1.

Please provide a summary of your organization's general comments on and materials shared on Sep 29th meeting

Comments on Storage Design and Modeling

Working Group Presentation on September 29, 2025

Department of Market Monitoring

October 14, 2025

Summary

The Department of Market Monitoring (DMM) appreciates the opportunity to comment on the Storage Design and Modeling working group presentation dated September 29, 2025.[1]

DMM appreciates the ISO’s attention to storage bid cost recovery (BCR) issues. DMM continues to support eliminating day-ahead (DA) BCR for storage resources unless specific instances are identified where DA BCR is clearly appropriate for storage resources. The ISO and stakeholders have not demonstrated that day-ahead BCR for storage resources is necessary to support market efficiency. Further, the current DA BCR design for batteries can lead to unwarranted BCR payments and is susceptible to gaming.

DMM recommends a similar approach to establishing real-time (RT) BCR eligibility for storage resources, with a default of no BCR, and eligibility for RT BCR is only provided under specific situations when it is deemed appropriate. This would address market efficiency issues created by the current RT BCR design for batteries, and would also solve other issues, including unwarranted RT BCR due to inaccurate DA initial state-of-charge (ISOC) parameters. If the ISO instead chooses to individually address each scenario that could lead to unwarranted RT BCR, DMM supports the proposals to require and incentivize accurate submissions of the DA ISOC parameter. DMM notes that even if the DA ISOC is accurate, there is still a bidding incentive issue if storage resources receive BCR for day-ahead buybacks due to insufficient state-of-charge.

DMM appreciates the ISO’s analysis indicating there is a low frequency of the market dispatching storage resources uneconomically. DMM continues to urge stakeholders to consider the overall benefits of multi-interval optimization (MIO), as an uneconomic dispatch in one interval may allow the storage resource to earn greater profits in future intervals. DMM’s analysis presented in these comments finds that batteries earn greater net energy revenues as the result of MIO, compared to schedules that are only driven by prices in the binding interval.

Developing DEBs for hybrid resources should be a relatively high priority. Currently, hybrid resources are not subject to local market power mitigation (LMPM). These resources should be subject to LMPM, and the ISO should develop an expedited default energy bid (DEB) approach to estimate the resources’ marginal costs. The DEB for hybrid resources can then continue to be enhanced as needed in future initiatives.

DMM supports the ISO’s direction to distribution-level resources to not use a “transmission induced” outage to reflect their distribution system charging constraints. DMM recommends further enhancements for the resources to reflect their charging limitations in the market and through the outage management system (OMS).

Comments

DMM supports battery BCR only where appropriate and necessary to support market efficiency

DMM supports the ISO addressing storage bid cost recovery issues as a top priority. DMM supports the ISO’s proposal to eliminate DA BCR for storage resources as there has yet to be any demonstration of DA BCR for storage resources being necessary to promote market efficiency or incentivize efficient bidding. In addition, DMM has found the vast majority of day-ahead BCR for storage resources arises from uneconomic schedules due to parameter submissions by the scheduling coordinators.[2],[3] As mentioned in previous comments, DMM recommends redesigning storage BCR rules to assume no eligibility, and only add eligibility under specific situations where it is deemed appropriate and necessary to support market efficiency.[4] If the ISO elects to maintain any DA BCR eligibility for batteries, DMM recommends the ISO or stakeholders provide examples or detailed scenarios where DA BCR is necessary to support market efficiency to justify incorporating these scenarios into the DA BCR framework.

DMM recommends the same bottom-up approach be taken to establish rules for real-time bid cost recovery for batteries. The current real-time bid cost recovery rules remove the exposure to real-time prices for storage resources with day-ahead schedules, which incentivizes these resources to submit real-time bids that are inconsistent with estimated real-time intraday opportunity costs, and can result in inefficient dispatch of storage resources in the real-time market.[5] DMM recommends the ISO determine which scenarios warrant RT BCR for storage resources and eliminate RT BCR in all other instances.

