ACP-California

Submitted 04/25/2023, 02:49 pm

Submitted on behalf of

ACP-California

1.

Please provide your organization’s overall comments on the Draft 2022-2023 Transmission Plan April 11, 2023 stakeholder call discussion.

ACP-California appreciates the opportunity to comment on the Draft 2022-2023 Transmission Plan and stakeholder call. ACP-California welcomes and strongly supports the CAISO’s more proactive and forward-looking approach to approving transmission in the 2022-23 TPP cycle, where the 30 MT Sensitivity Case (in addition to the base resource portfolio) was considered, where possible, in the selection of new transmission projects recommended for approval. This represents a more proactive approach to transmission planning than we have seen in the past and this type of approach is critically important to continue, and build on, in order to meet the infrastructure challenges that the state and the region are facing to bring new resources online to meet policy and reliability needs. As discussed below, proactive transmission planning is even more important given the delays we have seen in PTOs bringing approved projects online. Finally, we support CAISO’s efforts to explore transmission partnership opportunities and creative solutions and we encourage continued work on this front.

ACP-California is encouraged to see CAISO’s more proactive approach to transmission planning taken in the 2022-23 Draft Transmission Plan. In the 2022-23 Draft Transmission Plan CAISO has used the base case portfolio as the basis for project approvals but has also looked to the sensitivity case to help “right size” the proposed solutions. By using the sensitivity studies to advise approvals, CAISO may “get ahead” of the anticipated needs in next year’s TPP, allowing the better identification of transmission projects that are necessary to maintain the reliability of the ISO transmission system and unlock access to renewable resources to meet California’s energy needs.

This is critical for a number of reasons. For starters, it is efficient and represents prudent planning, given that the sensitivity case is far more reflective of the longer-term direction of the system (as compared to the base case in this cycle). Thus, right sizing proposed transmission to the long-term direction of the system will likely result in overall savings to ratepayers. Relatedly, the CAISO acknowledges its efforts to date to study transmission alternatives to facilitate offshore wind in the north and central coasts, as well as its intention to make decisions about these alternatives in the next transmission planning cycle. Following two cycles of sensitivity analyses, we are pleased that such projects will be considered for approval next cycle and expect the CAISO’s past analyses will help right-size projects and accelerate approvals to ensure offshore wind projects can be online on time.

Additionally, a more proactive approach to transmission approvals is imperative given the substantial delays that continue to be experienced by the PTOs in permitting and bringing approved transmission projects online. We appreciate the work CAISO has done in seeking to address these delays, such as hosting the Transmission Development Forum and also appreciate work ongoing in multiple venues to try to reduce these delays. However, this issue continues to create challenges in bringing new generation on to the system and it is essential for CAISO, the PTOs and stakeholders to seek to identify and implement other solutions to ensure timely transmission permitting and approval going forward. Given the significant delays that are being experienced, and the potential for them to be further exacerbated by ongoing supply chain issues, it is crucial for transmission projects to be approved as soon as possible, so that work can commence in permitting, construction and operationalization of the lines. We therefore commend CAISO for being more proactive and welcome continued work in this area in the future.

In the 2022-23 Draft Transmission Plan CAISO notes several projects where it is exploring partnership opportunities, such as SWIP-North and the Pacific Transmission Expansion Project (PTEP). We urge CAISO to continue to explore these projects, the potential for project partnerships on them and to engage in other creative transmission partnerships and solutions to bring renewable resources to California markets (such as what CAISO is doing with the Subscriber PTO process).

ACP-California commends the CAISO for all the work it has performed to-date on the 2022-2023 TPP and looks forward to continuing our engagement on these important issues, including in the upcoming 2023-34 TPP.

2.

Provide your organization’s comments on chapter 1 Overview of the Transmission Planning Process.

3.

Provide your organization’s comments on chapter 2 Reliability Assessment.

4.

Provide your organization’s comments on chapter 3 Policy-Driven Need Assessment.

5.

Provide your organization’s comments on chapter 4 Economic Planning Study.

6.

Provide your organization’s comments on chapter 5 Interregional Transmission Coordination.

7.

Provide your organization’s comments on chapter 6 Other Studies and Results.

8.

Provide your organization’s comments on chapter 7 Special Reliability Studies and Results.

9.

Provide your organization’s comments on chapter 8 Transmission Project List.

Advanced Energy United

Submitted 04/26/2023, 03:41 pm

1.

Please provide your organization’s overall comments on the Draft 2022-2023 Transmission Plan April 11, 2023 stakeholder call discussion.

Advanced Energy United appreciates this opportunity to submit comments regarding the draft 2022-23 Transmission Plan.

Advanced Energy United is a national trade association with over 100 member companies across the clean energy landscape, from large-scale renewable energy and transmission developers to providers of distributed clean energy resources, grid services and technologies. United members are highly impacted by the Transmission Plan as providers of transmission solutions, generators and offtakers of clean energy, and participants in energy markets.

In general, United is pleased that the Transmission Plan proposes a robust suite of transmission solutions to the daunting challenge of the clean energy development needs identified by the California Energy Commission (CEC) and Public Utilities Commission (CPUC). The projects identified in the Plan will help unlock tremendous clean energy resources across the state, strengthen energy and capacity trading opportunities across the West, and facilitate the integration of responsive, distributed energy resources in local communities. In short, this draft Transmission Plan is a response commensurate with the scale of the challenge.

2.

Provide your organization’s comments on chapter 1 Overview of the Transmission Planning Process.

- Support for tighter linkage between CAISO and California energy agencies, and between planning and procurement

United is pleased to see the benefits in this draft Transmission Plan (TP) of the tighter coordination between the ISO and California energy agencies as outlined in the December 2022 Memorandum of Understanding (MOU). That MOU was significant in that it builds on the longer-term statewide clean energy planning required by SB 100, incorporates the additional proactive resource planning capabilities at the CEC, memorializes the increased geographic specificity (busbar mapping) of the CPUC’s resource portfolios, and proposes tighter linkages between planning and procurement.

This last point is of critical importance, and it is a still nascent goal in the process of being operationalized at both the CPUC and CAISO. United appreciates CAISO’s re-iteration of its commitment to pursuing revisions to its interconnection process to prioritize resources with the operational characteristics and geographic locations consistent with the CPUC’s resource planning.

United believes the importance of this initiative can be substantiated with additional analytic output from the TP. Specifically, United recommends that where possible the CAISO highlight in the TP areas where such consistency is particularly important to the plan’s conclusions. In other words, if resource procurement or interconnection were not consistent with the CPUC’s resource portfolios in a given region, would the conclusions regarding transmission constraints and deliverability be materially different?

3.

Provide your organization’s comments on chapter 2 Reliability Assessment.

4.

Provide your organization’s comments on chapter 3 Policy-Driven Need Assessment.

- Addressing long-known constraints

United applauds CAISO for addressing major transmission constraints for the development of priority resources identified in multiple previous CAISO and state conceptual planning exercises, dating at least to the RETI 2.0 exercise in 2016-17. These include accessing the substantial renewable resources of the San Joaquin Valley, north of Lugo area, the Imperial Valley, and Eastern San Bernadino and Riverside counties.

Further, the substantial investments in new and re-conductored 500 kV lines between the LA Basin and southern Nevada and, through the Imperial Valley, to eastern Arizona are a critical investment to resolve long-known constraints to increased imports from out-of-state resources. United strongly supports both the technical advantages of strengthening linkages to the southwest, as well as the market signal this represents in the state’s openness to out-of-state resources and increased cooperation in both power and capacity transactions.

- Preferred Resources, Grid-Enhancing Technologies, and Non-Wires Alternatives

United strongly supports the consideration and integration of solutions to transmission constraints that leverage the capabilities of preferred resources, grid-enhancing technologies, and other non-wires alternatives (NWAs). We are concerned however that the TPP methodology for identifying and evaluating NWAs is opaque and potentially outdated, and we urge CAISO to include greater data and explanation of where and how NWAs were evaluated.

The final Study Plan for the 2022-23 TPP discussed preferred resources, including energy efficiency, demand response, renewable resources, and energy storage, and the evaluation methodology that CAISO initiated in 2013. The Study Plan attests that the methodology has been used in a limited number of special areas for specific local capacity areas conducted in certain years – including the Moorpark study in 2017 and the Oakland Clean Energy Initiative in 2018. The Study Plan states that the TP’s reliability assessment would evaluate the use of NWAs from a universe of resources comprising a) existing DR capacity, b) CEC’s projection of uncommitted energy efficiency, and c) CPUC-authorized storage procurement as mitigations. Lastly, the Plan promises that any storage identified as a transmission solution would be “for informational purposes only and clearly documented,” and that such options could be “pursued through a resource procurement process. In some situations, the storage could be approved as a transmission asset.”[1]

United notes that the final Transmission Plan does not in fact identify any targeted preferred resource deployments as mitigation. In fact, the TP mentions projects where previously-identified storage solutions are recommended for cancellation or reconfiguration.[2] We are concerned that, even after many years of effort, the consideration of preferred resources is lagging its potential. Accordingly, United suggests that CAISO:

- Provide greater clarity on the potential for storage as a transmission asset (SATA), either by re-opening the SATA initiative or explaining in the TP the criteria or general principles that could justify the CAISO’s approval of storage as a transmission asset.

