ACP-California

Submitted 02/29/2024, 02:33 pm

Submitted on behalf of

ACP-California

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

ACP-California thanks CAISO for taking the time to provide the proposed generic timeline for various studies and key dates under the proposed, new interconnection process. This provides a useful tool for developers and other stakeholders to review the timing of various studies and data points and how they will interact. At this time, we do not offer any specific comments on the overall timeline, other than recommending that CAISO provide, at the earliest opportunity, its thinking for when Cluster 16 might realistically open.

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

ACP-California appreciates that CAISO has clearly articulated a viable path forward for Energy-Only projects under the TPD Deliverability Option within the Draft Final Proposal. Providing the details and a path for these resources to interconnect is necessary to maintain open access and, therefore, ACP-California greatly appreciates CAISO attention to this matter and the details added to the Draft Final Proposal.

We encourage CAISO to provide additional details in the Final Proposal regarding how Energy Only projects seeking to interconnect under the Merchant Deliverability Option would be treated. There should be a path for Energy Only projects to interconnect in areas which are not deemed part of a “TPD Deliverability Zone,” but resources which interconnect as Energy Only in a Merchant Deliverability zone should not be able to later convert to Full Capacity Deliverability Status unless they pay their share of network upgrades which were paid for by those selecting Full Capacity Deliverability Status in a Merchant Deliverability zone. CAISO’s Final Proposal should ensure that Energy Only projects can interconnect in Merchant Deliverability zones but that they cannot use this approach to “free ride” on the upgrades paid for by others under the Merchant Deliverability approach.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

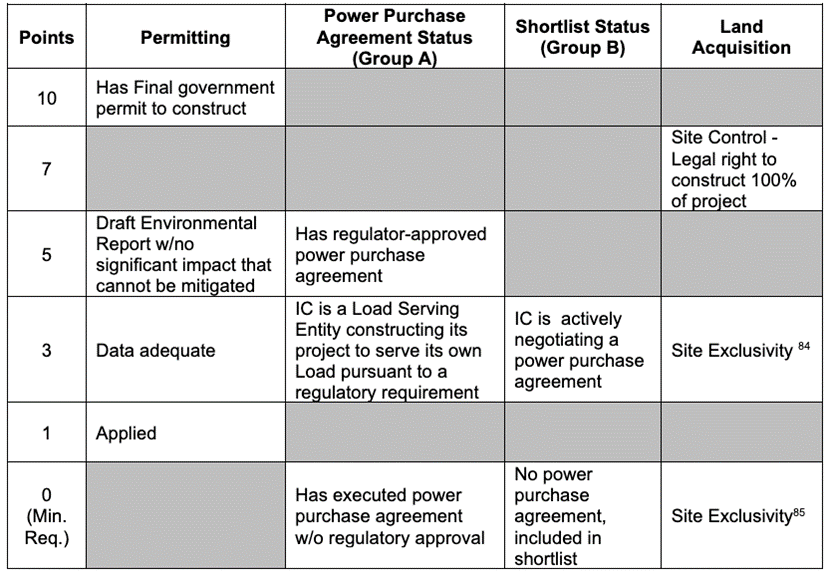

The Draft Final Proposal provides a significant number of improvements in the Scoring Criteria. Notably, we appreciate that CAISO has revised the weighting of the commercial interest score downward from the prior draft. This is an improvement, given how early projects will be in their development cycles when they seek to enter the queue and demonstrate commercial interest. We request that CAISO commit to revisiting the weighting of the commercial interest score after the first cluster is scored and studied under the new process.

As discussed below, ACP-California strongly supports the inclusion of points for arrangements with corporate offtakers and reiterates that providing this option is necessary to ensure open access and non-discriminatory treatment for projects serving these customers. We also reiterate the need for meaningful limitations on or restrictions for LSE self-build projects allocating themselves points under the commercial interest metric. And we request that CAISO provide additional details and modifications to the definitions under the scoring criteria for Long-Lead Time resources.

Point Allocation for Commercial Interest

The addition of the availability of points for interconnection projects which have demonstrated interest from commercial and industrial (corporate) offtakers is a significant improvement to the overall scoring process in the Draft Final Proposal. ACP-California commends CAISO for adding this component to the scoring criteria and reiterates that maintaining availability of points for these types of projects is imperative to a just and reasonable IPE proposal which ensures continued open access across the CAISO grid. While there may be disagreements over the exact number of points allocated to projects with commercial interest from corporate offtakers, what CAISO has put forward is a compromise. On the one hand, it does not provide projects with verified interest from corporate offtakers with the same level of points that are possible from LSE interest. But, on the other hand, it still appears to offer a potentially viable avenue for these projects to enter the queue.

ACP-California understands that some LSE’s expressed concern about the points from corporate offtaker projects potentially “crowding out” LSE projects. We do not believe this is likely to occur, especially given the higher number of points LSEs interest provides to a project, currently proposed to provide projects with LSE interest, with the Draft Final Proposal proposing to allocate four times the number of points for LSE interest as for corporate offtake interest. Given the heavy scoring preference for LSE projects, ACP-California suggests that CAISO monitor for any potential for “crowding out” when the new interconnection process is implemented and, if warranted, discuss potential modifications with stakeholders after observing how the process works during the first cluster. ACP-California looks forward to continuing to work with CAISO and other stakeholders to finalize a commercial interest point allocation process that maintains reasonable points for projects looking to sell their output to non-LSEs and which ensures projects that LSEs are interested in and intend to pursue can also enter the queue.

Limitations on LSE Self-Build Point Allocation

It is imperative that CAISO include limitations on the ability for LSEs to allocate commercial interest points to projects that they wish to self-build (referred to as “LSE-owned projects” in the Draft Final Proposal). This is necessary because without such restrictions LSEs might only allocate points to their own projects or may provide favoritism to their own projects over those of third-parties, providing discriminatory and preferential treatment to LSE projects over those developed by independent power producers and diminishing competition to provide generation resources to serve California customers. Because IPPs cannot “self-allocate” commercial interest points, while LSEs can, the ability for LSEs to self-allocate points must include restrictions to preserve competition. There may be a number of different approaches that could be utilized to address this concern, but the proposed simple approach of limiting LSEs to a single self-build project per cluster is a minimum requirement as part of a reasonable approach which prevents self-dealing and guards against the diminishment of competition through utilities self-selecting their own projects to enter the queue.

Point Allocation for System Need (Long Lead-Time Resources)

ACP-California appreciates CAISO’s ongoing work on long-lead time resources and the updates to the definition of long-lead time resources to correspond with the diverse resources eligible for central procurement under AB 1373 (2023) in the scoring criteria. However, we continue to believe that refinements are necessary to ensure this point category works as intended. First, CAISO should clarify that in order to receive points under this metric, the resource type seeking the points must:

- Be included in the CPUC’s base case resource portfolio; and

- Be eligible to be considered for central procurement under Assembly Bill 1373 (2023); and

- Be located in an area where the TPP has approved transmission projects to provide the necessary transmission or where transmission is known by CAISO to be required in order to provide transmission for the resources in the most recent CPUC approved base case resource portfolio.

These requirements will ensure that the sphere of resources eligible to receive long lead-time points is appropriately narrow and limited to resources that should receive such treatment. If the definition is not appropriately narrow, we are concerned that CAISO may need to implement other processes to limit the number of projects allocated these points.