DMM supports stronger incentives to submit accurate day-ahead initial state-of-charge

As DMM has previously noted, allowing real-time bid cost recovery for day-ahead buybacks due to insufficient state-of-charge (SOC) can lead to inefficient bidding and market outcomes. In addition to creating inefficient real-time bidding incentives, the current BCR design can also disincentivize submission of accurate DA ISOC values. This can lead to schedules that may be infeasible in real-time, and therefore can lead to increased levels of unwarranted BCR for day-ahead buybacks. The day-ahead ISOC parameter may be inaccurate because battery operators submit estimates that are not likely to materialize, or because battery operators fail to submit an estimate and the default of zero is different than the telemetered state-of-charge at the beginning of the operating day. DMM supports the ISO’s proposals to address the current lack of incentive for storage resources to submit accurate DA ISOC parameters.

DMM supports the ISO requiring the submission of the DA ISOC in order to submit DA bids, especially if the ISO inserting a default value for any missing submissions would be used as justification to provide BCR when the ISO’s default value is inaccurate. DMM believes that it would be more efficient if stakeholders were incentivized to submit accurate DA ISOC estimates. DMM recommends the ISO consider that this could be achieved by removing RT BCR for DA buybacks due to insufficient SOC. DMM would also support a proposal to incentivize more accurate ISOC estimates by making battery resources ineligible for RT BCR if their day-ahead ISOC is substantially different than their telemetered ISOC at the beginning of the operating day. However, DMM notes that even if resources submit accurate DA ISOC estimates, continuing to provide RT BCR for day-ahead buybacks due to insufficient SOC still results in inefficient bidding incentives and inefficient dispatch of storage resources in real-time.

Multi-interval optimization provides benefits that exceed the cost of uneconomic dispatches

Stakeholders have raised concerns about uneconomic dispatches of storage resources driven by the multi-interval optimization, which considers prices in advisory intervals when providing dispatch instructions to resources in the binding interval. DMM has recommended analyzing both the benefits and costs of the multi-interval optimization (MIO) prior to considering whether or not the ISO should provide uplift to storage resources for the uneconomic dispatches that may occur as a result of MIO.[6]

DMM appreciates the ISO’s analysis on the frequency of uneconomic dispatches of storage resources, which found that 80 percent of storage resources were dispatched uneconomically in less than 10 percent of intervals.[7] While this analysis provides some insight into the potential costs associated with MIO, the discussion has yet to focus on the potential benefits of MIO.[8] By considering prices in advisory intervals, a storage resource may receive an uneconomic dispatch in one interval that allows them to earn higher profits in future intervals.

To provide more insight into the benefits of the multi-interval optimization, DMM modeled a counterfactual of battery schedules based solely on the economics in the binding interval. DMM compared each unit’s schedule under this counterfactual “no MIO” model to the actual market schedules for each unit under MIO. Using these two schedules, along with locational marginal prices (LMPs), we can estimate the net energy revenues under the two different outcomes and compare them to assess the potential benefits of MIO.

It is important to note that this counterfactual does not account for many of the other reasons that dispatches in the binding interval may be uneconomic. The counterfactual solely accounts for resources’ bids, LMPs, state-of-charge, and ancillary state-of-charge constraint. As such, the counterfactual may imply schedules that are not feasible due to other reasons and could therefore over-estimate counterfactual profits that would occur without MIO. Currently, this analysis only calculates counterfactual schedules for the fifteen-minute market (FMM) and compares estimated FMM net energy revenues based on actual and counterfactual FMM schedules and FMM LMPs.

