1.

Provide a summary of your organization's comments on the September 15 and 17, 2020 working group discussion:

2.

Provide your organization’s feedback on the Unforced Capacity Evaluations topic as described in slides 6-68:

3.

Provide your organization’s feedback on the RA Imports topic as described in slides 71-120:

MSCG appreciates the work the CAISO has put into the RA enhancements stakeholder process and is concentrating its comments on Import RA. We understand the balance CAISO is trying to achieve between reliability and viable market participation / liquidity.

The work to date has led to a workable proposal along with some much needed improvements, specifically, the confirmation that WSPP Schedule B & C imports will continue to count for import RA and the CAISO alternative proposal of only requiring firm transmission on the last line prior to CAISO’s balancing authority. To summarize, the workable elements of CAISO’s proposal are:

- Identification of source BA

- Attestation of source and reasonable expectation of surplus to BA needs

- Firm transmission only on last line of interest

- Confirmation that WSPP Schedule B and C schedules will continue to count towards import RA

- No CAISO source on Import RA schedules

- UCAP adjustments for non-delivery due to use of short term non-firm transmission - resulting in lower ability to sell import RA going forward

combined with other existing CAISO tariff requirements set to take effect Jan 1, 2021 which include significant financial penalties for non-delivery of intertie energy, as part of intertie deviation settlements.

Taken together, the above criteria are sufficient to ensure real, physical resources, with highly reliable delivery capability are available to provide import RA to California load serving entities. The above criteria strike the workable balance between reliability and liquidity and adequate diversity of supply participation in CAISO import RA markets.

Yet, this proposal and all the hard work that went into it, is at risk of being undermined by a late addition of requiring monthly Non-firm transmission on all but the last leg to CAISO. This late addition, with no supporting data or analysis of how it will impact liquidity for Import RA makes the entire proposal unworkable. MSCG highlights some of the issues with this additional requirement below:

- Monthly (or weekly) non-firm transmission is not available for purchase in time to enable contracting for critical summer months given the cutoff for the for the annual RA showing. This will eliminate - multiple hundreds of MW of viable supply from contracting for and participating in the annual RA program where 90%+ of RA requirements are contracted.

- Advance purchase of Monthly non-firm transmission is not necessary on the BPA network for deliveries to California since that portion of the BPA transmission system is seldom near capacity on flows to Big Eddy and John.

- Pre FERC 888 Grandfathered contracts on the BPA network are released at 10pm the day prior to flow. Therefore, only a requirement to procure and eTag the day prior to flow is a workable solution on the BPA network in order to maintain the balance between reliability and liquidity.

The CAISO should drop this requirement for deliveries on Monthly (or weekly) non-firm and allow market participants to procure released firm transmission in the day ahead market. Otherwise, CAISO risks undermining an otherwise workable proposal.

MSCG will discuss and refute several myths that have been promulgated regarding the BPA network transmission further below.

