AES

Submitted 01/16/2024, 11:28 am

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

AES Clean Energy, “AES”, appreciates the CAISO for proposing an approach to provide data accessibility to enable the zonal approach. Consistent with AES’s comments on the revised straw proposal, AES believes the CAISO should look at the timeline of other related processes, including the TPP and TPD allocation, and reevaluate the interconnection process. In addition, while continuously updating the document as new information becomes available has good intentions, it will not provide stakeholders with certainty on what assumptions would be made in the following cluster cycle.

For Cluster 16 and beyond, AES urges the CAISO to determine a cut-off date that will then identify the assumptions made for the following cycle.? For example, CAISO can utilize June 1 as the cut-off date for assumptions made in the next cycle. June 1 will allow other processes (e.g. TPP and TPD allocation) to take place that affect the following cluster cycle.? The document will include all the proposed data information that is most up-to-date, and identify the capacity that will be studied in each interconnection zone.? This document will allow interconnection customers to understand the cluster cycle assumptions and studied capacity. As the proposal stands, interconnection customers will essentially need to guess whether or not a zone has capacity or are behind any constraints given the timing misalignment with other important processes, such as the TPP and TPD allocation processes. Since CAISO’s TPD allocation methodology will allocate TPD to projects if additional TPD is available, only a small fraction of deliverability will remain available after each allocation cycle. This makes it difficult for developers to commit resources to projects until after TPD allocation process is complete. To ensure timing alignment with other related processes, CAISO will need to reconsider changing the annual queue opening date from April to at least September of each year. This would allow interconnection customers time to process the updated information prior to being scored.?

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

?AES supports including transmission constraints, single line diagrams of resources, single line diagrams of POIs behind constraints, transmission capability estimates, and list of substations within each interconnection area into the document. However, AES believes there are major components missing from the proposed data sources:

-

Identification of capacity studied in each zone: AES urges the CAISO to include a capacity number that will be studied in the following cluster cycle for each interconnection zone. AES believes this information can be provided if CAISO determines a cut off date for assumptions made in the following cluster, as discussed above.

-

Substation expandability: In addition to the electrical information, the CAISO must provide information on the physical constraints of the CAISO system. Typically, the available transmission does not equate to existing physical space. AES urges the CAISO to work in tangent with the PTOs to provide information on substation expandability. While the proposed information can provide details on how much capacity are available at these POIs, this may be limited by the actual physical expansion that a substation is able to accommodate. For example, a substation may only have a limited number of gen tie expansions available, and the expansion of bays is limited. Therefore, even if transmission capacity is available in an area, the substation may reach its expansion limit before the transmission capacity is filled. This becomes a larger issue if existing queue positions have applications at the substation. Moreover, releasing substation expansion data becomes more pertinent if CAISO moves forward with a single phased study. While AES understands that substation information is typically housed within PTOs, it is important that the information be released so that CAISO receives the most viable applications capable of physical interconnection and additional transmission capacity.

-

Short Circuit information: Developers must also understand the short circuit expandability, or how much more MWs can be added before the short circuit will require a significant upgrade. The CAISO should publish a list of short circuit values at each CAISO bus,

-

Base Case Data: The CAISO should release base cases prior to cluster studies. In today’s practice, CAISO typically releases the base cases after the cluster studies. However, with the new zonal approach, interconnection customers need to be able to replicate studies in order to assess whether a project is viable.

-

Equipment Rating at Substations: The CAISO should work in tangent with the PTOs to provide equipment ratings to customers to provide a complete picture of the physical capabilities of each substation and transmission line. The CAISO should also provide the limiting element to the equipment rating and its location. The limiting factor can be a conductor, a breaker, a current transformer, etc. Understanding the limiting elements of the equipment rating can help interconnection customers better assess line ratings.

-

Cost Relief for Constraints: The CAISO should provide a $/MW cost relief estimate for the constraints identified in the Transmission Capability Estimates.

-

POI Constraints: The CAISO should provide GPS coordinates of the constraints and identify any contractual ownership.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

The CAISO should clarify how reassessments and WDAT clusters would be included in the documents and how that affects the data information provided to customers.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

?AES supports updating the heatmap after the annual TPD allocation cycle and cluster studies. AES also recommends the CAISO to include a short circuit layer into the heat map.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

The CAISO should redact the following information within the publicly posted individual interconnection reports:

-

Interconnection customer identification information (contact information, addresses, and signatures)

-

Information identifying consultants or landowners

-

Total costs and allocated network upgrade costs

7.

Please provide any additional comments on the zonal approach.

Avantus Clean Energy LLC

Submitted 01/16/2024, 04:14 pm

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

Avantus Clean Energy (Avantus) appreciates the opportunity to provide comments on the CAISO IPE initiative on the zonal approach moving forward.

Avantus supports the zonal approach as a very helpful information and guidance for developers on where to locate their future projects. Avantus has the following few questions for clarification:

