ACP-California

Submitted 12/03/2024, 03:28 pm

Submitted on behalf of

ACP-California

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

a) Allocation Groups

ACP-California greatly appreciates CAISO’s efforts to revise the proposed TPD allocation groups and TPD allocation process to better address a number of the concerns and concepts that were put forward during the working group meetings. ACP-California applauds CAISO’s proposal to incorporate “Conditional Deliverability” into the process going forward, and to do so in a manner that will be easier to administer than the original high-level concept put forward by ACP-California during the working group meetings. Given the full scope of the proposal, and simplified approach, ACP-California supports the Conditional Deliverability allocation group and approach, even though the deliverability allocated to this group would be counted as allocated when determining the 150% zonal limits for future clusters.

In general, ACP-California supports CAISO’s proposal for the TPD allocation groups for Cluster 15 and future clusters and is optimistic this will provide a reasonable path for projects to balance the TPD allocation process with the commercial development/contracting process. And, as CAISO stated in the stakeholder meeting, this approach will put the “bilateral procurement process in the driver’s seat” allowing for the procurement process to determine the value of projects competing for a PPA, while providing a “line of sight” to deliverability if the resource is contracted. Providing projects an opportunity to attain “Conditional Deliverability” and then seek a PPA, should provide some of the upfront assurances developers and offtakers need to make these processes work in tandem and able to support project development.

Allowing Conditional Deliverability to receive a deliverability allocation and then requiring a PPA to retain it appears to be a reasonable approach. However, ACP-California highlights that, if there are just 12-months from the time of a Conditional Deliverability allocation is received until a signed PPA must be demonstrated (as would generally be the case in most cycles), that is an incredibly tight timeline for both developers and offtakers to market projects, negotiate, and execute a PPA. We encourage the CAISO to offer some leeway for projects that are in the process of negotiating a PPA, but have not signed it yet. Providing some flexibility on this front will help ensure that: 1) developers and LSEs aren’t overly rushed to sign PPAs with problematic terms and conditions just to meet a short turnaround to retain the TPD allocation and 2) viable projects don’t lose their chance at a standard TPD allocation just because they couldn’t get the PPA fully executed in time to retain their deliverability allocation. ACP-California suggests that after receiving a Conditional Deliverability allocation, a project should have to demonstrate it is “actively negotiating PPA terms” through an affidavit from the resource developer and offtaker. This would be sufficient to retain the Conditional Deliverability allocation for one more TPD allocation cycle, but in the subsequent cycle, an executed PPA would be required.

We appreciate CAISO’s thoughtful and creative approach to the TPD allocation process and are optimistic that, with some adjustments, the proposed process could work well for CAISO, developers, and offtakers.

c) Opportunities to seek TPD

Providing three opportunities for Cluster 15 and future clusters to secure a deliverability allocation, while also providing a chance (or two, as discussed above) for the Conditional Deliverability group to secure a PPA appears to strike a reasonable balance of keeping projects moving through the process while also providing enough time for development activity to occur.

As discussed more in response to question #2, for Cluster 14 and earlier, we encourage CAISO to consider whether it would be prudent to offer a modified TPD deferral option for (long lead-time and other) resources with active interconnection requests in Cluster 14 or earlier.

d) Eligibility of Energy Only projects, including technology additions

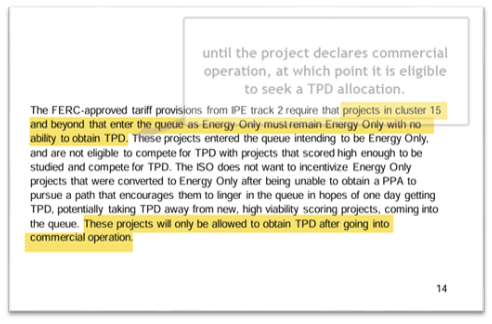

As far as ACP-California can tell, the prohibition on Energy Only projects ever seeking a deliverability allocation was first discussed and outlined by CAISO in the IPE Track 2 Final Addendum. And it appears that this policy was not well discussed – or understood – by at least a number of stakeholders. While we appreciate the CAISO’s interest in ensuring that projects don’t undermine the interconnection queue through an Energy-Only interconnection application that later seeks deliverability, ACP-California respectfully requests that CAISO reconsider this prohibition for projects that achieve commercial operation. In other words, we request that CAISO revise the IPE Track 2 policy and tariff language to allow for Energy Only projects that have achieved commercial operation to request a TPD allocation. It is appropriate for the CAISO to revisit this policy decision in IPE Track 3, given that this track (not Track 2) should have addressed modifications to the TPD allocation process and many stakeholders were not aware of this change to deliverability allocation eligibility for Energy Only that was made as part of the broader Track 2 filing.

We also point out that allowing Energy Only to compete for a TPD allocation is appropriate, and should not be expected to create queue management issues, when used only for the Commercial Operation group. The availability of this option is highly unlikely to be used by any resource developer simply to gain entry into the queue because the barriers, costs, and risks to actually executing on this option would be so high. To be successful in this “strategy” a project would have to come online at significant risk and cost before it could even seek a deliverability allocation. This is highly unlikely to be used as a strategy by any resource developers and, if CAISO were to allow it, allowing projects that are online to compete for a deliverability allocation would be expected to be used infrequently, if at all, but could offer significant benefits.

Thus, in evaluating this request to revisit the options for Energy Only projects to seek deliverability, CAISO should consider the implications of not allowing a project that is online to seek a TPD allocation. Imagine a situation, in the future, where there is an Energy Only project that has achieved commercial operation and there is a tight market for Resource Adequacy. And, in this example, assume that the existing, online Energy Only project could contribute additional capacity to the RA market, if it could just secure a TPD allocation. Under the current rules put in place in Track 2, CAISO would not allow this resource to compete for a deliverability allocation at all. And yet, a different project early in the development cycle, could apply to enter the queue and secure the same deliverability. But it would take many years for that other project to achieve commercial operation and actually be able to contribute to the RA requirements of LSE. And during those years, the Energy Only project would be available (and could have been contributing to RA requirements of LSEs). Thus, in this hypothetical example, as a result of CAISO’s policy, the RA market would be shorter than it needed to be (and than it would have been if the online, Energy Only could have sought a deliverability allocation). If this delay in securing additional RA resources results in an LSE being short on its RA requirements, there could also be penalties that would apply to the LSE. All-in-all, the policy of never permitting Energy Only resources to seek deliverability only serves to potentially increase costs for meeting RA needs and is not a reasonable approach. Instead, the CAISO should allow Energy Only projects to compete for deliverability through the Commercial Operation group for not only Cluster 14, but also for Cluster 15 and beyond. We urge CAISO to revisit this policy decision that was incorporated into IPE Track 2 with highly limited stakeholder engagement and discussion.

e) Modifications to the TPD Scoring Criteria

ACP-California is still considering whether the proposed TPD scoring criteria are appropriate or if they require revision under the revised TPD allocation approach included in the Consolidated Revised Straw Proposal.