Also, and importantly, we urge CAISO to expand how it considers transmission related to long-lead time resources. Rather than limiting long-lead time resources (and the associated points) to areas where the TPP has already approved the necessary transmission, CAISO should also allow resources to qualify in areas where CAISO knows that transmission approvals will be required to integrate the long-lead time resources included in a recent CPUC base case portfolio. In order for CAISO to allocate these points, it is not imperative for the transmission to already be approved. If CAISO knows that transmission will be required to integrate the resources in the CPUC’s approved base case portfolio, those resources should be eligible to receive long lead-time points (assuming they meet the other requirements as well). Take, for example, the case of north coast offshore wind. In order for these resources to receive long lead-time points, it should not be necessary for CAISO to have an approved transmission solution. Rather, if CAISO knows that transmission will be required for these resources, then once they are part of the CPUC’s approved base case, they should be eligible to receive points as a long lead-time resource. By limiting the point allocation to only areas where transmission has already been approved in a TPP, CAISO will unnecessarily prevent resources from getting in the queue at an earlier date and may, thereby, delay development efforts and extend timelines for projects to enter the queue and proceed to operation. Thus, we urge CAISO to expand the definition to allow for a more integrated and timely approach to allowing long lead-time resources to receive a point allocation under the TPD Deliverability Option. This recommendation is also in keeping with our comments below on TPD prioritization as well as the need to sync CAISO’s TPP and interconnection processes in a manner that facilitates diverse, long-lead time resource development.

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

As discussed above, ACP-California urges CAISO to provide some additional details around how Energy-Only projects might interconnect under the Merchant Deliverability option. Providing a path for Energy-Only interconnections in these zones, where there is not existing or approved transmission capacity, will be important to maintaining full open access to the grid. But CAISO needs to exercise caution in the details of how Energy-Only projects can receive future deliverability (even after they enter commercial operation) when one or more different customers paid for the transmission upgrades that allow deliverability in that area. In other words, the process needs to ensure that Energy-Only interconnections in a Merchant Deliverability area are not able to “free ride” on the deliverability that customers pay for under the Merchant Deliverability Option.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

CAISO should be commended for providing its initial thinking on modifications to the TPD allocation process in the Draft Final Proposal, even though such modifications are likely to be approved on a separate (later) track than the rest of the IPE 2023 proposals discussed in the Draft Final Proposal. ACP-California generally supports the modifications that CAISO has proposed, while recognizing that additional discussion and details will be required to ensure there is understanding and agreement on the path forward and to ensure that the “chicken and the egg” problem of securing a TDP allocation and a PPA/short list are addressed.

Notably, ACP-California agrees with CAISO that it already possesses the tariff-based authority to reserve TPD capacity for resources that align with TPP approved transmission projects to meet specific CPUC portfolio requirements. As the process moves forward, it would be valuable for the CAISO to provide additional details on what criteria it will use to reserve this capacity, as well as which network resources could be eligible for reservation. That detail could be provided through a business practice or other process document. To ensure competitiveness, it will be imperative that the CAISO not overly rely on this authority to broadly reserve TPD capacity but also have sufficient authority to achieve deliverability for specific policy-driven resources. Thus, having additional details around the considerations that CAISO will use in implementing this tariff authority would be helpful for all stakeholders and interconnection customers.

Additionally, ACP-California notes that the proposed elimination of Group D and restrictions on Group C may create challenges for resources looking to secure a TPD allocation. As CAISO is aware, offtakers generally want to have certainty that a project will have a TPD allocation before signing a PPA. If a PPA or short-list is required to get a TPD allocation, it may present challenges, even if there are more opportunities to seek an allocation and fewer resources in the queue under CAISO proposal and associated interconnection reforms. ACP-California recommends that CAISO consider a new TPD allocation group (“Group E”). Group E could receive a “conditional” TPD allocation and could then use that conditional allocation to secure a short list or PPA ahead of the following allocation cycle.[1] While there are certainly details to be worked out, this concept deserves further exploration as the proposed TPD changes proceed forward in the stakeholder process.

Additionally, CAISO should clarify that all active projects seeking TPD allocations (including those in Cluster 14 or earlier) will be permitted the proposed maximum opportunities (three) to seek a TPD allocation. Ensuring this proposed change is applied to all active interconnection customers will provide an appropriate opportunity for earlier projects to seek an allocation and ensure equitable treatment of all projects. Furthermore, we encourage CAISO to think through whether long lead-time resources may require additional opportunities to secure a TPD allocation or other treatment (perhaps longer granting of “conditional TPD” under the Group E concept discussed above).

And, finally, ACP-California requests that CAISO provide additional time for dialog with stakeholders around the proposed restrictions on Energy Only (Group C) allocations. Notably, stakeholders should consider whether projects which are involuntarily converted to Energy Only should be provided with an opportunity to withdraw before that conversion or are provided smaller withdrawal penalties, etc. We look forward to further discussions on this matter as the proposed TPD allocation modifications move forward in the stakeholder process.

[1] Note that the proposed new “Group E” which provides conditional deliverability may be, functionally, similar to retaining a revised Group D but not allowing any allocations under Group D to count against the 150% limits applied to new resources entering the queue. ACP-California recommends classifying this as a new allocation group to provide more opportunities to rethink how it would function.

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

ACP-California thanks CAISO for, within the proposed Commercial Viability Criteria, providing additional time for projects to secure a PPA should they lose a PPA due to a PTO delay. ACP-California appreciates the additional 12-months to secure a PPA in these instances. And we appreciate that CAISO has clarified the CVC requirements do not rely on a project’s commercial operation date.

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

ACP-California generally supports the CAISO’s proposal and is encouraged at the exploration of solutions to help reduce the long timelines that are being experienced for completing upgrades. While the CAISO’s proposal to secure earlier financial security postings and to require PTOs to commence activity on these upgrades within 30 days will be helpful, it is just one of many reforms that are necessary to address the persistent delays being experienced. We look forward to continuing to explore options to reduce the significant delays to upgrades in this and other forums.

Additionally, we encourage CAISO to consider options for developers responsible for shared network upgrades to delay payment of the third financial security posting if a GIA is not executed by the PTO.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

No comments at this time.

9.

Additional comments:

ACP-California thanks the CAISO for its ongoing work and diligence in improving the IPE 2023 proposal. We are encouraged by the modifications made in the Draft Final Proposal and look forward to continuing to engage with CAISO to finalize this proposal and move towards implementation and engagements with Cluster 15.

AES

Submitted 02/29/2024, 12:40 pm

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

AES Clean Energy, ”AES”, appreciates the opportunity to submit comments on the CAISO’s draft final proposal.

AES appreciates the CAISO providing an updated single document with data to enable the zonal approach. AES also supports the CAISO providing a single capacity number for each zone, but seeks clarification if each zone’s capacity number will be the accepted MWs for each Transmission Plan Deliverability (TPD) zone. If so, AES seeks clarification on when the CAISO will provide the single capacity numbers for each zone for each year.

