ACP-California

Submitted 09/18/2024, 03:56 pm

Submitted on behalf of

ACP-California

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

ACP-California appreciates CAISO’s recognition of the challenges caused by the long development timelines for transmission that the industry is currently facing and, in particular, how those interact with the proposed revisions to the TPD allocation process. While we appreciate CAISO’s interest in bringing forward creative solutions, as CAISO heard from many stakeholders during the working group meetings, it is not viable/beneficial to bring projects online earlier as energy-only. Instead, other solutions are necessary to better align generation development timelines, commercial activity, and the timelines from completion of deliverability network upgrades. In the next iteration for the proposal, CAISO should include example timelines to illustrate how these elements can align in a workable manner.

As CAISO develops an updated proposal, ACP-California encourages CAISO to consider whether it is appropriate to increase the number of opportunities that projects would receive to secure a deliverability allocation from three (as proposed in the July 2024 proposal) to four. Of course, the final decision about whether this is appropriate needs to be considered in the context of the CAISO’s proposal as a whole and how the various elements interact with one another. But we encourage CAISO to consider providing four opportunities for a TPD allocation as part of the solution set.

We also encourage CAISO to consider whether additional deliverability groups should be added to recognize commercial structures that are not as firm as a PPA. For instance, options contracts to enter into a PPA at a later date, conditional PPAs, etc. could be added as new types of deliverability allocation groups. If CAISO explicitly created a deliverability allocation group for these less firm types of contracts, it may drive the market towards creative solutions that provide better alignment with the various timelines, including the long transmission development timelines generators and offtakers are facing.

Ultimately, ACP-California appreciates CAISO’s recognition of the problem statement and looks forward to reviewing the next version of the proposal and continuing to contribute ideas to improve the deliverability allocation process in light of the current transmission and generation development environment. Once the process has been developed and the timelines/requirements are better understood, CAISO should evaluate if any of these modifications should apply to earlier clusters to address the disconnect between commercial timelines and transmission development horizons.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

Again, ACP-California appreciates CAISO’s recognition of the challenges created by long development horizons for network upgrades. Specific to reliability network upgrades, we encourage CAISO to continue evaluation of an approach that might allow some of these projects to proceed for approval through the Transmission Planning Process (TPP). Developing a mechanism that allows “least regrets” reliability network upgrades to be approved and constructed in a more timely fashion will benefit the state’s reliability and clean energy goals and is worth continued exploration.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

ACP-California understands that CAISO is already reserving deliverability for certain Long Lead-Time resources. We continue to support this effort and agree that CAISO has existing authority to reserve capacity in this way. We also request additional transparency on what types of resources qualify for reserved deliverability (perhaps according to an LRA),and the MW quantity that is being reserved. To the extent any of this “reserved” deliverability has been allocated, CAISO should disclose the MW of deliverability that has already been allocated and where on the system. ACP-California is not asking for any sensitive project information to be disclosed but does believe aggregated information on the capacity being reserved, types of resources it is being reserved for and what (if any) deliverability has already been allocated to these resource types would be helpful for all stakeholders and interconnection customers to understand. We encourage CAISO to provide this type of transparency as soon as possible.

ACP-California supports CAISO’s development of deliverability processes tailored to the specific needs of Long-Lead Time resources that meet the defined resource technology and policy goals of local regulatory authorities. These process solutions are distinct from the deliverability reforms needed for long transmission development timelines affecting all resource types in the CAISO system, and discussed in Question 2, above. Deliverability process accommodations for Long Lead-Time resources should enable Long-Lead Time projects to proceed through the interconnection and deliverability processes in alignment with their development and procurement timelines, and without being converted to Energy Only prematurely. As such, ACP-California agrees with many stakeholders at the workshops that there is a need to separately consider what processes, or special provisions may be required for Long Lead-Time resources to compete for, receive, and retain a deliverability allocation. And we note there is a need to also consider the alignment of timelines for Generator Interconnection Agreement tendering, execution, and associated financial requirements given the unique technological challenges and contracting processes for Long Lead-Teim resources.

However, we urge CAISO to consider this issue, and the unique needs of Long Lead-Time resources after there is a better understanding of the “standard” deliverability allocation rules that will go forward as part of this stakeholder initiative. In other words, the consideration of TPD allocation rules for Long Lead-Time resources should be sequenced after the CAISO puts forward a proposal for addressing the standard deliverability allocation procedures and challenges with long development timelines for transmission upgrades.

Once the “standard” deliverability allocation process is well defined, CAISO should work with stakeholders to develop a framework for the modifications needed to accommodate LLT resources and, moreover, for how the CAISO will resolve competition among eligible resources for the same reserved deliverability. At this time, the CAISO may also consider how and when to apply new processes for LLT deliverability awards and retention within the larger interconnection framework.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

Without the benefit of a comprehensive proposal to comment on, it is difficult to understand how all of the proposed reforms might function together. Despite that, ACP-California continues to believe that Group D should be retained, at least for a period of time, given the long transmission development timelines the industry is faced with. While ACP-California would prefer to see Group D retained and the available TPD for this group not serve as a reduction to the TPD capacity for future clusters, we understand the challenges and complications that would bring (as highlighted in the working group discussion on ACP-California’s “Conditional Deliverability” proposal). For the proposal at hand, we encourage CAISO to retain Group D and to continue to work towards future enhancements, including potentially adding new allocation groups for commercial arrangements that are significant, but less firm, than a PPA. These could include options contracts or agreements to enter into a PPA at a later date and could serve as a potential replacement for Group D in the future.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

ACP-California appreciates the opportunity to have presented on the “Conditional Deliverability” concept. We also understand the complications and study modifications that may be required to implement a proposal of this nature and, moreover, understand CAISO’s reluctance to further complicate the deliverability allocation study process and procedures. We are pleased to hear that, in response to stakeholder discussions, CAISO is considering retention of Group D. While we continue to believe that a Group D allocation which does not result in a reduction to the deliverability available for future clusters would be a preferable approach, we are willing to concede that the challenges of implementation may not be worth pursuing at this time. Thus, we look forward to considering other alternatives, like the overall retention of Group D, in the next proposal.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

ACP-California appreciates EDF Renewables’ presentation. It highlights many of the ongoing challenges and outlines that there are other commercial structures, which are not as firm as a fixed-price PPA, which may be able to be leveraged in the deliverability allocation process. As stated above, ACP-California supports CAISO exploring whether additional deliverability groups should be added for commercial structures that are not as firm as a PPA (e.g., options contracts, conditional PPAs).

7.

Please provide any additional feedback:

ACP-California looks forward to CAISO’s next iteration of the proposal for Track 3 of IPE and to considering how all of the proposed reforms will work together. As stated in these comments, we urge CAISO to focus on developing the standard rules for deliverability allocations and, subsequently, to consider the provisions required for Long Lead-Time resource deliverability allocation and retention.

