Bay Area Municipal Transmission Group (BAMx)

Submitted 12/05/2022, 04:43 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Please provide your organization’s comments on accessing out-of-state Idaho wind resources.

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the CAISO's 2022-23 Transmission Planning Process. The comments and questions below address the material presented at the CAISO Stakeholder meeting on November 17, 2022.

BAMx appreciates the CAISO's recognition of the need to take into account evolving CPUC portfolios for out-of-state (OOS) resources and concerns expressed by stakeholders.[2] Since the 2022 -2023 TPP does not explicitly include OOS wind from Idaho in the Base Case, BAMx believes it would be inappropriate for the CAISO to approve the SWIP-North project in the current TPP. It is the only current proposal providing direct access to the Idaho resources.[3]

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] “Accessing out-of-state Idaho wind resources,” 2022-2023 Transmission Planning Process Stakeholder Meeting

November 17, 2022, p.8.

[3] Ibid, pp3-4.

2.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the North region.

Need for Previously Approved PG&E Projects

BAMx has no comments on the recommended reliability projects less than $50 million for the North region at this time. However, as the CAISO has indicated in its response[1] to BAMx comments, the CAISO should review the need and timing for the proposed transmission projects in the Draft Transmission Plan. These projects include the Midway-Temblor 115 kV Line Reconductor & Voltage Support project and the Morgan Hill Area Reinforcement project.

Consideration of Reliability Upgrades: Cortina 60 kV Line and Garberville Area Reinforcement Projects

In our comments in response to the September 27-28, 2022, Stakeholder meeting, BAMx had encouraged the CAISO to explore other options for PG&E's Cortina and Garberville areas, where PG&E is proposing capital-intensive projects ($300 million) to accommodate small incremental demand increases. Since then, we have had the opportunity to further examine the reliability needs in these areas.

BAMx examination of the CAISO-posted reliability assessments and underlying power flow cases indicate no overloads on the Cortina #1 60kV, as observed in the PG&E assessment[2]. BAMx found low voltages in the 2032 case – 0.892 at the end of the line at the Dunnigan substation. Under normal conditions, the loading on the Cortina #1 60kV was 91.5%. The Cortina # 1 60 kV line is a radial line that serves one load and has no generation. So, its loading depends only on the load and is unrelated to the generation dispatch. The installation of battery storage will improve loading and voltages, but PG&E stated that this alternative is infeasible because the charging capability on the transmission line is limited.

Several switches are normally opened in this area. Closing some of them improves voltages. The system model has two open switches at the Arbalt 60 kV substation. Closing these connections between Arbalt and Arbuckle and Arbalt and Dunntap improves voltages and reduces loadings. In the 2032 case, the loading on the Cortina # 1 60 kV line was reduced from 91.5% to 77.4% by closing these switches. Closing the normally open switch on Wilkins between DIST2047 and DIST1500 60 kV buses will also improve voltages and reduce loadings. In the 2032 case, the loading was further reduced to 65.9%. In summary, BAMx believes that the CAISO needs to explore additional mitigation alternatives, such as the feasibility of the above switching operations.

We also believe alternatives, such as installing energy storage and shunt capacitors, should be explored. There needs to be a more detailed investigation of the feasibility of an appropriate charging cycle for the storage and the ability of shunt capacitors to solve any remaining voltage issues. Those alternatives should be investigated before approving the Cortina #1 60 kV line reconductoring.

While considering the Bridgeville-Garberville upgrade, it should be noted that loading of the Bridgeville-Garberville 60 kV line significantly depends on the output of the Humboldt Bay power plant, and its overload can be mitigated by reducing Humboldt Bay generation. It appears the Humboldt Bay Power plant output was reduced in the summer cases but was modeled at full output in winter. Reducing its output in the 2032 Winter case will mitigate the overload but will not help relieve low voltage criteria violations. Additional reactive support should be investigated as a solution for low-voltage violations. According to PG&E, space limitations at the Garberville substation prevent the installation of battery storage there. BAMx believes the feasibility of BESS needs to be investigated further. Even if a BESS at one of the substations connected to the Bridgeville-Garberville 60 kV line is unfeasible, other alternative locations should be investigated. Those investigations should include installation on the low side of existing transformers or obtaining a new site for installing BESS. BAMx endorses the CAISO methodology of only considering incremental interconnection costs for BESS that are needed for system issues. Even if there are interconnection costs, in this case, only those incremental costs should be included in an analysis of BESS for this area. A BESS should be investigated to mitigate any voltage or thermal criteria violations. BAMx believes that the CAISO needs to explore these additional mitigation alternatives before approving the Garberville Area Reinforcement project in the current planning cycle.

[1] CAISO Response Matrix to Stakeholder Comments, 2022-2023 Transmission Planning Process Stakeholder Meeting, September 27-28, 2022.

[2] PG&E September 28th Presentation, p.34.

3.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the South region.

No comments at this time.

4.

Please provide your organization’s comments on the MIC Expansion Requests.

No comments at this time.

5.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SCE and GLW areas.

Need For More Complete Information for Stakeholder Understanding of CAISO Policy-Driven Assessment

For the policy-driven assessments, the CAISO has not provided adequate information to stakeholders to understand and independently analyze the need for proposed Policy-Driven Projects. The CAISO needs to provide the kind of data and information it has provided for the last two TPP cycles. Such information includes, for each deliverability constraint, identifying the renewable portfolio capacity (MW) levels behind the constraint, energy storage (ES) portfolio capacity (MW) behind the constraint, renewable curtailment levels without mitigation (MW), etc.[1] When probed during the November 17 meeting, the CAISO indicated that there are considerably more renewal resources and deliverability constraint violations in the current TPP relative to the last year's TPP, which makes it challenging for the CAISO to present the current year's assessment results. This should not, by itself, be the justification to avoid providing the stakeholder with a complete set of information. Instead, the stakeholders should be provided every opportunity to review the detailed set of results to better understand the CAISO's policy-driven assessments and related decisions.

Per the CAISO's FERC-approved tariff, a Category 1 policy-driven transmission solution has to be identified to be needed "in the baseline scenario and at least a significant percentage of the stress scenarios."[2] Since several projects are not identified as needed under the Base portfolio, they clearly do not satisfy the criteria for Category 1 transmission and, therefore, should not be approved during the current TPP cycle. Furthermore, the draft 2023-2024 CPUC portfolios or any synergy with the CAISO 20-Year Outlook[3] should not be used as criteria to recommend any projects as Category 1 policy-driven transmission solutions in the current TPP. They could be classified as Category 2 policy-driven transmission solutions and can be studied in subsequent transmission planning cycles.

Need CPUC IRP-Developed Resource Portfolios To be Informed of All types of In-State, Offshore, and Out-of-State (OOS) Transmission Costs Triggered By Them

BAMx acknowledges that over the years, there have been improvements in the feedback loop between the CPUC Integrated Resource Planning (IRP) and CAISO TPP in terms of including appropriate scope and cost of transmission upgrades in the CPUC IRP's resource portfolio development. The CPUC resource portfolio mapping needs to abide by existing transmission constraints and trigger only potential upgrades which are likely to be cost-effective or necessary to meet policy goals and reliability requirements.[4] This process entails utilizing transmission constraints and upgrade information identified in the most recent CAISO’s White Paper – 2021 Transmission Capability Estimates, which includes forty-four (44) transmission constraints with on-peak and off-peak limits and identified upgrades.[5] As an example, in Table 1 below, we have extracted those that are applicable to SCE North of Lugo (NOL) Study Area Constraints and SCE/GLW East of Pisgah (EOP) Study Area Constraints used in the CPUC IRP process. However, it appears that these transmission capability estimates were not adequate in optimizing the in-State and out-of-State (OOS) resource selection in the 2022-2023 TPP portfolios.[6] For instance, there does not seem to be any recognition that the resources modeled in the VEA 138kV system will automatically result in the need for 230kV system upgrades, such as the Beatty 230kV project as identified by the CAISO in the current TPP.[7] Similarly, the addition of several OOS resources and other Southern Nevada resources connected to the Eldorado substation seem to be triggering multi-billion dollars upgrades to the transmission infrastructure in the SCE Eastern area, including those meant to address deliverability constraints, such as the Lugo-Victorville 500kV constraint. As shown in Table 1 below, the transmission cost estimates for additional upgrades for the SCE NOL and SCE/GLW EOP area with a sum total of $649 million is well short of the potential major transmission upgrades and related costs the CAISO has identified in these two areas in the current TPP.

