Bay Area Municipal Transmission group (BAMx)

Submitted 02/22/2022, 04:01 pm

Submitted on behalf of

Silicon Valley Power and City of Palo Alto Utilities

1.

Please provide your organization’s overall comments on the Draft 2021-2022 Transmission Plan Feb 7, 2022 stakeholder call discussion:

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the Draft 2021-2022 Transmission Plan (Draft Plan, hereafter), dated January 31, 2022. The comments and questions below also address the material presented at the CAISO Stakeholder meeting on Feb 7, 2022. BAMx acknowledges the significant effort of the CAISO staff to develop the Draft Plan. BAMx recognizes the tremendous amount of work the CAISO staff has completed in this planning cycle. BAMx also believes the CAISO staff must be allowed a corresponding amount of time to engage the stakeholders to explain the staff’s work.

In these comments, BAMx raises some major concerns about the skyrocketing CAISO transmission access charges (TAC) and the CAISO’s financial fiduciary responsibilities to Californians and grid users. BAMx comments should be construed as attempting to assist the State in its journey to achieve its climate goals and not as any opposition in taking the necessary steps. Further, BAMx recognizes that electric rates may continue to rise as a necessary outcome in achieving the State’s climate goals. That said, it is imperative and incumbent on the CAISO to design and develop an appropriate and cost-effective electric grid to accomplish those goals.

In order to understand the TAC impact of the projects the CAISO management may recommend for approval as part of the current planning process, BAMx developed an HV TAC forecast for the period of 2023-2031. BAMx’s forecast shows that the HV TAC would rise to more than $22/MWh in 2031 relative to the existing level of $16.6/MWh, a staggering 33% increase in less than ten years.

Out of the $22/MWh of forecasted HV TAC in 2031, more than 38% of the increase is solely attributed to the nearly $3 billion transmission projects the CAISO is considering for approval in the current TPP cycle. BAMx’s HV TAC projections show the tremendous impacts these potential project approvals will have on the ever-increasing CAISO-wide HV TAC. As detailed in the remaining BAMx comments, the CAISO and stakeholders must complete thorough reviews and analyses to ensure the “right” projects are proceeding forward while eliminating excessive or unnecessary projects.

BAMx recognizes that the combination of the dramatically increasing pace of renewable generation and load forecast growth are driving an increase in transmission requirements under certain portfolio scenarios. However, the CAISO and the stakeholders must refrain from rushing to approve projects without allowing adequate time to complete the appropriate evaluation of each proposed project.

In some cases, it appears the transmission alternatives have not yet been fully developed, screened, and analyzed. Alternatives are often discussed qualitatively but never quantitatively compared with the proposed alternative. For instance, the stakeholders do not have access to any “change” power flow cases for the policy-driven transmission analysis and documentation underlying the recommended projects’ needs.

Furthermore, the CAISO typically posts its responses to past stakeholder comments before issuing the Draft Plan. Previous TPPs included posted responses to comments on preliminary reliability assessment in mid-November. As of February 2022, the CAISO still has not posted its responses to stockholders’ comments dated October 10, 2021 and December 6, 2021. BAMx finds it extremely challenging to respond and comment on certain aspects of the Draft Plan without knowing the CAISO’s responses to prior concerns raised by BAMx and other stakeholders.

In a nutshell, some of the transmission projects that the CAISO has recommended for approval in this planning cycle need to be studied more extensively in the next cycle, or at the very least their approval needs to be delayed until later in this cycle after the Board approval of the Plan in March 2022.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

2.

Comment on chapter 1 Overview of the Transmission Planning Process:

BAMx agrees with the CAISO that the role of battery storage is expected to continue to grow as a complement to the renewable generation and also as a key source of capacity to meeting both system capacity needs and local needs.[1] Ultimately, storage resources will be available to meet energy needs during most periods when renewable resources are not available to generate. BAMx agrees with the conclusion that only the incremental interconnection cost for the storage should be compared to transmission costs when the batteries are located in local constrained areas.

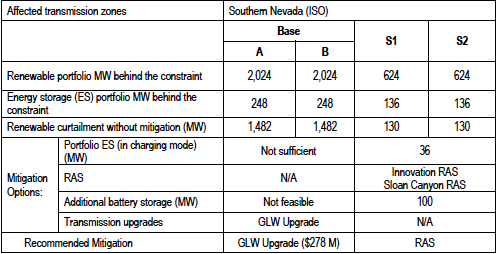

BAMx applauds the CAISO staff’s efforts in relying on the implementation of Remedial Action Schemes (RAS) and storage solutions in its Preliminary Policy Assessment. As shown in Table 1 compiled by BAMx below, the CAISO has effectively and rightfully utilized the existing/planned RAS dispatching portfolio battery storage in charging mode, and also includes new battery storage

as mitigations wherever applicable to mitigate the contingency overloads.

Table 1: Recommended Non-Wires Mitigations*

.png)

*Source: November 18th Presentation, “2021-2022 TPP Policy-driven Assessment,” pp. 30-55.

BAMx encourages the CAISO to transfer such valuable feedback to the California Public Utilities Commission (CPUC) and California Energy Commission (CEC) so that it is incorporated as part of the battery storage mapping exercise in the next Transmission Planning Process (TPP) cycle.

[1] Draft Plan, p.31.

3.

Comment on chapter 2 Reliability Assessment – Study Assumptions, Methodology and Results:

Previously Approved PG&E Projects

BAMx applauds the CAISO’s efforts in confirming the need for the previously approved projects. For example, the Fresno Area Preliminary Reliability Assessment Results identified the continued need for the following four previously-approved projects.

- Wilson 115kV Reinforcement Project;

- Herndon-Bullard 115 kV Reconductor;

- Reedley 70 kV Reinforcement (Dinuba Battery Energy Storage); and

- Wilson-Oro Loma Reconductoring.

Although this list excludes another project, namely Oro Loma 70kV Area Reinforcement Project, the Draft Plan includes it in the list of previously approved projects.[1]

BAMx urges the CAISO to review the continued need systematically and consistently for the previously-approved projects in all the planning areas including the three projects discussed below.

Ora Loma 70kV Reinforcement Project

The Oro Loma 70kV Reinforcement Project was approved in the 2011-2012 TPP. The original scope of the project included building a new 230/70kV substation near Mercy Springs Junction and converting a single-pole line into a double circuit tower line to create a new 70kV line from Mercy Springs to Canal.[2] Based on the information presented by PG&E as part of the Stakeholder Transmission Asset Review Process (STAR) process, the scope of the project has been reduced to reconductoring 2.4 miles of Los Banos-Livingston Jct-Canal 70kV line and reconductoring of 10.8 miles of Mercy Springs-Canal-Oro Loma line.[3]

The latest identified reliability need for the project is a thermal overload on Mercy Springs-Canal 70kV for the loss of Los Banos-Livingston Jct-Canal 70kV and a thermal overload on Los Banos-Livingston-Canal 70kV circuit for the loss of Mercy Springs-Canal 70kV.[4] However, this overload is not identified in any of the CAISO’s preliminary reliability results for the 2021-2022 TPP including the sensitivity cases. Moreover, when BAMx removed the proposed project from the 2031 Summer Peak Base Case for the Central Valley area and applied the identified contingencies, the post contingency loadings on Los Banos-Livingston-Canal 70kV and Mercy Springs-Canal 70kV circuits were 87% and 103%, respectively. Since these circuits are not overloaded in the 1-year-out (2023) and 5-year-out (2026) cases and show only a marginal overload in the 10-year-out case, BAMx suggests the CAISO reevaluate the need for the project and whether preferred resources, such as battery storage, could be used as an alternative mitigation measure.

Midway-Temblor 115kV Line and Voltage Support

The Midway-Temblor 115kV Line and Voltage Support reinforcement project was approved in the 2012-2013 Transmission Planning Process (TPP). The scope of the project is to reconductor approximately 15 miles of Midway-Temblor 115kV line and install 45MVAR of shunt capacitors at Temblor substation.

The latest identified need for the project is to mitigate a thermal overload on Midway-Temblor 115kV due to N-1-1 outage of Gates-Midway 500kV line and Gates 500/230kV bank. The voltage support portion of the project also mitigates low voltages at Temblor due to an N-1 outage of Midway-Temblor 115kV.[5] However, the overloads identified by PG&E were not observed in the latest Preliminary Reliability Results for years 2023 and 2026 posted by the CAISO for the 2021-2022 Transmission Planning Process. BAMx believes that the new second 500/230kV transformer at the Gates substation[6] that is currently operational potentially mitigates the identified N-1-1 or P6 overload on the Midway-Temblor line. BAMx requests the CAISO to re-evaluate the continued need for the project. If the project is found to be needed, the CAISO should identify the contingencies and the related overloaded transmission facilities driving the continued need for the project.

