and 70.

[3] AACE 96R-18 Cost Estimate Classification System – As Applied in Engineering, Procurement, and Construction for Power Transmission Line Infrastructure Industries, AACE International, August 7, 2020, p. 8.

[4] AACE 96R-18: Cost Estimate Classification System – As Applied in Engineering, Procurement, and Construction for the Power Transmission Line Infrastructure Industries, AACE International, August 7, 2020, p. 20.

[5] Business Practice Manual for Transmission Planning Process Version 21.0, CAISO, June 30, 2020, (BPM-TPP), pp. 51-52.

[6] CAISO Tariff Section 24 Comprehensive Transmission Planning Process, September 9, 2020 (Section 24), 24.4.5 Determination of Needed Transmission Solutions.

[7] Greater Bay Area Preliminary Reliability Assessment Results, 2023-2024 Transmission Planning Process Stakeholder Meeting September 26-27, 2023 (Presentation) at p. 21/

[8] PG&E’s 2023 Request Window Proposal CAISO 2023-2024 Transmission Planning Process, September 27, 2023 at p. 83.

[9] FERC Docket RM21-17-000, April 21, 2022, Item 274 at p. 217.

[10] CPUC Decision 23-02-040, Decision Ordering Supplemental Mid-Term Reliability Procurement (2026-2027) and Transmission Electric Resource Portfolios to California Independent System Operator for 2023-2024 Transmission Planning Process, Rulemaking 20-05-003, February 23, 2023 at p. 48.

[11] CPUC Energy Storage Procurement Study: End Uses and Multiple Applications, Attachment E, E-2.

[12] Volt-VAR describes a function in which inverters measure local voltage produce volt-amperes reactive (VARs) in proportion. This feature is described in the IOUs’ Rule 21 Tariffs. See Commission Rule 21 Interconnection, available at: https://www.cpuc.ca.gov/Rule21/.

[13] See R. K. Varma, E. M. Siavashi, S. Mohan and T. Vanderheide, "First in Canada, Night and Day Field Demonstration of a New Photovoltaic Solar-Based Flexible AC Transmission System (FACTS) Device PV-STATCOM for Stabilizing Critical Induction Motor," in IEEE Access, vol. 7, pp. 149479-149492, 2019, doi: 10.1109/ACCESS.2019.2935161. See also R. K. Varma and E. M. Siavashi, "PV-STATCOM: A New Smart Inverter for Voltage Control in Distribution Systems," in IEEE Transactions on Sustainable Energy, vol. 9, no. 4, pp. 1681-1691, Oct. 2018, doi: 10.1109/TSTE.2018.2808601.

2.

Provide your organization’s comments on the preliminary reliability results for the South area:

Cal Advocates has no comment on the Southern area reliability results at this time.

3.

Provide your organization’s comments on the PTO’s proposed reliability alternatives (SDG&E, PG&E, SCE, GLW):

San Diego Gas and Electric Company

Based on the significant differences between the reliability mitigations/projects that CAISO and SDG&E proposes for the SDG&E service area, Cal Advocates concludes that SDG&E is likely using a different load forecast or considering factors that have not been shared with CAISO. The following are the contrasting transmission mitigations that CAISO and SDG&E proposed for reliability issues identified in SDG&E’s service area and Cal Advocates recommendations.

- To address reliability issues at the Valley Center, CAISO proposes limiting energy storage charging and utilizing an existing Remedial Action Scheme (RAS).[1] In contrast, SDG&E proposes two new 5-mile 69 kV lines, reconductoring 0.1 mile of an existing line and de-energizing a section of a line at an estimated cost of $51 million.[2] Cal Advocates recommends that SDG&E present the results from its evaluation of CAISO’s recommended operational solutions, and the cost of this alternative mitigation.

- To address the identified reliability issues at the Clairemont Tap area, CAISO proposes installing energy storage at the Clairemont substation. SDG&E did not present this alternative or its costs.[3] Instead, SDG&E evaluated both rebuilding and reconductoring TL600B line section.[4] Cal Advocates recommends the CAISO and SDG&E evaluate adding energy storage as a least cost best fit alternative to address the reliability issues at the Clairemont Tap area. This evaluation should consider the amount of energy storage that is expected to be procured in the SDG&E service area and locating energy storage outside of the Clairemont substation if necessary.

- For the Penasquitos line area, CAISO does not identify any overloads in the area and specifically on the TL 6969 line for the next 10-year planning period. In contrast, SGD&E predicts that the TL 6969 line will be overloaded by 2030. To address this overload, SDG&E proposes a new 2-mile 69 kV Penasquitos – Mira Sorrento Line with an estimated cost of $26 million. SDG&E considered only reconductoring the TL 6959 line and did not present any analysis of a non-wire alternative to the proposed new line. Cal Advocates recommends further study of any possible reliability issues associated with the TL 6959 line since CAISO did not appear to identify any. If there is a reliability issue associated with this line, Cal Advocates request that SDG&E consider feasible non-wire alternatives.