Table 1: Transmission Capability Estimates for Use in CPUC's IRP process - Revised 10/28/2021

.png)

In summary, major transmission upgrades are needed, which were not incorporated in the CPUC’s selection of the renewable portfolios provided to the CAISO for the current transmission planning cycle. Therefore, these major transmission upgrades triggered by the 2022-2023 renewable portfolios should not be approved until further investigations regarding their need occur. Furthermore, the CPUC's 2023-2024 TPP resource portfolio development must be informed on such major transmission upgrades and costs so that it could potentially remap these resources elsewhere in the system. Without this vital step, the 2023-2024 TPP portfolios could lead to sub-optimal outcomes with potential stranded transmission investments in the long term.

SCE Metro Area

Except for the Mesa–Mira Loma 500 kV UG Cable, none of the other criteria violations identified in the on-peak SCE Metro study area occur in the Base portfolio. [8] Given the uncertainty associated with the need for the proposed SCE Metro study area mitigation alternatives[9], the CAISO should not approve them in the current TPP. Also, comprehensive transmission upgrades are identified for the sensitivity portfolio, but should not be approved in the current planning cycle. It is prudent and consistent with the CAISO Tariff to wait for the next TPP cycle to determine if such transmission solutions are needed for the Base portfolio.

The Draft Plan should lay out how the CAISO would determine the cost-effectiveness of the mitigation alternatives, such as Alternative 1 versus Alternative 2.[10] An economic assessment of all the competing alternatives should be accomplished in subsequent planning cycles.

SCE NOL Study Area

Some elements of the potential mitigation alternatives meant to address On-peak SCE NOL study area deliverability constraints that appear in the sensitivity portfolio are not needed in the Base portfolio. One example is “Rebuild/build Kramer–Victor 115 kV lines to 230 kV”.[11] Given the uncertainty associated regarding the need for such projects, the CAISO should not approve these elements and, therefore, the mitigation alternatives comprising them in the current TPP. It is prudent and consistent with the CAISO Tariff to wait for the next TPP cycle to determine if such transmission solutions are needed for the Base portfolio.

The Draft Plan should lay out how the CAISO would determine the cost-effectiveness of the mitigation alternatives, such as Alternative 1b versus Alternative 2[12] , in subsequent planning cycles.

SCE Eastern Area

Some elements of the potential mitigation alternatives meant to address On-peak SCE NOL study area deliverability constraints are not needed in the Base portfolio.[13] One such example is the new Devers-Mira Loma 500 kV transmission line.[14] Given the uncertainty associated regarding the need for such projects, the CAISO should not approve the mitigation alternatives analyzed in the current TPP. It is prudent to wait for the next TPP cycle to determine if such transmission solutions are needed for the Base portfolio.

The Draft Plan should lay out how the CAISO would determine the cost-effectiveness of the mitigation alternatives, such as Alternative 1 versus Alternative 2.[15]

VEA 138kV System

It is unclear to BAMx why only the 230kV (Beatty 230kV) upgrades to address multiple potential overloads on the 138kV were considered.[16] The CAISO should consider additional 138kV upgrades and compare the scope and costs of such upgrades with the Beatty 230kV project before approving the Beatty 230kV project.

GLW 230kV System

None of the transmission facilities except the IS Tap–Radar –Northwest 138kV line is overloaded in the Base portfolio.[17] Given the uncertainty associated regarding the need for the five alternatives[18] under consideration, the CAISO should not approve them in the current TPP. It is prudent to wait for the next TPP cycle to determine if such transmission solutions are needed for the Base portfolio.

Lugo-Victorville 500kV Constraint

Lugo-Victorville 500kV Line is overloaded in the Base Case only under one particular contingency.[19] The alternatives considered to address the potential overloads on the Lugo-Victorville 500 kV are excessive and prohibitively expensive.[20] BAMx understands from the latest Transmission Development Forum documents that the current expected operational date for the Lugo-Victorville 500 kV Transmission Line Upgrade Project that was approved in the 2016-2017 TPP is January 2025. The CAISO needs to consider additional upgrades to the Lugo-Victorville 500 kV upgrades in coordination with LADWP before approving major additional 500kV projects.

[1] For example, see On-Peak Delevan-Cortina 230kV line constraint on p.54 of the 2021-2022 TPP Policy-driven Assessment, November 18, 2021.

[2] CAISO Fifth Replacement FERC Electric Tariff, Effective as of January 1, 2022, 24.4.6.6 Policy-Driven Transmission Solutions.

[3] CAISO 20-Year Outlook, May 2022.

[4] CPUC Energy Division, “Proposed Electricity Resource Portfolios for the 2023-2024 Transmission Planning Process Workshop,” October 20, 2022, p.38

[5] See http://www.caiso.com/Pages/DocumentsByGroup.aspx?GroupID=79BEBAD0-E696-4E04-A958-1AAF53A12248

[6] CPUC Rulemaking 20-05-003, “Administrative Law Judge’s Ruling seeking comments from parties on electric resource portfolios to be used in the California Independent System Operator’s (CAISO’s) 2023-2024 Transmission Planning Process,” October 7, 2022.

[7] CAISO November 27th Presentation, “Policy-driven Deliverability Assessment Preliminary Results,” slide 53.

[8] Ibid, slides 15-16 and slide 21.

[9] Ibid, slide 18.

[10] Ibid, slides 19-20.

[11] Ibid, p.29.

[12] Ibid.

[13] BAMx recognizes that depending on the preferred transmission alternative for the SCE Eastern/SDG&E area, some of the upgrades identified here for the sensitivity portfolio may be needed for the base portfolio.

[14] CAISO November 27th Presentation, “Policy-driven Deliverability Assessment Preliminary Results,” p.29.

[15] Ibid, pp.43-44.

[16] Ibid, slide 53.

[17] Ibid, slide 57.

[18] Ibid, slides 59-67.

[19] Ibid, slide 70.

[20] Ibid, slide 72-74.

6.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SDG&E area.

As shown in Table 2 below, the costs associated with the options considered by the CAISO vary significantly from $1.3B to $3.6B. [1] Given the uncertainty associated regarding the need for the six options under consideration, the CAISO should not approve them in the current TPP. Furthermore, the Draft Plan should lay out how the CAISO would determine the cost-effectiveness of these options, including any economic assessment that the CAISO would perform in subsequent planning cycles.

Table 2: Considered Transmission Options and Related Costs in San Diego Study Area

.png)

*Costs are not identified for some elements in this Option

[1] Ibid, slide 87-94.

7.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the PG&E area.

BAMx supports relatively low-cost mitigation measures like the Series compensation on Collinsville-Pittsburg 230 kV lines and Series compensation on Contra Costa-Newark 230 kV path.[1] BAMx also appreciates the CAISO's consideration of a generic Battery Energy Storage System (BESS) to address potential violations of off-peak deliverability constraints. [2] As the CAISO has noted, a number of the criteria violations are identified in local areas on the 70 kV and 115 kV systems. As noted, alternatives that map generators at higher voltages (likely at 230 kV) need to be considered in subsequent planning cycles.[3] BAMx encourages the joint agencies (California Public Utility Commission, California Energy Commission, and CAISO) to develop such alternative mapping for the next TPP cycle.

[1] Ibid, slides 99 and 103.

[2] Ibid, slides 107-108.

[3] Ibid, p. 110.

8.

Please provide your organization’s comments on the Preliminary Economic Analysis Results.

Beatty 230 kV upgrades presented in the GridLiance/VEA policy assessment were modeled in the CAISO Production Cost Model (PCM) in order "to have feasible dispatch for the portfolio generators originally proposed at the 138 kV buses." [1] BAMx questions this modeling as it does not allow the stakeholders to meaningfully assess the potential economic benefits of the Beatty 230kV upgrades. Therefore, BAMx suggests that the CAISO model the Base portfolio without the Beatty 230kV upgrades.