Morgan Hill Area Reinforcement Project

The Morgan Hill Reinforcement project was originally approved in the 2013-2014 TPP cycle. Through project re-evaluation, the scope of the project has changed, and the latest approved project scope is to “Rebuild Metcalf-Green Valley 115kV into the Green Valley-Morgan Hill 115kV and convert Morgan Hill 115kV bus to a BAAH configuration”.[7]

The latest identified needs for the project are driven by the thermal overloads on Metcalf-Llagas 115kV circuit which are mitigated by the line re-arrangement associated with the Morgan Hill Area Reinforcement project. The justification for rebuilding the Morgan Hill 115kV substation into a breaker-and-a-half configuration is unclear. If PG&E needs an additional breaker position for the newly built Green Valley-Morgan Hill 115kV circuit, the existing substation configuration should be modified. BAMx requests the CAISO to reevaluate the need for rebuilding the Morgan Hill substation into a breaker-and-a-half configuration. If such a need is not identified, the scope of the project should be adjusted to exclude the rebuild of the Morgan Hill substation. BAMx requests the CAISO to reevaluate the need for rebuilding the Morgan Hill substation, a distribution substation, into a breaker-and-a-half configuration ?which is contrary to the enhanced-loop or the ring bus configuration as specified in PG&E's design standards.

CAISO-Recommended Reliability-driven Projects in the Draft Plan

San Jose Area HVDC Lines

BAMx appreciates CAISO’s attention and seeking solutions to address significant long term issues in the SVP/San Jose area.[8]

Table Mountain 500/230 kV Transformer Bank #2 Project

The need for a second 500/230kV transformer at Table Mountain was identified in real-time operations due to high voltage issues at Table Mountain and Palermo 230kV areas when the existing Table Mountain 500/230kV transformer is taken out of service for maintenance conditions, which is usually conducted around the October/November timeframe.[9] With Rio Oso Static VAR Compensator (SVC) going into service, the high voltage issue shifts from P0 under maintenance to P1 under maintenance conditions[10]. BAMx requests the CAISO to investigate whether the maintenance outages could be scheduled during other months outside of October and November and provide additional information on the duration and frequency of the maintenance outages of Table Mountain 500/230kV transformer before the project is approved.

Additionally, the CAISO has indicated there are remaining high voltage issues in the area that will likely require mitigation[11]. If additional mitigations are approved and constructed in future TPP cycles, some of these mitigation measures could potentially allow for additional opportunities to obtain maintenance outages on the existing Table Mountain 500/230kV transformer bank. BAMx urges the CAISO to review the need for the new Table Mountain Bank in consideration of other voltage mitigation projects that could materialize around the Table Mountain and Palermo 230kV areas.

Cortina 230/115/60 kV Bank #1 Replacement

Cortina 230/115/60kV Bank #1 was identified to be overloaded for a P1 loss of Cortina 230/115kV Bank #4 and a P3 contingency for the loss of the same Cortina 230/115kV Bank #4 and Wadham Generator #1. The total load served radially by the Cortina 60kV substation is approximately 73.6MW. The emergency rating of Cortina 230/115/60kV transformer bank is 84MVA, and the bank can reliably support all the load even with the Wadham units off-line. The overloads identified by PG&E are due to impedance imbalance causing a flow of approximately 65.1MW from Cortina 60kV to Cortina 115kV substation through the 115kV/60kV transformer as identified on diagram below.

.png)

The identified overloads on Cortina 230/115/60kV #1 bank can be avoided by keeping either Cortina 230/115/60kV #1 bank or Cortina 115/60kV bank normally open. This configuration will avoid replacing Cortina 230/115/60kV #1 bank, and Cortina 60kV substation will still be reliably served since the transformer kept normally open could be utilized to restore Cortina load in case of failure of the primary transformer. Therefore, BAMx recommends against approving the Cortina 230/115/60 kV Bank #1 Replacement Project at this time.

[1] Draft Plan, Table 8.1-1: Status of Previously Approved Projects Costing Less than $50 M, p.374.

[2] Oro Loma 70kV Area Reinforcement Project, Request Window Submission, Page 1.

[3] PG&E Stakeholder Transmission Asset Review Process Stakeholder Meeting, August 3, 2021, – Page 54 of 58.

[4] Ibid.

[5] PG&E Stakeholder Transmission Asset Review Process Stakeholder Meeting, August 3, 2021, – Page 58 of 58.

[6] CAISO 2020-2021 Transmission Plan, February 1, 2021, Table 8.1-2: Status of Previously-Approved Projects Costing $50 M or More, shows that the Gates #2 500/230 kV Transformer Addition project has been completed

[7] PG&E Stakeholder Transmission Asset Review Process Stakeholder Meeting, August 3, 2021, – Page 53 of 58.

[8] Reliability Assessment Recommendations –PG&E Area, Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting, February 7, 2022, slides #3 & #4.

[9] Reliability Assessment Recommendations –PG&E Area, Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting, February 7, 2022, slide #7.

[10] Appendix B, Draft 2021-2022 Transmission Plan Page B-86

[11] Appendix B, Draft 2021-2022 Transmission Plan Page B-84

4.

Comment on chapter 3 Policy-Driven Need Assessment:

During the February 7th stakeholder meeting, the CAISO presented seven (7) Policy-Driven Projects, for a total cost estimate of $1.5 billion, and the Draft Plan recommends them for Board approval. In the interest of transparency and meaningful stakeholder feedback, BAMx strongly urges the CAISO to provide the following additional details for each of these policy projects.

- Load flow results supporting the need for the project(s);

- Change file modeling of the proposed project(s); and

- Contingency files corresponding to each project.

Without this information, the stakeholders will not be able to gauge the effectiveness of the proposed upgrades in mitigating the deliverability constraints or suggest any cost-effective alternatives to the proposed project(s). Moreover, most of these projects were not introduced or discussed in detail during the previous 2021-2022 TPP stakeholder meetings. It would be challenging to analyze such extensive network upgrades and provide meaningful comments during the current two week period. Approving these projects now would not allow enough time for stakeholders to conduct their independent analysis and provide feedback.

PG&E Area CAISO-Recommended Policy-Driven Projects in the Draft Plan

Collinsville 500/230 kV Substation Project

The CAISO’s recommendation of the Collinsville 500/230 kV Substation Project is driven by multiple potential overloads on the 230 kV corridor between Contra Costa and Newark under normal, N-1, and N-2 contingency conditions in baseline and sensitivity scenarios in the on-peak deliverability assessment.[1] The specific deliverability constraints that can potentially be addressed by the proposed Collinsville 500/230 kV Substation Project are[2]

- Cayetano-North Dublin 230 kV line on-peak deliverability constraint;

- Lone Tree-USWP-JRW-Cayetano 230 kV line on-peak deliverability constraint; and

- Las Positas-Newark 230 kV line on-peak deliverability constraint.

However, reconductoring each of the above-mentioned 230kV lines could address the above-mentioned constraints and is expected to be an effective and adequate mitigation solution. The combined cost of the three reconductoring projects are in the range of $145.2M – $188.7M, which is less than one-third the cost of $475M – $675M associated with the New Collinsville 500 kV substation. BAMx recognizes that the Collinsville 500 kV substation could be a superior alternative to the 230kV reconductoring projects, which offers additional supply from the 500 kV system into the northern Greater Bay Area to increase reliability to the area and advance additional renewable generation in the northern area. However, BAMx is not convinced that it is the least cost way of achieving the State policy goals as envisioned per the CPUC-provided renewable resource portfolios studied in the current planning cycle. A synergy of the Collinsville 500/230 kV Substation with the transmission needed to accommodate offshore transmission development as studied in a single scenario under the 20-Year Transmission Outlook[3] should not, by itself, be used as a justification to approve the Collinsville project at this time. Therefore, BAMx urges that CAISO to delay the approval of the Collinsville 500/230 kV Substation Project as a policy-driven project until a rigorous reliability and economic analysis[4] of the competing alternatives is performed.