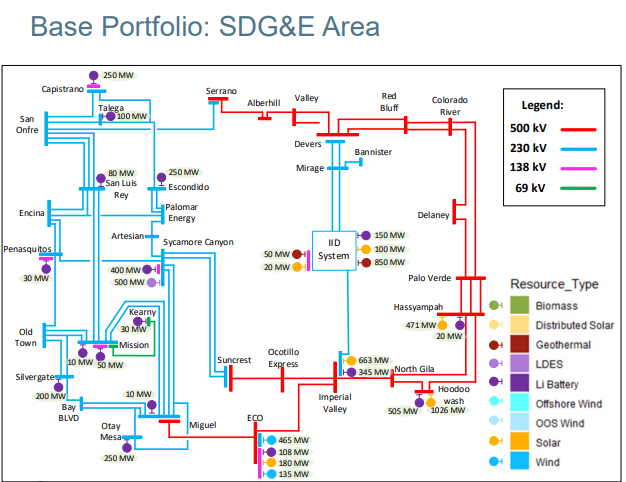

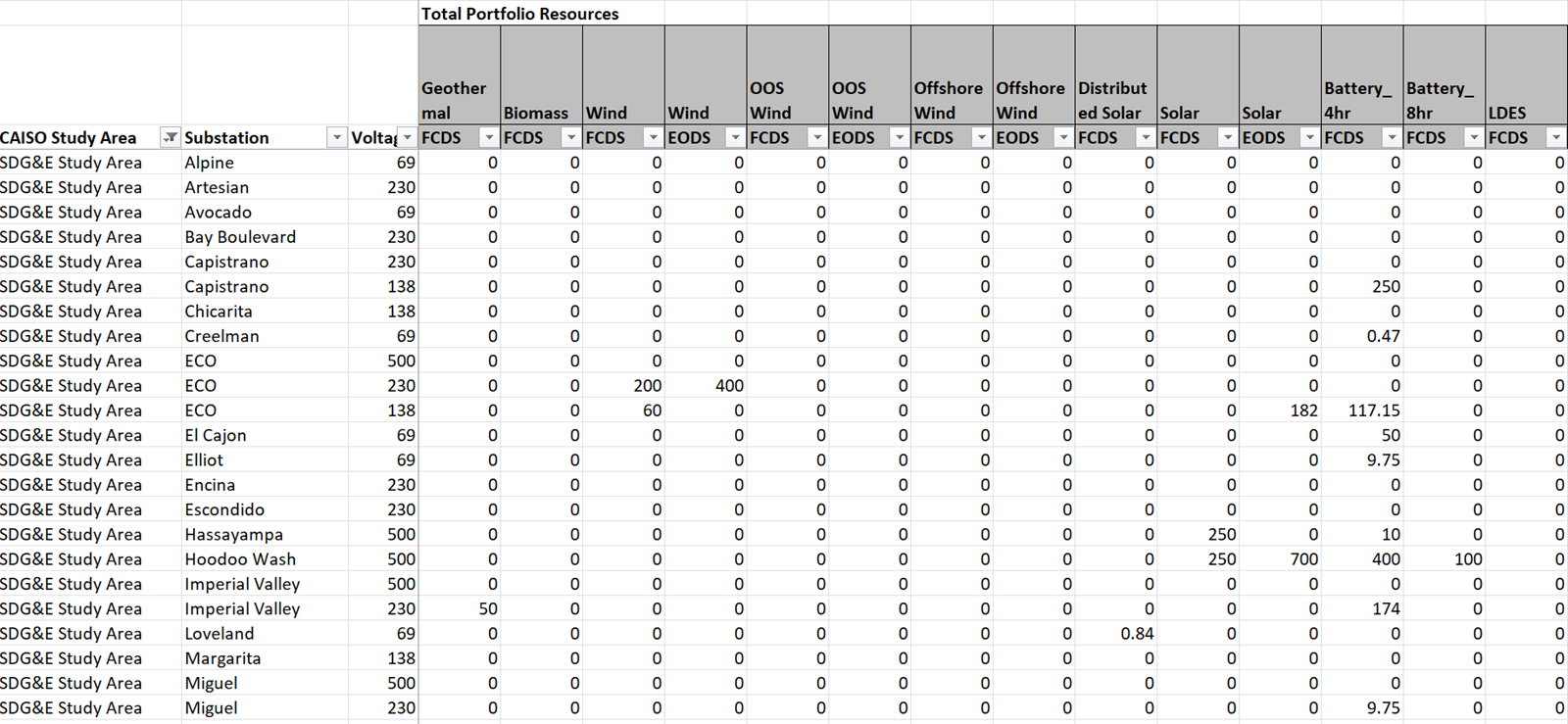

- Table 1, page 16, how do you interpret available generation at a substation for co-located projects? Can it be added arithmetically, or is it either/or? For example, Antelope 230 kV substation is shown to have Li_Battery of 439 MW FCDS and Solar for 450 MW FCDS. Does that mean Antelope 230 kV substation will be studied for 889 MW FCDS?

- Will EODS projects be modeled simultaneously with FCDS projects, or will they be studied under specific scenarios?

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

Avantus supports the ISO helping the developers with additional data on substations with available capacity within identified zones, potential constraints in each zone, and upgrades needed to increase Deliverability in each zone. Information on ADNUs that may remove constraints in multiple zones will also be very helpful.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

Avantus considers this additional deliverability-related information regarding projects in the queue extremely helpful. Avantus strongly supports this improvement in the CAISO queue.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