AES

Submitted 09/18/2024, 11:06 am

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

The CAISO should not adopt its suggestion to allow a PPA to operate as an Energy-Only (EO) prior to becoming FCDS for projects behind long lead-time Deliverability Network Upgrades (DNUs). While attendees suggested that this path could work for solar and wind, AES agreed with stakeholders on the call that this proposal will not make storage viable. Storage’s cost recovery is highly dependent on its ability to provide resource adequacy (RA). Unless the CPUC’s resource adequacy rules are revised to allow “interim” RA for storage resources during the EO years, storage resources would not be viable under this framework. Otherwise, AES recommends the CAISO to consider longer-term “interim” deliverability.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

AES asserts that there are significant development risks associated with contracting with projects with CODs far in the future. As noted by SCE and CalCCA on the August 28, 2024 workshop, projects are unable to commit to a binding PPA price for projects with far out CODs. Equipment costs could become variable in the future as technology changes. In addition, other development risks could exist, such as permitting. This proposal could only work if projects can enter into a price range PPA agreement with LSEs to account for the future pricing uncertainty and exist clause structures that minimize PPA termination fees if a project needs to withdraw. To address the issue of long lead time RNUs, AES encourages the CAISO to explore a funding mechanism similar to the CAISO’s Location Constrained Resource Interconnection Facility (LCRIF) process to allow for cost sharing.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

AES seeks clarity on how CAISO intends to reserve TPD capacity for long lead time (LLT) resources and whether reserving the capacity for LLT would result in less TPD available for short lead time resources. AES agrees with stakeholders on the September 4, 2024 workshop that increased transparency is critical.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

AES supports removing TPD Allocation Group D. AES resonates with CAISO’s reasoning that continuing Group D would reduce the capacity of projects in the future cluster studies. As CAISO contemplates increasing the attempts for TPD allocation from three to four, AES believes that there will be sufficient time for FCDS projects to see a PPA or be shortlisted. Projects in Group D are likely not as commercially ready compared to projects in Groups A-C and may slow down the study process with low probability of being awarded TPD. If the scoring criteria values commercial interest for queue entry, AES thinks that the TPD allocation process should be mirrored. Retaining Group D may divert from the intention of the purpose of linking procurement with the interconnection process. While AES appreciates ACP-CA’s proposal to retain Group D conditionally to eliminate the need to reduce capacity in future clusters, AES notes that this may create a potential for overprescription of conditional deliverability than what is actually available.

Retaining Group D will also decrease the ability for future clusters to be awarded TPD. Given that there is no TPD reservation system for projects entering the study process under the 150% queue cap, projects will have to rely on the chances to receive TPD allocation (i.e. 2/3 probability given that the queue cap is 150%). Adding Group D projects will decrease the probability given that more projects are competing for deliverability; this may ultimately undermine the purpose of the IPE to align the planning processes with interconnection.

In the case that Group D is eliminated, AES seeks clarification on the treatment of previous projects that were allocated TPD under Group D. Will previously allocated projects in Group D have grandfathered rules to follow?

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

AES continues to support the removal of Group D, as noted above.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

7.

Please provide any additional feedback:

Revised TPD Schedule

AES generally supports the proposed revised TPD allocation process and schedule. However, AES recommends the CAISO to consider extending the 2nd Interconnection Financial Security (IFS) posting deposit deadline for parked projects from the 2024 TPD allocation cycle. Under the current tariff, parked projects have a 12-month extension for their 2nd IFS postings. An extension would allow projects to attempt the TPD allocation process prior to making the 2nd IFS posting. With the delay of the 2025 TPD allocation cycle to conclude in March 2026, the CAISO to allow additional extension for parked project’s deposit to match the 2025 TPD allocation study delay.

Ensuring TPD Capacity is Available for Competition from Queue Entry to TPD Allocation

AES urges the CAISO to continue to consider a mechanism to reserve TPD capacity for clusters based on the 150% TPD MW they were admitted based on during the study process. At a minimum, CAISO should ensure that 100% of the 150% TPD capacity is available for the cluster to compete for. AES understands the CAISO’s concern that a reservation process can “tie up” capacity because older projects that are further in development would not have access to deliverability that is reserved for newer clusters. However, given that commercial interest arrangements are made for projects at the beginning of the study process, there should be a mechanism for projects to be sure that the TPD capacity will still be available for competition at the time of TPD allocation studies.

California Community Choice Association

Submitted 09/18/2024, 02:08 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

The California Community Choice Association (CalCCA) appreciates the opportunity to comment on the Track 3A working group meetings. The working group is seeking resolution on three categories of issues:

- Transmission Plan Deliverability (TPD) allocation issues for projects with long lead-time (LLT) or delayed Deliverability Network Upgrades (DNUs) approved in the ISO Transmission Planning Process (TPP).

- TPD allocation issues for projects with long lead-time or delayed Reliability Network Upgrades (RNUs) where the RNU only moves forward if funded by the projects needing the RNU.

- TPD allocation issues for long lead-time resources that meet the defined resource policy goals of local regulatory authorities for specific technologies and project locations.[1]

For the first issue, the California Independent System Operator (CAISO) put forth a potential solution that would increase the number of projects that would be able to come online in the near term as energy-only (EO) but must wait some period of years before being given full capacity deliverability status (FCDS). The CAISO asks, “Could a [power purchase agreement (PPA)] that allows a project to operate as [EO] for some period of time before becoming FCDS be a viable option?”[2]

The answer to this question is heavily dependent on the project’s ability to count for load-serving entity (LSE) compliance obligations (RA, Integrated Resource Plan (IRP), Renewable Portfolio Standard (RPS)) while the resource is EO. RA and IRP compliance programs currently require resources to have FCDS to count for compliance, with limited exceptions like the requirement to show excess capacity to charge co-located storage. For the CAISO’s proposed solution to be viable, the CAISO and the California Public Utilities Commission (CPUC) would both need to recognize these projects for RA and IRP compliance while they are EO. LLT DNUs take years to complete and if projects would not count for LSEs’ compliance obligations during this time, it would not be viable for them to finance these projects.[3]

If the CAISO and CPUC count projects that start as EO, which then receive FCDS after DNU completion, towards compliance obligations during the time they are EO, the CAISO’s proposed solution could be a viable and effective solution to the issue of LLT or delayed DNUs delaying interconnection of capacity seeking FCDS. It is unreasonable for LSEs procuring EO projects with expected future deliverability, at CAISO’s invitation, to bear the risk that these resources will be unable to satisfy CPUC requirements. The CAISO should therefore pursue this solution in collaboration with the CPUC.

[1] 2023 Interconnection Process Enhancements: Track 3A Working Group Meeting (Aug. 28, 2024) (CAISO Presentation) at 10: https://stakeholdercenter.caiso.com/InitiativeDocuments/2023-IPE-Track-3A-8-28-24-Working-Group.pdf.

[2] CAISO Presentation at 12.