- MYTH NO. 1 – BPA MONTHLY NONFIRM IS WIDELY AVAILABLE IN TIME TO CONTRACT FOR IMPORT RA

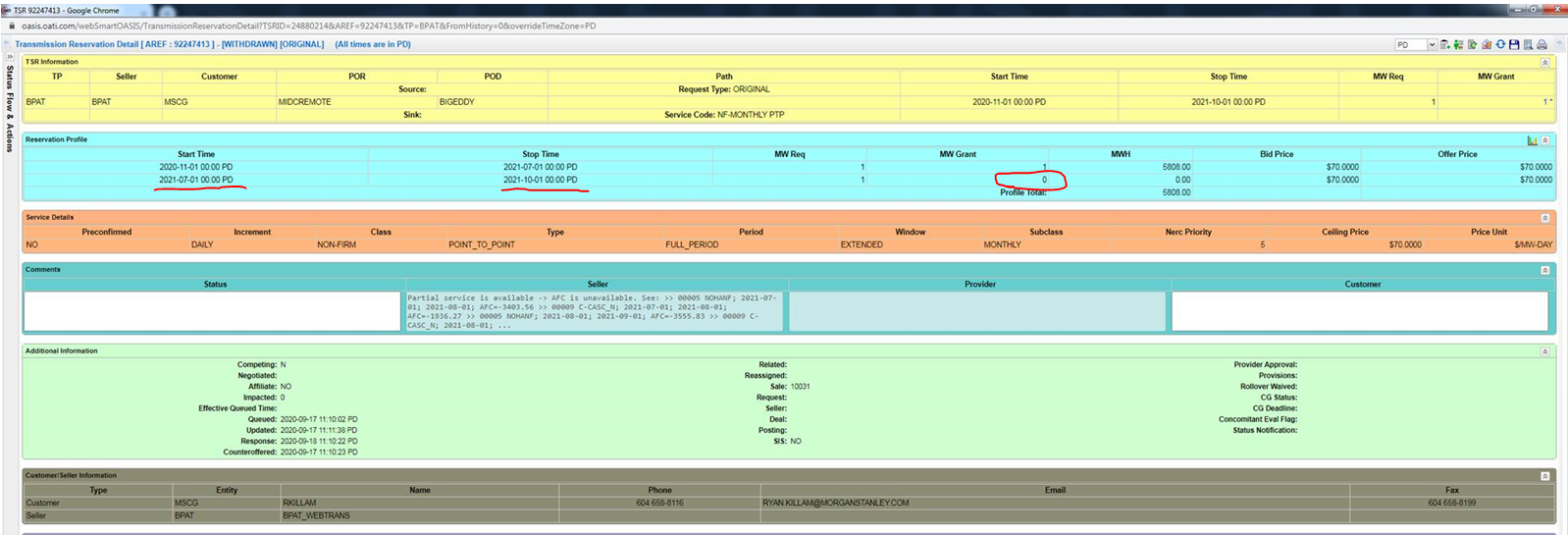

During the working group call on September 17th, MSCG submitted several Monthly non-firm transmission requests to access Big Eddy or John Day. The request below shows that MSCG requested monthly non-firm from Mid C remote (a liquid point on BPA network) to Big Eddy. Zero (0) MW were returned as granted/available for the peak summer months of July/August/September.

A few days later, MSCG noticed another market participant’s request for Monthly non-firm granted to John Day. When MSCG followed up with BPA, we were told that the BPA queue is dynamic, always changing and that BPA has to preserve the queue priority and pending long term requests encumber how much and if monthly non-firm is made available. This uncertainty and the random nature of monthly non-firm availability highlights that the queue can be encumbered with long term requests that sit in pending status, while others are automatically denied service. Therefore, any requirement for monthly non-firm transmission on the BPA network will prevent suppliers from committing their physical resources to California loads.

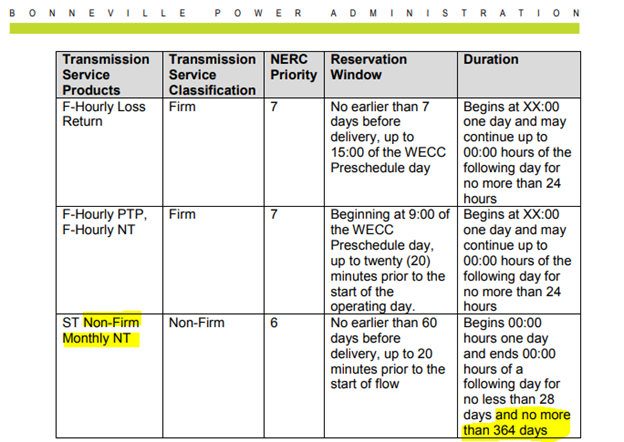

Equally troubling, is the duration of the monthly non-firm product itself. According to BPA business practises Monthly non-firm can only be bought for a maximum of 364 days. Since monthly transmission is only sold in equal monthly increments this limits the duration of the monthly product to eleven months.[1] Therefore any supplier looking to offer energy or capacity for the Annual RA program for the following Calendar year will not be able to participate. Similarly, any supplier looking to offer into the critical July, August, September time period for the following year (when California loads are actively looking for supply in the most severe shortage months) will have to wait until September to procure monthly non-firm transmission to span that period (if it is even available) since Monthly non-firm is only offered 60 days before the start of service and then for 11 months (i.e. a request would have to be placed on September 1 2020 for service from November 2020 through September 2021). Faced with the uncertainty of whether monthly non-firm will be available or not, the supplier is likely to take the ‘bird in hand’ and commit its supply to Southwest or other utilities that are also looking for reliable capacity. This loss of liquidity will be a detriment to California LSEs.