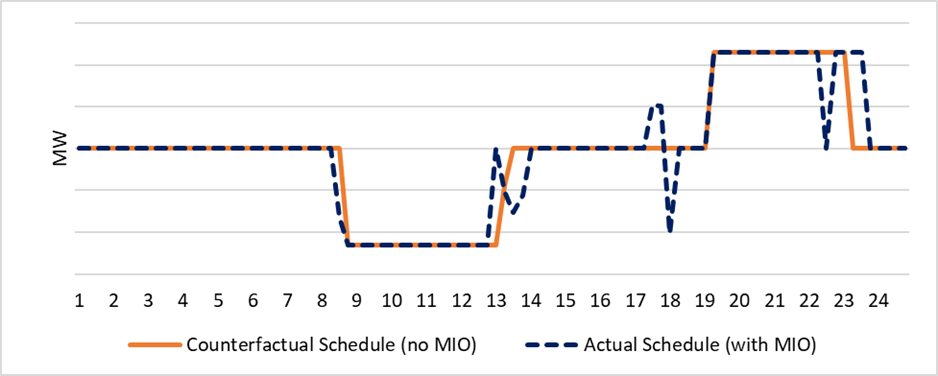

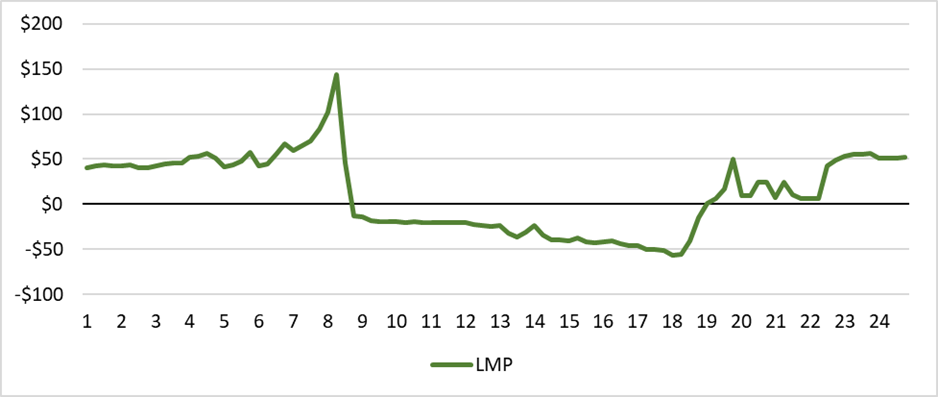

To demonstrate the importance of considering the benefits of MIO, we analyze the same storage resource on the same day highlighted by NextEra in the June 30th working group presentation.[9],[10] Figure 1 shows the actual schedule (dotted blue line) and the counterfactual schedule (orange line) of this resource on March 19, 2025, the day it received the uneconomic dispatch discussed in the presentation. During this presentation, NextEra noted this particular storage resource received an uneconomic schedule to discharge in hour-ending 17, which can be seen by the dotted blue line in Figure 1. Comparing the two schedules indicates that while the counterfactual schedule does not result in the uneconomic dispatch in hour-ending 17 or the other uneconomic dispatch in hour 22, it also does not schedule the resource to charge in hour-ending 18 or discharge in hour-ending 23. Figure 2 shows the FMM LMPs of this resource on this day, and it indicates that the deviations in hour-ending 18 and 23 allowed the resource to earn greater profits in those intervals.

By using the LMPs across this day, DMM estimates that the unit’s net energy revenues from the actual MIO schedule are 8 percent higher than the net energy revenues based on the unit’s counterfactual no-MIO schedule. This is a conservative estimate for the benefit of MIO on this day, as there may be other limitations on the battery that may be affecting the actual schedule that are not accounted for in the counterfactual. This example highlights the importance of considering more than just an uneconomic dispatch in a single interval, because that dispatch may position the battery to earn more profits later in the day – by either charging at a more negative price or discharging at a more positive price.

Figure 1 Actual and Counterfactual Schedule of Battery Resource on March 19, 2025

Figure 2 FMM LMPs of Battery Resource on March 19, 2025

DMM extended this analysis to calculate the estimated daily net energy revenues for all storage resources in the FMM based on both their actual MIO schedule and the counterfactual no-MIO schedule and relevant FMM LMPs. Specifically, the analysis included 138 CAISO storage resources from October 2024 to September 2025 that were on-line by the start of the sample period. This analysis is an initial exercise and is intended to introduce an approach that measures not only the costs of MIO but the benefits as well. The analysis currently does not consider schedules or revenues in the day-ahead or five-minute (RTD) market. All numbers reflect estimated settlement of the resource’s FMM schedule only on FMM prices.

Figure 3 compares the distribution of daily net energy revenues for the actual schedules with the daily net energy revenues for the counterfactual schedules. Table 1 provides some additional statistics on these distributions. The analysis indicates that overall, battery resources are very likely to earn higher net energy revenues from the MIO compared to market solutions that only consider the economics of the binding interval.