[3] It is possible that an EO resource could be viable to meet an LSE’s RPS requirements. However, under the current needs for countable capacity to meet IRP and RA, LSEs will have a strong preference for FCDS to meet those requirements.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

The CAISO states that “contracting with projects with earliest achievable commercial operation dates further into the future (beyond 5-7 years) could allow projects with LLT [reliability network upgrades] to obtain an allocation of TPD within the 3 (or 4) opportunities they have to seek an allocation of TPD.”[1] It asks if there are significant issues that make contracting for projects further into the future inappropriate. Contracting for projects further into the future can be problematic because it puts risks on LSEs and/or developers who do not yet know the estimated development costs or upgrade costs of the projects, the timing of those upgrades, or the likelihood that the projects will receive deliverability allocations. Solutions that depend on contracting further into the future need to be carefully considered and understood by LSEs and developers who will need to protect themselves against the risks of contracting before all the development and interconnection costs and timelines are known.

[1] CAISO Presentation at 13.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

The CAISO asks parties if special/unique TPD allocation criteria should be developed for LLT resources that meet the defined resource policy goals of local regulatory authorities so that they are not at risk of being converted to EO before procurement begins for these resources.[1] Unique TPD allocation criteria will be necessary for LLT resources such as offshore wind (OSW), out-of-state wind, and geothermal. These resources currently have longer project development cycles than other renewables and may not be compatible with a new process that converts projects to EO after some time.

The CAISO’s presentation seems to contemplate this question within the context of the central procurement entity (CPE) as the only entity procuring these LLT resources. The CAISO must take a more expansive view of LLT resources to avoid discriminating against LSEs that are also pursuing LLT resources. CCAs, for example, have already procured geothermal,[2] long-duration energy storage,[3] and out-of-state wind[4] resources and are interested in a pathway to eventually procuring OSW themselves.[5] The CPUC adopted D.24-08-064 “with the explicit intent not to interfere with LSE procurement”[6] and the CAISO should support this intent by adopting uniform TPD allocation criteria for LLT resources regardless of the procuring entity. For example, if the CAISO reserves TPD for offshore wind, it should allow that reserved TPD to be allocated to OSW procured by CPEs or LSEs. The CAISO should adopt a similar scope as it did in Track 2 of this initiative, where both CPE resources and resource types designated by the CPUC in their TPP portfolio are counted as LLT for the purposes of allocating TPD.

While the CAISO has stated its intent to review out-of-state wind in this process,[7] the CAISO should clarify on how it will integrate TPD reservations for any unknown out-of-state resources when compared to resources interconnecting to the CAISO controlled grid. This is particularly important to LSEs attempting to meet their IRP requirements who have an allocation of points and would like to have an out-of-state resource considered to meet their needs. Further, such a process must also examine how the CAISO would allocate Maximum Import Capability if an LSE places points on an out-of-state resource and/or if there is a separate process for allocating deliverability to LLT resources.

[1] Id. at 14.

[2] Summary of Compliance with Integrated Resource Planning (IRP) Order D.19-11-016 and Mid Term Reliability (MTR) D.21-06-035 Procurement (Aug. 2023) at 42-43: https://www.cpuc.ca.gov/-/media/cpucwebsite/divisions/energy-division/documents/integrated-resource-plan-and-long-term-procurement-plan-irpltpp/publicirpcompliancereport080123.pdf.

[3] Id.

[4] Howland, Ethan, Pattern Energy Secures $11b in Financing, Starts Full Construction on Sunzia Wind, Transmission Projects (Jan. 3, 2024): https://www.utilitydive.com/news/pattern-energy-sunziatransmission-wind/703508/.

[5] California Community Power and CADEMO Execute Offshore Wind MOU: https://cal-cca.org/california-community-power-and-cademo-execute-offshore-wind-mou/.

[6] D.24-08-064, Decision Determining Need for Centralized Procurement of Long Lead-Time Resources, R.20-05-003 (Aug. 29, 2024) at 51: https://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M539/K202/539202613.PDF.

[7] 2023 Interconnection Process Enhancements, Track 3-A Revised Straw Proposal and Track 3-B Straw Proposal (July 8, 2024) at 23: https://stakeholdercenter.caiso.com/InitiativeDocuments/Track-3A-Revised-Straw-Proposal-Track-3B-Straw-Proposal-Interconnection-Process-Enhancements-2023-Jul-05-2024.pdf.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

CalCCA has no comments at this time.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

ACP-CA states that “the long development timelines for transmission make the proposed elimination of group D particularly concerning,” and proposes instead to provide a pathway to deliverability prior to a project receiving a shortlist position or PPA through a new “Conditional Deliverability” group.[1] The CAISO would allocate more “conditional deliverability” than the “standard” TPD available, then allow projects with conditional deliverability to compete for standard deliverability. Conditional deliverability would remain available for future clusters.

CalCCA appreciates ACP-CA’s thoughtfulness in developing a solution to the problem of LLT upgrades holding up deliverability allocations. ACP-CA’s proposal, however, raises several questions that must be addressed before determining whether this solution is viable. These questions stem largely from the fact that ACP-CA’s proposal would allocate more conditional deliverability than standard deliverability. For example, if conditional deliverability remains available for future clusters, at what points in the process would a project with conditional deliverability know whether it will be converted to standard deliverability? How would projects with conditional deliverability and a PPA compete with projects in later clusters when both are seeking standard deliverability? What is the benefit of providing conditional deliverability, when the retention of deliverability to Group D projects is already conditional upon the project receiving a PPA? These questions should be further explored to determine if ACP-CA’s proposal provides enough certainty to an LSE that an LSE signing a contract with a Group D project with conditional deliverability will receive standard deliverability.

[1] Revised Group D Treatment, ACP-California Proposal from Prior Comments with Hypothetical Examples (Sept. 4, 2024): https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-ACP-CA-Group-D-Conditional-Deliverability-Presentation-Sep-04-2024.pdf.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

CalCCA has no comments at this time.

7.

Please provide any additional feedback:

CalCCA has no additional feedback at this time.

California Public Utilities Commission - Energy Division

Submitted 09/18/2024, 06:06 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

Note: As many stakeholders know, CPUC staff participates in the CAISO-led Transmission Development Forum, as well as the Tracking Energy Development (TED) Task Force which coordinates activities and information from several state agencies and the CAISO. The CPUC also manages the Transmission Project Review Process which reviews IOUs’ capital transmission projects, allowing the CPUC and stakeholders to receive robust data from Transmission Owners and provides transparency on the IOUs’ current and forecast transmission projects.

All these ongoing initiatives provide useful information to generator developers, load-serving entities (LSEs) and interested stakeholders about the status of specific transmission upgrades.

Long lead-time projects face a “chicken and egg” challenge. Which comes first: getting a signed PPA prior to a deliverability allocation or ensuring that a project with a PPA will get deliverability? How to align commercial decisions with the allocation of deliverability for a project?