- For the Imperial Valley Substation area, CAISO does not identify any reliability issues. It is worth noting there are two approved projects in the Imperial Valley Substation area, which are (1) the new Miguel-Sycamore Canyon kV line into Suncrest and (2) the new Imperial Valley - North of Songs 500 kV line and substation. Based on SDG&E’s system information, SDG&E proposed replacing the existing Imperial Valley substation 63kA circuit breaker with an 80kA circuit breaker for $15 million to address “overstressed 230 kV circuit breakers.[5] Since CAISO did not identify any reliability issues at the Imperial Valley Substation, Cal Advocates recommends CAISO provide an evaluation of the Imperial Valley substation performance issues and possible solutions.

- For reliability issues adjacent to the Miguel Substation area, CAISO proposes operational solutions and the proposed Miguel Sycamore Canyon 230 kV line Loop-into Suncrest.[6] SDG&E also proposes operational solutions and to modify an existing Remedial Action Scheme (RAS) for at total project cost of less than $1 million.[7] Cal Advocates requests CAISO provide the cost of its proposed operational solutions for comparison.

Pacific Gas and Electric

French Camp Reinforcement Project (Conceptual)

PG&E is currently evaluating transmission mitigation alternatives to address anticipated load growth and thermal violations on the Weber -French Camp #2 60 kilovolt (kV) line. Cal Advocates has two recommendations for this evaluation. First, PG&E should include demand reduction programs as part of the mitigation. As stated in PG&E’s presentation, the drivers of this project are load requests from distribution and merchandise centers. These centers anticipate expanding and increasing their building footprint and load.[8] New building expansions, if permitted, will have to comply with the state’s new building codes which now require buildings to reduce energy demands with on-site generation and other energy efficiency measures. Second, consider and provide the costs for a hybrid alternative that includes a 15-megawatt (MV) energy storage facility and reconductoring the Weber-French Camp #2 60 kV line with advanced conductors. This option may be the lowest cost alternative.

Diablo Canyon Area 230 KV High Voltage Mitigation

CAISO and PG&E do not appear to observe the same reliability issues for the Diablo Canyon area, and as a result propose different reliability solutions. CAISO proposes installing a series compensation rearrangement on the Table – Vaca – Collinsville – Tesla 500 kV path and a Series reactor on the Collinsville – Pittsburg 230 kV line as part of the approved Collinsville substation project.[9] PG&E, in contrast, proposes an MVAR shunt reactor at the MESA substation 115 kV Bus for a cost of $35 to $70 million.[10] CAISO already approved Dynamic Reactive Support facilities to alleviate the thermal overloads and high voltages in central California anticipated with the Diablo Canyon retirement.[11] This project will connect a Static Synchronous Compensator (STATCOM) to Midway-Gates 500 kV line to address anticipated thermal overloads and high voltages in the area. CAISO approved this project in the 2018-2019 TPP. Thus, Cal Advocates requests additional information to confirm PG&E’s proposed mitigation is still needed with the approved projects in place and that it is the least cost best fit solution.

Spence 60 kV Area Reinforcement Project (Conceptual)

PG&E is currently exploring different transmission solutions to mitigate its anticipated load growth in the Salinas area. Specifically, PG&E anticipates load to increase from 23.3 MW to 84.6 MW by 2035 in the Salinas area.[12] Cal Advocates recommends PG&E provide additional information to demonstrate the significant load growth PG&E forecasts in this rural California agricultural area. Cal Advocates also recommends that the Salinas-Firestone #1 and #2 60 kV line project approved in the 2019-2020 Transmission Plan be put on-hold and or reevaluated in light of the alternatives PG&E is proposing in the Salinas-Firestone substation area. These alternatives consider rebuilding or reconductoring the lines between the Salinas and Firestone substations.[13]

Valley Electric Association Area

For the Valley Electric Association (VEA) service area, CAISO’s reliability study results do not demonstrate a need for new transmission investments over the 10-year planning period. CAISO’s study results identify existing operational solutions and approved projects to address these identified reliability issues. These reliability mitigations include: (1) an undervoltage load shedding program;[14] (2) a planned Remedial Action Scheme (RAS); (3) the approved Gridliance West (GLW) Core Update at nearly $300 million;[15] and (4) generation redispatch and other operational measures.[16] In contrast, Gridliance West proposed the $2 billion Trout-Canyon Lugo 500 kV project to address reliability, economic, and policy issues in the VEA area. Since the 2023-2024 Transmission Planning Process (TPP) reliability results do not demonstrate a need for this project within a 10-year timeframe, CAISO should continue to study this proposed project as a policy and or economic project.

Provided as background, the following are the existing and proposed policy transmission investments for the VEA transmission system to meet the state’s clean energy goals.

- The GLW/VEA Core Upgrade with an estimated cost of $278 million.[17] This project was approved in the 2021-2022 CAISO Transmission Plan as a policy project to access renewables in southern Nevada.

- The Beatty 230 kV project with an estimated cost of $155 million.[18] This project was approved in the 2022-2023 CAISO Transmission Plan as policy project to access renewables in southern Nevada.

- The Trout-Canyon Lugo 500 kV line with an estimated cost of $2 billion.[19] This project was discussed in the 2022-2023 Transmission Planning Process (TPP) as a policy project to further improve access to renewables in southern Nevada. This project was put on hold for further study.[20] GLW presented this project again as a reliability, economic and or policy project in the 2023-2024 TPP.