Figure 3. Distributions of net energy revenues estimated for MIO vs. non-MIO schedules

Table 1. Distribution of estimated daily net energy revenues for MIO vs. non-MIO schedules

|

|

Net Energy Revenues of Actual MIO Schedules

|

Net Energy Revenues of Counterfactual (no MIO) Schedules

|

Estimated MIO Benefit

|

|

Average

|

$7,291

|

$5,901

|

24% higher

|

|

Median/50th percentile

|

$3,307

|

$2,338

|

41% higher

|

|

95th percentile

|

$29,816

|

$25,348

|

18% higher

|

|

99th percentile

|

$54,489

|

$48,345

|

13% higher

|

Daily net energy revenues from schedules using the MIO are 24 percent higher than net energy revenues from the counterfactual no-MIO schedules. In addition, the distribution of daily net energy revenues of actual schedules has a much longer tail of positive profits. This indicates that there is a higher probability of realizing some more extreme profits under the MIO that the resources would miss out on otherwise. This result is intuitive, as the MIO may optimize resources in the binding interval to capture upcoming price spikes that appear first in advisory intervals and may not be anticipated in the expectations of future prices that inform resource bids in the binding interval.

As noted above, this initial analysis is intended to establish a more complete assessment of the potential costs and benefits of MIO, extending the focus beyond individual intervals that may result in uneconomic dispatch. The results here provide a conservative estimate of the benefits of MIO and further refinements could improve the accuracy of the counterfactual. DMM will leverage this framework and continue to refine the analysis to further demonstrate the costs and benefits of the multi-interval optimization.

DMM supports mitigation of hybrid resources with an easily implementable default energy bid that can be enhanced in future initiatives

DMM continues to place a high priority on subjecting hybrid resources to local market power mitigation. This requires first developing a default energy bid for hybrid resources. To subject hybrid resources to local market power mitigation, in the near term DMM supports calculating a DEB for hybrid resources using the maximum of the DEBs that apply to each of the generation components that make up the hybrid resource. In cases where the resource is paired with storage, the DEB would often be driven by the opportunity cost of the storage component.[11] This initial approach should be easy to implement and should achieve the goal of subjecting hybrid resources to local market power mitigation in the near-term. After a near-term solution for hybrid DEBs is implemented, hybrid resource DEBs should continue to be enhanced to more accurately reflect the costs of hybrid resources as a full system of different generation components.

DMM has previously recommended the hybrid DEB vary hourly for hybrids with storage components.[12] The DEB for hybrids with a storage component should follow the hourly storage DEB enhancements as proposed by DMM for storage resources.[13]

In addition to future enhancements to allow hourly variation, hybrid resource DEBs should leverage the existing CAISO DEB structure that allows resources to have multiple bid segments in the DEB curve. This may be appropriate as hybrids can have underlying technologies with potentially very different marginal (or opportunity) costs. In hybrid configurations with hybrid components such as natural gas and storage, the opportunity cost of the storage resource may far exceed the variable costs of the natural gas component. In cases like this, for operational ranges where the storage resource is not being dispatched to increase the output of the hybrid resource beyond the operation of the gas resource, the DEB should reflect the cost of the lower cost of the gas resource, and not the higher opportunity cost of the storage resource.

As the storage DEB is being enhanced in this stakeholder process, DMM supports using the current storage DEB in the interim for hybrid resources with a storage component to subject hybrid resources to some degree of mitigation. However, DMM recommends the ISO and stakeholders discuss potential issues with using the current storage DEB for hybrid resources, and consider these issues in the ongoing refinements of a DEB for hybrid resources in the future.

DMM supports improved transparency and modeling of distribution-level charging constraints; DMM supports the ISO’s guidance that “transmission induced” outages are not the appropriate tool to reflect these constraints

Distribution-level resources have unique charging characteristics, and DMM continues to recommend the ISO identifying these resources in Master File. Further, DMM recommends the ISO develop a long-term solution to distribution-level resources to manage the unique constraints. A key element of the long-term solution DMM recommends is improvement to transparency of the charging limits imposed on distribution-level resources from the distribution system operator (DSO) tariffs.

In the near term, the ISO has directed resources to continue to reflect these limitations through OMS, and instructed resources not to use the “transmission induced” outage card.[14] DMM has previously observed distribution-level resources using these outages and brought this issue to the attention of the ISO. DMM agrees the transmission induced outage card is inappropriate for distribution-level charging constraints that are known constraints of the resource’s interconnection, and not the result of an outage on the transmission or distribution system. DMM encourages the ISO to provide guidance to the market participants on the correct outage card type to use in the interim, and develop a long-term solution to managing these constraints.