AES supports the proposed data including the single line diagrams, transmission constraints in each zone, list of substations in each interconnection area, POIs behind constraints, and allocated TPD. However, AES is disappointed that CAISO cannot provide critical information needed for the zonal approach including short circuit data, breaker ratings, and POI feasibility. Regarding POI feasibility information, the CAISO incorrectly states, “PTOs have provided within their interconnection handbooks known substations where there is not capacity to interconnect.”[1] PTO interconnection handbooks do not provide design standards nor a list of unavailable substations.[2] The CAISO sets the data requirements for interconnection studies. Since the CAISO is the central clearing house in enabling the zonal approach, the CAISO should ensure that interconnection customers have the necessary information to submit the readiest projects. It is AES’s understanding that CAISO already receives this information from the PTOs. If the CAISO does not provide the additional necessary information, at minimum, the CAISO should include: (1) the breaker ratings in the short-circuit models in the Cluster Study Interconnection Area Reports and (2) include all attachments to the published Appendix A individual interconnection reports with confidential information removed. AES is concerned with the timing mismatch of the proposed generic timeline. The CAISO should not open the request window until after the TPD allocation study. Developers need to be clear on the level of deliverability available prior to submitting applications, and the CAISO will also need to know how many MWs to accept in each study cycle. CAISO has stated during the February 15, 2024 stakeholder meeting that changing the TPD allocation study could disturb the timing of the Transmission Planning Process studies. If study timelines are a concern, then AES recommends the CAISO to take a TPD vintaging approach, by reserving a portion of the TPD from the current TPP cycle for the following cluster. For example, the results of the 2023-2024 TPP would be reserved for Cluster 15, and the results of the 2024-2025 TPP would be reserved for Cluster 16. This approach would allow the CAISO to conduct the TPD allocation study after the request window since a portion of the previous year’s TPP would be reserved for the upcoming cluster.

AES also seeks clarity on the proposed generic timeline with respect to CAISO’s intent to move into a single-phased study process. The proposed generic timeline assumes that cluster studies, restudy, and interconnection facilities studies are separate phased studies. If CAISO intends to move forward with a single-phased study, the generic timeline should be updated. Under the single-phased study process, the CAISO should also clarify: (1) how restudies would be performed and (2) whether the existing cost cap for network upgrades would apply.

In the near term, AES appreciates the CAISO’s willingness to provide the list of substations in each interconnection priority zone by the end of February. However, given that the TPD allocation studies conclude in May, the results may affect the boundaries of each zone. AES recommends the CAISO to update the list of substations in each interconnection priority zone after the TPD allocation study results so customers can accurately locate the interconnection priority zones for Cluster 15.

[1] Draft Final Proposal, p.24,

[2] See for example: https://www.sce.com/sites/default/files/custom-files/Web%20files/SCE_InterconnectionHandbook.pdf

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

AES does support exempting Energy Only Resources from the 150% study cap, but it does not support requiring Energy Only projects be subject to the scoring rubric and be held to the same standards as TPD projects. AES understands the CAISO’s intent to ensure that Energy Only projects have the same level of readiness and that Interconnection Customers don’t abuse Energy Only projects as a “work-around” the study cap. However, as the revised scoring criteria stand, Energy Only projects are not eligible to meet most of the criteria. As illustrated in Example 3 below, Energy Only projects can at most receive 21 points. LSEs would likely not allocate points to Energy Only projects since the points are based on the LSE’s available deliverability. The system need category would not apply to Energy Only projects. Based on the scoring criteria, Energy Only projects would not have equal access for entry.

Instead, the CAISO should approach Energy Only projects similar to Merchant projects. Energy Only projects would also be required to meet 90% site control requirements and study deposits. These projects should also be required to pay a commercial readiness deposit of $4,000/MW. The higher entry fees would incentivize the most ready Energy Only applications to enter the queue. Using this approach, the CAISO should also allow Energy Only projects into Merchant zones.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

AES appreciates the CAISO’s revised scoring criteria. AES supports the removal of permitting within the scoring criteria. However, AES is concerned that the revised scoring criteria do not provide enough granularity in the project viability and system need categories, leading to the commercial interest being the main determinant of selected projects. Below, AES provides examples of mock scoring to demonstrate how commercial interest will be the final determinant of projects being selected for studies.

Example 1: Project with LSE interest

Commercial Interest (30%)

- LSE allocation: 100 points

- Total category points: 30

Project Viability (35%)

- 20% Engineering Design: 20 points

- Expansion of gen facility: 10 points

- 100% site control of gen tie: 40 points

- Total category points: 24.5

System Need (35%)

- Local RA: 50 points

- Total category points: 17.5

Scoring Total: 72 points

----------------------------------------------------

Example 2: Project with non-LSE interest

Commercial Interest (30%):

- Non-LSE interest: 25 points

- Total category points: 7.5

Project Viability (35%)

- 20% Engineering Design: 20 points

- 100% site control of gen tie: 40 points

- Total category points: 21

System Need (35%)

- Local RA: 50 points

- Total category points: 17.5

Scoring Total: 46 points

In the examples above, the project viability categories have similar points, while the system needs category points are the same. Given that the project viability and system need category points are similar, this would mean that LSE interest is the final determinant of projects entering into the studies. Projects are also at risk of having the same score if given the same allocation points from the LSE or non-LSE. To increase point granularity in the scoring criteria, AES recommends the CAISO revise the project viability category. Instead of granting points to projects with 100% site control of gen tie, the CAISO can grant points up to the level of gen tie secured by interconnection customers. For example, interconnection customers can get 5 points per 10% of the gen tie secured.

AES supports the inclusion of non-LSEs in the commercial interest category, but believes that non-LSE interest criteria should be increased to a minimum of 50 points. As the proposal stands, at 25 points, projects with non-LSE interests would likely not be competitive in the selection process. To ensure equitable competition between LSE and non-LSE projects, the non-LSE criteria points should be increased. In addition, the CAISO should clarify what entity qualifies as non-LSE. For example, do non-LSE need to have Market Base Rates filed at FERC?

Regarding engineering designs, the CAISO should provide clearer definitions of the different proposed percentages. Although the CAISO recommended alignment with the Association for the Advancement of Cost Engineering (AACEI), these cost guidelines do not provide enough clarity to delineate engineering design percentage thresholds. The proposed design percentages do not align with the Class V – Class I cost definitions as defined by the AACEI.[1] AES recommends the CAISO provide definitions that include the package required to meet the proposed engineering design percentages. The engineering design definitions should include items, such as long lead time equipment count, general arrangement with total system size, and developer substation single line diagram showing metering and protection, parcels/easements, and site layout indicating multiple gen tie routes. Including clear definitions of required items for each design percentage will eliminate potential disputes as each developer may have different definitions for each design percentage.

Expansion of the generating facility under construction and expansion of operating facility should have higher point value should as incumbents have demonstrated experience in building a project to operation. AES recommended increasing the expansion of the generating facility under construction to 20 points and the expansion of operating facility to 30 points.

In addition, as discussed above, the scoring criteria would preclude Energy Only projects from entering the queue as the criteria do not apply. Below is an example of a mock Energy Only project scoring.

Example 3: Energy Only Project

LSE Interest (30%)

- LSE allocation: 0 points

- Total category points: 0

Project Viability (35%)

- 20% Engineering Design: 20 points

- 100% site control of gen tie: 40 points

- Total category points: 21

System Need (35%)

- Local RA: 0 points

- Long Lead Time Resource: 0 points

- Total category points: 0

Scoring Total: 21 points

Energy Only projects would not receive points in either LSE interest or system need given the options under the categories. The mock score of 21 points would not allow projects to enter into interconnection studies as the examples above show a minimum score of 46 points.