Manning 500/230 kV Substation Project

The CAISO’s recommendation of the Manning 500/230 kV Substation Project is driven by potential overloads on the Borden-Storey 230 kV lines under normal and N-1 contingency

conditions in baseline and sensitivity scenarios in the on-peak deliverability assessment.[5]

However, reconductoring of the Borden-Storey #2 230kV line is expected to be an effective and adequate mitigation solution. The cost of the reconductoring is in the range of $24.24M – $31.5M, which is less than 7 percent of the cost of $325M – $485M associated with the New Manning 500/230 kV substation. BAMx recognizes that the New Manning 500/230 kV substation could be a superior alternative to the 230kV reconductoring project, which provides benefit in allowing for the advancement of renewable generation within the Westlands/San Joaquin area. However, additional analysis should be performed to demonstrate that it is the least cost way of achieving the State policy goals as envisioned per the CPUC-provided renewable resource portfolios studied in the current planning cycle. A synergy of the Manning 500/230 kV Substation with the transmission needed to accommodate transmission development as studied in a single scenario under the 20-Year Transmission Outlook[6] cannot in itself be used as a justification to approve the proposed project at this time. Therefore, BAMx urges that CAISO to delay the approval of the Manning 500/230 kV Substation Project as a policy-driven project until a rigorous reliability and economic analysis[7] of the competing alternatives is performed.

Southern California CAISO-Recommended Reliability-driven Projects in the Draft Plan

GLW/VEA Area Upgrades Project

During the 2021-2022 TPP request window submission process, the GridLiance West (GLW) LLC submitted the GLW Upgrade project. The project scope includes rebuilding Desert View – Northwest 230kV, Pahrump – Gamebird 230kV, Gamebird – Trout Canyon 230kV and Trout Canyon – Sloan Canyon 230kV to double circuit lines; adding a second Innovation –Desert View 230 kV line; adding a 500/230 kV transformer at Sloan Canyon and looping in the Harry Allen – Eldorado 500kV line; an upgrade to WAPA’s Amargosa 230/138 kV transformer and a tentatively planned NV Energy (NVE) upgrade on the Mercury SW – Northwest 138 kV tie line. The estimated cost of this project is $213M with an in-service date of 2025. The CAISO has recommended an expanded version of the GLW project to include rebuilding the Innovation –Pahrump 230 kV line and installing a 138kV phase shifter at Innovation on the planned tie-line to NVE, which increases the project costs to $278M.

The overloads driving the GLW Project are identified only in the 2031 Off-Peak scenario, as shown in the GLW/VEA area off-peak deliverability constraint summary table included below.[8] The need for the GLW project is only identified in the Base portfolio. In contrast, the combination of existing Innovation RAS and Sloan Canyon RAS, and 100MW of battery storage are adequate under the two sensitivity portfolios.

Per the CAISO’s FERC-approved tariff, a Category 1 policy-driven transmission solution has to be identified to be needed “in the baseline scenario and at least a significant percentage of the stress scenarios.”[9] Since the GLW project is not identified to be needed under any of the two sensitivity portfolios, it clearly does not satisfy the criteria for Category 1 transmission, and therefore should not be approved as such. The CAISO could approve the project as Category 1 on the basis of the need under the baseline portfolio only if “the CAISO finds that sufficient analytic justification exists to designate them as Category 1 transmission solutions.”[10] However, CAISO has not provided such additional justification.

The GLW project meets the criterion for Category 2 as it is identified to be needed under the baseline portfolio. Therefore, BAMx requests approving the GLW project only as a Category 2 project to be studied further in the future planning cycles, and not be recommended as Category 1 policy-driven to the CAISO Board at this time.

[1] Policy Assessment Recommendations –PG&E Area, Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting, February 7, 2022, slide #5.

[2] Draft Plan, pp.192-195.

[3] Draft 20-Year Transmission Outlook, 2021-2022 Transmission Planning Process Stakeholder Meeting

February 7, 2022, slide #1.

[4] BAMx appreciates the economic analysis performed by the CAISO, which shows that the production benefits for CAISO ratepayers of the Collinsville Upgrade is $10 million per year in the Base portfolio (Draft Plan, p. 302), and encourages CAISO to perform such economic analyses for the base and sensitivity portfolios in the next planning cycle.

[5] Policy Assessment Recommendations –PG&E Area, Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting, February 7, 2022, slide #6.

[6] Draft 20-Year Transmission Outlook, 2021-2022 Transmission Planning Process Stakeholder Meeting

February 7, 2022, slide #12.

[7] BAMx appreciates the economic analysis performed by the CAISO, which shows that the production benefits for CAISO ratepayers of the Manning substation is $15 million per year in the Base portfolio (Draft Plan, p. 301), and encourages CAISO to perform such economic analyses for the base and sensitivity portfolios in the next planning cycle.

[8] Draft Plan, p.274

[9] CAISO Fifth Replacement FERC Electric Tariff, Effective as of January 1, 2022, 24.4.6.6 Policy-Driven Transmission Solutions.

[10] Ibid.

5.

Comment on chapter 4 Economic Planning Study:

Out-of-State Wind Study

All portfolios provided by the CPUC called for at least 1,062 MW of Out-Of-State (OOS) wind to be brought into California. Thus, the CAISO compared the effectiveness of the different transmission and resource options against each other as opposed to a “no out-of-state” case.[1] The New Mexico OOS wind resources were selected as the reference case against which other alternatives were compared, as they provided the least amount of direct interaction with transmission facilities impacted by other different alternatives, and possible transmission upgrades in New Mexico and Arizona, such as the SunZia Transmission Project (SunZia), may be moving forward on a subscriber basis. BAMx finds this aspect of the CAISO’s OOS wind study reasonable.

The economics of the OOS transmission should be based upon the Seller’s ability to access existing transmission or purchase transmission from developers of that transmission. To perform a systematic comparison of the transmission cost impact of the OOS transmission, the following transmission cost allocation principles should be applied. The fundamental principle for cost allocation is that it should be allocated in a way that is commensurate with benefits. In particular, the LSEs within the Local Regulatory Authorities (LRAs) approving resource procurement that are benefiting from the OOS resources should pay for that transmission delivering those resources to the CAISO border. BAMx believes that having the supplier build in its cost of delivering its product to the CAISO will also improve its ability to optimally deliver its product to the WECC-wide grid. This mechanism ensures that buyers of the remote generation will have the transmission costs outside of the CAISO captured in the power purchase agreement (PPA) pricing. This will also help accomplish the first principle of FERC Order 1000, that is, costs are allocated in a way that is roughly commensurate with benefits. Broadly, LSEs voluntarily procuring resources using transmission should pay for the cost of delivery. One such example is SunZia accessing the New Mexico wind, which is not seeking CAISO Transmission Access Charge (TAC) cost recovery to deliver its product to the CAISO boundary point.[2] In other words, the costs of new transmission outside CAISO are captured in the PPA pricing with LSE off-takers who are procuring New Mexico wind energy and will not be borne by all the CAISO-wide TAC payers.

BAMx supports the CAISO analysis that distinguishes between those OOS transmission projects seeking CAISO TAC-based recovery versus those that do not seek to recover their costs through the CAISO TAC. The Draft Plan states that the TransWest Express (TWE) project is being developed on a subscriber basis, without the need for CAISO transmission plan approval, to provide transmission service to resources seeking access to California markets.[3] However, this statement is only partially true. Out of the three segments of the TWE project, only half of two of the segments would use a subscriber model. In other words, out of nearly $2.18 billion, nearly $1.71 billion would ultimately be recovered from the CAISO ratepayers.[4] BAMx suggests that the CAISO should clarify in all references to TWE in the Draft Plan that TWE would only “partially” use a subscriber model.

The Draft Plan includes the benefit to cost ratio (BCR) of the three candidate transmission upgrades, viz. SWIP-North, Cross Tie, and TWE, with different out-of-state wind scenarios and different phase shifter setups.[5] In particular, the Draft Plan Table 4.10-4 shows that the BCRs for all three projects are well below 1.0. In other words, the candidate projects are not found to be economically viable. In addition to this base assessment, CAISO also calculated an alternative benefit to cost ratio for each project and alternative configuration assuming an added benefit of avoiding half of the cost of the SunZia project - as a proxy for the cost of delivering New Mexico wind generation to Pinal Central.[6] In the benefit to cost ratio calculations, the present value of the annualized revenue requirement for a 1,500 MW share of the SunZia project was considered as the avoided cost. Although the CAISO base method to calculate the BCRs of the candidate OOS projects is reasonable and intuitive, the alternative method does not seem to have a logical substantiation. The logic of providing avoided cost credit of half of the Sunzia capital cost to the candidate OOS transmission projects without netting its benefits is fundamentally flawed. After all, SunZia is not seeking any CAISO ratepayer recovery for any portion of its 3,000MW capacity. Therefore, it is inaccurate to attribute any portion of its cost avoidance to the remaining candidate OOs transmission projects. The CAISO’s alternative BCR calculations incorrectly overestimate the economic value of the candidate OOS projects, as shown in the last column of Table 4.10-4 in the Draft Plan, which is misleading. Therefore, BAMx urges the CAISO to exclude any discussion and BCR findings associated with alternative configuration assuming an added benefit of avoiding half of the cost of the SunZia project in the final transmission plan.