CPUC staff would like to enable ways, potentially in the integrated resource planning process (IRP), to provide better certainty for long lead-time resources that are dependent for their deliverability allocation upon completion of TPP-approved transmission projects. CPUC staff encourages reasonable and fair incentives for PPAs to be signed before a project receives a deliverability allocation. We also hope to contribute to any CAISO efforts to increase the level of certainty that projects with PPAs will likely get a timely deliverability allocation.

While we favor diminishing incentives for projects to jump into the queue mostly to save a spot to seek deliverability, we recognize that developers and LSEs can better judge the usefulness of adding a fourth opportunity to seek an allocation. We note, however, that maintaining Group D (with or without restrictions on material modifications or changing COD) could significantly impact the ability of long lead-time resources to gain deliverability because the amount of capacity available in future Clusters would likely be reduced.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

CPUC staff encourages consideration of a “least regrets” approach for identifying substations or other transmission infrastructure in certain zones that is likely to be needed for future interconnection of preferred resources. We anticipate that criteria and analysis would be developed, including potentially additional analysis in the CPUC led TPP portfolio development and busbar mapping work, to identify such transmission facilities through the TPP, rather than waiting for interconnection studies to identify such needed facilities. A key factor that should be considered in this approach is the level of risk that these facilities may be stranded if resources are not developed in those areas.

CPUC staff supports exploring with CAISO and stakeholders to develop this proactive approach, which would accelerate development of some transmission facilities that will likely be needed for interconnection of certain long lead-time projects and, we hope, incentivize contractual arrangements with such long lead-time projects. We are eager to coordinate with CAISO to determine which projects might be incorporated within TPP, recognizing that such action will change the cost responsibility for such upgrades.

Developing a process for “least regrets” inclusion in the TPP would entail specifically identifying areas where renewable development and transmission development are likely under a broad range of scenarios. We anticipate this unique kind of policy support would reduce uncertainty whether and when Reliability Network Upgrades would be built, thereby providing more certainty for long lead-time resources.

We also anticipate that further development by CPUC staff, and eventual implementation of, the Reliable and Clean Power Procurement Program (RCPPP) will generally help LSEs and developers to enter contracts with longer lead times. RCPPP is intended to improve upon the current order-by-order procurement approach in IRP by establishing and maintaining ongoing requirements for LSEs to contract with resources for reliability and greenhouse gas reduction.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

CPUC staff strongly supports reserving transmission capacity to ensure deliverability for specific resources that are identified in the TPP portfolios.

CPUC staff first noted back in the January 2022 comments to the CAISO’s 2021 IPE Issue Paper and Straw Proposal that “A mechanism for withholding transmission capacity for the achievement of policy goals can help ensure resource diversity. This is especially the case if this mechanism prioritizes large, long lead-time, or locationally constrained resource types.” Further, this would be consistent with the CPUC’s joint request with the California Energy Commission that CAISO preserve sufficient transmission capacity for specific out of state resources in its 2022-2023 TPP to ensure deliverability of policy-driven long lead-time renewable resources.

We anticipate coordinating with CAISO to develop a process to identify what resources could be eligible for transmission capacity reservation, and under what circumstances we might consider stopping the reservation.

CPUC staff anticipates that resource types being centrally procured by a state agency – such as offshore wind -- would be likely eligible for capacity reservation, but that other resources may also be considered.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

CPUC staff is concerned that maintaining Group D (with or without restrictions on material modifications or changing COD) could significantly impact the ability of long lead-time resources to gain deliverability because the amount of capacity available in future clusters would likely be reduced. Additionally, maintaining Group D could encourage more exploratory projects to continue entering the queue earlier than necessary and sit longer in the queue, limiting access to further developed projects seeking to enter at later dates.

CPUC staff continues to support one of the key goals of the IPE process, which is to transition to a queue with a manageable number of projects so that interconnection studies can provide meaningful results.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

CPUC staff has no comment at this time.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

CPUC staff has no comment at this time.

7.

Please provide any additional feedback:

CPUC staff would express concerns if implementation of broad auction use would likely lead to increases in the cost of resource development and those costs would then be passed on to the ratepayers.

We recognize that a limited auction process may occur under the CAISO’s recent IPE proposal that is currently under FERC review, but such a process would be used only in limited “tiebreaker” situations where certain projects had the same commercial interest scores and the same distribution factors.

A proposal for a broader, more frequently used auction process to determine which projects are allocated deliverability would likely be opposed by CPUC staff, if it led to increases in costs to ratepayers without corresponding benefits.

California Wind Energy Association

Submitted 09/18/2024, 04:54 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

No comment at this time.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

No comment at this time.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

- Resources that should qualify for TPD capacity reservation.

During the Sept. 4 workshop, CAISO stated that it is currently reserving TPD capacity for out-of-state wind (OOSW) and offshore wind (OSW) for the amounts in the CPUC’s baseline portfolio. At the Sept. 17 Interconnection Fair, CAISO stated that it is reserving capacity only for offshore wind. Either way, CalWEA strongly objects to reserving capacity for such a limited subset of resources, for which no rationale was provided.

CalWEA agrees with CAISO’s Track 3A Revised Straw Proposal[1] wherein CAISO stated that TPD capacity will be reserved “for long lead-time projects that align with TPP[-]approved new transmission to meet specific CPUC portfolio requirements for specific resource types, such as offshore wind, out-of-state wind and geothermal.” CAISO stated that “Sections 8.9.1(b) and (c) allow the ISO to reserve TPD capacity for resources outside the ISO and resources internal to the ISO that are designated as resource technologies and in locations that are needed to meet state policy goals.”[2] CalWEA recommends that CAISO define this policy more specifically to state that CAISO will reserve TPD capacity for all location-constrained resources as identified by the CPUC in its most recent Preferred System Plan (PSP) as well as the resources identified in the CPUC’s final decision on Central Procurement.

While CAISO also indicated that it would look to the CPUC’s decision on Central Procurement to “determine if it provides any relevant guidance on further TPD allocation modifications for long lead-time resources,”[3] that CPUC decision was focused solely on what resources require central procurement and did not address what resources require TPD capacity reservation. Therefore, CAISO should look to the CPUC’s most recent resource portfolio to determine which “resource technologies and in locations that are needed to meet state policy goals.”[4]

All location-constrained resources – projects that must locate in very limited, site-specific locations where commercial-grade resources are present – should qualify for TPD capacity reservation because the CPUC’s portfolio will not be realized without this treatment. These resources – namely, geothermal, all types of wind energy (offshore, in-state and out-of-state), and long-duration energy storage – also happen to constitute the diverse generation-resource supply in the CPUC’s PSP. CalWEA also agrees with CalCCA that resources that “may not be compatible with the updated interconnection process” should qualify. Indeed, CAISO has stated that its now-adopted interconnection reforms “incentivize projects to come into the queue when there is a realistic ability to secure a PPA or be shortlisted. However, projects such as offshore wind projects may need to enter the interconnection process prior to any realistic opportunity for procurement of their resource.”[5] While the example used was offshore wind, the rationale applies to any diverse, location-constrained resources entering the interconnection process prior to any realistic opportunity for procurement of their resource (e.g., 8-10 years from commercial operations for transmission or other reasons). Rather than using the term “long-lead-time” (LLT) resources in these comments, therefore, CalWEA will refer to the resources for which TPD capacity should be reserved as “qualifying” resources.