[1] CAISO November 27th Presentation, “Preliminary Economic Assessment Results,” p.16.

9.

Please provide your organization’s comments on the Preliminary LCR study results for the North region.

No comments at this time.

10.

Please provide your organization’s comments on the Preliminary LCR study results for the South region.

No comments at this time.

11.

Please provide your organization’s comments on the Special Study Reduced Reliance on Aliso Canyon Gas Storage.

BAMx appreciates the CAISO's efforts in performing the special study that addresses reduced reliance on Aliso Canyon gas storage. BAMx notes that these studies essentially stress the transmission system by assuming no additional internal generation within the LA Basin area. These studies assume that only increasing imports into LA Basin displace the retired generation. Transmission solutions should only be one of the solutions that should be investigated to reduce reliance on Aliso Canyon Gas Storage.

12.

Please provide any additional comments on the November 17, 2022 stakeholder meeting.

BAMx appreciates the opportunity to comment on the 2022-23 Transmission Plan Policy and Economic Assessment Results and acknowledges the significant effort of the CAISO staff to develop this material. The CAISO staff has spent significant efforts over the six months to perform the studies, identify the policy and economic transmission issues, and develop potential mitigation solutions. With the presentation of this extensive material in one stakeholder meeting and requiring responses in two weeks, stakeholders have not been able to digest this massive data and analysis and prepare complete and meaningful comments. The CAISO should consider modifying its process and providing more significant opportunities in its stakeholder engagements. BAMx intends to offer specific steps required in the next transmission planning cycle for more regular stakeholder input.

California Public Utilities Commission - Public Advocates Office

Submitted 12/05/2022, 07:46 pm

1.

Please provide your organization’s comments on accessing out-of-state Idaho wind resources.

The following are comments from the Public Advocates Office at the California Public Utilities Commission (Cal Advocates) on the California Independent System Operator’s (CAISO) 2022-23 Transmission Planning Process (TPP). Cal Advocates is an independent consumer advocate with a mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Regarding next steps for the analysis of out-of-state transmission lines, Cal Advocates agrees with the Executive Director of the Western Interstate Energy Board’s recommendation that an analysis of the entire western interconnection is needed to determine which out-of-state transmission lines are the most cost-effective. This analysis should consider all the generation that is planned in the western interconnection to determine the synergies and interplay between existing and planned resources to determine the western interconnection wide cost-effective solution/cost minimizing solution.[2]

Currently, the Department of Energy (DOE) is engaged in a National Transmission Planning Study. The study objectives are to:

(1) Identify interregional and national strategies to accelerate cost-effective decarbonization, while maintaining system reliability and specifically “test transmission options that lie outside current planning.”[3]

(2) Identify which transmission benefits are key drivers for investments in interregional lines.[4]

(3) Inform regional and interregional transmission planning processes, particularly by engaging stakeholders in dialogue; and

(4) Provide results that prioritize future DOE funding for transmission infrastructure support.[5]

This DOE study will identify transmission solutions that would provide California access to renewable resources in the western interconnection including wind from Wyoming and New Mexico. However, this DOE study may recommend different transmission line alignments than the transmission projects CAISO is currently evaluating. These alternative alignments may give greater consideration to the location of new and existing generation and load in the entire western interconnection. The DOE study considers current state energy policies and tests 168 resource development scenarios and is a much broader study in comparison to the CAISO’s out-of-state wind study.[6] The results of the DOE study are expected by July 2023. Given this short timeline, it would be prudent for CAISO to incorporate the DOE study results into CAISO’s out- of-state wind transmission study.

Regarding cost allocation for the proposed out-of-state wind projects, Cal Advocates agrees with the CAISO that Federal Energy Regulatory Commission (FERC) Order No. 1000 Interregional Coordination policy did not provide a framework for engaging in meaningful discussions on benefits and cost allocation, and decisions on moving forward with a joint project.[7] Cal Advocates also agrees that transmission planners in the western states need a better framework that outlines how consensus decision making and project participation are achieved. Based on Cal Advocates observations of prior interregional transmission planning meetings, an independent entity is needed to facilitate discussions on proposed interregional projects and system reliability issues and to assist with determining if there are possible solutions that could benefit more than one region.

Given the challenges of equitable cost allocation for interregional transmission projects, CAISO should focus exclusively on out-of-state transmission projects that are subscriber-based over projects requesting costs recovered through the CAISO transmission access charge (TAC). Subscriber-based projects comply with cost causation and results in more equitable outcomes for ratepayers. Sunzia and TransWest Express (TWE) projects are subscriber-based projects that are not seeking cost recovery through the TAC. To compete with these options, any transmission project considered for accessing Idaho wind should also be subscriber-based.

PacifiCorp also started construction on the Gateway South 500 kilovolt (kV) transmission in 2022 and is expected to complete this 400-mile line between Wyoming and Utah by 2024.[8] This transmission line will increase access to Wyoming wind in the western interconnection. Cal Advocates recommends that CAISO investigate whether California Load Serving Entities can reserve any capacity on Gateway South to access Wyoming wind in its out-of-state wind transmission options study.

[1] California (Cal) Public Utilities (Util). Code § 309.5.

[2] CAISO Stakeholder Symposium, Session 3 Solutions to transmission impasse and untangling the wires, November 9, 2022, 28:00 – 29:00 minutes.

[3] National Transmission Planning Study, U.S. Department of Energy, October 2022, slide 13.

[4] National Transmission Planning Study, U.S. Department of Energy, October 2022, slide 35.

[5] National Transmission Planning Study, U.S. Department of Energy, October 2022, slide 12.

[6] National Transmission Planning Study, U.S. Department of Energy, October 2022, slide 21.

[7] CAISO Stakeholder Symposium, Session 3 Solutions to transmission impasse and untangling the wires, November 9, 2022, 37:00 – 38:00 minutes.

[8] Gateway South (pacificorp.com)

2.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the North region.

Cal Advocates is concerned that Pacific Gas and Electric Company (PG&E) intends to move forward with a previously approved project that has significantly increased in cost. CAISO approved the Bellota-Warnerville 230kV Reinforcement project in the 2012-2013 TPP with an estimated cost of $28 million.[1] Based on the November 17, 2022, update on recommended reliability projects in the north region less than $50 million, the cost for this project has nearly quintupled to a cost ranging between $100 to $150 million and the project's status has not changed since its approval in 2012. Given this significant project cost increase and delay, this project should be reevaluated as a project over $50 million to confirm it is still needed and that there are no other lower cost alternatives that can be considered.[2]

[1] CAISO 2012-2013 Transmission Plan, CAISO, March 20, 2013, p. 374.

[2] 2022-2023 Transmission Planning Process PG&E Area Less than $50 million Project Approvals and Project for Concurrence (Presentation), CAISO, November 17, 2022 at p. 5.

3.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the South region.

Cal Advocates has no comment on this topic at this time.

4.

Please provide your organization’s comments on the MIC Expansion Requests.

Cal Advocates has no comment on this topic at this time.

5.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SCE and GLW areas.

For the 2022-2023 TPP, the California Public Utilities Commission (CPUC) forwarded two resource portfolios for study. The first is a base portfolio, which includes 26,597 megawatts (MW) of new renewable resources. This portfolio achieves the equivalent of a 74 percent renewable portfolio standard and 87 percent greenhouse gas-free resources in compliance with Senate Bill 100.[1] The second portfolio is a sensitivity portfolio that includes 70,489 MW of new resources, including double to triple the amount of out-of-state wind, offshore wind, solar, and long-duration energy storage resources than in the base portfolio. Based on CAISO’s resource portfolio delivery modeling, the base portfolio could be integrated into the CAISO bulk transmission system without significant mitigations. In contrast, CAISO modeling analysis for the integration of the sensitivity portfolio, which triples the state’s renewable capacity, finds that significant overloads may occur with the sensitivity portfolio and thus mitigations may be needed to capture the full capacity and benefit of the sensitivity portfolio.