- Update its methodology for evaluation of preferred resources, especially regarding the functionality of aggregated DERs or Virtual Power Plants

United also urges CAISO to provide greater clarity regarding the consideration of Grid-Enhancing Technologies (GETs), including dynamic line rating, advanced power flow control technologies, and topology optimization. GETs can be used to address constraints and unlock critically needed transmission capacity in the near term. A 2021 granular industry assessment[3] looked at the Southwest Power Pool system and found that deploying GETs could enable 2 adjoining states (Kansas and Oklahoma), to integrate 5,200 MW of wind and solar generation currently in interconnection queues by 2025 without any new large-scale transmission buildout, more than double the development possible without the technologies. This GETs deployment also created $175 million in annual production cost savings.

United would like to draw attention to the CAISO’s own comments to FERC in 2020, contending that RTO/ISOs specifically detail the consideration of GETs and how they were considered and evaluated for application. “The CAISO believes greater focus on how transmission providers consider grid enhancing technologies in the transmission planning process may help identify opportunities to pilot and deploy grid enhancing technologies. For example, transmission providers could publish within their transmission plans a summary of efforts to deploy grid enhancing technologies and the barriers or challenges that exist to such deployment. This information would provide transparency regarding how grid enhancing technologies might increase the capacity, efficiency, or reliability of transmission facilities.”[4]

United agrees with this recommendation, and requests that the CAISO follow its suggestion to include specific discussion of how GETs are evaluated and their barriers to deployment.

- Offshore wind scenarios

United understands that the base case CPUC resource portfolios transmitted for this TPP cycle do not include substantial North Coast offshore wind resources, and that the development potential of both Central and North Coast offshore wind resources are rapidly evolving in line with other state and federal planning processes. United supports the continued examination of transmission solutions that not only unlock these critical resources but also provide other critical system benefits. United looks forward to continued engagement on these opportunities in the 2023-24 Transmission Planning Process.

In the nearer term, United is supportive of continued investigation of the Pacific Transmission Expansion Project proposed HVDC line between Diablo Canyon and the LA Basin. United suggests that in its examination of this project, and in discussion with the Los Angeles Department of Water and Power (LADWP), that CAISO examine the potential for this project to deliver benefits for offshore wind development in the Morro Bay area beyond the 1.6 GW currently included in the CPUC resource portfolio, and in achieving goals for reducing local capacity requirements in the LA Basin.

[1] Final Study Plan, 2022-2023 Transmission Planning Process, June 30, 2022, section 2.8.1

[2] These include the North of Mesa and Wheeler Ridge Junction projects

[3] “Unlocking the Queue with Grid-Enhancing Technologies,” Brattle Group prepared for WATT Coalition, February 1, 2021

[4] Post-Technical Workshop Comments of the California Independent System Operator Corporation (at p. 2), Federal Energy Regulatory Commission Docket Number AD19-19-000 Grid Enhancing Technologies, February 14, 2020

5.

Provide your organization’s comments on chapter 4 Economic Planning Study.

6.

Provide your organization’s comments on chapter 5 Interregional Transmission Coordination.

7.

Provide your organization’s comments on chapter 6 Other Studies and Results.

8.

Provide your organization’s comments on chapter 7 Special Reliability Studies and Results.

- SB 887 Local Capacity Areas analysis

In the draft TP, the ISO has done important work in laying a foundation for identifying the transmission needs necessary to deliver clean resources into capacity-constrained local areas and reducing the need for local gas-fired resources. Indeed, the plan proposes twelve projects that will increase capacity into these areas. Of particular note, the upgrades to existing 500 kV and 230 kV lines and addition of new 500 kV lines to the LA Basin and San Diego areas represent the potential addition of significant new clean firm and ramping resources that promise to be significantly helpful in reducing local capacity requirements.

However, United is disappointed that CAISO has taken a conservative approach in valuing just the local capacity value of these projects. There appears to be sufficient information available to begin planning for the transmission impacts of gas-fired local capacity curtailments or retirements. For instance, the Aliso Canyon special study presented in Appendix K examines the transmission implications of substantial gas curtailments in the LA Basin and presents potential transmission project mitigations. United urges CAISO to continue this analysis to begin identifying projects that address these contingencies in the event of significant reduction of local gas-fired generation. As a specific and near-term example, it appears from the Aliso Canyon analysis that the Pacific Transmission Expansion Project would offer significant benefits to alleviating constraints in the event of reduced in-basin gas generation that are not currently considered in the reliability-, policy-, and economic-driven considerations of this project. United urges the ISO to include these benefits in its evaluation of this line as discussion with LADWP continues.

9.

Provide your organization’s comments on chapter 8 Transmission Project List.

Bay Area Municipal Transmission Group (BAMx)

Submitted 04/25/2023, 01:23 pm

Submitted on behalf of

City of Palo Alto Utilities and Silicon Valley Power (City of Santa Clara)

1.

Please provide your organization’s overall comments on the Draft 2022-2023 Transmission Plan April 11, 2023 stakeholder call discussion.

The Bay Area Municipal Transmission group (BAMx)[1] appreciates the opportunity to comment on the Draft 2022-2023 Transmission Plan (Draft Plan, hereafter), dated April 3, 2023. The comments and questions below also address the material presented at the CAISO Stakeholder meeting on April 11, 2023. BAMx recognizes the tremendous amount of work the CAISO staff has completed in this planning cycle. BAMx also believes the CAISO staff must allow a corresponding amount of time to engage the stakeholders to explain the staff’s work.

BAMx supports several elements of the Draft Plan. For example, BAMx supports the right-sizing of the projects when the Base portfolio assessment triggers them to ensure that the capacity offered by the proposed transmission projects is adequate to accommodate resources identified in the Sensitivity portfolio. BAMx also supports relatively low-cost mitigation measures like power system control devices that balance the flow on the existing transmission network and the CAISO's consideration of a generic Battery Energy Storage System (BESS) to address potential violations of off-peak deliverability constraints. [See BAMx’s response to Q.3 and Q.4 for details].

On the other hand, BAMx opposes the Draft Plan’s recommendation to approve transmission projects based only on the need identified in the sensitivity portfolio. Per the CAISO's FERC-approved tariff, a Category 1 policy-driven transmission solution has to be identified to be needed "in the baseline scenario and at least a significant percentage of the stress scenarios." Since some of the projects currently recommended for approval are not identified as needed under the Base portfolio, they clearly do not satisfy the criteria for Category 1 transmission and, therefore, should not be approved during the current TPP cycle. Furthermore, the draft 2023-2024 TPP CPUC portfolios or any synergy with the CAISO 20-Year Outlook should not be used as criteria to recommend any projects as Category 1 policy-driven transmission solutions in the current TPP. They could be classified as Category 2 policy-driven transmission solutions and can be studied in subsequent transmission planning cycles. BAMx recognizes that the CPUC’s letter[2] to the CAISO, dated January 13, 2023, in accordance with SB 887, requests CAISO to consider whether to approve the highest priority transmission facilities that are needed to allow for increased transmission capacity into local capacity areas to deliver renewable energy resources or zero-carbon resources that are expected to be developed by 2035 projects as part of the CAISO’s 2022–23 TPP. But that does not mean that the CAISO should rush approvals of the projects in violation of its FERC-approved tariff. As we indicate below, the CPUC resource portfolios can differ significantly from one transmission planning cycle to another. For instance, the 2035 Base portfolio that will be studied as part of the 2023-2024 TPP departs from its utilization of transmission capability from the 2035 Sensitivity portfolio that was studied under the 2022-2023 TPP, although both these portfolios are based on the 30MMT GHG target.[3] [See BAMx’s response to Q.4 for details].

In these comments, BAMx also raises some major concerns about the skyrocketing CAISO transmission access charges (TAC) and the CAISO’s financial fiduciary responsibilities to Californians and grid users. BAMx comments should be construed as attempting to assist the State in its journey to achieve its climate goals and not as any opposition to taking the necessary steps. Further, BAMx recognizes that electric rates will probably continue to rise as a necessary outcome in achieving the State’s climate goals. That said, it is imperative and incumbent on the CAISO to design and develop an appropriate and cost-effective electric grid to accomplish those goals.

In order to understand the TAC impact of the projects the CAISO management may recommend for approval as part of the current planning process, BAMx developed a High Voltage (HV) TAC forecast for the period of 2023-2031. BAMx’s forecast shows that the HV TAC would rise to $24.5/MWh in 2036 purely based on the recommended project approval under the Draft Plan relative to the existing level of $15/MWh, a staggering 63% increase in thirteen years. [See BAMx’s response to Q.8 for details].

Out of the $24.5/MWh of forecasted HV TAC in 2036, more than 50% of the increase (or ~$5/MWh[4]) is solely attributed to the nearly $8.6 billion[5] HV transmission projects the CAISO is considering for approval in the current TPP cycle. BAMx’s HV TAC projections show the tremendous impact these potential project approvals will have on the ever-increasing CAISO-wide HV TAC. As detailed in the remaining BAMx comments, the CAISO and stakeholders must complete thorough reviews and analyses to ensure the “right” projects are proceeding forward while eliminating excessive costly or unnecessary projects.