[1] Table 1. Association for the Advancement of Cost Engineering. Cost estimate classification system. https://web.aacei.org/docs/default-source/toc/toc_18r-97.pdf?sfvrsn=4

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

AES continues to urge the CAISO to allow projects that are unselected through the scoring process and Energy Only projects to continue as Merchant projects. If companies are willing to self-fund network upgrades within the priority zones, the CAISO should allow this to occur. The additional network upgrade built by self-funded projects provides additional grid benefits beyond the project's interconnection. The CAISO stated that allowing Merchant projects in priority zones would result in studying capacity in those zones potentially well above the 150% threshold and would be counterproductive to solving the issue identified in the problem statements of studying capacity levels so high that the study results lose accuracy, meaning, and utility. To prevent this issue, the CAISO can study TPD projects first, then study Merchant projects to prevent the loss of study accuracy. Merchant projects in the interconnection priority zones can help increase generation supply and help keep any potential market power in check by increasing competition. Merchant projects could also provide a cushion and more margin of error if the state’s resources planning process do not identify enough resources to cover increases in demand as they materialize in the future.

AES continues to be concerned that cost recovery of ADNUs will continue to be a roadblock in making the Merchant option viable.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

AES believes that the TPD allocation process modifications warrant further discussion to understand the implications of the changes. AES recommends that CAISO defer the proposal and bring it to the Board of Governors in July 2024. The CAISO should provide an analysis of how the removal of Group D allocation group would affect available TPD for future clusters with the zonal approach. AES’s initial concern is that the removal of Group D allocation group could exacerbate the issue of entities signing PPAs with multiple exit clauses determined by whether the project receives TPD; this could deflate the value of offtake agreements. AES opposes the CAISO’s proposal for limiting existing Energy Only projects to apply for allocation Group C (commercial operation). Existing Energy Only projects are further in development and in some cases, such as Cluster 13, were forced to convert to Energy Only due to the lack of TPD. AES believes it would be unfair to subject existing Energy Only projects to new TPD allocation rules.

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

AES understands the CAISO’s proposed commercial viability criteria (CVC) and time in queue requirements. AES seeks clarification if these requirements would also apply to Energy Only projects. Regarding the 3rd interconnection financial security posting requirement, the CAISO should clarify what portion would be at risk. Finally, the CAISO should elaborate further on the permitting requirements for the CVC. For the initial report, does a list of all permits suffice? For the annual reports after the CVC requirement, is there a minimum threshold that permitting needs to meet in order to meet CVC?

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

AES supports this proposal and recommends that CAISO clarify that the policy would apply to all shared network upgrades, such as deliverability network upgrades, reliability network upgrades, and local area network upgrades.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

AES supports the modified proposal for it to become voluntary to amend GIA nine months prior to synchronization. On a similar note, SCE opposed the original proposal, stating that the project scope changes through MMAs submissions and that the PTO should not be required to finance costs associated with incremental scope changes triggered through a modification. AES is concerned that developers are not provided with the most up to date scope and cost when submitting a modification. If there is not a requirement to provide this scope and cost updates, the PTOs will miss additional information that is key to developers. In AES’s experience, the amended scope has been missed by the PTOs or is not comprehensive in relation to the previously assigned scope, resulting in additional changes in a later process (i.e. execution) that shifts unknown financial risk to the developers. PTOs should be responsible for updating the scope that was originally identified in the studies through a modification. AES recommends that the PTO be responsible for providing a more comprehensive integration of the modification into the past report. This would further support the CAISO’s goals of having developers submit project ready and viable projects and modifications in a timely fashion.

9.

Additional comments:

AES is immensely concerned about the lack of timing certainty to reengage with Cluster 15. AES understands that CAISO cannot implement IPE Track 2 until all compliance filings, including CAISO’s Order 2023 compliance filing and IPE Track 2 compliance filing, are accepted. To mitigate timing uncertainty, the CAISO should reengage with Cluster 15 on April 1, 2025, or 60 days after FERC acceptance of all compliance filings, whichever date is later.

The CAISO should also amend the FERC-approved tariff in IPE Track 1 (Appendix DD, Section 17.1) given the timing delays of cluster 15 and clarify the one-time modifications allowed. The current tariff contains upcoming dates that will become moot given the pending IPE Track 2 changes and Order 2023 compliance filing. In addition, the tariff states the one-time modification period will commence between May 1, 2024 and September 26, 2026, and allow customers to make modifications permissible under Section 6.7.2.2(a)-(h).[1] However, the tariff language under Section 6.7.2.2(a)-(h) does not conform with the Final Track 1 proposal that was published.[2] Section 6.7.2.2(a)-(h) describes the allowed modifications at the time of Phase 1 Interconnection Study Results meeting, and not the unique modifications that were permissible under IPE Track 1. Particularly, Section 6.7.2.2(a)-(h) does not explicitly state that projects can make a POI modification within a study area, although the Final Track 1 proposal allows for this modification. AES requests the CAISO to amend the tariff to clarify the modifications, particularly changing POIs within a zone, that are allowed unique to Cluster 15 projects.

[1] Appendix DD, Section 17.1.

[2] IPE Track 1 Final Proposal, page 8.

Bay Area Municipal Transmission Group (BAMx)

Submitted 02/29/2024, 04:17 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

The Bay Area Municipal Transmission Group (BAMx)[1] appreciates the opportunity to comment on the CAISO’s 2023 Interconnection Process Enhancements Track 2 Draft Final Proposal (“Draft Final Proposal,” hereafter) and the subsequent workshop held on February 14, 2024.

BAMx supports this initiative's central tenet, prioritizing projects in areas with available transmission capacity for progression into the study process. This Draft Final proposal reflects the first principle established by the working group to “Prioritize interconnection in areas where transmission capacity exists, or new transmission has been approved while providing opportunities to identify and provide alternative points of interconnection or upgrades.”[2] BAMx also supports the element of the Draft Final Proposal, which allows the option to self-fund network upgrades through a modified “Merchant Deliverability” process to the projects or interconnection requests outside the zones.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] Draft Final Proposal, p.24.

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

BAMx finds this section of the Draft Final proposal reasonable because the Energy Only resource capacity will not count toward the 150% cap. BAMx appreciates that the 150% cap is based on Transmission Plan Deliverability capacity, and the inclusion of Energy Only projects would increase the number of projects that advance to the study process but would not increase the deliverable capacity to be studied.[1]

[1] Draft Final Proposal, p.30.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

With any scoring process, BAMx strongly supported, including any project that a non-CPUC jurisdictional Load-Serving Entity (LSE) demonstrates is a preferred resource in its resource plan approved by its Local Regulatory Authority (LRA).[1] This element of the Straw Proposal provided similar treatment to non-CPUC LRAs as the CAISO has provided to the CPUC LRA by prioritizing the CPUC-provided portfolio resources in the annual TPP. However, we are disappointed that this element of automatic study inclusion has been eliminated in the Draft Final proposal.

BAMx believes that the current study process is unfavorable to non-CPUC jurisdictional LSEs. The joint agency (CPUC/CEC/CAISO) MOU does not include these LSEs or their LRAs as signatories, and these LSEs have not historically been included in the TPP. The proposal to incorporate them in the TPP going forward is a welcome change but does not correct the fact that multiple prior clusters are still being studied against a TPP that does not consider non-CPUC LRA resource needs.