At this time, we simply highlight that CAISO will need to identify sufficient milestones for projects from LSE affiliates that are competing for a TPD allocation. There should be a significant requirement for these entities to demonstrate that their project is, in fact, on a commercial trajectory similar to a project with a signed PPA. And we encourage CAISO to hold additional discussions on this topic and to collect input on what might be appropriate for projects of LSE affiliates to move forward with securing a TPD allocation.

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

ACP-CA generally supports the proposal put forward by the CAISO for Special Considerations for Long Lead-Time, Location Constrained Resources. We appreciate the CAISO’s thoughtful approach to ensuring that all resource types have a viable pathway through the interconnection process culminating in allocations of deliverability. This proposal builds on CAISO’s Track 2 revisions which adopted scoring criteria specific to long lead-time (LLT) resources. It also reflects the energy agencies’ joint acknowledgement of the importance of resource diversity, including advancing procurement, transmission planning, and interconnection processes for LLT resources, like Offshore Wind (OSW), Out-of-State (OOS) wind and geothermal resources.

As CAISO is aware, many long lead-time resources will seek PPAs through the Department of Water Resources’ (DWR) Central Procurement program, and for some, this is the only viable pathway to procurement in the next decade. The central procurement program will offer discrete, limited opportunities for certain long lead-time resources to secure a PPA. Further, the timelines for central procurement are uncertain and may shift as the process evolves. Thus, it is imperative that CAISO develop a process for allocating deliverability to these resources that includes appropriate flexibility to recognize this unique set of circumstances. We appreciate CAISO’s efforts to incorporate this flexibility and we hope CAISO recognizes that, as more details become available and DWR firms up the solicitation schedule, there may be a need to further incorporate changes to the deliverability process to appropriately reflect the central procurement process.[1]

a) Eligibility

In the Consolidated Straw Proposal (page 32), CAISO puts forward four criteria which it expects that interconnection customers would need to meet “some or all” of in order to determine eligibility for the long lead-time treatment in the deliverability allocation process. ACP-California offers the following comments on the eligibility criteria.

First, we generally support the development of criteria where resources would need to meet “all” of the identified criteria in order to be eligible for the proposed long lead-time treatment in the deliverability allocation process. This requirement would provide more clarity to prospective customers and ensure the LLT TPD deferral option is utilized as intended by the CAISO. With that in mind, we offer the following recommendations for each of the draft eligibility criteria in the Consolidated Straw Proposal.

On the first bullet (on page 32 of the Consolidated Straw Proposal), which defines long lead-time technologies, ACP-California recommends that the terminology not be overly restrictive to very specific sub-technology types. In the examples, CAISO lists “Advanced Geothermal” and it is important to note that this terminology, to geothermal developers, is very specific to a sub-technology type and wouldn’t include other geothermal technologies like Enhanced Geothermal. We recommend simply listing “geothermal” and other resources generically so as to not overly restrict which resources can qualify for long lead-time treatment. We also highlight that if CAISO adopts a requirement for customers to meet “all” of these criteria, there is less need for the CAISO to define technologies very specifically.

ACP-California generally supports the second eligibility bullet which requires the resource technology to be “location constrained.” This criteria aligns with the CAISO’s approach to reserving policy-driven transmission for specific location-constrained resources.

On the third bullet, CAISO must make modifications to ensure – as CAISO did in IPE Track 2 eligibility for long lead-time points – that all long lead-time resources that have available transmission (whether approved or existing) can qualify. And, if CAISO makes these eligibility criteria that resources must meet all of, we further recommend against limiting the type of transmission that an otherwise qualifying long lead-time resource depends upon. ACP-California suggests the following language for the third eligibility criteria, which aligns with the IPE Track 2 tariff language for long lead-time point allocation:

“The resource corresponds to approved network upgrades in the CAISO’s transmission plan specifically designed to meet the long lead-time resource needs of the local regulatory authority or does not require additional transmission capacity to be built.”

This modification to the third bullet of eligibility requirements aligns with IPE Phase 2 (and CAISO’s existing tariff language) while also providing assurances that both central coast OSW projects seeking to utilize, in part, existing transmission capacity and out of state wind utilizing existing import capability can qualify for long lead-time resource treatment.

Additionally, on the fourth bullet, our understanding is that the quantity of a specified long lead-time resources in an LRA plan (e.g., the TPP base case) will serve as a gating mechanism for location constrained, long-lead time resources first through the zonal scoring process, and then in their request to elect a TPD deferral. For the latter, we would advocate that the quantity of deliverability that a long lead-time customer seeks should be defined based on quantities in LRA plans at the time of the affidavit for the upcoming TPD allocation process, after the customer has reinitiated the TPD allocation process post-deferral. This would align with the CAISO’s process of reserving TPD on an on-going basis according to quantities of LLT/location-constrained resources in each TPP.

b) Extension to seek TPD

ACP-California generally supports the proposed approach for long lead-time resources to defer their chances for a TPD allocation and looks forward to working with the CAISO on specifics. Regarding the deferral period, we would recommend that for OSW, long duration storage, and geothermal resources, customers can elect to defer until one (1) year after the latest CPUC-authorized solicitation for that resource is completed by the central procurement entity[2] or until three (3) years before their anticipated commercial operation date, whichever is later. For example, for OSW resources, the CPUC has currently authorized procurement of up to 7.6 GW of OSW through a series of solicitations beginning in 2027, though solicitation timelines are ultimately up to DWR as the central procurement entity. Thus, if DWR closes its last solicitation in accordance with this authorized procurement in 2032, a project entering the queue and electing deferral could reinitiate the TPD process by 2033.

CAISO has also requested input on the “triggers” for releasing TPD that has been reserved for long lead-time resources should the policy direction and/or portfolios change. The CAISO should only release TPD from the reservation process when there is certainty it is no longer required for the long lead-time resources which are expected to require it. This could include the conclusion of central procurement solicitations and subsequent revisions to CPUC (or other LRA) portfolios with reduced quantities of the long lead-time resources in question.

c) Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

As we consider the recent interconnection process changes through IPE Track 2 and Order 2023, and their impact to long lead-time resources, we note the CAISO may need to consider certain exceptions to the proposed “unavoidable time in queue” requirement of seven (7) years which adopted as part of the IPE Phase 2 proposal. It is likely that an “unavoidable” seven-year restriction on time spent in the queue may not provide sufficient flexibility to accommodate a longer deferral process as contemplated in the Phase 3 Consolidated Straw Proposal.

We appreciate the questions posed by CAISO related to additional needs for long lead-time resources and we encourage CAISO to continue developing specific exceptions to the current interconnection and deliverability allocation processes for these resources, as the Consolidated Straw proposal put forward.

At this time, we do not have specific recommendations for changes to the study process, commercial readiness, or GIA deposits for long lead-time resources but may consider these questions further in later stakeholder opportunities. ACP-CA would flag that following the state’s 1373 central procurement process timelines would be generally helpful for aligning timelines for allocation of deliverability for LLT resources.