Economic Assessment

GLW/VEA Area Upgrades Project

BAMx appreciates CAISO’s detailed production cost modeling (PCM) simulation economic assessment results presented in this planning cycle, which demonstrated that the GLW Upgrade has a 1.81 benefit to cost ratio. However, this analysis was performed only for the baseline portfolios and not the sensitivity portfolios. An analysis based upon a single baseline scenario as modeled in the CAISO’s PCM is inconsistent with CAISO’s Transmission Economic Assessment Methodology (TEAM) principles to account for risk and uncertainty.[7] Therefore, the GLW Upgrade project should not be recommended for approval as an economic-driven project in this planning cycle.

[1] Draft Plan, p.7.

[2] See Southwestern Power Group and Pattern Energy Group Joint Reply Comments on Administrative Law Judge’s Ruling on Portfolios for the 2021-2022 Transmission Planning Process, November 20, 2020, p.1. Southwestern Power Group (SWPG) is developing SunZia Transmission Project, a 520-mile independent transmission project to deliver New Mexico wind to Pinal Central (Palo Verde area) to serve Arizona and California markets.

[3] Draft Plan, p.7.

[4] Draft Plan p. 306.

[5] Draft Plan p. 313-314.

[6] This represents a 1,500 MW share of the 3,000 MW, $2.6 billion SunZia project, or $1.3 billion capital cost.

[7] The CAISO TEAM 2017, available at

https://www.caiso.com/Documents/TransmissionEconomicAssessmentMethodology-Nov2_2017.pdf

6.

Comment on chapter 5 Interregional Transmission Coordination:

No comments at this time.

7.

Comment on chapter 6 Other Studies and Results:

No comments at this time.

8.

Comment on chapter 7 Special Reliability Studies and Results:

No comments at this time.

9.

Comment on chapter 8 Transmission Project List:

The Draft Plan does not include an estimate of future High Voltage Transmission Access Charge (HV TAC) rates at this time. We understand that the CAISO is currently in the process of updating the “starting point” for the HV TAC estimating tool to January 1, 2022.[1] Given the need for urgency to show the TAC impact of the projects the CAISO has recommended for approval as part of the current planning cycle, BAMx developed an HV TAC forecast for the period of 2023-2031 as shown in the figure below. In this analysis, BAMx used the last version of the CAISO’s TAC Estimating model developed for the 2020-2021 TPP, and updated the model to include the CAISO January 01, 2022, TAC Rates (updated as of February 8, 2022). The newly added capital expenditures associated with the transmission projects and their schedule was based on the transmission projects found to be needed in the 2021-2022 TPP as per the Draft Plan.[2] That is, those included in

- Table 8.2-1: New Reliability Projects Found to be needed;

- Table 8.2-2: New Policy-driven Transmission Projects Found to be needed; and

- Table 8.2-3: New Economic-driven Transmission Projects Found to be needed

Transmission Capital Expenditures and HV TAC Projections: 2023-2031

.png)

As shown in the figure above, the HV TAC is expected to be more than $22/MWh in 2031 relative to the existing $16.60MWh, a 33% increase in less than a 10-year timeframe. Out of the $22/MWh HV TAC in 2031, more than $2/MWh is solely attributed to the nearly $3 billion transmission projects[3] the CAISO has recommended for approval in the current TPP cycle. These HV TAC projections show the tremendous impact these approvals will have on the ever-increasing CAISO-wide HV TAC and further justify the need to avoid approving excessive transmission projects without further review and analysis.

[1] Draft Plan, p.382.

[2] Draft Plan, pp.377-378.

[3] Compared to the average over the last five years of $217 million.

California Public Utilities Commission - Public Advocates Office

Submitted 02/24/2022, 11:29 am

1.

Please provide your organization’s overall comments on the Draft 2021-2022 Transmission Plan Feb 7, 2022 stakeholder call discussion:

The following are comments from the Public Advocates Office at the California Public Utilities Commission (Cal Advocates) to the California Independent System Operator Corporation (CAISO). Cal Advocates is an independent consumer advocate with a mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Background

The Draft 2021 Transmission Plan (Draft Plan) uses the California Public Utilities Commission’s (CPUC) 2021 electric resource procurement portfolios. These portfolios are intended to meet the state's renewable portfolio standard (RPS) target of 60% renewable resources portfolio and greenhouse gas (GHG) emission reduction target of 38 million metric ton (MMT) by 2031.[2],[3]

The CPUC provides the CAISO with a base resource portfolio and two resource sensitivity portfolios. The CPUC’s 2021 base portfolio includes 27,695 megawatts (MWs) of renewable resources, which is nearly three times the quantity proposed in prior years (~10,387 MW).[4] Subsequently, the Draft Plan recommends approval of $2.9 billion in new transmission investments, which is ten times higher than the average annual Transmission Planning Process (TPP) approval over the last five years.[5]

The resources of concern for ratepayers in the base and sensitivity portfolios are as follow:

- Base portfolio includes 1,062 megawatts (MW) of out-of-state wind on new transmission.

- Sensitivity 1 portfolio includes 1,500 MW of out-of-state wind on new transmission from Wyoming and New Mexico.

- Sensitivity 2 portfolio includes 1,500 MW of out-of-state wind on new transmission from Wyoming and New Mexico, as well as 8,300 MW of offshore wind.[6]

These resources are of concern because significant transmission investments are required to access these resources and more information is needed on the proposed transmission investments to determine that they are reasonable. These resources may also not be needed to meet the state’s 2031 resource portfolio target.[7]

Comments regarding transparency and stakeholder engagement

Cal Advocates recommends that the CAISO continue to improve the TPP, by increasing transparency and stakeholder participation. The CAISO has publicly stated their commitment to the principle of full transparency.[8] Cal Advocates, as a ratepayer advocate participating in the CAISO’s TPP, submitted comments during this 2021 TPP cycle regarding the proposed Draft Plan policy and reliability projects.[9],[10] In previous TPP cycles, the CASIO responds to stakeholder comments prior to issuing the Draft Plan. To date, the CAISO has not responded to comments on the proposed Draft Plan projects. Thus, it is unclear whether the Draft Plan is informed by previous stakeholder comments.

Also, the CAISO did not provide adequate time (two-weeks) for stakeholders to thoroughly review the 24 recommended projects, of which twelve were not discussed as recommended projects prior to the February 7, 2022, TPP stakeholder meeting. In short, there is insufficient information to justify the $2.9 billion in transmission investments recommended in this TPP cycle.

Cal Advocates recommends that the CAISO record and post all TPP meetings in a publicly accessible location. This is consistent with its practice for other CAISO stakeholder engagement initiatives and workshops. TPP meetings serve as the only forum in which the CAISO provides important information to stakeholders. Publicly posting the recordings of all TPP meetings would assist stakeholders who are unable to attend.

Essential Information Necessary for Recommended Transmission Projects

The CAISO Board of Governors should be provided sufficient basis upon which to approve a transmission project. Therefore, Cal Advocates recommends the CAISO provide the following essential information for recommended transmission projects:

- Detailed information regarding project alternatives. Currently, the TPP process does not provide sufficient detail for project alternatives. Cal Advocates recommends that the CAISO include a more substantive assessment (including costs) of grid enhancing technologies that could address the identified issues the proposed projects seek to address. Cal Advocates also recommends that the incumbent utilities cost information for project alternatives be vetted by the CAISO or a third party hired by the CAISO to confirm the costs for project alternatives.

- Detailed project cost information. Typically, the TPP includes rough project costs or book-end project costs. Cal Advocates recommends that the CAISO include a more substantial breakdown of the major project components’ and contingencies. To illustrate, for the proposed Collinsville 500/230 kilovolt (kV) substation project only a total project cost ranging between $475 to $675 million was provided. The proposed scope for this project includes a new substation looping in the Vaca Dixon – Tesla 500 kV line as well as two new 500/230 kV transformers with 1,500 mega volt-amp (MVA) ratings, and two new 230 kV cables between Collinsville and Pittsburg 230 kV substations.[11] Without this essential project information, the CAISO Board and stakeholders cannot confirm whether the proposed projects are justified based on their costs.

[1] Cal. Pub. Util. Code § 309.5.

[2] Senate Bill (SB) 100 (De Leon) Stats. 2018, Ch 312., revised the previous established goal of to achieve the 50 percent renewable resources target by December 31, 2030.

[3] SB 350 (De Leon ) Stats. 2015. Ch 547, the Clean Energy and Pollution Reduction Act, established greenhouse gas reductions goals including reducing GHG emission to 40 percent below 1990 levels by 2030 and to 80 percent below 1990 levels by 2050. California Air Resource Board, in coordination with the CPUC and CEC, as directed by S B 350 establishes the state’s GHG target that would meet or exceed the SB 350 target.

[4] 2021-2022 TPP Policy-driven Assessment, 2021-2022 Transmission Planning Process Stakeholder Meeting (Presentation), November 18, 2021, page 11.

[5] CAISO Draft 2021-2022 Transmission Plan, January 31, 2022 (Draft Plan), p. 5.

[6] CPUC Modeling Assumptions for the 2021-2022 Transmission Planning Process, February 9, 2021, p. 67.

[7] The California Load Serving Entities (LSE) did not select OOS wind on new transmission lines in their 10-year system portfolios submitted on September 1, 2020. Instead, LSE selected wind resources from New Mexico and the Pacific Northwest on existing transmission. Administrative Law Judge’s Ruling Seeking Comments on Proposed Preferred System Plan, CPUC R.20-05-003, August 17, 2021, p. 48.

[8] California State Legislature, State Assemble Committee on Utilities and Energy, Mid-August Heat Storm Joint Preliminary Report by California Energy Commission, California Public Utilities Commission, California Independent System Operator, October 12, 2021. Statement from CEO Elliot Mainzer.

[9] Public Advocates Office’s Comments on the September 27-29, 2021, CAISO stakeholder meeting, October 12, 2021, pp-4-9.

[10] Public Advocates Office’s Comments on the November 18, 2021, CAISO Stakeholder Meeting, November 6, 2021, pp.4-6, and 11.

[11] Draft Plan, p. 193.

2.

Comment on chapter 1 Overview of the Transmission Planning Process:

Focus of the 2021 TPP process should be on projects that are needed by 2031.

It is premature for the CAISO to propose extensive system upgrades in the Draft Plan in response to untested, unvetted, and unapproved resource portfolios.[1]

Specifically, in the Draft Plan, the CAISO proposes additional reliability and policy projects to accommodate the Senate Bill (SB) 100 Starting Point scenario based on load forecast and resource portfolio assumptions from the CPUC and the California Energy Commission (CEC). The SB 100 Starting Point scenario is intended to meet the state’s RPS policy directive of a 100% renewable portfolio by 2045.[2]

However, the CPUC and the CEC have not tested the SB 100 Starting Point scenario for reliability or fully vetted the scenario nor have they approved the Starting Point scenario.[3] Moreover, the CAISO acknowledges that the SB 100 Starting Point scenario is intended as “informational only and should not be used, in itself, to support approval of near-term infrastructure investments.”[4] Therefore it is premature to approve transmission projects to support the SB 100 Starting Point scenario within the 2021 Transmission Plan.

Cal Advocates recommends that the CAISO limit its consideration to transmission needs that support the CPUC 2021 resource portfolio in its 2021 Transmission Plan. To this end, Cal Advocates recommends that the CAISO exclude proposed projects that are not needed within the 10-year time frame and or are not the confirmed lowest cost solution. The projects that should be excluded because they are not needed to meet the state’s 10-year policy target are the: (1) San Jose High Voltage Direct Current line projects, (2) Antelope 66 kV Short Circuit Duty Mitigation project, (3) Collinsville 500/230 kV substation project and (4) Manning 500/230 kV substation project. These recommended projects to meet SB 100 goals have a combined cost of $2.3 billion.

[1] Draft Plan, p. 11.

[2] The state is required to study portfolios to achieve the State 100% clean energy goal by 2045.

[3] “this initial [Starting Point scenario ] portfolio is not an endorsement of any particular resource or potential transmission solution.” Draft 20-Year Transmission Plan, January 31, 2022, pp. 15-16.

[4] CAISO Draft 20-Year Transmission Outlook, January 31, 2022, p. 1.

3.

Comment on chapter 2 Reliability Assessment – Study Assumptions, Methodology and Results:

a. Cortina 230/115/60 kilovolt (kV) Transformer Bank No. 1 Replacement Project

The CAISO determined that potential overloads could occur in the Sacramento area at the Cortina substation by 2021. To address these overloads, the CAISO recommends implementing an existing operating procedure to avoid the loss of Bank #4 at the Cortina substation.[1] As noted in Pacific Gas and Electric Company’s (PG&E’s) presentation, with the implementation of this existing operating procedure, overloads would no longer be expected under a P3 contingency, and overloads would be dramatically reduced from 37.5% to 2.2% under a P1 contingency in 2023.[2] To address any remaining overload potential in the Cortina system area, the CAISO recommends upgrading the transformer Bank #1 for the long-term.[3]

In contrast, PG&E proposes a more expansive solution of replacing Bank #1 at the Cortina substation with two new transformer banks at a total project cost of $21 million to $42 million.[4] Because implementing the existing operating procedure largely addresses the observed overload issues in the Cortina system area, PG&E’s more costly alternative is not justified.

Cal Advocates recommended, in its October 12, 2021, comments, that PG&E evaluate upgrading Bank #1 as a long-term solution rather than replacing it.[5] Cal Advocates also recommended that the CAISO exclude PG&E’s proposed solution for the Cortina substation. Cal Advocates continues to recommend that the CAISO’s more cost effective solution be adopted rather than PG&E’s proposed Transformer Bank Replacement project.

b. Manteca-Ripon-Riverbank-Melones Area 115kV Line Reconductoring

The CAISO recommends potentially reconductoring a section of the Manteca – Ripon and Melones – Valley Home 115 kV line to address observed overloads starting in 2023 or an operating measure for the short-term. PG&E proposed reconductoring 4.2 miles of the Manteca-Ripon 115 kV line with an estimated project cost estimate ranging between $6.8 to $13.6 million.[6]

Recommendation: Cal Advocates requests additional evaluation of lower-cost alternatives for this project for the following reasons:

- PG&E’s power flow results presentation did not provide the impact on overloads in the area when utilizing its operating action plans.[7] The CAISO’s Draft Plan states that the project area will rely on operating action plans in the interim.[8]

- The alternative analysis did not state whether grid enhancing technologies were considered to address the identified overload issues.

- PG&E’s presentation demonstrates that overloads are expected to increase significantly by 2026 in the Manteca Stanislaus project area but then decreased by 2031. PG&E should be required to explain the reason for the forecasted decrease in overloads.[9]

- There is a larger line reconductoring project in the project area that includes a majority of the lines between the Manteca and Stanislaus substations. However, the CAISO did not provide analysis regarding whether this larger reconductoring project will significantly address the potential overload issues.[10]

c. Coppermine 70 kV Reinforcement Project

The CAISO determined that there are overloads and lower voltages occurring under normal system conditions on the Coppermine-Tivy Valley 70 kV line. To address these issues, PG&E proposes a project, costing between $21.8 and $43.6 million, that could be in service by 2027.[11] The project includes the following components: (1) reconductoring lines between Borden and Cassidy substations and the Cassidy and Coppermine substation (2) removing any limiting components and (3) installing a 20 MVAR voltage support.[12] Unfortunately, PG&E provided no cost estimates for the project components described — only a total project cost. Without additional detailed information regarding the project components and associated costs, it is unclear whether the project is justified, including whether the costs are reasonable.