While CAISO does identify where overloads might occur with the integration of the base and sensitivity portfolios, CAISO did not provide information on the type of renewable resources that are undeliverable without mitigations at specific constraints and specifically the amount of MW by resource type that are undeliverable. Nor did CAISO provide the energy storage capacity behind each identified constraint. This information is necessary to assist with determining the least cost resource portfolios.

Cal Advocates recommends:

- CAISO resume its practice of providing information on the amount and type of renewable capacity that is deliverable without mitigations and the amount and type of renewable capacity that would be undeliverable without mitigations at each constraint.

- CAISO provide cost estimates for the alternative mitigations considered.

- CAISO complete its studies on the impact of proposed mitigations on the base portfolio to determine if proposed mitigations are needed for both the base and sensitivity scenarios.

The following are Cal Advocates’ additional recommendations on the 2022 Deliverability Assessment by utility service area.

Southern California Edison Company (SCE) Metro Area

For the Southern California Edison Company (SCE) Metro area, CAISO observes some overloads on certain lines with the sensitivity portfolio. CAISO lists possible alternatives to address these issues with the sensitivity portfolio but has not determined if upgrades are needed for the base case as well. CAISO states that further study of proposed upgrades in the SCE Eastern/San Diego Gas & Electric Company (SDG&E) area will assist with determining possible upgrades to SCE Metro system for both the base and sensitivity portfolios.[2] Cal Advocates supports additional studies to determine if any policy upgrades are justified for the SCE metro area.

SCE North Lugo Area

For the SCE North of Lugo (NOL) area, CAISO foresees possible overloads on certain lines with the delivery of both the base and sensitivity portfolios. CAISO proposes several different alternatives to address these system issues but does not provide cost estimates for all the project alternatives under consideration.[3]

Cal Advocates recommends that CAISO consider an additional alternative, specifically reconductoring the Kramer-Victor 115 kV line. Cal Advocates notes that overloads are observed in both the base and sensitivity cases on the Kramer-Victor 115 kV line. The other alternatives considered propose building 230 kV and 500 kV improvements that may not be needed to address the identified issues and would be more costly.

Cal Advocates also recommends that the requested Kramer-Victor 115 kV reconductor project evaluation as well as the evaluation for the other suggested project area mitigations for the SCE NOL area also involve an evaluation of the alternatives effectiveness at reducing area congestion. This additional analysis will assist with determining the most cost-effective alternative with respect to meeting the state’s goals and reducing area congestion.

Cal Advocates also recommends that CAISO provide cost estimates for all alternatives considered.

SCE Northern Study

For the off-peak SCE Northern Study area, CAISO observes more significant overloads in the sensitivity case than in the base case. CAISO proposes making operational changes to provide additional capacity when needed. Cal Advocates supports this plan of action.

SCE Eastern Area

For the on-peak evaluation of the SCE Eastern Area, CAISO finds the New Devers-Mira Loma 500 kV transmission line is not needed to support the base case portfolio.[4] Cal Advocates, therefore, recommends that this project not be considered as a necessary mitigation for the SCE Eastern Area.

Additionally, Cal Advocates recommends CAISO further study the Imperial Valley – North Gila 500 kV transmission line, which is suggested as an alternative mitigation for the SCE Eastern Area.[5]

The $377 million Imperial Valley – North Gila 500 kV line would provide a second connection between the North Gila substation in southern Arizona and the Imperial Valley substation in SDG&E territory. Between those two points, it would also loop in a new substation (Dunes) in the service area of the IID (outside of CAISO).[6] The line connects to at least two entities outside the CAISO Balancing Authority Area (BAA), and thus CAISO should determine how the capacity, benefits, and costs of the line would be equitably distributed before making any decisions regarding this project. IID has volunteered to be responsible for $105 million of the $377 million capital cost, but neither the CAISO nor IID has specifically outlined what the terms would be for this investment.[7] While the line would likely provide benefits to Arizona ratepayers, the evaluation process for interregional projects has not quantified those benefits or indicated what Arizona’s share of the project’s costs would be.[8] Before CAISO approves this project, CAISO should estimate the project benefits to ratepayers outside the CAISO BAA and propose a cost sharing agreements commensurate with estimated benefits.

Gridliance West Area

CAISO’s deliverability analysis for the Valley Electric Association (VEA) 138 kV system demonstrates that there could be significant overload issues with integrating the base and sensitivity portfolios as proposed in the VEA service area.[9] CAISO recommends upgrades to VEA's connecting 230 kV system but does not consider upgrades to the 138 kV system. Cal Advocates recommends that CAISO consider upgrades to the 138 kV system as well to address the noted overload issues.

For the Gridliance West (GLW) 230 kV system constraints, CAISO’s results reveal that significant overloads may occur with the integration of the sensitivity portfolio on the GLW 230 kV system. To respond to these identified overloads with the integration of the sensitivity portfolio, CAISO presents several mitigation alternatives.[10] However, these alternatives represent a breakdown in the processes that the CPUC and the CAISO have established for identification and consideration of new transmission projects.[11] These alternatives were not assessed during the CPUC’s busbar mapping process, as part of the Integrated Resources Planning (IRP) proceeding, and as such the CPUC and stakeholders have not had the chance to assess whether these project alternatives are cost-effective and efficient ways to access renewable energy.[12]

The CPUC’s resource-to-busbar mapping process attempts to geographically locate new resources at substation interconnection points on bulk transmission networks to help assess where transmission upgrades might be needed to support the CPUC’s recommended resources portfolio.[13] This process identifies upgrades that may be triggered by the resource portfolio.[14] The proposed GLW Alternatives project mitigations 2, 3, and 4[15] have not been included in the CPUC’s IRP bus-bar mapping process.

GLW Alternatives 2, 3, 4 would connect the GLW system to SCE’s Lugo substation, at a cost of $2.56 billion, $2.84 billion, and $2.73 billion, respectively.[16] These projects would substantially increase the amount of revenue that GLW would collect from all CAISO ratepayers, and because these projects have not been vetted in the CPUC’s IRP process, it is unclear what benefits CAISO ratepayers would receive for this significant proposed investment. CAISO’s analysis also does not specify the incremental megawatts that these alternatives would unlock to justify these upgrades.

These alternatives should first be evaluated in the CPUC’s IRP process. In addition, CAISO should consider establishing a working group that would assess the viability of resources in southern Nevada and quantity of these resources needed to meet the state’s clean energy goals, with the goal of determining if additional, large-scale transmission connections represent cost-effective investments.

To conclude, since the GLW alternatives mitigations presented are only necessary to support the sensitivity portfolio and are not required to support the integration of the base portfolio, they should be further studied and preferably through the recommended working group.[17]

[1] CPUC Decision Adopting 2021 Preferred System Plan, R-20-05-003, CPUC, December 22, 2021 at p. 94.

[2] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 15.

[3] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 29.

[4] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 41.

[5] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 41.

[6] ITP Evaluation Process Plan for the North Gila – Imperial Valley #2 Transmission Project, WestConnect, June 15, 2022. Available at http://www.caiso.com/Documents/NorthGila-ImperialValley2-FinalInterregionalTransmissionProjectEvaluationProcessPlan.pdf.

[7] ITP Evaluation Process Plan for the North Gila – Imperial Valley #2 Transmission Project at p.3.

[8] ITP Evaluation Process Plan for the North Gila – Imperial Valley #2 Transmission Project, WestConnect. June 15, 2022. Available at http://www.caiso.com/Documents/NorthGila-ImperialValley2-FinalInterregionalTransmissionProjectEvaluationProcessPlan.pdf.

[9] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 51.

[10] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slide 57.

[11]CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slides 60-65.

[12] Specifically, these projects did not appear in the Busbar Mapping Dashboard created as part of the portfolios transferred from the CPUC to the CAISO for the 2022-23 Transmission Planning Process (Available at https://www.cpuc.ca.gov/-/media/cpuc-website/divisions/energy-division/documents/integrated-resource-plan-and-long-term-procurement-plan-irp-ltpp/2019-2020-irp-events-and-materials/busbarmapping_30_mmt_hesensitivity_dashboard_07_01_22.xlsx.)