We also ask the CAISO to consider whether it would be prudent to offer a modified TPD deferral option for resources with active interconnection requests in Cluster 14 or earlier (e.g. those in Group D currently). We note there are more than 2,000 MW of long lead-time OSW capacity with Group D allocations that face impending TPD retention requirements that will be difficult or impossible for them to meet, given their required development timelines. Similarly, there are non-LLT resources that may have C14 active requests that have been substantially delayed due to delays in, and long development timelines for, network upgrades they depend upon. For both these resource types, we recommend the CAISO offer a specific time-limited TPD retention deferral opportunity whereby projects can defer for a minimum of five (5) years and a maximum of ten (10) years.[3] This would limit the deferral option to only those projects that require significant extra time due to factors outside their control, rather than those projects that simply want additional opportunities to secure a PPA. It would also limit the deferral option in time so as not to keep C14 or earlier projects with active requests pending for an indefinite amount of time.

Finally, given the numerous design questions raised in these comments and the importance of aligning the long lead-time TPD deferral process with the development timeline for these resources, including those that will depend on the newly formed but to-be-implemented central procurement process, we agree that CAISO workshops on this topic would be an appropriate next step.

[1] The CPUC’s Decision 24-08-064 for Determining Need for Centralized Procurement of Long Lead-Time Resources, issued in R. 20-05-003, August 29, 2024, notes a potential DWR solicitation timeline for offshore wind with a first solicitation in late-2027, with contracts going to the CPUC for approval in mid-2028; a second solicitation in late 2029, with contracts going to the CPUC for approval in mid-2030; and a third solicitation in early 2030 with contracts seeking CPUC approval in late-2030.

[2] As authorized by the CPUC in accordance with AB 1373 (2023) requirements.

[3] With a longer potential timeline, if necessary, for projects dependent on the AB 1373 solicitation process.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

As with past iterations, ACP-California generally supports this proposal and encourages the CAISO to continue to provide additional details on the implementation process for intra-cluster prioritization.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

No comments at this time.

5.

Please provide any additional feedback:

No additional comments at this time.

AES

Submitted 12/03/2024, 09:19 am

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

a. Allocation Groups

AES is not opposed to reducing the number of allocation groups to three, including the removal of the shortlisted group. However, AES opposes the Commercial Operation group if it excludes operational Energy Only projects. As discussed below, CAISO should clarify within the proposal whether operational Energy Only projects can seek transmission plan deliverability (TPD). While CAISO staff indicated during the stakeholder call that Energy Only projects may never seek TPD, the revised straw proposal states, “These projects will only be allowed to obtain TPD after going into commercial operation.”1

AES seeks clarification regarding priority group 1, which is similar to the existing PPA group. AES seeks clarity if there are any retention requirements associated with group 1. For example, assume a PPA was executed with an offtaker for a project who then receives TPD under group 1. However, if the PPA was canceled, are there requirements for the project to retain its TPD allocation under group 1? In addition, are there restrictions with the size of LSE to the size of projects that can be contracted with? Finally, AES seeks clarity on whether the MWs contracted under the PPA must be congruent to the size of the project to qualify for group 1. Similarly, if a project was allocated TPD in the conditional group 3, would the PPA required to retain its TPD by the following TPD cycle must have the entire project size contracted?

AES seeks clarity on the treatment of projects that only receive partial TPD by the time their three attempts for TPD allocation have been reached. The CAISO should clarify whether projects would automatically or would require an MMA to downsize to the portion of the project receiving TPD.

b. Multi-fuel projects receiving an allocation with PPAs

AES recommends some flexibility for parties to transfer the received TPD from one fuel type to another fuel type should TPD only be awarded to one fuel type. PPA structures vary, and flexibility allows parties to identify the best pathway forward if only one portion of a multi-fuel project receives TPD. In addition, the CAISO should also clarify whether the portion that doesn’t receive TPD can continue to try in the future allocation cycle to receive TPD.

c. Opportunities to seek TPD

-

In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

AES is not necessarily opposed to the proposed three attempts to receive TPD allocation before being withdrawn from the queue, but is concerned that delayed long lead time DNUs and RNUs approved in the TPP may become the impediment for projects to receive TPD. The CAISO should continue to work for solutions to provide interim TPD for projects behind TPP-approved DNUs and RNUs so that they are not withdrawn before the three opportunities rule.

The CAISO should preserve the opportunity for projects to seek an allocation during the TPD cycle of the interconnection facilities study through demonstration of a PPA as long as it does not eliminate one of the three opportunities to receive TPD. AES recommends aligning the affidavit due date to align with the completion of the interconnection facilities study.

d. Eligibility of Energy Only projects, including technology additions

-

The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

AES seeks clarity on the CAISO’s proposal related to the Commercial Operation Group and Energy Only projects. The Revised Straw Proposal states that the CAISO proposes to reduce the allocation groups to three with the “2nd priority group as, “the Commercial Operation group (formerly group C) for eligible Energy Only projects that go into commercial operation.”2 However at the November 15, 2024 stakeholder meeting, the CAISO verbally stated that Energy Only projects cannot seek TPD, even after reaching commercial operations. AES urges the CAISO to provide Energy Only projects the opportunity to seek a TPD allocation after reaching commercial operations. If the CAISO’s goal is to provide TPD to the most viable projects, Energy Only projects, by coming online, meet this goal. The opportunity to request TPD for operational Energy Only projects should be reserved. Similarly treated, pre-Cluster 15 projects should also be able to seek TPD through the commercial operation group after the 2025 TPD allocation cycle. Pre-Cluster 15 projects entered the queue with certain assumptions of TPD allocation policies that should not be changed.

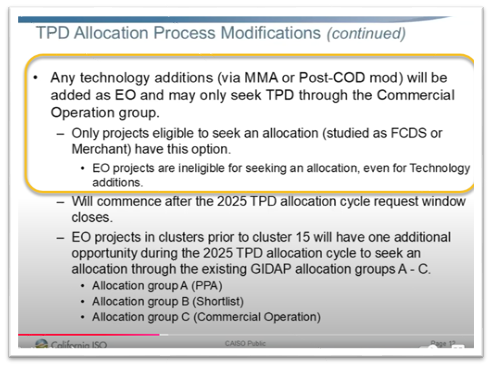

The CAISO should clarify the transferability of TPD as related to technology additions through the MMA process. The proposal currently states, “[a]ny technology additions (via MMA or Post-COD mod) will be added as EO and may only seek TPD through the Commercial Operation group.”3 The CAISO should clarify whether: (1) a project with the same queue position can transfer its TPD to the technology addition; and (2) a project from a different queue position can transfer TPD to the technology addition.

e. Modifications to the TPD scoring criteria

AES encourages the CAISO to consider the concern of early GIA commitments prior to being allocated TPD in a separate track. While AES understands that FERC Order 2023 requires GIA execution and commercial readiness deposits within a certain timeframe after the publication of the interconnection facilities studies, it is unclear to AES what the GIA will entail without a TPD allocation. Given the FERC Order 2023 timelines, a project must execute its GIA and pay a commercial readiness deposit of 20% Network Upgrades prior years before a project may be allocated TPD. The project will therefore be subject to immense financial risk without TPD certainty. This differs from today’s practice where projects do not typically execute GIAs until after TPD allocations. At minimum, the CAISO should clarify what the GIA will encompass and consider a deviation to Order 2023 given CAISO’s unique TPD procedures.

1 Revised Straw Proposal, p. 14.

2 Revised Straw Proposal, p. 17.

3 Revised Straw Proposal Presentation, slide 12.

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

AES has no comment.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

?AES supports the proposal’s intention to provide a quicker pathway for projects to come online sooner, prior to the completion of large Reliability Network Upgrades (RNUs). AES supports the 97% threshold for short circuit current to continue to require a limited operation study. AES seeks clarity on implementation. Specifically, will this be evaluated on a cluster-by-cluster basis (e.g. RNUs associated with Cluster 14, RNUs associated with Cluster 15)? The CAISO should provide a schedule of: (1) when the considered RNUs would be posted on the CAISO website, (2) when the affidavit is due; (3) when results of the assessment are expected. The CAISO should also publicly post the study for stakeholders to reference.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

?AES urges the CAISO to identify opportunities for projects behind long lead time DNUs and RNUs to receive interim TPD prior to withdrawal after the three TPD allocation opportunities.

?

5.

Please provide any additional feedback:

?The CAISO should grandfather parking for pre-Cluster 15 projects. Projects prior to cluster 15 entered the queue with an understanding of prior tariff rules and made business decisions around those rules. At minimum, pre-Cluster 15 projects should have one more opportunity to park prior to elimination. For Cluster 15 and beyond, AES is not opposed to removing parking. In addition, for existing parked projects, the CAISO should clarify the new posting due dates if the 2025 TPD allocation cycle’s affidavit due dates are pushed to September 2025.

?

California Community Choice Association

Submitted 12/02/2024, 03:26 pm

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

The California Community Choice Association (CalCCA) appreciates the opportunity to provide comments on the California Independent System Operator’s (CAISO) Track 3 Revised Straw Proposal. The transmission plan deliverability (TPD) allocation process is a critical part of project development because resources must obtain TPD to provide resource adequacy (RA). The CAISO proposes to redefine the TPD allocation groups as: (1) the power purchase agreement (PPA) group; (2) the commercial operation group; and (3) the conditional allocation group. The CAISO’s proposal would provide projects with three consecutive opportunities to seek a TPD allocation or retain a conditional TPD allocation, noting opportunities to seek and retain allocations of TPD are typically done on an annual basis but could be more than one year apart.[1]

CalCCA is still developing a position on this proposal and seeks clarification on the timing of the three opportunities to seek a TPD allocation for projects with and without conditional deliverability allocations after the first opportunity. The proposal states:

the first opportunity will be in the TPD allocation request window following the interconnection customer’s receipt of its interconnection facilities study report. After the third opportunity to seek an allocation, projects that have not received an allocation will be withdrawn. Projects that do receive an allocation through the Conditional group, but are unable to retain their allocation in the next request window by demonstrating an eligible PPA will be withdrawn.[2]

Applying the proposal to the Cluster 15 study timeline[3] appears to result in the following timeline:

- Facilities Study Report: November 2026

- Beginning of first opportunity / TPD Affidavits: March 2027

- For projects with conditional deliverability after first opportunity:

- Deadline to show a PPA or withdraw: March 2028[4]

- For projects without conditional deliverability after first opportunity:

- Beginning of second opportunity / TPD Affidavits: March 2028

- For projects with conditional deliverability after second opportunity:

- Deadline to show a PPA or withdraw: March 2029

- For projects without conditional deliverability after second opportunity:

- Beginning of third opportunity / TPD Affidavits: March 2029

Therefore, projects appear to have roughly one and half years after receiving the facilities study report to demonstrate a PPA or be withdrawn if a project receives a conditional deliverability allocation. If a project does not receive a conditional deliverability allocation, it will also have until March 2028 to either sign a PPA to get into the PPA group or seek conditional deliverability for its second opportunity. In the next iteration of the proposal, the CAISO should confirm or correct this understanding with a timeline or flow chart for the three opportunities using the Cluster 15 schedule, including the steps for projects that do and do not receive conditional allocations. This clarification will help stakeholders develop positions on the proposal.

CalCCA appreciates the CAISO’s responsiveness to stakeholder feedback in revising the PPA status points allocation criteria in Table 2 of the Straw Proposal. Categorizing projects based upon whether its PPA is with an off taker that has a RA obligation will result in a meaningful differentiation of projects that meet versus exceed the minimum requirement, because it bases its ranking on RA obligations which drive the need for TPD. It will also provide for uniform treatment of all PPAs with load-serving entities.

[1] See Straw Proposal at 19.

[2] Ibid.

[3] https://www.caiso.com/documents/resource-interconnection-standards-interconnection-study-timeline.xlsx.

[4] For this example, assume one year between successive opportunities to seek and retain an allocation of TPD for simplicity, although they may be more than one year apart in practice.

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

CalCCA agrees with the CAISO that it will be necessary to allocate TPD to long-lead time (LLT) resources such as offshore wind, out-of-state wind, and geothermal that currently have longer project development cycles that may not be compatible with the updated TPD allocation process outlined in Section 2. The CAISO’s straw proposal for allowing eligible resources an extension to seek TPD allocations can efficiently and equitably meet this need with additional work to define the details around: (1) how much TPD can be reserved for this purpose; and (2) when TPD that is reserved for LLT resources would be released after a certain time if it goes unused.

The straw proposal recognizes the need to release reserved TPD after a certain time, stating:

The ISO will have to establish a deadline for specified projects to begin seeking TPD for each cluster, which should align with the timeframe for the resource coming online in portfolios. The ISO will also have to develop conditions or a trigger mechanism for releasing reserved TPD if generation or transmission does not materialize. Such conditions would need to be driven by the transmission planning process, such as changes to the policy scenarios or canceling transmission projects.[1]

As the CAISO further defines this process, it should avoid over-reserving for LLT, or maintaining reservations for projects that prove unviable, as TPD is “inherently finite.”[2] The process for allocating TPD to LLT resources should maintain the incentive for resources to seek a PPA as soon as practical so that LLT resources with reserved TPD do not retain it without a viable path to using it. The process for LLT resources with reserved TPD should maintain a clear deadline for projects without a PPA to be removed from the queue and the TPD released to make room for other projects to seek an allocation.

[1] Straw Proposal at 32-33.

[2] Straw Proposal at 25.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

CalCCA supports the CAISO’s proposal to allow generators to interconnect up to an amount that will not trigger the need for the LLT short circuit upgrade or other reliability network upgrades. This proposal will provide opportunities for projects to come online and obtain deliverability more quickly when there is headroom to do so, helping to alleviate the current crisis of interconnection capacity scarcity.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

CalCCA has no comments at this time.

5.

Please provide any additional feedback:

CalCCA has no comments at this time.