By making monthly non-firm a tariff requirement in order to participate in its RA program, CAISO is making it difficult for suppliers to transact and artificially limiting supply in the annual RA market. If flowing on monthly non-firm transmission is important to CAISO, they should instead incentivize its use without limiting supplier’s ability to transact in the annual import RA market. That can be achieved by waiving UCAP adjustments for all schedules flowing on firm or monthly non-firm transmission. That way a supplier is not excluded from participating when they can’t purchase monthly non-firm due to timing constraints but is still incentivized to keep trying to procure firm or monthly non-firm transmission prior to flow.

The table below shows the BPA duration limits for when and for how long monthly non-firm can be purchased.

MYTH NO. 2 – THE BPA NETWORK TRANSMISSION IS UNRELIABLE FOR NON FIRM FLOWS

MSCG and SMUD have both provided data and charts to show that on coincident peak days across the west the BPA network was unconstrained and there was ample space to get to Big Eddy and John Day.

This had been mentioned several times but bears repeating, BPA releases unused firm transmission in the day ahead timeframe. Over 1500MW of grandfathered rights on the BPA network are released the day prior to flow and becomes available to purchase. This is why power can reliably flow on this transmission. CAISO has presented no evidence or data to the contrary. SMUD presented evidence that fewer than five curtailments have occurred on the entire BPA system in 2018, yet the response was that the situation “may get worse over time”. If and when (but not before) the evidence clearly shows that the situation has gotten worse that is the time to revisit this requirement, not now when generation capacity that could otherwise reliably serve California load will be prevented from participating in CAISO RA markets. At a time when CAISO is in competition with other BAs for excess surplus capacity, CAISO should not be artificially limiting the amount of generation supply that can participate in its markets.

CAISO risks excluding not only hundreds of MW of import RA capacity but potentially large quantities of WSPP Schedule B & C energy products (currently counting towards import RA obligations) that are delivered to CAISO using some form of transmission that is of lower priority than Monthly non-firm. Before CAISO brings in any requirement for Monthly non-firm transmission it should present a fulsome analysis of how many MW of energy contracts will be excluded from participation.

MSCG will not reproduce the charts here, but pages 95 through 102 of CAISO’s presentation[1] on September 17th make the case abundantly clear why firm transmission should be required only on the last leg prior to CAISO BA, and why a transmission requirement on the BPA network leg is unnecessary.

MYTH NO 3. – USFs CURTAILMENTS ARE IMPACTED BY FLOWING ON NON FIRM TRANSMISSION TO COB OR NOB

In its fifth revised straw proposal stakeholder comments, Powerex stated (page 8) that path 66 (COB) experiences unscheduled flows (USFs) and that NERC curtailment priority will curtail non-firm schedules first. What Powerex failed to mention is that schedules flowing to COB are ON PATH and scheduled, therefore not affected by USF, which stands for UNSCHEDULED flow.

For example, on a P66 USF and a delivery schedule to COB, with import at MALIN, the schedule is considered “on-path” and therefore the entire schedule is considered firm 7-F since it’s imported on firm CAISO transmission. This means the network portion of the transmission could be non-firm and the whole tag will still be viewed as FIRM and thus the highest priority.

There should also be no debate that USFs are not an issue for schedules flowing to NOB because that is a direct current line and not impacted by USFs. Therefore, USFs are no reason to not allow non-firm transmission on the BPA network for flowing reliably to John Day or Big Eddy and eventually to COB and NOB.

MYTH NO 4. – IMPORT RA ON BPA NETWORK NONFIRM IS LESS RELIABLE THAN INTERNAL RA

The data that SMUD provided in its fifth revised straw proposal comments show there were less than 5 curtailments in 2017 & 2018 on the BPA network transmission. That is on ALL paths across the BPA network not just to Big Eddy or John Day. That is a very high standard considering the thousands of schedules that flow on BPA network every year and will compare favorably to any deliverability requirement or outage rate that internal generators are held to.

.png)

CAISO has provided no evidence or data to justify requiring firm or monthly non-firm transmission on the BPA network. Before such a requirement can be put in place, additional data and analysis must be provided to show why it is needed (as requested by many commenters in the CPUC process including CAISO DMM).

In the last round of comments alone, load serving entities representing over 80% of CAISO peak load have come out against the requirement of needing firm transmission on the BPA network (SCE, PG&E, SDG&E, CALCCA, SMUD). In fact, the few market participants in favor of a source to sink firm transmission requirement are either internal generators or external vertically integrated utilities that have a vested interest in reducing liquidity for and competition from other suppliers of Import RA. CAISO cannot ignore this bias and blindly recommend the need for firm or monthly non-firm transmission without providing any data or analysis to support their proposal.