[13] Methodology for Resource-to-Busbar Mapping and Assumptions for the Annual TPP. CPUC Energy Division. December 2021. Available at https://files.cpuc.ca.gov/energy/modeling/Busbar%20Mapping%20Methodology%20for%20the%20TPP_V2021_12_21.pdf.

[14] See the “2_Tx_Calculator” tab of the Busbar Mapping Dashboard.

[15] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slides 60-65.

[16] CAISO Policy-Driven Deliverability Assessment Preliminary Results (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022, slides 60-65.

[17] CAISO Fifth Replacement FERC Electric Tariff, Section 24, Comprehensive Transmission Planning Process, September 9, 2020, Section 24.4.6.6. Policy Driven Transmission Solutions. Per the CAISO tariff, if a transmission project is identified as needed for the base case portfolio and at least a significant percentage of the stress scenario portfolios, it may be recommended for approval as a Category 1 policy-driven project in the current TPP cycle.

6.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SDG&E area.

Cal Advocates has no comment on this topic at this time.

7.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the PG&E area.

Request for Project Cost Information

CAISO does not provide enough information to establish that the proposed mitigations for PG&E area are just and reasonable. Indeed, the proposed mitigation projects for the PG&E area did not include any cost information. CAISO's Business Practice Manual states that one of the criteria for determining the need for policy-driven projects is "the expected planning level cost of the transmission solutions as compared to the potential planning level costs of other alternative transmission solutions."[1] CAISO should provide the estimated cost information for each proposed PG&E project and for each alternative considered to allow stakeholders to analyze the merits of the proposed projects in light of alternative project cost.

PG&E Unable to Complete its TPP-Approved Projects in a Timely Manner

PG&E has demonstrated that it is not capable of completing its TPP-Approved projects in a timely manner. Figure 1. below shows the percentage of finished CAISO-approved projects from 2007 to 2020 for the three major investor-owned utilities (IOUs) - PG&E, SCE, and San Diego Gas and Electric Company (SDG&E).[2] PG&E completed 73% of its projects, SCE completed 77% of its projects, and SDG&E completed 83% of its projects. Based on these percentages, PG&E appears to be the least likely to be able to finish its own projects. Additionally, as noted in the CAISO Transmission Development Forum workbook, PG&E has a total of 83 CAISO TPP-approved transmission projects that are delayed or pending operational status to date. One of PG&E’s severely delayed projects, the Metcalf-Piercy & Swift and Newark-Dixon Landing 115 kV Upgrade, was approved by CAISO nearly 20 years ago, in 2003. [3] Indeed, PG&E has seven delayed projects that were approved before 2010 and 13 projects that were approved prior to the 2011 TPP.

It is critical that CAISO scrutinize the need for previously approved transmission projects that are severely delayed. If a project was found to be necessary 20 years ago but is still not built and isn’t scheduled to be built for another four years, it is imperative that CAISO determine if the same system conditions exist today as at the time of approval. Over the last 20 years system conditions have changed dramatically and new technology solutions are now available to address system issues at lower costs. Ratepayers should not be burdened with funding transmission projects that have become unnecessary or obsolete due to changes in grid resources, demand, and system conditions since the project was approved. More importantly, re-evaluating projects on hold or delayed for 10 years or more would allow ratepayers to benefit from advances made in lower cost grid enhancing technologies to address system issues.

Figure 1: This graph shows the percent of each utility’s finished projects out of each utility’s CAISO-approved projects from 2007 to 2020. PG&E completed 73% of its projects, SCE completed 77% of its projects, and SDG&E completed 83% of its projects.

It is critical, given the urgency of the climate crisis and California’s efforts to both maintain reliability and transition its energy sector to zero-carbon resources, that transmission projects are not unnecessarily delayed.

PG&E Northern Area

Cal Advocates recommends that the CAISO provide all the information used in conducting Policy Assessment studies, including projected load data sets and all inputs, conditions, and assumptions along with prepared detailed study results and recommendations to stakeholders. This will help stakeholders better understand the Policy Assessment analysis.

PG&E Southern Area

On-Peak Constraints – Sensitivity Case Only

The study results for the on-peak constraints identify overloads with the integration of the sensitivity portfolio and as a result, CAISO recommends reconductoring several lines. During the November 17, 2022, CAISO TPP meeting, the presenter mentioned that a remedial action scheme (RAS) was considered for each of the lines, but CAISO chose to propose line reconductoring. No further information was provided regarding why RAS would not work as a project alternative.

Given the lack of information regarding the viability of RAS to address noted overloads with the sensitivity portfolio and that no overloads were observed with the integration of the base portfolio, CAISO should continue to study the proposed reconductoring projects and possible alternatives.

Off-Peak Constraints – Sensitivity Case Only

CAISO discusses eight potential mitigations to address over loads for the off-peak constraints in the sensitivity-only case listed on slide 109 of CAISO’s November 17, 2022, presentation. CAISO frames these potential mitigations as needed “if economic." This suggests that the proposed mitigations are not needed for policy reasons alone.[4] These eight projects are also not needed to address overload issues with the base portfolio. Among these eight proposed projects are three proposed line reconductoring projects and no information is provided on alternatives considered to these costly reconductoring projects. Also, no cost information was provided for any of these projects. Without information on the alternatives considered and their costs and the costs of the selected mitigations, stakeholders cannot assess the projects in a meaningful way. CAISO should provide information on the costs of proposed projects and possible mitigation alternatives considered. Since the eight projects mentioned are not needed for the base portfolio, CAISO should perform further studies to determine if these projects provide policy and or economic benefits in future TPP cycles.[5]

[1] CAISO Business Practice Manual Version 23.0, CAISO, March 18, 2022, at p. 45, Section 4.6.1.(c). Available here: https://bpmcm.caiso.com/BPM%20Document%20Library/Transmission%20Planning%20Process/Transmission_Plannig_Process_BPM_Version_23_03182022_Redline.pdf.

[2] This data was compiled from CAISO-approved transmission projects that were found to be needed from each year’s final CAISO Transmission Plan from year 2007 to 2019-2020. It was compared against the unfinished projects listed in the final CAISO 2021-2022 Transmission Plan for each respective year. CAISO 2021-2022 Transmission Plan, CAISO, March 17, 2022, at pp. 373-376, Table 8.1-1: Status of Previously Approved Projects Costing Less than $50 M and Table 8.1-2: Status of Previously Approved Projects Costing $50 M or More.

[3] CAISO 2021-2022 Transmission Plan, CAISO, March 17, 2022, at pp. 373-376, Table 8.1-1: Status of Previously Approved Projects Costing Less than $50 M and Table 8.1-2: Status of Previously Approved Projects Costing $50 M or More.

[4] CAISO 2022-2023 TPP Presentation, Nov 17, 2022, slides 143-358 of the lists several potential mitigations, such as “Reconductor if economic,” “Increase area export capacity if economic, “and “Evaluate existing reactor or reconductor if economic.”

[5] CAISO Fifth Replacement FERC Electric Tariff, Section 24, Comprehensive Transmission Planning Process, September 1, 2020, P. 22, Section 24.4.6.6. Available here: www.caiso.com/Documents/Section24-ComprehensiveTransmissionPlanningProcess-asof-Sep1-2022.pdf.

8.

Please provide your organization’s comments on the Preliminary Economic Analysis Results.

Southwest Intertie Project-North

CAISO continues to evaluate the South-West Intertie North (SWIP-North) project in the TPP to determine if this project has economic and or policy benefits that are greater than the project costs. SWIP-North has a cost estimate of $636 million in 2020 dollars and would provide approximately up to 1,100 MW of bi-directional transmission capacity between Midpoint substation in Idaho and Harry Allen substation in Nevada. Through this link, SWIP-North could provide California access to Idaho renewable resources including wind.[1] The 2021 Transmission Plan did not determine that SWIP-North would generate ratepayer benefits that would justify the project costs. In addition, the capacity factor for wind in Idaho is considerably less than New Mexico or Wyoming wind at 33.9% versus 41.4 to 42%, respectively.[2] Therefore the benefit to cost ratio for accessing Idaho wind was considerably less than from Wyoming or New Mexico. Cal Advocates recommends that CAISO continue to compare the benefits of accessing Idaho wind versus Wyoming and New Mexico wind, considering the ratepayer benefits with a subscriber-based project versus a fully ratepayer funded project.