As the California Municipal Utilities Association (CMUA) issue brief[6] indicates,

“Based on California’s planned and anticipated transmission upgrades, this upward cost pressure could lead to another 43% increase to [HV + LV] TAC by 2030, reaching $48.7 per MWh, and a potential 98% increase by 2040, reaching $67.5 per MWh. This means the monthly cost of transmission for an average Northern California residential customer could rise from $27 in 2022 to $37 by 2030, and $54 in 2040 — a 100% increase over 18 years.”

The CMUA brief also compares the transmission costs in California to the rest of the nation.

“To put this in context, Northern California’s transmission costs are more than two and a half times the national average in 2022. Nationwide residential electric customer spending on transmission is expected to further increase by 86% by 2040, but in Northern California, it may rise an estimated 100%. The result is electric customers in California could be paying almost three times the national average for transmission in 2040.”

Rushed investments to build out additional transmission could lead to higher electricity prices and make California’s climate goals more difficult and more expensive to achieve. We caution that prohibitively expensive transmission costs could also compel current CAISO Load-Serving Entities (LSE) to exit the CAISO Balancing Authority Area (BAA), leading to a death spiral, further increasing the transmission costs for those LSEs that remain within the CAISO BAA.

BAMx recognizes that the combination of the dramatically increasing pace of new renewable generation and load forecast growth are driving an increase in transmission requirements under certain portfolio scenarios. However, the CAISO and the stakeholders must refrain from rushing to approve projects without allowing adequate time to complete the appropriate evaluation of each proposed project.

Furthermore, the CAISO typically posts its responses to past stakeholder comments before issuing the Draft Plan. This year, the CAISO posted them on the same day as the stakeholder meeting. This meant that stakeholders did not have adequate time to review the CAISO’s responses to their comments submitted in early December 2022 or digest their contents before having an opportunity to ask questions during the April 11th stakeholder meeting. BAMx finds it extremely challenging to respond and comment on certain aspects of the Draft Plan without fully assessing the CAISO’s responses to prior concerns raised by BAMx and other stakeholders.

In a nutshell, although BAMx does not oppose the need for most of the transmission projects recommended for approval, some of the remaining transmission projects that the CAISO has recommended for approval in this planning cycle need to be studied more extensively in the next cycle or at the very least their approval needs to be delayed until later in this cycle after the Board approval of the Plan in May 2023. The CAISO claims that “the [Draft] Plan also aligns with the 20-Year Transmission Outlook –and puts us on the right trajectory to meet 2045 goals.”[7] However, more information is necessary to systematically compare the transmission upgrades recommended in the Draft Plan and those envisioned in the 20-Year Transmission Outlook[8]. We see multiple benefits of such an exercise. First, it will provide the policy-makers, decision-makers, and stakeholders with information on how the CAISO’s transmission prioritization has evolved over the last transmission planning. Second, it will provide insights into updated cost estimates of the transmission projects needed to meet the State policy goals and their impact on the transmission access charge. Third, it will provide a glimpse into how the long-term plan or a refresh of the 20-Year Transmission Outlook expected in the 2023-2024 TPP cycle needs to be changed to account for the transmission recommended for approval in the Draft plan. BAMx has included a high-level analysis performing such a comparison based on certain assumptions (see BAMx’s response to Q.8. In particular, Table 8.1); however, we request the CAISO to confirm this assessment and include it in the Final Transmission Plan.

[1] BAMx consists of City of Palo Alto Utilities and City of Santa Clara, Silicon Valley Power.

[2] http://www.caiso.com/InitiativeDocuments/Letter-2022-2023-Transmission-Planning-Process-Jan%2013,%202023.pdf

[3] See Policy-driven Assessment Recommendations Draft 2022-2023 Transmission Plan, Transmission Infrastructure Planning 2022-2023 Transmission Planning Process Stakeholder Meeting, April 11, 2023, pp.5-6.

[4] This amount is consistent with the CAISO’s estimate of 0.5 cents per kWh impact included in the Draft Plan (p.4)

[5] This amount purely captures the HV portion of the $9.3 billion of a total infrastructure investment plus a revised cost estimate of two previously approved projects, that is, Wheeler Ridge Junction Project and incremental GLW/VEA Area Upgrades project.

[6] https://www.cmua.org/Files/Issue%20Briefs/CMUA_Transmission_Costs_IB_August2022.pdf?mc_cid=d19a1104ee&mc_eid=92addbdaa9

[7] Introduction Draft 2022-2023 Transmission Plan, Neil Millar, Vice-President, Infrastructure & Operations Planning, 2022-2023 Transmission Planning Process Stakeholder Meeting, April 11, 2023, pp.5-6.

[8] http://www.caiso.com/InitiativeDocuments/20-YearTransmissionOutlook-May2022.pdf

2.

Provide your organization’s comments on chapter 1 Overview of the Transmission Planning Process.

BAMx agrees with the CAISO that the role of battery storage is expected to continue to grow as a complement to renewable generation and also as a key source of capacity to meet both system and local capacity needs.[1] Ultimately, storage resources will be available to meet energy needs during most periods when renewable resources are not available to generate. BAMx agrees with the conclusion that only the incremental interconnection cost for the storage should be compared to transmission costs when the batteries are located in local constrained areas.

BAMx applauds the CAISO staff’s efforts in relying on the implementation of Remedial Action Schemes (RAS) and storage solutions in its Preliminary Policy Assessment. The CAISO has effectively and rightfully utilized the existing/planned RAS dispatching portfolio with battery storage in charging mode, and also includes new battery storage to mitigate the contingency overloads. BAMx understands the CAISO’s recommendation for transmission upgrade alternatives for the base portfolio that take into consideration the inadequacy and complexity of RAS in certain planning areas. BAMx encourages the CAISO to transfer such valuable feedback to the California Public Utilities Commission (CPUC) and California Energy Commission (CEC) so that it is incorporated as part of the battery storage mapping exercise in the next Transmission Planning Process (TPP) cycle.

[1] Draft Plan, p.26.

3.

Provide your organization’s comments on chapter 2 Reliability Assessment.

Consideration of Reliability Upgrades: Cortina 60 kV Line and Garberville Area Reinforcement Projects

In our prior comments in this planning cycle, BAMx had encouraged the CAISO to explore other options for PG&E's Cortina and Garberville areas, where PG&E is proposing capital-intensive projects ($300 million) to accommodate small incremental demand increases. Since then, we have had the opportunity to further examine the reliability needs in these areas.

BAMx’s examination of the CAISO-posted reliability assessments and underlying power flow cases indicate no overloads on the Cortina #1 60 kV, as observed in the PG&E assessment[1]. BAMx found low voltages in the 2032 case – 0.892 at the end of the line at the Dunnigan substation. Under normal conditions, the loading on the Cortina #1 60 kV was 91.5%. The Cortina # 1 60 kV line is a radial line that serves one load and has no generation. So, its loading depends only on the load and is unrelated to the generation dispatch. The installation of battery storage will improve loading and voltages, but PG&E stated that this alternative is infeasible because the charging capability on the transmission line is limited.

Several switches are normally opened in this area. Closing some of them improves voltages. The system model has two open switches at the Arbalt 60 kV substation. Closing these connections between Arbalt and Arbuckle and Arbalt and Dunntap improves voltages and reduces loadings. In the 2032 case, the loading on the Cortina # 1 60 kV line was reduced from 91.5% to 77.4% by closing these switches. Closing the normally open switch on Wilkins between DIST2047 and DIST1500 60 kV buses will also improve voltages and reduce loadings. In the 2032 case, the loading was further reduced to 65.9%.[2] BAMx supports the Draft Plan determination to not approve the Cortina #1 60 kV line reconductoring in the current cycle.

When considering the Bridgeville-Garberville upgrade, it should be noted that loading of the Bridgeville-Garberville 60 kV line significantly depends on the output of the Humboldt Bay power plant, and its overload can be mitigated by reducing Humboldt Bay generation. It appears the Humboldt Bay Power plant output was reduced in the summer cases but was modeled at full output in winter. Reducing its output in the 2032 Winter case will mitigate the overload but will not help relieve low voltage criteria violations. Additional reactive support should be investigated as a solution for low-voltage violations. According to PG&E, space limitations at the Garberville substation prevent the installation of battery storage there. BAMx believes the feasibility of BESS needs to be investigated further. Even if a BESS at one of the substations connected to the Bridgeville-Garberville 60 kV line is unfeasible, other alternative locations should be investigated. Those investigations should include installation on the low side of existing transformers or obtaining a new site for installing BESS. BAMx endorses the CAISO methodology of only considering incremental interconnection costs for BESS that are needed for system issues. Even if there are interconnection costs, in this case, only those incremental costs should be included in an analysis of BESS for this area. A BESS should be investigated to mitigate any voltage or thermal criteria violations. In response to BAMx’s query on the consideration of battery storage as alternative mitigation, the CAISO stated that the battery storage size was limited by the capacity on the line south of Bridgeville and also that the 4-hour battery storage was found to be inadequate in addressing the 24-hour commercial load in this area. BAMx requests the CAISO to include more detailed explanation of all alternatives considered to justify the need for the proposed Garberville Area Reinforcement project in the Final Transmission Plan.