As we’ve seen, for example, with Imperial Valley geothermal, the Southern California capacity approved in the 2022-23 TPP cycle could have served these resources had the TPD capacity reservation policy been in place at that time. As it was not, all that capacity was allocated to solar and battery resources. So, the geothermal in the PSP in Imperial Valley and elsewhere must now be planned for – and reserved – in the current (2024-25) and subsequent TPP cycles. Similarly, if the CPUC’s portfolio is to be realized, the “in-state” wind energy (including Baja-area wind), out-of-state wind, offshore wind, and LDES resources included in the PSP must be planned for in the current and subsequent TPP cycles, and their TPD capacity reserved in the immediately following TPD allocation process.

- How and when capacity should be reserved.

In the current (2024-25) TPP cycle (with the plan to be approved in May 2025), CAISO must include in the study a combination of queued and generic (or “phantom”) resources at planned substations that fulfill the CPUC’s resource plan and assign them deliverability in developing the plan. If the queued capacity in QCs 13, 14 and 15, for each qualifying capacity type is insufficient to meet the CPUC’s planning target for that type, the CAISO should add sufficient generic capacity in the TPD allocation process to achieve that goal. That capacity should be reserved for the QC16 TPD allocation process in 2028, and for resources in later queue clusters as necessary.

The reserved TPD capacity should become available at POIs designated for the designated qualifying resource according to the busbar map (e.g., offshore wind at Humboldt, onshore wind in Northeast California, geothermal in Imperial Valley, etc.). Collector substations should be planned accordingly until a sufficient amount of projects in these areas materialize, adjusting substation locations as needed.

CAISO should accept projects of all types into the interconnection study process at these POIs until total capacity (in-queue) of qualifying resources reaches 150% of portfolio goals since not all projects will succeed. Planning for and reserving of TPD capacity for qualifying resources should be done throughout the interconnection study process, from intake of the application to TPD allocation. During the cluster study/restudy, these qualifying resources should be studied, along with any non-qualifying projects. In the TPD allocation process, if the amount of qualifying queued resources is not sufficient to reach the CPUC portfolio goals, additional “phantom” resources should be added to make up for the difference and the total sum of qualifying resources should be allocated TPD on a priority basis before allocating TPD to non-qualifying projects seeking TPD based under the TPD allocation rules.

For out-of-state resources, there are two different mechanisms – projects that require MIC and projects in the CAISO queue. CAISO should explain how it is going to reserve the proper amount of TPD in each step of the study process and ensure that TPD capacity is not double counted.

- Rules regarding converting capacity to different technologies.

It is CalWEA’s understanding that a total of 5.6 GW of OSW capacity was reserved in the latest TPD allocation at Humboldt (1.6 GW – generic OSW capacity) and Central Coast (4 GW – all queued projects). However, under current CAISO rules, queued OSW resources can convert from OSW to another technology if they cannot secure PPAs or other procurement assurances within a few years. The new technology is likely to be battery storage, but certainly not other types of location-constrained resources, which do not exist in the Humboldt or Central Coast locations.

To ensure that sufficient capacity is reserved to achieve the CPUC’s portfolio, if any Central Coast OSW resources convert from qualifying to non-qualifying technologies, CAISO should plan for additional generic OSW capacity in the following TPP cycle to make up for the converted capacity.

In the future, beginning with QC15, qualifying resources that benefit from capacity reservation should not be allowed to convert to non-qualifying resource types, except for some fraction of their net injection to storage to provide reasonable flexibility.

- Addressing near-term reliability needs

To ensure that the capacity reservation policy for qualifying resources does not interfere with capacity that is needed for the mid-term period, interconnection customers should be able to request, during the TPD allocation process, release of capacity that would otherwise be reserved for qualifying resources. Capacity should be released to such customers if they prove to CAISO that they can come online within the MTR timeline (by 2028). New capacity should be planned in the next TPP cycle to make up for what is allocated to MTR resources.

[1] CAISO Track 3-A Revised Straw Proposal (July 8, 2024) at p. 12.

[2] Id. at p. 23.

[3] Ibid.

[4] Ibid.

[5] Ibid.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

No comment at this time.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

No comment at this time.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

No comment at this time.

7.

Please provide any additional feedback:

No comment at this time.

CESA

Submitted 09/18/2024, 12:30 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

The California Energy Storage Alliance (CESA) appreciates the opportunity to provide comments on the 2023 Interconnection Process Enhancements Track 2 working group meetings.

CESA appreciates the additional discussion at the two working groups on how to grapple with long lead-time deliverability network upgrades. CESA supports CAISO’s proposal to allow for an additional TPD attempt through the introduction of the three annual TPD allocation opportunities. As stated in previous comments, CESA is concerned that while directionally positive the three-attempt limit could result in the window expiring before developers and load serving entities are able to enter into power purchase agreements if the earliest commercial operating dates for the projects are beyond the CPUC’s procurement requirements.

Currently the three-year window is by cluster. The CAISO could consider allowing projects more flexibility to enter the TPD allocation window in the year of its choice as long as it can still meet the unavoidable time-in-queue requirements. The CAISO could consider allowing projects to enter the TPD allocation window based upon the completion date of the long lead time upgrades impacting the project’s forecasted commercial operation date. The CAISO should still prioritize earlier queued projects in the TPD allocation. For example, projects with commercial operation dates in 2034, the three-year TPD allocation window would be 2029, 2030, and 2031. After 2031, the project would be converted to energy only.

CESA looks forward to other proposals on how to bridge this gap between procurement requirements and completion of transmission upgrades.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

See above.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

In prior comments, CESA requested CAISO to provide greater transparency on the process to determine the quantity of TPD held back for long lead-time resources from the TPD allocation process and other processes. CESA recommends that the CAISO leverage the Constraint Mapping with TPD Allocated spreadsheet to add Reserved TPD for each area deliverability constraint. CAISO should consider reposting the August 30 constraint mapping spreadsheet with this data given the surprise expressed by many stakeholders that the long lead-time resource TPD was already withheld from cluster 15 interconnection request intake process.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

No comment.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

CESA appreciated ACP-CA’s proposal. CESA agrees that 2024 TPD Cycle allocations to Group D will significantly reduce the TPD availability to be used in determining the quantity of new interconnection requests to be studied if the proposed changes pending at FERC are approved. During the workshop, CAISO stated that it is becoming convinced that Group D should be maintained. If Group D is maintained, all or a portion of the TPD allocated in this group during 2024 should be included as available TPD in the interconnection request process.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

CESA believes this proposal highlights that coordination between the CAISO and CPUC is needed to implement changes to issue procurement directives beyond 2028. The proposed changes seem to be more under the CPUC purview than CAISO. CAISO should focus efforts in this initiative to changes or clarifications that are fully within the CAISO’s purview.

7.

Please provide any additional feedback:

CESA requests the CAISO provide a status update on proposed changes in the Generation Deliverability Methodology Review initiative. CAISO proposed to provide deliverability while a resource is waiting for the related n-2 deliverability upgrades to be completed if the contingency is not considered always credible in the operations horizon and does not risk cascading outages. Did the 2024 TPD allocation deliverability study include the change above?

Also, the CAISO should consider additional increases in interim deliverability as well as introducing multi-year interim deliverability as discussed in early tracks of this initiative. Expanding the use of interim deliverability will allow projects, such as storage, which are reliant on resource adequacy payments to enter into power purchase agreements and come on-line earlier.

EDF Renewables

Submitted 09/18/2024, 05:20 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

EDF Renewables (EDF-R) appreciates the opportunity to provide comments on CAISO’s IPE Track 3A 8/28 and 9/4 working group meetings and thanks the CAISO for prioritizing these discussions prior to posting the Second Revised Straw Proposal expected in late October 2024. Additionally, for CAISO improving the alignment between the 2025 & 2026 TPD studies to accommodate Cluster 15 interconnection studies which allows the needed time for better TPD policy development in a post-Order 2023 and IPE Track 2 regulatory landscape.

Need for accommodation when DNU in-service dates are 7 years out or further

As for the challenges of LLT DNUs as it relates to projects in queue, EDF-R strongly believes that CAISO should create a procedure with unique considerations for projects affected by LLT DNUs. It is not reasonable for CAISO to request projects show an executed PPA for TPD allocation or for Commercial Viability Criteria (CVC) in circumstances where estimated FCDS dates are more than 7 years after IR submission date. Historically, LSEs have not signed contracts for those long-term timelines. If this was a common practice, much of this conversation would be moot.

EDF-R discussed this item in detail in its July 29th comments. In brief, projects with these LLT DNUs should be allowed to delay requirements for showing an executed PPA until closer to possible FCDS achievement (or a secure long-term IDS allocation.) Without this policy, CAISO asks developers to risk catastrophic financial losses because CAISO’s GIA financial security posting requirements in GIDAP and RIS, which becomes immediately at-risk.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

EDF-R commends CAISO for extending the timeline for this initiative to accommodate thorough discussion of this item. EDF-R requests CAISO assign additional time and resources to further discussion and research on the possibility of funding RNUs via a subscription mechanism, or funding least-regrets RNUs via the TPP. EDF-R appreciates the willingness of CAISO’s transmission department to devote staff time to identifying how useful such a proposal could be.

EDF-R also notes that CAISO must find a way for projects with these LLT RNUs to reduce some of the financial risk currently inherent to CAISO’s process, and suggests that CAISO should have a third posting approach for these projects that allows for RNU construction to begin without requiring developers to risk catastrophic financial losses because CAISO’s GIA and third posting procedures require immediate execution and posting of 100% financial security. Executed E&P agreements could allow for these actions while protecting ICs from the most extreme financial risks. For these LLT RNU and DNU circumstances, CAISO’s process should reflect risks to developer financial security that are reasonable and prudent. Creating circumstances where projects can only possibly succeed if developers are willing to take absurd risks does not filter for viable projects nor does it serve California ratepayers.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

No comments at this time.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

EDF-R encourages CAISO to retain Group D with future enhancements, potentially adding a new allocation group for projects affected by LLT DNUs.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

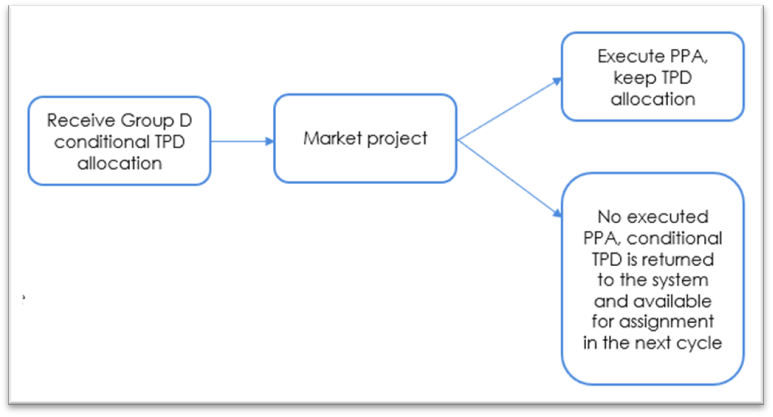

EDF-R requests more time be allocated to discussion to ACP-CA’s conditional TPD proposal. EDF-R understands the proposal to be, simplified in the figure below:

In their presentation, ACP-CA indicated a priority order for allocation conditional deliverability, EDF-R suggests projects seeking Conditional TPD for the first time get priority in the allocation, projects seeking Conditional TPD for a second time get second priority, and projects seeking Conditional TPD for the third time get third priority in the allocation. This priority order would allow the “cream to rise to the top” -- giving new projects the same chance to market themselves in their first TPD allocation year that the previous years projects had.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

EDF-R thanks CAISO for the opportunity to present at the working group, and hopes the information provided spurs discission.

EDF-R looks forward to hearing from the CAISO and stakeholders if there are feasible alternative contract options that could occur before PPA execution, that would provide more certainty for continued project development, given LSEs are not executing PPAs for projects more than 5 years from COD/FCDS dates.

EDF-R encourages CAISO to consider Conditional PPAs conditioned on certain regulatory approvals, technological benchmarks, and or project developments, being met within a specific timeframe. Another consideration is allowing for a more CAISO-centric metrics conditioned on meeting development milestones, such as GIA milestones. The Conditional TPD allocation and retention could be structured with specific milestones that the Project must meet over the development period based on the FCDS date. This second option would allow for more CAISO oversight.

7.

Please provide any additional feedback:

EDF-R urges CAISO to move forward to implementation exercises as it pertains to improving IDS allocations, and potentially allowing IDS lock in times for more than 1 year. This item has come up several times in various venues, and CAISO has indicated willingness to do so. As with any item, we will have a better collective understanding of how viable the proposal is by exploring a real-world example. As a next step perhaps, CAISO could look at a study area in PG&E and a study area in SCE and outline how much TPD is currently available. Not available for allocation in the study process, but available for IDS use for projects coming online. Now seems an opportune time given CAISO recently published NQC data. EDF-R posits that this longer-term IDS assignment will never be a routine task, that unique factors will need to be taken into consideration based on study area, and in some areas a long-term IDS assignment may not be possible – but this information would be very valuable for marketing efforts.