Pacific Transmission Expansion Project

The Pacific Transmission Expansion (PTE) project consist of 2,000 MW of controllable high-voltage direct current (HVDC) subsea transmission cable that connects northern and southern California via submarine cables in the Pacific Ocean just off the coast of California. This project, as proposed, would have transfer capacity of 2,000 MW to and from PG&E area and the SCE/SDG&E area. The PTE project would run parallel to the lines in Path 26 and thus could potentially reduce congestion on Path 26. PTE’s current cost estimate (from 2021) is $1.85 billion. CAISO production cost modeling simulation of PTE in 2021 did not demonstrate that the PTE could significantly reduce congestion on Path 26 to justify its cost. Also, the production cost modeling results with PTE demonstrated that congestion could also increase on Path 15.[3]

Cal Advocates recommends that the economic risks associated with this project be factored into CAISO’s analysis. California is served by only three HVDC transmission lines, which include: (1) the 3,100 MW Pacific Intertie; (2) the 2,400 MW Intermountain Power Project (Path 27), and (3) the 400 MW Trans Bay Cable. Given the state’s limited experience with HVDC lines, choosing an HVDC subsea alternative could result in massive cost over-runs and/or project delays. For example, the Trans Bay Cable line’s original cost estimate of $200 million later increased to $571.9 million, which exceeded the 50% project cost cap.[4]

North Gila-Imperial Valley #2

For the 2022 TPP cycle, the North Gila-Imperial Valley #2 project developer and Imperial Irrigation District (IID) jointly submitted the North Gila-Imperial Valley #2 project for economic benefit consideration. The North Gila-Imperial Valley #2 project developer also submitted this project to CAISO and WestConnect for cost recovery through the Interregional Transmission Project Evaluation process. As mentioned previously, this line connects to the IID, and IID proposes an investment partnership. However, all the terms and details of this partnership are unknown at this time. Since the Interregional Transmission Planning Evaluation for this project is underway, it is also not clear whether California ratepayers would receive sufficient benefits to justify a CAISO partnership in this project. Given the multiple benefits (reliability, economic etc.) that IID may gain with this project,[5] Cal Advocates recommends that the CAISO analysis of this project consider the western interconnection-wide benefits to determine the full extent of benefits and beneficiaries for this project. Cal Advocates also recommends that the CAISO determine if the project benefits to CAISO ratepayers justify any level of partnership in this proposed new line, and the maximum level of participation based on determined benefits. IID proposes to pay for roughly 1/3 of the project, but it is not known that California’s benefits would justify funding the remaining project costs.

Fresno Avenal Area Congestion

Cal Advocates notes that projects in the Fresno Avenal Area were studied in prior TPP cycles. In the 2019-2020 TPP, CAISO selected the PG&E Gates-Tulare Lake 70kV line in the Fresno Avenal Area for further study due to the area’s impact on the entire CAISO system and heavy congestion in the area.[6] Specifically, there are long hours of congestion on the Kettleman Hills Tap to Gates 70 kV section of the Gates-Tulare Lake 70 kV line. PG&E proposed reconductoring the Gate-Tulare Lake 70 kV line to address this issue. This congestion occurs mainly when solar output is high in summer months.[7] In 2019, CAISO found that the benefits of the proposed upgrade didn’t justify the costs. Cal Advocates notes that renewable curtailment has noticeably reduced in the PG&E Fresno area due to additional energy storage capacity in the area,[8] and recommends the CAISO consider grid enhancing technologies such as energy storage to address any significant remaining congestion issues in the Fresno Avenal area.

Inyokern 230 kV Upgrade

SCE submitted the Inyokern 230 kV upgrade to address congestion in the NOL area. This area has the longest hours of congestion and the highest cost to the system (with congestion costs estimated at $77.93 million).[9] Cal Advocates supports the consideration of reconductoring the 115 kV Kramer-Victor line to address congestion in the SCE NOL area and recommends this project be evaluated for both policy and economic benefits.

Cal Advocates also recommends that energy storage be considered as part of the solution to address issues in the SCE NOL area. The 2018-2019 Transmission Plan noted that because the Kramer and Inyokern zones are in a radial pocket, they can experience severe congestion due to high levels of behind the-meter solar especially during off-peak hours.[10]

Moss Landing – Las Aquilas 230 kV Line Reevaluation

Vistra requested a study to identify cost-effective solutions to address transmission congestion on the Moss Landing – Las Aguilas 230 kV line in the PG&E areas. The 2021 TPP observed that congestion on this line was correlated with solar generation output in the PG&E Fresno Area during the summer months.[11]

In prior comments, Cal Advocates requested that grid issues on the Moss Landing 230 kV line be reassessed with the current energy storage capacity expected in the Moss Landing area.[12] During the February 7, 2021, TPP Meeting discussion on this project, CAISO acknowledged that it had not evaluated the Vistra Moss Landing energy storage expansion project.[13] The original energy storage project at 400 MW at Moss Landing is now complete. Vistra also recently signed a resource adequacy agreement with PG&E to expand this existing Moss Landing energy storage facility to 1,500 MW by 2026. For this reason. Cal Advocates also recommends reevaluation of the project needs for this line and the previously approved 10 ohms series reactor project, to determine if this upgrade is still needed. [14]

Gridliance West Upgrades

Regarding the economic planning study request from Gridliance West (GLW) for a GLW 500 kV upgrade and a GLW Geothermal upgrade project, Cal Advocates recommends that the CAISO establish a working group to confirm the available geothermal resources in southern Nevada to meet the state’s clean energy goals and options to access these resources. This working group would be open to all interested CAISO stakeholders and would assess the viability of resources in southern Nevada with the goal of determining if additional and significant transmission upgrades to GLW system would be cost-effective investments to meet California’s clean energy goals.

California Oregon Intertie and Wyoming Wind Congestion Study

CAISO’s production cost modeling results for the base and sensitivity portfolios on the California Oregon Intertie (COI) indicate that wind from Wyoming is causing congestion on this Intertie.[15] If wind from Wyoming can now travel to California via PacifiCorp transmission lines and cause congestion on the COI, Cal Advocates recommends that CAISO include in its evaluation of out-of-state wind options, how California could schedule access to Wyoming wind through PacifiCorp’s transmission system.

[1] 2021-2022 Transmission Plan, CAISO, March 17, 2022 at p. 305.

[2] 2021-2022 Transmission Plan, CAISO, March 17, 2022 at p. 307.

[3] 2021-2022 Transmission Plan, CAISO, March 17, 202 at p. 290.

[4] An Introduction to Trans Bay Cable, (Presentation), February 2011, SteelRiver Infrastructure Partners, slide 13.

[5] North Gila Imperial Valley #2 500 kV Transmission Project (Presentation), ITC Grid Development and Southwest Transmission Partners, LLC, May 18, 2018 at p. 9.

[6] 2019-2020 Transmission Plan, CAISO, March 25, 2020 at p. 247.

[7] 2019-2020 Transmission Plan, CAISO, March 25, 2020 at p. 272.

[8] CAISO Preliminary Economic Assessment, (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022 at p. 19.

[9] CAISO Preliminary Economic Assessment (Presentation) 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022 at p.10.

[10] 2018-2019 Transmission Plan, CAISO, March 29, 2019 at p. 217.

[11] 2021-2022 Transmission Plan, CAISO, March 17, 2022 at p. 295

[12] Cal Advocates Comments on Draft 2021-2022 Transmission Plan, 2021-2022 Transmission Planning Process, February 22, 2022 at p. 14.

[13] California ISO 2021-2022 Transmission Planning Process – Draft Plan and Draft 20-Year Transmission Outlook Meeting, Customized Energy Solutions, February 9, 2022 at p. 14.

[14] 2021-2022 Transmission Plan, CAISO, March 17,2022 at p. 299

[15] CAISO Preliminary Economic Assessment (Presentation),) 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022 at p.13.

9.

Please provide your organization’s comments on the Preliminary LCR study results for the North region.

Long-Term Local Capacity Technical Study: North Region

Cal Advocates recommends that CAISO provide all the information used in conducting local capacity requirements (LCR) studies, including projected load data sets and all inputs, conditions, and assumptions along with prepared detailed study results and recommendations to stakeholders. For example, in the 2032 Draft Long-Term LCR Study Results Humboldt Area, (Slides 1 – 7, presentation pages 214-216) the Local Capacity Requirement shows 182 MW as the projected area load without qualification. CAISO should clarify whether this is an evaluation for a summer peak scenario or whether it is for the winter demand scenario. Also, for CAISO’s proposed topology changes, (Slide 3) the Resource Addition of a 15 MW energy storage system may be sufficient for a summer peak scenario but would likely be inadequate for a winter demand scenario that could require an eight to 12 hours of energy storage system. Cal Advocates recommends the CAISO specify the sensitivity, such as summer on-peak in which the proposed 15 MW of energy storage would be useful. Cal Advocates also recommends that for winter peaking areas, that studies be performed to determine energy storage capacity to address winter peaking needs and that the results be presented to stakeholders.

10.

Please provide your organization’s comments on the Preliminary LCR study results for the South region.

Cal Advocates has no comment on this topic at this time.

11.

Please provide your organization’s comments on the Special Study Reduced Reliance on Aliso Canyon Gas Storage.

Cal Advocates supports additional cost studies for the proposed Alison Canyon Gas Storage alternatives provided on slides 16 and 17 (presentation pages 352 and 353) comparing Alternatives 1A, 2B, 2C, 7B, and 8B. Cal Advocates supports cost-effective alternatives that also provide policy benefits through increased access to lower cost resources.

To the extent that the North Gila – Imperial Valley 500 kV line is being considered in this study, please refer to Cal Advocates’ concerns about this project in its response to (the North Gila – Imperial Valley Section in the response to Question 5).

12.

Please provide any additional comments on the November 17, 2022 stakeholder meeting.

Cal Advocates echoes the comments from two speakers at the CAISO Symposium on November 9, 2022, on the CEO Panel in response to a question regarding the biggest system planning changes and challenges in the next five years. Specifically, regarding electrification of the grid, General Manager and Chief Executive Officer of Seattle City of Light stated that new building electrification codes are both exciting and scary because mandating these changes requires providing funds for ratepayers to participate in building electrification to reduce demand. However, figuring out the funds and programs to assist with this transition to electrifying the grid is still a challenge. Demonstrating this challenge, the subsidy for California’s heat pump water heater program ran out of money earlier in 2022. Due to overwhelming demand, program funding was suspended in all territories except southern California.[1] We agree with Seattle City of Light’s comments, that considerations of program funding, pacing and current inflation impacts should be considered in future electrification load forecasts and project need assessments.

Regarding the costs of the proposed transmission investments, the Los Angeles Department of Water and Power (LADWP), stated

A huge infusion of federal dollars is needed to make these changes for this future... there is no way that ratepayers of the west and beyond are going to be able to withstand the rate increases needed…if this is all on their backs.[2]

Cal Advocates agrees with the LADWP that it is necessary to consider other methods to finance large transmission infrastructure projects in-state and out-of-state, other than through the transmission access charge. Offshore wind transmission investments and out-of-state wind transmission investments will provide additional benefits to regions with respect to new jobs and economic growth, in addition to access to new renewable resources. For California, offshore wind is anticipated to bolster the economies of California coastal communities and increase workforce development, supply chain growth, and new renewable resources.[3]

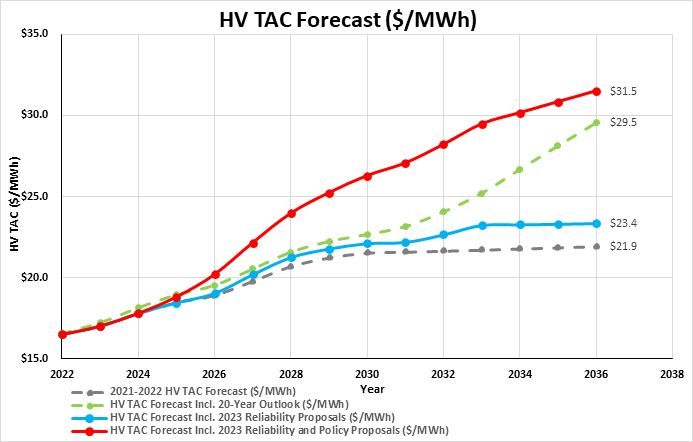

High-Voltage Transmission Access Charge Forecast Analysis

To illustrate the impacts of the presented 2022-2023 TPP proposed policy mitigations, Cal Advocates updated CAISO's 2021-2022 High Voltage (HV) Transmission Access Charge (TAC) forecast (shown below) to include the combined revenue from all participating transmission owners (PTO) that submitted reliability projects and the cost estimates for policy mitigations for the 2022-2023 TPP cycle. Figure 2. is Cal Advocates’ estimate of the baseline HV TAC forecast[4], as well the forecast of $30.5 billion capital expenditures estimated in CAISO's 20-Year Transmission Outlook.[5]

It should be noted that the HV TAC forecast presented in Figure 2. likely underestimates the cost impact to ratepayers, as the CAISO did not provide complete cost estimates for several proposed policy mitigations in the San Diego area,[6] and failed to provide any cost estimates for the proposed policy mitigations in the PG&E area.[7]

Figure 2: HV TAC Forecast ($/MWh)

[1]Tech Clean California at https://techcleanca.com/incentives/ and https://tech.freshdesk.com/support/solutions/articles/69000812680)

[2] California Stakeholder Symposium, November 9, 2022, Session 1, CEO Roundtable, 53:00-55:00 minutes.

[3] California Offshore Wind Industry Report, Offshore wind California, November 2022 at p. 48.

[4] Cal Advocates used the CAISO 2021-2022 HV TAC Forecast model with baseline assumptions and updated annual revenue requirement projections based on the cost estimates and in-service dates, if provided, presented in the 2022-2023 TPP presentations. CAISO 2021-2022 HV TAC Forecast model available at: http://www.caiso.com/Documents/2021-2022TransmissionAccessChargeForecastModelwithNewCapital.xlsx

[5] CAISO 20-Year Transmission Outlook, CAISO, May 2022 at p. 3.

[6] CAISO Preliminary Economic Assessment (Presentation), 2022-2023 Transmission Planning Process Stakeholder Meeting November 17, 2022, November 17, 2022 at pp.89-94.

California Western Grid Development, LLC

Submitted 12/05/2022, 04:51 pm

1.

Please provide your organization’s comments on accessing out-of-state Idaho wind resources.

Cal Western does not have comments on out-of-state Idaho wind resources

2.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the North region.

Cal Western Does not have comments on the Recommended Reliability Projects less than $50 million

3.

Please provide your organization’s comments on the Recommended Reliability Projects less than $50 million for the South region.

Cal Western Does not have comments on the Recommended Reliability Projects less than $50 million

4.

Please provide your organization’s comments on the MIC Expansion Requests.

Cal Western does not have comments on the MIC Expansion Requests

5.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SCE and GLW areas.

Cal Western is not surprised to see that the CAISO has found a considerable amount of new transmission will be needed to support the CPUC Base and Sensitivity Portfolios. We are pleased the CAISO has included an assessment of deliverability needs within the LA Metro Study area, not simply delivery to the LA Metro Area.

However, we urge the CAISO not to view the problem too narrowly. More than deliverability is at stake. Finding the best solutions to achieve deliverability may require stepping back and looking at a broader range of needs for the LA Metro Area.

The 11/17/22 CAISO presentation shows at Slide 52 of 358 alternative solutions ranging in cost from $810 million to $860 million to address deliverability constraints within the SCE Metro study area.

Cal Western urges CAISO review the robustness of these project alternatives with a broader set of objectives in mind, e.g., with a goal of not only meeting deliverability needs driven by the assumed generator mapping of new resources, but additional needs driven by policy objectives such as reduced LCR requirements, reduced reliance on the Aliso Canyon Gas Storage facility, enabling offshore wind, reduce wildfire risk and increased wildfire mitigation, and repurposing legacy transmission that was built to deliver coast fossil generation output to load.

In other words, if the CAISO were to approve a subsea transmission line into the LA Basin such as shown in transmission alternates 1A, 2B or 2C from the CAISO special study on Reduced Reliance on Aliso Canyon (slide 354 of 358) how might that change the need for the $810 to $860 million of SCE Metro area deliverability projects?

And, by focusing on simply solving deliverability needs the CAISO may miss valuable opportunities. Slide 350 of 358 of the Stakeholder Presentation identifies major new transmission alternatives needed to bring resources into SCE’s Metro LA service area to accommodate the potential closing of Aliso Canyon, including a project like PTEP. PTEP was not designed simply to allow the State the option to reduce reliance on Aliso Canyon. Yet, CAISO’s conclusion (see, slide 350) is correct, PTEP can be an important factor to support the policy objective of reduced reliance on Aliso canyon. But PTEP does so much more. PTEP also:

- Delivers new clean energy into transmission constrained West Los Angeles (“LA”) and reduces Local Capacity Requirements (“LCR”) on a MW for MW basis.

- Reduces reliance on fossil generation in the LA Basin area, improves air quality generally and particularly in disadvantage communities.

- Does not involve much if any wildfire risk and mitigates the risk of wildfires reducing power flows from the East (SB 887 provides that “new transmission facilities should be designed to minimize the risk of Transmission-triggered wildfires.”[1]

- Allows for the delivery of offshore wind or terrestrial energy from northern and central California and provides another outlet for energy delivered to Diablo Canyon if the closing of Diablo Canyon is delayed further and absorbs the transmission capacity at Diablo Canyon.

- Reduces congestion on Path 26 and can move power North to South or South to North.

- Provides the CAISO with tremendous operating flexibility as the VSC Converters provide the same operating flexibility as large generators and will reduce congestion within the SCE Metro area and may reduce the need for $810 to $860 million of new Metro Area transmission.

- Produces other quantifiable economic benefits that offset half of its Project cost not counting unquantifiable benefits like wildfire risk mitigation and clean air benefits.

We urge CAISO to select projects based on the cumulative benefits projects provide in meeting a broad range of policy, economic and deliverability objectives.

[1] SB 887; Section 454.57 (b)(7).

6.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the SDG&E area.

Cal Western does not have comments on the Preliminary Policy Assessement Results for the SDG&E area

7.

Please provide your organization’s comments on the Preliminary Policy Assessment Results for the PG&E area.

Cal Western does not have comments on the Preliminary Policy Assessment Results for the PG&E area

8.

Please provide your organization’s comments on the Preliminary Economic Analysis Results.

Cal Western does not have comments on the Preliminary Economic Analysis Results

9.

Please provide your organization’s comments on the Preliminary LCR study results for the North region.

Cal Western does not have comments on the Preliminary LCR study results for the Northern Region

10.

Please provide your organization’s comments on the Preliminary LCR study results for the South region.

Cal Western is also pleased that CAISO will be updating LCR studies as part of this 2022-23 TPP. We are not surprised that LCR requirements are increasing given the higher load forecast in this year’s base case and sensitivity forecasts and the continued need for transmission into transmission constrained major load centers such as the LA Basin.

In past LCR studies CAISO has quantified the cost of the LCR deficiency using an analysis of LCR procurement cost estimates specific to each transmission constrained local area and compared that local RA cost to system RA costs. The CAISO has then evaluated the benefit of potential new transmission investments based on the delta between system RA costs and Local RA costs.

While Cal Western continues to believe this approach vastly understates the value of new transmission in meeting LCR requirements, Cal Western has three specific requests concerning the CAISO LCR studies this year:

- Please share with stakeholders the $/KW costs the CAISO intends to assume in its economic evaluation of LCR requirements procurement costs for each local transmission constrained area, and especially the LA Basin and the source of that $/kw estimate.

- Please share with stakeholders the $/kw cost CAISO plans to assume for any System RA deficiency and the source of that $/kw estimate.

- Cal Western believes that by 2030 the marginal resource for meeting CAISO system RA will be storage/batteries. Please share with stakeholders what resource category CAISO will assume to be on the margin for calculating marginal system RA for use in LCR economic analysis in this 2022-23 TPP.

11.

Please provide your organization’s comments on the Special Study Reduced Reliance on Aliso Canyon Gas Storage.

Cal Western is pleased to see the CAISO is evaluating several transmission alternatives to meet the state policy objective of reducing reliance on Aliso Canyon Gas Storage facility. Several of these alternatives include a multi-terminal HVDC subsea VSC line from the Diablo Canyon area to the LA Basin and San Diego areas.

At Slide 354 the CAISO notes it is in the process of assessing applicable dynamic models that will be required for dynamic stability analysis. Cal Western supports and applauds this effort by the CAISO. As the CAISO knows, the industry is moving toward inverter-based technologies, including HVDC transmission lines. Modeling of grid forming VSC is lagging. With the massive deployment of inverter technology underway and yet to come in California there is an urgent need for the CAISO to exert leadership in finding and promoting standard models and approaches for assessing HVDC VSC transmission in the Western United States. As the largest transmission planning and operating organization in the West, the CAISO has a critical role to play in both the context of model development for this TPP and within the broader WECC.

Cal Western has been working with industry experts for more than a year to develop dynamic stability models for HVDC VSC lines. One of our goals has been to find modeling solutions that work in a PSLF environment. We are now able to do dynamic analysis of HVDC VSC lines using PSLF. We encourage the CAISO to look at the work we have completed, which was submitted to the CAISO on a confidential basis.

Aside from the efforts of Cal Western, there have also been recent dynamic modelling advances elsewhere in North America and Europe. We encourage CAISO to continue its assessment of dynamic modelling tools so that modeling does not stand in the way of approving needed transmission in this 2022-23 TPP.

12.

Please provide any additional comments on the November 17, 2022 stakeholder meeting.

Comments of California Western Grid on CAISO’s November 17, 2022, Transmission Planning Presentation to Stakeholders on the 2022-2023 TPP

Three Rivers Energy Development, LLC (TRED) is an Independent Transmission Developer that is developing the proposed Pacific Transmission Expansion Project (“PTE Project” or “PTEP”) on behalf of California Western Grid Development, LLC. (“California Western Grid” or “Cal Western”). The PTE Project is a 2,000 MW controllable HVDC subsea transmission cable that the California Independent System Operator (“CAISO”) has found will allow new and existing supply, available to the Diablo Canyon 500 kV switchyard, or new offshore wind to be delivered to the LA Basin and Big Creek Ventura and reduce local capacity requirements while also solving other issues. The PTE Project is described in Section 4.8.8 of the 2020-2021 CAISO Transmission Report issued March 24, 2021. The PTE Project is also currently being restudied by the CAISO as part of 2022-2023 CAISO Transmission Planning Process (“TPP”).

Introduction

California Western Grid is pleased to submit comments on the CAISO November 17, 2022 stakeholder briefing , that outlined, among other things, CAISO’s preliminary analysis of current policy, economic and deliverability driven transmission needs and solutions under consideration.[1] As an initial matter, we note that on October 14, 2022, we submitted comments on behalf of California Western Grid regarding the CAISO’s Strawman Proposal dated September 22, 2022 (“Strawman Comments”). In those comments we commended the CAISO for recognizing that changes to the TPP are needed immediately if the CAISO is going to be able to plan and approve transmission to accommodate the tripling of clean energy resources the 2021 Joint Agency Report to the Legislature found is necessary to meet “SB 100”[2] goals. We also detailed the various public policy findings embodied in SB 887[3] that new transmission is urgently needed to accommodate State public policy needs. We point out that considering SB 887, the CAISO must make considerable progress on planning and approving new transmission in the current 22-23 TPP pursuant to its FERC Tariff obligation to timely plan and approve transmission to meet State policy goals. We will not repeat those Strawman Comments but have attached them hereto as Attachment A.