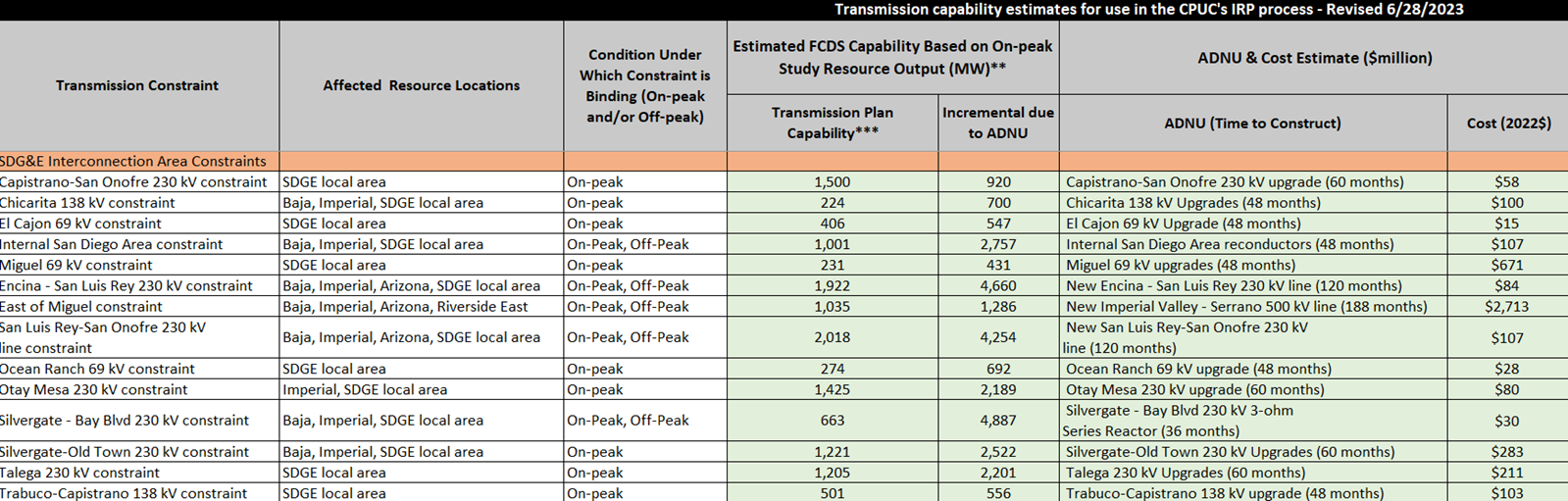

These are excellent examples showing resource information on the single line diagrams and detailed information about available transmission capacity and incremental transmission capacity due to ADNUs, in a tabular format. CAISO is commended for this improvement in its reports.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

Avantus strongly supports ISO’s proposal to provide a heatmap after annual TPD and after Cluster Study and Restudy. Information in the heatmap, as shown in the MISO example, is very helpful and very valuable to developers. It can avoid picking the wrong locations and wrong sizes of the projects, thus minimizing upgrade costs and chances of project withdrawals.

Avantus suggests clarifying information in the heatmap that the data reflects peak load conditions or worst-case scenario, as appropriate.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

Avantus supports providing redacted Appendix A on the Market Participant Portal. Avantus suggests only financial information of each project be kept confidential. Rest of the information can be kept as is.

7.

Please provide any additional comments on the zonal approach.

California Public Utilities Commission

Submitted 01/24/2024, 08:38 am

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

CPUC staff support the zonal approach and the ISOs’ effort through the IPE to align the interconnection process with the CPUC’s integrated resource planning (IRP), including its interaction with transmission planning. Aligning the interconnection process with IRP busbar mapping is an important step for addressing where long-term transmission is needed in our system. The ISOs’ use of the zonal approach and heat map will help consolidate information to help inform market participants. This approach is consistent with the strategic direction of the CAISO-CPUC-CEC Memorandum of Understanding to strengthen connections between resource and transmission planning, interconnection processes, and resource procurement.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

CPUC staff support the ISO consolidating the following information into one accessible source to better help inform market participants: (1) the transmission constraint, (2) the limit imposed by the transmission constraint, (3) the cost and timeline associated with mitigating the transmission constraint via new transmission solutions, (4) the amount of TPD capacity that has already been allocated, and (5) the capacity remaining and available for future allocation (if any). By ensuring that this information is readily available, the ISO will increase the transparency and accessibility for market participants, creating a pathway for more informed interconnection requests with increased viability.

One additional area that could be explored would be providing information on the ongoing viability of projects that have been awarded TPD capacity. With this improvement, projects in the queue with TPD allocations that miss milestones will free up TPD for re-allocation over time. In addition, if there is a way to identify areas that may be subject to re-allocation, market participants could be better informed regarding whether it is reasonable to stay in the queue.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

CPUC staff laud the ISO for the increased information made available in the updated queue reports. Further, CPUC staff would like the ISO to attach each executed LGIA in the queue report as well as list out the LGIA signatory and parent company for each queue position each in its own excel column. Additionally, since one of the milestones in the interconnection process relates to making progress on permitting, the CAISO should require queue participants to provide links (that can be published in the queue) to the publicly available CEQA State Clearinghouse number(s) that is associated with permitting the project.

While not every project will have a State of California CEQA document (e.g. out of state projects or CEQA exempt projects), most of them will have documents published by a city, county, or state agency at https://ceqanet.opr.ca.gov/. Using the State Clearinghouse Number, or SCH Number, the CAISO (or any stakeholder) could identify whether there was a publicly available notice of preparation, draft environmental document, comment letters and notice of determination. These CEQA documents are distinct from conditional use permits and other permits required for construction, but the CEQA document certification process is usually a necessary precursor to specifically required permits.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

?No comment at this time.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

CPUC staff support the ISO’s heat map proposal and compliance with FERC order 2023.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

CPUC staff support the ISO releasing redacted versions of Appendix A to market participants to increase awareness of interconnection facility network upgrades and distribution upgrades.

7.

Please provide any additional comments on the zonal approach.

CPUC staff support the use of the zonal approach paired with the technology-agnostic, attribute-based procurement approach that the CPUC has generally used when taking procurement action. CPUC staff expect this approach to interconnection and resource procurement to help increase market awareness of procurement needs and transmission constraints, and to ultimately lead to a cost-effective and reliable transmission system that supports state policy goals.

As the ISO rolls out the new interconnection process, CPUC staff encourage the ISO to create a process map on the existing and future processes (and which set(s) rules apply to which projects). Process maps will help provide clarity on the final process changes as well as continued workshops and events to create an open communication channel for market participants as they navigate the existing and new processes.

California Wind Energy Association

Submitted 01/16/2024, 04:39 pm

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

As discussed in our January 9 comments, CalWEA believes that, without performing meaningful studies at the POI level, the zonal approach is flawed. The available transmission capacity should be determined during the cluster study. Then projects can be selected to fill out the transmission capacity before the cluster restudy.