BAMx supports using LSE interest points to allow LSEs to indicate projects they need to meet regulatory and other requirements. The LSE-interest scoring criteria would assure comparable access to the interconnection process for non-CPUC jurisdictional LSEs by ensuring they receive sufficient LSE-interest points to have a meaningful opportunity to designate needed projects. The LSE interest points mechanism is already designed to limit the use of LSE interest points to a percentage of the overall transmission capability available. It is important to note that LSE interest points also contribute only 35% of the overall points potentially obtainable.[2] This leaves plenty of room for other projects to earn points for other sources.

In the draft Final proposal, the CAISO proposes that LSEs may only award points to one self-built project each cycle. In particular, if an LSE opts to use the full allocation election for a self-built project, that election may not exceed 150% of that LSE’s total capacity allocation for the cluster.[3] BAMx finds such limitations on the LSE-owned projects to be arbitrary and discriminatory. The Draft Final Proposal allows merchant generators to receive points for any or all of their projects, while LSEs may only receive points for some of their own projects. This seems to be unduly discriminatory. BAMx supports Northern California Power Agency’s (NCPA) comments on the Draft Final Proposal on why LSEs pursuing self-build projects is not discriminatory to the FERC Open Access principle, especially as FERC does not deal with LSE procurement processes, which is LRA-jurisdictional. In summary, BAMx strongly opposes any limitations on LSE-owned projects, especially for the non-CPUC jurisdictional LSEs.

BAMx also supports NCPA’s request that the Draft Final Proposal should be updated to clarify that multiple LSEs can aggregate their Full Allocation Election priority interest in one project when the individual LSEs participating in the aggregation do not have sufficient aggregate capacity to allocate to that project’s full MW size, including the 150% capacity threshold being included for the group of LSEs selection for a single preferred project election.

[1] Straw Proposal, p.26 and CAISO Workshop Presentation, p.23.

[2] Draft Final Proposal, p.39.

[3] Draft Final Proposal, p.41.

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

BAMx believes the following elements in the Draft Final proposal to be reasonable.

- Only projects seeking to interconnect in areas that have no available or planned TPD capacity are eligible to select the Merchant option.

- Merchant option projects are not eligible to seek to interconnect in zones with available capacity, and projects not selected to be studied in these zones cannot switch to the Merchant option.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

No comments at this time.

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

No comments at this time.

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

No comments at this time.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

No comments at this time.

9.

Additional comments:

No comments at this time.

California Community Choice Association

Submitted 02/29/2024, 01:41 pm

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

The California Community Choice Association (CalCCA) appreciates the opportunity to comment on the California Independent System Operator’s (CAISO) Interconnection Process Enhancements (IPE) Draft Final Proposal. The Draft Final Proposal reflects the CAISO’s ongoing collaboration with stakeholders to improve the interconnection queuing and study processes to align them with transmission planning, resource planning, and resource procurement. It further solidifies important improvements to the interconnection process that will enable it to keep pace with the need for new capacity on the system to support reliability and greenhouse gas (GHG) emissions reduction goals.

CalCCA supports the CAISO’s commitment to providing data to stakeholders to support the zonal approach. The data will be critical for developers, who must plan their proposed projects in locations where transmission capacity exists or is planned. It will also be critical for load-serving entities (LSE), who will evaluate and procure proposed projects based on their ability to meet system reliability and GHG-reduction targets, their compliance obligations, and their customers’ needs and preferences. Data transparency before the submittal of interconnection requests and before LSE interest scoring should result in a zonal approach to interconnection that is aligned with transmission planning, resource planning, and resource procurement.

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

CalCCA has no comments on this element of the Draft Final Proposal at this time.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

LSE Interest Scoring Criteria

CalCCA supports most elements of the Draft Final Proposal as it relates to the scoring criteria for prioritization in the study process. The CAISO’s proposal recognizes the importance LSE interest will play when narrowing down the pool of interconnection study requests. LSEs, as procuring entities, conduct long-term planning activities in their individual integrated resource plans, where they start to identify the technologies, locations, and magnitudes of projects they will pursue to support the communities they serve. This information is factored into the California Public Utilities Commission’s (CPUC) preferred system plan, which then informs the CAISO’s transmission planning process. Without an LSE interest scoring criteria, the CAISO would risk having an interconnection queue that is not aligned with resource and transmission planning processes taking place in these forums. Under a zonal approach that does not study all interconnection requests submitted, the CAISO must ensure that the requests that do get studied result in an interconnection queue that offers a diverse set of resources. Scoring criteria that reflect LSE interest can drive a balanced interconnection queue because LSEs must procure a range of technologies to meet reliability and GHG-reduction targets in a cost-effective manner that meets their customers’ needs and, for some LSEs like community choice aggregators, directives from their boards. Indeed, the need to have balanced resources to meet load profiles throughout the day is important not only for Integrated Resource Plan (IRP) but are increasingly important to meet RA obligations as hourly needs for capacity are increasing.

The result of CAISO’s project scoring should be an interconnection queue that reflects LSEs’ desired resource mix planned for in resource planning processes like the CPUC’s IRP proceeding. A 30 percent weighting for LSE interest balances the need for LSEs to help drive interconnection studies without making LSE interest a determining factor that impinges on the ability for other interconnection requests to move forward. For these reasons, the CAISO should adopt its proposal to allow LSEs to score projects based on their interest to inform the interconnection study requests the CAISO studies.

The CAISO must, however, reconsider its proposal to require LSEs to submit their interest scores at the same time interconnection customers submit their interconnection requests. The CAISO should modify the draft final proposal to (1) have the CAISO issue a simple report with project name, technology, point of interconnection, developer name, and megawatts (MW) for each interconnection request received, and (2) allow LSEs to use this report to finalize their interest scores and submit them one month after the issuance of the report. These proposed modifications would allow LSEs to review interconnection requests and finalize their interest scores in parallel with other work the ISO will be doing to validate interconnection request information before starting the cluster study.

This process is superior to requiring LSEs to submit their interest scores based solely upon requests for information (RFI) because it allows LSEs to review interconnection requests, compare the requests to the results of their RFIs to ensure consistency, and submit interest scores that correctly reflect projects they are interested in as communicated in the interconnection request. Requiring LSEs to submit their interest scores before seeing the interconnection requests submitted seems prone to errors that could require more work for the CAISO to validate.

Based on the proposed schedule posted on the CAISO’s website,[1] this would result in LSEs conducting RFIs in advance of interconnection customers submitting their interconnection requests by July 31, reviewing interconnection requests in August, and finalizing and submitting their interest scores by late August or early September. When finalizing the timeline, the CAISO should clarify when it will allocate capacity/points to LSEs. Such information should be provided well before LSEs submit their interest scores to the CAISO.

Self-Built Projects

The CAISO proposes to only allow LSEs to submit points to one self-built project per cycle. The intent of this proposal is to prevent LSEs from giving preferential treatment to their own projects. The CAISO should remove this limitation due to its potential unfair impacts on different LSEs. A single project could be 1 MW or 1,000 MW. Basing a limitation on number of projects would benefit LSEs who can self-build one large project over those who can self-build multiple small projects. It also makes the possibility of assigning points to projects that are jointly built by multiple LSEs more difficult. If the CAISO determines some sort of limitation on assigning points to self-built projects is needed, it should create a limit based upon a share of the LSEs’ allocated points rather than number of projects (e.g., an LSE can only allocate half its points to self-built projects). This would avoid over-preference on self-built projects without eliminating the possibility of building more than one project.