In prior comments, Cal Advocates requested further study of the Trout Canyon - Lugo 500 kV line and the GLW/VEA Core Upgrade projects because these projects were not evaluated in CPUC’s integrated resource planning (IRP) proceeding.[21], [22] The IRP proceeding uses the CAISO transmission capacity information to determine the optimal portfolio of resources to meet the state’s goals.

Cal Advocates also raises questions regarding the justification for approving the GLW/VEA Core Upgrade project since it was not consistent with CAISO’s definition of a Category 1 policy project for recommended approval. Per CAISO’s tariff, Category 1 projects are those that are needed for the base case and a “significant percentage of the stress scenarios” and are recommended for approval.[23] The GLW/VEA Core Upgrade project was not needed for a “significant percentage of the stress scenarios,” so it did not appear to qualify as a Category 1 project. Similarly, the Trout Canyon - Lugo 500 kV project was not identified as needed for the base case and thus it also did not appear to qualify as a Category 1 policy project.[24]

Based on recent Load Serving Entity (LSE) procurements, there are likely resources available at competitive and potentially lower costs in other locations than southern Nevada. Cal Advocates notes that LSEs are also pursing geothermal resources in California and northern Nevada where there is more geothermal power potential than in southern Nevada.[25], [26], [27], [28]

Thus, Cal Advocates continues to request an evaluation of the proposed and approved VEA transmission system upgrade projects to determine if they are appropriately scoped for the current proposed 2035 California resource portfolio and are cost effective for California ratepayers.

At a minimum, Cal Advocates requests that CAISO evaluate the proposed alternative to the GLW Trout Canyon – Lugo 500 kV project which was suggested in the 2015-2016 TPP and last April 2023 to meet any policy or economic needs.[29], [30] This alternative, referred to as the Mead - Adelanto Project Upgrade (MAP Upgrade Project), would convert the existing Mead - Adelanto line from High-Voltage Alternating Current operation (“HVAC”) to High-Voltage Direct Current (“HVDC”) operation. This conversion is anticipated to increase the Mead - Adelanto line capacity from 1,291 megawatt (MW) to 3,500 MW. This increased transmission capacity would be between southern California and southern Nevada, and specifically the Eldorado-Lugo corridor. This project alternative is also anticipated to cost significantly less than the proposed $2 billion for the Trout Canyon-Lugo 500 kV project.

Southern California Edison Company

Cal Advocates has no comment on Southern California Edison Company’s (SCE) reliability results and proposed projects at this time.

[1] San Diego Gas & Electric Area Preliminary Reliability Assessment Results, 2023-2024 Transmission Planning Process Stakeholder Meeting September 26-27, CAISO, September 26, 2023 (CAISO SDG&E Presentation), at Slide 25.

[2] SDG&E 2023 TPP Projects – SDG&E, September 27, 2023 (SDG&E Presentation), at p. 6.

[3] CAISO SDG&E presentation at slide 20.

[4] SDG&E Presentation at p. 9.

[5] SDG&E presentation at p. 15.

[6] CASIO SDG&E presentation slide 11.

[7] SDG&E presentation slide 18.

[8] PG&E 2023 Request Window Proposals CAISO 2023-2024 Transmission Planning Process, September 27, 2023 (PG&E Presentation) at 31.

[9] CAISO Greater Bay Area Preliminary Reliability Assessment Results (Presentation), September 26, 2023 at page 21.

[10] PG&E Presentation at p. 39.

[11] CAISO 2018-2019 Transmission Plan, March 29, 2019 at p. 476

[12] PG&E Presentation at p. 51.

[13] PG&E Presentation at pp. 51-52 and 54.

[14] CAISO Valley Electric Association Preliminary Reliability Assessment Results, 2023-2024 Transmission Planning Process Stakeholder Meeting (Presentation), September 26-27, 2023, (CAISO VEA Reliability Results) at p. 8.

[15] CAISO VEA Reliability Results at p. 9.

[16] CAISO VEA Reliability Results at pp. 10-14.

[17] CAISO 2021-2022 Transmission Plan, March 17, 2002 at p. 378.

[18] CAISO 2022-2023 Transmission Plan, May 18, 2023 at p. 168.

[19] CAISO 2022-2023 Transmission Plan, May 18, 2023 at p. 82.

[20] CAISO 2022-2023 Transmission Plan, May 18, 2023 at p. 3, footnote 7.

[21] Public Advocates Office Comments on the Draft 2021-2022 Transmission Plan, February 24, 2022 at pp. 11-12.

[22] Public Advocates Office Comments on the CAISO Policy and Economic Study Results 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, December 5, 2023 at p. 6.

[23] CAISO Fifth Replacement FERC Electric Tariff, Section 24.4.6.6. Policy Driven Solutions, September 20, 2023 at p. 22.

[24] Policy-driven Assessment Recommendations Draft 2022-2023 Transmission Plan, CAISO 2022-2023 Transmission Planning Process Stakeholder Meeting Presentation, April 11, 2023, (Policy Project Presentation) at p. 36.