BAMx Appreciates CAISO’s Due Diligence In Identifying Relatively Low-Cost Mitigation Measures

BAMx supports relatively low-cost mitigation measures like the Series compensation proposed on the Lone Tree – Cayetano – Newark Corridor path.[3] BAMx also appreciates the CAISO's consideration of a generic BESS to address potential violations of off-peak deliverability constraints. As the CAISO has noted, a number of the criteria violations are identified in local areas on the 70 kV and 115 kV systems. As noted, alternatives that map generators at higher voltages (likely at 230 kV) need to be considered in subsequent planning cycles.[4] BAMx encourages the joint agencies (California Public Utility Commission, California Energy Commission, and CAISO) to develop such alternative mapping for the next TPP cycle.

[1] PG&E September 28th Presentation, p.34.

[2] We also believe alternatives, such as installing energy storage and shunt capacitors, should be explored. There needs to be a more detailed investigation of the feasibility of an appropriate charging cycle for the storage and the ability of shunt capacitors to solve any remaining voltage issues. Those alternatives should be investigated before approving the Cortina #1 60 kV line reconductoring.

[3] Draft Plan pp.43-44.

[4] Ibid, p. 110.

4.

Provide your organization’s comments on chapter 3 Policy-Driven Need Assessment.

BAMx Needs to See More Complete Information Provided in Draft Plan for Better Stakeholder Understanding of CAISO Policy-Driven Assessment

For the preliminary policy-driven assessments, the CAISO had not provided adequate information to stakeholders to understand and independently analyze the need for proposed Policy-Driven Projects. However, in the Draft Plan, consistent with BAMx’s request[1], the CAISO has provided the critical data for each deliverability constraint, identifying the renewable portfolio capacity (MW) levels behind the constraint, energy storage (ES) portfolio capacity (MW) behind the constraint, renewable curtailment levels without mitigation (MW), etc. BAMx appreciates the CAISO staff's responsiveness to stakeholder input.

BAMx Opposes CAISO Recommended Approval of Transmission Needs Only Identified in Sensitivity Portfolio

BAMx opposes the Draft Plan’s recommendation to approve transmission projects based on the need identified only in the sensitivity portfolio. Per the CAISO's FERC-approved tariff, a Category 1 policy-driven transmission solution has to be identified to be needed "in the baseline scenario and at least a significant percentage of the stress scenarios." Since some of the projects currently recommended for approval are not identified as needed under the Base portfolio, they clearly do not satisfy the criteria for Category 1 transmission and, therefore, should not be approved during the current TPP cycle. Furthermore, the draft 2023-2024 TPP CPUC portfolios or any synergy with the CAISO 20-Year Outlook should not be used as criteria to recommend any projects as Category 1 policy-driven transmission solutions in the current TPP. They could be classified as Category 2 policy-driven transmission solutions and can be studied in subsequent transmission planning cycles.

Therefore, BAMx urges the CAISO to delay the approval of the following projects and any others that do not meet the criteria included in the CAISO tariff in the 2023-2024 TPP.

- Trout Canyon – Sloan Canyon 500 kV Upgrade: The Trout Canyon – Sloan Canyon 500 kV Upgrade was considered to alter the scope of the GLW/VEA Area Upgrades project when the need for the former project was only triggered in the Sensitivity portfolio.[2] The Innovation RAS appears adequate to address GLW 230 kV System issues in the Base portfolio.

- Trout Canyon – Lugo 500 kV Line: The Trout Canyon – Lugo 500 kV Line is recommended for approval based on the sensitivity portfolio to address Lugo-Victorville 500 kV constraint.[3] Lugo – Victorville RAS's expansion seems adequate in the Base portfolio.

Furthermore, it appears that the proposed Serrano–Del Amo–Mesa 500 kV Transmission Reinforcement project is not needed in the Sensitivity portfolio given its lack of need to address the Serrano–Barre corridor constraint[4] and South of Mesa corridor constraint[5]. Therefore, the CAISO needs to fully explain the need for the Serrano–Del Amo–Mesa 500 kV Transmission Reinforcement project under the Sensitivity portfolio. But the project should not be approved now because it does not seem to be needed in the base portfolio.

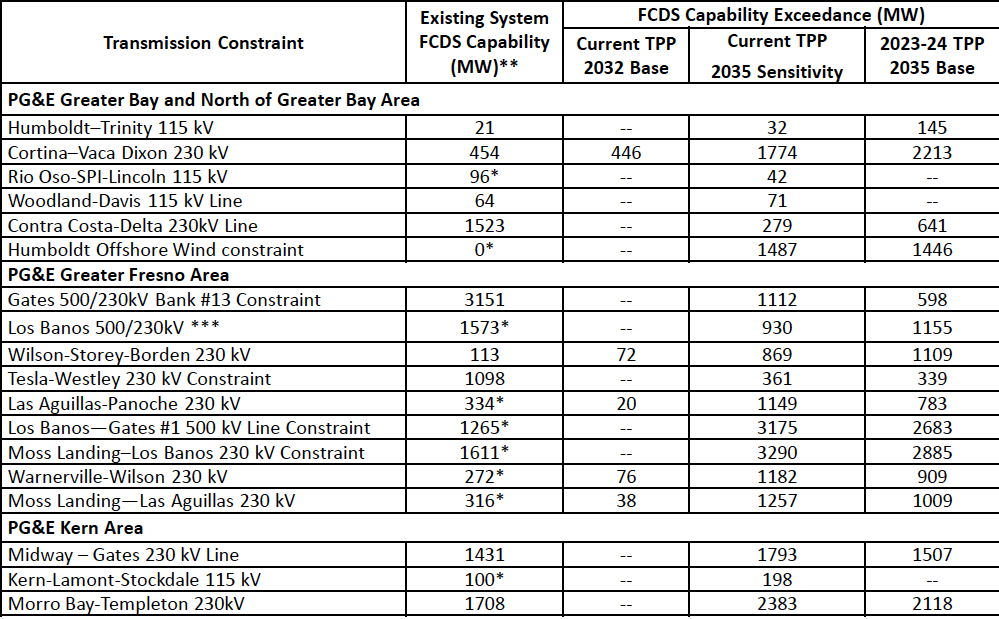

BAMx recognizes that the CPUC’s letter[6] to the CAISO, dated January 13, 2023, in accordance with SB 887, requests CAISO to consider whether to approve the highest priority transmission facilities that are needed to allow for increased transmission capacity into local capacity areas to deliver renewable energy resources or zero-carbon resources that are expected to be developed by 2035 projects as part of the CAISO’s 2022–23 TPP. But that does not mean that the CAISO should rush approvals of the projects when uncertainty exists about the need and proper scope of the transmission upgrades, especially when they are driven by CPUC resource portfolios that differ significantly from one transmission planning cycle to another. For instance, the 2035 Base portfolio that will be studied as part of the 2023-2024 TPP departs from its utilization of transmission capability from the 2035 Sensitivity portfolio that was studied under the 2022-2023 TPP, although both these portfolios are based on the 30MMT GHG target. As seen from those tables reproduced in Table 4.1 below, the last two columns are not identical and differ significantly for some of the transmission constraints, such as the Victor to Lugo 230 kV Constraint and Lugo 500/230 kV Transformer Constraint.[7] Therefore, any project that is approved in the current TPP based on the Sensitivity portfolio may not be needed or have the proper scope based on next year’s Base portfolio. It is important to recognize that the CPUC resource portfolios are dominated by generic resource buildout and not by projects that are currently under development. Similarly, it may make sense to wait for another year to determine the scope of the new policy-driven transmission projects or expansion of the previously-approved transmission projects, such as the GLW/VEA Area Upgrades project. As shown in Table 4.1 below, the FCDS capability exceedance level is dramatically reduced from 1,676 MW in the current TPP Sensitivity portfolio to 1,058 MW in the next year’s TPP Base portfolio for the GLW-VEA Area constraint.

Table 4.1: Utilization of Transmission Capability by Portfolios

|

North

|

|

South

* Default constraints; ** Include values updated by CPUC based on information in 2021-22 TPP;

*** capability includes projects approved in 2021-22 TPP

|

Furthermore, BAMx’s analysis of the CPUC busbar mapping spreadsheet indicates that CPUC’s 2035 Base portfolio of FCDS resources exceeds the FCDS capability of not only the existing system FCDS capacity as shown in the CAISO’s February 28th presentation as part of the 2023-2024 TPP, but also exceeds the incremental FCDS capacity offered by the additional area delivery network upgrades (ADNU) identified by the CAISO.[8] BAMx’s analysis suggests inadequate assessment of transmission cost, where the CPUC-provided Base portfolio of resources in the year 2035 exceeded the FCDS capability of the existing plus the Area Delivery Network Upgrades (ADNU) identified by CAISO for thirteen (13) different transmission constraints, such as the Los Banos 500/230kV Transformer Constraint and Serrano – Alberhill – Valley 500 kV Constraint.

CAISO Should Explore Every Option to Reduce TAC-payer Burden for Approving Out-of-State Transmission Projects

BAMx appreciates the CAISO's recognition of the need to take into account evolving CPUC portfolios for out-of-state (OOS) resources and concerns expressed by stakeholders.[9] Since the 2022-2023 TPP does not explicitly include OOS wind from Idaho in the Base Case, BAMx believes it would be inappropriate for the CAISO to approve the SWIP-North project in the current TPP.[10] It is the only current proposal providing direct access to the Idaho resources. SWIP-North project is not needed in the Base portfolio for the current TPP but only in the sensitivity portfolio. [11] The SWIP-North project appears not to meet the criteria defining interregional transmission projects.[12] Since the SWIP-North project developer is not opting for a subscriber-based model, if this project is approved as a policy-driven project, its entire cost of $640 million would be borne by the CAISO TAC payers. Therefore, it is incumbent that every effort needs to be made for sharing that burden with other potential beneficiaries. BAMx welcomes the CAISO discussion with Idaho Power (and potential other transmission service providers) regarding their interest in the part of the South to North capacity of the SWIP North project.[13] BAMx also supports the opportunities for DOE funding for unutilized capacity that the CAISO is currently exploring. [14] BAMx does not believe that the CAISO should approve the SWIP North as a regional policy-driven project until the TAC reduction efforts associated with it are fully explored in consultation with the stakeholders.

[1] See BAMx’s comments on the CAISO Preliminary Policy-Driven and Economic Assessment, December 5, 2022.

[2] Draft Plan p. 76

[3] Draft Plan p. 80

[4] CAISO April 11th Stakeholder Meeting Presentation, p.101

[5] CAISO April 11th Stakeholder Meeting Presentation, p.103

[6] http://www.caiso.com/InitiativeDocuments/Letter-2022-2023-Transmission-Planning-Process-Jan%2013,%202023.pdf

[7] See Policy-driven Assessment Recommendations Draft 2022-2023 Transmission Plan, Transmission Infrastructure Planning 2022-2023 Transmission Planning Process Stakeholder Meeting, April 11, 2023, pp.5-6.

[8] See BAMx’s comments on the CAISO 2023-2024 Draft Transmission Study Plan (See Table 1 in Response to Q.2) , dated March 14, 2023.

[9] “Accessing out-of-state Idaho wind resources,” 2022-2023 Transmission Planning Process Stakeholder Meeting

November 17, 2022, p.8.

[10] BAMx recognizes that the CPUC Base portfolio calls for 1,062MW either Idaho or Wyoming wind. However, if 1,062MW Wyoming accessed via Transwest Express is assumed, then there will not be anu need to access Idaho wind in compliance with the Base portfolio.

[11] Ibid, pp3-4.

[12] Draft Plan, p.100.

[13] Ibid.

[14] Ibid.

5.

Provide your organization’s comments on chapter 4 Economic Planning Study.

No comments.

6.

Provide your organization’s comments on chapter 5 Interregional Transmission Coordination.

No comments.

7.

Provide your organization’s comments on chapter 6 Other Studies and Results.

No comments.

8.

Provide your organization’s comments on chapter 7 Special Reliability Studies and Results.

No comments.

9.

Provide your organization’s comments on chapter 8 Transmission Project List.

BAMx found the schematics presented by the CAISO during the April 11th meeting mapping the recommended policy-driven project for approval to the zonal resource portfolio driving their needs to be very helpful.[1] BAMx suggests that the CAISO include it in the Final Transmission Plan.

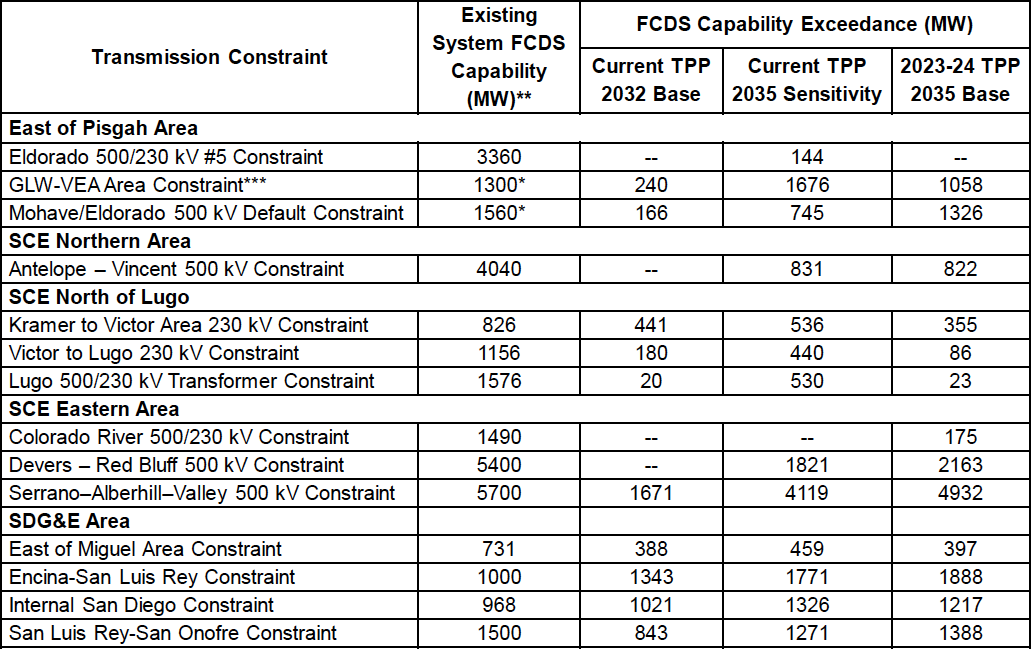

The Draft Plan does not include an estimate of future High Voltage Transmission Access Charge (HV TAC) rates at this time. The CAISO may be currently in the process of updating the “starting point” for the HV TAC estimating tool to January 1, 2023. Given the need for urgency to show the TAC impact of the projects the CAISO has recommended for approval as part of the current planning cycle, BAMx developed an HV TAC forecast for the period of 2023-2036, as shown in the figure below. In this analysis, BAMx used the last version of the CAISO’s TAC Estimating model developed for the 2021-2022 TPP, and updated the model to include the CAISO January 01, 2023, TAC Rates (updated as of April 7, 2023). The newly added capital expenditures associated with the transmission projects and their schedule were based on the transmission projects found to be needed in the 2022-2023 TPP as per the Draft Plan.[2] That is, those included in

- Table 8.2-1: New Reliability Projects Found to be needed; and

- Table 8.2-2: New Policy-driven Transmission Projects Found to be needed.

Figure 8.1: Transmission Capital Expenditures and HV TAC Projections (Base and Draft Plan Recommended Approvals): 2023-2036

.png)

As shown in Figure 8.1 above, the HV TAC would rise to $24.5/MWh in 2036 purely based on the recommended project approval under the Draft Plan relative to the existing level of $15/MWh, a staggering 63% increase in thirteen years.

Out of the $24.5/MWh of forecasted HV TAC in 2036, more than 50% of the increase (or ~$5/MWh[3]) is solely attributed to the nearly $8.6 billion[4] HV transmission projects the CAISO is considering for approval in the current TPP cycle.

The CAISO claims that “the [Draft] Plan also aligns with the 20-Year Transmission Outlook –and puts us on the right trajectory to meet 2045 goals.”[5] However, more information is necessary to systematically compare the transmission upgrades recommended in the Draft Plan and those envisioned in the 20-Year Transmission Outlook[6]. We see multiple benefits of such an exercise. First, it will provide the policy-makers, decision-makers, and stakeholders with information on how the CAISO’s transmission prioritization has evolved over the latest transmission planning cycle. Second, it will provide insights into updated cost estimates of the transmission projects needed to meet the State policy goals and their impact on the transmission access charge. Third, it will provide a glimpse into how the long-term plan or a refresh of the 20-Year Transmission Outlook expected in the 2023-2024 TPP cycle needs to be changed to account for the Draft Plan recommended approvals. BAMx has included a high-level analysis performing such a comparison in Table 8.1 below. However, we request the CAISO confirm this assessment and include some version of it in the Final Transmission Plan. For instance, we request the CAISO to confirm whether the projects recommended for approval under the Southern Area Reinforcement project replace and therefore eliminate the need for any (all) of the projects envisioned in the 20-Year Transmission Outlook, such as Devers – La Fresa HVDC ($1.2 B), Lugo – LA Basin HVDC ($1.0 B), and Sycamore – Alberhill HVDC ($1.0 B).

Table 8.1: A Comparison of Project Approvals in the 2022-2023 Draft Transmission Plan and Those Identified in the 20-Year Transmission Outlook and Associated Capital Cost

|

2022-2023 Draft Transmission Plan

|

20-Year Transmission Outlook

|

|

Trout Canyon-Lugo 500 kV Line ($2B)

|

Eldorado – Lugo 500 kV line ($1B)

|

- Colorado River-Red Bluff 500 kV 1 Line Upgrade ($50M)

- Devers-Red Bluff 500 kV 1 and 2 Line Upgrade ($140M)

- Devers-Valley 500 kV 1 Line Upgrade ($40M)

|

- Colorado River – Devers 500 kV line ($1.2 B)

|

|

North Gila–Imperial Valley 500 kV line ($340M)*

|

North Gila – Imperial Valley 500 kV line ($500M)

|

|

Lugo–Victor–Kramer 230 kV Upgrade ($480M) contains the following elements.

- Add 3rd Lugo 500/230 kV Transformer;

- Reconductor Lugo–Victor 230 kV No. 1, 2, 3 & 4 lines;

- Rebuild/build Kramer–Victor 115 kV lines to 230 kV; and

- Loop the old segment of Kramer–Victor 115 kV into Roadway.

|

Add 3rd Lugo 500/230 kV Transformer ($100M)

|

|

Recommended Southeast California Transmission Development (including Southern Area Reinforcement), primarily North Gila–Imperial Valley–N.SONGS*–Serrano–Del Amo*–Mesa 500kV AC Development ($4,710M) contains the following elements.

- Imperial Valley–North of SONGS 500 kV Line and Substation ($2,288M)

- N. SONGS–Serrano 500 kV line (30 miles) ($503M)

- Serrano–Del Amo–Mesa 500 kV Transmission Reinforcement ($1,125M)

- SCE Eastern area 500kV and 230 kV line upgrades (Six 500 kV, three 230 kV) ($426M), and

- Other SDG&E area upgrades ($28M)

|

It is unclear whether the Southern Area Reinforcement recommended for approval in the 2022-2023 Draft Plan below replaces the need for the following projects.

- Devers – La Fresa HVDC ($1.2 B)

- Lugo – LA Basin HVDC ($1.0 B)

- Sycamore – Alberhill HVDC ($1.0 B)

BAMx requests the CAISO to provide stakeholders with this much-needed insight into how the Draft Plan aligns with the 20-Year Transmission Outlook.

|

*Possible reduction due to a potential joint project with IID?

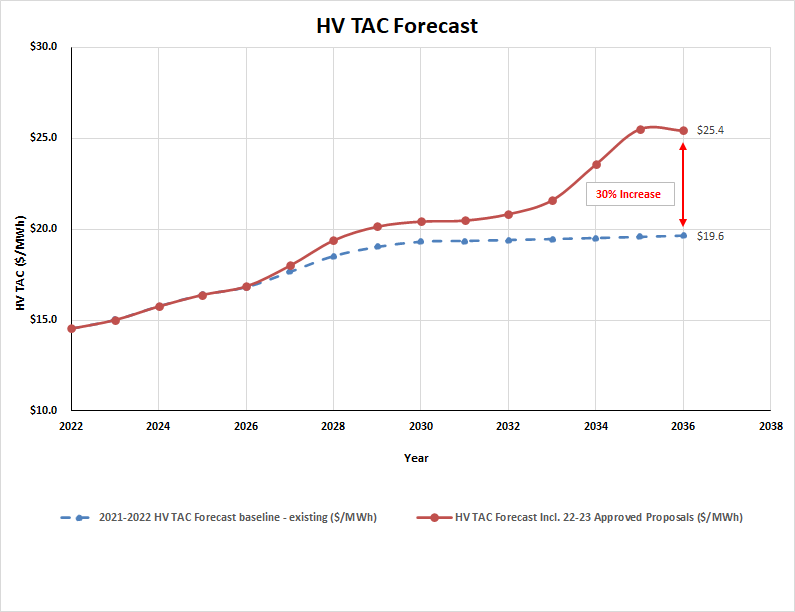

The 20-Year Outlook does not include an estimate of future HV TAC at this time. Given the need to show the TAC impact of the projects the CAISO has recommended for approval as part of the current planning cycle, BAMx developed an HV TAC forecast for 2023-2036, as shown in Figure 8.2 below. BAMx then incrementally considered the transmission projects identified in the 20-Year Outlook, namely $10.4 billion of upgrades to the existing CAISO footprint, $8.11 billion for Offshore Wind (OW) integration, and approximately $9.95 billion for Out-of-State (OOS) wind integration.[7] Table 8.2 compares the capital cost identified in the original CAISO 20-Year Transmission Outlook, and the 20-Year Transmission Outlook Refresh used to develop the HV TAC forecast included in Figure 8.2 using the updated information in the Draft Plan.

|

Transmission Development

|

Estimated Cost ($ billions)

|

|

CAISO 20-Year Transmission Outlook

|

20-Year Transmission Outlook Refresh

|

|

Upgrades to existing ISO footprint consisting of:

• 230 kV and 500 kV AC lines

• HVDC lines

• Substation upgrades

|

$10.74 B

|

$5.02 B*

|

|

Offshore wind integration consists of the following:

• 500 kV AC lines

• HVDC lines

|

$8.11 B

|

$8.11 B

|

|

Out-of-state wind integration consisting of:

• 500 kV AC lines

• HVDC lines

|

$ 11.65 B

|

$6.95 B**

|

|

Total estimated Cost of transmission development rolled into CAISO-Wide HV TAC

|

$ 30.5 B

|

$ 20.0 B

|

*Replaces the capital cost for the projects (or their substitutes) in the Original 20-Year Outlook with those included in the Draft Plan based on the assessment in Table 8.1.

** Assumes that both the Transwest Express and SunZia projects opt for the subscriber model, excluding the $2.1B and $2.6B capital costs associated with those two projects, respectively.

Figure 8.2: Transmission Capital Expenditures and HV TAC Projections (Base, Draft Plan Recommended Approvals and Refreshed 20-Year Transmission Outlook): 2023-2036

.png)

As shown in Figure 8.2 above, the HV TAC would rise to $37.8/MWh in 2036 based on the recommended project approval under the Draft Plan and incremental expected transmission upgrades under the 20-Year Transmission Outlook Refresh. As can be seen in Figure 8.2, these incremental transmission upgrades under the 20-Year Outlook Refresh of nearly $20 billion will add another $13.3/MWh to the HV TAC by 2036. Even with a very conservative estimate of these potential transmission projects, BAMx’s HV TAC projections show the immense impact they will have on the ever-increasing CAISO-wide HV TAC.

Rushed investments to build out additional transmission could lead to higher electricity prices and make California’s climate goals more difficult and more expensive to achieve. We caution that prohibitively expensive transmission costs could also compel current CAISO LSEs to exit the CAISO BAA leading to a death spiral, further increasing the transmission costs for those LSEs that remain within the CAISO BAA. In summary, although BAMx does not oppose the need for most of the transmission projects recommended for approval in the Draft Plan, some of the remaining transmission projects that the CAISO has recommended for approval need to be studied more extensively in the next cycle or at the very least their approval needs to be delayed until later in this cycle after the Board approval of the Plan in May 2023 with a better understanding of how those projects fit into the CAISO’s long-term transmission outlook.

[1] Introduction Draft 2022-2023 Transmission Plan, Neil Millar, Vice-President, Infrastructure & Operations Planning, 2022-2023 Transmission Planning Process Stakeholder Meeting, April 11, 2023, p.6.

[2] Draft Plan, pp.165-176.

[3] This amount is consistent with the CAISO’s estimate of 0.5 cents per kWh impact included in the Draft Plan (p.4)

[4] This amount purely captures the HV portion of the $9.3 billion of a total infrastructure investment plus a revised cost estimate of two previously approved projects, that is, Wheeler Ridge Junction Project and incremental GLW/VEA Area Upgrades project.

[5] Introduction Draft 2022-2023 Transmission Plan, Neil Millar, Vice-President, Infrastructure & Operations Planning, 2022-2023 Transmission Planning Process Stakeholder Meeting, April 11, 2023, pp.5-6.

[6] http://www.caiso.com/InitiativeDocuments/20-YearTransmissionOutlook-May2022.pdf

[7] See CAISO 20-Year Transmission Outlook, May 2022, pp.56-59.

California Public Utilities Commission - Energy Division

Submitted 04/25/2023, 05:37 pm

1.

Please provide your organization’s overall comments on the Draft 2022-2023 Transmission Plan April 11, 2023 stakeholder call discussion.

COMMENTS OF THE STAFF OF THE CALIFORNIA PUBLIC UTILITIES COMMISSION REGARDING THE DRAFT 2022-2023 TRANSMISSION PLAN FOLLOWING THE APRIL 11, 2023 STAKEHOLDER MEETING

April 25, 2023

The Staff of the California Public Utilities Commission (“CPUC Staff”) appreciates this opportunity to provide comments on the Draft 2022-2023 Transmission Plan discussed at the CAISO’s April 11, 2023 stakeholder meeting.

General Statement

This annual TPP assessment utilized the “Preferred System Plan” (PSP) portfolio adopted by the Commission in D.22-02-004, which is designed to drive greenhouse gas emissions down to a 38 million metric ton (MMT) target in 2030, dropping to 35 MMT by 2032. This portfolio incorporated the integrated resource plans of 40+ LSEs that were filed in 2020 and supplemented or revised in 2021. It is based on modeling to optimize clean energy resource procurement and reflects the most cost-effective system plan to reach these aggressive greenhouse gas emissions targets, while ensuring reliability. Notably, the CPUC’s modeling takes into account the capital costs of new resources, including any necessary new transmission infrastructure, and the variable costs of reliably operating the grid.

Together with the CEC’s high electrification demand assumptions, these key inputs drove a significant increase in the transmission infrastructure that CAISO staff has identified for development within the 2022-2023 Draft Transmission Plan -- especially for policy-related projects -- compared to previous TPP cycles.

For the 2023-2024 TPP cycle, the Commission already (in D.23-02-040) has conveyed to CAISO a base case portfolio with a 30 MMT emissions target that includes an even larger set of new resources (69 GW by 2033) compared to the 2022-2023 TPP. This portfolio reflects the potential for increased electrification occurring in other sectors of California’s economy and, notably, this is largely the same portfolio that the CPUC had requested CAISO to study as a sensitivity case in this 2022-2023 TPP cycle. Thus, it is helpful that CAISO staff has utilized its analysis of this sensitivity case to create more inclusive upgrades in this 2022-2023 Draft Transmission Plan that will fit the bigger portfolio that is coming as the base case for the 2023-2024 TPP. The Commission (in D.23-02-040) encouraged getting this kind of a “head start” on needed transmission projects wherever possible.

Overall, CPUC Staff greatly appreciates CAISO’s efforts to produce this comprehensive transmission analysis, which is extremely important for reliability while achieving the state’s clean energy goals. We support this 2022-2023 Draft Transmission Plan in which the CAISO has identified the transmission buildout currently needed to reliably integrate the resource mix that will keep the state on the optimal and most cost-effective pathway toward a 100% carbon-free CAISO grid by 2045.

It is also important to reiterate how the CPUC’s integrated resource planning process continually interacts with the CAISO’s Transmission Planning Process to identify cost-effective ways to achieve this transition in the state’s electric grid. Along with these expected large increases in transmission investments, CPUC Staff anticipates intensified efforts to ensure ratepayers are getting good value.

For example, CPUC Staff looks forward to working with CAISO and others to consider possible refinements to the methodology for estimating costs of transmission projects. We will be seeking ways and possibly new tools to minimize cost escalations, enhance the competitiveness of bidding to develop certain transmission projects and utilize timely updates on transmission limits to enhance RESOLVE capacity resource modeling. The CAISO’s quarterly Transmission Development Forums have been helpful in providing information and greater public visibility on transmission project delays and the implications on project costs; this has helped improve coordination with resource developers and provided valuable details for ratepayer advocates and other stakeholders. We hope to build on these efforts to enhance the cost-effectiveness of California’s resource and transmission investment.

Cost Management and Ratepayer Protections

The 2022-2023 Draft Transmission Plan proposes approval of $9.3 billion in projects, with $1.76 billion on 24 reliability-driven projects and $7.53 billion on 22 policy-driven projects aimed at furthering California’s clean energy goals. Energy Division looks forward to supporting the CAISO as it takes steps to manage costs in the implementation of these projects, particularly with ongoing monitoring of estimated costs and schedules of the proposed projects.

Opportunities exist for the CAISO to support cost containment of the proposed projects in the Draft Transmission Plan. These include careful consideration of total costs for both the incumbent and independent TOs’ portions of projects in Phase 3 of the TPP and in the implementation of these projects. The potential benefits from a well-priced and cost-capped competitive bid could be lost if careful cost management of the incumbent utility’s portion does not also occur.

CPUC Staff also encourages expeditious implementation of projects to avoid unnecessary accrual of allowance for funds used during construction (AFUDC). The accrual of AFUDC on projects of this magnitude could result in substantial additions to rate base and unnecessary impacts on ratepayers.

CPUC Staff notes that the impact on the Transmission Access Charge (TAC) was missing in Section 8.5 of the Draft Transmission Plan. CPUC Staff encourages the CAISO to include this information for stakeholders as soon as possible, as the approval of this scale of projects will result in substantial impacts on ratepayers.

2.

Provide your organization’s comments on chapter 1 Overview of the Transmission Planning Process.

3.

Provide your organization’s comments on chapter 2 Reliability Assessment.

4.

Provide your organization’s comments on chapter 3 Policy-Driven Need Assessment.

5.

Provide your organization’s comments on chapter 4 Economic Planning Study.

6.

Provide your organization’s comments on chapter 5 Interregional Transmission Coordination.

7.

Provide your organization’s comments on chapter 6 Other Studies and Results.

8.

Provide your organization’s comments on chapter 7 Special Reliability Studies and Results.

9.

Provide your organization’s comments on chapter 8 Transmission Project List.

California Western Grid Development, LLC

Submitted 04/25/2023, 11:37 am

1.

Please provide your organization’s overall comments on the Draft 2022-2023 Transmission Plan April 11, 2023 stakeholder call discussion.

Comments of California Western Grid

on CAISO’s Draft 2022-2023 Transmission Plan

April 25, 2023

Three Rivers Energy Development, LLC (TRED) is an Independent Transmission Developer that is developing the Pacific Transmission Expansion Project (“PTE Project” or “PTEP”) on behalf of California Western Grid Development, LLC. (“California Western Grid” or “Cal Western”). The PTE Project is a 2,000 MW controllable HVDC subsea transmission cable that the California Independent System Operator (“CAISO”) has found will allow new and existing supply, available to the Diablo Canyon 500 kV switchyard, or new offshore wind (OSW) delivered to the LA Basin and Big Creek Ventura areas to reduce local capacity requirements while also solving other significant issues. The PTE Project is described in Section 4.8.8 of the 2020-2021 CAISO Transmission Report issued March 24, 2021. The PTE Project is also currently being restudied by the CAISO as part of 2022-2023 CAISO Transmission Planning Process (“TPP”).

California Western Grid appreciates the opportunity to submit comments on the CAISO’s April 3, 2023, Draft 2022-2023 Transmission Plan (“Draft Plan”). As an initial matter, we note that on October 14, 2022, we submitted comments on behalf of California Western Grid regarding the CAISO’s Strawman Proposal dated September 22, 2022 (“Strawman Comments”). In those comments we commended the CAISO for recognizing that changes to the TPP are needed if the CAISO is going to be able to plan and approve transmission to accommodate the tripling of clean energy resources that the 2021 Joint Agency Report to the Legislature found is necessary to meet “SB 100”[1] goals. We also detailed the various public policy findings embodied in SB 887[2] that confirm that new transmission is urgently needed to accommodate State public policy needs. We pointed out that to comply with SB 887, the CAISO must make considerable progress on planning and approving new transmission in the current 2022-2023 TPP under its FERC Tariff obligation to timely plan and approve transmission to meet State public policy goals. We will not repeat those Strawman Comments but rather incorporate them herein by reference.

We commend CAISO for taking significant steps forward in the Draft 2022/2023 TPP Plan issued April 3, 2023. The Draft Plan recommends approval of $9.3 Billion of transmission projects that are urgently needed to maintain grid is reliability and take initial steps to meet the State Public Policies reflected Senate Bill 100 and Senate Bill 887. However, more is needed. The PTE Project is an example of the type of muti-purpose project that should be approved in this 2022-2023 planning cycle.

In this regard, the CAISO concluded in its Draft Plan[3] that:

The ISO will also continue to explore gas-fired generation retirement plans with the CPUC and work with LADWP on potential collaboration opportunities regarding the Pacific Transmission Expansion Project both leading up to presenting this Plan to the ISO Governors for approval, and after the Plan has been approved.

Cal Western appreciates the CAISO’s continued review of PTEP and its efforts to accommodate the transmission needs of both the CPUC’s resource plans and the needs of LADWP that can be addressed by a Joint Subsea Project with PTEP. In these comments we urge the CAISO to take proactive steps in the months ahead to assure needed transmission projects such as PTEP are available when needed.

As the CAISO points out on page 8 of the Draft Plan:

While SB 887 calls for the CPUC to provide to the ISO by March 31, 2024, resource projections expected to reduce the need to rely on non-preferred resources in local capacity areas by 2035, these projections are not yet reflected in the portfolios provided by the CPUC for the 2022-2023 Plan and the gas-fired generation is being relied upon across the planning horizon for system capacity.

The CAISO should request the CPUC to provide guidance on reduced use of gas fired generation in local capacity areas including any expected gas plant retirement plans in advance of the SB 887 March 2024 statutory deadline. CAISO should request this information be made available to the CAISO this summer. The CPUC has already studied these issues, and the gas plants in question will in many cases be more than 40 years old in the next decade. In the case of LADWP, it has already announced plans to reduce reliance on the gas plants and planning for gas plant retirements by 2035. [4] Surely the CAISO working with the CPUC in the next few months can arrive at the guidance needed in this 2022-23 TPP to reduce reliance on gas plants, at least for the LA Basin, where there is also growing pressure to phase out or retire Aliso Canyon.

Cal Western also applauds the CAISO for producing the special study to identify transmission that is needed to reduce reliance on Aliso Canyon Gas Storage facility. Cal Western agrees that PTEP is a robust solution to assist in Aliso Canyon closure while also reducing Path 26 congestion, reducing Local Capacity Resource (LCR) requirements, reducing the current expense of maintaining an aging fleet of gas-fired generation, and providing a myriad of other benefits.