California Wind Energy Association

Submitted 12/03/2024, 03:18 pm

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

a. Allocation Groups

For allocating TPD capacity, CAISO has proposed prioritizing projects as follows:

- Those that meet existing PPA eligibility requirements

- Eligible projects in commercial operation

- Non-operational projects without PPAs (“conditional group projects”).

CalWEA recommends that the highest priority be placed on operational projects, including those that entered the queue with an EO request (as opposed to current policy that prohibits such projects from ever attaining FCD status). Second priority should be placed on projects meeting PPA eligibility requirements. Third priority should be placed on “conditional group projects,” however, among conditional group projects, those on procurement shortlists should be prioritized over other projects.

CalWEA’s proposed order of priority promotes timely attainment of reliability goals at the lowest cost to ratepayers. Regarding EO resources, CAISO’s proposal that these resources never be given an opportunity to seek FCDS is at odds with the current lack of available substitute RA supply, concerns over the ability of the system to meet reliability criteria, and the tightening of available RA supply post-2028 due to the use of the UCAP methodology rather than ICAP. FERC has held that RA revenues are an appropriate incentive for market participants to rely on for market entry and exit decisions. And while CAISO and the CPUC intend that their coordinated transmission planning process will match RA needs, enabling operational EO resources to attain FCDS would nevertheless bolster the RA market, with benefits accruing to ratepayers, at a challenging and uncertain time.

b. Multi-fuel projects receiving an allocation with PPAs.

No comments at this time.

c. Opportunities to seek TPD. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

CalWEA does not support creating an additional TPD opportunity during the facilities study for PPA group projects as it would create an opportunity for unfair competitive advantage for utility-owned projects. Utilities may have early access to facilities study results, providing an opportunity to favor utility-owned projects over the projects of independent power producers.

On a related topic, projects seeking TPD capacity should be allowed to convert to EO after any of the three cycles and continue towards completion if they have met all the requirements of the GIA. If they decide to convert to EO, their postings for LDNUs should be released.

d. Eligibility of Energy Only projects, including technology additions. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

All EO projects should be eligible to seek and receive TPD.

Requiring a developer to obtain a PPA to add EO storage to a project is impractical and puts developers at the mercy of LSEs. An EO addition to an existing project should be able to remain in the queue if it meets the requirements of its amended GIA.

e. Modifications to the TPD scoring criteria

As with the allocation groups, shortlisted projects should have higher priority within the conditional group.

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

a. Eligibility

Eligibility should require "all" rather than "some or all" of the list of criteria. However, criteria 1 and 2 – “long lead-time technology” and “location-constrained” – should be condensed as “location constrained,” which is more precise.

In-state onshore wind and all geothermal energy resources should be included in the list of resources, and long-duration storage resources should be limited to location-constrained types. The list can then serve as an exclusive list rather than a series of examples. (Alternatively, regarding wind energy, the list can simply include “wind energy” rather than listing three locational types of wind energy. If “in-state” is used, it should be defined as “CAISO-interconnected” wind energy.)

The third criterion should be restated as “Resources included in CPUC or LRAs’ portfolios at a specific busbar that are dependent on existing or TPP-approved transmission lines, with explicit guidance from the CPUC or LRAs regarding TPD capacity reservation.” The policy should be busbar specific, consistent with CPUC/LRA portfolios. All new resources that are dependent on policy-approved transmission will be dependent also on portions of the existing transmission grid, which CAISO has recognized in its capacity reservation proposal. Thus, there is no reason to exclude from this policy resources in LRA portfolios that are dependent solely on existing transmission capacity.

Rather than requiring resources to “Enter the queue requesting appropriate amount of capacity per LRA's resource portfolio,” all location-constrained resources at specific busbars should be eligible until TPD allocation occurs at which time allocation can be based on scoring.

b. Extension to seek TPD

Financial security postings for LLT (better termed “location constrained”) resources should be tied to transmission development, aligning postings with actual transmission procurement and construction activities to assure financiers that construction will occur, thus reducing risk. For example, postings could be required when orders for breakers are placed, and when actual construction activities commence. (This same policy should apply to non-location-constrained resources that are awaiting transmission.)

With its recommended changes, CalWEA does not see the need for a discrete interconnection process for location-constrained resources.

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

No comments at this time.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

In addition to using TPD scoring criteria for the purpose of intra-cluster prioritization for the use of existing headroom, CalWEA recommends adding criteria related to a project’s development activities as follows:

- 5 points should be offered to projects for having 90% of engineering design completed

- 10 points should be offered to projects for having a purchase order of resource equipment with project specificity

- 7 points should be offered to projects for having a purchase order of resource equipment without project specificity.

The criteria should require Interconnection Customers to demonstrate every six months that they continue to meet the criteria that their eligibility was based on.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

No changes are being proposed, nor should changes to current practice be considered.

5.

Please provide any additional feedback:

Regarding the affidavit for seeking or retaining TPD capacity, CAISO should add some flexibility, enabling the eligible project offtaker to provide a formal letter attesting that a PPA is awaiting final approvals and will be executed within a month of the affidavit submittal deadline.

Calpine

Submitted 12/02/2024, 02:13 pm

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

Opportunities to seek TPD

Calpine supports the proposal to allow at least three consecutive “allocation opportunities” for Cluster 15 and beyond, beginning when the Facilities Study is completed. However as discussed below, if the Facilities Study for any resource includes long-lead equipment, the Interconnection Customer (IC) should have the opportunity to defer the first of those three opportunities or have the option to preserve conditional deliverability beyond the third year to a time closer to the in-service date of the long lead equipment.

At the conclusion of the allocation window, Calpine supports forced-queue-withdrawal rather than conversion to Energy-Only deliverability status. The queue currently contains approximately 10,000 MW of energy-only projects, many of which do not seem to be progressing – or even executing LGIAs. These projects likely are causing other more-viable projects to be exposed to the cost and construction delays of Reliability Network upgrades that will likely not be needed but for stalled EO projects.

In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

Calpine does not support the proposal to allow an extraordinary opportunity to seek TPD prior to, or during the Facilities Study process. It creates an unjust priority within the same group of clustered Interconnection Customers.

Eligibility of Energy Only projects, including technology additions.

Calpine strongly supports the proposal to allow all pre-C15 Energy-Only projects only one more opportunity to obtain TPD. Based on the current queue, there are approximately 60 EO projects (100 if partial deliverability is included) representing over 10,000 MW (20,000 with PCDS). Of those EO projects, only about one-third have executed LGIAs (20).

Nonetheless, these EO projects could be forestalling the CODs of other, more viable projects because the stalled EO projects may require RNUs that, as described below, are significantly backordered – with delivery dates pushing CODs out 4-7 years. Absent these RNU delays, other CPUC MTR projects may be able to move ahead more expeditiously.

The CAISO, in supporting this proposal, should review the extent to which RNUs (or other upgrades) associated with EO projects are delaying subsequently queued projects.

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

Eligibility

First and foremost, Calpine asserts that any project that contributes to the State’s ambitious carbon reduction goals and requires long-lead time upgrades should be allowed special consideration. The description on page 32 of the Revised Straw Proposal (RSP) of the resources that qualify for special consideration is broad and somewhat ambiguous. Perhaps rather, the ISO should consider a simpler, yet transparent and non-discriminatory basis for special considerations that ties TPP planning to actual interconnection study results.

For example, the CPUC mapping creates the roadmap for transmission investment. That investment takes the form of policy-driven upgrades which support the specific POIs of the resources that the CPUC maps. If, in fact, deliverability is created by long-lead transmission investments, that deliverability should be identified in the TPP and preserved for any resource that meets the CPUC’s bus-bar mapping in the targeted area. Special considerations should apply to all targeted resources.

Second, it appears, based on p24 of the RSP that the CAISO has preserved nearly 9000 MW of TPD for various out-of-state and off-shore wind projects. Indeed, while helpful now, this information should be transparently disclosed when it is reserved in the TPP /TPD process. That is, each time a policy-driven upgrade is approved, the CAISO should identify the deliverability that will be withheld, the POIs that will benefit from this deliverability and as discussed below, the conditions under which that capacity might be later released.

Third, to our knowledge, the deliverability preservations – particularly to support out-of-state wind east of California – do not include transmission upgrades within the State. Calpine is unaware of any study that demonstrates that these incremental flows will not negatively impact the deliverability of existing resources inside the State. This crucial matter should be discussed, and if necessary, studied in the next draft.

Finally, the tariff requires that MIC allocations be performed on an annual basis. There are not provisions to allow a multi-decade allocation of MIC to new interconnecting transmission. Perhaps more clarity on the CAISO’s envisioned allocation of intertie capacity could be included in the next draft.

Extension to seek TPD

The RSP suggests that long-lead resources be given an “option” to take additional time to seek TPD. Calpine does not object conceptually to giving any resource that triggers – or is dependent on – long-lead interconnection facilities some reasonable options. For example, if a storage project at a CPUC mapped location is dependent on a TPP deliverability upgrade or a long-lead RNU, it should be given the option to preserve that deliverability or delay its application for TPD.

Calpine also agrees that the CAISO and stakeholders will need to develop triggering mechanisms to allow the release of preserved deliverability. For example, in the last TPP, the CAISO approved billions of dollars in investment to support off-shore wind in the Humboldt area. As a result, the CAISO withheld roughly 1600 MW of deliverability in te latest TPD allocation. Collectively, we should discuss the conditions under which that preserved deliverability, as well as the deliverability preserved for other aspirational resources, might be released for future allocations.

Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

Calpine suggests that a separate queue for long-lead resources seems to introduce the real possibility of unjust and inequal treatment. Without more detail on what is proposed, we cannot comment substantively.

Calpine does not support extensions for commercial readiness or GIA deposits for long-lead resources. However, if the supporting TPD upgrades are canceled beyond the reasonabe control of the Interconnection Customer, perhaps special consideration on refundability could be considered.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

Calpine supports the proposal to identify and allocate existing RNU headroom to the most viable and deliverable projects.

However, most importantly, Calpine believes that the CAISO should do what it can to stabilize, rather than disrupt, the PPA market. As described below, commercial transactions may be facing strong headwinds due to changes in the Administration and supply chain delays.

Above all, and for the foreseeable future, the CAISO should reconsider and perhaps, not move forward with its Track 2 “Queue Maintenance” proposal which places immutable deadlines on life-in-queue and the continuous need to demonstrate commercial viability. Specifically, given the potential turmoil in the PPA market, projects that lose their PPA due to these headwinds should be granted a time-limited amnesty to renegotiate PPAs before losing their deliverability.

As the CAISO weighs further changes to the Interconnection Process it should countenance the real risk of delayed CODs and increasing costs. Even without further IPE changes, these trends will create havoc in the PPA market, where delay damages could mount leading to possible breach or default. Adding pressure, e.g. with immutable deliverability deadlines or unbending PPA requirements, will only add to the failure rate. PPA failures will threaten MTR targets and progress toward the States goals.

The first disruption is related to supply chain. The delivery times for interconnection equipment necessary for any resource addition are growing. Transformers, reactors, and breakers of all transmission voltages are currently experiencing 4-to-5-year delivery delays. This, in combination with capital allocation decisions by LSEs that prioritized system hardening, undergrounding and other wildfire responses have resulted in deferring necessary upgrades (including overstressed breakers and other precursor network upgrades) and delaying CODs by as much as 6 to 7 years.

The second disruption is the change in Administration and the real likelihood of increased costs for imported goods through the imposition of higher trade tariffs. Unless panels, batteries, inverters, breakers and transformers are on ships steaming toward CA ports, prices are likely to rise, potentially substantially. Domestic production is not poised to replace offshore orders – at least for several years.

Adding pressure to PPAs as the unbending form of commercial viability will do nothing to accelerate accomplishment of the State’s carbon reduction goals. Given these trends, it is more likely that revoking deliverability allocations upon PPA failure will merely shift these problems to a new group of resources that will face even more daunting delivery and pricing challenges. As such, for resource that have been granted deliverability, upon failure of a PPA, the CAISO should consider at least a one deliverability-cycle amnesty period during which its allocation is preserved and the project is not withdrawn or converted to energy-only.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

No comment

5.

Please provide any additional feedback:

No comment

Clearway Energy Group

Submitted 12/03/2024, 02:38 pm

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

a. Allocation Groups

Clearway supports the “conditional allocation” in concept but notes that the requirement to show a PPA in the next TPD allocation cycle may not be feasible for projects behind long-lead network upgrades. Clearway appreciates the CAISO’s acknowledgment of this timing issue in the Revised Straw Proposal (p. 8) and during stakeholder meetings. However, there is still no solution on the table to allow projects in this situation to move forward. Clearway hopes to see a procurement pathway created for projects behind long-lead-time network upgrades, but such a pathway does not exist yet. Today many of these “conditional allocation” projects will be in the same position as the formally designated “long lead time resources,” and will similarly need flexibility in when to begin seeking a TPD allocation.

d. Eligibility of Energy Only projects

The Revised Straw Proposal leaves some ambiguity about which Energy Only projects would be eligible to seek TPD after reaching commercial operation: pre-Cluster 15 projects only, both pre- and post-Cluster 15 projects, or none. Clearway’s position is that all EO projects that have reached commercial operation should be eligible to seek TPD. These projects have demonstrated that they are viable and should have a path to TPD.

Projects that do not receive TPD should be allowed to remain in the queue as Energy Only and should not be automatically withdrawn. California will need EO PV resources to meet its clean energy needs in the future, as demonstrated by the resource portfolios adopted by the CPUC. It is getting more difficult to find sites that are viable for PV+BESS (sites with both available TPD and available land), so PV development is likely to remain focused in more remote areas while energy storage resources can be located closer to load. This dynamic can be seen in the CPUC’s resource portfolios and reflects the reality of project development.

Instead of automatically withdrawing EO projects from the queue, CAISO should rely on the CVC criteria that requires a PPA after 7 years in the queue; this will force EO projects to show EO PPAs to remain in the queue. This 7-year period will show whether the project is desirable to the market without TPD, and if the project cannot obtain an EO PPA after 7 years, the CVC criteria will remove the project from the queue.

Technology additions

Clearway disagrees with the CAISO’s position that the system no longer has an “urgent need for new resources” (p. 15) that can be met with technology additions to existing resources. Energy storage retrofits to operating renewable resources are a uniquely efficient way to meet the evolving needs of the grid. The ISO has not justified its statement that “that need has been fulfilled.” Looking at the pace of new resource additions called for in the CPUC IRP portfolios, as well as the very long timelines for new projects to interconnect and receive FCDS, it is clear that there is still a need for shovel-ready projects that can be built quickly and provide RA. Specifically, increasing curtailment of renewable energy resources* shows the value in adding storage to operating standalone renewable generators.

* https://www.caiso.com/about/our-business/managing-the-evolving-grid

2.

Please provide your organization’s questions or comments on Special Considerations for Long Lead Time, Location Constrained Resources, specifically:

a. Eligibility

b. Extension to seek TPD

c. Broader procedural changes to the interconnection process for long lead-time, location-constrained resources

a. Eligibility

Given the potential impact of carveouts and reservations for LLT resources, there needs to be more clarity on what qualifies as a LLT resource. The criteria listed in the Revised Straw Proposal (p. 32) are not specifically defined. For example, all utility-scale PV and wind resources are “location-constrained,” but it is clear from context that the CAISO is not proposing to treat all PV and wind resources as LLT resources. Additionally, there is a lack of clarity as to which long-duration energy storage technologies are eligible. The CPUC has defined long-duration energy storage differently in different policy contexts. Decision 21-06-035, authorizing midterm reliability procurement, defines “long-duration storage” as any technology “providing 8 hours of storage or more,” but Decision 24-08-064, determining the need for central procurement of certain technologies, defines “long-duration energy storage” for purpose of that procurement as technologies other than lithium-ion batteries providing 12 hours of storage or more. The CAISO should provide more specific rules about which long-duration energy storage projects would qualify for LLT treatment in the TPD allocation process.

The CAISO should also clarify how many MW of TPD are reserved today and at what busbars; the Revised Straw Proposal references broader areas such as “Central Coast,” but the selection of a specific busbar will have an impact on interconnection studies and TPD availability for other projects in the queue. For future reservations of TPD, the CAISO should specify the busbar and number of MW.

Generally, Clearway is concerned about the potential disruption to the TPD allocation process that this reservation process could cause and encourages the CAISO to limit the amount of TPD reserved for LLT resources. The MW numbers listed in the Revised Straw Proposal (p. 24-25) suggest that the CAISO is planning to reserve large amounts of TPD for LLT resources and that the location of the reserved TPD may change substantially from one cycle to the next as the CPUC’s busbar mapping changes. Reserving significant amounts of TPD for long-lead-time resources at a single busbar can skew results in favor of resources that are inherently higher-risk and may not be able to move toward viability.

b. Extension to seek TPD

Clearway supports flexibility on timing to seek TPD for all resources with COD driven by long-lead RNUs, as well as designated LLT resources. As discussed in prior rounds of comments, these resources face the same challenge given the mismatch between their CODs and LSEs’ focus on near-term resource acquisitions. Flexibility on timing to seek TPD can allow both types of long-lead resources to better align with commercial milestones and procurement.

Clearway also supports the proposal to develop a mechanism for releasing reserved TPD if generation or transmission does not materialize. The CPUC’s decision recommending LLT resources for central procurement, Decision 24-08-064, was clear that procurement of any amount of these resources is subject to a determination that the costs are reasonable. These resources will need more time than others to go through permitting and construction, but they should not be exempt from the need to prove their viability and make progress toward commercial operation.

c. Broader procedural changes

Clearway does not support creating a separate interconnection process for LLT resources. Creating a separate IR process just for LLT resources would create biased opportunities for such resources. While LLT may need more time for permitting and construction, an extension to seek TPD should be enough for these resources to move towards viability without biasing the IR process in favor of these resources.

3.

Please provide your organization’s questions or comments on Intra-cluster Prioritization of Use of Existing SCD/RNU Headroom:

Clearway previously requested that CAISO expedite this intra-cluster prioritization proposal. Clearway continues to recommend that CAISO move forward with this process as soon as the tariff change is approved, using existing studies. Projects need to know as early as possible whether earlier CODs will be feasible so that they can act to accelerate development and construction schedules to take advantage of the opportunity. If the CAISO waits to use the next TPD affidavits for this exercise (Sept 2025) that would mean Q1 2026 implementation – which would be too late for some projects to change construction schedules to take advantage of acceleration.

Clearway is supportive of the scoring matrix using similar metrics to the TPD allocation scoring matrix, but we recommend adding expansion points to the scoring matrix to ensure that this process is supporting projects that can be built first. While expansion points would be accounted for in queue entry scoring for Cluster 15+ projects, this scoring did not happen for pre-Cluster 15 projects.

Additionally, Clearway is supportive of expanding the scope of prioritization to include other long-lead RNUs beyond SCD upgrades. CAISO should expand the scope of this prioritization to include situations where multiple projects are collectively triggering an upgrade but only one project’s ISD is being delayed (for example, because other projects initially requested later ISDs).

There are some aspects of the proposal that need some further clarification:

- The CAISO should describe how funding costs for studies will be defined, since the value from this process for the generator will largely depend on how much it will cost the generator. The proposal indicates that current studies will be used to the extent possible, (p. 37) but it seems possible further studies could be needed.

- The scope should include pre-Cluster 15 projects that are behind precursor network upgrades and RNUs. If a pre-Cluster 15 project is waiting for two sets of upgrades that delay the project several years, then the project should also qualify for this prioritization.

- The CAISO should determine the length of delay that an upgrade is causing to a project’s in-service date based only on RNUs and interconnection facilities, not DNUs. The example provided in the Revised Straw Proposal suggests that DNUs would factor into the determination that an RNU is creating a three-year delay (see footnote 13 on p. 37). Clearway recommends that CAISO only look at RNUs and interconnection facilities and that DNUs not be used to assess whether the delay crosses the three-year mark, since a DNU does not prevent a project from being placed in service. The delay should be determined by the wait time for the longest-lead upgrade minus the next gating RNU or PTO interconnection facility, since these are the upgrades that determine the in-service date. However, as discussed further in our response to question 4, Clearway strongly supports extending the same “headroom” approach to DNUs to enable projects to achieve FCDS or Interim Deliverability status earlier.

4.

Please provide your organization’s questions or comments on Modifications to the Priority for Awarding Interim Deliverability:

Clearway offers additional comments on the feasibility of multi-year interim deliverability, in response to the statement in the Revised Straw Proposal that the CAISO “does not think it is likely that there will be sufficient information to predict when allocated deliverability will go unused for multiple years” (p. 38).