[25] California-based Community Choice Aggregator (CCA) Peninsula Clean Energy (PCE) signed a 20-year power purchase agreement (PPA) for 6 MW of geothermal power from Open Mountain Energy (OME) with an on-line date of 2025. The power will come from OME’s Whitegrass No. 2 project, which OME is developing in Lyon County, Nevada. Lyon Country, Nevada is in northern Nevada. PCE also signed a 26-year PPA with Ormat for Technologies for 26 MW of geothermal power from a plant in California’s Imperial Valley. Source: https://www.peninsulacleanenergy.com/peninsula-clean-energy-signs-four-contracts-expanding-renewable-power-storage-capability and Ormat seals 26-MW geothermal PPA with California CCA (renewablesnow.com)

[26] California to build first geothermal power plants in a decade - Los Angeles Times (latimes.com)

[27] National Renewable Energy Laboratory at geothermal-undiscovered-hydrothermal.jpg (5101×3301) (nrel.gov) and geothermal-identified-hydrothermal-and-egs.jpg (5101×3301) (nrel.gov)

[28] Why Geothermal Energy Development in the West is Lagging Behind, California Energy Markets, March 24, 2023 at p. 3.

[29] 2015-2016 CAISO Transmission Plan, March 28, 2016 at p. 111.

[30] Letter regarding Alternative to the CAISO proposed Trout Canyon – Lugo 500 kV Transmission Line, Lotus Infrastructure Partners, April 25, 2023.

4.

Provide your organization’s comments on the high voltage TAC update:

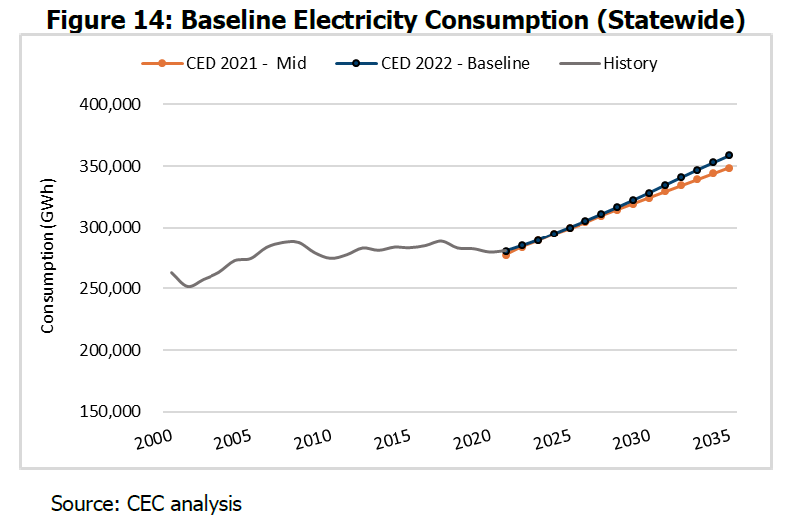

Cal Advocates appreciates the effort that went into creating the High Voltage Transmission Access Charge (HV TAC) forecast but cautions that if the California Energy Commission (CEC) load growth and load sales assumptions are incorrectly elevated, then the HV TAC will rise and impact individual ratepayers more than estimated. CAISO’s HV TAC model assumptions pull heavily from the CEC’s 2022 Integrated Energy Policy Report (IEPR). The baseline load growth estimates provided by the CEC in its 2022 IEPR sharply increases to a growth rate of 1.8% annually in 2023, after about a decade of remaining relatively steady (See Figure 1).[1]

Figure 1: Baseline Electricity Consumption (Statewide)

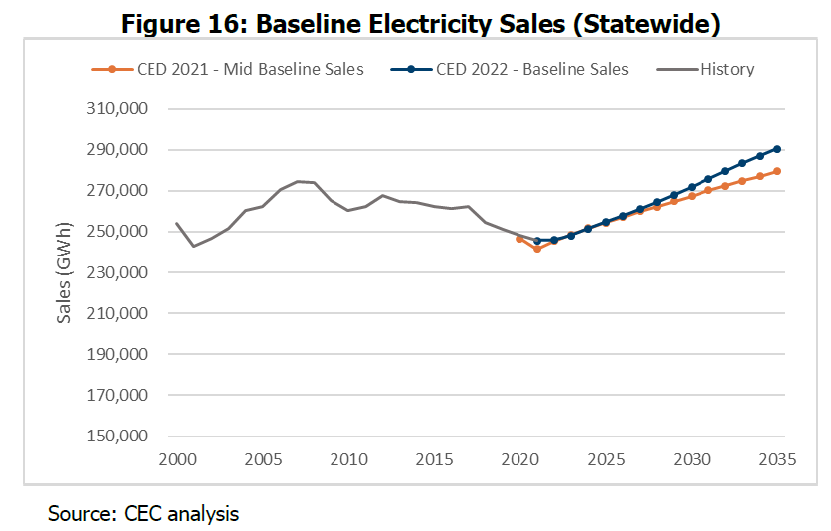

A similar trend can be seen in the CEC's electricity sales forecast. Sales have been declining over time due to an increase in behind-the-meter solar photovoltaic energy (PV)[2] but are still forecasted to sharply increase. (See Figure 2).[3]

Figure 2: Baseline Electricity Sales (Statewide)

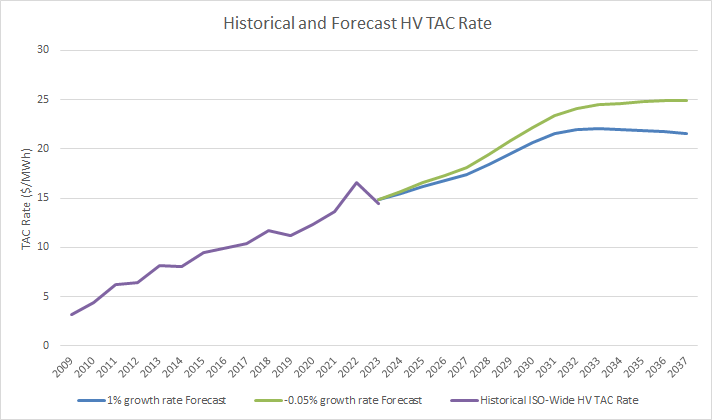

In general, Cal Advocates observed that the CEC's IEPR load growth and electricity sales forecasts tend to overestimate the amount of growth that actually occurs over time.[4] If the previous HV TAC forecast's -0.05% load growth assumption is maintained in this year's forecast, it increases the HV TAC rate. Under this assumption, the 2037 HV TAC rate would be $3.40/MWh more expensive than CAISO's current 2037 HV TAC rate forecast. Additionally, the estimated transmission investments could raise the HV TAC by $10.50/MWh from 2023 to 2037. See Figure 3.

Figure 3: Historical and Forecast HV TAC Rate

Source: Cal Advocates analysis from CAISO 2023 HV TAC model and historical rate data.

Cal Advocates encourages CAISO to ensure that transmission projects approved through the TPP are cost-effective and exhaust less expensive least-regrets alternatives before turning to more costly solutions. Keeping costs low can help lessen the HV TAC rate impact on ratepayers, regardless of the load growth over time.

[1] Data in this graph was produced by the CEC as part of its California Energy Demand (CED) report and California Energy Demand Update (CEDU). Additionally, Figure 1 is referred to as Figure 14 in the 2022 IEPR.

[2] 2022 Integrated Energy Policy Report Update, California Energy Commission, February 2023 at pp.59-60. Available at: https://efiling.energy.ca.gov/GetDocument.aspx?tn=250084

[3] Figure 2 is referred to as Figure 16 in the 2022 IEPR.

[4] Observations drawn from the electricity sales reported in CEC’s IEPR reports from 2017 to 2022.

5.

Provide your organization’s comments on the policy assessment update:

Cal Advocates has no comment on the policy assessment update at this time.

6.

Provide your organization’s comments on the economic assessment update:

Please refer to Cal Advocates’ comments on the California Energy Commission’s forecast in response to question 4 above. Cal Advocates has no other comments on the economic assessment update at this time.

7.

Provide your organization’s comments on the 20-year transmission outlook update:

In CAISO’s 20-Year Transmission Outlook, CAISO stated it based its gas retirement assumptions on the gas generation facility’s age and proximity to disadvantaged communities.[1] As a result, CAISO’s diagram of transmission and resource development in the CAISO’s 20-Year Outlook document depicts two areas for gas retirements: the Greater Bay Area with 4.5 gigawatts of gas retirement and the Los Angeles Basin with 3.5 GW of gas retirement.[2] Consistent with this practice, CAISO should continue to depict known natural gas power plant retirements in its updated 20-Year Transmission Outlook maps and other related documents. This depiction will provide consolidated system information.

[1] CAISO 20-Year Transmission Outlook, May 2022, ES-1: Illustrative Diagram of Transmission Development at p. 2.

[2] CAISO 20-Year Transmission Outlook, May 2022, ES-1: Illustrative Diagram of Transmission Development at p. 2.

[1] CAISO 20-Year Transmission Outlook, May 2022, ES-1: Illustrative Diagram of Transmission Development at p. 2.

8.

Provide any additional comments your organization has on the September 26-27, 2023 Transmission Planning Process Meeting:

Cal Advocates has no additional comments at this time.

Center for Energy Efficiency and Renewable Technology

Submitted 10/11/2023, 08:01 am

1.

Provide your organization’s comments on the preliminary reliability results for the North area:

One of the more notable aspects of the 2023-2024 North area reliability analysis is the quantity of previously approved transmission projects that are modeled in the base cases. The North area has significantly more transmission projects that are under development and assumed to be completed during the next five years than is the case for the South Area.

There are 102 previously approved transmission projects and eight voltage support projects in the North area. Many of the reliability projects are located in rural or agricultural regions of the state including the Greater Fresno Area (18 projects), the Kern Area (8 projects) and the Stockton/Stanislaus area (10 projects) of the Central Valley. These areas are good locations for the development of solar and battery projects that can improve system and local area reliability. The CAISO should target transmission enhancements to create opportunities for Load Serving Entities to procure projects from these areas that would improve system and local reliability.

In the CAISO Transmission Development Forum it has been noted repeatedly that PG&E has been falling behind in the completion of multiple reliability projects. These delays have impacted the interconnection of projects with executed interconnection agreements and in some cases impacted new loads like electric vehicle charging stations. CEERT recommends that the CAISO further examine and report on the impact that the slippage of project in-service dates has on reliability for the North area.

CEERT also notes that the that there are significant overloads on the Gates - Midway 500 kV and 230 kV lines during the 2025 spring off season period that will require redispatch of generation. Also overloads are noted on the Los Banos – Manning – Midway 500 kV lines in the 2028 and 2035 spring off season period. The CAISO should examines solutions such as the deployment of battery energy storage systems to minimize redispatch and curtailment of projects located in the Central Valley.

2.

Provide your organization’s comments on the preliminary reliability results for the South area:

In contrast to the North area the South area is much better prepared for the clean energy transformation that is underway. There are 18 previously approved projects modelled in the base cases including 13 projects that were approved in the 2022-2023 transmission plan. The major challenge in the South area is assuring that the permitting of the new projects is completed in a timely manner.

CEERT is concerned that the Imperial Valley – North of SONGS 500 kV line and substation could be delayed beyond the expected in-service date of 2034. Based on the CPUC adopted base case portfolio this project is essential to assure the deliverability of New Mexico wind resources as well as solar and battery resources to the east. CEERT encourages the CAISO to consider further transmission expansion through Riverside County to assure that the state’s climate goals are met even if the Imperial Valley - North of SONGS project is delayed. Given the additional clean energy resources that will need to be added during the 2035 to 2045 period, additional transmission in the South area should be considered a no regrets solution.

3.

Provide your organization’s comments on the PTO’s proposed reliability alternatives (SDG&E, PG&E, SCE, GLW):

CEERT wishes to draw attention to specific PG&E reliability alternatives for projects located in disadvantaged regions of California. In these areas CEERT recommends that PG&E and the CAISO evaluate how alternatives could scale to address longer-term load growth, including opportunities to promote economic development in these areas.

Three projects stand out for additional analysis of alternatives – 1) the French Camp Reinforcement Project, 2) Spence 60 kV Area Reinforcement Project and 3) the Gates 230/70 kV Transformer Bank Addition Project. For the French Camp Reinforcement Project CEERT recommends that PG&E further evaluate Alternatives 1 and 2 which entail looping in one of the Bellota-Tesla 230 kV lines at the French Camp substation in Stanislaus County. For the Spence 60 kV Area Reinforcement Project CEERT recommends that PG&E further evaluate Alternative 3 to build a new 115 KV substation near Chualar in Monterey County. For the Gates Project in Fresno County CEERT recommends that PG&E consider converting the 70 kV network to a 115 kV network.

4.

Provide your organization’s comments on the high voltage TAC update:

CEERT appreciates the update on the forecasts of the high voltage TAC. It is CEERT’s view that load growth from transportation electrification, artificial intelligence applications and the displacement of natural gas for heating will likely be higher than anticipated. This higher load growth will have a positive impact on lowering the TAC over time.

5.

Provide your organization’s comments on the policy assessment update:

CEERT appreciates the policy assessment update and finds the graphic display of the busbar mapping to be particularly helpful. We are looking forward to the November update.

6.

Provide your organization’s comments on the economic assessment update:

CEERT has no comments on the economic assessment update at this time. We are looking forward to the November update.

7.

Provide your organization’s comments on the 20-year transmission outlook update:

CEERT appreciates the update on the 20-year transmission outlook planning process and the CAISO’s commitment to coordinate this process with stakeholder sessions in the 2023-2024 TPP. We understand that the purpose of the 20-year transmission outlook is to explore the feasibility of alternative transmission solutions going out to 2045. We believe that this parallel, longer-term scoping of alternative transmission solutions is particularly helpful.

CEERT recognizes that California has set very ambitious goals for the development of offshore wind, particularly along the North Coast. The 20-year outlook envisions as much as 14,600 megawatts of offshore wind capacity to be developed not only in the existing Humboldt Wind Energy Area but also in areas to be considered in the future off the coasts of the Del Norte and Cape Mendocino areas.

CEERT notes that the U.S. Bureau of Ocean Energy Management has identified call areas for the central and southern coast of Oregon near the communities of Brookings and Coos Bay. Projects in these areas will also require significant transmission investment to bring the energy to load. CEERT encourages the CAISO to coordinate with Northern Grid and the State of Oregon as it develops alternative transmission solutions for regional offshore wind development.

CEERT recommends that at least one transmission solution being considered for Northern California offshore wind not include high voltage transmission overland.

CEERT also notes that the 20-year transmission outlook includes 17,568 megawatts FCDS in the Greater Fresno Area and 13,520 megawatt FCDS in the East Kern Area. The busbar mapping for these areas shows that a significant quantity of interconnected capacity will be on the 115 kV and 70 kV. It will be helpful to understand how the CAISO intends to study these regions of the bulk energy system.

8.

Provide any additional comments your organization has on the September 26-27, 2023 Transmission Planning Process Meeting:

CEERT recommends that the CAISO include consideration of Grid Enhancing Technologies in the 2023-2024 TPP. In particular, technologies that enable the CAISO and participating transmission owners to determine dynamic line ratings have the potential for expanding deliverability in the near term while assuring system reliability.

Silicon Valley Power

Submitted 10/11/2023, 04:19 pm

1.

Provide your organization’s comments on the preliminary reliability results for the North area:

The City of Santa Clara, dba Silicon Valley Power (SVP), appreciates the opportunity to comment on developing the 2023-24 Transmission Plan. The comments and questions below address the material presented at the CAISO Stakeholder meeting on September 26-27, 2023. SVP acknowledges the significant efforts of the CAISO and PTO staff to develop this material.

SVP’s Load Continues to Grow At a Dramatic Rate, and CEC and SVP Expect Significant Load Growth Over the Next Several Years

As the CAISO is aware, SVP’s load is expected to grow considerably in the next several years, primarily driven by hyper-scale data centers. SVP’s load growth includes CEC-approved small generator exemptions granted to hyper-scale data centers in SVP’s service territory. SVP has three new 60 kV data centers that came in-service in the past two years. SVP is actively working with fifteen future data center customers. Eight 60 kV data centers are under construction and expected to be in-service in the next two years. Five 60 kV data centers and two 12 kV data centers are waiting for an approval to connect to SVP system contingent upon the completion of CAISO Newark to NRS 230 kV HVDC line projects and several SVP’s non-BES projects. All these existing and future data centers are expected to ramp up significantly in the future 12-year planning horizon and beyond causing SVP’s load forecast to increase beyond 1296 MW in 2035.

Table 2 compares the 1-in-10 Summer Peak loads for SVP modeled in the last four planning cycles with the actual 2022 and 2023 peak loads. SVP’s actual peak load in September 2022 was 716 MW (a major increase from 592 MW of peak load in 2021), well exceeding the 2030 1-in-10 peak load of 670 MW assumed in the CAISO 2020-2021 TPP. SVP understands there is uncertainty concerning the rate of load growth but is quite concerned about the CAISO not approving sufficient transmission to meet the needs for reliable electric service to SVP’s customers. Consistent with the projections of the CEC, we believe that the CAISO should consider the projected SVP peak loads in the years 2025, 2028, and 2035 assumed in the 2023-2024 TPP base cases to be realistic, given its rapid load growth trend.

Table 2: A Comparison of SVP’s Actual 2022 Peak Load and 1-in-10 SVP Summer Peak Loads (MW) Modeled in Last Three TPP Cycles

|

Year

|

Actual (MW)

|

CAISO 2020-2021 TPP (MW)

|

CAISO 2021-2022 TPP (MW)

|

CAISO 2022-2023 TPP (MW)

|

CAISO 2023-2024 TPP (MW)

|

|

2021

|

592

|

|

|

|

|

|

2022

|

716*

|

624

|

|

2023

|

670**

|

|

821

|

|

2024

|

|

|

814

|

|

2025

|

657

|

|

804

|

|

2026

|

|

1,076

|

|

|

2027

|

|

1,082

|

|

2028

|

|

1,003

|

|

2030

|

670

|

|

|

2031

|

|

1,175

|

|

2032

|

|

1,168

|

|

2035

|

|

1,296

|

*Counterfactual load adding back load curtailment and unplanned outages

**Actual load of 670MW, when adjusted for 1-in-10 conditions translate to 707MW.

Additional Transmission Upgrades Are Required to Address Multiple NERC and CAISO Planning Criteria Violation Years before the Construction of the HVDC Line

The CAISO has recognized that other improvements besides the approved Santa Clara (Los Esteros) Series Compensation project are needed to reliably serve the SVP load before the scheduled HVDC line. In the 2021-2022 Transmission Plan, the CAISO approved adding a series compensation device to the Los Esteros- Nortech 115 kV line. SVP fully supports this short-term mitigation. However, it is not sufficient by itself to serve the SVP reliably before the installation of the HVDC line. The CAISO 2021-2022 Transmission Plan correctly recognized that this solution would not be adequate by itself to address the near-term reliability issues for the SVP system. And we see strong evidence of that in CAISO’s preliminary reliability assessment in the current TPP cycle.

CAISO’s preliminary reliability assessment shows several P1, P2, and P7 contingencies-driven overloads on the Nortech-NRS 115kV line and Los Esteros PST path in the near-term, i.e., in 2025.[1] SVP relies on these PG&E facilities to serve its load reliably. The proposed Santa Clara Series compensation does not mitigate some of these overloads as the series compensation devices installed at the Los Estero substation are ineffective under a contingency that entails the loss of the Los Esteros-Nortech 115kV line. No additional interim solution is proposed for these reliability issues in the CAISO preliminary reliability assessment that is the subject of these comments. SVP conducted an independent power flow analysis to replicate the CAISO findings, which confirmed the need to add transmission capacity before the installation of the HVDC line. The CAISO preliminary reliability assessment shows a P7 overload (loss of Newark - Los Esteros 230kV & Los Esteros - Metcalf 230kV lines) on the Newark-Northern Receiving Station #2 115 kV line, but only in one of the sensitivity scenarios (2025 SP Heavy Renewable & Min Gas Gen). However, the SVP study shows that this line has a P6 issue (loss of Los Esteros-Nortech 115 kV line and the Los Esteros PST line), i.e., a 107% overload as early as 2025. For the same contingency, the Newark-Northern Receiving Station #2 115 kV line is overloaded to 113% in 2025. SVP studies indicate the reconductoring of the two existing Newark-NRS 115 kV lines would eliminate the major near-term overloads on all the above-mentioned lines. The addition of an HVDC line also eliminates these overloads, but an interim solution is needed to eliminate criteria violations before the HVDC project is built.