As the CAISO knows, the CPUC has sent CAISO a portfolio for the 2023-2024 TPP that includes an incremental 86 GW of clean energy to be in-service by 2035. It is also likely that transmission will be needed in this same time period to be able to reduce its reliance on the Aliso Canyon gas storage facility and gas plants generally. Cal Western submits that, given the recharging limitations on batteries, it is not likely that these needs can be met without new transmission particularly into populated coastal load centers like Los Angeles (“LA”). Indeed, when faced with similar needs reflected in the 2021 Joint Agency Report to the Legislature on the meeting SB 100 goals, the CAISO found that a project like PTEP is needed between Diablo and LA.

Any project approved this year will have 11-12 years to develop, permit, finance, and construct the transmission to meet these needs. The CAISO has advised the CPUC repeatedly that the lead time for new transmission is 10 years or more which, in this case, leaves little time for unexpected delays. Yet there are many reasons to expect the unexpected.

First, as CAISO is aware, there are many projects in California that have historically exceeded a 10-year lead-time to design, permit, procure materials and build.

Second, the CAISO’s 20-Year Transmission Outlook concludes that to meet SB 100 needs will require $30.5 billion of new transmission. With the amount of new transmission in the Draft Plan and the dramatic amounts of additional transmission that will be added as we move forward, it is almost certain to cause logjams at the permitting agencies including the CPUC. This is particularly true given the challenges of permitting land-based transmission in large coastal load centers like LA.

Third, the dramatic amount of new transmission needed is not unique to California. Cable and converter manufacturers are expecting to be overwhelmed by increasing worldwide demand and have indicated that projects that do not contract now are likely to find themselves in long queue lines or worse. Currently, there are similar shortages developing with respect to skilled workers and construction equipment and ocean vessels.

On the positive side, the CPUC has wisely requested the CAISO to focus on multi-purpose projects that will foster least-risk planning. PTEP is just such a project:

- PTEP is needed to relieve congestion on Path 26 with or without the gas plants in service.

- PTEP is needed for OSW to reach Southern California with or without Diablo running.

- PTEP allows for increased battery storage in LA by providing recharging power.

- PTEP provides the ability to access and deliver solar from the Central Valley directly to the LA Basin

- PTEP allows the flexibility for the use of gas plants to be decreased or eliminated.

- PTEP allows the flexibility for reduced reliance on Aliso Canyon.

- PTEP has the best chance of navigating environmental permitting challenges and providing a contribution to urgent transmission needs.

- PTEP provides a major contribution to mitigating wildfire service interruptions.

- PTEP increases the likelihood that clean energy can meet increasing electrification demand in LA.

- PTEP’s costs, under conservative assumptions, are offset 50% by economic benefits that are quantifiable.

- PTEP also provides many other benefits that are difficult to quantify but easy to recognize such as assistance in black start events to rapidly restore normal operations.

- PTEP allows for reduced gas use that will improve air quality in Disadvantaged Communities in the LA Basin—a major goal underlying SB 100 and SB 887.

- PTEP is the type of project that DOE has in mind as eligible for federal funding.[5]

In light of all of the above, we submit that the proper path forward is to plan for the worst and hope for the best. We urge the CAISO to proactively engage with the CPUC to collaborate on plans to reduce reliance on gas plants in advance of the SB 887 March 2024 statutory deadline. We also encouraged continued collaborative discussions with LADWP to explore the potential for a joint subsea transmission project with PTEP.

We appreciate CAISO’s continued review of PTEP in this 2022-2023 planning cycle and we stand ready to help in any way that would be constructive.

Respectfully submitted,

Marty Walicki, Managing Partner

Three Rivers Ener

[1] “The 100 Percent Clean Energy Act of 2018,” Senate Bill 100 (SB 100, De León):

[2] Senate Bill 887 “Accelerating Renewable Energy Delivery Act” (“SB 887”).

[3] Draft Plan pp. 14-15.

[4] https://www.ladwpnews.com/100-percent-carbon-neutral-power-by-035-los-angeles-city-council-approves-landmark-initiative/

[5] Infrastructure Investment and Jobs Act signed into law on Nov. 15, 2021. Find a summary of key electric transmission provisions at: https://www.energy.gov/bil/transmission-facilitation-program [5] and

https://www.energy.gov/bil/program-upgrading-our-electric-grid-and-ensuring-reliability-and-resiliency

2.

Provide your organization’s comments on chapter 1 Overview of the Transmission Planning Process.

Cal Western has no comment

3.

Provide your organization’s comments on chapter 2 Reliability Assessment.

Cal Western has no comment

4.

Provide your organization’s comments on chapter 3 Policy-Driven Need Assessment.

We commend CAISO for taking significant steps forward in the Draft 2022/2023 TPP Plan issued April 3, 2023. The Draft Plan recommends approval of $9.3 Billion of transmission projects that are urgently needed to maintain grid is reliability and take initial steps to meet the State Public Policies reflected Senate Bill 100 and Senate Bill 887. However, more is needed. The PTE Project is an example of the type of muti-purpose project that should be approved in this 2022-2023 planning cycle.

In this regard, the CAISO concluded in its Draft Plan[1] that:

The ISO will also continue to explore gas-fired generation retirement plans with the CPUC and work with LADWP on potential collaboration opportunities regarding the Pacific Transmission Expansion Project both leading up to presenting this Plan to the ISO Governors for approval, and after the Plan has been approved.

Cal Western appreciates the CAISO’s continued review of PTEP and its efforts to accommodate the transmission needs of both the CPUC’s resource plans and the needs of LADWP that can be addressed by a Joint Subsea Project with PTEP. In these comments we urge the CAISO to take proactive steps in the months ahead to assure needed transmission projects such as PTEP are available when needed.

As the CAISO points out on page 8 of the Draft Plan:

While SB 887 calls for the CPUC to provide to the ISO by March 31, 2024, resource projections expected to reduce the need to rely on non-preferred resources in local capacity areas by 2035, these projections are not yet reflected in the portfolios provided by the CPUC for the 2022-2023 Plan and the gas-fired generation is being relied upon across the planning horizon for system capacity.

The CAISO should request the CPUC to provide guidance on reduced use of gas fired generation in local capacity areas including any expected gas plant retirement plans in advance of the SB 887 March 2024 statutory deadline. CAISO should request this information be made available to the CAISO this summer. The CPUC has already studied these issues, and the gas plants in question will in many cases be more than 40 years old in the next decade. In the case of LADWP, it has already announced plans to reduce reliance on the gas plants and planning for gas plant retirements by 2035. [2] Surely the CAISO working with the CPUC in the next few months can arrive at the guidance needed in this 2022-23 TPP to reduce reliance on gas plants, at least for the LA Basin, where there is also growing pressure to phase out or retire Aliso Canyon.

Cal Western also applauds the CAISO for producing the special study to identify transmission that is needed to reduce reliance on Aliso Canyon Gas Storage facility. Cal Western agrees that PTEP is a robust solution to assist in Aliso Canyon closure while also reducing Path 26 congestion, reducing Local Capacity Resource (LCR) requirements, reducing the current expense of maintaining an aging fleet of gas-fired generation, and providing a myriad of other benefits.

As the CAISO knows, the CPUC has sent CAISO a portfolio for the 2023-2024 TPP that includes an incremental 86 GW of clean energy to be in-service by 2035. It is also likely that transmission will be needed in this same time period to be able to reduce its reliance on the Aliso Canyon gas storage facility and gas plants generally. Cal Western submits that, given the recharging limitations on batteries, it is not likely that these needs can be met without new transmission particularly into populated coastal load centers like Los Angeles (“LA”). Indeed, when faced with similar needs reflected in the 2021 Joint Agency Report to the Legislature on the meeting SB 100 goals, the CAISO found that a project like PTEP is needed between Diablo and LA.

Any project approved this year will have 11-12 years to develop, permit, finance, and construct the transmission to meet these needs. The CAISO has advised the CPUC repeatedly that the lead time for new transmission is 10 years or more which, in this case, leaves little time for unexpected delays. Yet there are many reasons to expect the unexpected.

First, as CAISO is aware, there are many projects in California that have historically exceeded a 10-year lead-time to design, permit, procure materials and build.

Second, the CAISO’s 20-Year Transmission Outlook concludes that to meet SB 100 needs will require $30.5 billion of new transmission. With the amount of new transmission in the Draft Plan and the dramatic amounts of additional transmission that will be added as we move forward, it is almost certain to cause logjams at the permitting agencies including the CPUC. This is particularly true given the challenges of permitting land-based transmission in large coastal load centers like LA.

Third, the dramatic amount of new transmission needed is not unique to California. Cable and converter manufacturers are expecting to be overwhelmed by increasing worldwide demand and have indicated that projects that do not contract now are likely to find themselves in long queue lines or worse. Currently, there are similar shortages developing with respect to skilled workers and construction equipment and ocean vessels.

On the positive side, the CPUC has wisely requested the CAISO to focus on multi-purpose projects that will foster least-risk planning. PTEP is just such a project:

- PTEP is needed to relieve congestion on Path 26 with or without the gas plants in service.