MYTH NO. 5 – HAVING NONFIRM ON THE BPA NETWORK, MAKES THE ENTIRE SCHEDULE NON FIRM

This is not true in Morgan Stanley’s experience. Curtailments are done by transmission segment so when a schedule has firm rights on the Southern Intertie (last leg of prior to CAISO), and there is a curtailment on the Southern Intertie portion of the line (i.e. NOB or COB), then ALL firm schedules on the southern intertie leg are curtailed pro-rata irrespective of what transmission they are flowing on the BPA network leg.

As has been shown previously curtailments on the BPA network are extremely rare. Therefore having firm on the Southern intertie portion is adequate to make the schedule FIRM for when there are curtailments on the more congested last line of interest access COB or NOB.

MYTH NO. 6 – THERE IS AMPLE FIRM TRANSMISSION TO BIG EDDY OR JOHN DAY FOR PURCHASE

The below excerpt is reproduced from page 12 of Powerex’s fifth revised straw proposal comments where they pointed to recent OASIS activity as proof that firm BPA network transmission is readily available for purchase.

.png)

On the contrary, the above excerpt is evidence that requiring firm (or monthly non-firm) transmission on the BPA network will restrict competition, in the critical summer months when California needs import RA the most. Several key points can be taken from the above excerpt:

- All of the firm BPA network transmission MSCG was able to secure above came after the annual RA showings by loads were due – i.e. October of the year prior. Over 90% of RA contracts are executed prior to the annual showing timeframe and therefore, had there been a firm transmission requirement on BPA network enshrined in CAISO’s tariff, MSCG would have been unable to participate and sell any RA in the annual showing. This would have driven up RA prices and reduced competition at COB.

- Despite trying vigorously MSCG was unable to secure ANY firm transmission to Big Eddy for the months of July, August or September 2020, the critical RA months for California. Therefore again, MSCG (and other suppliers) would not have been able to compete for RA contracts at NOB. However, MSCG has been able to successfully and reliably deliver on our RA commitments this summer, by using a combination of BPA network transmission priorities and firm on the Big Eddy to NOB portion (last line of interest).

- Finally, the 228 MW of yearly firm transmission MSCG recently acquired through the secondary market that Powerex mentions above, is from the North Hurlburt wind farm that interconnects near Big Eddy. MSCG is not going to sell import RA off a wind facility. If we try to redirect this transmission on a firm or monthly non-firm basis to our flexible contractual resources on the Columbia River (Grant or Chelan) it will go into BPA’s transmission queue because it is now on a different flowgate. MSCG is already in queue for long term transmission to access Big Eddy and John Day and already a part of BPA’s cluster study. Those studies can take many months and we have been told to not expect a result until late summer 2021. Again, this uncertainty will result in unnecessary exclusion from participating in the Annual RA program.

CONCLUSION:

CAISO has the elements of a workable proposal and is near the finish line on this long and difficult task of updating the import RA rules while striking a needed balance between reliability and market participation / liquidity. It should not undermine these efforts and lose the support of numerous market participants and majority of load serving entities by introducing an artificial eTag deadline or transmission requirement on the BPA network that is wholly unnecessary. In MSCG’s respectful opinion the CAISO’s final proposal should be:

- Source identification in advance

- Attestation the capacity is expected to be surplus to the BA’s needs

- Firm transmission on the last line of interest

- UCAP adjustments if a participant fails to deliver (with allowable excuse if firm transmission or monthly non-firm transmission is curtailed).

- eTag for import RA awards on the day prior to flow submitted prior to midnight (after BPA transmission release at 10pm the day prior to flow).

Importantly, there should not be an explicit tariff requirement to flow on only monthly non-firm transmission as this will prevent participation in import RA markets.

Thank you for the opportunity to participant and comment on this important process.

[1] http://www.caiso.com/InitiativeDocuments/Presentation-ResourceAdequacyEnhancements-Sep15-17WorkingGroup.pdf

[1] In fact, BPA’s available transfer capacity (ATC) procedures prevent it from selling this monthly non-firm transmission, when the firm has already been sold, until it is released in the day ahead timeframe. https://www.bpa.gov/transmission/Doing%20Business/ATCMethodology/Documents/ATCID.pdf

4.

Provide your organization’s feedback on the Planned Outage Process Enhancements topic as described in slides 121-125:

5.

Provide your organization’s feedback on the UCAP for local topic as described in slides 126-139:

6.

Additional comments on the September 15 and 17, 2020 working groups: