Bay Area Municipal Transmission Group (BAMx)

Submitted 02/28/2024, 09:06 am

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Submission Title

First entry provide responses to questions 1-7.

Routinely Reevaluating the Need for All Previously-Approved Transmission Projects

2.

Has this issue been previously submitted?

No.

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the CAISO’s discretionary policy initiatives catalog submission.

The primary issue that the proposed initiative will address is as follows. The current CAISO transmission planning process (TPP) requires the CAISO to select mitigation projects for identified reliability criteria violations or to meet policy objectives with only rudimentary studies of the cost and environmental impact of those proposed projects. Since proposed transmission projects take a long time to permit and construct, there is a high chance that changed circumstances will affect the timing and selection of the most effective project to meet the reliability needs of policy objectives.

There are nearly thirty (30) projects that were approved by the CAISO under its annual TPP more than ten years ago (as early as in 2007) and have not begun their construction yet.[2] Certain Participating Transmission Owners (PTOs) appear to have put these projects on lower priority. In some cases, the PTO decision to delay the projects may be driven by financial constraints that the CAISO has no control over. Therefore, the question becomes, have the circumstances changed since the CAISO’s original approval of those projects more than a decade ago? Similarly, are the PTOs aware of different information that would affect the timing and need for certain CAISO-approved projects?

Although there is no systematic mechanism for project re-assessment, there are a couple of circumstances where this was accomplished. A good example of changing planning conditions is the CAISO reevaluation of the need for certain previously approved projects in the 2015-2016 and 2016-2017 Transmission Plan that resulted in cancellation and scope change for several major and small-scale transmission projects.[3] At that time, consistently declining load forecasts across the entire forecast period – especially for the 1-in-10 peak load forecasts - as well as higher than anticipated development of behind-the-meter solar photovoltaic generation meant many load-driven transmission projects were no longer needed.

Another example is the Trout Canyon-Lugo 500 kV Line with an estimated capital cost of $2 billion that CAISO recommended for approval in the Draft 2022-2023 Transmission Plan.[4] However, its approval was held back in the Final Transmission Plan due to a letter from Lotus Infrastructure Partners on April 25, 2023,[5] which identified an alternative solution, causing the CAISO additional time to assess.[6] If this alternative had not been proposed at the end of the 2022-2023 TPP cycle, the CAISO likely would have approved the Trout Canyon-Lugo 500 kV line as one of the policy-driven transmission projects in the Final Transmission Plan. It is the CAISO’s standard practice to model all the previously-approved projects in the starting power flow cases that are used in a given transmission planning cycle.[7] So, had the CAISO approved the Trout Canyon-Lugo 500 kV line in the 2022-2023 Transmission Plan, it would have been modeled in the 2023-2024 TPP cases as given. Therefore, the continued need for the Trout Canyon-Lugo 500 kV line would not have been evaluated in the 2023-2024 TPP. Since the Trout Canyon-Lugo 500 kV line was not approved in the 2022-2023 TPP, the CAISO is evaluating whether that project is the most effective mitigation solution in the 2023-2024 TPP. The preliminary policy findings for the East of Pisgah Interconnection area do not identify the need for the Trout Canyon-Lugo 500 kV project.[8] BAMx believes this is an example of the need to reexamine the appropriateness of projects, even if they have been previously approved.

CAISO, as part of its annual TPP, sometimes tests and confirms the need for some, but not all, of the previously approved projects.[9] But, there needs to be a systematic process to select projects for re-evaluation and to re-evaluate all of the projects that are selected as part of each CAISO TPP.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] List of Approved Projects Transmission Planning Process, provided as part of Transmission Development Forum, January 2024.

[3] CAISO 2016-2017 Transmission Plan, p.1.

[4] CAISO Draft 2022-2023 Transmission Plan, p. 6 & 133, April 3, 2023.

[5] http://www.caiso.com/InitiativeDocuments/Letter-Alternative-to-Trout-Canyon-Lugo-500-kV-line-Apr242023.pdf

[6] CAISO Final 2022-2023 Transmission Plan, p. 82, May 10, 2023.

[7] CAISO 2023-2024 Transmission Study Plan, p.14.

[8]

[9] For example, the Fresno Area Preliminary Reliability Assessment Results identified the continued need for the following twenty-four (24) previously-approved projects. Source: CAISO 2023-2024 TPP Stakeholder meeting on September 26-27, 2023.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

BAMx requests the CAISO develop a stakeholder process to define a set of circumstances when such reevaluation would occur. We understand that there would be limitations to such a reevaluation process. Project cost could be one such criterion. Of course, regulatory issues like PTO recovery of costs for an abandoned project would need to be considered. But ratepayer costs to reimburse for early feasibility work would, for most examples, probably be more than offset by not having to build a project or selecting a better alternative with the latest information on the need for projects. One good option to consider would be to apply the proposed initiative as part of the existing annual transmission process. Under this option, the CAISO would delineate a detailed process to reevaluate the need for the previously approved transmission projects as part of the Transmission Study Plan at the beginning of each transmission planning cycle, in particular, at the February public stakeholder meeting #1 [Phase 1 of TPP]. The stakeholders would have the opportunity to provide feedback on the CAISO’s proposed plan as part of their comments on the Study Plan. The CAISO would provide a separate analysis of the continued need for the previously approved reliability-driven projects in its September public stakeholder meeting #2 to discuss the reliability study results and PTO’s reliability projects [Phase 2 of TPP]. A similar analysis would be provided for the previously-approved policy and economic-driven projects in its November public stakeholder meeting #3 to discuss the reliability study results and PTO’s reliability projects.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

If the CAISO assessment finds a continued need for the previously-approved project, especially in the near term, then it can urge the PTOs to prioritize those projects. On the other hand, if the CAISO finds those projects are either unnecessary, or their scope needs to be altered in response to changed circumstances, they can either be canceled or rescoped. In the latter case, the PTOs can then prioritize the other transmission projects needed for reliability or policy needs to interconnect renewables. In either case, the proposed discretionary initiative will support one of CAISO’s strategic objectives of reliably and efficiently integrating new resources by proactively upgrading operational capabilities. It is also consistent with CAISO’s other strategic objective of providing highly responsive and inclusive stakeholder engagement. Without a systematic approach to reevaluate the need for all previously-approved projects, some transmission projects will be built even if they are not needed, and delay the construction of those transmission projects that are truly needed to meet the reliability and state policy goals.

6.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

See response to Q.3 above.

7.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Yes. See response to Q.4 above.

8.

Submission Title

Second entry provide responses to questions 8-14.

Providing Local Regulatory Authorities with Better Guidelines to Develop Resource Portfolios in Close Proximity to the Existing Transmission Network

9.

Has this issue been previously submitted?

No.

10.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Currently, the CAISO provides input into the CPUC Integrated Resource Planning (IRP) capacity expansion process transmission capability information. For this purpose, the CAISO develops Full Capacity Deliverability Status (FCDS) and Energy-Only Deliverability Status (EODS) transmission capability estimates that limit the amount and deliverability status of candidate resources that can be selected or mapped in transmission-constrained areas. The information includes previously identified conceptual transmission upgrades along with an estimate of the associated incremental increase in transmission capability. The CAISO primarily relies on its prior TPP and generation interconnection studies to develop this data. However, this data does not go far enough in identifying how many more FCDS and EODS resources can be accommodated by adopting grid-enhancing technologies (GET), reconductoring the transmission facilities with advanced composite-core conductors, etc, on the existing transmission corridors. For example, one of the recent studies finds that large-scale reconductoring with advanced composite-core conductors can cost-effectively double transmission capacity within existing right-of-way (ROW) with limited additional permitting.[1] BAMx agrees with the study authors, on the rationale of using the high-temperature low sag (HTLS) conductors over opting for new corridors, i.e., their significantly faster realization, bypassing permitting delays and difficulties to secure new ROWs due to high population density, as well as significantly lower capex[2].

Currently, the determination of the transmission need in the CAISO TPP is driven by the resource portfolios provided by the CPUC for a given transmission planning cycle. So, if in any resource area or zone, there are no reliability planning or deliverability criteria violations, the CAISO does not identify the potential GETs or reconductoring projects that could allow for accommodating additional resources in those areas. Under the proposed initiative, the CAISO will perform analysis to expand upon their database to explore the existing ROWs' transmission capability fully. This appended transmission capability information can then be fed into the CPUC IRP, where CPUC will have the option to select resources in areas that may not necessarily be cost-effective from the resource cost standpoint but could be built more timely with relatively little transmission infrastructure delay and cost.

To better understand BAMx’s ask under the proposed initiative, we provide an example summarized in the table below.

|

Affected Zone

|

Existing Transmission Capability Based on Approved Transmission Plan (MW)

|

Expanded Transmission Capability by GETs and/or Reconductoring on existing RoW (MW)

|

Expanded Transmission Capability by Building New Transmission Network Upgrades (MW)

|

|

Zone A

|

1,000

|

Not Available

|

Not Available

|

|

Zone B

|

1,500

|

2,200

|

3,000

|

|

Zone C

|

1,200

|

Not Available

|

3,000

|

For Zone A, the past TPP resource portfolios and resource interconnections in the past generation interconnection (Cluster) studies have been accommodated on the existing transmission with a capability of 1,000MW. So, the CAISO has not performed any analysis to determine the additional FCDS or EODS resources that can be accommodated with GETs and/or the reconductoring of certain facilities can add to Zone A’s capability.

In the case of Zone B, the past resource portfolios (or interconnections in the generation interconnection studies) have exceeded the existing transmission capability of 1,500MW, and the CAISO has considered the additional capacity that GETs/reconductoring (and therefore identified the incremental MWs associated with it, i.e., 2,200MW). However, in the subsequent planning cycles, the level of resource portfolios became so high in Zone B that the CAISO also identified new network upgrades with an incremental capability of 3,000MW to accommodate those resources. So, in the case of Zone B, we have all the data that we need.

In the case of Zone C, given the high level of resource portfolio studied in the past TPP/Cluster studies, the CAISO never studied an intermediate level of resources that can be accommodated with GETs/reconductoring and only identified a major new transmission upgrade with an incremental capability of 3,000MW.

In a nutshell, BAMx’s proposed initiative will help identify the missing data/ information that the CPUC/LRA portfolios can use to select resources in Zone A and Zone C (highlighted in yellow cells in the above table).

[1] Chojkiewicz, Emilia, Umed Paliwal, Nikit Abhyankar, Casey Baker, Ric O’Connell, Duncan Callaway, Amol Phadke (February 14, 2024). “Accelerating transmission expansion by using advanced conductors in existing right-of-way”, Working Paper, Energy Institute at Haas, University of California, Berkeley.

[2] Reconductoring projects take less than half the time and are less than half the cost of new-build projects. Source: Ibid.

11.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

This initiative will operate in parallel to the existing annual transmission planning process, where the CAISO will develop a database that will identify the incremental FCDS and EODS resources that can be accommodated on each of the major existing transmission ROWs, assuming the deployment of GETs and reconductoring of transmission facilities. Some of the data is already available from the prior TPP cycles and generation interconnection studies. Additional data needs to be developed as part of the proposed initiative in coordination with the stakeholders. BAMx suggests a series of stakeholder workshops as the most suitable vehicle to start this initiative.

12.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

This initiative will directly meet CAISO’s following objectives.

- Reliably and efficiently integrate new resources by proactively upgrading operational capabilities;

- Strengthen resource adequacy and meet California’s SB 100 goals through long-term transmission planning and effective coordination with state agencies; and

- Provide highly responsive and inclusive stakeholder engagement and customer service.

13.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

The State is facing major challenges in meeting the ambitious regulatory and legislative policy goals in a timely manner. As described in response to Q.10 above, any new greenfield transmission solutions to accommodate renewable resources are bound to face major feasibility and permitting challenges relative to those that use and/or repurpose the existing transmission corridors. The sooner we plan and build the transmission infrastructure that we need to accommodate new resources, the higher the likelihood of meeting the state policy goals in a timely manner.

14.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

See responses to Q.10 and Q.11 above.

15.

Submission Title

Third entry provide responses to questions 15-21.

16.

Has this issue been previously submitted?

17.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

18.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

19.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

20.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

21.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

22.

Submission Title

Fourth entry provide responses to questions 22-28.

23.

Has this issue been previously submitted?

24.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

25.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

26.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

27.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

28.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

29.

Submission Title

Fifth entry provide responses to questions 29-35.

30.

Has this issue been previously submitted?

31.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

32.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

33.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

34.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

35.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Bonneville Power Administration

Submitted 02/28/2024, 02:14 pm

1.

Submission Title

First entry provide responses to questions 1-7.

Non-Generating Resources (NGR) bid cap under 831 conditions. (related to Price Formation but not currently in scope for PFE)

2.

Has this issue been previously submitted?

This issue has been brought up in the Price Formation Enhancements initiative. We are not aware that it has been introduced as a new initiative previously.

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

NGRs are currently limited to the $1000/MWh cap under 831 conditions (where the cap is allowed to move up to $2000). When exposed to $1000 hard price cap, NRGs are unable to control INC/DEC dispatch and help bring price stability to the market and reliability to the grid. For example, a hard $1000 INC cap could render BPA useless during the morning or evening peak to balance the grid (reliability) or provide price stability under extreme price scenarios. This leaves NRGs no choice but to exit the market when their limited charge/discharge capabilities are exhausted due to overly restrictive hard price cap.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities and participating resources. It specifically impacts storage resources. This initiative would consider whether the NGR bid cap is appropriate and/or if it leads to adverse price formation impacts on market participants. It may include analysis of impacts of the NGR bid cap on market outcomes.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities and participating resources. It specifically impacts storage resources.

6.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

There are not regulatory requirements for implementation dates. The urgency would be to improve market outcomes and resource availability for future times when 831 conditions occur and increase the incentives for NGR resources to remain in the market during these events.

7.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Data regarding the impact of the current policy of limiting NGR bids in 831 conditions may support analysis of the issue.

8.

Submission Title

Second entry provide responses to questions 8-14.

Operational enhancements in the WEIM.

9.

Has this issue been previously submitted?

The issues addressed by this initiative have been previously submitted as CIDI tickets.

10.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

This initiative is intended to address the following two operational issues:

1) Dual submittals of base schedules (multiple data sources for resilience). For base ETSRs between one entity and another, currently only one entity can submit. Enhancement would be to allow both entities to submit. (CIDI263858)

2) Allow for an EIM entity to set default limits for dynamic and static ETSRs. Currently, if an entity does submit a limit for an ETSR, it becomes 9999. (CIDI 248622)

11.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

The proposed initiative would address the two issues described above: 1) Whether dual submittals of base schedules can be permitted, including addressing any issues or concerns with the change. And 2) whether an EIM entity can set default limits for dynamic and static ETSRs.

12.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities.

13.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

There are not regulatory requirements for implementation dates. The consequences to not addressing this issue is continued errors or inefficiencies in the market which may need to be corrected after-the-fact due to one entity’s challenges in submitting base schedules or ETSR limits.

14.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

15.

Submission Title

Third entry provide responses to questions 15-21.

Settlements enhancements in the EIM.

16.

Has this issue been previously submitted?

No

17.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

This initiative is intended to address two settlements-related issues in the EIM:

- Assess CAISO practices regarding resolving settlements issue or disputes. Consider allowing price adjustments more than 5 days after operating day.

- Review policies and practices regarding resolution of inappropriate outcomes in the market and settlement-related resolution of the financial outcomes. i.e. If an entity submitted an incorrect base ETSR that resulted in a charge and credit, but both entities agree that the ETSR submitted was wrong. CAISO could develop practices to move that money around as a settlement adjustment between the BAs without rerunning the market.

18.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

The proposed initiative would address the two issues described above to improve market practices with regards to settlements.

19.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities.

20.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

There are not regulatory requirements for implementation dates. The consequences to not addressing this issue is continued errors or inefficiencies in the market settlement process.

21.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

22.

Submission Title

Fourth entry provide responses to questions 22-28.

Exploration of congestion revenue allocation alternatives and impacts and a potential initiative.

23.

Has this issue been previously submitted?

Unknown

24.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

This proposal is to conduct data analysis and then consider a stakeholder initiative based on the results of the data analysis. The initial request is to conduct a report from winter 2023/24 to better understand the congestion revenue allocation during the cold snap and winter period. Depending on the data, consider a stakeholder initiative regarding how congestion rent flows to non-CAISO entities in the day ahead market and EIM to inform EDAM and DAME congestion revenue allocation.

25.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Question 24 describes the scope of the initiative. It would address congestion revenue allocation in the EIM, current day ahead market, EDAM and DAME.

26.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities, participants in CAISO’s day ahead market, and future participants in EDAM and DAME.

27.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

There are not regulatory requirements for implementation dates.

28.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

A report from winter 2023/24 to better understand the congestion revenue allocation during the cold snap and winter period.

29.

Submission Title

Fifth entry provide responses to questions 29-35.

Automated approval of outage changes in the EIM.

30.

Has this issue been previously submitted?

No, although it has been brought up in meetings with the CAISO.

31.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

When outage changes are submitted to CAISO during real time, it requires a manual approval from CAISO. The proposal is to explore automated outage data approval to improve this process.

32.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

The initiative would explore automating approval of outage changes in the EIM. Currently CAISO’s outage submittal approval process is rather lengthy and manual. CAISO could automate the outage approval to avoid delayed CAISO responses that leads to updated outage data in WebOMS and incorrect Pmax calculations.

33.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Yes, this supports Initiative 3. The parties potentially impacted by the proposed initiative would include WEIM entities.

34.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

No known urgency. The consequences are issues with outdated outage data in WebOMS leading to inefficient operations in the WEIM.

35.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

California Department of Water Resources

Submitted 02/28/2024, 02:24 pm

1.

Submission Title

First entry provide responses to questions 1-7.

Investigate the increase in Real-time Congestion Offset (RTCO) charges observed in the 2021-2023 period. Initiate Stakeholder process to discuss how the RTCO settlement could be designed to be a true neutrality charge code.

2.

Has this issue been previously submitted?

No.

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

The RTCO charges normalized by Load Serving Entities’ (LSE) loads have increased steadily over the years. However, there was a significant increase, about 50%, in the RTCO charges observed in 2021 (compared with the year 2020) and in the year 2022 (compared with the year 2021 values). While investigating the causes for such increases, CDWR recommends CAISO initiate a Stakeholder process to discuss what can be done to transform the current RTCO into a true neutrality charge code that reverses to each market participant the respective market participant’s Hour Ahead (HA) and Real Time (RT) congestion rents.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

While investigating the causes for such increases, CDWR recommends that the CAISO initiate a Stakeholder process to discuss what can be done to transform the current RTCO into a true neutrality charge code that reverses to each market participant the respective market participant’s Hour Ahead (HA) and Real Time (RT) congestion rents.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

CDWR believes that the main objective of the RTCO settlement mechanism is to reverse the HA and RT congestion rents collected from a market participant. However, the RTCO charge code does not provide the CAISO stated neutrality and includes additional much larger charges than the reverse of the HA and RT congestion rents collected from the market participants.

6.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

CDWR believes the main objective of the RTCO settlement mechanism is to reverse the HA and RT congestion rents collected from a market participant. Not addressing this issue will further incur higher RTCO charges over time for all LSEs, as observed by CDWR.

7.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Existing data:

- RTCO data from 2009 – 2023.

Missing data:

- Reasons for spikes in the RTCO observed in2021 and 2022.

- Granular breakdown of the Charge Code 6774

8.

Submission Title

Second entry provide responses to questions 8-14.

Investigate the need to split the On-Peak CRR into two Times Of Use; On-Peak and Super-Peak

9.

Has this issue been previously submitted?

No.

10.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

The current CAISO CRR market design defines two time periods for the Time of Use (TOU): the On-Peak and the Off-Peak. The On-Peak covers the period from HE07 to Hour HE22, with the Off-Peak covering the remaining of the period from HE23 to HE06. The current CAISO CRR design for the TOU was suitable when the CAISO load demand curve was seen as a “one hump camel shape”. With the fast implementation of the renewable generation in the CAISO grid, the CAISO load demand curve changed to a “two humps camel shape” and the value of an On-Peak CRR that covers 16 hours from HE07 to HE22 has diminished considerably and become not only be unpredictable but also volatile. The diminishing of the On-Peak CRR value is most likely the result of big fluctuations that happen in the CAISO load demand curve which resulted in big fluctuations in the LMP (MCC) pricing. As such, from HE07 to HE16, the LMP (MCC) prices are extremely low, the CAISO Control Area has extra generation, and the direction of the congestion is most likely from the load to the generator. Starting at HE17 when the solar generation starts diminishing and the CAISO load demand starts increasing, CAISO LMP(MCC) prices become high due to the ramping need in the CAISO system. At this time the CAISO Control Areas lack generation to match the ramping demand which could be supplied by fast start natural gas power plants or by importing energy from outside California. This lack of generation and the fact that the fast start natural gas power plants are not necessarily located where the solar generation is could change the congestion direction and thus change the value of an On-Peak CRR.

11.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

During past Stakeholder CRR processes, CAISO said the above-described TOU issue could be fixed if the On-Peak TOU could be split in two: the Super-Peak TOU covering the HE17 to HE 21 period, and the New (Regular) On-Peak TOU covering the HE07 to HE16, and HE22.

12.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

The strategic objective of the CAISO CRR design as stated in the CAISO Tariff is to make the CRR processes feasible and give LSEs a possibility to recoup their Day Ahead congestion rents by participating in the CRR processes. LSEs’ ability to forecast congestion rents and request performant CRRs relies heavily on the continuity, and equilibrium in the LMP (MCC) pricing. With the heavy implementation of renewable resources, the values of the On-Peak congestion rents spread over 16 hours of TOU have lost these characteristics. CDWR believes a split of the current CAISO CRR design of the On-Peak TOU in two as mentioned above in #4 will bring continuity and equilibrium to the CRR market by making the CRR revenues more predictable, transparent, and reduce their volatility.

13.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

The sooner CAISO explores the possibility of splitting the current CAISO CRR On-Peak TOU in two as mentioned above in #4, the better the LSEs will be able to hedge their DA congestion rents with CRRs.

14.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Existing data:

With the existing CRR revenues data CAISO studies should be able to determine what is the best split for the On-Peak period.

Missing data:

15.

Submission Title

Third entry provide responses to questions 15-21.

Eliminate the Global Derate Factor (GDF) from the monthly CRR Allocation processes if the intended outcome of GDF application is minimal.

16.

Has this issue been previously submitted?

No.

17.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

CDWR recommends that CAISO perform studies to determine how much the GDF has helped improve the CRR Auction Efficiency. These studies should cover periods before and after the implementation of the CAISO Track 1B proposal. If the improvement provided by the GDF is minimal in comparison with the improvement provided by the Track 1B features, then the GDF can be removed from the monthly CRR allocation processes.

18.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

The initial scope of introducing the GDF in the CAISO CRR design was to improve the CRR Auction Efficiency by reducing the number of CRRs allocated in the monthly CRR processes. Currently, the GDF can reduce the Available Transmission Capacity (ATC) for the monthly CRR allocation up to 35%[1] of the CRR Total Transmission Capacity (TTC).

The use of the GDF greatly reduces LSE’s ability to adequately hedge its congestion rents by reducing the amount of CRRs LSEs could request in the monthly CRR allocation process. This issue is exacerbated for LSEs that rely heavily on hydrology or employ other resources that have variable output power forecasts due to the uncertain nature of the environmental effects in the state of California. For these LSEs, the participation in the annual CRR allocation process is very limited by the difficulty to forecast, more than a year ahead, such as hydrologic conditions, hence, to estimate the amount of congestion rents needed to be hedged with CRRs is difficult. To some extent, the LSEs whose load relies heavily on hydrologic conditions are bound to request most of their CRR in the monthly CRR allocation processes, when, prior to the startup of the monthly CRR allocation process, these LSEs have a much better estimate of the hydrologic conditions and could estimate more accurately their congestion rents.

Since the introduction of the GDF in the monthly CRR allocation processes, GDF values ranged between as high as 22.5% of the CRR Total Transmission Capacity (TTC) and as low as 7.5% of the CRR TTC. On average, the GDF amounted to 17.5%, a value that CAISO has maintained steadily for the past five years of monthly CRR allocation processes, meaning that the ATC for the monthly CRR processes was limited to half of what was mentioned in the initial CAISO CRR design (when the GDF was not yet introduced).

CDWR’s ability to obtain CRR in the annual CRR allocation process, was further impacted by other CAISO CRR design features which were implemented after the initial CRR design was implemented, with the scope of maintaining the CRR Auction Efficiency by reducing the number of allocated CRRs such as:

4.1. Median Operating Transmission Capacity (MOTC), not used in Year one of the annual CRR allocation process, reduced the amount of CRRs CDWR and other similar entities could request in the annual CRR Allocation processes after the MOTC was implemented.

4.2. The combined effect of existing LT-CRR allocated prior to the MOTC implementation and MOTC implementation resulted in even greater diminishing of the ATC for the annual CRR Allocation processes.

4.3. The implementation of the Track 1B proposal reduced the ATC for the annual CRR allocation from 75% of TTC to 65% of TTC.

For all the reasons explained above, CDWR’s ability to hedge its Day Ahead congestion rents depends heavily on obtaining sufficient CRRs in the monthly CRR allocation processes. Furthermore, CDWR believes that by reinstating the ATC CRR for the monthly CRR allocation process to the initial CRR design by eliminating the GDF concept, will benefit not just CDWR but all the other LSEs that participate in the CAISO CRR allocation process.

[1] Prior to the implementation of the Track 1B proposal the ATC for the monthly CRR allocation processes was 25% of the TTC.

19.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

The strategic objective of the CAISO CRR design as stated in the CAISO Tariff is to make the CRR processes feasible and give LSEs a possibility to recoup their Day Ahed congestion rents by participating in the CRR allocation process. The LSE’s ability to obtain sufficient CRRs that would provide CRR revenues for an adequate hedge of the LSEs congestion rents is diminished using the GDF concept.

20.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

The sooner CAISO eliminates the GDF, the better LSEs will be able to hedge their DA congestion rents with CRRs.

21.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Existing data:

- With the existing CRR data CAISO could perform studies to estimate the extent to which GDF benefits towards maintaining CR Auction Efficiency prior and after the implementation of the Track 1B proposal.

Missing data:

22.

Submission Title

Fourth entry provide responses to questions 22-28.

Congestion Revenue Rights Counter-Flow CRR

23.

Has this issue been previously submitted?

Yes.

24.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

In the current CAISO CRR design, the Counter-Flow methodology was implemented to maximize the number of direct flow CRRs allocated from the Trading Hubs (THs) to the sink nodes when the market participants to the CRR Allocation processes request such CRRs. There were numerous cases when CDWR had requested (direct flow) CRRs from the THs to CDWR Sink nodes and had received an excessive amount of CF-CRRs. CDWR believes this excessive amount of direct flow CRR and CF-CRR could exacerbate the CRR Auction Efficiency, since when settled, the CF-CRR might not be the same value with the direct flow CRR due to the changes in the CAISO grid occurred when the CRR market is settled.

For example, an excessive amount of direct flow and CF-CRR means that, when CDWR had requested x = 100 MW from a TH to one of its sinks, there were allocated as many as y = 100 MW direct flow CRR and z = 99 MW of CF-CRR. For the benefit of 1 MW of direct flow CRR (y-z), 199 MW of CRR were added to the CAISO CRR Market (y+z). CDWR believes the introduction of such a big amount of CRR in the CAISO CRR market could have an impact on the CRR Auction Efficiency.

25.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

CDWR supports the CAISO’s exploration of ways to revise the counter-flow CRR methodology used for allocating CRRs sourced at the trading hubs, as the current methodology is insufficient and contributes to revenue imbalance of the CRR balancing account as explained above. CAISO needs to implement a limit on the ratio of x, y, z that reduces the impact of the excessive amount of direct flow and CF-CRR in the CRR Allocation processes.

26.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

The strategic objective of the CAISO CRR design is to make the CRR processes feasible and give LSEs a possibility to recoup their Day Ahead congestion rents by participating in the CRR allocation process. By allocating too many CRR in the allocation process, the current CRR design could exacerbate the CRR Revenues Insufficiency.

27.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

The sooner the CF-CRR issue is fixed, the sooner the chances the CRR Auction Sufficiency is met, if other pending issues that impacts the CRR Auction Efficiency such as Track 1B are fixed.

28.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Existing data:

Past data of Market participants requesting CRR from the THs to their sink and the amount of the CF-CRR. Determine if the excessive amount of direct flow CRR and CF-CRR impacted the CRR Auction Efficiency.

Missing data:

CAISO needs to implement a limit on the ratio of x, y, z that reduces the impact of the excessive amount of direct flow and CF-CRR in the CRR Allocation processes.

29.

Submission Title

Fifth entry provide responses to questions 29-35.

Real-Time Load Bidding

30.

Has this issue been previously submitted?

Yes: in Policy Initiatives Catalogs 2013 – 2023 under “Aggregated Pumps and Pump Storage.”

31.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Participating Load Resources currently do not have the ability to bid demand in the real-time market. The proposed initiative is to seek a solution to allow load resources to be bid in real-time to increase or decrease energy consumption. The ability to bid demand in the real-time market would greatly reduce the current barriers to Participating Load’s participation in the wholesale demand response and could help with system reliability during abnormal grid conditions or overgeneration periods.

32.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

The initiative scope would be to explore current CAISO models that could potentially be used to allow for Participating Load Resources to bid in demand in the real-time market, explore modification of existing CAISO models that can be utilized for Participating Load Resources to bid in demand in real-time or potentially explore new models that would allow for this functionality.

33.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Strategic Objective 3: Build on the Foundation of the Western Energy Imbalance Market to Further Expand Western Market Opportunities

Strategic Objective 3B: Effectively prioritize and sequence market design enhancements.

Strategic Objective 3C: Enable new technologies through efficient market rules and interfaces.

Strategic Objective 1: Reliably and Efficiently Integrate New Resources by Proactively Upgrading Operational Capability

Strategic Objective 1A: Modernize tools that support control center operations.

The proposed initiative for real-time load bidding could possibly improve system reliability during grid conditions such as overgeneration periods. With real-time load bidding, Participating Load Resources could better respond to ramping needs by shifting demand during critical ramping periods when water conditions permit. Real-time load bidding would provide ISO more visibility on how much flexibility each participating load resources may have during real time conditions. This can assist with load forecasting to improve grid reliability.

34.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

No

35.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

N/A

California ISO - Department of Market Monitoring

Submitted 02/29/2024, 05:15 pm

1.

Submission Title

First entry provide responses to questions 1-7.

The text of DMM's full set of comments is pasted into this response to question 1. A fully formatted version of the same comments is included as a pdf attachment below the final question.

Comments on Policy Initiatives Catalog and Roadmap Process 2024

Department of Market Monitoring

February 29, 2024

Summary

DMM appreciates the opportunity to comment on the ISO’s Policy Initiatives Catalog and Roadmap Process 2024[1]. DMM recommends the ISO consider adding policy initiatives aimed at (1) improving ability for non-gas resources to submit reference level change requests, (2) more accurately reflecting intraday opportunity costs in the default energy bids of storage resources, and (3) changing the congestion revenue rights (CRR) auction to a market based on willing sellers. The policy suggestions to improve the reference level change request process, and to improve default energy bids for storage resources, could be included in the current price formation enhancements initiative. DMM also continues to recommend that the ISO develop revisions to bid cost recovery rules for battery storage resources. DMM understands that the ISO is assessing this issue internally, and will be considering potential market design changes as part of an upcoming initiative.

Improving reference level change request process for non-gas resources

When the $2,000/MWh bid cap is in effect, internal resources must submit a reference level change request in order to submit energy bids over the $1,000/MWh soft bid cap. The policy initiative that led to the implementation of the reference level change request process was primarily focused on gas resources being able to accurately reflect higher gas prices in their reference level costs.[2] While non-gas resources can also submit reference level change requests, there is less guidance for these types of resources. Therefore, there may be shortcomings in the current implementation that prevent non-gas resources from being able to successfully submit these requests, and thereby accurately reflect their costs in energy bids and default energy bids. DMM recommends the ISO open a policy initiative to consider improvements to the reference level change request process to ensure non-gas resources are able to submit requests to accurately reflect costs in default energy bids when the $2,000/MWh bid cap is in effect.

This issue is particularly prevalent for non-gas resources that face intraday opportunity costs, which may exceed $1,000/MWh on days when the $2,000/MWh bid cap is in place. While this is an issue for battery resources, it may affect other types of resources as well – particularly some hydro resources with certain daily limitations. According to the CAISO tariff, hydro resources are unable to submit automated reference level change requests. [3] DMM’s understanding is that they could submit a manual reference level change request, but there may not be clear guidance on what documentation is needed, or how the ISO would validate these requests.

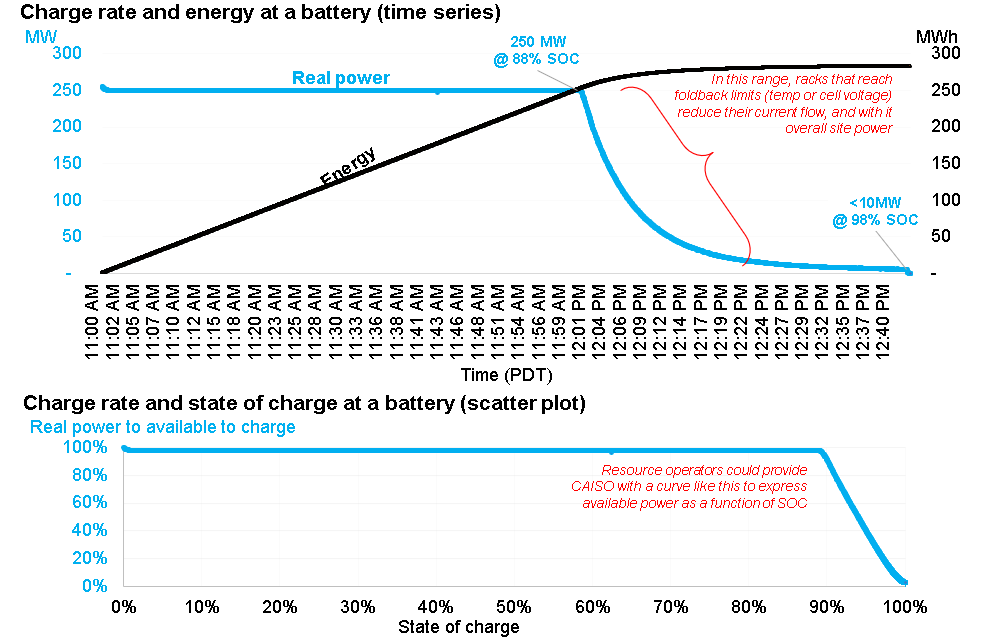

Default energy bids for storage resources that reflect intraday opportunity costs

During the price formation enhancements working group meeting on January 24, 2024, the ISO highlighted the current inability of energy storage resources to submit reference level change requests.[4] As noted in the previous recommendation, DMM believes that non-gas resources should be able to submit reference level change requests that reflect higher intraday opportunity costs on days when the $2000/MWh bid cap is in effect. Intraday opportunity costs faced by storage resources can vary by hour, depending upon state of charge and future charging and discharging opportunities. Therefore, DMM also recommends the ISO consider a policy enhancement to allow storage default energy bids (DEBs) to vary by hour. This would allow the DEBs to accurately reflect hourly changing intraday opportunity costs, while continuing to mitigate local market power in hours of lower opportunity cost.

Allowing reference level change requests for storage resources to account for intraday opportunity costs would require careful policy development. However, pairing this policy change with a DEB that varies hourly would support more efficient dispatch of storage resources. This policy change may be especially beneficial on the highest load days, when peak demand hour prices may be the highest. It would also improve reliability by decreasing the probability of early dispatch of storage resource before hours of highest need, as well as improve price formation by allowing storage resources to set prices that appropriately reflect their opportunity costs. While an hourly DEB that reflects intraday opportunity costs may be most relevant for battery resources, this hourly design could potentially benefit other resources in some circumstances.

Changing congestion revenue rights auction to a market based on willing sellers

Transmission ratepayers continue to lose money under the current congestion revenue right (CRR) auction design. In the five years since the ISO implemented CRR reforms aimed at reducing these losses in 2019, ratepayers have lost $312 million (or an average of $62 million per year) and have received only 67 cents in auction revenues per dollar paid out.[5] In 2023, transmission ratepayers lost about $58 million from CRRs auctioned off by the ISO, receiving 76 cents in auction revenue per dollar paid out.

Under the current CRR market design, the ISO uses and transmission model that creates large amounts of price taking CRR supply which transmission ratepayers are obligated to back. DMM continues to recommend that the ISO stop offering CRR positions on behalf of transmission ratepayers at $0 offer prices. DMM recommends that the ISO open a policy initiative to alter the CRR auction design so that trades only take place between willing sellers bidding into a market for these financial contracts.[6]

Bid Cost Recovery for Battery Storage

As noted in DMM’s 2022 Annual Report, DMM continues to recommend that the ISO develop revisions to bid cost recovery rules for battery storage resources.[7] These new BCR rules are needed to mitigate potential gaming opportunities, and improve the efficiency of market dispatch when day-ahead state of charge values deviate significantly from actual state of charge values in real-time. DMM understands that the ISO is assessing this issue internally, and will be considering potential market design changes as part of an upcoming initiative.

[1] https://stakeholdercenter.caiso.com/RecurringStakeholderProcesses/Annual-policy-initiatives-roadmap-process-2024

[2] https://stakeholdercenter.caiso.com/StakeholderInitiatives/Commitment-costs-and-default-energy-bid-enhancements

[3] Tariff Section 30.11.3.1.

[4] Price Formation Enhancements Working Group Session #13: https://www.caiso.com/InitiativeDocuments/Presentation-Price-Formation-Enhancements-Jan24-2024.pdf

[5] See 2022 Annual Report on Market Issues and Performance, July 11, 2023. pp. 18, 183-190. https://www.caiso.com/Documents/2022-Annual-Report-on-Market-Issues-and-Performance-Jul-11-2023.pdf

[6] Ibid, p. 190.

[7] Ibid, p. 26.

2.

Has this issue been previously submitted?

Please see question 1 or attached PDF.

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see question 1 or attached PDF.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see question 1 or attached PDF.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see question 1 or attached PDF.

6.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see question 1 or attached PDF.

7.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see question 1 or attached PDF.

8.

Submission Title

Second entry provide responses to questions 8-14.

Please see question 1 or attached PDF.

9.

Has this issue been previously submitted?

Please see question 1 or attached PDF.

10.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see question 1 or attached PDF.

11.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see question 1 or attached PDF.

12.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see question 1 or attached PDF.

13.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see question 1 or attached PDF.

14.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see question 1 or attached PDF.

15.

Submission Title

Third entry provide responses to questions 15-21.

Please see question 1 or attached PDF.

16.

Has this issue been previously submitted?

Please see question 1 or attached PDF.

17.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see question 1 or attached PDF.

18.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see question 1 or attached PDF.

19.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see question 1 or attached PDF.

20.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see question 1 or attached PDF.

21.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see question 1 or attached PDF.

22.

Submission Title

Fourth entry provide responses to questions 22-28.

Please see question 1 or attached PDF.

23.

Has this issue been previously submitted?

Please see question 1 or attached PDF.

24.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see question 1 or attached PDF.

25.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see question 1 or attached PDF.

26.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see question 1 or attached PDF.

27.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see question 1 or attached PDF.

28.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see question 1 or attached PDF.

29.

Submission Title

Fifth entry provide responses to questions 29-35.

Please see question 1 or attached PDF.

30.

Has this issue been previously submitted?

Please see question 1 or attached PDF.

31.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see question 1 or attached PDF.

32.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see question 1 or attached PDF.

33.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see question 1 or attached PDF.

34.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see question 1 or attached PDF.

35.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see question 1 or attached PDF.

California Public Utilities Commission

Submitted 04/04/2024, 11:37 am

1.

Submission Title

First entry provide responses to questions 1-7.

Correction of the hourly shaping factors used in the maximum import bid price.

2.

Has this issue been previously submitted?

Please see attachment "24-04-02 - Annual Policy Initiative Proposal - Shaping Factor - CPUC Energy Division"

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see attachment.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see attachment.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see attachment.

6.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see attachment.

7.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see attachment

8.

Submission Title

Second entry provide responses to questions 8-14.

Revisions to the Resource Adequacy Availability Incentive Mechanism (RAAIM).

9.

Has this issue been previously submitted?

Please see attachment "24-04-02 - Annual Policy Initiative Proposal - RAAIM - CPUC Energy Division."

10.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see attachment.

11.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see attachment.

12.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see attachment.

13.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see attachment.

14.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see attachment.

15.

Submission Title

Third entry provide responses to questions 15-21.

Liquidity of bilateral indices used in FERC Order 831 implementation

16.

Has this issue been previously submitted?

Please see attachment "24-04-02 - Annual Policy Initiative Proposal - Liquidity of bilateral indices - CPUC Energy Division."

17.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

Please see attachment.

18.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Please see attachment.

19.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

Please see attachment.

20.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

Please see attachment.

21.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

Please see attachment.

22.

Submission Title

Fourth entry provide responses to questions 22-28.

23.

Has this issue been previously submitted?

24.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

25.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

26.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

27.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

28.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

29.

Submission Title

Fifth entry provide responses to questions 29-35.

30.

Has this issue been previously submitted?

31.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

32.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

33.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

34.

Timing and Urgency: Are there regulatory requirements for implementation dates, or time-sensitive reliability impacts? Are there consequences to not addressing this issue?

35.

Data: Identify existing data and missing data needed to analyze the issue and develop solutions.

California Public Utilities Commission - Public Advocates Office

Submitted 02/28/2024, 09:59 am

1.

Submission Title

First entry provide responses to questions 1-7.

Allow Competitive Bidding on Regional Projects Above 100 kV

2.

Has this issue been previously submitted?

To Cal Advocates’ knowledge, this specific proposal has not been previously submitted

3.

Issue Description: Briefly provide a description of the issue that the proposed initiative is intended to address.

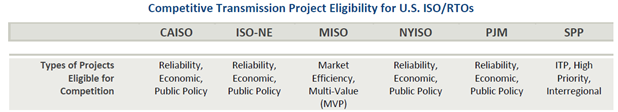

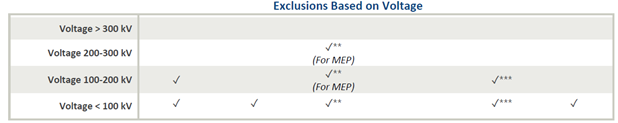

FERC Order 1000 (Order 1000) removed incumbent utilities’ “right of first refusal” (ROFR) from FERC-jurisdictional tariffs, with exceptions for local transmission facilities and transmission facility upgrades (i.e., local projects). Paragraph 63 of Order 1000 defines a “local transmission facility” as a “facility located solely within a public utility transmission provider’s retail distribution service territory or footprint that is not selected in the regional transmission plan for purposes of cost allocation.” In contrast, CAISO’s Tariff (effective August 2, 2023) defines a “local transmission facility” as a facility that is “(1) under the CAISO Operational Control, (2) is owned by a Participating TO [Transmission Owner] or to which a Participating TO has an Entitlement that is represented by a Converted Right, (3) operates at a voltage below 200 kilovolts, and (4) only in the case of a transmission facility approved in the final 2013/2014 comprehensive Transmission Plan and thereafter, is located entirely within a [Participating Transmission Owner’s (PTO)] footprint or PTO Service Territory.”

The CAISO stated the reason it separates regional and local projects at 200 kV is that it aligns with many regional and local benefits.[1] However, this strict division is arbitrary based on what benefits are considered. Further, CAISO admits that certain relatively low-voltage transmission projects blur the line between providing regional and local benefits.[2] There are certain transmission facilities, under 200 kV, which could still be providing reliability benefits, but not bulk power flow benefits. Additionally, in its FERC Order 1000 Compliance Filing, CAISO states “[a]lthough there could be instances in which a low voltage transmission facility provides some regional benefits, the ISO does not view this as anything more than a rare occurrence in light of the configuration and operation of the ISO grid.”[3] But it is important to note, some high-voltage facilities provide benefits to low-voltage facilities, beyond bulk power flow, such as absorbing unexpected frequency changes.[4] This could be considered a regional facility that is providing reliability benefits to a low-voltage system with unstable voltage. In addition, certain projects that are above 100 kV could have clear regional benefits, depending on how they are being used in relation to the transmission grid.

By failing to competitively bid these projects, CAISO is potentially missing out on the opportunity for more cost-effective projects to be built to the detriment of ratepayers. California ratepayers, in particular, pay approximately 45 percent to 80 percent higher electrical costs than the national average.[5] Competitive bidding can reduce project costs by 20-30%, and by extension, benefit ratepayers with cost efficient spending.[6] Continuing to place strict arbitrary limitations on which projects can be competitively bid burdens ratepayers with imprudent spending and unnecessarily increased rates.

References

[1] Reply Comments of the California Independent System Operator Corporation, NOPR Docket No. RM21-17-000, September 19, 2022, Section G.1.a at p. 65.

[2] California Independent System Operator Corporation, Order 1000 Compliance Filing, Exhibit ISO-1, Attachment D - Prepared Direct Testimony of Neil A. Millar, October 11, 2012, at 5, states: “existing facilities less than 200 kV generally support local service, and in instances where they remain parallel to high voltage facilities, they remain so only because the transition to higher voltage facilities is occurring gradually, only when increased flow patterns necessitate capital expenditures.”

[3] California Independent System Operator Corporation, Order 1000 Compliance Filing, Exhibit ISO-1, October 11, 2012, p. 29.

[4] California Independent System Operator Corporation, Order 1000 Compliance Filing, Exhibit ISO-1, Attachment D - Prepared Direct Testimony of Neil A. Millar, October 11, 2012, at 7, states: “High voltage transmission facilities enable the ISO to absorb unexpected changes in frequency that occur from time to time and support adequate voltage levels throughout the system, thereby reducing the risk of voltage collapse and thermal overloads throughout the region.”

[5] Borenstein, S., Fowlie, M., & Sallee, J., “Designing Electricity Rates for An Equitable Energy Transition.” Energy Institute at UC Berkeley’s Haas School of Business and NEXT 10. February 23, 2021, at 4 (“In the least expensive territory, Southern California Edison (SCE), residential prices per kilowatt hour are about 45 percent higher than the national average. Prices for Pacific Gas & Electric (PG&E) are about 80 percent higher, and prices in San Diego Gas & Electric (SDG&E) are roughly double the national average.”) https://www.next10.org/sites/default/files/2021-02/Next10-electricity-rates-v2.pdf.

[6] Cost Savings Offered by Competition in Electric Transmission, Brattle Group Report, April 2019, at 1. Brattle figures are for all of the US.

4.

Propose Initiative Description: To the extent possible, discuss proposed initiative scope. What elements of existing ISO market design do you propose to address?

Cal Advocates proposes to increase the scope of projects eligible for competitive bidding to benefit ratepayers. CAISO should maintain the automatic 200 kV and above split that puts regional projects up for competitive bidding, since there are many regional benefits gained from projects at that high voltage. However, for projects that are between 100 kV and 200 kV, if CAISO, a stakeholder, or a developer identifies a clear regional benefit for a project in Phase 2 of the Transmission Planning Process (TPP), then the project should be eligible for competitive bidding.

The CAISO could determine, with stakeholder input, which measurable regional benefits a project must provide in order to qualify for competitive bidding. Cal Advocates recommends that regional benefits include moderate power flow between areas, congestion reduction, or voltage stability. An example of such a project is the Redwood City Area 115 kV system reinforcement project, which was approved in the CAISO’s 2022-2023 TPP in order to address P6 and P7 contingencies resulting in overloads on multiple 115 kV lines.[7] The project proposes to reconductor two 115 kV lines and add a new 230 /115 kV transformer at the Ravenswood substation. While reconductoring the 115 kV lines largely provides local benefits, the new transformer at the Ravenswood substation would provide reliability benefits to the 230 kV system it connects to.

References

[7] CAISO 2022-2023 Transmission Plan, May 18, 2023, Section 2.5.2 Projects Recommended for Approval, at 45.

5.

Business Justification: Does the propose initiative support ISO strategic objectives or existing ISO initiatives? Identify parties potentially impacted by the proposed initiative. Is the proposed initiative in response to regulatory requirements?

The parties impacted by increased competitive bidding are the CAISO, project developers, PTOs, and California ratepayers.