Recommendation: Since there are reliability issues already occurring within the project area, Cal Advocates recommends that the CAISO provide additional information on solutions that could be implemented within an early timeframe. PG&E recommends against using energy storage, which could likely be installed within an early timeframe, because PG&E claims that installing energy storage would trigger a bus upgrade with an estimated cost between $35 million and $70 million.[13] However, there is no confirmation that PG&E’s estimated integration costs are reasonable. The CAISO stated at the November 18, 2021, TPP Policy and Economic stakeholder meeting that it does not perform a cost comparison between the estimates that PG&E provides for installing energy storage and for similar integration projects.[14] Without verification of the project cost and cost of alternatives, it is not possible to determine if lower cost alternatives would be more cost effective than PG&E’s proposed line reinforcement project.

d. Weber-Mormon Jct Line Section Reconductoring Project

In response to the potential overloads at the Weber 60 kV substation by 2023 and in real-time operations, PG&E recommends a line reconductor project with a cost ranging from $9.3 million to $18.6 million.[15] PG&E only assessed energy storage as an alternative to address the noted reliability issues and recommended against it because PG&E claimed the cost to integrate energy storage would be between $13 million to $26 million.[16]

Recommendation: Similar to our recommendation for the Coppermine 70 kV reinforcement project, Cal Advocates recommends that the CAISO provide more details on the upgrades needed and confirmation on the cost estimate to assist with determining whether energy storage is a feasible alternative solution. Additionally, Cal Advocates recommends that CAISO consider other potential lower-cost grid enhancing technologies, such as Smart Wires, to address observed overload issues prior to recommending approval for PG&E’s recommended project.

e. San Jose Two High-Voltage Direct Current Line Projects

To address an anticipated load increase in the San Jose area within the next 10 years,[17] the CAISO recommends a new 230 kV or 500 kV source.[18] The anticipated increase in load in the San Jose area is primarily due to extremely large-scale data centers expected in the Silicon Valley Power (SVP) service area.[19] As illustrated in PG&E’s presentation, SVP’s load growth is expected to increase significantly between 2021 and 2026. In response to this anticipated load growth, PG&E recommends building two new high-voltage direct current (HVDC) lines in the San Jose sub-area for an expected total cost ranging between $750 million and $1.125 billion.[20]

Recommendation: In our September 2021 TPP comments, Cal Advocates recommended that the CAISO instruct PG&E to evaluate and provide cost estimates for lower cost alternative projects to meet SVP load growth needs.[21]

Cal Advocates continues to recommend that the CAISO consider lower cost alternatives. These alternatives include:

- Alternative 1: Install an energy storage facility with a capacity no greater than 375 MW (theoretical limit of energy storage capacity in the load area).[22]

- Alternative 2: Install a 375-MW energy storage facility and a reactive support device, as well as reconductor the Los Esteros – Nortech – NRS 115 kV line.[23]

Regarding Alternative 2, the CAISO states in its Draft Plan that “adding about 2 ohms reactors on the Los Esteros-Nortech 115 kV line would be the optimal solution along with running the Silicon Valley Power (SVP) phase-shifter transformer at its limit and energy storage addition in the SVP system.”[24] The CAISO estimates that this alternative project would cost between $10 and $15 million with an in-service date of 2023.[25] The CAISO proposes this project for approval under the project name Series Compensation on Los Esteros-Nortech 115 kV line. Cal Advocates supports further consideration of Alternatives 1 and 2.

Cal Advocates also questions the load growth assumptions for the proposed new data centers. New data centers permitted before 2023 are required to comply with the 2019 Building Energy Efficiency Standard (BEES), which requires solar generation on site and energy efficient design to reduce load and manage load through demand response devices. Data centers permitted after December 31, 2022, must comply with 2022 BEES, which requires solar generation and storage installations on new commercial buildings as well as more aggressive energy efficient design. The new data centers in San Jose would be subject to BEES and also be subject to time-of-use rates to reduce their demand on the electric system during peak hours. Thus, the anticipated load growth from the new data centers in the San Jose area could be much less than previously anticipated. During the February 7, 2022, CAISO stakeholder meeting CAISO staff did not confirm whether the 2019 and 2022 BEES changes were considered in the forecast used for the current TPP cycle.

In addition, California is served by only three HVDC transmission lines which include: (1) the 3,100 MW Pacific Intertie; (2) the 2,400 MW Intermountain Power Project (Path 27), and (3) the 400 MW Trans Bay Cable. For this reason, Cal Advocates requests that the CAISO further evaluate the schedule and costs for the proposed HVDC lines. Given the state’s limited experience with HVDC lines, choosing an HVDC alternative could result in cost over-runs and/or project delays. For example, the Transbay Cable line’s original estimate of $200 million and later increased to $303 million.[26] Ultimately, the final project cost was $571.9 million, which exceeded the 50% project cost cap.[27]

Cal Advocates recommends that the CAISO consider the project cost estimates and likely project issues further prior to recommending the project for approval.

- Table Mountain 500/230 kV Transformer Bank #2 Project

PG&E provided a cost estimate ranging between $38.4 million and $76.8 million for a proposed second 500/230 kV transformer at the Table Mountain substation with an expected completion date of 2027.[28] According to the CAISO a second transformer would address observed high voltage issues that occur when the existing Table Mountain transformer is taken out of service for maintenance (~ October/November time-frame).[29] However, the CAISO did not explain why rescheduling the transformer maintenance outages to a lower demand timeframe is not an option. The CAISO considered an alternative reactive support device to address the noted issues, but did not provide the cost for this option.[30]

Recommendation: Cal Advocates recommends the CAISO provide cost information on the alternatives considered and further examine the transformer maintenance schedule to determine if maintenance can occur at a different timeframe to reduce impacts to the system.

- Antelope 66 kV Short Circuit Duty Mitigation Project

The CAISO proposes to upgrade the existing Antelope 66 kV switchrack to a 50 kiloampere (kA) short circuit duty rating for $55 million to accommodate the anticipated new renewable resources at the Antelope 230 kV substation. Southern California Edison Company (SCE) did not present this project at the CAISO’s September 2021 TPP reliability assessment meetings, and instead presented the project in SCE’s filed comments on the September 2021 TPP reliability assessment meetings.[31] In its comments, SCE described this project as a proactive investment to assist with meeting the state’s resource portfolio goals. The CAISO 2021 Draft Plan explains that the base portfolio from the CPUC will trigger the need for circuit breaker replacements at the Antelope Substation.[32]

This proposed project, however, is much more extensive than replacing circuit breakers, and neither the CAISO nor SCE provided justifications for the additional project components. The project presentation was also unclear on whether the additional project components are necessary to support the CPUC 2031 base case resource portfolio or future resource portfolios.

Recommendation: Cal Advocates recommends that the CAISO and SCE provide sufficient justifications for all project components and a complete analysis that compares the Antelope 66 kV switchrack project with the 41 circuit breakers replacement alternative. Also, the CAISO should study the impact of the 2021 CPUC base case resource portfolio on the Antelope 66 kV switchrack.

The other components of this project that were not sufficiently explained are:

- Replacing 101 of the installed 66 kV ground disconnect switches;

- Replacing 45 of the installed 66 kV potential transformers;

- Performing a ground grid study;

- Removing 15 steel lattice structures; and

- Installing 15 new dead-end structures.[33]

[1] Central Valley Area Preliminary Assessment Results, 2021-22 Transmission Planning Process Stakeholder Meeting September 27-28, 2021, CAISO, September 27, 2021, page 8.

[2] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 18.

[3] Central Valley Area Preliminary Assessment Results, 2021-22 Transmission Planning Process Stakeholder Meeting September 27-28, 2021, CAISO, September 27, 2021, page 8.

[4] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 19.

[5] Public Advocates Office Comments on September 27-28 Stakeholder Call Discussion 2021-2022 Transmission Planning Process, October 12, 2021, p. 5.

[6]PG&E’s 2021 Request Window Proposals CAISO 2021-2022 Transmission Planning Process, September 28, 2021, slide 14.

[7] PG&E’s 2021 Request Window Proposals CAISO 2021-2022 Transmission Planning Process, September 28, 2021, slide 11.

[8] Draft Plan, p. 96.

[9] PG&E’s 2021 Request Window Proposal, CAISO 2021-2022 Transmission Planning Process, September 28, 2021, (Presentation), PG&E, September 28, 2021, slide 9.

[10] PG&E’s 2021 Request Window Proposal, CAISO 2021-2022 Transmission Planning Process, September 28, 2021, (Presentation), PG&E, September 28, 2021, slide 9.

[11] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 25.

[12] CAISO Draft 2021-2022 Transmission Plan, p. 110

[13] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 25.

[14] California ISO (CAISO) 2021-2022 Transmission Planning Process Meeting CAISO Preliminary Results Policy and Economic Assessment, November 18, 2021, Customized Energy Solutions, November 22,2021, p. 12.

[15] Draft Plan, p. 95-96.

[16] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 7.

[17] PG&E’s 2021 Request Window Proposals, CAISO 2021-22 Transmission Planning Process (Presentation), PG&E, September 28, 2021, slide 40 and slides 45-47.

[18] Greater Bay Area Preliminary Reliability Assessment Results, 2021-22 Transmission Planning Process Stakeholder Meeting (Presentation), CAISO September 27-28, 2021, slide 15.

[19] Silicon Valley Power CEO’s Letter to the CAISO Board of Governors, March 22, 2021, pp. 1-2..

[20] Draft Plan, p. 377.

[21] Public Advocates Office comments on September 27-28 Stakeholder Call Discussion 2021-2022, Transmission Planning Process, October 12, 2021, p. 6.

[22] CAISO Reliability Assessment Recommendations – PG&E Area Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting (Presentation), February 7, 2022, slide 5.

[23] Public Advocates Office comments on September 27-28 Stakeholder Call Discussion 202102022Transmission Planning Process, October 12, 2021, p.6.

[24].Draft Plan, p. 105.

[25] Draft Plan, p. 105.

[26] 2005 Transmissional Letter, Transbay Cable LLC, FERC Docket No. ER05-985-000, May 19, 2005, p. 5.

[27] An Introduction to Trans Bay Cable, (Presentation), February 2011, SteelRiver Infrastructure Partners, slide 13.

[28] Draft Plan, p. 123.

[29] Draft Plan, p. 124.

[30] CAISO Reliability Assessment Recommendations – PG&E Area Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting, February 7, 2022 (Presentation), CAISO, February 7, 2022, slide 7.

[31] Southern California Edison’s Comments on the September 27-28 Stakeholder Call Discussion 2021-2022 Transmission Planning Process, October 12, 2021, p. 3.

[32] Draft Plan, p.135.

[33] Draft Plan, p. 135.

4.

Comment on chapter 3 Policy-Driven Need Assessment:

Cal Advocates recommends the CAISO conduct its Transmission Economic Assessment Methodology (TEAM) on the proposed policy projects and consider all three of the 2021 CPUC resource portfolios in its analysis. Based on the information provided in the CAISO’s TPP, Cal Advocates provides the following recommendations regarding the proposed policy projects.

- Delevan Cortina 230 kV Line Reconductoring Project

The CAISO recommends reconductoring the Delevan Cortina 230 kV line to address possible overloads on the line with the 2021 CPUC resource portfolios under the highest system need scenario.[1] These portfolios would add 437 MW of new resources to the area and result in 479 to 713 MW of undeliverable baseline resources.[2]

Recommendation: Cal Advocates recommends that the CAISO consider other grid enhancing technologies, such as energy storage, series reactors, or Smart Wires rather than the proposed reconductoring project which has an estimated cost between $17.7 million and $35.4 million.[3] The provided alternative analysis is insufficient, stating only that a remedial action scheme was considered. Cal Advocates requests that the CAISO and PG&E consider grid enhancing technology alternatives to be further explored prior to recommending this project for approval.

- Rio Oso-SPI Jct-Lincoln 115 kV line Reconductoring Project

The CAISO recommends reconductoring the Rio Oso-SPI Jct-Lincoln 115 kV line to address possible undeliverable resource capacity ranging between 368 to 615 MW on the line with the 2021 CPUC resource portfolios. These portfolios would add 152 MW of new wind to the project area.[4] The CAISO only considered a remedial action scheme as a project alternative.[5]

Recommendation: Cal Advocates recommends that the CAISO and PG&E further examine addressing the identified overload issues with energy storage or other grid enhancing technologies that would likely be considerably less expensive than the proposed line reconductoring project which has an estimated cost range between $10.6 million and $21.2 million.[6]

- Collinsville 500/230 kV Substation Project

During the November 2021 CAISO TPP stakeholder meeting, the CAISO noted that overloads could occur with 2021 CPUC resource portfolios on the 230 kV corridor between Contra Coast and Newark.[7] To address these issues and reduce reliance on gas generation in the Greater Bay Area, the CAISO proposes adding a new Collinsville 500/230 kV substation, loop in the Vaca Dixon – Tesla 500 kV line and 230 kV connecting lines to allow additional supply from the 500 kV system such as offshore wind from Humboldt Bay to the Greater Bay Area.[8]

Approval of this project at this time is premature because it would accommodate a resource identified in the unvetted SB 100 Scenario rather than the required 2021 CPUC resource portfolios. Also, the CAISO’s analysis regarding options to integrate Humboldt Bay offshore wind favor an alternative integration point other than the proposed new Collinsville substation. At the November 2021 TPP stakeholder meeting, the CAISO presented three options for integrating Humboldt offshore wind, which included an option at the Fern Road substation that is expected to be in service by June 2024 and at the new proposed Collinsville substation. Both options require upgrades to transmission lines to bring Humboldt wind to load centers and address congestion. The Fern Road substation option had the least impact on Humboldt wind curtailment among the options considered. Thus, Cal Advocates recommends the CAISO conduct further analysis and allow for more stakeholder discussion on the Fern Road substation option to confirm whether it is the most reasonable and cost effective option for integrating offshore wind at Humboldt Bay.

Also, the amount of offshore wind considered in the CPUC resource portfolios has changed. As mentioned above, the 2021 CPUC sensitivity 2 resource portfolio included 8,351 MW of offshore wind by 2031.[9] Whereas, the 2022 CPUC resource portfolio only includes 1,708 MW of offshore wind to meet the state’s 2031 resource targets. Specifically, the 2022 CPUC resource portfolio for study in the CAISO 2022 TPP cycle considers only 1,588 MW of offshore wind at Morro Bay and 120 MW of energy only offshore wind at Humboldt Bay by 2032.[10]

Recommendation:

To address the reliability issues noted on the 230 kV corridor between Contra Costa and Newark, Cal Advocates suggests the CAISO consider lower cost alternatives. The anticipated amount of new renewable portfolio MW generation on the 230 kV Corridor is 102 MW of wind and the undeliverable generation along sections of the 230 kV corridor ranges between 201 MW and 642 MW for the 2021 CPUC resource portfolios.[11] The higher quantity of undeliverable generation is due only to the 8,300 MW of offshore wind considered in the 2021 CPUC sensitivity 2 resource portfolio.

Given the quantity of undeliverable existing resources and the changing CPUC resource portfolio, the proposed HVDC line project is not justified, at this time. Cal Advocates recommends that the CAISO and PG&E consider grid-enhancing technologies to address reliability issues and impact of any gas retirements in the area.

If lower-cost grid enhancing technologies are found not cost-effective, Cal Advocates recommends consideration of the proposed three line reconductoring projects at the Cayetano-North Dublin 230 kV line, Lone Tree-USWP-JRW Cayetano 230 kV line, and the Las Positas-Newark 230 kV line with the caveat that the CAISO delay approval of these projects until the transmission needs for the 2022 CPUC resource portfolio are confirmed. For reference, these alternative line reconductoring projects have an estimated total cost that is less than half the price of the proposed Collinsville project with a total estimated cost ranging between $145 and $189 million.[12]

- Manning 500/230 kV Substation Project

The CAISO proposes a new 500/230 kV substation with an estimated cost ranging between $325 million and $485 million to access Westland’s renewable generation.[13] The CAISO also identifies the new Manning 500 kV substation as a mitigation for potential overloads on the Borden Storey #2 230 kV Line based on the 2021 CPUC resource portfolios. The estimated quantity of undeliverable resources is between 44 and 181 MW on the Borden Storey 230 kV line.[14] To address these overloads, the CAISO previously considered a line reconductoring project at Borden Storey #2 with a cost ranging from $24.24 to $31.5 million.[15]

For reference, of the 733 MW of solar resources proposed for integration in the area, between 552-659 MW would be deliverable without any transmission investments.[16] The only mitigation considered for the estimated overloads in the project area is a remedial action scheme. No other potentially lower-cost grid enhancing technologies were considered as project alternatives.

Recommendation: Because the proposed project has an extremely high cost ranging from $325 to $485 million and there is a relatively small number of resources that would be undeliverable without it, Cal Advocates recommends that this project be deferred and studied in the next TPP cycle. The CAISO has not demonstrated that this project is needed to serve the 10-year transmission needs or provided an adequate alternative analysis that considers lower-cost grid enhancing technologies. If the CAISO demonstrates that the lower-cost grid enhancing technologies are not cost-effective, Cal Advocates supports further consideration of the alternative Borden-Storey line reconductoring project in the CAISO 2022 TPP cycle as this alternative project has an estimated cost that is less than one-tenth the proposed project cost.

- Laguna Bell-Mesa No. 1 230 kV Line Rating Increase Project

The CAISO recommends reconductoring five miles of the Laguna Bell Mesa No.1 230 kV line to address possible overloads with the 2021 CPUC resource portfolios. The CAISO also estimates that up to 3,000 MW of new capacity would be undeliverable due to overloads on the Mesa-Laguna Bell No.1 230 kV line.

Recommendation: Cal Advocates recommends consideration of the Smart Wires’ Laguna Bell – Mesa Series Compensation project estimated at $6.7-$8 million[17] as a possible mitigation rather than the proposed line reconductoring project, which has a cost estimate of $17.3 million. Cal Advocates also recommended this in our comments on the November TPP presentations and stakeholder meeting.[18] Because the amount of resources to be integrated in the area is 500 MW of energy storage,[19] Cal Advocates also requests that the CAISO provide information on the gas generation in the project area and its retirement date, if known.