DMM recommends the ISO develop a lasting solution to managing and monitoring distribution-level charging constraints. In the forthcoming OMS enhancements, DMM continues to recommend the ISO include a unique outage card type that reflects these limitations. The transmission induced outage card is exempt from the resource adequacy availability incentive mechanism (RAAIM). The distribution-level charging constraint limitation should not be exempt from RAAIM because this limitation is known in advance of the development of the resource, and not a result of a transmission or distribution equipment outage. As the ISO considers development of a unique outage card for these constraints, it too should not be RAAIM exempt, or exempt from any potential future mechanism to incentivize RA availability.

Given the nature of the constraints, DMM recommends the ISO pursue a policy that allows distribution-level resources to reflect their limits with as little latency as possible. As DMM has previously noted, this could potentially be achieved through the use of dynamic limits by distribution-level resources, but only if they are registered in Master File as distribution-level resources, and only if there is sufficient data available for monitoring the use of such limits.[15],[16] If dynamic limits were to be used for this purpose, DMM recommends considerations for resource adequacy be thoroughly contemplated, as DMM has discussed in previous comments.[17]

[1] Working Group on Uplift & DEB, SOC Management, and Mixed-Fuel & Distribution-Level Resources presentation, California ISO, September 29, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Storage-Design-and-Modeling-Sep-29-2025.pdf

[2] Comments on Storage Bid Cost Recovery and Default Energy Bids, Department of Market Monitoring, July 18, 2024: https://www.caiso.com/documents/dmm-comments-on-storage-bcr-and-default-energy-bids-july-8-2024-workshop-jul-18-2024.pdf

[3] Comments on Storage Design and Modeling Working Group Session 1, Department of Market Monitoring, January 8, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-working-group-session-dec-11-2024-jan-8-2025.pdf

[4] Comments on Storage Design and Modeling May 28, 2025 Presentation, Department of Market Monitoring, June 11, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-may-28-2025-presentation-jun-11-2025.pdf

[5] Comments on Storage Design and Modeling June 30, 2025 Presentation, Department of Market Monitoring, July 16, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-jun-30-2025-working-group-presentation-jul-16-2025.pdf

[6] Comments on Storage Design and Modeling June 30, 2025 Presentation, Department of Market Monitoring, July 16, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-jun-30-2025-working-group-presentation-jul-16-2025.pdf

[7] Working Group on Uplift & DEB, SOC Management, and Mixed-Fuel & Distribution-Level Resources presentation, California ISO, September 29, 2025, slide 33: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Storage-Design-and-Modeling-Sep-29-2025.pdf

[8] It is important to remember that there are a variety of other reasons besides economics in advisory intervals that can result in uneconomical dispatches.

[9] NextEra Presentation – CAISO Storage Design and Modeling Initiative, NextEra Resources, June 30, 2025, slide 5: https://stakeholdercenter.caiso.com/InitiativeDocuments/NexteraPresentation-StorageDesignandModeling-Jun30-2025.pdf

[10] DMM received consent from NextEra to present additional analysis of this example resource in an anonymized fashion.

[11] Comments on Storage Design and Modeling June 30, 2025 Presentation, Department of Market Monitoring, July 16, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-jun-30-2025-working-group-presentation-jul-16-2025.pdf

[12] Ibid.

[13] Comments on Storage Design and Modeling Working Group Session 2 and 3, Department of Market Monitoring, March 7, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-working-group-sessions-2-and-3-mar-07-2025.pdf

[14] Working Group on Uplift & DEB, SOC Management, and Mixed-Fuel & Distribution-Level Resources presentation, California ISO, September 29, 2025: https://stakeholdercenter.caiso.com/InitiativeDocuments/Presentation-Storage-Design-and-Modeling-Sep-29-2025.pdf

[15] Comments on Storage Design and Modeling Working Group Session 2 and 3, Department of Market Monitoring, March 7, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-working-group-sessions-2-and-3-mar-07-2025.pdf

[16] Comments on Storage Design and Modeling June 30, 2025 Presentation, Department of Market Monitoring, July 16, 2025: https://www.caiso.com/documents/dmm-comments-on-storage-design-and-modeling-jun-30-2025-working-group-presentation-jul-16-2025.pdf

[17] Ibid.