Emeren

Submitted 09/18/2024, 04:28 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

7.

Please provide any additional feedback:

Our comments relate to the proposed revised 2025 & 2026 schedule for TPD allocation processes.

In respect to the push-out of the 2024/25 TPD affidavit/allocation cycle, we request an earlier opportunity to seek TPD allocation for projects that have secured PPAs with RA obligations or RA agreements with LSEs after the 2023/24 cycle commenced. This would be consistent with the CAISO goal to prioritize "shovel ready" projects. The delay of the 2024/25 cycle by a year will jeopardize the ability of these near-term projects to fulfill 2026/27 RA commitments within their LSE agreements.

In respect to the cancellation or skipping of the 2026 TPD cycle, Wholesale Distribution Access Tariff (WDAT) projects have PTO study processes and interconnection agreement timelines that proceed at a different pace than the CAISO interconnection processes. It is highly likely that WDAT projects that requested to be studied for full capacity deliverability in conjunction with Cluster 15 will have their PTO Facilities Studies or Phase II Interconnection Studies completed (and in many cases interconnection agreement executed) prior to the completion of the Cluster 15 Restudy & Reassessment. WDAT projects with completed Facilities Studies or Phase II Studies and CAISO Deliverability restudy results should be afforded the opportunity to seek TPD allocation in 2026. They should not have to wait until the 2027 cycle after the CAISO Cluster 15 Facilities Study process is completed.

Fervo Energy Company

Submitted 09/18/2024, 01:18 pm

Submitted on behalf of

Fervo Energy Company

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

Fervo Energy (Fervo) appreciates CAISO’s recognition of the unique challenges faced by Long Lead-Time resources like Enhanced Geothermal Systems (EGS), which play a critical role in California’s clean energy transition. With an over 80% capacity factor, EGS can significantly enhance grid reliability amidst the growing presence of intermittent resources. Securing early TPD assurances is vital to attract offtake agreements and financing for these capital-intensive projects.

We encourage CAISO to explore additional deliverability categories that account for commercial readiness indicators beyond PPAs, such as site control or purchase orders for key generation equipment. These steps could better align deliverability timelines with the extended development periods faced by Long Lead-Time projects.

Fervo also recommends that policy-driven resources with established readiness signals be prioritized in the Transmission Planning Process (TPP) and considered in the Maximum Import Capability (MIC) process. Coordination between the CAISO TPP and IPE teams, as well as with CPUC, will be crucial to ensuring timely network upgrades for these essential resources, especially those appropriated through the Central Procurement Entity (CPE). Given this special policy appropriation to Long Lead-Time resources issued by the California Public Utilities Commission (CPUC), we encourage the CAISO to consider additional deliverability groups that recognize commercial readiness signals other than a PPA.

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

N/A

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

Fervo thanks CAISO for its continued commitment to reserving deliverability for Long Lead-Time resources, which has been essential for meeting California’s reliability goals. Given the ALJ’s recent decision not to mandate specific procurements unless contractually appealing to the Department of Water Resources (DWR), we request continued transparency regarding how CAISO will determine network upgrades for Central Procurement Entity procurements.

We also support the development of resource-specific deliverability processes that allow Long Lead-Time resources to apply for interconnection and deliverability allocations without prematurely being converted to Energy Only. Specifically, FERVO supports a special TPD allocation category for Long Lead-Time resources to ensure that they are not crowded out by resources with shorter development timelines. This is crucial for maintaining competition while recognizing the unique challenges these resources face and without convoluting their value to fit into a process that does not adequately recognize their system benefits. The state of California has recognized the need for reliable clean firm power, many of which have long lead-times as such, our transmission allocation process must adequately match policy driven resource need with transmission delivery.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

N/A

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

N/A

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

Fervo appreciates EDF’s examination of the deliverability challenges faced by Long Lead-Time resources. We agree that readiness parameters should reflect the commercial realities of extended development timelines. We support EDF’s proposal to incorporate alternative readiness indicators, such as development milestones, financial guarantees, or strategic partnerships, in addition to traditional markers like site control.

Deliverability assurance, as highlighted by EDF, is key to de-risking projects and securing funding from less risk-tolerant lenders. This approach will expedite project development and foster innovation, as demonstrated by Fervo’s ongoing work across the West. Fervo thanks EDF for their analysis and suggestions which address concerns about deliverability for Long Lead-Time resources and present a suite of potential solutions.

7.

Please provide any additional feedback:

Fervo thanks the CAISO for its continued efforts to improve the transmission deliverability processes to align with policy driven appropriations. We look forward to future iterations while urging the CAISO to present viable solutions that will unlock Long Lead-Time resource deliverability to match the unprecedented demand as seen in California.

Golden State Clean Energy

Submitted 09/19/2024, 12:29 am

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

Golden State Clean Energy (“GSCE”) opposes the continuation of Group D, especially if a deliverability allocation via Group D reduces the available deliverability for the next queue cluster’s intake process. Under CAISO’s pending track 2 queue reforms, a project could receive deliverability via Group D without demonstrating additional commercial readiness since it entered the queue, and that deliverability allocation would prohibit new capacity from seeking interconnection in the next queue cluster window. Projects that receive an allocation of deliverability via Group D are not necessarily more viable than new projects that wish to apply for interconnection. Group D is at odds with IPE track 2 queue intake reforms and does not create the right incentives by rewarding projects that are not necessarily taking key commercial steps.

Without any further demonstratable readiness, it is overly limiting to future projects for Group D to enable any given queue cluster to swallow up all available deliverability, only for some of the deliverability to potentially be relinquished the next year if retention criteria is not met. If CAISO retains Group D, GSCE supports it being a conditional allocation. GSCE supports a modified and simplified version of ACP-CA's proposal where a Group D allocation does not count against the available deliverability for interconnection request intake until a project has met its retention criteria (either through a PPA, shortlisting, or active commercial negotiations).

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

7.

Please provide any additional feedback:

Hydrostor Inc.

Submitted 09/18/2024, 04:48 pm

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

Hydrostor agrees with parties that indicated during the stakeholder workshop that the pathway envisioned by the CAISO – i.e., that projects operate for several years as Energy Only (EO) before becoming Full Capacity Deliverability Status (FCDS) while waiting for long lead-time (LLT) deliverability network upgrades to be completed – would not work well for energy storage resources. For energy storage resources, and in particular, long-duration energy storage resources (LDES), their key value derives from the ability to provide Resource Adequacy (RA) benefits to load-serving entities (LSEs).

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

Contracting for LLT resources, including many LDES technologies, is already challenging given the preference of many LSEs for projects with earlier in-service dates. Further compounding the Commercial Operating Date (COD) issues with extended in-service dates for reliability network upgrades only serves to exacerbate these timeline issues.