- Gridliance West Area Upgrades

Cal Advocates opposes the CAISO’s approval of this project in the 2021 Transmission Plan. The CAISO found that the proposed Gridliance West (GLW) upgrades are only necessary in the 2021 CPUC base resource portfolio, and not the CPUC sensitivity 1 and 2 resource portfolios.[20] Section 24.4.6.6 of CAISO’s Comprehensive Transmission Planning Process Tariff states that “[t]ransmission solutions that are included in the baseline scenario, but which are not included in any of the stress scenarios or are included in an insignificant percentage of the stress scenarios, generally will be Category 2 transmission solutions.”[21] Therefore, the proposed GLW Area upgrades are a Category 2 project. Additionally, the CAISO did not provide an in-service date for this project as the Eldorado Substation requires some short-circuit duty mitigation before the GLW Area upgrades can be put in-service.[22] Thus, it is unclear when ratepayers would begin to benefit from this project. Proposed projects should have a reasonable in-service date within the 10-year time frame for the given TPP cycle.

Recommendation: Cal Advocates opposes approval of GLW project in the 2021 Transmission Plan and recommends the CAISO further study this project as Category 2 project in the 2022 TPP cycle.

[1] CAISO 2021-2022 TPP Policy-Driven Assessment, 2021-2022 Transmission Planning Process Stakeholder Meeting November 18, 2021 (Presentation), November 18, 2021, Slide 54.

[2] Draft Plan, p. 191.

[3] CAISO Policy Assessment Recommendations – PG&E Area Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting February 7, 2021 (Presentation), Slide 3.

[4] Draft Plan, p. 197.

[5] ibid.

[6] ibid

[7] CAISO Policy Assessment Recommendations – PG&E Area Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting February 7, 2021 (Presentation), Slide 5.

[8] CAISO Policy Assessment Recommendations - PG&E Area Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process Stakeholder Meeting February 7, 2021 (Presentation), Slide 5.

[9] CPUC Modeling Assumptions for the 2021-2022 Transmission Planning Process, February 9, 2021, p. 18.

[10] CPUC Modeling Assumptions for the 2022-2023 Transmission Planning Process, CPUC Staff Report, February 15, 2022, pp. 61 and 63.

[11] Draft Plan, pp. 192-196.

[12] Draft Plan, pp. 192-196.

[13] Draft Plan, p. 6.

[14] Draft Plan, p. 198.

[15] Draft Plan, p. 198.

[16] Draft Plan, p. 198.

[17] CAISO 2021-2022 TPP Policy-Driven Assessment, November 18, 2021, p. 88.

[18] Public Advocates Office’s Comments on November 18, 2021, stakeholder meeting 2021-2022 Transmission Planning Process, p.3.

[19] Draft Plan, p. 179.

[20] Draft Plan, p. 248.

[21] California Independent System Operator Corporation, Fifth Replacement FERC Electric Tariff, Section 24, 24.4.6.6.

[22] Draft Plan, p. 214.

5.

Comment on chapter 4 Economic Planning Study:

General comment regarding all economic evaluated projects (screening factor)

The CAISO uses the phrase “Applying the CAISO’s screening factor of 1.3 to convert the capital cost of a project to the present value of the annualized revenue requirement, referred to as the “total” cost.”[1] The CAISO should explain how the screening factor of 1.3 converts the capital cost of a project to the present value of the annualized revenue requirement to arrive at the “total cost.” Typically, for transmission projects submitted to the CPUC for a Certificate of Public Convenience and Necessity (CPCN), 50 years of total cost is greater than a factor of 1.3 when including projected 50 years of operation and maintenance costs plus original capital costs. The capital cost to revenue requirement multiplier of 1.3 is inconsistent with the CAISO’s own assumptions and may underestimate the cost of new transmission facilities.

Section 4.3.1 of the Draft Plan describes how the CAISO coverts the capital cost of a facility to the present value of the revenue requirement that the transmission owner will collect from ratepayers associated with that facility using a ratio of 1.3. The resulting figure constitutes the “total cost” of a project in the CAISO’s cost-benefit analysis.[2] However, the CAISO’s reliance on a ratio of 1.3 is contradicted by the CAISO’s own publicly available TAC Forecast Model.[3] While the TAC Forecast Model uses the same financial assumptions (cost of debt and equity, tax rates, etc.), the ratio is higher than the capital cost to revenue requirement multiplier.[4]

To illustrate, if a hypothetical new project is entered into the model with a capital cost of $200 million, an in-service date of 2023, and an assumed 50-year economic life,[5] the net present value of the annualized revenue requirement – assuming the CAISO’s 7% discount rate – is $304 million. This is greater than 1.5 times the capital cost, and this ratio holds for multiple capital cost assumptions.

Recommendation: Given that this ratio underpins the CAISO’s cost-benefit analyses, CAISO staff should, in a revised draft, address this discrepancy and justify the 1.3 ratio using historical data that compares annualized revenue requirements of transmission facilities with its CPUC-approved capital costs.

Section 4.8 Economic Planning Study Requests:

a. GridLiance West/VEA Congestion and Mitigations Proposed Projects

The CAISO uses TEAM to quantify the economic benefits of a proposed transmission project.[6] According to its tariff, the CAISO must consider the degree to which, if any, the benefits of the transmission solutions outweigh the costs. If a transmission solution generates a benefit-cost-ratio greater than 1.0, the CAISO finds that its benefits outweigh its costs.

The CAISO’s TEAM framework for economic assessments requires an analysis of the effects of uncertainty on the Proposed Project’s expected economic benefits. This requirement recognizes that a project’s benefits may change in the future based on certain factors, including load, natural gas prices, new power plants, retired power plants, plant locations, and the future growth of the electrical network. The CAISO conducted only one uncertainty analysis that used the CPUC’s 2021 base resource portfolio for its economic project studies.[7] Cal Advocates recommends that the CAISO perform its TEAM analysis using all the CPUC provided resource portfolios for study in the 2021-2022 TPP cycle.

- PG&E Moss Landing – Las Aquilas 230 kV Series Reactor Proposed Project

This project is proposed to address congestion on the Moss Landing - Las Aguilas 230 kV line. In this TPP cycle, the CAISO observed congestion “mainly under emergency conditions with P1 or P7 contingencies.”[8] The only exception is that the Moss Landing – Las Aguilas 230 kV line also was congested under normal conditions for 26 hours over the course of a year.[9]

Recommendation: To demonstrate the need for this project, Cal Advocates recommends the CAISO provide the following basic project information:

- Information on the total number of hours annually that the Moss Landing – Las Aguilas 230 kV line experiences an N-1 condition.

- Confirmation that a Benefit-to-Cost evaluation was performed for the Moss Landing – Las Aguilas 230 kV line under normal conditions (i.e., not during N-1 conditions).

- Details on the sensitivity case studies performed on this project to comply with the CAISO TEAM as mentioned in the background section. Cal Advocates recommends that the CAISO perform the analysis for Moss Landing – Las Aguilas 230 kV line experiencing an N-1 condition using the CPUC Sensitivity Case 1 and provide the Benefit-Cost Ratio.

- Cal Advocates recommends that the CAISO request proposals for solutions to address congestion resulting from the overload of the Moss Landing – Las Aguilas 230 kV line to be technology neutral. The proposed solution for the Moss Landing – Las Aguilas 230 kV line experiencing an N-1 condition is an evaluation of potential benefits due to addition of a “series reactor.” This proposal appears to be a technology prescriptive solution. A solicitation using the term “series compensation,” which may include both active and passive solutions, should be proposed. Cal Advocates recommends that the CAISO solicit a technology neutral request for proposals for competitive bids from suppliers and that the proposals should be evaluated on the ability to reduce the greatest amount of congestion with the lowest cost solution under normal conditions and under an N-1 contingency.

- The grid issues on the Moss Landing 230 kV line should also be reassessed with the current energy storage capacity expected in the Moss Landing area. During the discussion of this project at the February 7, 2021, TPP Meeting, the CAISO acknowledged that it had not evaluated the Vistra Energy Moss Landing energy storage expansion project announced in January 2022.[10] The original energy project at Moss Landing is complete and is a 400 MW facility. Vistra Energy recently signed a resource adequacy agreement with PG&E to expand its existing Moss Landing energy storage facility to 1,500 MW by 2026.

- GridLiance West/VEA Congestion and Mitigations Proposed Projects