Additional Mitigations Needed Even After the Previously Approved HVDC Project is Built for Longer-Term Reliability

The CAISO preliminary reliability assessment shows contingency overloads on the multiple SVP import facilities in 2035, even with the Newark-NRS HVDC line is built as listed below.

- A P1 contingency (loss of Los Esteros-Nortech 115kV) caused overloading of 102% on the Los Esteros-SSS 230 kV line. Separately, there is also a P2 overload observed on the Los Esteros-SSS 230 kV line;

- Note that SVP internal study found out that P1 contingency (loss of Newark to NRS 230 kV HVDC line) without Nortech series compensation project cause overload on Los Esteros to SSS 230 kV line and Los Esteros to Nortech 115 kV line in 2028 and 2035. This overload was also reported in CAISO TPP 22/23 report. SVP already notified CAISO about this missing overload in the preliminary reliability results and CAISO plans to report them in final posting.

- A P3 contingency (loss of DVR Gen Units & SSS 230/230KV TB 1) caused overloading of 134% on the Nortech-NRS 115 kV line.

- A P6 contingency (loss of SSS 230/230KV TB 1 & NRS-NEWARK HVDC VSC) caused overloading of 104% on Newark-NRS 115 kV #1 line; and

- A P6 contingency (loss of SSS 230/230KV TB 1 & Los Esteros-Nortech) caused overloading of 118% on the Kifer-FMC 115 kV line.

In order to mitigate the contingency overloads on the above-mentioned SVP import facilities, SVP believes the CAISO needs to approve the reconductoring of the two existing Newark-NRS 115 kV lines in this planning cycle. SVP studies indicate the reconductoring project would eliminate the major overloads on all these lines. SVP studies show that the reconductoring of the Newark-NRS 115kV reconductoring project in combination with series compensation and/or SVP-internal battery storage (BESS) would be effective in the long term. These solutions are not only effective in relieving overloads before the completion of the CAISO-approved HVDC lines but also improve the capability to serve growing loads after their installation. SVP is eager to work with PG&E and CAISO staff to develop timely additions to the PG&E system to ensure reliable service to SVP customers.

Counterintuitive Results for P6 Overloads on NRS-Scott 115kV lines

The CAISO preliminary reliability assessment shows a category P6 (loss of NRS-SRS#2 (or #1) 115 kV & new SVP 115kV line - NRS-KRS 115 kV) caused 108% overload on the NRS-Scott No. 1 and No. 2 115 kV lines in Summer 2028. However, there is no such overload found in Summer 2035. The CAISO reliability assessment has identified the “NRS rebuild project” as a mitigation project to address the 2028 overload. However, a substation rebuild is not expected to eliminate overload with the Category P6 contingency. Also, SVP’s independent power flow analysis shows that there is a significant overload on the NRS-Scott No. 1 and No. 2 115 kV lines in Summer 2035 under the above-mentioned P6 contingency. SVP requests the CAISO to evaluate these findings further and make corrections in the final reliability assessment accordingly.

Operational Mitigations (Incorporating Dynamic Response of Series Reactor, BESS, and PST)

SVP performed an internal study to understand how coordination between the PST, Kifer BESS project, and Nortech reactor settings can be used to avoid overloads in the SVP area. The study showed that these operational mitigations can assist SVP’s bulk electric system (BES) to avoid several overloads and increase the load serving capacity. SVP requests CAISO to perform a similar study and add detailed operational solutions (if any) for the different overloads identified in the final report. SVP is interested in working with PGAE, Smart Wires and CAISO to determine the detailed sequence of operations.

[1] CAISO 2023-2024 ISO Reliability Assessment - Preliminary Study Result, PG&E Greater Bay Area, September 26, 2023, slide #14.

2.

Provide your organization’s comments on the preliminary reliability results for the South area:

No comments at this time.

3.

Provide your organization’s comments on the PTO’s proposed reliability alternatives (SDG&E, PG&E, SCE, GLW):

SVP notes that none of PG&E's proposed mitigation alternatives presented during the September 27th stakeholder meeting are expected to address SVP issues in the interim described in its response to Q.1 above.

4.

Provide your organization’s comments on the high voltage TAC update:

No comments at this time.

5.

Provide your organization’s comments on the policy assessment update:

No comments at this time.

6.

Provide your organization’s comments on the economic assessment update:

No comments at this time.

7.

Provide your organization’s comments on the 20-year transmission outlook update:

No comments at this time.

8.

Provide any additional comments your organization has on the September 26-27, 2023 Transmission Planning Process Meeting:

No comments at this time.