Clearway continues to believe that interim deliverability enhancements are necessary to provide interconnection customers a reasonable means to identify, with sufficient outlook, interim deliverability available to projects that are reliant on numerous deliverability upgrades to provide for the level of interconnection service. Currently, there are earlier queued projects that have been materially delayed given the delay in deliverability upgrades. Third-party analysis has identified sufficient interim deliverability; however, the current rules require the project to be well under construction to initiate the annual interim deliverability analysis officially confirming what capacity is available to the project. This sequencing does not support the financing and contracting timelines for projects, therefore rendering this interim deliverability unutilized.

There have been more than $10 billion approved for upgrades that will enable TPD, but many projects rely on several different upgrades that move on different and disconnected timelines, and there is a history of these upgrades being delayed for several years. Additionally, not all prior queued projects will come online as planned, leaving more capacity available. This unused transmission capacity exists today, and without interim deliverability there is value being left on the table.

Clearway understands that it is not possible to say with certainty how much interim deliverability will be available and when, but this is not a reason to drop this proposal. We encourage the CAISO to implement a framework for multi-year interim deliverability, at least on a trial basis. If after multiple studies there is no interim deliverability available, then CAISO could eliminate this provision. Additionally, there is potential for the intra-cluster prioritization of SCD/RNU headroom to be more valuable if projects that are allowed to interconnect earlier have a path to accessing interim deliverability.

To increase transparency in the interim deliverability study and allocation process, Clearway also recommends including an interim deliverability assessment in the annual NQC study. Clearway recommends including details about specific dispatch, flow assumptions and any other modeling assumptions that will allow stakeholders to replicate the NQC studies. Clearway also recommends that NQC study cycle should be used to explore the multi-year interim deliverability studies. We believe this will help CAISO provide the pathway to deliverability for projects that are delayed because of long lead-time deliverability upgrades but can benefit from the intra-cluster prioritization of RNUs to achieve an earlier operation.

5.

Please provide any additional feedback:

EDF-Renewables

Submitted 12/05/2024, 01:07 pm

Submitted on behalf of

EDF-Renewables

1.

Please provide your organization’s questions or comments on the Modifications to TPD Allocations by these sections:

a. Allocation Groups

b. Multi-fuel projects receiving an allocation with PPAs

c. Opportunities to seek TPD

i. In addition, the ISO seeks stakeholder input on whether a project should be able to seek an allocation during the interconnection facilities study by demonstrating they have a PPA.

d. Eligibility of Energy Only projects, including technology additions

i. The ISO seeks stakeholder input on whether pre-cluster 15 EO projects should be able seek TPD through the Commercial Operation group after the 2025 TPD allocation cycle.

e. Modifications to the TPD scoring criteria

EDF Renewables (EDF-R) appreciates the opportunity to provide comments on CAISO’s IPE Track 3A consolidated revised straw proposal.

b. Multi-fuel projects receiving an allocation with PPAs and c. Opportunities to seek TPD

Slice of Day and CPUC procedures encourage and sometime require market responsiveness that is not always aligned with the CAISO’s new IR request timelines – e.g. 4+ years in advance. Preserving agility in CAISO’s processes should be a priority.

EDF-R strongly opposes CAISO’s limits on project technology changes. Provided a modification is not deemed material in CAISO’s MMA process, CAISO should remain neutral on the topic of an interconnection customer’s technology change. EDF-R requests CAISO preserve this agile policy and retain the option for projects to seek a technology change and transfer their TPD to the newly added technology. a prohibition would limit RA market competition, which is harmful to reliability and ratepayers. The CAISO has not demonstrated that its current policies that allow technology changes harm the interconnection queue, particularly in requests where project milestones are not also changed.

EDF-R understands CAISO’s need to have projects indicate which fuel type should be allocated first in instances where TPD allocation amounts are less than 100%, procedurally speaking. EDF-R requests CAISO justify why interconnection customers should not have the ability to shift allocated deliverability within the project provided the allocation score for both fuel types was the same. This is an unnecessary prohibition, especially this early in the interconnection process.

EDF-R also requests CAISO clarify two items:

-

If, when a project receives its requested TPD allocation for only one fuel type, the IC must accept or have the portion of project that was allocated TPD withdrawn from the queue, or can the IC decline the allocation in hopes of a full allocation in the next allocation cycle?

EDF-R supports and appreciates CAISO’s proposal to allow projects with conditional TPD allocations to seek an allocation if the project is not able to retain its conditional allocation in allocation attempt one or two.

EDF-R shares stakeholders concerns about the eligibility of Energy Only projects to seek TPD allocation under the commercial operation group and requests CAISO provide more clarity on the eligibility of Energy Only projects to seek TPD under the commercial operation group.

Firstly, EDF-R notes that stakeholders were not provided an opportunity to provide comment or opinion on Appendix KK prior to its submission, despite requesting the opportunity and CAISO precedent for such review (see FERC Order 765, FERC Order 831, FERC Order 881, and FERC Order 1000.)

EDF-R supports CAISO’s proposal to allow Energy Only projects to be eligible for an allocation through the Commercial Operation group, regardless of how they became Energy Only, as specified in the consolidated revised straw proposal page 14.

However, CAISO’s slide 12 and discussion on the workshop call seems to indicate the opposite, that technology additions to projects that entered the queue Energy Only will not be eligible to seek TPD in the commercial operation group.

CAISO stated on the call that Appendix KK was designed to reward interconnection customers that had the “foresight” to request a particular technology by prohibiting developers that change directions mid-stream from “queue jumping.” This is not queue jumping, projects are still paying for their proportional shares of network upgrades, and the charges have been deemed non-material but CAISO and the PTO. EDF-R requests CAISO revise any language in Appendix KK that would disallow a project that has declared COD from seeking TPD for itself, or an Energy Only technology addition.

As stated above, EDF-R strongly opposes CAISO’s proposed limits on project technology additions. Provided a modification is not deemed material in CAISO’s MMA process, CAISO should remain neutral on the topic of an interconnection customer’s technology change. EDF-R requests CAISO preserve the existing agile process that allows projects to seek a technology change and seek a TPD allocation when that portion of the project has declared COD. Eliminating this policy removes developer’s ability to quickly respond to market signals (which are changing all the time, as evidenced in year over year change to CPUC’s TPP base case to the CAISO) and limits RA market competition, which is harmful to reliability and ratepayers. The CAISO has not demonstrated that its current policies that allow technology changes harm the interconnection queue, particularly in requests where project milestones are not also changed, and policies that declare commercial operation before seeking TPD have proven commercial viability and literally cannot clog the queue.

Furthermore, EDF-R urges CAISO to reconsider the proposal to prohibit Energy Only projects with executed PPAs from providing a PPA that specifies an Energy Only product to extend its COD. This would eliminate the possibility for projects to come online Energy Only, declare COD, and then seek TPD. CAISO should require PPAs for RA for TPD retention, but should remain neutral if a PPA has an RA component when an Energy Only project receives a COD extension.