Auction

The CAISO proposes to conduct a market-clearing, sealed-bid auction for the right to be studied if excess proposed capacity exists after applying the viability criteria and projects are deemed equal in viability rating. For the reasons described in previous comments,[2] the CAISO should, instead of developing an auction, focus on scoring criteria robust enough to rank projects’ viability and minimize occurrences of equal viability scores among projects. If projects do receive the same viability score, the CAISO should study all tied projects.

Non-LSE Points

The CAISO proposes to allow non-LSEs, like commercial entities, to assign up to 25 points to projects if the commercial entities can provide signed affidavits indicating and affirming commercial interest from its procurement division. Prior to this addition, the proposed scoring criteria only allowed for scoring by entities that have a tariff-defined relationship with the CAISO (i.e., LSEs). The CAISO now proposes to allow a non-LSE commercial entity to apply points. The CAISO notes concerns that without a tariff-based relationship, the CAISO will need to carefully evaluate the legitimacy of such requests. The CAISO notes that it is “is reluctant to provide a definition or criteria” to further define how the CAISO will implement this feature. This represents a significant departure from how entities with a relationship to the CAISO interact with the CAISO. For those entities, the tariff and business practice manuals clearly define expectations and are transparent to all market participants. In the Final Proposal, the CAISO should better define the process that will be used to allow non-LSEs to assign points so that the process is transparent and subject to a tariff. Not only will this ensure that points are only assigned by legitimate entities but the process will be transparent and have a process through FERC to resolve any disputes of the application of the tariff.

Additionally, if the CAISO allows non-LSEs to assign points to interconnection requests, it should ensure it maintains a prioritization process in the deliverability allocation process that prioritizes non-LSE projects that have Resource Adequacy (RA) contracts with LSEs over those that do not have RA contracts with LSEs. This will ensure deliverability is assigned to projects that will actually be used as RA.

Long-Lead Time (LLT) Resource Category

The CAISO proposes to give points to interconnection requests that will address system needs, including the need for LLT resources. CalCCA supports the LLT resource category. This category, along with the LSE interest category, appears to be the mechanism that will be relied upon to ensure resource diversity among the portfolio of projects selected for study. While the Draft Final Proposal indicates resources required to meet the CPUC resource portfolio are eligible, the CAISO should update the Final Proposal to provide more clarity around how it will categorize LLT resource for the purpose of assigning points. It appears the Draft Final Proposal adopts some of CalCCA’s recommendations on the process for defining LLT in its January 9, 2024 comments,[3] additional clarity would be helpful to ensure the definition (1) reflects actually needing a long period of time, such as five years or more, to construct from the initial proposal, not inclusive of the period spent in the CAISO interconnection queue, (2) includes priority for resource types that are needed, as defined by the CPUC in its IRP process, but underrepresented in the CAISO queue, and (3) assigns LLT resource points to interconnection requests that fit the definition regardless of the type of LSE procuring, (e.g., central procurement entity, groups of LSEs, or single LSE).

Ensuring Competition Among Developers Contracting with LSEs

If the CAISO implements a transmission zone-based approach that limits the amount of interconnection requests based on existing and planned transmission capacity, the CAISO must ensure sufficient interconnection capacity is studied to maintain competition among developers contracting with LSEs to meet LSE procurement obligations. Studying capacity up to 150 percent of the available and planned transmission capacity is too limiting, especially in light of the fact that the CAISO decided to forego its proposal to put a cap on the number of interconnection requests it would study from a single developer. The ISO plans the transmission system based on resource portfolios the CPUC projects will be needed to support reliability and policy goals. LSEs will ultimately need to procure capacity consistent with those plans. If the ISO only studies 150 percent of the amount of capacity needed to support reliability and policy goals, LSEs may experience significantly reduced bids in their request for offers (RFO) relative to their procurement needs. Past experience also shows that many projects do not ultimately proceed in the development process and may drop out after submitting their interconnection request but before the contracting process. While some projects may offer to multiple LSEs, multiple LSEs may have interest in the same project, too. Using 150 percent as the overall ratio of total capacity to total need is likely too low to ensure competition among developers competing for contracts with LSEs. The CAISO should study as much capacity as maintains the usefulness of the study results, but at least 200 percent of the available and planned transmission capacity.

[1] https://www.caiso.com/InitiativeDocuments/ProposedSchedule-InformationAvailability-InterconnectionStudyProcess.pdf.

[2] https://stakeholdercenter.caiso.com/Comments/AllComments/db2a7c50-3962-46ad-b217-59749bef1704#org-cefa3c17-c05a-494f-8e8e-9d8e1c470eeb.

[3] https://stakeholdercenter.caiso.com/Comments/AllComments/db2a7c50-3962-46ad-b217-59749bef1704#org-cefa3c17-c05a-494f-8e8e-9d8e1c470eeb

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

The CAISO proposes that only projects interconnecting in areas with no available or planned transmission deliverability capacity would be eligible to use the merchant deliverability option. The merchant deliverability option would not be available for projects that did not score enough to be studied in the transmission zones with planned or available capacity. The CAISO should modify this proposal to allow projects within transmission zones to elect to move forward using the merchant deliverability option. If the CAISO anticipates an influx of merchant deliverability projects after the implementation of IPE 2023, the CAISO could consider additional requirements to ensure the merchant deliverability projects do not overwhelm the interconnection queue, like requiring interconnection customers to select the merchant deliverability option up front or limit the amount of merchant deliverability projects that can move forward through the same scoring criteria used by projects electing not to use the merchant deliverability option.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

The Draft Final Proposal indicates that the scoring process for allocating transmission plan deliverability (TPD) will be determined once the scoring process for interconnection intake is completed. When defining the scoring process for allocating TPD, the CAISO should aim to align it with the scoring criteria for interconnection intake as much as possible, so that the projects deemed most ready are first to receive TPD allocations.

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

The CAISO should adopt its proposal to require all projects in the queue to demonstrate commercial viability to remain in queue beyond seven years, regardless of deliverability status. The CAISO should also adopt its proposal to require each project to meet commercial viability criteria by an unavoidable time-in-queue requirement. These changes should prevent the stagnation of projects in the interconnection queue without a clear process for moving them forward or removing them from the queue.

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

CalCCA has no comments on this element of the Draft Final Proposal at this time.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

CalCCA has no comments on this element of the Draft Final Proposal at this time.

9.

Additional comments:

CalCCA has no additional comments on the Draft Final Proposal at this time.

California Public Utilities Commission - Public Advocates Office

Submitted 02/29/2024, 03:40 pm

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

The Public Advocates Office at the California Public Utilities Commission (Cal Advocates) provides these comments on the California Independent System Operator’s (CAISO Interconnection Process Enhancements), 2023 Phase 2 Revised Straw Proposal.? Cal Advocates is an independent consumer advocate with a mandate to obtain the lowest possible rates for utility services, consistent with reliable and safe service levels, and the state’s environmental goals.[1]

Cal Advocates supports the CAISO’s proposed generic timeline, which includes posting of Transmission Plan Deliverability (TPD) Heat Maps eight (8) months before the opening of the Interconnection Request submission window.[2] Cal Advocates supports the CAISO’s proposal to increase the accessibility of grid information by consolidating the available information, along with lists of substations and constraints in each transmission zone, into a single-user accessible data source. Cal Advocates supports CAISO’s development of TPD Heat Maps to comply with Federal Energy Regulatory Commission (FERC) Order 2023.

Cal Advocates supports the CAISO proposed study timelines indicating completion of Cluster Study within 150 days which complies with FERC Order 2023.

[1] CAISO Draft-Final-Proposal-Interconnection-Process-Enhancements 2023 Initiative - Track 2, February 8, 2024, pp. 14-28, DraftFinalProposal-InterconnectionProcessEnhancements2023.pdf (caiso.com)

[2] Public Utilities Code Section 309.5.

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

Cal Advocates supports the CAISO proposal that the process of submitting and reviewing interconnection requests be the same for all projects seeking Full Capacity Deliverability Status (FCDS), Partial Capacity Deliverability Status (PCDS), and Energy Only Status. In doing so, the CAISO proposal appears to provide equal and non-discriminatory access to the transmission system for all Interconnection Customers submitting Interconnection Requests.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

No comment

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

Cal Advocates supports the CAISO proposal to have the developer of a Merchant Deliverability Option project finance all of the delivery network upgrades necessary to connect that project to CAISO service area.[1] In addition, CAISO customers should not compensate the developer for funds used to construct the required Area Deliverability Network Upgrades (ADNUs) for a Merchant Deliverability project.

Implementation of this CAISO proposal protects ratepayers from additional TAC charges.

[1] CAISO Draft-Final-Proposal-Interconnection-Process-Enhancements 2023 Initiative - Track 2, February 8, 2024, p. 59-62.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

No Comment

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

Cal Advocates supports the CAISO proposal for implementing strict Commercial Viability Criteria (CVC) and time-in-queue requirements for all projects in the generation interconnection queue.[1] The CVC requires Interconnection Customers in the queue to demonstrate commercial viability by showing both a signed Generation Interconnection Agreement and an executed Purchase Power Agreement within seven (7) years of submission of the proposed project Interconnection Request.

Reducing the number of non-viable projects in the queue through implementing strict Commercial Viability Criteria (CVC) and time-in-queue requirements for all projects would reduce delays to viable projects reaching their Commercial Operation Date and help California meet its climate change goals. By implementing strict CVC and time-in-queue requirements, the CAISO can utilize its resources more efficiently which in turn should lower costs to ratepayers.

[1] CAISO Draft-Final-Proposal-Interconnection-Process-Enhancements 2023 Initiative - Track 2, Feb 15, 2024, pp. 80-89.

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

Cal Advocates supports the CAISO proposal that the designated Participating Transmission Owner will have 30 days to commence the transmission upgrade project upon receipt of all Resource Developers financial security deposits for Shared Network Upgrades as specified in the Generation Interconnection Agreements.[1] The proposed improvements in this process should lead to more certainty in the completion of generation interconnection transmission grid upgrades and deliverability of new resources to support customer loads.

[1] CAISO Draft-Final-Proposal-Interconnection-Process-Enhancements 2023 Initiative - Track 2, Feb 15, 2024, pp. 92-97.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

Cal Advocates acknowledges the CAISO’s efforts to address inefficiencies in executed Generator Interconnection Agreement contract management.[1] Cal Advocates supports revising the timing of updating Amendments to an executed Generation Interconnection Agreement (GIA) in order to expeditiously incorporate project modifications reducing time and resources executing changes to the GIA. The CAISO reports that the GIA must be changed each time an Interconnection Customer (Resource Developer) submits a Material Modification for a proposed project. Continuous revisions to projects through the current Material Modification Assessment (MMA) process then require that contract negotiators for the Interconnection Customer, CAISO, and Participating Transmission Owner (PTO) work together to update changes to the GIA. PTOs and CAISO are required to continually amend the GIAs. From 2021 to date, the CAISO and PTOs have serially processed 376 MMAs. To reduce this time-consuming effort, CAISO’s Draft Final Proposal proposes that the MMA Results Report, which incorporates any change to scope, schedule, or cost, be the binding document and that the GIA would only be amended once. By addressing the timing of GIA Amendments issue, CAISO, PTO, and Resource Developer resources would be more efficiently utilized which in turn lowers costs to ratepayers.

[1] CAISO Draft-Final-Proposal-Interconnection-Process-Enhancements 2023 Initiative - Track 2, Feb 15, 2024, pp. 97-100.

9.

Additional comments:

No Additional comments.

California Wind Energy Association

Submitted 02/29/2024, 04:45 pm

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

CalWEA recommends that the timeline also include the following information:

- Show when the three TPD allocation opportunities start for a particular cluster.

- Show when the CPUC provides its specific IRP resource portfolios to be used by the CAISO for its queue entry selection.

- Show when the available capacity information will be published by CAISO.

Since the TPD allocation study happens in parallel with the cluster window that is underway, the projects going through the TPD allocation process are not counted against the capacity ostensibly available for the next queue cluster. The consequence is that, while queue entry is eased, interconnection customers (ICs) will find it to be more difficult to get a TPD allocation once the study process is completed unless CAISO ensures sufficient ADNU (policy upgrade) capacity is added to the grid as part of its cluster study(ies) – which itself can take many years to complete. So, while the proposed process requires ICs to achieve a very high level of readiness, the timeline inherently creates a high level of uncertainty regarding the availability of timely TPD capacity. This increased risk of the costly study process will limit developer participation and is one reason why CalWEA objects to the overall proposal (see response to Question 9).

2.

Provide you organization’s comments on new section 2.2.3 – Treatment of Full Capacity Deliverability Status and Energy Only Resources:

Requiring EO projects to go through the same scoring process as projects requesting FCDS will make it nearly impossible for EO projects to proceed. At points of interconnection (POIs) where no FCDS is available, the proposal prevents EO projects from being studied simply because FCDS resources cannot be studied, which does not make sense. Where FCDS is available, LSE allocation points will presumably go to FCDS applications, which will prevent most, if not all, EO projects from being studied.

EO requests should be allowed in all zones purely based on project readiness independently of FC availability or requests. Alternatively, CAISO could use the EO resources in the CPUC’s IRP resource portfolio to identify a zonal EO study limit for each zone.

3.

Provide your organization’s comments on modifications to Section 2.4 Scoring Criteria for Prioritization to the Study Process:

CalWEA first reiterates previously stated concerns that CAISO’s overall proposal is fundamentally flawed because it moves the study process forward for a small minority of early-stage projects absent the information that is most important to project viability: transmission upgrade costs and timelines. Thus, the entire process upon which projects are proposed to be advanced rests on subjective control by LSEs and subject to anti-competitive behavior by developers, and thus is likely to leave many projects behind that could otherwise prove to be the most attractive and viable. Moreover, because the proposed process will drive applications and LSE selections to local capacity reliability (LCR) areas where development costs are typically much higher(suitable for developers with deepest pockets) and large-scale solar and wind development are simply infeasible.

Nevertheless, we offer the following recommendations to marginally improve the proposed process.