CalWEA continues to support its ”Proposal to Effectively Address the Queue Overload While Preserving Open Access, Competition, and Resource Diversity” as presented at the July 11, 2023, stakeholder meeting, with slight modifications, some of which are to conform to FERC’s Order 2023 framework. We summarized this proposal in our January 9 comments.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

CalWEA generally supports CAISO making these data available. However, developers’ ability to make use of such data depends on the timing of each step in the generation interconnection process. Without the details of how CAISO is going to change the process to comply with FERC Order 2023, it is difficult to comment. CalWEA urges CAISO to release the draft FERC Order 2023 filing as early as possible.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

CalWEA supports the planned enhancements to the Queue Report and asks CAISO to implement them consistently. For example, CAISO already publishes the allocation group in the queue for most of the projects, but not all applicable projects.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

CalWEA has no objection to the information being made available. However, CalWEA has the same comment as No. 2 above. In addition, CalWEA suggests that CAISO make transparent how it selects representative flow gates for each constraint. This could include a general methodology description in the BPM and reporting all the overloads in the cluster study reports.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

CalWEA requests that CAISO clarify two issues:

- The heatmap is built from the most recent deliverability assessment case for the study area where the POI is located. How will it capture transmission constraints in other study areas that could be the worst constraint for the POI?

- The base case used to show pre- and post-POI injection flows does not capture the stressed dispatch in the deliverability assessment. Therefore, the reported flows could be significantly lower than they would be in the cluster study. Could the heatmap be optimistically misleading?

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

CalWEA has no objection. However, CalWEA believes the best way to provide cost information that is meaningful for LSEs to determine project interest is to perform meaningful cluster studies. Then the projects can be more meaningfully ranked before the cluster restudy.

7.

Please provide any additional comments on the zonal approach.

Clearway Energy Group

Submitted 01/16/2024, 04:57 pm

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

Clearway appreciates the CAISO’s efforts to enhance information availability and data accessibility.

- Viewing data accessibility in context of the IPE Track 2 straw proposal, it is important to recognize that cost information for deliverability as well as interconnection (as EO) is critical in order to make LSE interest a meaningful input to scoring of projects before studies begin.

- Clearway recommends including more information on RNUs by POI. We appreciate CAISO’s efforts to bring transparency and analysis to deliverable capacity. It is also critical to provide thoroughly analyzed transmission capability and cost signals for Energy Only resources. As noted in our prior comments, both the IRP and CPUC RA policy frameworks anticipate Energy Only resources playing a greater role on the system going forward. There is now a need to go beyond rule of thumb assumptions for estimating EO capability in zones and make this information specific to POIs.

- Stakeholders need clarity on how the 150% study cap will be implemented. How will CAISO translate the MW impact from each POI within a zone on the 150% FCDS transmission capability? We heard on the December 19 stakeholder meeting that CAISO will not capture the granular impact of POIs on constraints that will dictate the 150% study cap. Could CAISO provide examples or a case study to show how this will work in a study area with multiple POIs and constraints limiting deliverability? Establishing clearly communicated rules and calculations around this issue is critical because this could create a major barrier to entering cluster studies for new projects. Consider the following example: Behind a certain constraint, 800 MW modeled at certain POIs could hit the 150% limit, but 1,000 MW modeled at a different set of POIs may not cause any overload. How would CAISO apply the 150% study cap in this case?

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

Clearway appreciated the granular information in the form of list of substations within a zone and associated data that can map each POI to a constraint within the transmission capability workbook. We encourage CAISO to consider at least two enhancements:

- Incorporating POI-specific information on interconnection feasibility. Providing deliverability information is critical but not useful if the POI has an interconnection feasibility issue. CAISO and PTOs should work together to gather the number of available bus positions and IRNU cost. It should be possible to use publicly available per-unit costs for Interconnection Facilities and certain RNUs. This work can be limited to only those POIs that are mapped in the latest CPUC portfolios, not every possible POI.

- Using past studies to provide expected GRNU and the magnitude of such GRNU costs.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

Clearway strongly supports this enhancement and appreciates the CAISO’s effort on this front.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

Clearway supports this proposal provided the developer identity is redacted.

7.

Please provide any additional comments on the zonal approach.

Clearway appreciates the CAISO’s willingness to consider options and incorporate some of the recommendations made by the stakeholders so far. We would like to reiterate that providing expected interconnection outcomes that include RNU as well as DNU (cost and duration) at the POIs identified by the CPUC in the portfolio mapping process is essential if the pre-study scoring is to be implemented in a meaningful way.

EDF-Renewables

Submitted 01/17/2024, 03:08 pm

Submitted on behalf of

EDF-Renewables

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

EDF-R appreciates CAISO’s efforts to work toward information access levels needed to support implementation of the zonal approach. This information is crucial to developers successfully navigating the zonal approach. EDF-R endorses ACP’s comments encouraging CAISO to “continue to evaluate and discuss with the CPUC how the transition to the zonal approach will change the data sources and availability of data sources that are relied upon in this process today. For instance, by transitioning to the zonal approach, the information used for the Transmission Capability Estimates may be more limited than it is today which will, in turn, make it more difficult for developers to understand whether projects will have available capacity.”

In the revised proposal CAISO indicated that providing the updated report 6 months before the opening of the queue window will “result in out of date or stale data.” EDF-R understands the complexity of the interconnection reporting asks, but requests that the CAISO provide in the context of this IPE discussion an analysis of when the data will be available, and memorization of that timeline in the tariff. EDF-R is sympathetic to the complexity of the task, developer work is as complex and time consuming as CAISO’s work on the transmission system. EDF-R suggests that CAISO should commit to providing the report no less than 120 days prior to the opening of the queue window, and the tariff should require a day-for-day extension to the close of the queue window for any day less than the 120-days.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

Taken in totality the proposal appears top set up a timeline where relevant data, such as available transmission capacity by zone, constraints by zone, constraint(s) per individual POIs, and all POIs in a specific zone, will be consolidated during the second quarter of 2024. This consolidation process will incorporate the findings from the C14 Phase 2 study and the 2024 TPD allocation process. As described above, this timeline is concerning. If CAISO is releasing this information sometime between April 1 to June 30, the information release will not align with the IR opening/ closing dates.

EDF-R suggests that CAISO should commit to providing the report no less than 120 days prior to the opening of the queue window, and the tariff should require a day-for-day extension to the close of the queue window for any day less than the 120-days. Or, given how frenetic the day-for-day extension could be, EDF-R suggests that alternatively CAISO could shift the interconnection request window to opening on June 1. Given the IPE effort is likely to reduce the number of requests seeking interconnection in the first place and shorten study timelines, it seems possible that the shifting of the schedule could be accommodated without issue.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

EDF-R strongly supports additional information and clarity CAISO plans to implement in the interconnection queue.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

EDF-R looks forward to a CAISO’s heatmap, and additional details on CAISO’s proposal. It would be useful if CAISO could also include planned upgrades needed to create additional TPD.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

7.

Please provide any additional comments on the zonal approach.

EDF-R generally supports the Zonal Approach, but encourages CAISO to include more flexibility due to the nature of electric infrastructure development being balanced between centralized planning efforts and the decentralized development. As California has experienced an increase in both the number of LSEs over the last decade and a significant demand for clean energy resources, decentralized risk of independent power producers (IPPs) allows for flexibility in the continually changing dynamics reflected in the CPUC Inputs and Assumptions, CEC Demand Forecasts, and CAISO Study Plans. Any forecast of the future is useful for planning, but flexibility in the development process is required to achieve maximum success.

For example, the two major 500 kV transmission lines approved, permitted, and built to support California 33% RPS by 2020 are a shining example of numerous planning entities[1] pointing in the right direction with the details remaining blurry. It was IPPs taking the brunt of the development risk in the changing political, economic, technological, environmental, and land use landscapes. For example, the Sunrise Powerlink Transmission (SPL) Project Purpose and Need application[2] referenced the following resource types: geothermal, solar thermal and wind. Ultimately, over 80% of the available transmission capacity (~1,000MW) turned out to be utilized by solar PV technology due to land-use issues and the improved economics and efficiency of solar PV panels. Again, a central tenet for success is flexibility between planning and final development outcomes.

Conversely, LSE’s have the regulatory requirement to meet California’s ambitious clean energy policies. LSEs would also benefit with resource type flexibility (technology neutral) if there are specific requirements to procure energy from a specified planning zone as proven successful from CPUC Decision[3] related to SPL procurement requirements associated to a specific area.

To this end EDF-R is concerned that any proposal to withhold transmission capacity for a particular fuel type could unintentionally result in RPS deficiencies.

[1] CAISO, CPUC, CEC, and PTO/LSEs

[2] https://www.sdge.com/sites/default/files/A_05_12_014_public_report_0.pdf

[3] https://docs.cpuc.ca.gov/PUBLISHED/FINAL_DECISION/95750-01.htm

Intersect Power

Submitted 01/16/2024, 12:04 am

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

- It is unclear whether CAISO intends to limit interconnection applications to 150% of capacity available behind each transmission planning zone or each constraint. If CAISO intends to limit applications to 150% of available capacity in each transmission planning zone, it is not clear why the constraint boundary is important. It would be helpful if CAISO could clarify what “zone” it is referring to in its proposal (transmission planning zones or constraint zones).

- CPUC portfolio busbar mapping data also indicates which POIs are within each transmission planning zone. The CPUC should provide this information organized by constraint rather than zone, or ideally both.

- Intersect Power appreciates CAISO’s effort to provide more consolidated information to help developers assess the location of available transmission capacity but is concerned about the time frame within which this data will be provided as it relates to the Cluster 15 process. Intersect Power encourages CAISO to provide a timeline for when the new reports will be provided, following the QC14 TPD allocation, in relation to the deadlines related to interconnection applications for Cluster 15 and clusters thereafter. CAISO should also provide a clear cut-off date after which no new data will be added, resulting in a final version of the reports that the market can rely upon to make decisions for the following application window.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

Intersect Power encourages CAISO to also consider adding the following information:

- Information about the Area Deliverability Network Upgrades (ADNUs) required to relieve each constraint and other data from the whitepaper (e.g. expected online date, cost) so developers can easily assess the severity of the upgrade needed at each POI instead of reverting back to the whitepaper where data about the impacted POIs is not provided.

- Similar data on Reliability Network Upgrades (RNUs). Estimated RNU data (e.g. expected online date and cost).

- Substation expandability data. CAISO should also provide data about whether the project can be physically interconnected at each substation. CAISO is in the best position to compile this data from Participating Transmission Owners (PTOs), and at the December 18th workshop at least one PTO was open to providing this data. CAISO should provide this data at least for substations that are included in the CPUC resource portfolio.

- Short circuit data at each CAISO bus so that all pertinent information is provided in one place.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

CAISO’s efforts to update the queue to show which projects have requested TPD and which have received it will be very helpful. The Transmission Capability Estimates Whitepaper shows how much TPD is available when new upgrades are built, but it does not indicate how much of that has already been allocated or will likely be allocated in the next TPD cycle to projects already in the queue. The new TPD data fields will give the market a better indication of whether there is available capacity behind each constraint.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

No comment.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

The heatmap data showing where capacity remains after TPD allocations will be helpful. However, as stated above in response to question 2, it would be more helpful if CAISO also provided an indication of the upgrade that CAISO assumes will be in place for the capacity to be available. This would help developers make a more educated assessment of the risk that the upgrade will be delayed.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

Information that should be considered confidential includes:

- Interconnection Customer and any language or exhibits providing Interconnection Customer information, e.g., exhibits and single line diagrams often have company logos and names in the title blocks

- Project Location / Generating Facility Location

- Project Vicinity Map / Generating Facility Location Map

7.

Please provide any additional comments on the zonal approach.

As raised multiple times in prior Intersect Power comments, Intersect Power remains opposed to the establishment of capacity caps implemented on a zonal or constraint level and strongly encourages the CAISO to instead take a simpler approach by implementing a reasonable maximum total queue capacity and maximum number of projects for each Cluster. The zonal approach has several unnecessary complications and disadvantages including, but not limited to: (i) necessity to accurately define the zones geographically / electrically, (ii) determination of the base zonal capacities (which are inherently dynamic and heavily influenced by processes such as the TPP), (iii) rationalization and establishment of an arbitrary zonal capacity buffer (e.g., 150% of available or planned capacity), (iv) timing misalignment for transmission planning inputs and the establishment of cluster study assumptions, (v) necessity for bespoke Option B pathways, and (vi) the elimination of a valuable market feedback mechanism due to an overreliance on CPUC planning assumptions (further described below).

Intersect Power is primarily concerned with an overreliance on the CPUC portfolios, which are constructed using a variety of planning-level assumptions that carry a wide-range of uncertainty and accuracy, to constrain where developers can pursue projects. It is critical to maintain a robust, diverse, market-driven approach to generation development to ensure that realized portfolios (as opposed to planned portfolios) are the most cost-effective outcome for rate payers. The CAISO’s Transmission Planning Process (TPP), which relies upon the CPUC’s recommended generation portfolios, already analyzes impacts to the grid for the described portfolio and provides market signals, in the form of transmission upgrades, to generator developers for where resources are preferred based on techno-economic modeling outcomes. The CPUC’s current Busbar Mapping process utilizes commercial interest (i.e., the active CAISO interconnection queue) as one of its factors influencing portfolio creation, serving as a valuable feedback loop between planning institutions and market participants. Implementation of strict locational restrictions for generator IRs eliminates that valuable feedback loop and creates a self-fulfilling portfolio outcome entirely driven by the CPUC, lacking any real competitive pressure to challenge planning-level assumptions and their resulting outcome.

Given the CAISO has provided no indication for reconsideration of the zonal approach, Intersect Power strongly believes the 150% capacity buffer needs to be significantly increased (and CAISO should consider adding a minimum MW-level, i.e., 150MW, because 150% of an insignificant number is still insignificant), at a minimum for Cluster 15, due to several factors, including:

- The novelty of the of the concept and lack of precedent and objective rationale for its establishment at the current 150% level

- The lack of sufficient data for the market to assess caps by zone / constraint at the time of initial interconnection applications (note, site control efforts are well underway to support QC15 applications, and these rules are still in the process of being debated and devised)

- Following QC14 TPD allocations, there may be little to no deliverability available in many areas, thus, this approach will effectively close off the queue for potential deliverable projects in those areas and eliminate any ability for new projects to provide insurance for queue attrition

- the inability for CAISO, or any stakeholder, to accurately foresee potential negative ramifications of these drastic changes to the study process.

These factors serve as more than sufficient justification to err on the side of conservatism, i.e., the study a larger amount. The 150% study cap may be where the CAISO ultimately settles in future clusters, but it would be prudent to start at a higher level and refine the cap down (if necessary) once the process has been utilized and the proper evaluation of outcomes can be assessed.

LSA

Submitted 01/16/2024, 04:34 pm

Submitted on behalf of

Large-scale Solar Association

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

- LSA appreciates CAISO’s efforts to consolidate relevant materials in one place. These materials are intended to address the following issues:

- Identifying zonal boundaries

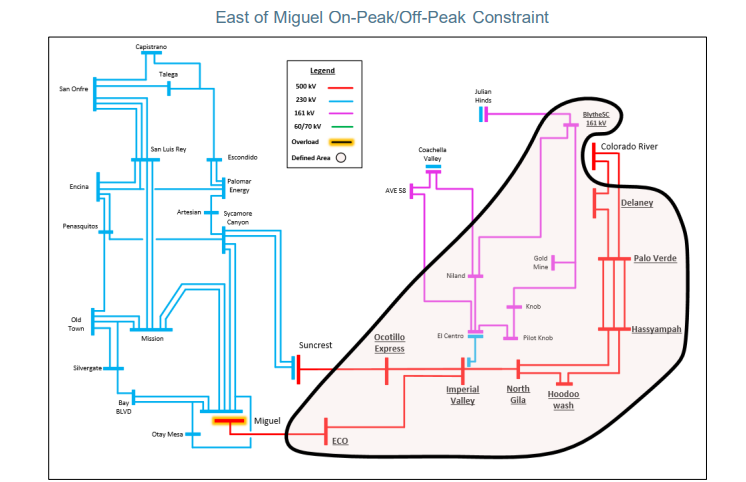

- Transmission constraint diagrams provided with the Transmission Capability Estimates Whitepaper provide a high-level visual map of where the constraint boundary is located. However, it is unclear whether CAISO intends to limit interconnection applications to 150% of capacity available behind each transmission planning zone or each constraint. If CAISO intends to limit applications to 150% of available capacity in each transmission planning zone, it is not clear why the constraint boundary is important. It would be helpful if CAISO could clarify what “zone” it is referring to in its proposal (transmission planning zones or constraint zones). In addition, it is not clear what happens if one POI within a constraint zone is maxed out at 150% of its available capacity. LSA believes that an otherwise viable project that exceeds the 150% limit at a specific POI should still be eligible for study at another feasible POI within the same constraint zone.

Source: Attachment-B1-Deliverability-Constraint-Boundaries.pdf (caiso.com)

-

-

- Interconnection area mapping diagrams provided as part of the TPP show which POIs are within each zone. If CAISO intends to base the 150% limit on constraints rather than transmission planning zones, this information is not as useful. In addition, this map would be more useful if it showed available transmission capability rather than resource MWs.

-

- CPUC portfolio busbar mapping data also indicates which POIs are within each transmission planning zone. The CPUC should provide this information organized by constraint rather than zone, or ideally both.

Source: https://www.cpuc.ca.gov/-/media/cpuc-website/divisions/energy-division/documents/integrated-resource-plan-and-long-term-procurement-plan-irp-ltpp/2023-irp-cycle-events-and-materials/assumptions-for-the-2024-2025-tpp/dashboard_prelimmapping_v2_12-08-23.xlsx (Res_By_Sub_2030 tab)

-

- Assessing available capacity

- Transmission Capability Estimates Whitepaper provides a list of constraints with available transmission capacities, timing and cost estimates.

Source: https://www.caiso.com/Documents/Transmission-Capability-Estimates-for-use-in-the-CPUCs-Integrated-Resource-Planning-Process.xlsx

-

-

- Constraint Boundary Substation List will show how many constraints each POI is behind and how many POIs are behind each constraint. For a project to get deliverability at a specific POI, there would have to be deliverability available at all the constraints that impact that POI.

- Public queue: new fields will show TPD status for each project including

- Which projects have TPD allocations

- Which projects have requested FCDS but not received it yet

- The interconnection zone (in addition to the POI). LSA notes that zonal information may not be useful, unless by “zone” the CAISO means “constraint”.

- Heat maps: once CAISO determines how much TPD has been allocated, the heat map will show where there is remaining availability.

- LSA appreciates CAISO’s effort to provide more consolidated information to help developers assess the location of available transmission capacity but is concerned about the time frame within which this data will be provided. Initial reports provided at the end of January will not include Cluster 14 data but will be updated in Q2 2024 after Transmission Plan Deliverability (“TPD”) allocations. If CAISO updates the reports by May, for example, then developers need at least six months to analyze the data and make commercial decisions. They would ideally make final decisions about whether to advance Cluster 15 projects no earlier than December 2024. This 6-month period gives them time to assess the CAISO’s data regarding available capacity, along with land availability and commercial agreements necessary to achieve 90% site control.

- LSA also encourages CAISO to provide a timeline for when the new reports will be provided in relation to the deadlines related to interconnection applications. CAISO should also provide a clear cut-off date after which no new data will be added, resulting in a final version of the reports that the market can rely upon to make decisions for the following application window.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

- Constraint Boundary Substation List: This report will help developers determine which POIs are impacted by which constraints. They can then refer to the Transmission Capability Estimates Whitepaper to estimate the severity/timing/cost of the upgrades required to relieve the constraint. This is an improvement over similar data provided in TPD reports because all results are provided in one place, and it will also be easier for all stakeholders to access since it will not be restricted to the market participant portal. However, it would be more useful if the Constraint Boundary Substation List also included:

- Information about the Additional Deliverability Network Upgrades (ADNUs) required to relieve each constraint and other data from the whitepaper (e.g. expected online date, cost) so developers can easily assess the severity of the upgrade needed at each POI instead of reverting back to the whitepaper where data about the impacted POIs is not provided.

- Similar data on Reliability Network Upgrades (RNUs). Estimated RNU data (e.g. expected online date and cost) will help LSEs determine whether projects are viable and if they want to allocate a point to such projects as part of the project viability screening process.

- Substation expandability data. CAISO should also provide data about whether the project can be physically interconnected at each substation. CAISO is in the best position to compile this data from Participating Transmission Owners (PTOs), and at the December 18th workshop at least one PTO was open to providing this data. CAISO should provide this data at least for substations that are included in the CPUC resource portfolio.

- Short circuit data at each CAISO bus so that all pertinent information is provided in one place.

- Data for POIs that have not yet been studied. CAISO should consider providing at least high-level estimates of transmission capability available at PIOs that CAISO has not studied as part of its cluster process. This information will be important as the 150% cap pushes developers to consider new places to interconnect.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

CAISO’s efforts to update the queue to show which projects have requested TPD and which have received it will be very helpful. The Transmission Capability Estimates Whitepaper shows how much TPD is available when new upgrades are built, but it does not indicate how much of that has already been allocated or will likely be allocated in the next TPD cycle to projects already in the queue. The new TPD data fields will give the market a better indication of whether there is available capacity behind each constraint.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

LSA has no comments at this time.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

The heatmap data showing where capacity remains after TPD allocations will be helpful. However, as stated above in response to question 2, it would be more helpful if CAISO also provided an indication of the upgrade that CAISO assumes will be in place for the capacity to be available. This would help developers make a more educated assessment of the risk that the upgrade will be delayed.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

LSA has no comments at this time.

7.

Please provide any additional comments on the zonal approach.

LSA has no additional comments at this time.

New Leaf Energy

Submitted 01/16/2024, 04:25 pm

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

New Leaf Energy, Inc. (NLE”) appreciates the CAISO’s work to consolidate all relevant data to inform and support the zonal approach. These efforts are essential to provide the market with clear information on zonal boundaries and available interconnection capacity within the zones.

Based on the December 18-19, 2023 Interconnection Process Enhancements (“IPE”) workshops, NLE understands that the CAISO intends to limit interconnection requests accepted for study to 150 percent of the available capacity behind each constraint—rather than overall capacity available within each zone. Therefore, NLE recommends that the CAISO publish information on the electrical boundaries of each constraint and the available deliverability behind each constraint.

NLE supports the CAISO’s efforts to ensure consistency of the constraint diagrams. Developers need this information to identify substations within the boundaries of a constraint, but the diagrams in the Transmission Plan Deliverability (“TPD”) Allocation Reports have not always been accurate in the past. For example, the 2023 TPD Allocation Report contains an inaccurate diagram regarding the Sobrante 230 kilovolt (“kV”) bus and 115 kV subsystem behind the Bay Area Constraint.[1] NLE respectfully urges the CAISO to verify the accuracy of the diagrams before releasing them.

Further, the existing diagrams mostly provide high-level information on the 230 kV and above transmission system. NLE seeks clarification on whether the CAISO plans to provide diagrams for the lower voltage portions of the transmission system within the zonal boundaries. This information would be helpful to developers seeking to interconnect a resources at a Point of Interconnection (“POI”) on the lower voltage systems.

Finally, NLE has concerns with the timeframe for providing the data. The CAISO agreed to release a report on available capacity for Cluster 15 in January 2024, but the report’s available zonal capacity estimates will likely change significantly following the results of the 2024 TPD allocation process, which is not scheduled to conclude until May 2024. Thus, the CAISO should commit to updating those estimates as soon as possible after the TPD allocation process concludes.

In the future, NLE respectfully urges the CAISO to provide all relevant data as early as possible before a cluster window opens. The CAISO should explicitly state the final cut-off date for new data and assumptions to be incorporated into the available capacity analysis. This cut-off date should be at least six months before the next cluster window opening in order to provide sufficient time for developers’ prospecting activities. In the next iteration of the IPE proposal, it would also be useful for the CAISO to propose, and for stakeholders to have the opportunity to comment on, example timelines for Cluster 15 and beyond. The timeline for Cluster 15 is particularly urgent, as developers need time to determine: 1) which projects are viable and warrant further effort to develop and 2) which projects are not viable and should therefore be modified or withdrawn.

[1] CAISO, 2023 Transmission Plan Deliverability Allocation Report at 32, available at: https://mpp.caiso.com/tp/Documents/2023%20TPD%20Allocation%20Report.pdf.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

NLE respectfully urges the CAISO to provide the following additional data:

- List of substations within the zonal and constraint boundaries: The CAISO’s proposal to provide a list of substations within the zonal boundaries will help developers determine whether specific constraints impact a POI. Developers can supplement this data with the Transmission Capability Estimates Whitepaper to estimate the timing, severity, and costs of upgrades required to mitigate constraints. Reliability Network Upgrade (“RNU”) cost data is especially important to help inform development decisions due to the RNU reimbursement cap. NLE recommends that the CAISO additionally provide information on upgrades in the zonal data package in order to give developers easy access the POI-level information—rather than needing to refer to the whitepaper’s constraint-level data.

- Data on unstudied POI locations: During the December 19, 2023 workshop, the CAISO proposed to use POI data from previously completed clusters and TPD allocation reports. NLE respectfully urges the CAISO to also create a process to allow developers to request a distribution factor (“DFAX”) screening for POIs not studied in the prior cluster window. Recognizing the time and resources necessary to prospect and submit an interconnection request, it would be useful for the CAISO to provide developers with certainty on whether a previously unstudied POI is within a zone. Further, following an interconnection request submission, the CAISO should provide DFAX values for each constraint a project is behind.

- Substation expandability data: NLE recommends that the CAISO provide data to assist developers in determining whether a project can physically interconnect to a specific substation (i.e., available positions and potential for more). Though substation expandability information resides with the Transmission Owners, the CAISO can act as a central repository to collect and distribute the data.

- Short circuit values at each bus: Providing short circuit values at each bus would assist developers in determining whether it is technically feasible to interconnect a project.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

NLE appreciates the CAISO’s proposal to update the interconnection queue to include information on TPD requests and awards. The Transmission Capability Estimates Whitepaper contains information on available TPD following construction of new upgrades, but it does not indicate how much TPD the CAISO has allocated or will likely allocate in the next TPD cycle. Providing this additional information would resolve this issue and help inform prospecting and development decisions.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

NLE has no comments on this item.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

NLE supports the CAISO’s heatmap proposal. As stated in response to prompt 2 above, it would also be useful to provide information on planned upgrades needed to create additional TPD. This information would help developers assess potential construction delay risks.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

NLE supports the CAISO’s proposal to post Appendix A reports but does not have any comments on what information the CAISO should redact before releasing the reports.

7.

Please provide any additional comments on the zonal approach.

NLE has no comments on this item.

Power Applications and Research Systems, Inc.

Submitted 01/05/2024, 11:48 am

1.

Provide your organization’s comments on data accessibility to inform and support the zonal approach

PARS Energy generally supports the zonal approach and would like to see more details.

2.

Provide comments on additional data the ISO will be providing, I.e. list of substations within zone/interconnection area, workbook with studied POI behind each constraint, and TPD allocated behind each constraint.

1. Data Access- Substations Under CAISO Control

CAISO control of the California power grid is by voltage class. For example, PG&E voltages of 60 kV and above are under CAISO control. SCE voltage of 230 kV and above are under CAISO control and SDG&E’s voltage 69 kV and above are under CAISO control. The problem is that there are exceptions. For example, some PG&E 115 kV voltages are not under CAISO control and some of SCE’s 115 kV voltages are under CAISO control. The Issue is that this information is not public and causes submission of interconnection applications to the incorrect jurisdiction.

Recommendation: It is suggested that CAISO provide the list of substations that are under its control and keeps it updated as some of this information changes from time to time.

2. Data Access- Interconnection Forbidden Substations

Some California utilities no longer accept interconnection requests to their substations. PARS Energy expects that in the coming years, more utilities may decide that they no longer accept interconnection requests to specific substations. During Cluster 15, applications were submitted to interconnection Forbidden substations creating confusion and, redesign and resubmissions of interconnection requests.

Recommendation: It is suggested that CAISO create, maintain and continuously update a list of substations to which utilities no longer accept interconnection requests.

3.

Provide comment on the information identified in the queue and planned upgrades to it.

4.

Please provide comments on the examples provided to assess available capacity behind constraint(s) for studied POIs.

5.

Provide comment on the heatmap and ISO’s proposal to provide a heatmap after annual TPD Allocation in addition to after Cluster Study and Restudy.

Would like to see the implementation plan for a CAISO Heatmap.

6.

Provide comment on ISO proposal to post redacted Appendix A reports on Market Participant Portal including additional information that should be considered confidential in the reports.

PARS Energy does not generally support posting any reports as it can create creaate complications for the developers.

7.

Please provide any additional comments on the zonal approach.