3.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time resource issue:

Hydrostor notes that in the CPUC’s August 22, 2024 Decision 24-08-064 (“Decision Determining Need For Centralized Procurement Of Long Lead-Time Resources”), the CPUC appropriately included LDES technologies as long-lead time resources (specifically, LDES that can discharge for 12 or more hours that does not employ lithium-ion batteries). To ensure consistency, the CAISO’s definition of LLT resources should be broadly consistent with the CPUC’s definition and include LDES.

Hydrostor agrees with parties that have indicated that unique Transmission Plan Deliverability (TPD) allocation criteria should apply to LLT resources that meet certain technology and policy goals. However, Hydrostor is concerned that the focus on treatment of LLT resources in the interconnection queue thus far has been narrowly focused on off-shore wind (OSW). We further understand that some deliverability was held back for OSW, but it remains unclear what deliverability, if any, has been held back for LDES resources that have been identified as required by the CPUC in their Preferred System Portfolio.

Importantly, unique TPD allocation and interconnection processes for LLT resources, including LDES, is required to facilitate the timely development of these much-needed resources. In the CPUC's Decision 24-02-047, the Preferred System Portfolio includes 3.8 GW of LDES in 2035 (modeled as 8-hour energy storage, pumped hydro and other LDES), increasing to 10 GW in 2040. These required amounts are even greater in the High Gas Retirement Sensitivity case. CAISO facilitation of the development of these resources through the interconnection process is entirely consistent with the December 2022 Memorandum of Understanding (MOU) between the CPUC, California Energy Commission (CEC) and CAISO regarding transmission and resource planning and implementation. As the CAISO has noted, the MOU is intended to tighten the linkages between resource and transmission planning, interconnections, and procurement so California is better equipped to meet its reliability needs and clean-energy policy objectives required by Senate Bill 100.

Hydrostor is further concerned about interconnection study processes and timelines that further delay in-service dates for LDES resources. For example, some of the interconnection study areas that have the potential for beneficial LDES development (e.g., North of Lugo, East of Pisgah) appear to have had deliverability allocated already with little or no deliverability available in Cluster 15. This puts LDES developers in the difficult decision of either trying to proceed in Cluster 15 in some form (e.g., merchant transmission, Energy Only) or waiting until Cluster 16 (which would not begin until late 2026). Waiting until Cluster 16 would further delay LDES development, pushing CODs even further out and making the CAISO grid increasingly dependent on a small subset of resources (i.e., short-duration battery storage and solar projects). Hydrostor therefore urges the CAISO to consider how it may be able to allow LLT resources, including LDES, to be studied in Cluster 15. This clarity is needed urgently given Cluster 15 deadlines and the need by LLT developers to make decisions in the near term including the posting of sizable deposits.

Hydrostor understands that the CAISO plans on convening a separate effort to consider LLT resources and their treatment. While we intend to participate in this stakeholder effort, we also wish to underscore the urgency given current Cluster 15 study timelines.

4.

Please provide your organization’s questions or comments in response to the Track 3A: continuing allocation group D as it operates now, removing the restrictions and have the group D allocations reduce the available TPD capacity for the cluster studies:

No comments at this time.

5.

Please provide your organization’s questions or comments in response to the ACP-CA “Group D Conditional Deliverability” presentation:

No comments at this time.

6.

Please provide your organization’s questions or comments in response to the EDF Renewables “Development Alignment Proposal” presentation:

No comments at this time.

7.

Please provide any additional feedback:

No further comments at this time.

LSA

Submitted 09/18/2024, 08:47 pm

Submitted on behalf of

Large Scale Solar Association

1.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time deliverability network upgrade issue:

LSA appreciates the CAISO's effort here. Unfortunately, the CAISO’s premise that PPAs could be developed allowing for years of Energy Only service before FCDS is awarded was not supported by LSEs or other stakeholders during the workshops. The older Standard Offer contracts implemented a form of this concept, projecting high oil and gas prices in the future and including a levelized pricing mechanism that allowed some payment on that basis earlier in the contract term, to provide sufficient revenue for earlier development of more efficient and renewable resources to replace them.

However, the regulatory regime has moved away from that approach. Based on statements from SCE and others, LSEs are not willing to pay for NQC that they are not receiving, years in advance, and they will clearly not move in that direction without regulatory support or mandates. The CAISO mentioned at the working-group meetings that it is “talking to the CPUC” about these matters, and this could be included as a topic in those discussions.

This problem is a particular issue for energy storage, a badly needed resource to manage growing intermittent-generation penetration and fossil-fuel retirements. The common RA-only PPAs for storage resources generally pay exclusively for NQC (adjusted for counting-rule changes over time) and nothing else. NQC is generally the payment basis even for most so-called “tolling” arrangements, which provide for broader services, with deductions where the project fails to meet certain other performance metrics.

In other words, these facilities appear to have little value to off-takers other than their RA/FCDS value, and off-takers will not pay for them without that attribute under current procurement directives.

As SCE stated, the new CPUC Slice-of-Day (SoD) RA framework makes deliverability more important even for variable resources. Though they may not provide much NQC on their own, depending on the technology, they must have deliverability in order to count toward filling storage resources not located at the same Point of Interconnection (POI).

Aside from the contract changes discussed above, the best solution to this problem is determining a way to provide RA status sooner to these projects. LSA continues to believe that the CAISO should develop a way to implement a longer-term Interim Deliverability Status (IDS) model, even if only a limited amount of capacity could be made available on that basis. That is better than zero.

(The elimination of N-2 upgrades (in the absence of cascading outages) in the Deliverability Assessment Methodology was posited as a way to provide FCDS sooner. However, that implementation has been completely opaque. It would be helpful if the CAISO could provide information on how often this revision enabled FCDS to be awarded sooner, and how much capacity received FCDS sooner as a result.)

2.

Please provide your organization’s questions or comments and potential solutions to the Track 3A long lead-time reliability network upgrade issue:

LSA is confused about the CAISO’s question here. Whenever workshop participants suggested a solution here – e.g., a framework similar to the Location-Constrained Resource Interconnection Facility (LCRIF) provision in the tariff, which allows for temporary ratepayer funding of “trunkline” gen-tie lines where alternative forms of commercial interest can be demonstrated – the CAISO responded that RNUs needed to accommodate the TPP resource portfolio were approved in the TPP, so these other RNUs were not really needed. The CAISO itself has hypothesized that these upgrades will not really be needed once the “overheated” queue is reduced to more realistic levels.

Well, if needed upgrades are already approved in the TPP, and these upgrades may not actually be needed, what was the point of this question?

The LCRIF framework may work especially well for RNUs. Gen-tie costs are typically borne by new generation projects, but RNU costs are usually borne by ratepayers anyway, so this approach would not require additional ratepayer funding, just the same funding a bit earlier. In addition, busbar mapping in the resource portfolios is not a perfect exercise, and to the extent that new resources develop in slightly different locations indicated by commercial interest, presumably that would allow similar upgrades to be eliminated elsewhere.