Commercial interest

The LSE-interest scoring element provides too much subjective control over the process by LSEs without these LSEs having any information about the transmission impact of the resources they are selecting. To address this, CAISO should:

- reduce the LSE-interest score to a maximum of 20% of the total score;

- adopt the CAISO proposal to limit each LSE to scoring only one of the LSE’s sponsored or affiliated projects per cycle;

- further develop the CAISO proposal to also award points for projects with documented commercial interest from non-LSE off-takers, which should be consistent with the point system for LSE interest; and

- establish guidelines to ensure a transparent and objective process for the allocation of points.

In its next paper, CAISO should explain how total available capacity on the system is calculated and should provide a realistic estimate of that capacity. This figure should be used in the example illustrating the process.

Project viability:

- It is not clear how the AACEI cost estimate classification helps to define the percentage of engineering design plan completeness. In any case, engineering design plans are only a matter of expense, increasing the cost of development without differentiating the viability of projects, and this criterion is therefore not a useful indicator of project viability.

System need:

- Long lead-time (LLT) resources (a term that requires further consideration as discussed below) should not be placed in the same scoring system as other resources. Elsewhere in the proposal, CAISO proposes to reserve TPD capacity for such resources in the resource portfolio. Such reservation will require a separate scoring process for LLT projects in which LLT projects would compete only against each other for the reserved TPD capacity. Non-LLT projects behind the same constraint would compete for any remaining capacity.

4.

Provide your organization’s comments to additional modifications to the merchant deliverability option:

This element of the proposal requires further clarification: “The ISO will calculate a single capacity number for each zone, which will be based on the CPUC portfolio. These zonal capacity numbers will be used to designate Transmission Plan Deliverability zones and Merchant Deliverability zones.” Please clarify whether the CPUC portfolio will serve as the CAISO’s base portfolio and whether the zonal capacity is the total FC capacity in the base portfolio.

Regarding this statement: If the Merchant Deliverability project(s) has not executed a GIA, and the ADNU has not been included in the TPP base case, projects are released from funding the ADNU and be refunded once GIA executed. The project retains the deliverability for two years, with a retention requirement of meeting TPD allocation Group A or B within the next two years. Converting to EO if it can't retain. If the Merchant Deliverability project(s) has executed GIA, and the ADNU has been included in TPP base case as a merchant ADNU, the project continue funding the ADNU and proceed as MD” -- these two paths could leave a gap, where some projects may not fall into either path. CalWEA recommends that, regardless of GIA status, a project be able to choose one of the options right after ADNUs are approved in the TPP.

5.

Provide you organization’s comments on new section 2.7.1 – TPD Allocation Process Modifications:

CalWEA supports the proposal to reserve TPD capacity for “long-lead-time” resources with some modifications:

- The nebulous term “long-lead-time” (which could encompass any resource awaiting transmission) should be replaced with “location-constrained resources” – i.e., projects that tap resources that exist in limited locations on the CAISO grid – and that are contained in the resource portfolios of the CPUC or other Local Regulatory Authority. CAISO should request that LRAs identify such resources in their resource portfolios.

- CAISO should clarify that location-constrained resources may be supported by existing transmission as well as newly approved transmission upgrades.

- As discussed in response to question 3, the scoring process for queue entry should align with the TPD capacity reservation.

- CAISO must place phantom projects, equal to the capacity being reserved, in the base case so that needed capacity throughout the system will be reserved.

In addition:

- Energy Only projects, especially ones that have converted to EO due to lack of transmission capacity, should continue to be able to seek TPD under Groups A and B upon securing a PPA or being short-listed.

- TPD-Allocation Group D should be retained. Even under the proposed queue entry process, projects will still have a high risk of not getting deliverability. Group D helps to break the deadlock of PPA and deliverability interdependency.

6.

Provide your organization’s comments on updates made to Section 3.6 - Viability Criteria and Time in Queue:

EO projects should be able to acquire a PPA for RA capacity and at that point request TPD capacity.

7.

Provide your organization’s comments on updates made to Section 3.8 – Earlier Financial Security Postings for Projects with Shared Upgrades:

No comment.

8.

Provide your organization’s comments on updates made to Section 3.9 – Revise Timing of GIA Amendments to Incorporate Modification Results:

CalWEA supports the updates.

9.

Additional comments:

Zones

- Please confirm that Morro Bay Offshore Wind and Humboldt Offshore Wind will be treated as separate zones from Fresno and North of Greater Bay Area as shown in Figure 1.

TPP portfolio and base case

- Please confirm that, where CAISO refers to “TPP portfolio” and “base case,” it means the base portfolio.

Fulfillment of 150% available capacity

- Zonal capacity is the capacity in the IRP portfolio, directed to the CAISO TPP, which by design could exceed the current transmission capacity and trigger new transmission upgrades. In contrast, fulfillment of 150% of available capacity is based on actual deliverability constraints. At the time of fulfillment, the new transmission upgrades may not be approved yet. Thus, it is possible that zonal capacity could exist, but no projects in the zone are allowed into the study process due to the deliverability constraints. This disconnect between zonal capacity and transmission capacity could cause inefficiency and delay projects in needed areas by potentially many years. This additional flaw in CAISO’s proposal is one more reason why CalWEA cannot support it.

Limitation to TPD transferability

- CalWEA objects to requiring a project that transfers its deliverability to withdraw from the queue or to downsize its generating capacity to its remaining deliverability. Such projects are subject to the commercial viability criteria and time-in-queue requirements proposed in Section 3.6. Therefore, they should be allowed to develop as EO projects if shown to be commercially viable as an EO project or seek deliverability if viability criteria are met.

Overall Proposal

As indicated in our responses to questions 1 and 3, and the comment on 150% available capacity above, CalWEA does not support the CAISO’s overall proposal to address the large volume of resources in the queue. It is fundamentally flawed because it moves the study process forward for a small minority of early-stage projects from deep-pocketed developers based on information other than what is most vital to project viability -- transmission upgrade costs and timelines. The proposal increases the risk of the study process by requiring developers to commit to the study process without knowing the amount of available capacity. The process upon which projects are proposed to be advanced rests on subjective control by LSEs and is thus subject to anti-competitive behavior. As a result of all of these factors, the process is likely to leave many projects behind that could otherwise prove to be the most attractive and viable. It will also drive applications to LCR areas where development costs are higher and large-scale solar and wind development is not feasible. For all of these reasons, the proposal is fundamentally at odds with open-access principles and is anti-competitive, which will drive costs up for electricity consumers.

Clearway Energy Group

Submitted 02/29/2024, 04:59 pm

1.

Provide your organization’s comments on the proposed generic timeline proposed in Section 2.1 - The Zonal Approach: Data Accessibility:

Clearway appreciates CAISO’s commitment to invest time and effort in providing additional data to stakeholders in order to make the interconnection process more meaningful. Clearway would like to commend CAISO for laying out the process framework in Figure 4 of the Draft Final Proposal. We understand that the timelines depicted in Figure 4 are subject to change. Given that, Clearway requests that CAISO confirm that the TPD Allocation study to be performed in 2025 will be tied to the timing of the Board of Governors’ approval of the 2024-2025 Transmission Plan and will include all the approved projects as topology assumptions. Not doing so will result in a lost opportunity to allocate TPD to generation projects that are mature in the study process. This will potentially result in a constrained supply of resources for offtakers looking to contract resources to meet long-term RA needs.